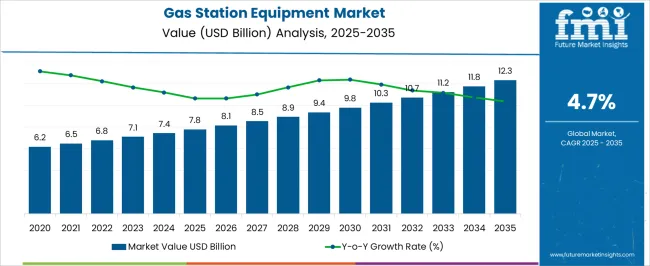

The gas station equipment sector is projected to expand from USD 7.8 billion in 2025 to USD 12.3 billion in 2035, advancing at a CAGR of 4.7%. Year-on-year analysis shows incremental growth, with values moving from 7.8 billion in 2025 to 8.9 billion by 2028 and 9.8 billion by 2030. This steady trajectory highlights the consistent demand for fueling pumps, storage tanks, payment terminals, and maintenance systems across both developed and emerging regions.

Analysts consider the YoY curve as stable, reflecting replacement cycles, regulatory upgrades, and integration of safety features that drive equipment adoption in fuel retailing operations. By 2031, the industry is expected to reach 10.3 billion, advancing to 11.2 billion in 2033 and closing at 12.3 billion in 2035. The YoY growth curve suggests reliable expansion shaped by the need for upgraded infrastructure, enhanced dispensing accuracy, and greater operational efficiency in forecourts. While the pace is moderate, the trajectory validates the long-term relevance of gas station equipment as essential assets for fuel distribution networks. The curve underlines a dependable expansion cycle, where steady investments in modernization and compliance reinforce the role of equipment suppliers in maintaining competitiveness within the fueling ecosystem.

| Metric | Value |

|---|---|

| Gas Station Equipment Market Estimated Value in (2025 E) | USD 7.8 billion |

| Gas Station Equipment Market Forecast Value in (2035 F) | USD 12.3 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The gas station equipment segment is estimated to contribute nearly 40% of the fuel dispensing equipment market, about 33% of the retail fuel infrastructure market, close to 28% of the petroleum equipment market, nearly 22% of the convenience store and forecourt solutions market, and around 18% of the automotive service equipment market. Collectively, this equals an aggregated share of approximately 141% across its parent categories.

This proportion demonstrates the strategic role of gas station equipment as the operational backbone of refueling infrastructure and consumer-facing forecourt services. Its importance has been defined by the integration of dispensing systems, storage tanks, point-of-sale technologies, and vapor recovery units that together maintain compliance, safety, and efficiency at fueling sites.

Analysts view gas station equipment not only as hardware but also as a business enabler that drives customer engagement, influences throughput, and strengthens service models for operators. The demand has been supported by high volumes of liquid fuel consumption, modernization of retail forecourts, and expanding service station networks in emerging economies.

Gas station equipment has also shaped competition by allowing differentiation through advanced dispensing accuracy, payment integration, and maintenance reliability. Its position in the value chain ensures that the segment remains indispensable, reinforcing its influence across the parent markets and continuing to define operational standards and investment priorities for the global fuel retail ecosystem.

The gas station equipment market is experiencing steady growth, driven by the rising global demand for fuel and the modernization of fuel retail infrastructure. Increasing vehicle ownership in emerging economies, coupled with ongoing upgrades in developed markets, is contributing to the expansion of the market.

Technological advancements in fuel dispensing, storage, and monitoring systems are enhancing operational efficiency and safety, while regulatory compliance requirements are encouraging equipment replacement and upgrades. The growing shift towards automation, cashless transactions, and real-time fuel management systems is further shaping the market’s evolution.

With the expansion of urban areas and highway networks, the number of retail fueling stations continues to increase, generating sustained demand for advanced fueling equipment. Future growth is expected to be influenced by the integration of digital technologies, predictive maintenance solutions, and the gradual adaptation to alternative fuel infrastructure, ensuring long-term market potential.

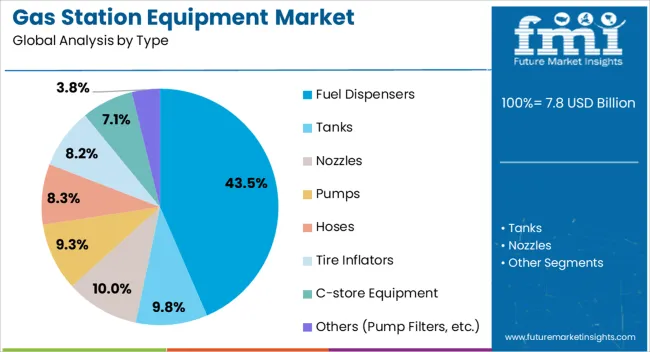

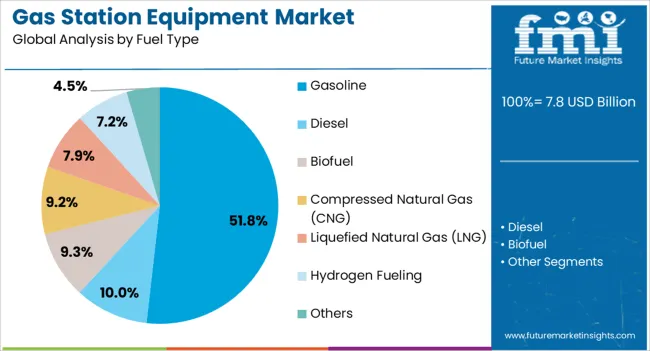

The gas station equipment market is segmented by type, fuel type, end use, distribution channel, and geographic regions. By type, gas station equipment market is divided into Fuel Dispensers, Tanks, Nozzles, Pumps, Hoses, Tire Inflators, C-store Equipment, and Others (Pump Filters, etc.). In terms of fuel type, gas station equipment market is classified into Gasoline, Diesel, Biofuel, Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG), Hydrogen Fueling, and Others.

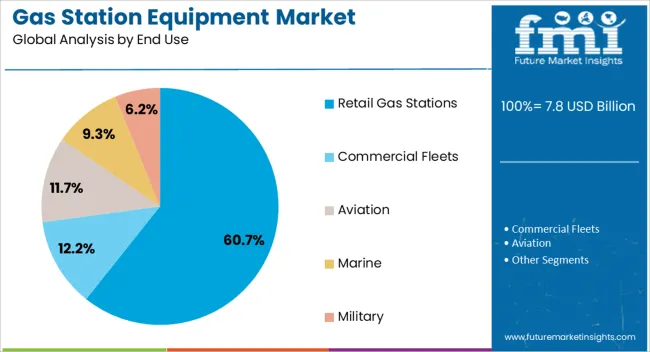

Based on end use, gas station equipment market is segmented into Retail Gas Stations, Commercial Fleets, Aviation, Marine, and Military. By distribution channel, gas station equipment market is segmented into Indirect and Direct. Regionally, the gas station equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fuel Dispensers segment is projected to account for 43.5% of the Gas Station Equipment market revenue in 2025, making it the leading segment by type. This dominance is being supported by the critical role of dispensers in the fueling process, as they serve as the primary interface between fuel storage and end users.

The demand for advanced dispensers is increasing due to the need for accurate metering, faster fueling speeds, and integration with payment and monitoring systems. Upgrades to support automated fueling, contactless payment, and real-time data collection are further driving adoption.

The longevity and durability of modern dispenser units, along with their ability to be upgraded with new software functionalities, have also contributed to their sustained market leadership. Additionally, regulatory standards for safety and emissions compliance are prompting fuel station operators to invest in high-performance dispensing units, reinforcing the segment’s strong position.

The Gasoline segment is anticipated to capture 51.8% of the Gas Station Equipment market revenue in 2025, making it the largest fuel type category. This leadership is being driven by the widespread dominance of gasoline-powered vehicles in both developed and emerging economies.

Continued reliance on gasoline as the primary transportation fuel, coupled with the extensive global infrastructure supporting its distribution, is maintaining high demand for related fueling equipment. Equipment designed for gasoline handling benefits from ongoing advancements in pumping efficiency, vapor recovery, and safety systems, ensuring compliance with stringent regulations.

Urban population growth and increased vehicle ownership are further sustaining gasoline consumption, while the slow transition to alternative fuels in many markets is allowing this segment to retain its dominance. Long-term replacement cycles and regular maintenance requirements for gasoline-compatible equipment are also contributing to steady market revenue from this segment.

The Retail Gas Stations segment is expected to hold 60.7% of the Gas Station Equipment market revenue in 2025, making it the leading end-use category. This dominance is being attributed to the large and growing network of fuel retail outlets worldwide, particularly in urban centers and along high-traffic transportation corridors.

Retail stations rely heavily on advanced equipment to provide efficient, safe, and customer-friendly fueling services. Increased consumer expectations for speed, convenience, and digital payment options are prompting station operators to invest in upgraded dispensers, storage systems, and point-of-sale technologies.

Additionally, the trend toward integrating convenience stores and value-added services within retail stations is driving higher transaction volumes, further justifying investments in modern equipment. The ability to integrate monitoring and automation solutions to improve operational efficiency and reduce downtime is reinforcing the strong demand from this segment, ensuring its continued leadership in the market.

The gas station equipment market is projected to expand steadily, supported by growth in fuel retail networks, replacement of outdated systems, and demand for advanced dispensing solutions. Rising fuel consumption in developing economies is reinforcing equipment upgrades across pumps, storage tanks, and point-of-sale systems.

Opportunities are emerging through integration of payment terminals, EV charging add-ons, and automation features. Trends highlight enhanced safety systems, digital monitoring platforms, and modular station formats. However, challenges such as high installation costs, compliance burdens, and fluctuating fuel demand patterns continue to affect market growth.

Demand for gas station equipment has been reinforced by the growth of fuel retail outlets and the need for modern dispensing systems. Developing economies with expanding vehicle fleets have prioritized investments in storage tanks, dispensers, and canopy infrastructure. Opinions suggest that replacement demand in mature economies is significant, as outdated pumps and monitoring systems require upgrades to meet current safety and efficiency standards.

Fuel retailers are also expanding service offerings by adopting automated systems and integrated payment solutions to attract customers. With increasing demand for convenience, gas stations are incorporating car wash systems, kiosks, and small-scale retail setups. This consistent expansion illustrates why demand for gas station equipment remains resilient, with suppliers benefiting from both new station rollouts and the modernization of legacy infrastructure across global markets.

Opportunities in the gas station equipment market are being shaped by automation, digital integration, and hybrid service formats. Automated dispensing systems with contactless payment capabilities are opening opportunities for retailers seeking faster, more efficient service. EV charging integration alongside conventional fuel dispensing has created hybrid station opportunities, expanding revenue models for operators. Aftermarket services such as predictive maintenance, real-time monitoring, and software upgrades represent promising opportunities for suppliers.

Expansion in developing economies provides further scope for entry, as governments support infrastructure development to meet rising transport fuel demand. Strategic partnerships with payment solution providers and energy companies are also enabling operators to diversify services. These opportunities demonstrate how gas station equipment is no longer limited to fuel dispensing but is evolving into a platform supporting multi-service convenience hubs.

Trends in the gas station equipment market emphasize digital monitoring, enhanced safety, and modular service formats. Remote monitoring platforms are trending, allowing operators to track fuel levels, pump performance, and payment transactions in real time. Enhanced safety features, such as leak detection sensors and vapor recovery systems, are gaining traction due to stricter compliance requirements. Opinions suggest that modular station formats, designed for rapid deployment in urban and semi-urban areas, are reshaping retail strategies. Integration of loyalty programs with digital payment terminals has also trended upward, improving customer retention. Automated car washes and retail add-ons are expanding the scope of station services beyond fuel. These trends highlight how gas stations are being transformed into digitally connected service centers, balancing fuel dispensing with convenience-oriented customer experiences.

Challenges in the gas station equipment market are centered on high capital costs, regulatory compliance, and fuel demand volatility. Establishing new fuel stations requires significant upfront investment in pumps, tanks, and safety systems, limiting expansion in cost-sensitive regions. Opinions highlight that regulatory compliance concerning emissions, leak prevention, and safety adds to operational burdens for station operators. Fluctuating fuel demand, influenced by economic cycles and regional energy transitions, has created uncertainty for equipment suppliers. Smaller operators face difficulties in maintaining profitability due to intense competition from large-scale fuel retailers with greater resources. Supply chain disruptions in equipment components have also delayed installations and replacements. These challenges underscore that while opportunities exist in modernization and diversification, long-term growth in the gas station equipment market depends on reducing costs, ensuring compliance, and stabilizing demand patterns.

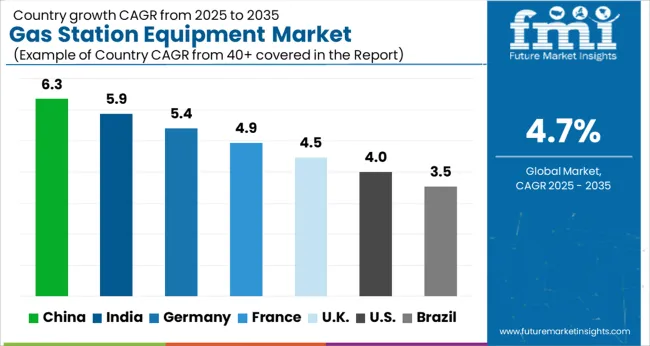

| Countries | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

The global gas station equipment market is projected to grow at a CAGR of 4.7% between 2025 and 2035. China leads expansion at 6.3%, followed by India at 5.9% and Germany at 5.4%. The United Kingdom is expected to record 4.5%, while the United States shows slower growth at 4.0%. Market expansion is supported by rising fuel retailing volumes, modernization of service stations, and integration of digital payment and monitoring technologies. Asia records faster adoption due to infrastructure growth and demand for automated dispensing systems, while Europe emphasizes compliance with environmental regulations and efficiency upgrades. The USA shows moderate growth, reflecting a mature market driven by replacement cycles and gradual adoption of alternative fueling equipment. This report includes insights on 40+ countries; the top markets are shown here for reference.

The gas station equipment market in China is projected to grow at a CAGR of 6.3%. Expansion is supported by a rapidly expanding vehicle fleet, government backed fuel infrastructure projects, and adoption of smart dispensing systems. Investments in automation, leak detection, and vapor recovery technologies ensure compliance with evolving safety regulations. Domestic equipment manufacturers strengthen competitiveness through scaled production and integration of digital control systems. With growing demand for both conventional and alternative fueling, China remains the most dynamic market for gas station equipment globally.

The gas station equipment market in India is forecast to expand at a CAGR of 5.9%. Growth is driven by rising vehicle ownership, expanding fuel retail networks, and government initiatives for energy access. Demand for advanced dispensing equipment, automated payment systems, and leak detection solutions is increasing across urban and semi urban regions. Oil marketing companies focus on modernizing forecourts with integrated service facilities, which sustains equipment demand. Private and public investment in fueling stations supports both conventional fuels and initial phases of EV charging integration.

The gas station equipment market in Germany is projected to grow at a CAGR of 5.4%. Expansion is supported by strict EU environmental regulations, modernization of existing stations, and integration of vapor recovery systems. German operators focus on digital payment, leak detection, and efficient dispensing systems to comply with safety standards. Adoption of hybrid stations offering conventional fuel alongside EV charging points boosts equipment demand. Germany’s role as a technology leader reinforces innovation in advanced forecourt management systems and safety components.

The gas station equipment market in the UK is expected to grow at a CAGR of 4.5%. Growth is moderate, shaped by mature infrastructure and focus on efficiency upgrades. Demand is sustained by replacement of old dispensing units, introduction of digital payment systems, and adoption of environmentally compliant storage tanks. The gradual integration of EV charging and alternative fuels creates opportunities for equipment diversification. Retailers emphasize modernization to meet changing consumer expectations for convenience and safety, ensuring steady albeit slower market expansion.

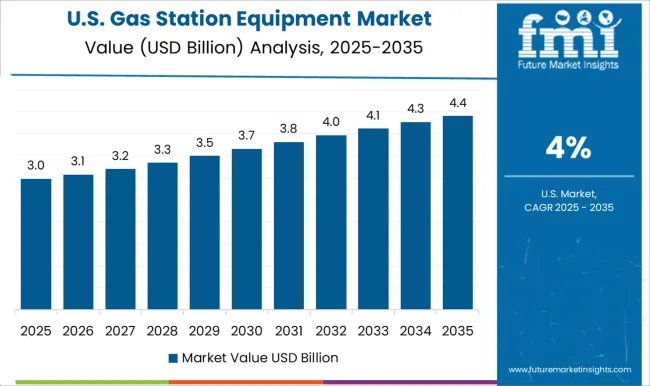

The gas station equipment market in the US is projected to grow at a CAGR of 4.0%. Expansion is slower due to a mature network, but steady replacement demand for pumps, storage tanks, and monitoring systems sustains momentum. Compliance with EPA regulations for vapor recovery and leak detection ensures recurring investments in upgraded equipment. Adoption of EMV compliant payment systems and integration of digital platforms strengthen consumer experience. Growth opportunities arise from multi fuel stations that incorporate EV charging infrastructure, though conventional fuel remains dominant in the near term.

Competition in gas station equipment has been built around how brochures package reliability, safety, and digital integration. Gilbarco Veeder-Root and Wayne Fueling Systems distribute catalogues that highlight dispenser efficiency, EMV payment modules, and leak detection, showing complete station integration. Dover Corporation and Franklin Fueling Systems issue brochures with detailed underground storage, piping systems, and environmental compliance tools, presenting side-by-side feature grids.

Tatsuno Corporation and Tokheim Group promote fueling systems through brochures that emphasize precision metering, ergonomic nozzles, and certified safety ratings. Bennett Pump Company stresses customizable dispensers with brochures showcasing multi-grade fueling and payment options. Beijing Sanki, Censtar, and China Hongyang compete with product literature highlighting affordability, high-throughput dispensers, and regional compliance credentials. Korea EnE and Peltek position brochures on automation, smart monitoring, and compact footprint dispensers.

Across all players, brochures have become technical handbooks that turn station builds into transparent procurement choices. Strategy has centered on using brochures as decisive marketing tools where operators compare performance claims line by line. Flow rates, meter accuracy, payment compatibility, tank monitoring features, and safety certifications are displayed in tables that simplify evaluation.

VeriFone strengthens competitiveness by producing brochures that stress POS integration, cloud-based monitoring, and user-friendly interfaces. U-Fuel highlights modular station brochures that target remote or temporary sites, emphasizing quick installation and compact layouts. Competitive edge is not secured by slogans but by how brochures document warranty terms, uptime metrics, and regulatory approvals.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.8 Billion |

| Type | Fuel Dispensers, Tanks, Nozzles, Pumps, Hoses, Tire Inflators, C-store Equipment, and Others (Pump Filters, etc.) |

| Fuel Type | Gasoline, Diesel, Biofuel, Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG), Hydrogen Fueling, and Others |

| End Use | Retail Gas Stations, Commercial Fleets, Aviation, Marine, and Military |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gilbarco Veeder-Root, Beijing Sanki Petroleum Technology, Bennett Pump Company, Censtar Science and Technology Corp. Ltd., China Hongyang, Dover Corporation, Franklin Fueling Systems, Jiangsu Furen Group, Korea EnE Co. Ltd., Peltek, Tatsuno Corporation, Tokheim Group, U-Fuel Corporate HongYang Group, VeriFone, and Wayne Fueling Systems |

| Additional Attributes | Dollar sales by equipment type (fuel dispensers, storage tanks, POS systems, payment kiosks, canopies & signage), Dollar sales by application (retail fueling stations, commercial fleets, highway service stations), Trends in automation, contactless payment, and digital fuel management, Role of vapor recovery systems and compliance-driven equipment upgrades, Growth in adoption of alternative fueling infrastructure including EV chargers, Regional installation patterns across North America, Europe, and Asia Pacific. |

The global gas station equipment market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the gas station equipment market is projected to reach USD 12.3 billion by 2035.

The gas station equipment market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in gas station equipment market are fuel dispensers, tanks, nozzles, pumps, hoses, tire inflators, c-store equipment and others (pump filters, etc.).

In terms of fuel type, gasoline segment to command 51.8% share in the gas station equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA