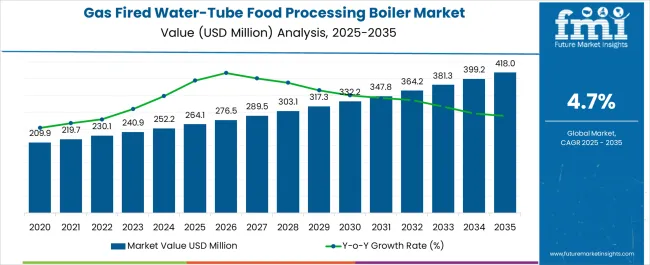

The gas fired water-tube food processing boiler market, estimated at USD 264.1 million in 2025 and projected to reach USD 418.0 million by 2035 at a CAGR of 4.7%, demonstrates a steady growth trajectory influenced significantly by regulatory frameworks governing industrial emissions, energy efficiency, and food safety standards. Regulatory bodies in key markets have established stringent emission norms, requiring lower emissions of nitrogen oxides, carbon monoxide, and particulate matter from industrial boilers.

These regulations directly impact manufacturers’ production processes, driving investments in cleaner combustion technologies, advanced burners, and enhanced heat recovery systems. This increases the overall cost structure but enables compliance and market access. Between 2025 and 2030, the incremental growth from USD 264.1 million to USD 317.3 million reflects gradual regulatory compliance, as existing installations are retrofitted or replaced with units meeting updated emission standards. Market adoption in this period is driven by regulatory enforcement in regions with high industrial activity, while regions with looser standards exhibit slower uptake.

From 2031 to 2035, with the market reaching USD 418.0 million, regulatory influence continues to shape product design and operational practices, including fuel quality requirements and efficiency certifications. Compliance requirements encourage manufacturers to develop innovative, modular, and compact designs that reduce energy consumption and emissions. The regulatory frameworks act as a critical growth enabler while simultaneously imposing cost pressures, ensuring the market evolves toward environmentally compliant, energy-efficient solutions.

| Metric | Value |

|---|---|

| Gas Fired Water-Tube Food Processing Boiler Market Estimated Value in (2025 E) | USD 264.1 million |

| Gas Fired Water-Tube Food Processing Boiler Market Forecast Value in (2035 F) | USD 418.0 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

The gas fired water-tube food processing boiler market represents a specialized segment within the global industrial boiler and food processing equipment industry, emphasizing efficiency, high heat transfer, and rapid steam generation. Within the overall food processing equipment market, this segment accounts for about 5.6%, driven by demand in bakeries, dairy, and beverage processing plants. In the industrial boiler sector, its share is approximately 6.2%, reflecting preference for water-tube designs that enable high pressure and fast response times. Across the commercial and institutional food production market, it contributes around 4.8%, supporting continuous operations and large-scale steam requirements. Within the energy-efficient heating solutions category, it represents 3.9%, highlighting adoption of gas-fired systems for cost-effective thermal energy. In the overall food and beverage processing ecosystem, the market contributes about 4.5%, emphasizing operational reliability, process efficiency, and integration with modern food processing lines.

Recent developments in the gas fired water-tube food processing boiler market have focused on fuel efficiency, emission reduction, and automation. Groundbreaking trends include the integration of low-NOx burners, advanced combustion controls, and digital monitoring systems to optimize steam generation and reduce fuel consumption. Key players are collaborating with food processing operators and technology providers to implement real-time monitoring, predictive maintenance, and automated control systems.

Adoption of modular boiler designs, compact footprint solutions, and heat recovery systems is gaining traction. The integration with renewable energy sources, IoT-enabled performance tracking, and improved safety protocols are shaping market competitiveness.

The gas fired water-tube food processing boiler market is witnessing gradual expansion, driven by the rising demand for efficient and reliable steam generation in food and beverage manufacturing. Enhanced energy efficiency, quick startup times, and high steam output capabilities make gas fired water-tube boilers suitable for diverse processing operations.

The market benefits from stricter hygiene and quality standards in the food industry, which require consistent and controlled steam supply. Growing emphasis on energy cost reduction and emissions control is pushing adoption of advanced boiler technologies with improved thermal efficiency.

The current landscape reflects stable demand across bakeries, dairy processing, and beverage production, with future growth expected from modernization initiatives in processing facilities. Integration of automation and remote monitoring capabilities is further enhancing operational efficiency, supporting the market’s positive outlook.

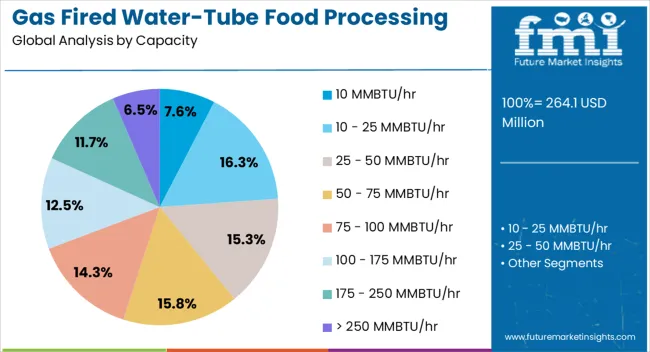

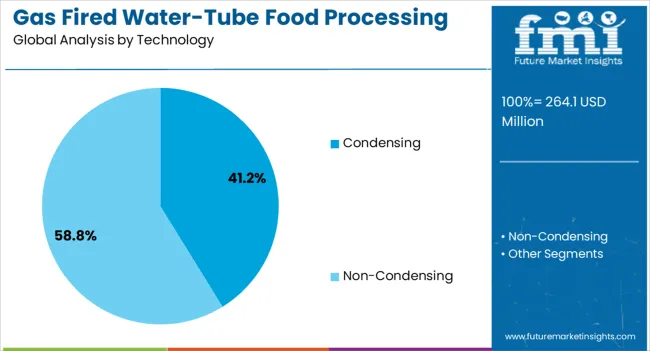

The gas fired water-tube food processing boiler market is segmented by capacity, technology, and geographic regions. By capacity, gas fired water-tube food processing boiler market is divided into 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr. In terms of technology, gas fired water-tube food processing boiler market is classified into Condensing and Non-Condensing. Regionally, the gas fired water-tube food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10 MMBTU/hr segment leads the capacity category in the gas fired water-tube food processing boiler market, holding approximately 7.6% share. This capacity range is favored for medium-scale processing facilities that require a balanced combination of output efficiency and operational flexibility.

It is well-suited for facilities with variable steam load demands, ensuring consistent performance without excessive fuel consumption. The segment’s adoption is supported by its ability to meet processing needs while maintaining compliance with industry efficiency standards.

In addition, compact design and optimized heat transfer in this range contribute to reduced operational costs. With food processing plants focusing on cost management and sustainable operations, demand for boilers in this capacity range is expected to remain steady.

The condensing segment dominates the technology category with approximately 41.2% share. Its leadership is attributed to significantly higher energy efficiency compared to non-condensing models, achieved by recovering latent heat from exhaust gases.

This efficiency improvement directly translates to fuel savings and reduced greenhouse gas emissions, aligning with sustainability goals in the food processing industry. Condensing technology also supports lower operating costs over the boiler’s lifecycle, making it a preferred choice for modern facilities.

Although the initial investment cost is higher, long-term operational savings and environmental compliance drive strong adoption. As regulations on energy efficiency become stricter, condensing technology is expected to retain its dominant share in the market.

The market has witnessed steady expansion due to rising demand for efficient and reliable steam generation in food manufacturing, dairy processing, and beverage production. These boilers utilize high-pressure water tubes to generate steam, providing rapid heat transfer, operational flexibility, and precise temperature control. The preference for gas-fired systems is driven by lower emissions, ease of operation, and faster start-up times compared to conventional fuel-fired boilers. The market is also shaped by increasing adoption of automated food processing lines and hygienic production standards, requiring consistent steam supply.

Gas fired water-tube boilers are increasingly deployed across food processing plants to provide reliable, high-quality steam for cooking, sterilization, and drying operations. Dairy facilities, bakeries, and beverage plants rely on these boilers for consistent temperature control to maintain product quality. Water-tube designs allow higher pressure operation, supporting multi-stage production processes efficiently. Gas-fired systems are preferred over other fuels due to cleaner combustion, lower maintenance, and faster responsiveness. The compact footprint of these boilers enables installation in space-constrained facilities, while modular designs allow scalability. Increasing production capacities, coupled with strict hygiene requirements, ensure continued adoption in the expanding global food and beverage sector.

Technological improvements in water-tube boiler design are boosting performance and energy efficiency in food processing applications. Enhanced tube metallurgy, advanced burners, and automated control systems improve heat transfer and reduce fuel consumption. Digital monitoring and smart control solutions allow operators to maintain precise pressure and temperature profiles, optimizing process outcomes. Innovations in compact and modular designs have simplified installation and maintenance, supporting faster commissioning. Gas combustion systems with lower NOx emissions are becoming industry standards, meeting environmental regulations while ensuring operational efficiency. Continuous advancements in boiler technology are making gas fired water-tube systems more reliable, sustainable, and economically viable for diverse food processing operations worldwide.

Strict food safety and industrial safety standards are influencing boiler selection in food processing facilities. Gas fired water-tube boilers offer cleaner operation, reducing soot and particulate emissions, which aligns with hygiene and environmental regulations. Safety features such as pressure relief valves, flame monitoring, and automated shutdown systems ensure compliance with workplace safety codes. Facilities are increasingly adopting boilers that meet international certifications for food-grade steam production. Compliance with regulatory standards also reduces operational risks and liability, making these systems a preferred choice for plant operators. As global food safety regulations tighten, the adoption of gas fired water-tube boilers is expected to expand across regulated markets.

Energy efficiency remains a key driver for the adoption of gas fired water-tube boilers in food processing. Efficient combustion systems, reduced heat loss, and fast steam generation minimize fuel consumption, lowering operational costs. Operators benefit from reduced downtime due to the reliability and longevity of water-tube designs. Integration with waste heat recovery systems and energy management solutions further enhances efficiency and reduces environmental impact. The combination of performance, cost-effectiveness, and regulatory compliance makes these boilers attractive for large-scale and continuous food production operations. Rising focus on operational optimization and energy management across the food processing industry is expected to sustain market growth in the coming years.

| Countries | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA. | 4.0% |

| Brazil | 3.5% |

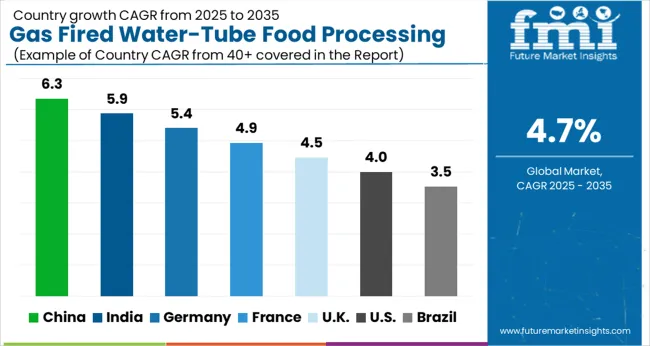

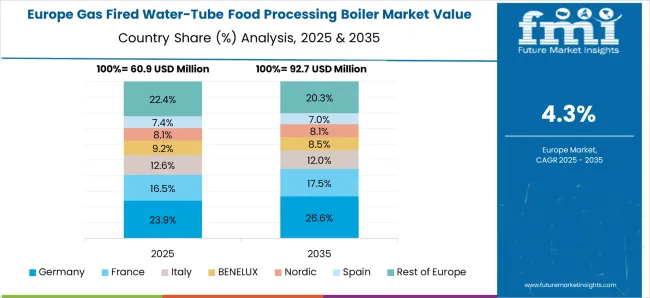

The market is expected to expand at a CAGR of 4.7% from 2025 to 2035, driven by growing industrial food processing and energy efficiency demands. China leads with 6.3%, supported by extensive food manufacturing and modernization of processing plants. India follows at 5.9%, with rising investment in commercial and industrial food infrastructure. Germany records 5.4%, where stringent efficiency and safety standards guide market growth. The UK shows 4.5%, while the USA stands at 4.0%, reflecting steady industrial adoption. Increasing focus on high-performance boilers and emission reduction technologies is expected to bolster the market across these regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China advanced at a 6.3% CAGR, driven by increasing industrial food processing activities and modernization of food production plants. Manufacturers focused on high efficiency, energy-saving, and low emission water-tube boilers suitable for large-scale operations. Adoption was highest in processed food, beverage, and dairy sectors where reliability and thermal efficiency were critical. Competitive strategies emphasized compact design, automation integration, and local manufacturing to reduce costs. Research and development targeted rapid steam generation, fuel efficiency, and compliance with emission standards. Expansion of food processing facilities and increasing demand for packaged and processed food further accelerated adoption across industrial hubs.

India registered a 5.9% CAGR, supported by rising processed food demand and modernization of manufacturing units. Manufacturers developed energy-efficient, compact, and low emission boilers to cater to diverse food processing requirements. Adoption was highest among dairy, bakery, and beverage processing companies. Competitive strategies included partnerships with local distributors, after-sales services, and on-site customization. Research targeted steam efficiency, operational safety, and low maintenance features. Government initiatives to promote food processing infrastructure and compliance with energy efficiency standards further supported market growth, while manufacturers focused on reducing operational costs and improving reliability for small and medium scale enterprises.

Germany progressed at a 5.4% CAGR, driven by stringent food safety regulations and high operational standards in industrial kitchens and food processing plants. Manufacturers emphasized energy efficiency, emission compliance, and automation integration for consistent steam production. Adoption was highest in large-scale food processing, dairy, and beverage manufacturing sectors. Competitive advantage was achieved through high-quality material usage, precision engineering, and integration of digital monitoring systems. Research focused on heat transfer optimization, fuel efficiency, and safety mechanisms. Export of high-efficiency boilers also strengthened Germany’s presence in global food processing equipment markets.

The United Kingdom recorded a 4.5% CAGR, influenced by demand for energy-efficient, compact, and low emission boilers in industrial food processing facilities. Manufacturers prioritized automation, rapid steam generation, and reliability for large-scale operations. Adoption was highest among dairy, bakery, and beverage producers. Competitive strategies included product customization, after-sales services, and integration with modern production lines. Research focused on thermal efficiency, operational safety, and emission reduction. Government regulations promoting energy efficiency and food safety further encouraged adoption in commercial kitchens and industrial food plants.

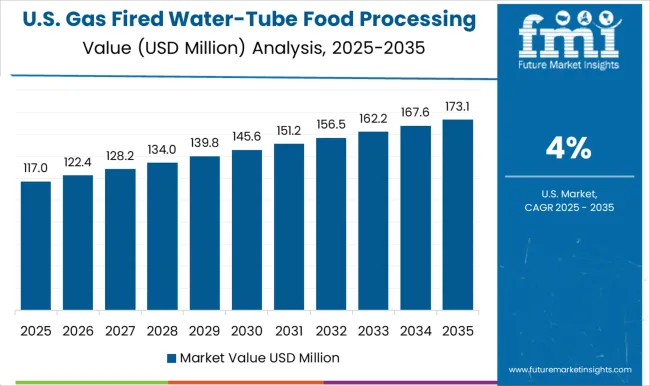

The United States expanded at a 4.0% CAGR, driven by increasing industrial food processing, beverage manufacturing, and bakery operations. Manufacturers invested in energy-efficient, compact, and low emission water-tube boilers with automation features. Adoption was highest in large-scale food processing plants requiring consistent steam output and operational reliability. Competitive strategies included partnerships with distributors, after-sales service networks, and product innovation in thermal efficiency. Research focused on emission reduction, fuel optimization, and maintenance simplification. Increasing regulatory focus on energy efficiency and environmental compliance reinforced market growth across commercial and industrial food processing sectors.

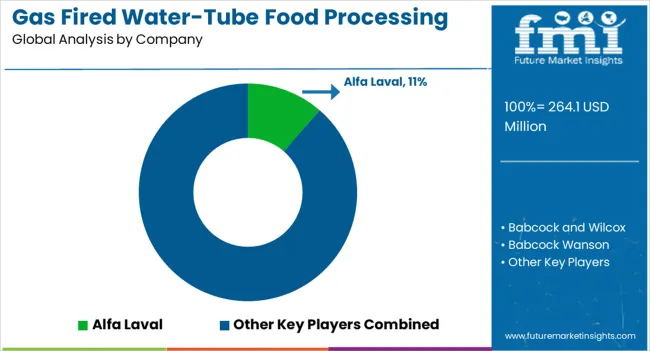

The market has been shaped by global engineering leaders and specialized regional manufacturers, competing on efficiency, reliability, and process integration. Alfa Laval, Babcock and Wilcox, and Bosch Industriekessel have focused on high efficiency designs, rapid steam generation, and robust construction for industrial kitchens and food production plants. Their strategies emphasize precise temperature control, low emissions, and compliance with hygiene and safety regulations. Babcock Wanson and Clayton Industries have targeted modular solutions, providing compact units suitable for medium-scale operations. Cleaver-Brooks, Forbes Marshall, Fulton, and Hurst Boiler have differentiated through advanced control systems and fuel flexibility. Product brochures highlight high heat transfer efficiency, water-tube construction advantages, and ease of maintenance. Miura America and Johnston Boiler emphasize rapid start-up capabilities, energy conservation, and low operational costs. Rentech Boilers focuses on custom configurations for food processing applications, ensuring integration with existing production lines. Brochures consistently highlight safety features, corrosion resistance, and compact footprint, appealing to industrial buyers seeking reliability and performance. Competition in the market revolves around energy efficiency, operational reliability, and service support. Alfa Laval and Babcock emphasize automated controls and scalable solutions, while Cleaver-Brooks and Fulton focus on low emissions and long service life. Forbes Marshall and Miura highlight fast steam generation and space-saving designs. Product literature serves as a critical tool to communicate performance metrics, fuel efficiency, and safety compliance. The market is increasingly driven by operational optimization, thermal efficiency, and hygienic design, positioning manufacturers as trusted partners in industrial food processing environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 264.1 Million |

| Capacity | 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Technology | Condensing and Non-Condensing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfa Laval, Babcock and Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cleaver-Brooks, Forbes Marshall, Fulton, Hurst Boiler, Johnston Boiler, Miura America, and Rentech Boilers |

| Additional Attributes | Dollar sales by boiler type and application, demand dynamics across dairy, beverage, meat, and bakery processing sectors, regional trends in energy-efficient steam generation adoption, innovation in gas-fired water-tube design, automation, and safety systems, environmental impact of fuel consumption and emissions, and emerging use cases in sustainable food production, clean steam applications, and renewable energy integration. |

The global gas fired water-tube food processing boiler market is estimated to be valued at USD 264.1 million in 2025.

The market size for the gas fired water-tube food processing boiler market is projected to reach USD 418.0 million by 2035.

The gas fired water-tube food processing boiler market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in gas fired water-tube food processing boiler market are 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 41.2% share in the gas fired water-tube food processing boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA