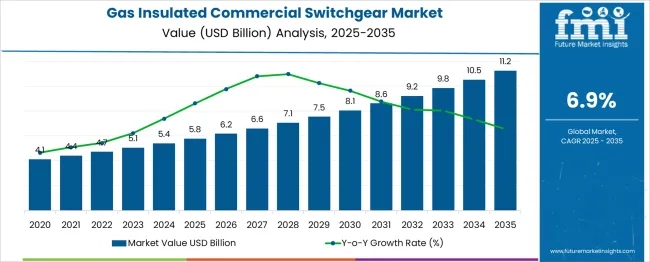

The gas insulated commercial switchgear market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 11.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. During the first five-year phase (2025–2030), the market will increase from USD 5.8 billion to USD 8.1 billion, contributing USD 2.3 billion, which accounts for 42.6% of the total incremental growth. This phase is driven by rising demand for compact, safe, and high-performance switchgear solutions across commercial buildings, metro projects, and industrial complexes where space optimization and operational reliability are critical.

The second half (2030–2035) is expected to deliver USD 3.1 billion, representing 57.4% of incremental growth, signaling steady acceleration due to smart grid development, urban infrastructure expansion, and renewable energy integration requiring high-capacity, low-maintenance systems. Annual increments in the early years average USD 0.46 billion, supported by replacement demand and modernization of electrical distribution networks in developed markets. Later-phase growth will be driven by energy efficiency regulations and increased adoption of digital monitoring features. Manufacturers prioritizing SF₆ alternatives, modular configurations, and IoT-enabled diagnostics will be best positioned to capture this USD 5.4 billion opportunity globally.

| Metric | Value |

|---|---|

| Gas Insulated Commercial Switchgear Market Estimated Value in (2025 E) | USD 5.8 billion |

| Gas Insulated Commercial Switchgear Market Forecast Value in (2035 F) | USD 11.2 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The gas-insulated commercial switchgear market holds a specialized role within several electrical and power distribution segments. In the switchgear market, its share is approximately 10–12%, as air-insulated switchgear remains more widely used in cost-sensitive applications. Within the gas-insulated switchgear (GIS) market, the commercial segment accounts for about 20–22%, reflecting strong adoption in urban buildings and infrastructure requiring compact and reliable systems. In the power distribution equipment market, its share is around 4–5%, given that this category also includes transformers, circuit breakers, and panels. For the commercial electrical equipment market, it contributes approximately 6–7%, as lighting systems, cabling, and control devices dominate overall spending.

In the medium voltage equipment market, its share stands at nearly 8–9%, supported by the growing demand for safe and space-saving solutions for commercial complexes, hospitals, and data centers. Market growth is driven by increasing urbanization, modernization of building infrastructure, and the need for reliable power distribution with minimal maintenance. Advantages such as compact size, enhanced safety, and resistance to environmental conditions make gas-insulated switchgear highly suitable for commercial installations. With rising energy efficiency requirements and space constraints in urban developments, this market is expected to strengthen its position within these parent markets in the coming years.

Increasing urbanization, along with stringent safety and reliability standards for power distribution systems, has prompted widespread adoption of gas insulated technology. These systems offer superior insulation, reduced footprint, and enhanced reliability compared to conventional air-insulated alternatives.

The market outlook remains optimistic as governments and private utilities invest in modernizing grid networks and commercial power systems to handle increased loads while ensuring operational safety. Advancements in digital monitoring, predictive diagnostics, and modular configurations have enabled gas insulated switchgear to meet the evolving demands of commercial users.

Concerns around environmental safety and operational efficiency are fostering demand for sustainable and maintenance-friendly switchgear solutions. As commercial facilities continue to prioritize uninterrupted power supply and efficient energy use, the demand for advanced gas insulated switchgear systems is expected to grow substantially across developed and emerging markets..

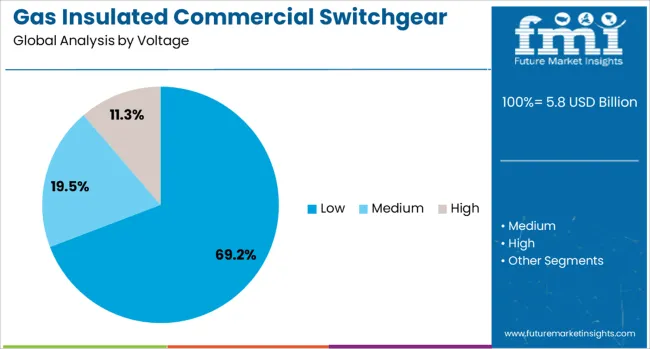

The gas insulated commercial switchgear market is segmented by voltage, current, and geographic regions. The voltage of the gas-insulated commercial switchgear market is divided into Low, Medium, and High. In terms of the current state of the gas-insulated commercial switchgear market, it is classified into AC and DC. Regionally, the gas-insulated commercial switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to account for 69.20% of the Gas Insulated Commercial Switchgear market revenue share in 2025, establishing it as the dominant voltage category. Growth in this segment has been attributed to the increasing demand for compact and reliable distribution systems in commercial buildings, data centers, and office complexes. Low voltage gas insulated switchgear has been preferred for its high operational safety, minimal maintenance requirements, and efficient power distribution capabilities.

These systems are particularly well-suited for environments where space is limited but operational continuity is critical. Adoption has been further supported by regulations mandating safe and efficient low voltage distribution infrastructure in commercial sectors.

The scalability and modularity of these solutions have enabled flexible integration with existing power systems, enhancing their long-term viability. The segment’s dominance has also been reinforced by growing investments in smart building technologies and energy-efficient infrastructure, which require precision-engineered low voltage solutions that can support real-time monitoring and control..

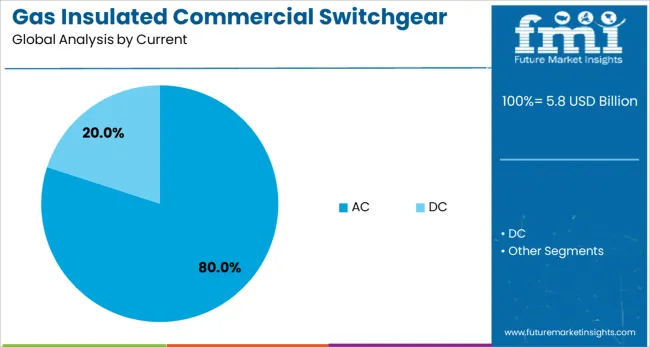

The AC current segment is expected to hold 80% of the Gas Insulated Commercial Switchgear market revenue share in 2025, positioning it as the leading current type. This leadership has been driven by the widespread use of alternating current in commercial electrical systems for power distribution and load management. AC switchgear has been adopted extensively due to its compatibility with grid-based energy systems and its ability to support long-distance power transmission with minimal loss.

In commercial environments, where diverse electrical loads and reliability are essential, AC-based switchgear solutions offer high operational efficiency and ease of integration. The availability of advanced safety features, digital monitoring capabilities, and rapid fault-clearing functions has further solidified the appeal of AC switchgear in commercial settings.

As commercial infrastructure becomes increasingly digitized and interconnected, the reliability and scalability of AC systems have supported their continued dominance. The ongoing modernization of commercial power networks and the integration of renewable energy sources have also reinforced the demand for robust AC switchgear solutions.

Deployments in metro projects, data centers, and high-rise developments support growth. Opportunities are emerging in compact, modular designs and retrofitting of aging electrical systems. Trends include SF₆-free solutions, digital monitoring integration, and prefabricated assemblies for faster installations. However, market restraints include high initial investment, limited awareness in developing economies, and stringent environmental regulations for insulating gases. Overall, the outlook suggests steady growth driven by infrastructure expansion and modernization projects.

The major growth driver is the increasing demand for reliable power distribution in space-constrained commercial settings. In 2024 and 2025, gas insulated switchgear systems were widely adopted in metro stations, airports, and high-rise complexes to achieve compact installations without compromising performance. Their ability to operate safely under harsh conditions and minimize maintenance downtime made them highly favored by developers. Data centers also adopted these systems to support high load capacities with minimal footprint. This trajectory confirms that energy reliability and floor space optimization are primary drivers in commercial infrastructure development.

Significant opportunities are present in retrofitting outdated electrical infrastructure with modern gas insulated switchgear systems. In 2025, replacement projects in commercial complexes and smart office spaces accelerated to meet enhanced safety and efficiency standards. Compact modular designs suitable for underground substations and integrated with advanced protection relays attracted large-scale adoption in Europe and the Asia-Pacific. These opportunities emphasize the growing preference for compact configurations that reduce land use while improving reliability, creating a competitive advantage for manufacturers offering space-saving and energy-efficient systems tailored to modern building requirements.

Emerging trends include the integration of digital monitoring solutions and the adoption of eco-friendly gas alternatives. In 2024, leading manufacturers launched switchgear with IoT-enabled sensors for real-time fault detection and predictive maintenance, enabling operators to reduce downtime. Development of SF₆-free insulation systems gained momentum to address stringent environmental compliance. Prefabricated switchgear modules optimized for faster commissioning were also introduced for commercial facilities requiring quick deployment. These advancements indicate a clear industry movement toward smarter and environmentally aligned designs, enhancing operational efficiency and sustainability for commercial electrical distribution networks.

The market faces restraints due to high capital costs and strict environmental standards related to insulating gases. In 2024 and 2025, smaller commercial projects delayed gas insulated switchgear installations due to significant upfront investment compared to air-insulated alternatives. Compliance with emission limits for SF₆ and related reporting obligations increased operational complexity for contractors. Limited technical awareness in emerging markets further slowed adoption, impacting growth in cost-sensitive regions. These challenges underline the importance of cost-optimized solutions, regulatory-ready designs, and training programs to enhance adoption and maintain competitiveness across commercial applications.

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

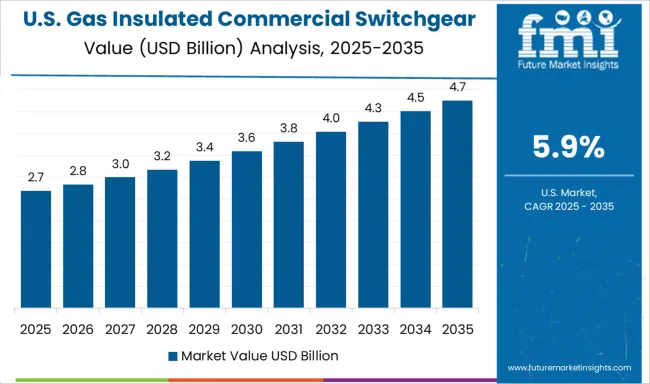

| USA | 5.9% |

| Brazil | 5.2% |

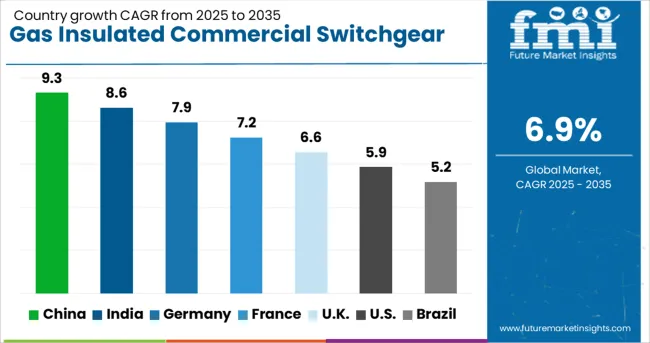

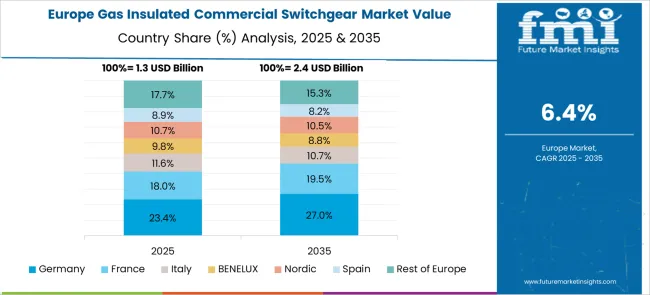

The global gas insulated commercial switchgear market is expected to grow at 6.9% CAGR from 2025 to 2035. China leads with 9.3% CAGR, driven by rapid infrastructure development and large-scale commercial building projects. India follows at 8.6%, supported by investments in smart grids, renewable energy integration, and urban infrastructure expansion. Germany records 7.9% CAGR, focusing on modernizing grid systems and adopting sustainable, SF₆-alternative technologies. The UK posts 6.6%, while the United States grows at 5.9%, reflecting stable demand in a mature market with emphasis on retrofitting and eco-compliant solutions. Asia-Pacific dominates growth due to construction booms and energy security goals, while Europe and North America prioritize compact, energy-efficient, and environmentally friendly designs.

China is projected to grow at 9.3% CAGR, leading the global market with strong adoption in commercial complexes, smart buildings, and large-scale infrastructure projects. Rapid urbanization and government investments in sustainable energy systems drive demand for compact, gas-insulated designs that ensure operational safety in space-constrained urban environments. Local manufacturers provide cost-effective solutions for mid-tier projects, while global suppliers introduce SF₆-free switchgear aligned with environmental regulations. Rising deployment in metro stations, data centers, and high-rise buildings further accelerates growth.

The market in India is forecasted to expand at 8.6% CAGR, fueled by rapid construction of commercial real estate, smart cities, and high-capacity transport hubs. Growing integration of renewable energy and urban grid modernization programs promotes the use of gas-insulated switchgear for reliable power distribution. Demand is particularly strong in large office spaces, hospitals, and airports, where compact designs enhance safety and efficiency. Domestic manufacturers are strengthening their product range to meet cost-sensitive segments, while global players introduce eco-friendly variants to comply with green building standards.

Germany records a 7.9% CAGR, driven by modernization of electrical networks and EU energy transition goals. Strong adoption of SF₆-free switchgear reflects strict environmental compliance, making Germany a hub for sustainable power distribution technologies. Demand is prominent in commercial complexes, public transport stations, and industrial facilities requiring compact, low-maintenance systems. Manufacturers focus on smart switchgear featuring IoT integration for predictive maintenance and real-time monitoring. Electrification of commercial heating and mobility solutions further supports GIS deployment in substations.

The United Kingdom market is projected to grow at 6.6% CAGR, supported by the rising need for compact and eco-compliant switchgear solutions in urban commercial projects. Increasing investment in electrification for transport hubs, healthcare facilities, and educational institutions promotes adoption of GIS. Manufacturers emphasize innovation in compact, modular designs that simplify installation and reduce maintenance. The demand for sustainable and low-emission alternatives accelerates product development, as government green energy programs set stricter environmental compliance benchmarks for power distribution systems.

The United States is forecasted to grow at 5.9% CAGR, reflecting moderate expansion driven by retrofit demand in aging commercial infrastructure and upgrades to ensure grid reliability. GIS adoption is gaining traction in large-scale data centers, airports, and high-rise offices where space optimization and safety are priorities. Federal energy efficiency mandates push utilities and building operators toward advanced designs with IoT integration for remote monitoring. Leading manufacturers are investing in SF₆-alternative technologies to comply with emerging environmental standards and corporate sustainability objectives.

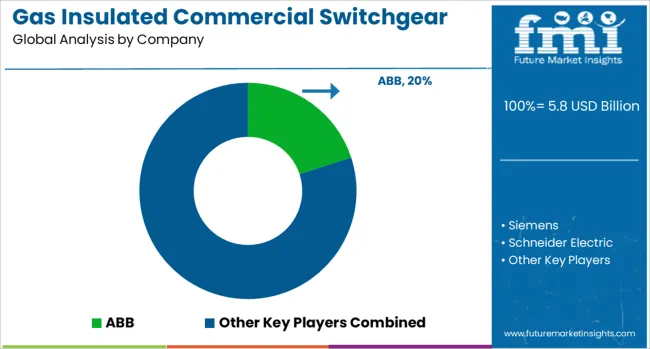

The gas insulated commercial switchgear market is moderately consolidated, with ABB recognized as a leading player due to its advanced GIS technology, strong global presence, and expertise in delivering compact, high-performance systems for commercial and industrial applications. ABB’s focus on reliability, low maintenance, and smart grid integration reinforces its position as a dominant supplier. Key players include Siemens, Schneider Electric, GE (General Electric), Hitachi Energy, Eaton, and others such as Mitsubishi and Toshiba. These companies provide gas insulated switchgear (GIS) solutions designed for space-constrained environments, ensuring high safety standards, superior insulation, and operational efficiency. Their products are widely used in commercial buildings, data centers, transportation hubs, and critical infrastructure. Market growth is driven by increasing urban infrastructure development, the need for high-reliability power distribution systems, and growing adoption of smart grid technologies.

Leading manufacturers are focusing on eco-efficient GIS solutions using alternative gases to replace SF₆, along with digital monitoring systems for real-time performance analysis. Emerging trends include the integration of IoT for predictive maintenance, modular GIS designs for faster installation, and energy-efficient configurations to meet regulatory standards. Asia-Pacific is the fastest-growing region due to rapid commercial construction and urban development, while North America and Europe maintain strong demand through modernization projects and smart energy initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.8 Billion |

| Voltage | Low, Medium, and High |

| Current | AC and DC |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, Schneider Electric, GE (General Electric), Hitachi Energy, Eaton, and Others (Mitsubishi, Toshiba…) |

| Additional Attributes | Dollar sales by voltage class (low- and medium-voltage) and installation type (indoor, outdoor). Global market estimated at USD 5.4 B in 2024, projected \~USD 7.2 B by 2034 at \~7.1% CAGR. Asia-Pacific dominates; North America driven by modernization. Buyers seek SF₆-free compact systems, remote automation, and predictive monitoring. Key innovations: hybrid setups, eco-insulation, IoT diagnostics. |

The global gas insulated commercial switchgear market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the gas insulated commercial switchgear market is projected to reach USD 11.2 billion by 2035.

The gas insulated commercial switchgear market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in gas insulated commercial switchgear market are low, medium and high.

In terms of current, ac segment to command 80.0% share in the gas insulated commercial switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA