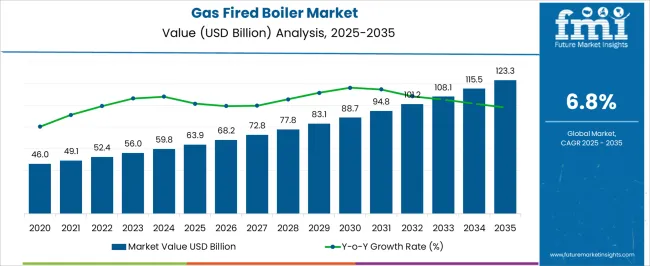

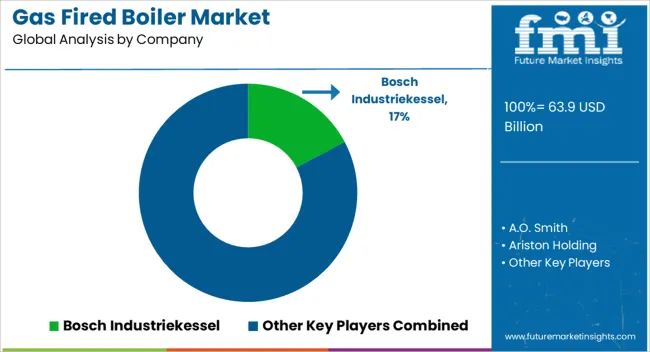

The gas fired boiler market is estimated to be valued at USD 63.9 billion in 2025 and is projected to reach USD 123.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

From 2020 to 2024, the market rises from USD 46.0 billion to USD 59.8 billion, driven by accelerating adoption in residential heating, commercial buildings, and industrial applications. Annual gains such as USD 49.1 billion in 2021, USD 52.4 billion in 2022, and USD 56.0 billion in 2023 highlight consistent progress, fueled by replacement demand for outdated systems and the increasing requirement for energy-efficient solutions to meet stricter emission regulations. By 2025, the market reaches USD 63.9 billion, marking the entry into its scaling phase. Between 2026 and 2030, the market grows from USD 68.2 billion to USD 94.8 billion, contributing nearly 37% of the overall projected increase.

This phase reflects strong investments in modern boiler technologies with enhanced fuel efficiency, digital monitoring, and lower carbon emissions, particularly in fast-growing industrial economies. From 2031 to 2035, the market advances from USD 101.2 billion to USD 123.3 billion, adding around 29% of total growth. Demand during this stage is supported by infrastructure modernization, urban expansion, and continued reliance on reliable heating technologies across diverse industries. The gas fired boiler market shows a stable long-term growth trajectory, driven by regulatory compliance, energy efficiency needs, and rising heating demand worldwide.

| Metric | Value |

|---|---|

| Gas Fired Boiler Market Estimated Value in (2025 E) | USD 63.9 billion |

| Gas Fired Boiler Market Forecast Value in (2035 F) | USD 123.3 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The gas fired boiler market occupies a critical position within the global industrial and residential heating ecosystem, representing nearly 24–26% share of the broader boiler systems segment due to its efficiency, versatility, and relatively lower emissions compared to coal- or oil-fired alternatives. Within industrial process heating applications, gas fired boilers account for approximately 18–20% share, driven by usage in food processing, chemical manufacturing, and textile production where precise temperature control and rapid start-up capabilities are essential. In the commercial and institutional heating domain, they hold close to 15–17% share, as office complexes, hospitals, and educational facilities increasingly adopt natural gas-based systems for energy efficiency and operational reliability. Residential adoption contributes roughly 12–14% share, supported by rising preference for compact, low-maintenance heating solutions compatible with urban housing infrastructure.

Market growth is influenced by regional expansion in Asia-Pacific and North America, where infrastructure modernization, natural gas availability, and regulatory incentives for cleaner energy solutions are driving uptake. Leading manufacturers are focusing on high-efficiency condensing boilers, modular designs, and integration with smart energy management systems to enhance operational performance. Despite challenges such as fluctuating natural gas prices, installation costs, and competition from electric and renewable-based heating solutions, adoption remains strong owing to proven reliability and scalability. Long-term projections suggest that gas fired boilers will continue to hold a central role in industrial, commercial, and residential heating systems worldwide, particularly in regions emphasizing low-emission energy transition strategies.

The gas fired boiler market is witnessing significant growth due to the rising demand for efficient and cleaner industrial heating solutions. Regulatory emphasis on reducing carbon emissions and transitioning from coal-based systems is encouraging the adoption of natural gas-fired technologies.

Industrial and commercial users are upgrading to high-efficiency condensing boilers to achieve operational cost savings and meet sustainability targets. In addition, modernization of district heating systems and investments in energy infrastructure are supporting long-term growth.

As energy prices fluctuate, the ability of gas-fired boilers to deliver stable and scalable performance continues to drive their market preference.

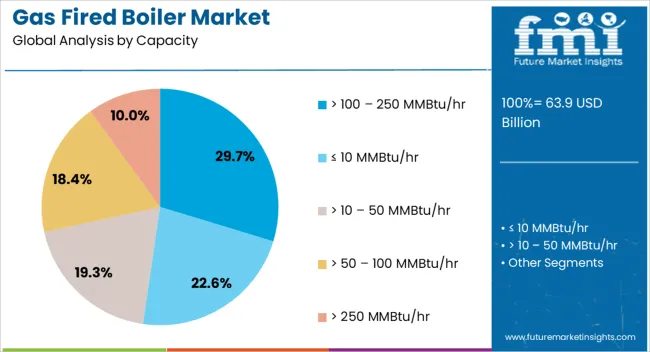

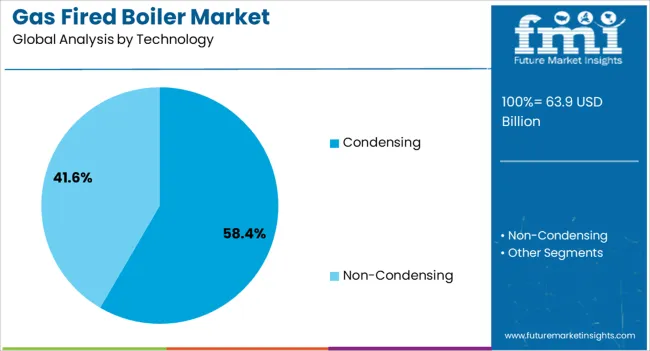

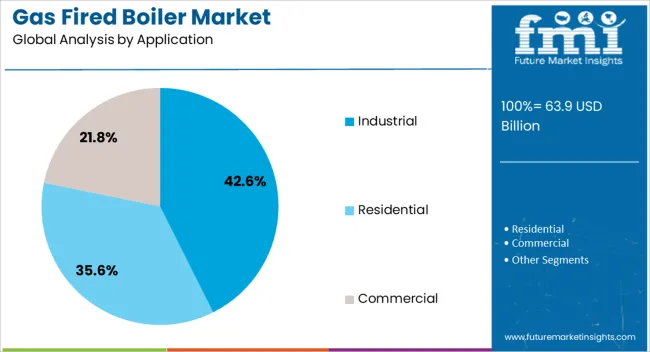

The gas fired boiler market is segmented by capacity, technology, application, and geographic regions. By capacity, gas fired boiler market is divided into > 100 – 250 MMBtu/hr, ≤ 10 MMBtu/hr, > 10 – 50 MMBtu/hr, > 50 – 100 MMBtu/hr, and > 250 MMBtu/hr. In terms of technology, gas fired boiler market is classified into condensing and non-condensing. Based on application, gas fired boiler market is segmented into industrial, residential, and commercial. Regionally, the gas fired boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

This capacity range is expected to command 29.7% of the market share in 2025 due to its applicability in large-scale industrial operations and centralized heating plants. These boilers offer optimal balance between efficiency and output, supporting diverse high-load requirements in processing and manufacturing environments. Their compatibility with modular system designs also allows for flexible installation and phased capacity expansion.

Condensing boilers are projected to dominate the technology segment with a 58.4% share, as industries prioritize energy efficiency and emissions reduction. These boilers recover latent heat from exhaust gases, achieving higher thermal efficiency than conventional systems. Widespread adoption is being driven by stringent environmental regulations and incentives for low-NOx technologies, particularly in Europe, North America, and parts of Asia-Pacific.

The industrial application segment is set to lead with 42.6% of market share in 2025, supported by increasing heating demands in sectors such as chemicals, food processing, and metal manufacturing. Gas-fired boilers offer fast startup times, high reliability, and the ability to maintain consistent thermal output, making them ideal for industrial processes. Modernization of outdated boiler infrastructure is also contributing to this segment's growth.

Gas fired boilers are being propelled by industrial demand, regulatory support, and operational efficiency. Regional infrastructure expansion further reinforces their adoption across commercial and industrial sectors.

The gas fired boiler market is witnessing traction in industrial sectors due to the increasing need for consistent heat supply and process control. Food processing, chemicals, and textile manufacturing are key industries adopting these systems to maintain operational efficiency and reduce downtime. Modular and high-capacity gas boilers are being preferred for their ability to handle large-scale operations while minimizing start-up times. Industrial players are investing in centralized heating systems, allowing multiple facilities to optimize energy use and operational costs. Maintenance and lifecycle support services are also expanding, giving operators confidence in long-term reliability. The demand is further encouraged by government initiatives promoting cleaner fuel alternatives in industrial processes, particularly in regions transitioning from coal and oil-fired boilers.

Policy frameworks across multiple regions are encouraging the adoption of gas fired boilers due to their lower emissions relative to coal and oil-fired systems. Emission standards, energy efficiency regulations, and incentives for clean energy are compelling industries and commercial establishments to replace outdated equipment. Tax benefits, rebates, and subsidized financing for low-emission boilers have improved market accessibility for small and medium-sized enterprises. Regulatory oversight in energy-intensive sectors such as pharmaceuticals and food manufacturing is promoting the use of certified high-efficiency boilers. Compliance monitoring and safety certifications are also influencing procurement decisions, ensuring that operators select systems that meet environmental and operational standards. These factors collectively drive the steady growth and adoption of gas fired boilers globally.

Modern gas fired boilers are being equipped with advanced control systems that allow precise temperature management, load balancing, and remote monitoring capabilities. Condensing boilers, for example, capture heat from flue gases, improving efficiency and reducing fuel consumption. Integration with building management and energy monitoring systems allows operators to optimize performance, lower operational costs, and plan predictive maintenance. Modular designs provide scalability, enabling operators to adjust capacity according to demand fluctuations, thereby improving efficiency. Safety mechanisms, pressure controls, and automated shutdown features also enhance operational reliability. Manufacturers are increasingly offering solutions tailored to specific industrial and commercial requirements, strengthening adoption across diverse sectors, while reducing risk of energy waste and operational downtime.

Gas fired boilers are gaining traction across Asia-Pacific, North America, and Europe due to expanding industrial infrastructure, urban commercial complexes, and residential heating demands. In developing regions, rapid industrialization and increased energy access are driving the installation of gas boilers in factories and commercial centers. In mature markets, replacement demand for aging coal or oil-fired systems supports stable growth. Infrastructure projects in chemical, textile, and food processing plants are integrating gas boiler systems to meet operational and environmental standards. Additionally, pipeline availability and reliable natural gas supply chains influence regional adoption patterns. Manufacturers are establishing localized production and service centers to cater to regional requirements, ensuring timely delivery, installation, and maintenance support.

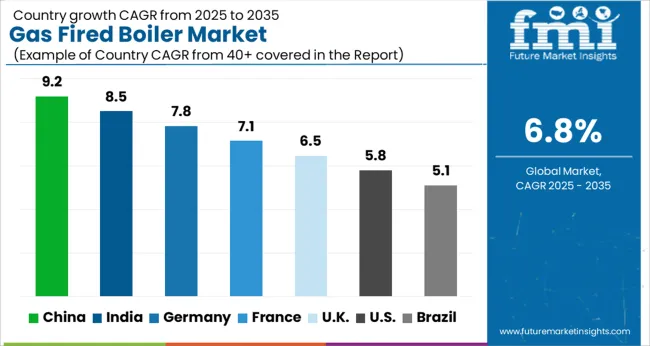

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

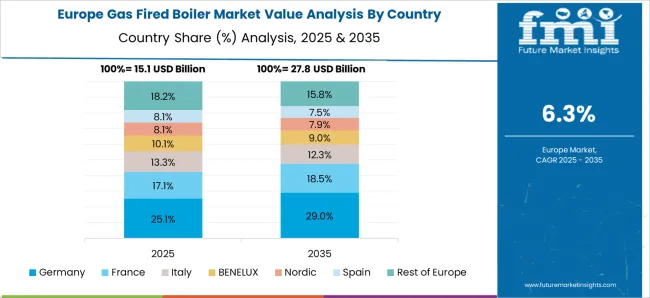

The gas fired boiler market is projected to expand globally at a CAGR of 6.8% from 2025 to 2035, supported by rising industrial demand, commercial heating requirements, and regulatory incentives for cleaner fuel adoption. China leads with a CAGR of 9.2%, driven by industrial expansion, urban commercial developments, and government programs promoting energy-efficient heating solutions. India follows at 8.5%, supported by industrial modernization, growing commercial complexes, and adoption of high-efficiency gas boilers in manufacturing and hospitality sectors. France records 7.1%, shaped by strict emission norms, replacement of aging oil-fired systems, and incentives for energy-efficient boilers. The United Kingdom achieves 6.5%, influenced by regulatory compliance, industrial retrofitting, and commercial heating upgrades. The United States posts 5.8%, a mature market with steady replacement demand and gradual adoption in industrial and residential applications. This outlook highlights Asia as the primary growth hub for gas fired boilers, Europe as a regulation-driven market, and North America as a mature region with consistent demand shaped by replacement and efficiency requirements.

China is projected to record a CAGR of 9.2% for 2025–2035, up from 8.1% during 2020–2024, surpassing the global average of 6.8%. Initial growth was supported by industrial heating demand, commercial expansion, and replacement of aging coal-based systems. The higher CAGR in the 2025–2035 period reflects accelerated adoption in industrial parks, increased commercial complexes requiring efficient heating, and government programs promoting low-emission solutions. Expansion of high-efficiency gas boiler manufacturing and domestic supply chains has reinforced market penetration. China’s rising industrial base, combined with urban and suburban commercial projects, continues to drive substantial incremental demand in the gas fired boiler segment.

India is expected to achieve a CAGR of 8.5% for 2025–2035, compared with 7.4% during 2020–2024, exceeding the global benchmark of 6.8%. Early adoption was concentrated in industrial units and hospitality sectors where older heating systems were being replaced. The stronger growth phase is driven by industrial modernization, growing commercial real estate, and government-backed energy efficiency initiatives. Increasing awareness of fuel efficiency and lower operational costs has prompted manufacturers and industrial operators to upgrade to gas-fired boilers. India’s expanding industrial hubs and urban commercial projects continue to fuel adoption, positioning the country as a rapidly growing market for gas fired boilers.

France is forecasted to post a CAGR of 7.1% for 2025–2035, improving from 6.0% in 2020–2024, slightly above the global CAGR of 6.8%. Growth during 2020–2024 was shaped by replacement of aging residential and industrial boilers, coupled with moderate commercial adoption. Expansion in 2025–2035 is supported by stricter emission standards, energy efficiency incentives, and retrofitting of industrial heating systems. Utilities and commercial complexes are increasingly investing in gas-fired boilers due to cost efficiency and compliance requirements. The country’s focus on reducing carbon intensity in energy consumption has accelerated modernization of boiler systems, creating steady growth opportunities in both industrial and commercial domains.

The United Kingdom’s CAGR for gas fired boilers is projected at 6.5% for 2025–2035, rising from 5.3% during 2020–2024, slightly below China and India but close to the global 6.8% benchmark. Earlier growth was driven by replacement demand in industrial heating and residential systems, limited by mature infrastructure and high upfront costs. The 2025–2035 phase benefits from tighter efficiency regulations, government-backed incentive programs for commercial buildings, and modernization of older industrial heating plants. Rising adoption in commercial real estate, hospitals, and educational institutions also supports demand. UK manufacturers and installers continue to focus on high-efficiency gas-fired boilers to meet regulatory compliance and cost-saving objectives.

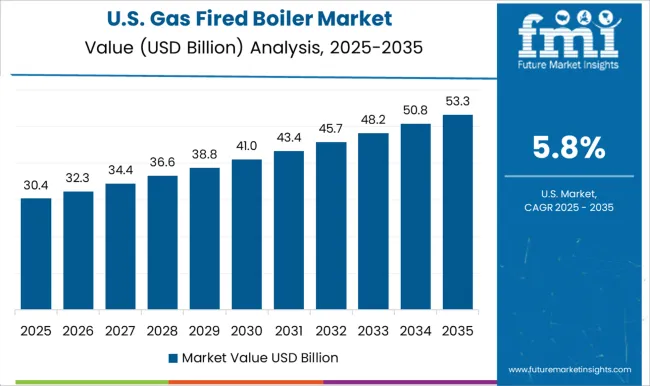

The United States is expected to achieve a CAGR of 5.8% for 2025–2035, up from 4.7% during 2020–2024, below the global average of 6.8% due to market maturity. Early growth was led by replacement of older oil- and coal-fired systems and limited industrial expansion. Growth in the later phase is supported by efficiency-driven retrofits, modernization of commercial and institutional heating systems, and gradual industrial adoption of high-efficiency gas-fired boilers. North America’s large-scale commercial buildings, healthcare facilities, and manufacturing plants continue to provide steady incremental demand, sustaining long-term opportunities despite a saturated residential segment.

The gas fired boiler market is characterized by participation from leading global manufacturers and specialized heating solution providers, addressing both industrial and commercial heating requirements. Bosch Industriekessel maintains a strong position, leveraging its engineering expertise and broad product portfolio to deliver high-efficiency boilers for diverse applications. A.O. Smith is prominent through its focus on residential, commercial, and industrial heating solutions, emphasizing energy efficiency and compliance with regional regulations. Ariston Holding strengthens its presence with compact, technologically integrated boilers suited for urban and commercial projects. Babcock & Wilcox Enterprises continues to play a vital role with industrial boiler systems designed for large-scale operations, while BDR Thermea Group focuses on innovative heating solutions for European and global markets. Bradford White Corporation is recognized for its durable commercial and residential boilers, supported by extensive distribution networks.

Burnham Commercial Boilers, Carrier, and Daikin differentiate through customized offerings, high-efficiency systems, and service excellence in North American and Asian markets. Ferroli, Forbes Marshall, Groupe Atlantic, and Hurst Boiler & Welding Co contribute with region-specific industrial and commercial heating solutions, catering to local standards and installation practices. Lochinvar and Miura America emphasize compact, high-performance systems for industrial and institutional applications. Rentech Boilers, The Fulton Companies, and Vaillant Group enhance market depth with technologically advanced, energy-efficient boilers targeting commercial and industrial adoption. Viessmann and WM Technologies are noted for their integration of smart heating controls and high-efficiency systems in both residential and commercial settings. Competitive differentiation across the market is driven by product efficiency, compliance with emission standards, installation and after-sales support, and partnerships with contractors and industrial operators. Collectively, these players leverage innovation, scale, and regional expertise to sustain relevance and capture incremental opportunities in the expanding global gas fired boiler market.

| Item | Value |

|---|---|

| Quantitative Units | USD 63.9 billion |

| Capacity | > 100 – 250 MMBtu/hr, ≤ 10 MMBtu/hr, > 10 – 50 MMBtu/hr, > 50 – 100 MMBtu/hr, and > 250 MMBtu/hr |

| Technology | Condensing and Non-Condensing |

| Application | Industrial, Residential, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Industriekessel, A.O. Smith, Ariston Holding, Babcock & Wilcox Enterprises, BDR Thermea Group, Bradford White Corporation, Burnham Commercial Boilers, Carrier, Daikin, Ferroli, Forbes Marshall, Groupe Atlantic, Hurst Boiler & Welding Co, Lochinvar, Miura America, Rentech Boilers, The Fulton Companies, Vaillant Group, Viessmann, and WM Technologies |

| Additional Attributes | Dollar sales, share by capacity (residential, commercial, industrial), fuel efficiency trends, regional adoption rates, replacement vs new installation demand, regulatory compliance impact, competitive pricing, and emerging technology integration. |

The global gas fired boiler market is estimated to be valued at USD 63.9 billion in 2025.

The market size for the gas fired boiler market is projected to reach USD 123.3 billion by 2035.

The gas fired boiler market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in gas fired boiler market are > 100 – 250 mmbtu/hr, ≤ 10 mmbtu/hr, > 10 – 50 mmbtu/hr, > 50 – 100 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 58.4% share in the gas fired boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Commercial Hot Water Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA