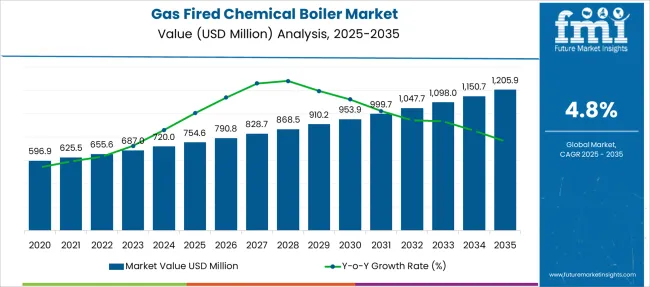

The Gas Fired Chemical Boiler Market is estimated to be valued at USD 754.6 million in 2025 and is projected to reach USD 1205.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Gas Fired Chemical Boiler Market Estimated Value in (2025E) | USD 754.6 million |

| Gas Fired Chemical Boiler Market Forecast Value in (2035F) | USD 1205.9 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The gas fired chemical boiler market is experiencing stable expansion, supported by the demand for reliable and energy-efficient thermal systems in chemical processing applications. Growth is being driven by the need to maintain precise temperature control, minimize emissions, and meet increasingly stringent environmental regulations. Chemical manufacturers are transitioning toward cleaner combustion technologies to align with decarbonization initiatives and reduce operational costs.

Natural gas, as a lower-emission fuel compared to coal and oil, has emerged as a preferred energy source in boiler systems. The industry is witnessing a shift toward integration of digital control systems, which improve thermal efficiency and reduce downtime. These trends are creating long-term demand for advanced gas fired boilers with modular designs and higher thermal outputs.

Government incentives for energy optimization and stricter enforcement of boiler efficiency standards are further reinforcing market development. As energy reliability and emissions reduction continue to guide industrial investments, the adoption of gas fired boilers across chemical facilities is expected to accelerate consistently through the forecast period.

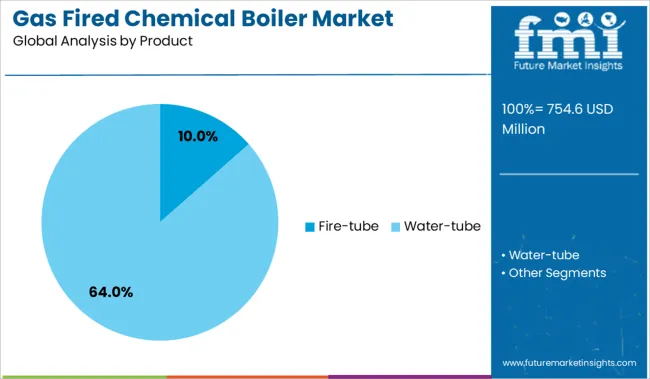

The market is segmented by Capacity, Product, and Technology and region. By Capacity, the market is divided into < 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr. In terms of Product, the market is classified into Fire-tube and Water-tube.

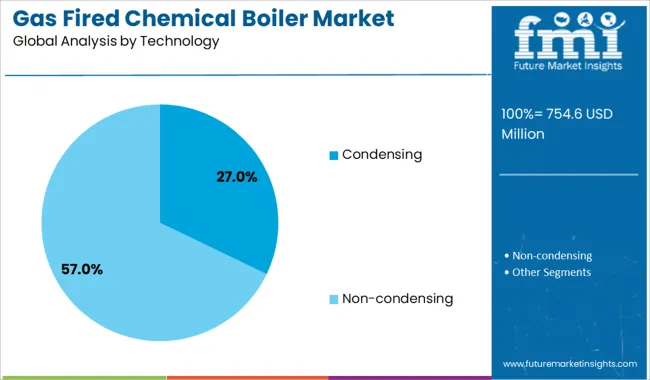

Based on Technology, the market is segmented into Condensing and Non-condensing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 10 MMBTU/hr capacity segment is expected to account for the leading share of the gas fired chemical boiler market in 2025. The segment’s growth has been supported by the rising demand from small and mid-sized chemical processing units that require compact and energy-efficient thermal systems. This capacity range has been preferred for its operational flexibility, ease of installation, and compatibility with modular plant designs.

Chemical manufacturers have increasingly adopted boilers in this category due to their capability to deliver controlled heat with minimal startup times, which improves overall productivity. Cost-effectiveness in terms of initial investment and ongoing fuel consumption has further enhanced the appeal of boilers within this capacity range.

Moreover, compliance with efficiency standards and low NOx emissions have made these units suitable for regions with strict environmental norms. As decentralization of chemical processing facilities becomes more common, boilers with less than 10 MMBTU/hr capacity are being positioned as optimal solutions for distributed heating requirements.

The fire-tube segment is projected to hold a major share of the gas fired chemical boiler market in 2025. This product type has been favored due to its simple mechanical design, low maintenance requirements, and cost-efficient operation in low to medium pressure applications. Fire-tube boilers have been widely utilized in chemical manufacturing processes that involve indirect heating, batch operations, or moderate steam needs.

Their durability and ability to handle varying load conditions have made them a reliable choice for continuous and intermittent heating cycles. In addition, their compact footprint and ease of installation have supported their adoption in space-constrained chemical plants.

The segment’s performance has also benefited from advances in burner technology, enabling better thermal efficiency and emissions control. As cost optimization and energy efficiency remain critical for chemical manufacturers, fire-tube boilers have continued to gain traction as practical and economical solutions across diverse processing environments.

The condensing segment is expected to represent a significant share of the gas fired chemical boiler market in 2025. Growth in this segment has been primarily driven by the increasing focus on energy conservation and reduced greenhouse gas emissions. Condensing boilers have been selected for their ability to extract latent heat from exhaust gases, thereby achieving thermal efficiencies exceeding conventional boiler technologies.

Chemical plants operating under sustainability targets have integrated condensing systems to meet energy efficiency benchmarks and reduce fuel expenses. These boilers have demonstrated superior performance in applications with lower return water temperatures, where heat recovery is maximized. Advances in corrosion-resistant materials and control systems have further improved the reliability and lifespan of condensing boilers.

The segment’s momentum has also been supported by regulatory mandates and voluntary certification programs encouraging high-efficiency boiler adoption. As chemical manufacturers prioritize cleaner and more cost-effective heating technologies, condensing boilers are expected to continue gaining prominence in the market.

The gas-fired chemical boiler market is gaining traction through cogeneration opportunities that combine steam generation with onsite electricity production. From 2023 to 2025, chemical plants adopted integrated boiler systems to enhance energy efficiency, reduce grid reliance, and support site expansion. These systems have repositioned boilers from single-output units to dual-function assets, creating clear value for operators focused on cost control and energy synchronization.

The sharp rise in industrial steam requirements has been identified as a pivotal driver in the gas-fired chemical boiler market. In 2023, process plants were noted to increase boiler capacity to support expanding production of specialty chemicals. By 2024, petrochemical facilities were found to replace aging coal-fired units with gas-fired boilers that offer rapid ramp-up times and operational flexibility. In 2025, demand was further amplified in chemical clusters undergoing expansion, where continuous, high-pressure steam supply was essential for catalytic reactions. These trends indicate that schedule-driven production scales, rather than energy trends, are prompting operators to favor gas-fired boiler systems capable of meeting intensive industrial steam demand.

In 2023, gas-fired chemical boilers were increasingly paired with onsite electricity generation units, allowing manufacturers to capture waste heat and reduce operational costs. By 2024, these cogeneration configurations were being integrated across larger plant sites to enhance steam and power self-sufficiency. Moving into 2025, chemical producers have been observed deploying compact gas boiler-driven micro cogeneration modules, enabling rapid site expansion and grid independence. These applications show that when steam and electricity demands are served through linked systems, chemical plants benefit via synchronized energy management. Vendors offering boiler designs specifically tailored for cogeneration compatibility are thus being positioned to capture demand from operators seeking multi-output efficiency and capital payback.

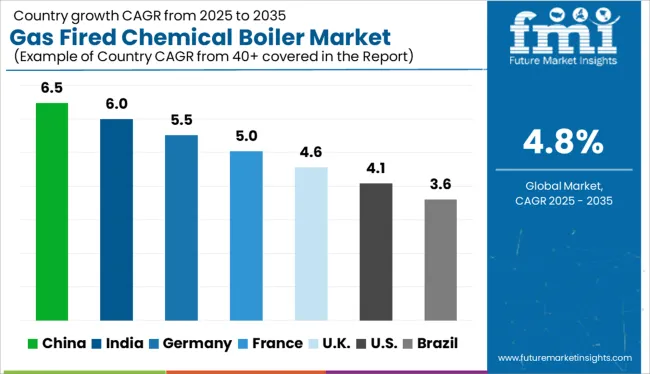

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

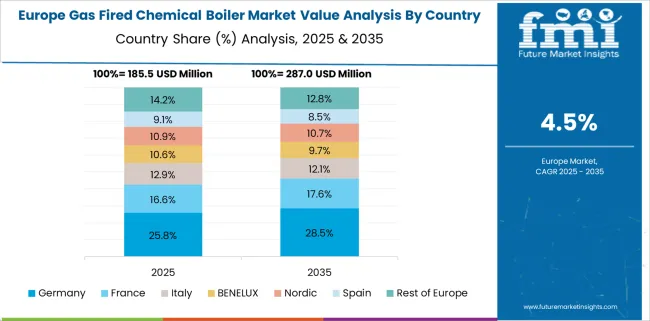

The gas fired chemical boiler market is projected to expand globally at a CAGR of 5% from 2025 to 2035. China leads with 6.5%, followed by India at 6.0% and Germany at 5.5%. France aligns with the global average at 5.0%, while the United Kingdom records a modest 4.6%. Growth in China and India is driven by increasing chemical production capacity and government encouragement to replace coal-based systems. Germany leverages high-efficiency condensing boilers and low-NOx burners for process reliability. France supports growth through process heat electrification targets, while the UK focuses on hybrid retrofits and emissions compliance in legacy chemical plants.

China is expected to lead the gas fired chemical boiler market with a 6.5% CAGR, driven by aggressive decarbonization policies and substitution of small coal boilers in chemical parks. Provinces such as Jiangsu and Shandong have adopted high-efficiency gas boilers for low-pressure and process steam generation in bulk chemical production. OEMs are supplying dual-fuel systems with low-NOx configurations to meet national emission thresholds.

India is projected to grow its gas fired chemical boiler market at a 6.0% CAGR, supported by growing downstream chemical investments and urban pollution controls. Manufacturers are transitioning from furnace oil and coal-based systems to gas-fired units in Gujarat, Maharashtra, and Tamil Nadu. Public sector gas distribution expansion enables wider access to natural gas in industrial estates. Indigenous OEMs are offering shell-type and packaged units tailored to chemical production loads.

Germany is expected to grow its gas fired chemical boiler market at a 5.5% CAGR, backed by industrial decarbonization roadmaps and stringent EU emissions compliance. Specialty chemical plants are adopting low-emission condensing boilers paired with thermal fluid heating systems. Hybrid solutions combining solar thermal and natural gas are gaining traction in mid-size facilities. Retrofitting programs are actively replacing legacy systems with modulating burner technology.

France is forecast to grow at a 5.0% CAGR, with demand coming from small and mid-scale chemical manufacturers seeking stable process heat with lower emissions. The national shift from heavy oil to cleaner energy in process industries drives gas boiler retrofits. Government subsidies under heat decarbonization schemes support high-efficiency boiler replacements. French OEMs are developing vertical boilers and water-tube units for industrial cleaning and solvent processing.

The United Kingdom is expected to grow at a 4.6% CAGR, reflecting measured adoption through phased compliance with industrial emissions directives. Most installations occur in specialty and fine chemical plants with aging oil-based systems. Regional distributors offer modular gas-fired systems for steam-intensive cleaning and blending operations. Boiler manufacturers are integrating flue gas economizers to increase operating efficiency.

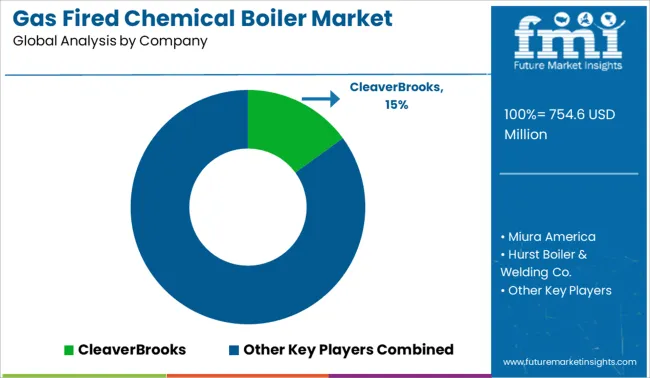

The gas fired chemical boiler market is moderately consolidated, led by CleaverBrooks with a significant market share. The company holds a dominant position through its high-efficiency boiler systems, safety-compliant designs, and widespread adoption across chemical processing facilities. Dominant player status is held exclusively by CleaverBrooks. Key players include Miura America, Hurst Boiler & Welding Co., Fulton Boiler Works, and Rentech Boilers - each offering customized gas-fired boiler systems designed for process heating, steam generation, and energy optimization in chemical production environments. Emerging players are currently limited in this segment due to capital-intensive manufacturing and stringent operational safety certifications. Market demand is driven by rising chemical output, on-site energy needs, and tighter emission control standards across industrial boiler installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 754.6 Million |

| Capacity | < 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Product | Fire-tube and Water-tube |

| Technology | Condensing and Non-condensing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CleaverBrooks, Miura America, Hurst Boiler & Welding Co., Fulton Boiler Works, and Rentech Boilers |

| Additional Attributes | Dollar sales by boiler capacity and configuration, regional demand trends, competitive landscape, buyer preferences for low-NOx and efficient models, integration with process control systems, innovations in modulating burners and emissions reduction. |

The global gas fired chemical boiler market is estimated to be valued at USD 754.6 million in 2025.

The market size for the gas fired chemical boiler market is projected to reach USD 1,205.9 million by 2035.

The gas fired chemical boiler market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in gas fired chemical boiler market are < 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of product, fire-tube segment to command 0.0% share in the gas fired chemical boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA