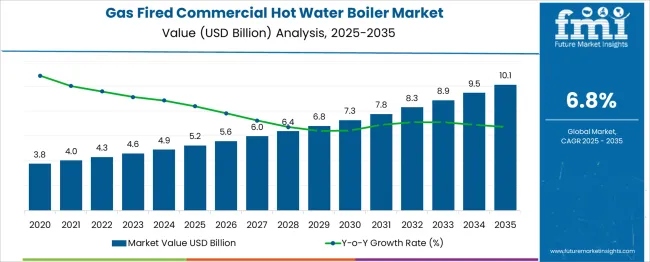

The Gas Fired Commercial Hot Water Boiler Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 10.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 5.2 billion to USD 7.3 billion, indicating a consistent growth trajectory driven by rising demand in hospitality, healthcare, and institutional facilities. Year-on-year analysis highlights steady increments, reaching USD 5.6 billion in 2026 and USD 6.0 billion in 2027, supported by infrastructure modernization and higher energy efficiency requirements across commercial establishments.

By 2028, the market is anticipated to reach USD 6.4 billion, advancing to USD 6.8 billion in 2029 and USD 7.3 billion by 2030. Growing emphasis on reliable heating systems and adoption of condensing boiler technologies for improved thermal performance are likely to strengthen market expansion. Regulatory standards promoting energy-efficient equipment and cost-effective operations are projected to encourage further installations.

These dynamics underscore the continued relevance of gas-fired commercial hot water boilers in balancing performance, cost, and compliance, making them an essential component in modern commercial heating solutions across diverse application sectors worldwide.

| Metric | Value |

|---|---|

| Gas Fired Commercial Hot Water Boiler Market Estimated Value in (2025 E) | USD 5.2 billion |

| Gas Fired Commercial Hot Water Boiler Market Forecast Value in (2035 F) | USD 10.1 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The gas fired commercial hot water boiler market occupies a defined segment within multiple heating and energy-related markets. In the commercial heating equipment market, it accounts for approximately 18–20%, as hot water boilers are a primary solution for space and water heating in commercial buildings. Within the HVAC market, its share is more modest at 4–5%, since this category includes air conditioning, ventilation, and various heating technologies.

In the industrial and commercial boilers market, it holds a significant share of around 22–25%, given its dominance in hospitality, healthcare, and institutional applications. For the energy and power equipment market, the share is smaller at 2–3%, as this market spans power generation and large-scale energy systems. In the natural gas equipment market, its contribution is nearly 6–8%, supported by growing adoption of high-efficiency gas-based heating systems.

Market expansion is fueled by rising demand for reliable and cost-efficient heating in urban commercial spaces, government incentives promoting energy-efficient systems, and replacement of aging coal-based boilers. Technological upgrades such as condensing boilers, smart controls, and integration with renewable energy sources further strengthen adoption. This positions gas fired commercial hot water boilers as a critical solution within the broader energy efficiency and heating infrastructure ecosystem.

The gas fired commercial hot water boiler market is experiencing steady growth as energy efficiency standards, operational cost pressures, and sustainability objectives drive adoption across diverse end use sectors. Transitioning from outdated heating systems to modern gas fired solutions has been accelerated by the need for lower emissions, improved heat recovery, and compliance with stringent building codes.

Operators have increasingly favored gas fired boilers for their ability to deliver consistent performance while aligning with energy efficiency goals. Looking ahead, advancements in condensing technology, integration with building management systems, and demand for space saving, high output equipment are expected to create new growth opportunities.

The market is being shaped by heightened awareness of lifecycle costs, rising gas availability, and regulatory incentives that encourage cleaner combustion technologies, collectively paving the way for broader deployment in commercial facilities.

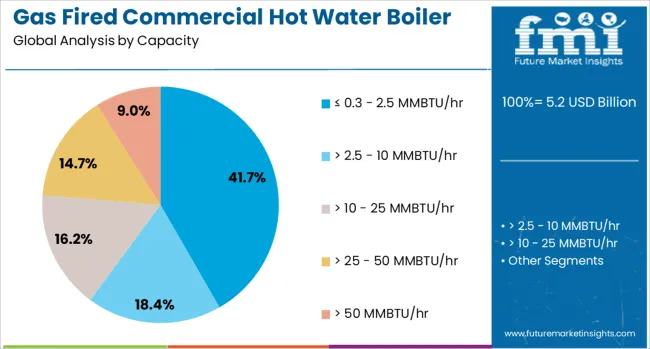

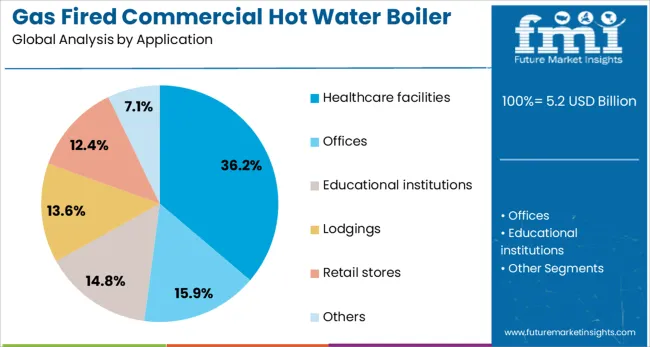

The gas-fired commercial hot water boiler market is segmented by capacity, application, technology, and geographic regions. The gas-fired commercial hot water boiler market is divided into ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 25 MMBTU/hr, > 25 - 50 MMBTU/hr, and > 50 MMBTU/hr. In terms of application, the gas-fired commercial hot water boiler market is classified into Healthcare facilities, Offices, Educational institutions, Lodgings, Retail stores, and Others.

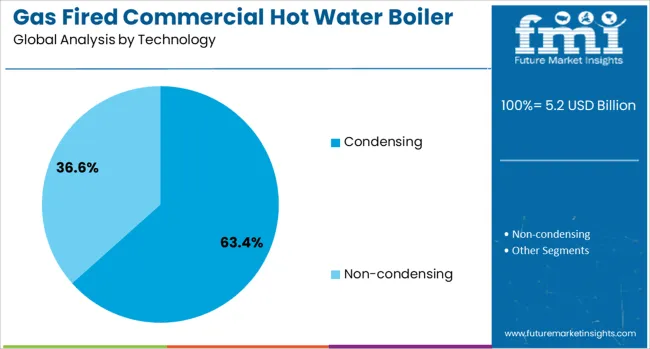

Based on technology, the gas-fired commercial hot water boiler market is segmented into Condensing and Non-condensing. Regionally, the gas-fired commercial hot water boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by capacity, the ≤ 0.3 to 2.5 MMBTU/hr segment is projected to hold 41.7 % of the market revenue in 2025, emerging as the leading capacity range. This leadership is attributed to the versatility and suitability of these boilers for a wide range of medium-scale commercial establishments.

Their ability to balance compact design with adequate heating output has made them preferable for facilities that require dependable service without excessive installation space or capital expense. This segment’s prominence has also been strengthened by demand from retrofitting projects where existing infrastructure limits larger capacity installations.

The combination of operational efficiency, cost effectiveness, and adaptability to diverse floor plans has positioned this capacity range as the preferred choice for many commercial applications.

In terms of application, healthcare facilities are expected to account for 36.2 % of the market revenue in 2025, establishing themselves as the top application segment. This dominance has been driven by the critical need for reliable and hygienic hot water supply in hospitals, clinics, and care homes.

The healthcare sector has increasingly adopted high performance gas fired boilers to meet stringent sanitation requirements, patient comfort standards, and uninterrupted service expectations. This segment’s growth has been further reinforced by ongoing expansions and renovations in medical infrastructure, which demand efficient and compliant heating solutions.

Enhanced focus on energy savings and operational resilience in healthcare settings has ensured that gas fired boilers remain the preferred choice, solidifying this segment’s leadership.

When segmented by technology, condensing boilers are forecast to capture 63.4 % of the market revenue in 2025, securing their position as the leading technology segment. This leadership has been underpinned by the superior energy efficiency and reduced emissions offered by condensing designs compared to traditional alternatives.

The ability to recover latent heat from exhaust gases and operate with higher thermal efficiency has made condensing boilers particularly attractive in markets with strict energy codes and carbon reduction targets. Their lower operating costs over time and ability to integrate seamlessly into modern building systems have strengthened their adoption.

This segment’s prominence has also been supported by manufacturers’ focus on compact, easy-to-maintain designs that cater to space-constrained commercial environments, reinforcing condensing technology’s continued dominance.

The meat tenderizer market is seeing increased adoption among processors, foodservice operators, and retail brands focused on enhancing texture and cook quality. In 2024, demand rose for enzymatic and mechanical tenderizers used in both meat preparation and pre-packaged offerings. In 2025, culinary channels incorporated advanced tenderizer formats for premium cuts and restaurant-grade preparations.

Providers delivering validated tenderizing solutions with consistent performance, recipe alignment, and operational ease are gaining recognition across food production and chain kitchen operations.

Consumer expectations for uniform tenderness have pushed processors to standardize meat texture across product lines. In 2024, meat processors began deploying enzymatic tenderizers to achieve repeatable softness in high-cut items without altering cooking behavior. In 2025, foodpack brands utilized mechanical tenderizer tools to reduce variability between batches, especially in lean or tough cuts.

These shifts indicate that consistency in mouthfeel—not branding or novelty—is guiding tenderizer adoption. Suppliers providing tenderizing solutions with validated activity profiles and minimal impact on flavor or moisture retention are thus gaining traction in production settings.

Seafood processing presents a growing opportunity due to its natural variation in texture and consumer preference for softer products. In 2024, pilot programs introduced enzyme-based tenderizers tailored for fish and shellfish to enhance eating quality and yield. In 2025, processors scaled use of marine-specific tenderization to deliver consistent texture in higher-value species such as grouper and tuna. These initiatives demonstrate that targeted tenderizing approaches can improve product acceptability and reduce preparation time in kitchens. Suppliers capable of formulating stable, marine-certified tenderizer blends with minimal residue and consumer-acceptable labeling are well placed to address expanding seafood-tenderizer demand.

In 2024 and 2025, it was noted that installation complexity associated with high‑capacity gas-fired commercial hot water boilers imposed a notable barrier. Integration of large units, especially those generating output above 25 MMBTU/hr, required upgraded piping, venting infrastructure and skilled labour. The need for specialized site preparation and permitting adds to the upfront investment. Facilities such as hospitals and universities in North America and Europe were reported to postpone replacement plans due to retrofit complexity and cost uncertainty. That structural and installation burden has been observed to restrict procurement decisions by cost‑sensitive operators and facility managers.

In 2024, the adoption of smart control systems and IoT integration within gas‑fired commercial hot water boiler units was reported to climb by approximately 22 percent, fostering improved operational monitoring and performance tuning. Building operators began to utilise remote diagnostics and automated scheduling to reduce fuel consumption and maintenance intervals.

Rollouts in commercial buildings and institutional facilities in Asia‑Pacific and North America demonstrated reduced downtime and more efficient heat delivery. This provides one clear opportunity for suppliers to differentiate via data‑driven service offerings and remote monitoring platforms tailored for boiler management.

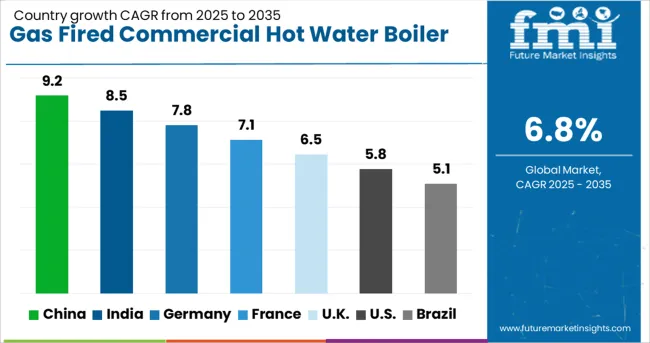

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| U.K. | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global gas-fired commercial hot water boiler market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads with 9.2%, followed by India at 8.5% and Germany at 7.8%. France records 7.1%, while the United Kingdom posts 6.5%. Growth is fueled by rising energy efficiency requirements, infrastructure development, and modernization of heating systems in commercial spaces. China and India dominate due to strong construction activity and stringent energy norms, while Germany prioritizes condensing boiler technology. France and the UK emphasize hybrid systems integrating renewable energy sources for carbon reduction goals.

China is forecast to grow at 9.2%, driven by rapid urban development and strict emission control mandates. Condensing boilers dominate installations for improved energy efficiency and compliance with low-NOx standards. Manufacturers invest in IoT-enabled monitoring systems to enhance operational reliability. Expansion of district heating projects further boosts market penetration.

India is projected to grow at 8.5%, supported by increased adoption in hospitality, healthcare, and institutional facilities. Compact, modular boilers dominate installations for space-limited commercial buildings. Manufacturers focus on cost-efficient condensing systems to address affordability concerns. Rising government initiatives for energy-efficient equipment drive demand across metropolitan regions.

Germany is expected to grow at 7.8%, driven by stringent EU energy directives and increasing retrofitting projects. High-efficiency condensing boilers dominate premium installations across hotels, offices, and industrial facilities. Manufacturers integrate smart controls for predictive maintenance and energy savings. The country’s decarbonization roadmap supports hybrid systems with renewable integration.

France is projected to grow at 7.1%, supported by modernization of heating systems and expansion in commercial real estate. Wall-hung condensing boilers dominate space-constrained commercial buildings. Manufacturers introduce low-emission burners to comply with evolving environmental standards. Demand for hybrid heating models combining solar thermal and gas solutions is increasing.

The UK is forecast to grow at 6.5%, driven by decarbonization strategies and replacement of aging heating systems. Floor-standing condensing boilers dominate installations in large commercial spaces. Manufacturers integrate AI-driven energy optimization for reduced operational costs. Hybrid systems combining gas and heat pumps gain traction in compliance-driven projects.

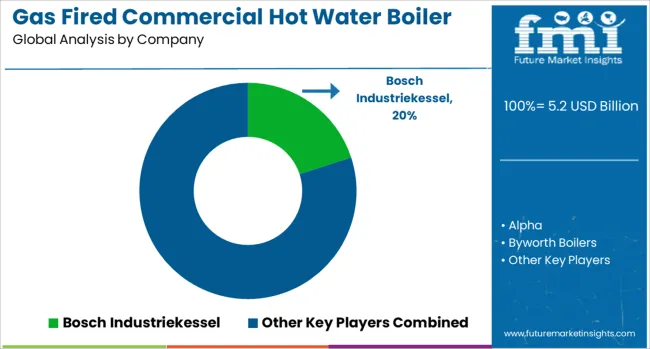

The gas-fired commercial hot water boiler market is moderately consolidated, with Bosch Industriekessel recognized as a leading player through its high-efficiency condensing and non-condensing boiler systems designed for commercial and institutional applications. Bosch leverages advanced thermal technology and robust distribution networks to maintain its leadership position.

Key players include Alpha, Byworth Boilers, CFB Boilers, Cochran, ECR International, Energy Kinetics, FERROLI, Fulton, P.M. Lattner Manufacturing, Parker Boiler, Remeha, Suntec Energy Systems, Thermal Solutions, Thermon, and Viessmann. These companies offer a wide range of commercial boilers that prioritize energy efficiency, low emissions, and reliable operation for sectors such as hospitality, healthcare, education, and manufacturing. Market demand is driven by increasing energy efficiency regulations, modernization of heating infrastructure, and the need for reliable hot water systems in high-capacity commercial settings.

Leading manufacturers are investing in digital monitoring technologies, modular designs, and hybrid systems integrating renewable energy sources. Additionally, compact, easy-to-install units and remote control capabilities are becoming key differentiators for customers. Growth is particularly strong in North America and Europe due to stringent emission norms, while Asia-Pacific offers significant potential owing to rapid commercial construction and industrial expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Capacity | ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 25 MMBTU/hr, > 25 - 50 MMBTU/hr, and > 50 MMBTU/hr |

| Application | Healthcare facilities, Offices, Educational institutions, Lodgings, Retail stores, and Others |

| Technology | Condensing and Non-condensing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch Industriekessel, Alpha, Byworth Boilers, CFB Boilers, Cochran, ECR International, Energy Kinetics, FERROLI, Fulton, P.M. Lattner Manufacturing, Parker Boiler, Remeha, Suntec Energy Systems, Thermal Solutions, Thermon, and Viessmann |

| Additional Attributes | Dollar sales by boiler capacity and efficiency type, regional demand trends (Asia-Pacific fastest; Europe regulations driving), competitive landscape, buyer preferences for low-NOₓ condensing systems, integration with IoT and building automation systems, innovations in smart monitoring and emissions control. |

The global gas fired commercial hot water boiler market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the gas fired commercial hot water boiler market is projected to reach USD 10.1 billion by 2035.

The gas fired commercial hot water boiler market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in gas fired commercial hot water boiler market are ≤ 0.3 - 2.5 mmbtu/hr, > 2.5 - 10 mmbtu/hr, > 10 - 25 mmbtu/hr, > 25 - 50 mmbtu/hr and > 50 mmbtu/hr.

In terms of application, healthcare facilities segment to command 36.2% share in the gas fired commercial hot water boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Boiler Water Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Gensets Market Size and Share Forecast Outlook 2025 to 2035

Commercial Hot Dog Cooker Market Size and Share Forecast Outlook 2025 to 2035

Commercial Boiler Market

Gas Insulated Commercial Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Waterproof Orthotics Market

Underwater Hotel Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA