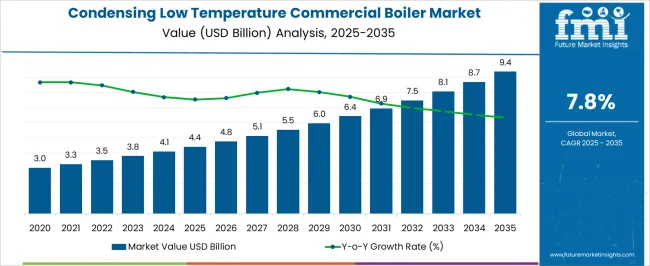

The condensing low-temperature commercial boiler market is valued at USD 4.4 billion in 2025 and is set to grow to USD 9.4 billion by 2035, with a CAGR of 7.8%. In the first five years from 2021 to 2025, the market experiences steady growth from USD 3.0 billion to USD 4.4 billion. This progression is driven by increasing demand for energy-efficient heating solutions in commercial buildings. The shift towards low-emission and eco-friendly technologies, alongside the adoption of smart control systems, bolsters this growth.

Between 2026 and 2030, the market strengthens further, advancing from USD 4.4 billion to USD 6.4 billion. Annual values move from USD 4.8 billion to USD 5.5 billion, 6.0 billion, and 6.4 billion, as commercial sectors increasingly prioritize sustainability and cost efficiency. Innovations in boiler design, fuel efficiency, and heat recovery systems play a key role in driving adoption.

| Metric | Value |

|---|---|

| Condensing Low Temperature Commercial Boiler Market Estimated Value in (2025 E) | USD 4.4 billion |

| Condensing Low Temperature Commercial Boiler Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The heating, ventilation, and air conditioning (HVAC) market is a major contributor, accounting for about 30-35%, as these boilers are integral to efficient heating systems in commercial buildings where temperature control and energy efficiency are essential. The commercial heating equipment market plays a direct role, contributing approximately 25-30%, as low-temperature condensing boilers are widely used in offices, retail spaces, and factories, providing reliable and efficient heating.

The energy efficiency and green building market drives demand for these boilers, contributing around 15-20%, as they are favored in eco-friendly construction projects due to their energy-saving capabilities. The industrial boilers market also plays a part, accounting for about 10-15%, as many industrial facilities, such as food processing and chemical production, rely on low-temperature condensing boilers for heating applications.

The renewable energy market contributes around 8-10%, with these boilers being integrated into systems that combine renewable energy sources like solar or heat pumps with conventional heating, optimizing energy use. These parent markets highlight the widespread adoption of condensing low-temperature commercial boilers, particularly in industries focusing on energy efficiency, sustainability, and reliable heating solutions.

The condensing low temperature commercial boiler market is expanding steadily due to the growing emphasis on energy efficiency, cost savings, and compliance with stringent emission regulations. Rising demand from commercial establishments such as offices, hotels, and educational institutions for reliable and environmentally sustainable heating solutions has been a major driver.

Technological advancements in heat exchanger design, digital control systems, and integration with building management systems have further enhanced efficiency and operational performance. Government incentives and rebate programs promoting high efficiency heating equipment are also encouraging adoption.

The market outlook remains positive as building operators increasingly prioritize systems that minimize operational costs, reduce greenhouse gas emissions, and align with long term sustainability targets.

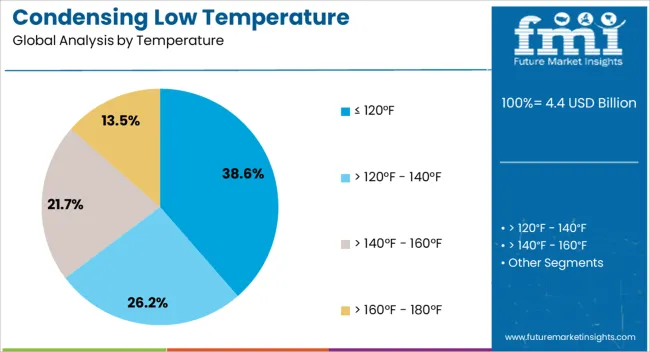

The condensing low temperature commercial boiler market is segmented by temperature, capacity, fuel, application, and geographic regions. By temperature, condensing low temperature commercial boiler market is divided into ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F. In terms of capacity, condensing low temperature commercial boiler market is classified into ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr.

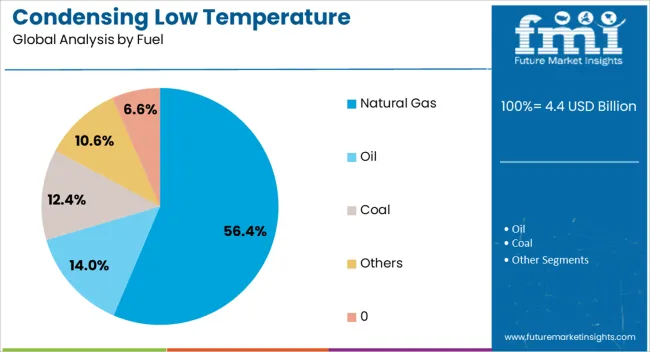

Based on fuel, condensing low temperature commercial boiler market is segmented into Natural Gas, Oil, Coal, Others, and .. By application, condensing low temperature commercial boiler market is segmented into Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others. Regionally, the condensing low temperature commercial boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 120°F temperature segment is expected to account for 38.60% of total revenue by 2025, making it a key contributor within the temperature category. This dominance is supported by its ability to optimize condensing efficiency, reduce fuel consumption, and deliver consistent heating performance in low-temperature applications.

Adoption has been reinforced by compatibility with underfloor heating and low-temperature radiators, both of which benefit from enhanced efficiency at reduced water temperatures.

The segment’s strong performance is also linked to increased awareness of operational cost savings and environmental benefits in commercial heating systems.

The natural gas segment is set to hold 56.40% of total market revenue by 2025 within the fuel category, making it the dominant choice. The preference for natural gas is driven by its cost-effectiveness, widespread availability, and lower carbon emissions compared to other fossil fuels.

Advancements in burner technology and combustion control systems have increased the efficiency and reliability of natural gas boilers.

Additionally, policy incentives favoring cleaner-burning fuels have reinforced their adoption in commercial heating applications, ensuring their continued leadership in the market.

The condensing low-temperature commercial boilers, which operate at lower temperatures and condense flue gases to recover heat, provide higher efficiency and reduced energy consumption. The drive for cost savings, regulatory mandates on energy efficiency, and growing awareness of environmental impact are key factors propelling market demand. Challenges include the high initial installation cost and the need for regular maintenance and servicing.

Opportunities exist in the development of hybrid systems, integration with renewable energy sources, and expansion into emerging markets. Trends indicate greater adoption of smart boilers with IoT capabilities, offering improved monitoring and control for better energy management. Suppliers offering advanced, cost-effective, and high-performance condensing boilers are positioned for long-term growth in the global market.

The condensing low-temperature commercial boiler market is driven by the growing demand for energy-efficient heating solutions in various commercial and industrial sectors. As governments impose stricter energy efficiency regulations, businesses are opting for high-efficiency heating systems to reduce energy consumption and operational costs. Condensing boilers, which recover heat from exhaust gases and reintroduce it into the system, are considered the ideal solution to meet these requirements. The rising cost of energy and the focus on reducing carbon footprints are also major drivers of this trend. These boilers offer the dual benefit of reducing energy consumption while improving heating performance, making them highly attractive for a wide range of applications in commercial buildings, manufacturing facilities, and other commercial establishments.

The market for condensing low-temperature commercial boilers faces several challenges, particularly related to the high initial cost of installation and system integration. These boilers require advanced materials and a complex design to operate efficiently, which increases the overall investment required for businesses. Additionally, the need for regular maintenance and servicing can further drive up operating costs over the lifespan of the system. Regulatory constraints, including compliance with local and international emissions standards, also add complexity to the market. Supply chain challenges for specialized components and raw materials can lead to price fluctuations, affecting the availability and affordability of condensing boilers. Manufacturers must focus on optimizing production processes, reducing installation costs, and ensuring compliance with evolving regulations to remain competitive in the market.

There are significant opportunities in the development of hybrid systems that combine condensing low-temperature boilers with renewable energy sources such as solar and geothermal. These systems offer businesses a way to reduce their reliance on fossil fuels while further improving energy efficiency. Integration with smart building management systems that enable remote monitoring and control can enhance the appeal of these boilers, allowing businesses to optimize energy usage in real-time. Moreover, as emerging markets, particularly in Asia and Africa, continue to industrialize, there is increased demand for advanced and energy-efficient heating solutions. Suppliers that focus on offering integrated heating solutions, combining conventional and renewable energy sources, are poised to tap into these growing markets, creating long-term growth opportunities.

The condensing low-temperature commercial boiler market is trending toward the integration of smart technologies, particularly the Internet of Things (IoT). These smart boilers are equipped with sensors and connected to cloud-based platforms, allowing for real-time monitoring, diagnostics, and performance optimization. IoT-enabled boilers can track energy usage, detect system inefficiencies, and provide predictive maintenance alerts, improving overall operational efficiency. The ability to remotely control and monitor these systems is highly beneficial for large commercial operations, as it reduces the need for on-site interventions and optimizes energy consumption.

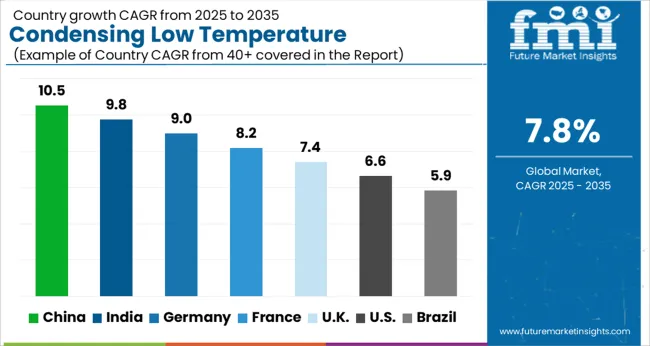

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

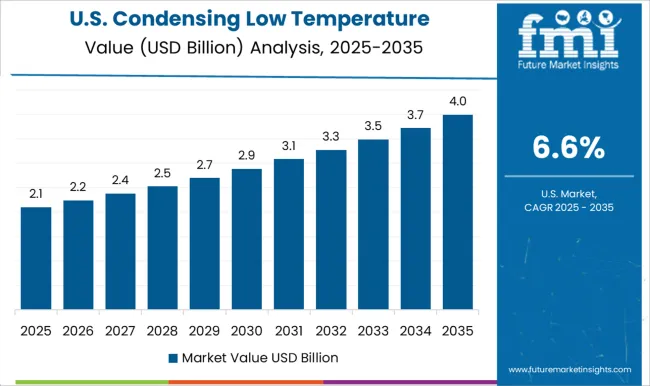

| USA | 6.6% |

| Brazil | 5.9% |

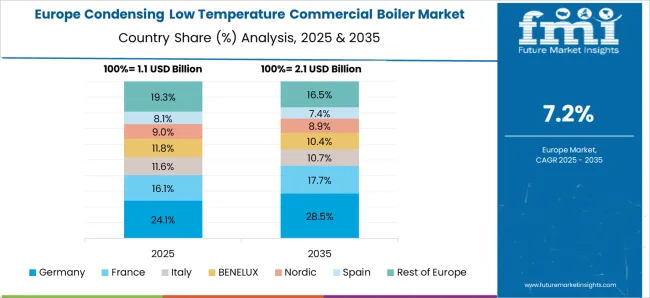

The global condensing low-temperature commercial boiler market is projected to grow at a CAGR of 7.8% from 2025 to 2035. China leads with 10.5%, followed by India at 9.8%, and France at 8.2%. The UK and USA show moderate growth at 7.4% and 6.6%, respectively. Demand is primarily driven by the need for energy-efficient heating solutions, with governments offering financial incentives and subsidies. Industries and commercial establishments are increasingly adopting these boilers to reduce operational costs, meet energy consumption regulations, and contribute to environmental goals. The growth is supported by expanding infrastructure and commercial construction sectors worldwide. The analysis covers 40+ countries, with leading markets outlined below.

The condensing low-temperature commercial boiler market in China is projected to grow at a robust CAGR of 10.5% from 2025 to 2035. The country’s rapid industrialization and urbanization are the major drivers behind the rising demand for energy-efficient heating solutions. China’s commitment to improving energy efficiency across industries is fueling the adoption of condensing boilers, which offer better performance and lower operational costs. The booming real estate and commercial construction sectors further contribute to market growth, as these boilers are increasingly used in commercial buildings, offices, and large facilities. The government’s push toward reducing carbon emissions and promoting eco-friendly technologies is bolstering the demand for high-efficiency boilers. With stringent environmental regulations, the preference for condensing boilers, which maximize heat recovery and reduce energy consumption, is expected to rise.

The condensing low-temperature commercial boiler market in India is expected to grow at a CAGR of 9.8% from 2025 to 2035. The country’s growing commercial infrastructure, including hotels, hospitals, and industrial facilities, is fueling demand for energy-efficient heating solutions. The increasing focus on reducing energy costs and carbon footprints across various sectors is also driving the adoption of condensing boilers. India’s strong push toward green building technologies and the government's energy efficiency programs are accelerating the market’s growth. Industrial sectors like food processing, pharmaceuticals, and textiles are increasingly opting for these boilers to improve operational efficiency and comply with energy consumption norms. With the rise in commercial construction and industrial expansion, the demand for reliable, low-maintenance, and cost-effective heating solutions like condensing boilers is expected to surge.

The condensing low-temperature commercial boiler market in France is expected to grow at a CAGR of 8.2% from 2025 to 2035. The demand for energy-efficient heating solutions is increasing as industries and commercial establishments in France seek ways to reduce energy consumption and adhere to stringent energy efficiency regulations. The French government has been offering financial incentives and subsidies to encourage the adoption of eco-friendly technologies, which further enhances the market for condensing boilers. The growing emphasis on green building practices and energy-efficient commercial properties is also driving the demand for these heating systems. The shift toward renewable energy sources and eco-conscious solutions is contributing to the growth of the condensing boiler market in France.

The UK condensing low-temperature commercial boiler market is projected to grow at a CAGR of 7.4% from 2025 to 2035. The country’s stringent regulations on energy efficiency, combined with increasing awareness about the environmental impact of traditional heating systems, are driving the demand for condensing boilers. The UK government’s push for net-zero emissions by 2050 has also created a favorable market environment for energy-efficient solutions. Commercial buildings, including offices, schools, and hospitals, are increasingly adopting these boilers to reduce operational costs and improve overall efficiency. With the rise of renewable energy integration in the commercial sector, condensing boilers are expected to play a key role in meeting energy-saving targets.

The USA condensing low-temperature commercial boiler market is projected to grow at a CAGR of 6.6% from 2025 to 2035. As energy efficiency becomes a focal point across various industries, demand for condensing boilers is steadily increasing. The USA commercial sector, including retail, hospitality, and healthcare, is increasingly adopting these high-efficiency systems to lower heating costs and improve energy use. The USA government’s initiatives, including tax incentives for energy-efficient technologies, are boosting the adoption of condensing boilers. As more companies focus on reducing their carbon footprint, these boilers are becoming a popular choice due to their ability to provide high heating efficiency while minimizing fuel consumption.

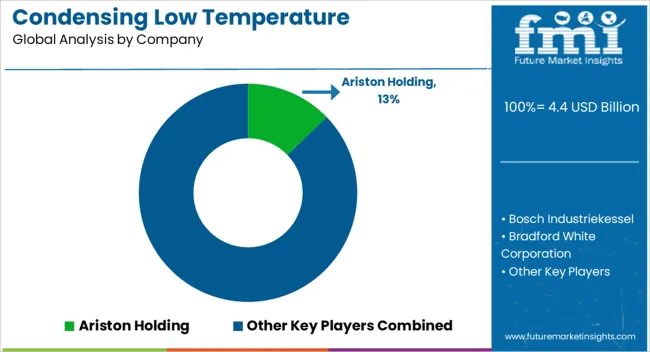

In the condensing low-temperature commercial boiler market, competition is largely driven by energy efficiency, reliability, and advanced technology. Ariston Holding stands out with its high-performance, energy-efficient condensing boilers, catering to commercial and industrial needs. The company emphasizes user-friendly designs and integration with smart home and building management systems. Bosch Industriekessel is a major competitor, known for providing reliable and highly efficient condensing boilers. The company’s solutions are widely used in both large-scale commercial heating and industrial applications, focusing on low-emission systems and robust performance. Bradford White Corporation and Burnham Commercial Boilers target the USA market with their durable and energy-efficient boiler systems. Both brands offer a range of products with varying capacities, emphasizing design versatility and compliance with local regulations. Cleaver-Brooks provides advanced condensing boiler technology, focusing on cutting-edge controls, fuel flexibility, and cost-effective energy solutions, primarily in industrial settings. De Dietrich and Ferroli bring innovation in condensing boiler technology, focusing on environmentally-friendly, compact solutions suitable for both residential and commercial applications, with a strong focus on low operating costs and extended service life. Fondital and Fulton offer competitive products, focusing on high efficiency and robust design suited for diverse commercial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Temperature | ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F |

| Capacity | ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Fuel | Natural Gas, Oil, Coal, Others, and . |

| Application | Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ariston Holding, Bosch Industriekessel, Bradford White Corporation, Burnham Commercial Boilers, Cleaver-Brooks, De Dietrich, Ferroli, Fondital, Fulton, Hoval, Hurst Boiler & Welding, Precision Boilers, Vaillant Group International, Viessmann, Weil-McLain, and Wolf |

| Additional Attributes | Dollar sales by boiler type (wall-mounted, floor-standing), heating capacity (small, medium, large-scale), and fuel type (gas, oil, electric). Demand dynamics are influenced by rising energy efficiency regulations, growing commercial and industrial building projects, and the shift towards eco-friendly and sustainable heating solutions. Regional trends indicate strong growth in Europe, North America, and Asia-Pacific, driven by energy efficiency mandates, stringent environmental regulations, and the demand for low-carbon, high-efficiency heating systems in commercial sectors. |

The global condensing low temperature commercial boiler market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the condensing low temperature commercial boiler market is projected to reach USD 9.4 billion by 2035.

The condensing low temperature commercial boiler market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in condensing low temperature commercial boiler market are ≤ 120°f, > 120°f - 140°f, > 140°f - 160°f and > 160°f - 180°f.

In terms of capacity, ≤ 0.3 - 2.5 mmbtu/hr segment to command 41.7% share in the condensing low temperature commercial boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Condensing Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Industrial Condensing Units Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Transportation Condensing Units Market Growth – Trends & Forecast 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA