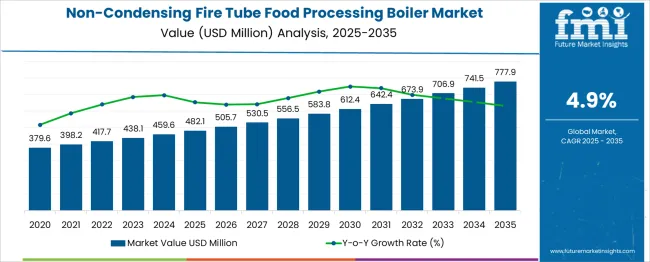

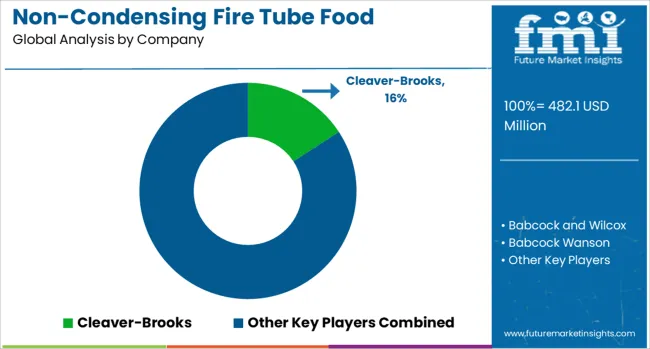

The Non-Condensing Fire Tube Food Processing Boiler Market is estimated to be valued at USD 482.1 million in 2025 and is projected to reach USD 777.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Non-Condensing Fire Tube Food Processing Boiler Market Estimated Value in (2025 E) | USD 482.1 million |

| Non-Condensing Fire Tube Food Processing Boiler Market Forecast Value in (2035 F) | USD 777.9 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The non-condensing fire tube food processing boiler market continues to demonstrate stable demand, driven by the food industry's need for reliable, high-temperature steam generation across a wide range of processing operations. These boilers are favored for their ease of installation, robust construction, and suitability for consistent performance in medium- to high-pressure applications.

While energy efficiency and emission reduction have become growing priorities, non-condensing models remain relevant in facilities prioritizing capital cost, operational simplicity, and space-saving designs. Market expansion is also supported by modernization of older food processing plants and rising demand for processed and packaged food globally.

As manufacturers focus on meeting safety and compliance standards, advancements in control systems and heat transfer technologies are further enhancing product value. With ongoing investment in industrial infrastructure and capacity expansion by food manufacturers, the demand for reliable boiler systems is expected to remain steady over the coming years.

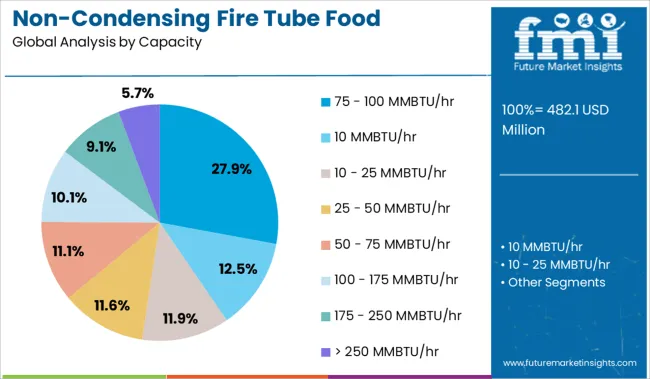

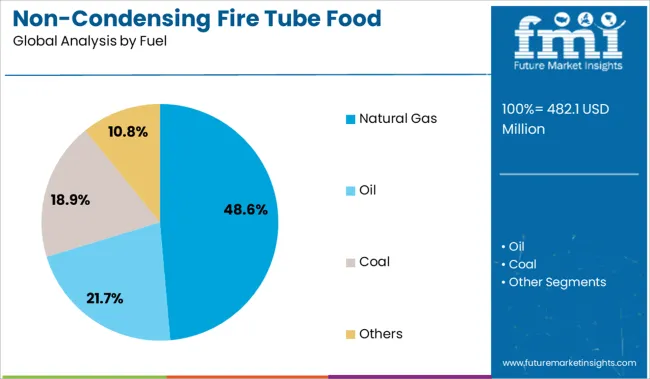

The non-condensing fire tube food processing boiler market is segmented by capacity and fuel, and geographic regions. The capacity of the non-condensing fire tube food processing boiler market is divided into 75 - 100 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr. In terms of fuel, the non-condensing fire tube food processing boiler market is classified into Natural Gas, Oil, Coal, and Others. Regionally, the non-condensing fire tube food processing boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 75 – 100 MMBTU/hr capacity segment holds a leading 27.9% market share, owing to its balance of output capacity and efficiency, making it well-suited for mid- to large-scale food processing operations. This range offers sufficient steam output for a variety of food preparation, sterilization, and packaging tasks without incurring excessive operational complexity.

Its dominance is underpinned by widespread adoption in facilities with consistent production loads, where reliability and cost control are paramount. Manufacturers favor this segment due to its strong demand across dairy, meat, and bakery sectors, where precise temperature regulation is essential.

This capacity range is also frequently selected during facility upgrades and replacements due to its compatibility with existing systems. As automation in food processing grows and batch sizes increase, the 75 – 100 MMBTU/hr category is expected to remain a preferred choice among operators seeking durable and adaptable boiler systems.

Natural gas dominates the fuel category with a 48.6% share in the non-condensing fire tube food processing boiler market, driven by its cleaner-burning properties, high energy efficiency, and cost competitiveness. It has become the preferred choice for food manufacturers aiming to reduce operational emissions while maintaining consistent heat delivery.

Natural gas-fired boilers are valued for their fast start-up times, ease of maintenance, and compatibility with automation systems, supporting smooth and uninterrupted processing workflows. Regulatory incentives and infrastructure developments promoting cleaner industrial fuel use have further accelerated adoption.

As energy policies increasingly favor low-emission sources, food processing facilities are more inclined to transition from oil or coal-based systems to natural gas. The segment is expected to maintain its leadership due to favorable pricing trends, availability of pipeline infrastructure, and the food industry’s emphasis on sustainability and compliance with evolving environmental standards.

The need for energy-efficient, multi-fuel compatible boilers that ensure consistent heat transfer and lower emissions in large-scale food processing. Emphasis on safety, compliance, and automation adoption further boosts demand for reliable, low-maintenance systems.

The demand for non-condensing fire tube boilers in food processing has been influenced by the rising need for energy efficiency and precise thermal control during large-scale production. These boilers are widely selected for their ability to provide consistent heat transfer, ensuring steady cooking, sterilization, and drying processes in bakeries, beverage units, and meat processing facilities. Regulatory pressures on reducing operational emissions have further driven manufacturers to incorporate advanced combustion systems and optimized burner designs. The compatibility of these boilers with multiple fuel types has improved adoption in regions where natural gas access is limited, making them a cost-effective choice for diverse production facilities that require high reliability in continuous operations.

Operational safety and reliability have remained crucial considerations in the food processing sector, particularly for steam and hot water applications that demand precise temperature maintenance. Non-condensing fire tube boilers are preferred for their robust construction, simplified maintenance, and long service life, which reduces downtime in high-output environments. Industry-specific compliance norms related to food safety and thermal performance have encouraged investments in models featuring enhanced pressure control and monitoring systems. The rising adoption of automation for boiler management has helped operators optimize performance and lower fuel consumption, reinforcing their suitability in plants seeking streamlined operations without compromising heat quality or safety.

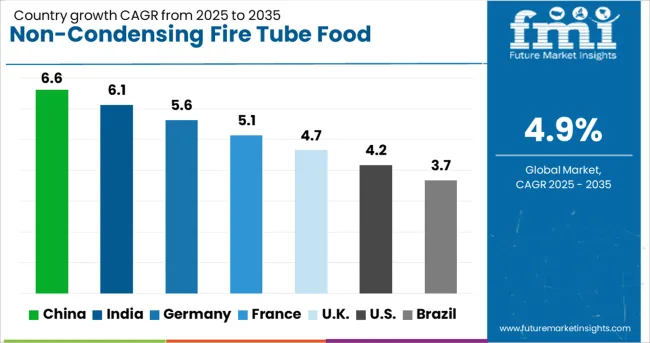

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

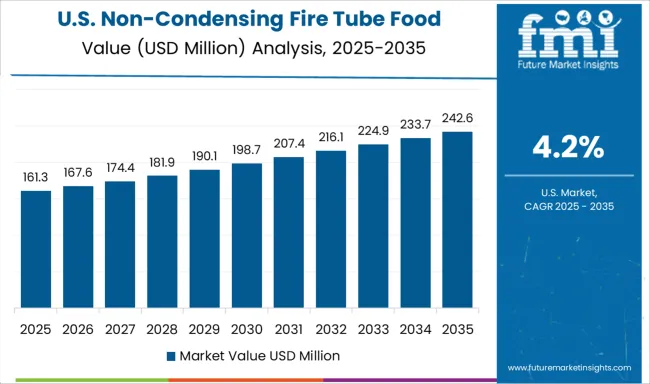

| USA | 4.2% |

| Brazil | 3.7% |

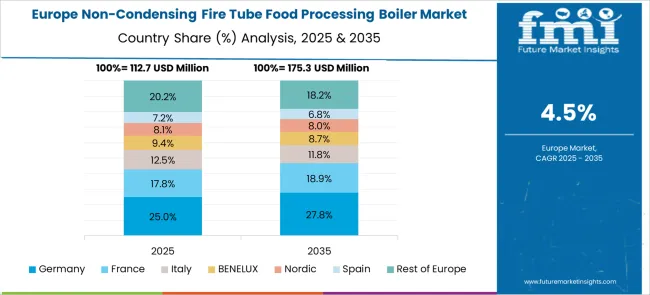

The non-condensing fire tube food processing boiler market, projected to grow at a global CAGR of 4.9% from 2025 to 2035, shows diverse growth patterns across leading economies. China, a BRICS nation, leads with a CAGR of 6.6%, supported by the modernization of food processing facilities, higher demand for energy-efficient thermal systems, and government-backed food safety initiatives. India follows at 6.1%, driven by expansion in dairy, bakery, and beverage processing plants, coupled with rising adoption of reliable steam generation solutions. Germany records 5.6%, propelled by strict EU energy efficiency mandates and retrofitting in advanced food manufacturing units. The UK posts 4.7%, influenced by investments in packaged food operations and sustainability-focused boiler upgrades despite cost concerns. The USA sees a 4.2% CAGR, shaped by the steady modernization of aging boiler systems and emphasis on compliance with emission standards. BRICS countries lead through rapid capacity additions and affordable solutions, while OECD markets focus on advanced designs, automation, and regulatory-driven efficiency improvements. The report includes a detailed analysis of 40+ nations, with the top five markets highlighted for reference.

The CAGR of the USA non-condensing fire tube food processing boiler market moved from nearly 3.6% during 2020-2024 to 4.2% for 2025-2035, influenced by higher investments in process heating for the meat and bakery industries. Regulatory standards for thermal efficiency have driven the replacement of older units with modern boilers offering optimized heat distribution. Equipment durability and ability to support multi-shift production cycles have become critical as food plants scale up output. The shift toward natural gas as a preferred energy source has supported cost-efficiency while limiting compliance risks. Integration of automated controls for steam regulation in large-scale operations is also shaping demand for premium-grade models in the country.

The CAGR in the UK rose from about 3.8% in 2020-2024 to 4.7% for 2025-2035, supported by modernization across bakery and ready-meal facilities. Rising adoption of gas-fired systems has with efforts to maintain lower fuel expenditure without switching to condensing models. Post-Brexit regulatory alignment has encouraged localized sourcing of boiler components, ensuring uninterrupted supply to processing plants. Regional food manufacturers have shown a preference for compact fire tube designs that meet capacity constraints while ensuring compliance with safety standards. Automation in temperature and pressure control systems is increasingly integrated to reduce operational risks in multi-line facilities.

Germany’s CAGR improved from 4.9% during 2020–2024 to 5.6% over 2025–2035, driven by demand in dairy and beverage processing plants. The preference for durable boilers that maintain thermal consistency across long production cycles has remained strong, especially for high-volume dairy operations. Compliance with EU thermal safety regulations has pushed for advanced combustion systems and enhanced insulation. Large-scale brewery expansions have also contributed to market momentum, with breweries favoring fire tube boilers for steady steam output. Increased automation integration in food facilities has further raised adoption of models with advanced monitoring and control features for energy optimization.

China’s market advanced from a CAGR of 5.3% during 2020–2024 to 6.6% for 2025–2035, led by government-backed modernization of food infrastructure and expansion in large-scale meat and noodle production plants. Domestic manufacturers are scaling output of high-capacity fire tube boilers to meet rising demand for continuous heat supply in processing lines. Cost competitiveness and localized service networks have encouraged adoption among Tier 2 and Tier 3 industrial zones. Regional food clusters have adopted energy optimization frameworks, boosting the preference for automated boiler systems integrated with heat recovery features for operational efficiency.

India’s CAGR climbed from about 5.4% in 2020–2024 to 6.1% in the 2025–2035 period, fueled by investments in snack and confectionery manufacturing facilities. Food processing parks under government-backed industrial programs have adopted high-capacity fire tube boilers for bulk cooking and sterilization needs. The market has also benefited from increasing preference for solid-fuel compatible systems in areas where natural gas availability is limited. Strategic alliances between boiler OEMs and contract manufacturing units have accelerated distribution across emerging industrial corridors. Boiler automation for precise heat regulation is becoming more common as plants optimize costs while maintaining consistency in product quality.

In the non-condensing fire tube boiler segment, leading manufacturers are focused on enhancing thermal efficiency, integrating automation for temperature control, and improving system safety for large-scale food processing operations. Companies like Cleaver-Brooks, Babcock and Wilcox, and Babcock Wanson are investing in high-capacity boilers with optimized combustion systems to reduce operational costs. Bosch Industriekessel and Viessmann emphasize modular solutions designed for multi-shift production environments, while Forbes Marshall and Thermax are expanding offerings tailored to regional fuel availability. Mid-sized players such as Clayton Industries, Fulton, and Hurst Boiler cater to specialized needs, including compact configurations for space-constrained facilities. Miura America and Hoval are prioritizing low-maintenance systems that ensure consistent heat output, while Cochran, Johnston Boiler, BM GreenTech, and Thermodyne Boilers are gaining traction through cost-effective units with automation-enabled monitoring features for improved reliability and operational safety.

In February 2025, Cleaver Brooks launched the EOS 500 Burner Control System, a high-precision parallel-positioning burner control with integrated flame safeguard capabilities on its official site.

| Item | Value |

|---|---|

| Quantitative Units | USD 482.1 Million |

| Capacity | 75 - 100 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 25 - 50 MMBTU/hr, 50 - 75 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Fuel | Natural Gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cleaver-Brooks, Babcock and Wilcox, Babcock Wanson, BM GreenTech, Bosch Industriekessel, Clayton Industries, Cochran, Forbes Marshall, Fulton, Hoval, Hurst Boiler, Johnston Boiler, Miura America, Thermax, Thermodyne Boilers, and Viessmann |

| Additional Attributes | Dollar sales, share by region, capacity segment performance, competitive pricing benchmarks, adoption trends in food sectors, fuel preference patterns, regulatory compliance impact, automation integration rates, and regional growth projections. |

The global non-condensing fire tube food processing boiler market is estimated to be valued at USD 482.1 million in 2025.

The market size for the non-condensing fire tube food processing boiler market is projected to reach USD 777.9 million by 2035.

The non-condensing fire tube food processing boiler market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in non-condensing fire tube food processing boiler market are 75 - 100 mmbtu/hr, 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of fuel, natural gas segment to command 48.6% share in the non-condensing fire tube food processing boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Condensing Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA