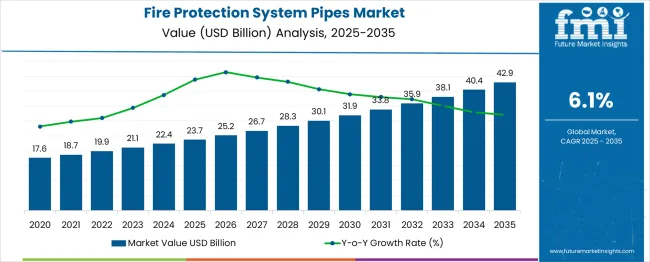

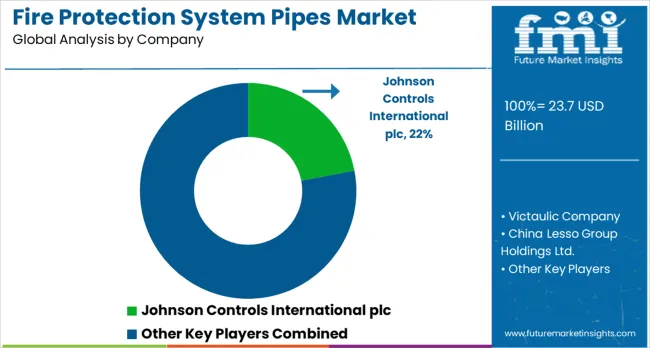

The market is estimated at USD 23.7 billion in 2025 and is expected to reach USD 42.9 billion by 2035, reflecting a CAGR of 6.1%. Saturation point analysis suggests that the market is on a steady upward trajectory but has not yet reached maturity, with room for expansion across commercial, industrial, and residential infrastructure projects. The moderate CAGR indicates a controlled pace of growth, implying that demand will remain stable without abrupt surges. While adoption is widespread, the market is far from saturation, as modernization of existing infrastructure and stricter regulatory frameworks continue to drive replacement and upgrade cycles. This points to sustained opportunities before approaching any plateau in market expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 23.7 billion |

| Forecast Value in (2035F) | USD 42.9 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The market has grown steadily in recent years, supported by stricter safety regulations, rising construction activity, and increased awareness of fire risk management. Historical year-on-year (YoY) growth data shows moderate volatility, with annual expansion ranging between 4% and 7%, depending on regional demand cycles and raw material price fluctuations. Based on this volatility, three forward-looking scenarios can be developed. In the optimistic scenario, strong construction sector recovery, widespread adoption of advanced fire safety codes, and investment in industrial infrastructure could push YoY growth toward 7% to 8%, driving faster market expansion. The base scenario assumes that growth will remain aligned with historical averages, with YoY increases of 5% to 6% supported by stable demand across commercial and residential segments.

The pessimistic scenario considers potential challenges such as economic slowdowns, fluctuations in steel prices, or delays in safety regulation enforcement. Under these conditions, YoY growth may decline to 3% to 4%, with weaker construction activity and budget constraints limiting new installations. While such downside risks could temporarily slow expansion, long-term demand for fire protection infrastructure remains resilient. The scenario analysis highlights that despite short-term uncertainties, the market has a stable foundation, with optimistic and base projections showing strong potential and pessimistic conditions likely to only moderate rather than reverse growth.

Market expansion is being supported by the increasing focuses on fire safety regulations and the corresponding demand for compliant fire protection infrastructure that can ensure reliable water delivery for sprinkler and suppression systems. Modern building codes and safety standards are increasingly focused on comprehensive fire protection measures that require robust piping networks capable of delivering adequate water pressure and flow rates during fire events. Fire protection system pipes' proven reliability in maintaining system integrity and performance makes them essential components of life safety infrastructure across all building types.

The growing focuses on construction quality and building safety is driving demand for fire protection system pipes that can provide long-term reliability and meet stringent performance standards. Building owner preference for piping systems that combine durability with code compliance and ease of installation is creating opportunities for innovative pipe materials and joining technologies. The rising influence of insurance requirements and liability considerations is also contributing to increased adoption of high-quality fire protection piping systems that can ensure system reliability and reduce risk exposure.

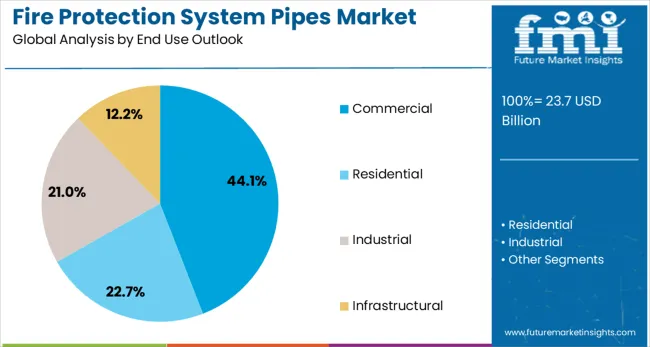

The market is segmented by material type, end use, and region. By material type, the market is divided into steel, CPVC, copper, and others. Based on end use, the market is categorized into commercial, residential, industrial, and infrastructural. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The steel segment is projected to account for 45.7% of the fire protection system pipes market in 2025, reaffirming its position as the dominant material choice. Building contractors and fire protection system designers increasingly prefer steel pipes for their superior strength, pressure resistance, and proven performance in demanding fire suppression applications. Steel pipes' well-documented durability and ability to withstand high water pressures and temperature variations directly address fire protection system requirements for long-term reliability and code compliance.

This material type forms the foundation of most fire protection piping installations, as it represents the most trusted and widely accepted solution across multiple building types and fire protection system designs. Manufacturer investments in corrosion-resistant steel formulations and advanced joining technologies continue to strengthen market adoption. With building owners prioritizing system reliability and regulatory compliance, steel pipes align with both performance requirements and industry standards, making them the central component of fire protection piping systems.

Commercial applications are projected to represent 44.1% of fire protection system pipes demand in 2025, underscoring their critical role in office buildings, retail centers, hotels, and other commercial properties. Building developers and facility managers prefer comprehensive fire protection systems for their ability to protect occupants and assets while meeting insurance and regulatory requirements. Positioned as essential infrastructure for commercial buildings, fire protection piping systems offer both life safety benefits and property protection advantages.

The segment is supported by continuous commercial construction activity and increasing adoption of advanced fire protection technologies in existing building retrofits. Additionally, commercial building operators are investing in fire protection system upgrades to maintain compliance with evolving safety codes and insurance requirements. As commercial real estate prioritizes tenant safety and regulatory compliance, fire protection system pipes will continue to dominate commercial applications while supporting comprehensive building safety strategies.

The market is advancing steadily due to increasing construction activity and growing focuses on fire safety compliance across building sectors. The market faces challenges including material cost volatility, installation complexity requirements, and competition from alternative fire suppression technologies. Innovation in pipe materials and joining systems continue to influence product development and market expansion patterns.

The growing adoption of smart building technologies is enabling integration of fire protection piping systems with building management platforms and IoT monitoring capabilities. Smart fire protection systems offer real-time monitoring of pipe pressure, flow rates, and system integrity that enhance building safety management. Building operators are increasingly recognizing the operational and safety advantages of connected fire protection infrastructure.

Modern pipe manufacturers are incorporating advanced material formulations, protective coatings, and corrosion-resistant technologies to improve fire protection pipe longevity and performance. These technologies enhance pipe durability while reducing maintenance requirements and providing better resistance to environmental factors. Advanced pipe designs also enable improved flow characteristics and reduced installation complexity for enhanced system performance.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

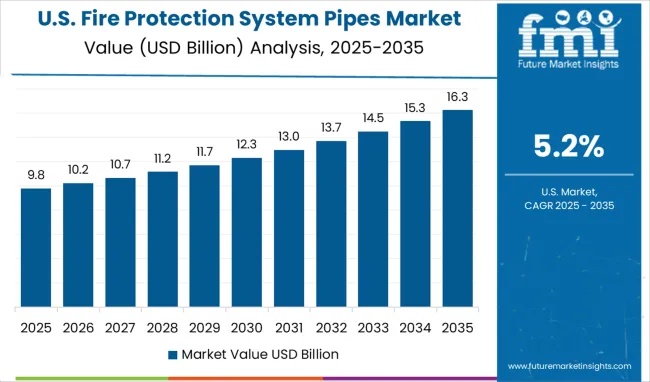

| U.S. | 5.2% |

| Brazil | 4.6% |

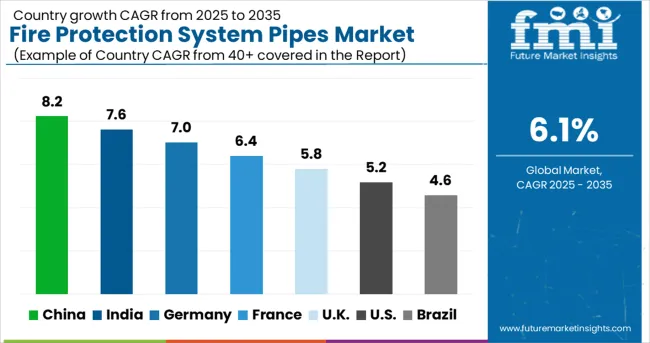

The global market is expected to grow at a CAGR of 6.1% between 2025 and 2035, driven by stricter safety regulations and increasing infrastructure development. China leads with 8.2% growth, supported by rapid urban construction and rising adoption of advanced fire safety systems. India follows at 7.6%, reflecting growing industrial expansion and government initiatives to improve building safety standards. Germany records 7.0%, driven by strong regulatory frameworks and demand for high-quality piping solutions in commercial and industrial facilities. France is projected at 6.4%, supported by modernization of existing infrastructure and emphasis on fire prevention. The U.K. grows at 5.8% with increasing upgrades to safety systems, while the U.S. expands at 5.2%, influenced by stringent safety codes and replacement of aging infrastructure. Brazil shows 4.6%, reflecting gradual adoption of fire protection standards. The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to grow at a CAGR of 8.2% during 2025–2035, driven by extensive construction activities and government mandates for advanced fire protection systems. Rapid urban infrastructure expansion and industrial development have led to widespread demand for certified fire protection pipes. Domestic manufacturers and multinational players have invested in local production facilities and advanced coating technologies to meet standards. Steel pipes with enhanced corrosion resistance and CPVC pipes have gained significant adoption in high rise buildings, factories, and commercial complexes. Government oversight and national safety standards have reinforced compliance and accelerated technology integration. Rising adoption of smart fire systems has further supported growth.

India is forecasted to register a CAGR of 7.6% between 2025 and 2035, influenced by rising safety requirements in commercial complexes, manufacturing facilities, and residential developments. Adoption of fire protection system pipes has increased due to government regulations and insurance compliance standards. Domestic manufacturers have strengthened supply networks, while international players such as Tata Steel and Astral Pipes have focused on premium quality and innovative product lines. Growing construction activity across Tier 1 and Tier 2 cities has further supported demand. Continuous investment in industrial zones and high density buildings is anticipated to expand the market. CPVC and galvanized steel pipes remain the preferred choices due to reliability and low maintenance.

Germany is anticipated to expand at a CAGR of 7.0% during 2025–2035, supported by stringent building codes and industrial safety regulations. The market has experienced strong adoption of fire protection system pipes in commercial facilities, airports, and industrial manufacturing plants. Steel and ductile iron pipes are widely preferred due to durability and compliance with European standards. Companies such as Viega and Geberit have invested in expanding smart pipe systems and sustainable coating technologies. German industries have increasingly relied on prefabricated piping systems to reduce installation time and improve efficiency. Continued investment in infrastructure upgrades, coupled with advanced fire suppression technologies, is expected to drive growth over the forecast period.

France is projected to grow at a CAGR of 6.4% from 2025 to 2035, influenced by strict safety compliance frameworks in commercial and public infrastructure. Adoption of CPVC and galvanized steel pipes has risen in offices, hospitals, and residential complexes due to their reliability and long life cycle. The government has reinforced adherence to safety standards such as APSAD and European directives, driving higher investments in certified systems. Market players have introduced prefabricated and corrosion resistant pipes to meet growing demand. Renovation of old building structures and retrofitting of fire protection systems have further supported adoption. France’s market is expected to remain stable, with growth concentrated in large metropolitan areas and high occupancy structures.

The United Kingdom is expected to grow at a CAGR of 5.8% during 2025–2035, supported by fire safety legislation and demand for advanced suppression systems in commercial and residential buildings. CPVC, galvanized steel, and ductile iron pipes have gained adoption due to adherence to British Standards and BSI certifications. Leading suppliers such as Wavin and Polypipe have emphasized product innovation, corrosion resistant solutions, and faster installation methods. The retrofitting of existing infrastructure and expansion of healthcare and educational facilities have boosted demand. Insurance-driven safety audits and inspections have further encouraged compliance with advanced fire protection systems across the UK.

The market in the United States is projected to expand at a CAGR of 5.2% from 2025 to 2035, driven by rising enforcement of fire safety codes across commercial, residential, and industrial buildings. Strict regulations set by NFPA and OSHA have pushed industries to upgrade or replace outdated fire suppression systems with advanced piping solutions. Steel and CPVC pipes are being increasingly adopted for their durability and compliance with safety standards. Leading providers such as Johnson Controls and Victaulic have focused on product innovation, prefabrication, and distribution expansion to meet rising demand. Investments in infrastructure modernization and awareness of workplace fire safety continue to support long term market growth.

Brazil is forecasted to grow at a CAGR of 4.6% during 2025–2035, driven by increasing fire safety requirements in commercial facilities, industrial plants, and high rise residential projects. The adoption of fire protection system pipes has been supported by government fire codes and insurance compliance policies. Steel and CPVC pipes are widely adopted due to their strength, cost effectiveness, and compliance with local safety standards. Domestic manufacturers have strengthened distribution channels, while international companies have introduced prefabricated and coated piping systems. Infrastructure modernization and safety awareness programs are expected to accelerate growth across major Brazilian cities, while rural adoption remains moderate.

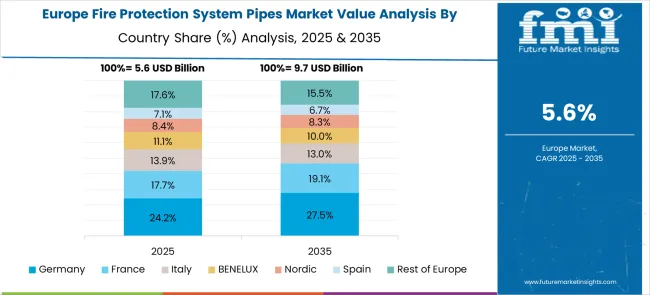

The market in Europe demonstrates mature development across major economies with Germany showing strong presence through its advanced construction industry and stringent fire safety regulations, supported by companies leveraging engineering expertise to implement high-quality fire protection piping solutions that focuses on reliability, compliance, and advanced installation techniques across commercial and industrial applications. France represents a significant market driven by its construction sector development and sophisticated understanding of fire protection requirements, with companies focusing on comprehensive fire protection piping systems that combine French engineering excellence with advanced pipe technologies for enhanced building safety and regulatory compliance in commercial and residential developments.

The UK exhibits considerable growth through its focuses on building safety standards and fire protection compliance, with strong adoption of advanced fire protection piping systems in commercial buildings, residential developments, and industrial facilities. Germany and France show expanding interest in pipe materials and smart fire protection applications, particularly in green building projects and intelligent building management systems. BENELUX countries contribute through their focus on construction quality and advanced building technologies, while Eastern Europe and Nordic regions display growing potential driven by increasing construction activity and expanding adoption of modern fire protection standards.

Competition in the market is highly influenced by product durability, compliance standards, and the ability to serve diverse construction projects. Johnson Controls International plc, Tyco Fire Products, and Victaulic Company compete through integrated solutions that combine piping with sprinklers, valves, and suppression systems. Their market strength lies in certification-backed reliability, global distribution, and advanced installation technologies that reduce project timelines. Victaulic, in particular, differentiates with mechanical joining systems that replace traditional welding, appealing to projects that demand speed and safety.

Tata Steel Limited and China Lesso Group Holdings Ltd. compete on scale and manufacturing strength. Tata Steel leverages its global reputation in high-grade steel pipes, ensuring strength and corrosion resistance for critical safety infrastructure. China Lesso, by contrast, leads in thermoplastic pipe production, offering cost-effective solutions widely adopted in Asia-Pacific markets. Both companies compete by ensuring large-volume availability and strong distribution networks.

Regional and mid-sized players, including Georg Fischer AG, Aliaxis Group, JM Eagle, Astral Pipes, and Zurn Industries LLC, compete by targeting cost-efficiency, lightweight alternatives, and adaptability. Georg Fischer and Aliaxis focus on modular systems that enhance flexibility, while JM Eagle and Astral Pipes position thermoplastic pipes as durable, low-maintenance options for both commercial and residential use. Zurn Industries strengthens its position by providing pipes that integrate seamlessly with fittings and water management systems.

The competitive environment is defined by certifications, technical specifications, and integration with fire suppression technologies. Larger multinational corporations compete on global scale and advanced system design, while regional firms compete through pricing, material innovation, and localized support. The market remains fragmented, with success driven by the ability to deliver safety assurance, long service life, and efficient installation tailored to customer needs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 23.7 billion |

| Material Type | Steel, CPVC, Copper, Others |

| End Use | Commercial, Residential, Industrial, Infrastructural |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Johnson Controls International plc, Victaulic Company, China Lesso Group Holdings Ltd., Tata Steel Limited, Georg Fischer AG, Aliaxis Group S.A., JM Eagle Inc., Astral Pipes, Tyco Fire Products, and Zurn Industries LLC |

| Additional Attributes | Dollar sales by material type and end use category, regional demand trends, competitive landscape, buyer preferences for steel versus alternative materials, integration with fire protection systems, innovations in pipe materials, joining technologies, and corrosion resistance advancement |

United States

Canada

Mexico

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

China

Japan

South Korea

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Brazil

Chile

Rest of Latin America

Kingdom of Saudi Arabia

Other GCC Countries

Turkiye

South Africa

Other African Union

Rest of Middle East & Africa

The global fire protection system pipes market is estimated to be valued at USD 23.7 billion in 2025.

The market size for the fire protection system pipes market is projected to reach USD 42.9 billion by 2035.

The fire protection system pipes market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in fire protection system pipes market are steel, cpvc, copper and others.

In terms of end use outlook, commercial segment to command 44.1% share in the fire protection system pipes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA