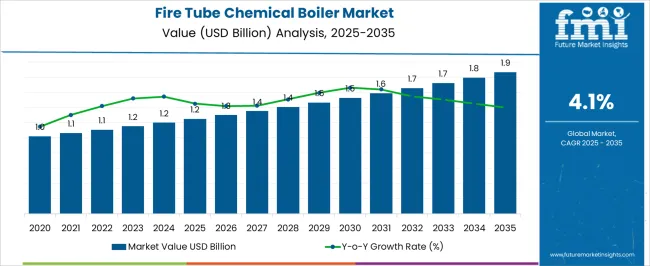

The fire tube chemical boiler market is expected to grow from USD 1.2 billion in 2025 to USD 1.9 billion by 2035, registering a 4.1% CAGR and generating an absolute dollar opportunity of USD 0.7 billion. Growth is driven by increasing demand for efficient steam generation in chemical, pharmaceutical, and industrial process applications. Fire tube boilers offer advantages such as compact design, ease of operation, and lower maintenance requirements, making them suitable for small- to medium-scale industrial setups globally. Acceleration and deceleration patterns provide insights into variations in market momentum over the forecast period.

From 2025 to 2028, growth accelerates steadily, driven by initial adoption in North America and Europe, where replacement of aging boilers and regulatory compliance create incremental demand. Between 2029 and 2032, the market experiences moderate deceleration as adoption in mature regions begins to stabilize and incremental revenue is increasingly dependent on retrofits, maintenance, and efficiency upgrades. From 2033 to 2035, a secondary acceleration phase emerges in Asia Pacific and Latin America, fueled by expanding chemical and pharmaceutical production capacities, industrialization, and rising energy efficiency mandates.

| Metric | Value |

|---|---|

| Fire Tube Chemical Boiler Market Estimated Value in (2025 E) | USD 1.2 billion |

| Fire Tube Chemical Boiler Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The fire tube chemical boiler market is primarily driven by the chemical and process industry, which accounts for around 44% of the market share, as these boilers provide efficient steam generation for heating, reaction processes, and sanitation. The food and beverage sector contributes approximately 25%, using fire tube boilers for cooking, sterilization, and process heating applications.

The pharmaceutical and biotechnology segment represents close to 15%, leveraging boilers for controlled heating, sterilization, and formulation processes. The textile and paper industry accounts for roughly 10%, integrating boilers for dyeing, bleaching, and paper processing. The remaining 6% comes from small-scale industrial units, educational institutions, and research facilities requiring reliable, compact, and low-maintenance steam generation systems. The fire tube chemical boiler market is evolving with advancements in energy efficiency, safety, and emission control. High-efficiency designs with optimized heat transfer and improved fuel utilization are gaining adoption. Integration with advanced monitoring and control systems allows real-time performance tracking and predictive maintenance.

Low-NOx and environmentally friendly combustion technologies are being increasingly implemented to meet regulatory standards. Modular and compact designs are simplifying installation and reducing operational space requirements. Manufacturers are focusing on corrosion-resistant materials, durable construction, and customizable options for diverse chemical and industrial applications. Growing demand for reliable steam generation, process optimization, and regulatory compliance continues to drive global market growth.

The fire tube chemical boiler market is gaining traction owing to rising industrial demand for energy efficient and cost effective steam generation systems. Increasing focus on process optimization, stringent emission regulations, and the need for high thermal efficiency are accelerating the adoption of advanced boiler technologies.

Manufacturers are investing in compact boiler designs, enhanced heat recovery systems, and integrated control platforms to improve output and lower operational costs. Additionally, chemical sector expansion in emerging economies is driving new installations, while replacement demand in mature markets is influenced by stricter energy codes and carbon reduction mandates.

With a growing emphasis on clean fuel usage and performance reliability, the fire tube boiler segment continues to evolve as a critical component in industrial heating and processing operations.

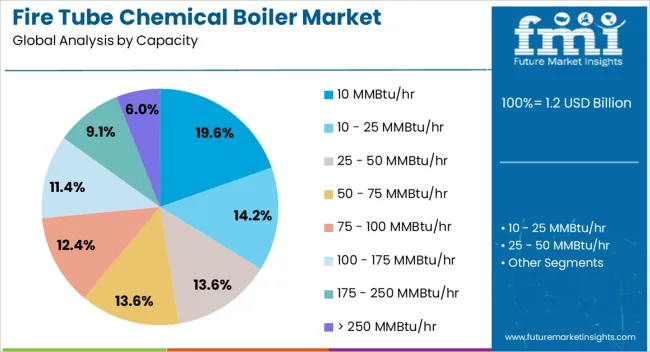

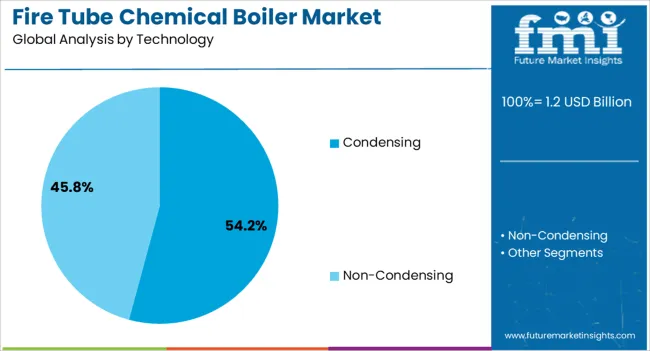

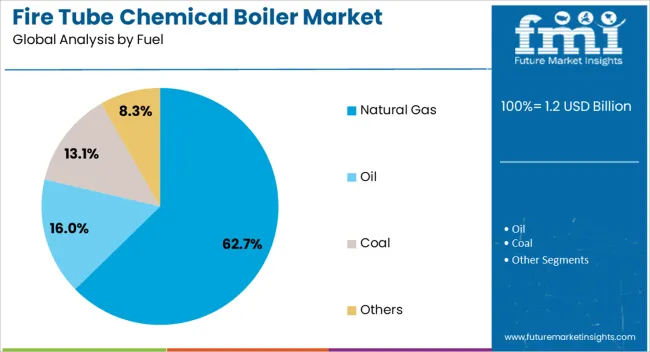

The fire tube chemical boiler market is segmented by capacity, technology, fuel, and geographic regions. By capacity, fire tube chemical boiler market is divided into 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 100 - 175 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr. In terms of technology, fire tube chemical boiler market is classified into Condensing and Non-Condensing. Based on fuel, fire tube chemical boiler market is segmented into Natural Gas, Oil, Coal, and Others. Regionally, the fire tube chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 10 MMBtu per hour capacity segment is projected to account for 19.60% of the market revenue by 2025, making it a key contributor within the capacity category. This segment is preferred for its balance between operational efficiency and installation flexibility, especially in mid scale chemical processing units.

Its suitability for batch operations and moderate steam requirements makes it an attractive choice for facilities that prioritize compact footprint and manageable maintenance costs. Moreover, its compatibility with modular plant expansions and process adaptability has strengthened its deployment across various chemical applications.

The ability to deliver consistent output with lower fuel input reinforces its growing adoption in both new and retrofit projects.

Condensing technology is anticipated to represent 54.20% of total revenue within the technology category by 2025, securing its position as the dominant segment. This is driven by the superior thermal efficiency of condensing boilers which recover latent heat from exhaust gases, significantly improving energy utilization.

In chemical processing, where steam demand varies and fuel savings are critical, condensing units offer operational advantages and environmental compliance. Reduced greenhouse gas emissions and enhanced heat recovery align with sustainability goals set by industrial operators.

The technology’s lower lifecycle cost and compliance with energy performance standards have positioned it as the preferred choice for future ready chemical boiler installations.

The natural gas segment is projected to hold 62.70% of total market revenue by 2025 within the fuel category, reflecting its leadership in fuel preference. Natural gas is favored for its clean combustion profile, lower operational cost, and stable supply across industrial zones.

As emission regulations tighten, chemical manufacturers are increasingly shifting from coal and oil fired systems toward gas powered alternatives to meet regulatory thresholds and reduce carbon footprint. Additionally, compatibility with advanced boiler technologies like condensing systems has reinforced its widespread usage.

Natural gas’s high combustion efficiency and minimal residue production make it the fuel of choice for continuous and high precision chemical processing operations.

The fire tube chemical boiler market is expanding due to increasing demand in chemical processing, food & beverage, and pharmaceutical sectors. Asia Pacific leads with approximately 7,500 units installed in 2024, driven by China (3,500), India (2,500), and Japan (1,500). Europe accounted for 6,000 units, led by Germany (2,400), France (1,800), and UK (1,800). North America deployed around 5,500 units, mainly in the USA, while the rest of the world represents 1,000 units. Key applications include chemical processing (35%), pharmaceuticals (25%), food & beverage (20%), textiles (10%), and other industries (10%). Average boiler capacities range from 0.5–10 tons per hour, depending on industrial requirements.

Market growth is fueled by the need for efficient steam generation, energy recovery, and process heating. Chemical processing accounts for 35% of installations, pharmaceuticals 25%, food & beverage 20%, textiles 10%, and other industries 10%. Asia Pacific leads at 7,500 units, Europe 6,000, and North America 5,500. Energy efficiency improvements reduce fuel consumption by 8–12% per unit annually, with operational cost savings of USD 2,500–3,500 per boiler. Rising demand for compact boilers in small to medium-scale chemical plants, coupled with stricter emission standards, is accelerating adoption. Integration with waste heat recovery and automation systems enhances operational efficiency across sectors.

Key trends include low-emission combustion systems, automated control, and modular boiler designs. Approximately 40% of new boilers in Europe and North America are equipped with automated control systems for real-time temperature and pressure management. Low-NOx and fuel-flexible designs are gaining adoption, particularly in Asia Pacific, representing 30% of units deployed. Modular boilers allow phased capacity expansion, reducing installation downtime by 20%. IoT integration enables predictive maintenance and remote monitoring for 25% of units in industrial plants. Adoption of compact designs for capacities under 5 tons per hour is increasing in pharmaceutical and food & beverage sectors globally.

Opportunities exist in chemical processing, pharmaceuticals, food & beverage, textiles, and other industrial applications. Chemical plants account for 35% of adoption, pharmaceuticals 25%, food & beverage 20%, textiles 10%, and other industries 10%. Asia Pacific is expected to install 9,000 units by 2027, Europe 7,000, and North America 6,500. Expansion of chemical parks, pharmaceutical production facilities, and food processing plants creates new market opportunities. Integration with energy-efficient systems, waste heat recovery, and automation solutions provides additional cost savings of USD 2,500–3,500 per unit annually. Partnerships with equipment suppliers and engineering contractors enable large-scale deployment in industrial hubs.

Challenges include high initial costs, maintenance complexity, and fuel quality sensitivity. Fire tube boilers cost USD 12,000–25,000 per unit for capacities of 0.5–10 tons per hour. Poor-quality fuels can reduce efficiency by 5–8% and increase maintenance costs by USD 500–800 per year. Installation and retrofitting in existing plants may require 15–25% additional investment. Compliance with emission and safety regulations varies across regions, adding USD 200–400 per unit in certification costs. Skilled workforce requirements and limited service availability in developing regions, particularly Africa, Latin America, and parts of Southeast Asia, further constrain adoption. Supply chain disruptions for pressure vessels and burners can delay deployment by 4–6 weeks.

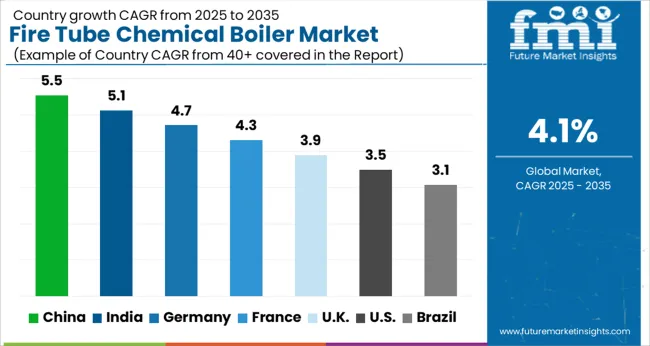

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The fire tube chemical boiler market is projected to grow at a global CAGR of 4.1% through 2035, driven by increasing demand for industrial heating solutions, chemical processing, and energy-efficient boilers. China leads at 5.5%, a 1.34× multiple over the global benchmark, supported by BRICS-driven expansion in chemical manufacturing, industrial plants, and energy infrastructure projects. India follows at 5.1%, a 1.24× multiple of the global rate, reflecting growth in chemical processing, pharmaceuticals, and industrial heating applications. Germany records 4.7%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in boiler efficiency, process optimization, and industrial applications. The United Kingdom posts 3.9%, 0.95× the global rate, with adoption concentrated in chemical plants, industrial facilities, and commercial heating projects. The United States stands at 3.5%, 0.85× the benchmark, with steady uptake in industrial, commercial, and specialty chemical processing installations. BRICS economies drive the majority of market volume, OECD countries emphasize efficiency and advanced technology, while ASEAN nations contribute through expanding industrial and chemical infrastructure.

The fire tube chemical boiler market in China is projected to grow at a CAGR of 5.5%, driven by rising demand in chemical, pharmaceutical, and food processing industries. Domestic suppliers such as Zhengzhou Boiler Co. and Shanghai Boiler Works provide high-efficiency fire tube boilers with advanced heat transfer and safety systems. Technological developments focus on energy efficiency, corrosion resistance, and automated control systems. Growth is further supported by industrial expansion and strict regulatory standards for safe chemical processing operations.

The fire tube chemical boiler market in India is expected to grow at a CAGR of 5.1%, supported by expansion of chemical processing plants, pharmaceuticals, and industrial manufacturing facilities. Key suppliers such as Thermax and Forbes Marshall provide high-capacity fire tube boilers with advanced automation and safety features. Technological improvements focus on fuel efficiency, emission control, and automated monitoring. Adoption is concentrated in chemical, food processing, and pharmaceutical sectors, driven by industrial safety regulations and energy optimization requirements.

Germany’s fire tube chemical boiler market is projected to grow at a CAGR of 4.7%, influenced by demand in chemical manufacturing, pharmaceuticals, and food processing industries. Suppliers such as Viessmann and Bosch Thermotechnology provide high-efficiency boilers with advanced heat recovery, emission control, and safety systems. Technological developments emphasize energy savings, automated monitoring, and environmental compliance. Demand is concentrated in industrial plants and chemical production facilities, with an increasing focus on eco-friendly and high-performance solutions.

The fire tube chemical boiler market in the United Kingdom is expected to grow at a CAGR of 3.9%, driven by modernization of chemical plants, pharmaceuticals, and food processing facilities. Suppliers focus on high-efficiency, low-emission boilers with automated monitoring and safety features. Technological improvements emphasize compliance with environmental regulations, operational efficiency, and durability. Adoption is concentrated in chemical and pharmaceutical industries, with food processing facilities gradually upgrading to advanced boiler systems.

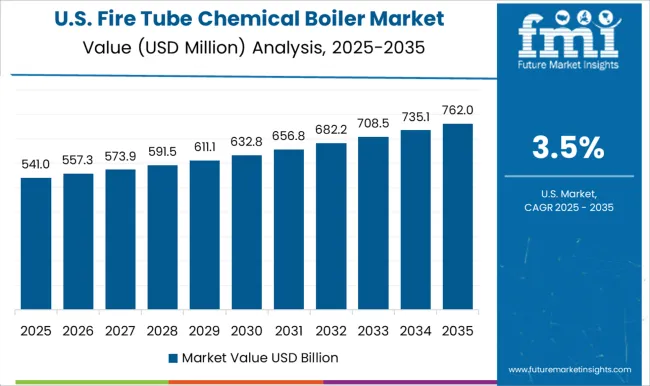

The fire tube chemical boiler market in the United States is projected to grow at a CAGR of 3.5%, supported by chemical, pharmaceutical, and food processing industries upgrading their boiler systems. Major suppliers such as Cleaver-Brooks and Hurst Boiler provide high-efficiency boilers with automated control, safety systems, and fuel optimization. Technological developments focus on energy efficiency, corrosion resistance, and emission reduction. Adoption is concentrated in industrial facilities requiring consistent heat supply and regulatory compliance.

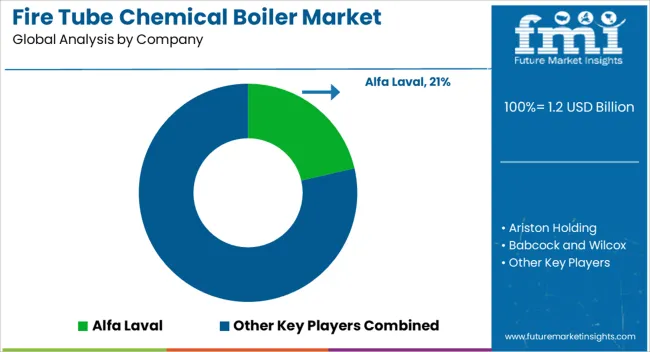

Competition in the fire tube chemical boiler market is being shaped by thermal efficiency, operational reliability, and compliance with industrial safety standards for chemical processing, manufacturing, and steam generation applications. Market positions are being reinforced through advanced heat transfer technologies, durable construction, and global service networks that ensure consistent performance and longevity. Alfa Laval and Ariston Holding are being represented with high-efficiency boilers engineered for rapid heat transfer, corrosion resistance, and compact installation. Babcock and Wilcox and Babcock Wanson are being promoted with industrial solutions structured for continuous operation, fuel adaptability, and energy optimization. BM GreenTech and Bosch Industriekessel are being applied with systems optimized for process steam generation, chemical processing, and safe operation under high temperature and pressure. Clayton Industries and Cleaver-Brooks are being showcased with modular designs structured for ease of maintenance, precise temperature control, and scalable deployment. Cochran, Forbes Marshall, Miura America, and Rentech Boiler Systems are being advanced with boilers engineered for robust performance, automated operation, and efficient fuel consumption. Thermax, Thermodyne Boilers, and Viessmann are being represented with specialized designs structured for long-term stability, regulatory compliance, and industrial versatility.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Capacity | 10 MMBtu/hr, 10 - 25 MMBtu/hr, 25 - 50 MMBtu/hr, 50 - 75 MMBtu/hr, 75 - 100 MMBtu/hr, 100 - 175 MMBtu/hr, 175 - 250 MMBtu/hr, and > 250 MMBtu/hr |

| Technology | Condensing and Non-Condensing |

| Fuel | Natural Gas, Oil, Coal, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alfa Laval, Ariston Holding, Babcock and Wilcox, Babcock Wanson, BM GreenTech, Bosch Industriekessel, Clayton Industries, Cleaver-Brooks, Cochran, Forbes Marshall, Miura America, Rentech Boiler Systems, Thermax, Thermodyne Boilers, and Viessmann |

| Additional Attributes | Dollar sales by boiler type and end use, demand dynamics across chemical, pharmaceutical, and industrial sectors, regional trends in process heating adoption, innovation in efficiency, safety, and emission control, environmental impact of fuel use and wastewater, and emerging use cases in hybrid heating systems and process optimization. |

The global fire tube chemical boiler market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the fire tube chemical boiler market is projected to reach USD 1.9 billion by 2035.

The fire tube chemical boiler market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in fire tube chemical boiler market are 10 mmbtu/hr, 10 - 25 mmbtu/hr, 25 - 50 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 54.2% share in the fire tube chemical boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Non-Condensing Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA