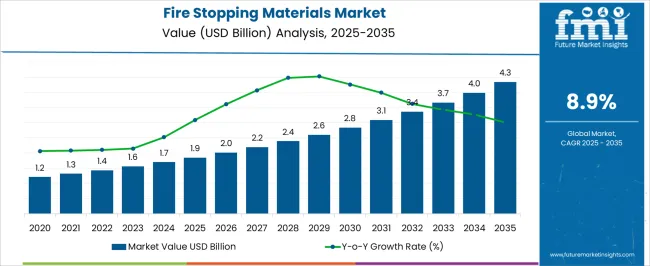

The fire stopping materials market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period. This initial phase is driven by the growing focus on fire safety regulations, particularly in construction and infrastructure projects. Increasing awareness of fire hazards in commercial buildings, residential properties, and industrial facilities boosts demand for fire stopping solutions. From 2026 to 2030, the market continues to strengthen, moving from USD 1.9 billion to USD 2.8 billion.

This period sees the continued adoption of fire prevention technologies in both new builds and retrofits, as stricter fire safety standards in industrial, commercial, and residential sectors drive strong growth across the market.

| Metric | Value |

|---|---|

| Fire Stopping Materials Market Estimated Value in (2025 E) | USD 1.9 billion |

| Fire Stopping Materials Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The construction materials market is the largest contributor, accounting for approximately 35-40%, as fire stopping materials are essential in new building construction, particularly in residential, commercial, and industrial sectors. With increasing safety regulations and codes, the demand for these materials continues to grow in construction projects. The building safety and fire protection market follows with around 25-30%, as fire stopping solutions are an integral part of ensuring building safety. With fire protection standards becoming stricter, especially in high-rise and commercial buildings, the need for fire stopping materials rises.

The insurance market contributes about 10-12%, driven by the need for buildings to comply with fire safety standards to reduce risk and ensure proper coverage. Insurance companies are pushing for enhanced fire protection measures, increasing demand for fire stopping materials in insured properties. The renovation and retrofit market accounts for approximately 12-15%, as fire stopping materials are essential in upgrading older buildings to meet modern fire safety standards. As more buildings undergo retrofitting, particularly in urban areas, the need for these materials increases. The industrial manufacturing market contributes 8-10%, with industries like oil and gas, power plants, and manufacturing relying on fire stopping materials to protect high-risk infrastructure.

The fire stopping materials market is expanding steadily, driven by the increasing enforcement of stringent fire safety regulations across commercial, industrial, and residential construction sectors. As urban infrastructure continues to grow vertically and complexity in building design intensifies, the demand for high-performance fire containment solutions has accelerated.

Fire stopping materials are integral to passive fire protection strategies, offering critical barriers that compartmentalize flames, smoke, and heat during fire incidents. The market is witnessing technological progress focused on enhancing material durability, environmental compliance, and ease of application.

Looking ahead, the adoption of green construction standards and increasing awareness regarding structural safety are expected to support sustained demand. Government mandates and insurance requirements will continue to push fire safety as a fundamental design criterion, ensuring the long-term relevance of fire stopping solutions in both new and retrofitted buildings.

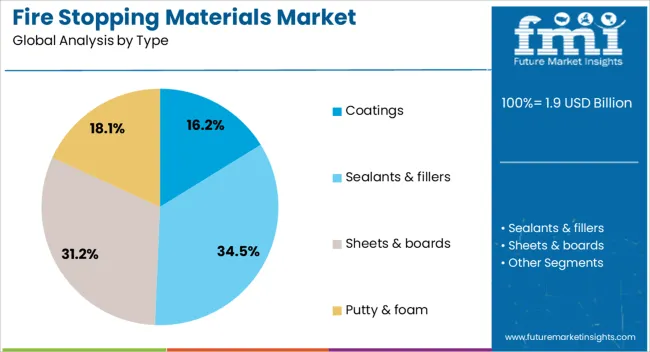

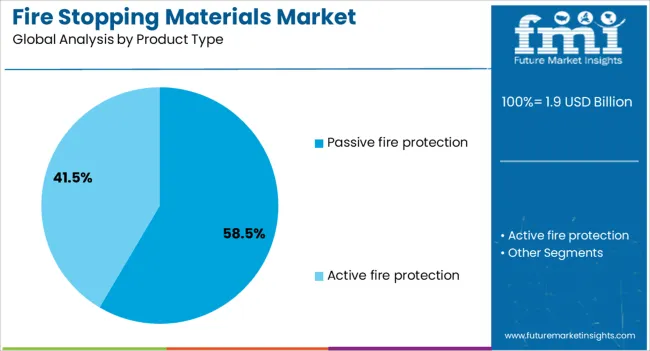

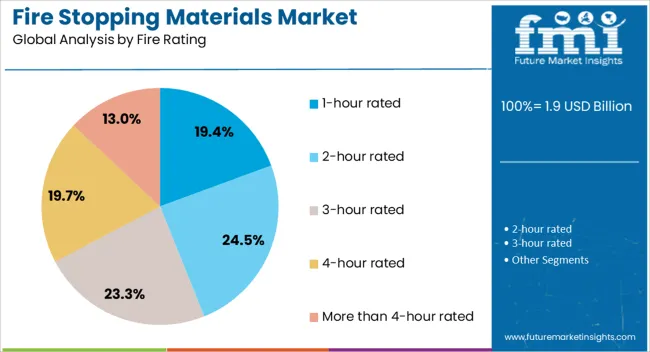

The fire stopping materials market is segmented by type, product type, fire rating, application, end use, and geographic regions. By type, the fire stopping materials market is divided into Coatings, Sealants & fillers, Sheets & boards, Putty & foam, and Others (collars, fire blocks, etc.). In terms of product type, fire stopping materials market is classified into Passive fire protection and Active fire protection. Based on fire rating, fire stopping materials market is segmented into 1-hour rated, 2-hour rated, 3-hour rated, 4-hour rated, and More than 4-hour rated.

By application, fire stopping materials market is segmented into Electrical, Mechanical, Plumbing, and Others. By end use, fire stopping materials market is segmented into Residential, Commercial, and Industrial. Regionally, the fire stopping materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coatings segment represents 16.2% of the fire stopping materials market, reflecting its role as a critical component in enhancing fire resistance through surface applications. These coatings are commonly used on steel structures, cables, and ductwork to prevent temperature escalation and structural failure during fire exposure.

The segment has gained traction due to growing preferences for intumescent coatings, which expand when exposed to heat and form insulating char layers. Manufacturers are innovating with low-VOC and water-based formulations to meet evolving environmental standards while maintaining compliance with global fire resistance certifications.

Increased construction in high-rise and industrial facilities where steel frameworks are prevalent has bolstered demand for coating-based fire protection. As infrastructure regulations become more rigorous, the coatings segment is expected to maintain consistent growth by providing cost-effective, adaptable solutions for diverse architectural needs

Passive fire protection products dominate the market with a commanding 58.5% share under the product type category, emphasizing their foundational role in modern building safety strategies. These systems are designed to contain fire and prevent structural collapse without requiring external activation, offering reliable protection in both occupied and unoccupied structures.

Demand for passive fire protection is being fueled by increased construction in commercial buildings, hospitals, and data centers, where uninterrupted protection is critical. Manufacturers are focused on producing modular, pre-tested systems that comply with regional fire codes while simplifying installation.

The market also benefits from the retrofitting of older buildings to meet updated safety standards, further driving product uptake. As awareness of fire-related risks rises and building codes evolve globally, the segment is expected to retain its market dominance due to its critical function and long-term performance reliability.

The 1-hour rated segment holds 19.4% of the fire rating category, highlighting its significance for applications requiring moderate fire containment in non-load-bearing partitions and low-risk areas. Products in this segment are widely utilized in office complexes, residential properties, and light commercial buildings where fire compartmentation must be achieved for at least 60 minutes.

Its market share is supported by balanced performance requirements that meet regulatory compliance without incurring high installation or material costs. This segment benefits from simplified certification processes and broad acceptance under international fire safety standards.

The demand for 1-hour rated fire stopping materials is expected to grow in tandem with the development of mixed-use buildings and renovations where space optimization and cost efficiency are prioritized. Continuous improvements in material composition and testing accuracy are further strengthening the appeal of this segment among architects and builders seeking dependable yet flexible fire-rated solutions.

Fire stopping materials are critical for sealing openings and joints in walls, floors, and ceilings to prevent the spread of fire, smoke, and toxic gases. Market growth is driven by the rising demand for safety in buildings, particularly high-rise structures, as well as the growing need for compliance with evolving fire safety codes. Challenges include fluctuating material costs, regulatory complexity, and the requirement for innovative solutions to meet the diverse needs of modern, complex building designs. Opportunities exist in the development of advanced fire-resistant materials, particularly for use in eco-friendly and energy-efficient buildings.

The fire stopping materials market is being driven by the rising need for fire safety solutions in the construction and infrastructure sectors. As urbanization increases, so does the number of high-rise buildings and large-scale commercial projects, both of which have higher fire risks. Fire stopping materials such as intumescent sealants, fire-resistant coatings, and mortar are used to prevent the spread of fire and smoke through penetrations and joints in walls and floors. These materials are now required by building codes in both new constructions and retrofitting projects, particularly in commercial, residential, and industrial buildings. As fire safety standards become stricter, the demand for high-quality fire stopping solutions is expected to grow, especially as building designs become more complex and incorporate new materials. The emphasis on fire protection, combined with the need for safety, is set to continue propelling the market.

The fire stopping materials market faces several constraints, including the rising cost of raw materials, such as fire-resistant compounds, cement, and sealants. These fluctuations in material prices can increase overall production costs. The market is also affected by the complexity of regional fire safety regulations, with different regions requiring varying certifications, tests, and approvals for fire stopping products. Manufacturers must navigate this regulatory landscape to ensure their products meet the necessary standards in each region. Additionally, technical challenges related to the durability and effectiveness of fire stopping materials under extreme conditions, such as high heat or moisture, pose difficulties in ensuring long-term performance. Manufacturers are increasingly looking for ways to reduce costs, improve product performance, and streamline compliance processes to make fire stopping materials more accessible and affordable.

Opportunities in the fire stopping materials market are strongest in the growing trend of high-rise buildings and energy-efficient construction. As urban areas become more densely populated, the demand for fire protection solutions in multi-story buildings has surged. Fire stopping materials are essential for ensuring that fire, smoke, and toxic gases do not spread from one floor to another, making them crucial for safety in high-rise structures. Additionally, the increasing focus on energy-efficient buildings has created demand for fire stopping materials that can also provide thermal insulation and support eco-friendly designs. Manufacturers offering innovative fire-resistant materials compatible with advanced insulation, green building components, and energy-efficient construction techniques are well-positioned to capture market share in both the commercial and residential sectors.

Fire stopping products that offer additional benefits, such as enhanced thermal insulation, soundproofing, or water resistance, are becoming increasingly popular. The ability to meet multiple building needs while ensuring compliance with fire safety regulations is a key selling point for these materials. Furthermore, innovations in product application are streamlining the installation process, such as the development of spray-on fire stopping products that offer quicker, more efficient application. As fire safety regulations continue to evolve and become more stringent, manufacturers are focusing on ensuring that their products meet the latest compliance standards. Companies offering versatile, high-performance fire stopping materials that address a variety of building needs and comply with safety standards are poised for significant growth.

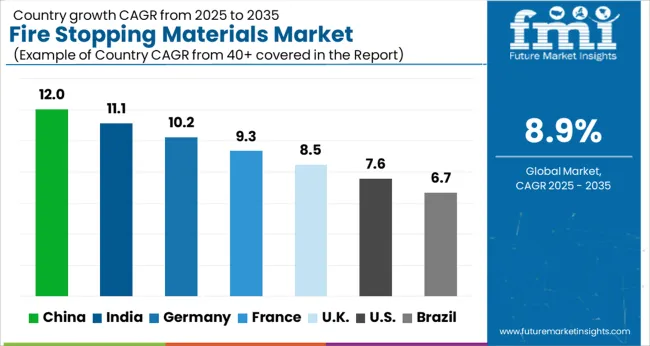

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The global fire stopping materials market is growing at a CAGR of 8.9% from 2025 to 2035. China is the fastest-growing market, with a growth rate of 12.0%, followed by India at 11.1%. France, the UK, and the USA show growth rates of 9.3%, 8.5%, and 7.6%, respectively. The market is largely driven by the increasing focus on fire safety regulations, the growing construction sector, and rising awareness of fire risks. Government regulations, infrastructure developments, and a focus on high-performance fire-resistant materials continue to push the adoption of fire stopping materials globally. The analysis spans 40+ countries, with leading markets profiled below.

The fire stopping materials market in China is expected to expand at a CAGR of 12.0% from 2025 to 2035. The country’s booming construction sector is the primary driver of this growth, with increasing urbanization and infrastructure projects pushing demand for fire-resistant solutions. As China’s cities continue to expand, there is a growing need for safe, efficient building materials to comply with stringent fire safety regulations. Fire stopping materials like sealants, fire-resistant boards, and sprays are essential in ensuring the integrity of firewalls, preventing the spread of flames and smoke in commercial and residential buildings. The demand for high-rise buildings, coupled with government regulations promoting fire safety standards, has further accelerated the use of these materials. Furthermore, the growth in manufacturing industries such as chemicals, oil and gas, and automotive is also contributing to the demand for fire protection materials.

The fire-stopping materials market in India is projected to grow at a CAGR of 11.1% from 2025 to 2035. The country’s construction boom, particularly in urban and infrastructure projects, has led to a higher adoption of fire protection solutions. With India’s rapidly growing population and a surge in commercial, residential, and industrial developments, the need for high-performance fire-resistant materials is increasing. The government’s push toward enforcing stricter fire safety regulations in buildings and commercial structures has also spurred demand for fire stopping materials. Additionally, the increasing awareness about the importance of fire safety and the potential risks in high-traffic areas such as malls, hospitals, and schools is further driving market growth. The industrial sector, including manufacturing and oil refineries, also contributes to the rising demand for fire-resistant materials as part of their safety measures.

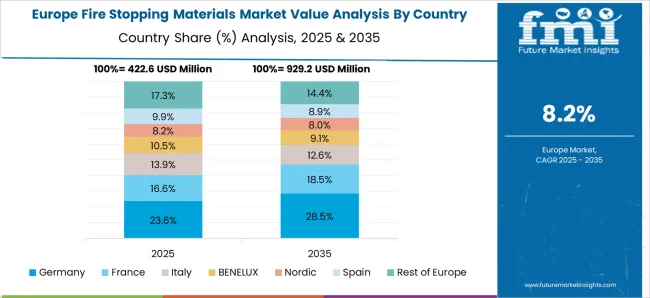

The fire stopping materials market in France is expected to grow at a CAGR of 9.3% from 2025 to 2035. The demand for fire protection materials in France is driven by its robust construction industry, particularly in commercial and infrastructure projects. Stricter fire safety codes and regulations have significantly increased the demand for fire-resistant solutions in both public and private sector buildings. The rising focus on energy-efficient and resilient building designs also contributes to the adoption of fire stopping materials. Large-scale infrastructure developments such as metro systems, airports, and hospitals require advanced fire prevention solutions. The growing number of renovations, combined with rising safety concerns, has contributed to increased demand for fire-resistant seals, coatings, and boards.

The UK fire stopping materials market is forecasted to grow at a CAGR of 8.5% from 2025 to 2035. The UK construction market is experiencing a surge in demand for fire-resistant materials due to the increasing importance placed on safety standards in both new developments and renovations. As urbanization accelerates, there is a greater focus on protecting high-rise buildings, office spaces, and public facilities from fire hazards. In addition, the government’s stringent building codes and fire safety regulations are encouraging widespread use of fire stopping solutions, such as fire-resistant sealants, fire barriers, and intumescent products. The industrial and commercial sectors also present a growing demand for these materials, especially in environments such as hospitals, schools, and manufacturing facilities. The awareness surrounding fire safety in public and residential buildings is contributing to market growth as building owners and developers prioritize fire prevention.

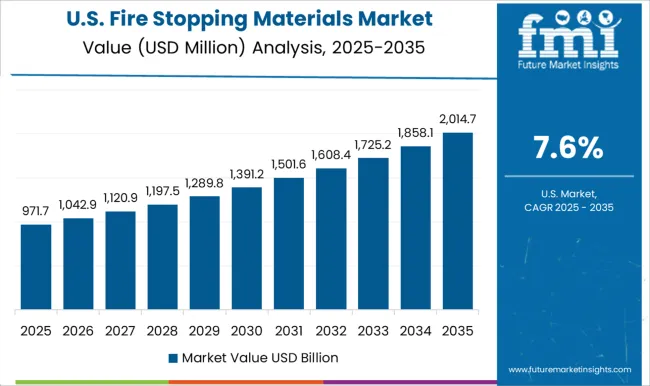

The USA fire stopping materials market is projected to grow at a CAGR of 7.6% from 2025 to 2035. The demand for fire-resistant materials in the USA is driven by stringent safety codes and regulations that require buildings to comply with fire protection standards. High-rise commercial buildings, industrial complexes, and residential properties increasingly rely on fire stopping materials to prevent the spread of fire, smoke, and toxic gases. The adoption of fire-resistant sealants, coatings, and systems is critical to meeting the requirements for modern building projects. With the USA also experiencing growth in infrastructure development and industrial sectors, the demand for fire protection solutions is further boosted. The expansion of the residential and commercial real estate markets and the increasing awareness of fire risks in densely populated areas are fueling the adoption of these materials.

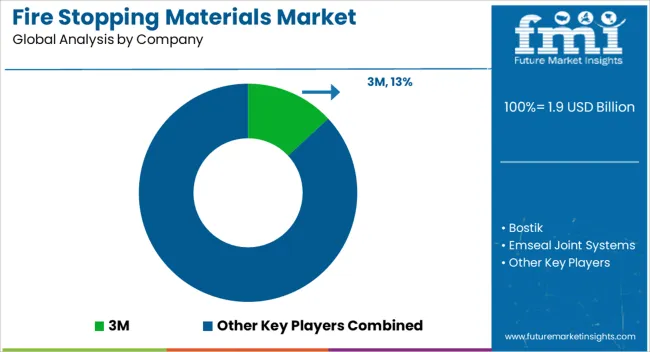

In the fire stopping materials market, competition is defined by product innovation, regulatory compliance, and application versatility. 3M competes with a wide range of firestopping solutions, including firestop sealants, caulks, and intumescent materials designed for both industrial and commercial applications. Their strategy emphasizes ease of application and long-lasting protection. Bostik offers fireproofing products known for their ease of use and flexibility, with a focus on sealing joints and penetrations. Emseal Joint Systems provides a highly specialized product range, including fire-rated sealants for expansion joints, which is essential for maintaining building integrity during fire events. Fosroc and Flame Stop focus on providing high-performance sealants and fire-resistant barriers, emphasizing their ability to withstand extreme temperatures.

H.B. Fuller Company offers versatile firestopping materials designed to meet global building standards, targeting both industrial and commercial markets. Hilti’s approach centers on a broad portfolio of passive fire protection systems, offering comprehensive firestopping products that include seals, wraps, and foam. Their strategy focuses on providing reliable protection across all types of substrates.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Type | Coatings, Sealants & fillers, Sheets & boards, Putty & foam, and Others (collars, fire blocks etc.) |

| Product Type | Passive fire protection and Active fire protection |

| Fire Rating | 1-hour rated, 2-hour rated, 3-hour rated, 4-hour rated, and More than 4-hour rated |

| Application | Electrical, Mechanical, Plumbing, and Others |

| End Use | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Bostik, Emseal Joint Systems, Everkem, Flame Stop, Fosroc, H. B. Fuller Company, Hilti, Promat, RectorSeal, Rockwool, Sika, Specified Technologies, Tremco, and Unique Fire Stop Products |

| Additional Attributes | Dollar sales by product type (sealants, coatings, joint systems, fire-resistant barriers), fire ratings (1-hour, 2-hour, 3-hour), and application (commercial, residential, industrial, infrastructure). Demand dynamics are driven by the need for enhanced fire safety regulations, increasing construction activity, and rising awareness about fire safety in residential and commercial sectors. Regional trends show substantial growth in North America and Europe, due to stringent fire protection codes, while the Asia-Pacific region experiences significant growth due to expanding infrastructure and the adoption of fire safety standards in emerging markets. |

The global fire stopping materials market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the fire stopping materials market is projected to reach USD 4.3 billion by 2035.

The fire stopping materials market is expected to grow at a 8.9% CAGR between 2025 and 2035.

In terms of product type, passive fire protection segment to command 58.5% share in the fire stopping materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA