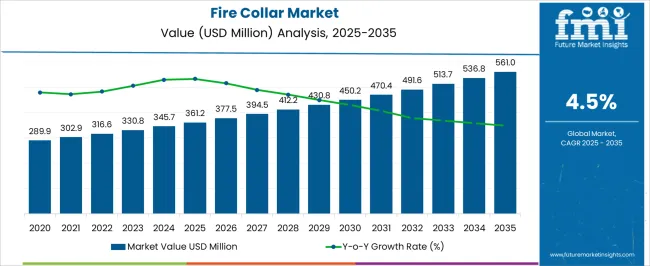

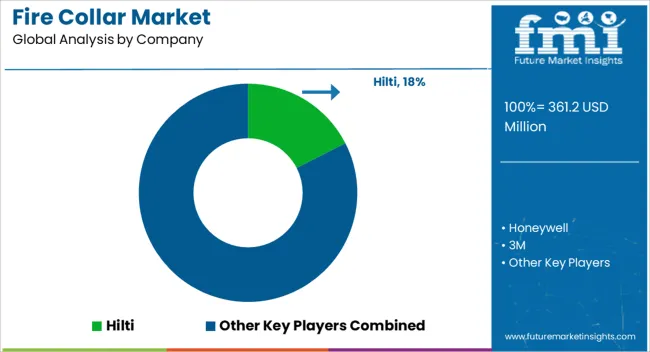

The Fire Collar Market is estimated to be valued at USD 361.2 million in 2025 and is projected to reach USD 561.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. During the early adoption phase (2020–2024), the market expanded from USD 289.9 million to USD 345.7 million as construction companies and building developers increasingly adopted fire collars to enhance passive fire protection in residential, commercial, and industrial projects.

Early adoption was driven by stricter fire safety regulations, growing awareness of building safety, and the need to comply with international standards. However, high initial costs and limited knowledge of advanced fire collar technologies constrained rapid deployment.

From 2025 to 2030, the market enters a scaling phase, with revenues increasing from USD 361.2 million to approximately USD 450.2 million. Wider adoption was supported by increasing urbanization, infrastructure development, and the integration of fire safety in green building practices. Manufacturers focused on producing cost-effective and standardized fire collars, while rising construction activity globally drove higher demand.

Between 2030 and 2035, the market transitions into consolidation, reaching USD 561.0 million by 2035. Key players strengthened positions through partnerships, optimized supply chains, and product standardization. Incremental innovations focused on installation efficiency, durability, and compliance with evolving safety standards.

The market matured into a competitive, reliable, and technologically advanced segment, moving from early adoption to scaling and finally to consolidation.

| Metric | Value |

|---|---|

| Fire Collar Market Estimated Value in (2025 E) | USD 361.2 million |

| Fire Collar Market Forecast Value in (2035 F) | USD 561.0 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The fire collar market is witnessing sustained expansion, driven by the increasing emphasis on fire safety regulations across commercial and residential infrastructure projects. Rising investments in urban construction and retrofit projects have prompted demand for reliable passive fire protection systems, including collars that ensure compliance with international building codes.

The need for containment of fire, smoke, and toxic gases through effective pipe penetration sealing has accelerated the adoption of fire collars across various material types and installation configurations. Continuous innovation in intumescent technology and improvements in product lifespan and thermal expansion resistance have enhanced performance metrics.

Additionally, collaboration between manufacturers and regulatory bodies is shaping industry standards, which are expected to support long-term market growth, particularly in commercial and industrial real estate segments.

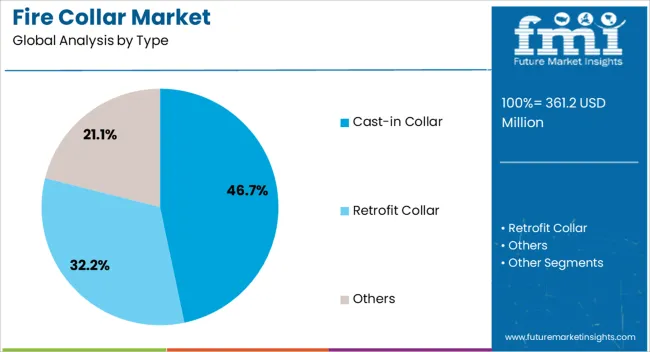

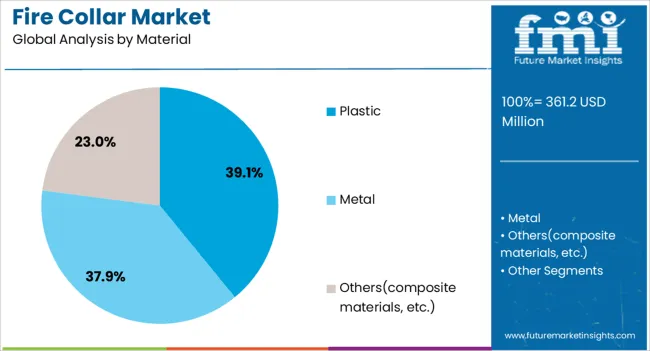

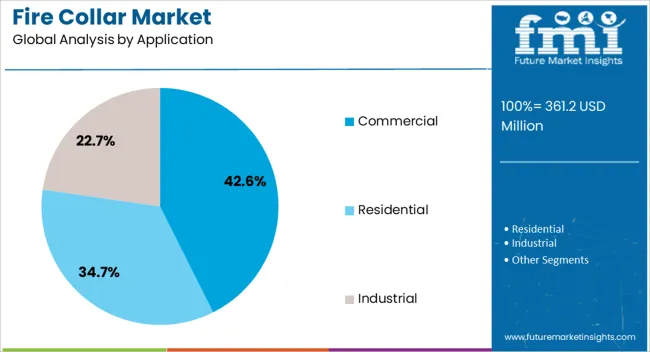

The fire collar market is segmented by type, material, application, distribution channel, and geographic regions. By type, the fire collar market is divided into Cast-in Collar, Retrofit Collar, and Others. The fire collar market is classified by material into Plastic, Metal, and Others (composite materials, etc.).

Based on the application, the fire collar market is segmented into Commercial, Residential, and Industrial. The distribution channel of the fire collar market is segmented into Direct and Indirect. Regionally, the fire collar industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Cast-in collars are projected to account for 46.70% of the fire collar market revenue in 2025, positioning them as the leading type segment. Their dominance is being attributed to seamless integration during the initial construction phase, reducing labor costs and post-installation disruptions.

Cast-in solutions offer built-in firestopping around pipe penetrations, improving structural integrity while maintaining compliance with fire resistance ratings. Builders and contractors prefer this configuration due to its time efficiency and reduced margin for human error during installation.

The growing adoption in multi-story commercial developments, hospitals, and high-density buildings where pre-planned passive protection is critical has reinforced the segment’s lead. Ongoing improvements in cast-in sleeve design and adjustability further strengthen its appeal in fast-paced construction environments.

Plastic materials are expected to hold a 39.10% revenue share of the overall market by 2025, leading the fire collar market by material. This dominance stems from the widespread use of plastic pipes in plumbing, drainage, and HVAC applications across both residential and commercial construction.

Plastic collars are specifically engineered to expand rapidly and seal pipe openings upon heat exposure, making them suitable for thermoplastic pipe types such as PVC and HDPE. Their lightweight structure, ease of installation, and cost-effectiveness have made them a preferred solution, particularly in emerging economies with high-volume housing demand.

Advancements in intumescent materials compatible with plastic have also improved sealing reliability and longevity, further solidifying their position as the top material segment.

The commercial sector is projected to lead with a 42.60% revenue share in 2025, making it the top application segment in the fire collar market. This leadership is being driven by stringent fire safety codes in commercial real estate, including office buildings, malls, educational institutions, and healthcare facilities.

Fire collars are mandated in multiple zones across these structures to ensure compartmentalization and delayed fire spread through service penetrations. The sector’s demand is further reinforced by increasing construction activity in high-rise and mixed-use developments where enhanced fire protection is prioritized.

The need to align with regional and international compliance standards has led to greater specification and use of certified fire collar systems in commercial projects, contributing to the segment’s sustained dominance.

The fire collar market is expanding as construction regulations and building safety standards tighten worldwide. Fire collars protect structural openings, such as pipes and conduits, from the spread of fire and smoke, ensuring compliance with fire safety codes. Growing urban construction, industrial facilities, and infrastructure projects drive demand. Manufacturers are developing collars with advanced intumescent materials, easy installation designs, and compatibility with various pipe types. Rising awareness of life safety, property protection, and regulatory adherence fuels adoption across commercial, residential, and industrial construction sectors.

Rising awareness of fire hazards and the importance of safeguarding occupants and property drives fire collar adoption. Facility owners, architects, and construction companies increasingly recognize that fire collars are essential for risk mitigation in multi-story buildings, hospitals, schools, and industrial complexes. Fire incidents highlight the need for preventative measures, prompting retrofitting of existing structures with fire collars. This focus on safety and proactive fire prevention, combined with insurance and liability considerations, supports steady growth in both new construction and renovation markets worldwide.

Global building codes increasingly mandate the use of fire collars in new constructions and renovations to prevent fire spread through penetrations. Compliance with fire safety regulations reduces property damage and enhances occupant safety. Construction companies, facility managers, and contractors prioritize products that meet standardized fire ratings and certification requirements. Fire collars that are tested for multiple pipe diameters and materials gain preference, as they simplify installation and ensure code compliance. The push for regulatory adherence drives consistent demand across both developed and emerging markets.

Fire collars rely on intumescent and high-temperature resistant materials to expand and seal openings during a fire. Consistent performance, longevity, and resistance to environmental factors such as humidity, vibration, and temperature fluctuations are critical for effectiveness. Products with proven fire-rating certifications and tested reliability in real-world conditions attract builders and safety inspectors. Manufacturers focus on material quality, manufacturing consistency, and product durability, which increases trust and adoption in commercial, residential, and industrial construction applications where safety and code compliance are non-negotiable.

Quick and easy installation is a key factor for contractors selecting fire collars. Designs that accommodate different pipe diameters, materials, and configurations reduce labor costs and project timelines. Flexible collars that can be retrofitted in existing constructions or integrated into new builds are highly valued. Ease of installation minimizes the risk of errors, ensuring effective fire protection. Products that combine versatility with reliable performance are increasingly preferred, encouraging manufacturers to offer solutions compatible with a wide range of applications, from residential plumbing to complex industrial piping systems.

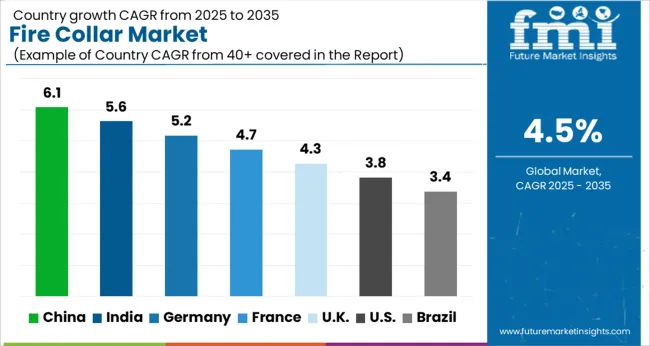

The global fire collar market is projected to grow at a CAGR of 4.5%, driven by rising safety regulations and increasing construction activities. China leads with a growth rate of 6.1%, supported by stringent fire safety standards and rapid urban development. India follows at 5.6%, fueled by expanding residential and commercial infrastructure.

Germany shows steady growth at 5.2%, leveraging advanced construction safety technologies. The UK and USA record moderate growth rates of 4.3% and 3.8%, respectively, reflecting consistent demand for fire protection solutions in both new and existing buildings. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the fire collar market with a 6.1% growth rate, driven by rapid urbanization and stringent fire safety regulations. Construction of high-rise residential and commercial buildings increases demand for passive fire protection solutions like fire collars. Manufacturers focus on high-performance, heat-resistant materials that expand under fire to seal penetrations in walls and floors.

Government initiatives for fire safety compliance boost adoption in new and renovated buildings. Industrial and commercial construction sectors are major end-users. Technological advancements enhance durability, ease of installation, and reliability. Export opportunities to other Asian countries also contribute to market growth. Strong distribution networks and competitive pricing further support market penetration.

Fire collar market in India grows at 5.6%, fueled by residential and commercial construction projects emphasizing fire safety compliance. Government regulations for building safety promote adoption of high-quality fire collars in new constructions. Industrial, commercial, and high-density residential projects represent key demand segments. Manufacturers introduce innovative materials and designs for enhanced heat resistance and easier installation.

Export opportunities to neighboring countries support growth. Increasing awareness of fire hazards in urban areas encourages proactive adoption. Contractors and building managers prefer reliable, durable, and cost-effective solutions. Distribution channels, including online platforms and specialized dealers, improve market reach. Competitive pricing helps domestic manufacturers capture market share from international players.

Germany shows a 5.2% growth rate, with demand driven by strict fire protection regulations in residential, commercial, and industrial buildings. Manufacturers focus on fire collars that meet high safety and quality standards. Technological innovations improve installation efficiency, heat resistance, and long-term reliability. Industrial and commercial construction sectors are key end-users.

Urban renovation and new construction projects support steady growth. Export of German-made fire collars strengthens global market presence. Contractors prefer durable, certified, and easy-to-install solutions. Market expansion is supported by government safety initiatives and building code compliance. Competitive pricing with advanced features attracts professional users across construction segments.

The UK fire collar market grows at 4.3%, fueled by residential renovation, commercial construction, and public infrastructure projects emphasizing fire safety. Manufacturers focus on certified, durable, and easy-to-install fire collars. Technological advancements enhance performance under high-temperature conditions and ensure regulatory compliance. Industrial and commercial sectors are major end-users.

Contractors and building managers prefer reliable solutions for long-term safety. Distribution through dealers and online platforms expands market reach. Government initiatives promoting fire safety in urban areas drive adoption. Cost-effective products with proven performance help manufacturers capture market share. Growing awareness of fire hazards in residential and commercial buildings further supports growth.

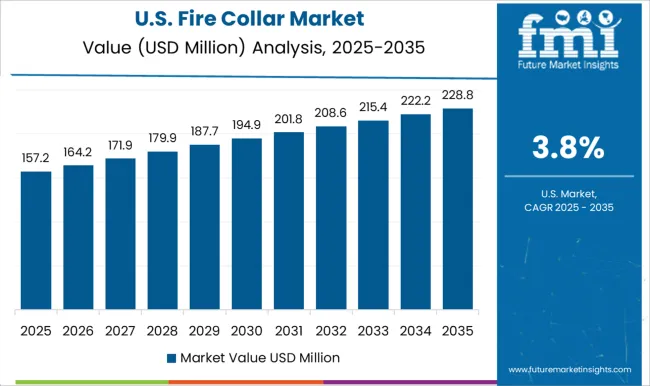

The USA market grows at 3.8%, with demand driven by industrial, commercial, and high-rise residential projects requiring fire safety compliance. Manufacturers focus on high-quality, heat-resistant fire collars for new and renovated constructions. Technological innovations improve installation efficiency, reliability, and durability. Industrial and commercial construction projects represent significant demand segments.

Distribution networks, including retailers and online platforms, enhance market penetration. Government fire safety codes and regulations support adoption across all building types. Contractors and industrial users prefer certified, long-lasting, and easy-to-install solutions. Urban redevelopment projects further contribute to market growth. Competitive pricing with advanced features attracts professional users and large construction firms.

Hilti, 3M, Honeywell, and Sika are setting benchmarks by positioning collars as part of broader fire safety ecosystems. Their influence extends upstream, where specifications are embedded into codes and project blueprints, ensuring procurement preference before tenders are issued. This creates pull-through advantage and margin protection across global infrastructure projects. Specialist competitors such as PFC Corofil, RectorSeal, Firesafe, Firefly, and Ramset compete differently, building advantage through agility and proximity to contractors. They tailor collar sizes, materials, and installation designs for site-specific needs, responding quickly to changing local codes. Their edge lies in fast certification and responsiveness, making them preferred partners for mid-sized projects where global multinationals may appear too rigid or costly.

Diversified players, including Jotun Group, A.B. Chance, Flexfire, and Trelleborg, leverage strengths in coatings, polymer engineering, and fastening systems to extend into fire collars. Their advantage comes not from stand-alone innovation but from cross-category bundling. Collars are offered alongside paints, sealants, or structural products, simplifying procurement for contractors who value consolidated sourcing. This strategy relies heavily on channel reach and distributor depth.

Rosenberger Hochfrequenztechnik represents an unusual entrant, transferring expertise in precision engineering and sealing solutions from advanced electronics into fire safety. This demonstrates how engineering competencies from other sectors can be repurposed into compliance-heavy building products, broadening the scope of competition. Competition is ultimately shifting from selling a component to controlling specification, certification, and bundling. Fire collars are increasingly framed as compliance anchors — documentation-intensive products that guide contractor choice. Companies that combine technical reliability with regulatory assurance and integrated sourcing are positioned to capture a durable, long-term advantage in a market where specification influence matters as much as product performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 361.2 Million |

| Type | Cast-in Collar, Retrofit Collar, and Others |

| Material | Plastic, Metal, and Others(composite materials, etc.) |

| Application | Commercial, Residential, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hilti, Honeywell, 3M, PFC Corofil, RectorSeal, Pemko Manufacturing, Firefly, Rosenberger Hochfrequenztechnik, Trelleborg, Firesafe, Ramset, Jotun Group, A.B. Chance, Flexfire, and Sika |

| Additional Attributes | Dollar sales by type including intumescent collars and mechanical collars, application across residential, commercial, and industrial buildings, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising building safety regulations, demand for effective fire protection solutions, and increasing construction activities. |

The global fire collar market is estimated to be valued at USD 361.2 million in 2025.

The market size for the fire collar market is projected to reach USD 561.0 million by 2035.

The fire collar market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in fire collar market are cast-in collar, retrofit collar and others.

In terms of material, plastic segment to command 39.1% share in the fire collar market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA