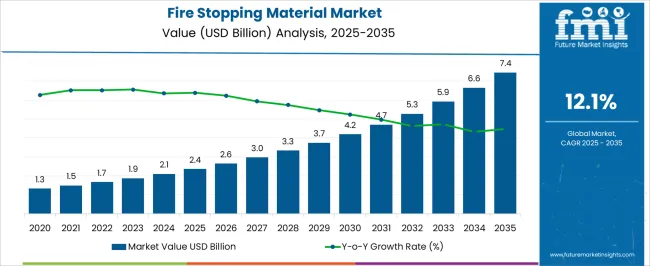

The Fire Stopping Material Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| Fire Stopping Material Market Estimated Value in (2025 E) | USD 2.4 billion |

| Fire Stopping Material Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The fire stopping material market is gaining momentum due to stricter building safety regulations, heightened awareness of fire protection standards, and increasing investment in commercial and industrial infrastructure. Demand is being reinforced by the necessity to maintain compartmentalization in buildings, ensuring structural integrity and limiting fire spread.

The market is currently characterized by strong adoption in large-scale construction projects where compliance with international fire safety codes is mandatory. Rising urbanization and the growth of high-rise structures have further accelerated the use of advanced fire stopping materials across electrical, mechanical, and structural applications.

Product innovations focusing on low VOC, easy-application, and environmentally sustainable formulations are enhancing market competitiveness. With ongoing global infrastructure expansion and stricter enforcement of safety protocols, the market outlook remains positive, and fire stopping materials are expected to play a vital role in ensuring resilience and safety across modern construction practices.

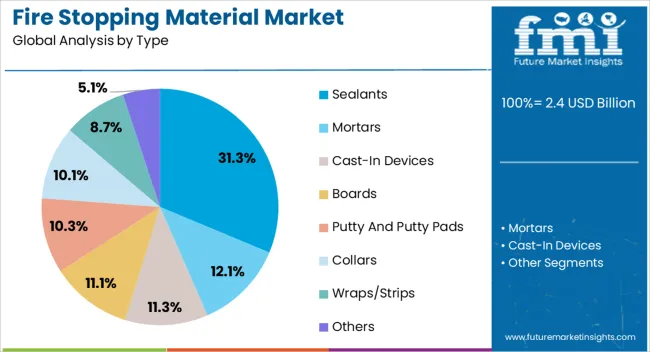

The sealants segment leads the type category with approximately 31.3% share, driven by their versatility in sealing gaps, joints, and penetrations across multiple construction areas. Their ability to form durable, flexible barriers against smoke, fire, and toxic gases has made them a preferred choice in both new construction and retrofitting projects.

Growth in this segment is further supported by the ease of application, compatibility with diverse building materials, and compliance with evolving safety standards. Sealants are particularly valued for their adaptability in high-density installations, including walls, ceilings, and floor penetrations.

Continuous improvements in intumescent formulations, ensuring expansion under heat, have further strengthened market adoption. With widespread application in large-scale infrastructure and commercial projects, the sealants segment is expected to retain its leadership within the market.

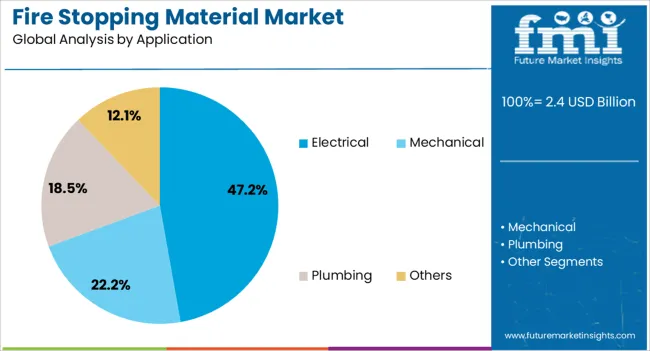

The electrical segment accounts for approximately 47.2% share of the application category in the fire stopping material market. Its dominance is attributed to the increasing complexity of building wiring systems, which create multiple penetration points requiring effective fire sealing.

Rising demand for fire-rated cables and protective solutions in commercial and industrial facilities has further driven growth. The segment benefits from regulatory emphasis on preventing fire propagation through electrical conduits and ensuring system integrity during emergencies.

High adoption in data centers, office complexes, and high-rise residential buildings underscores its significance. With the expansion of power infrastructure and digital connectivity projects worldwide, the electrical segment is expected to maintain its leadership throughout the forecast horizon.

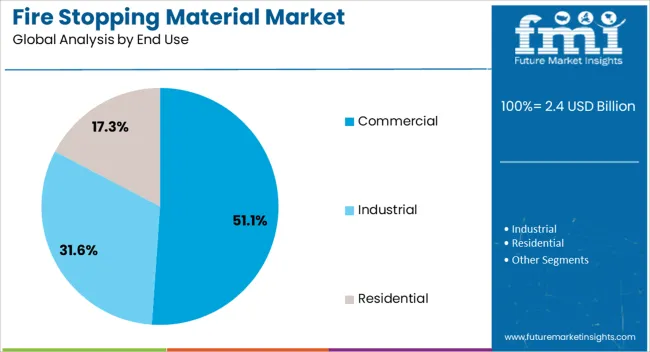

The commercial segment leads the end-use category, holding approximately 51.1% share in the fire stopping material market. This dominance is linked to stringent fire safety regulations in commercial spaces such as offices, shopping malls, healthcare facilities, and educational institutions.

High footfall in these structures necessitates compliance with advanced safety protocols, driving demand for fire-resistant materials. The segment is further supported by consistent investment in commercial real estate development across both developed and emerging economies.

Retrofitting projects in aging commercial buildings to meet updated fire safety codes have also boosted consumption. With urbanization accelerating and commercial infrastructure projects expanding globally, the commercial segment is anticipated to sustain its leading share in the forecast period.

The fire stopping material market is anticipated to surpass a global valuation of USD 7.4 billion by 2035, expanding at a 12.2% CAGR. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

| Attributes | Details |

|---|---|

| Top Type | Sealants |

| CAGR (2025 to 2035) | 12.00% |

Depending on the type, the fire stopping material market is bifurcated into sealants, mortar, boards, etc. The sealants segment dominates the market, growing at a CAGR of 12.0% through 2035.

| Attributes | Details |

|---|---|

| Top Applications | Electrical |

| CAGR (2025 to 2035) | 11.8% |

Based on applications, the fire stopping material market is categorized into electrical, mechanical, plumbing, etc. The electrical segment dominates the market and is anticipated to grow at a CAGR of 11.8% through 2035.

The section provides an analysis of the fire stopping material market by country, including Japan, China, the United States, South Korea, and the United Kingdom. The table presents the CAGRs for each country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.20% |

| Japan | 13.80% |

| United Kingdom | 13.20% |

| China | 12.80% |

| United States | 12.50% |

South Korea is one of the leading countries in this market. The South Korean fire stopping material market is anticipated to retain its dominance by progressing at a CAGR of 14.20% till 2035.

Japan is another Asian country leading the fire stopping material market. The Japanese market is anticipated to retain its dominance by progressing at an annual growth rate of 13.80% till 2035.

In the European region, the United Kingdom dominates the fire stopping material market. The United Kingdom market is anticipated to exhibit an annual growth rate of 13.20% through 2035.

China is another country leading the market in the Asian region. The Chinese fire stopping material market is anticipated to register a CAGR of 12.80% through 2035.

In the North American region, the United States leads the market. Over the next ten years, the demand for fire stopping material is projected to rise at a 12.50% CAGR.

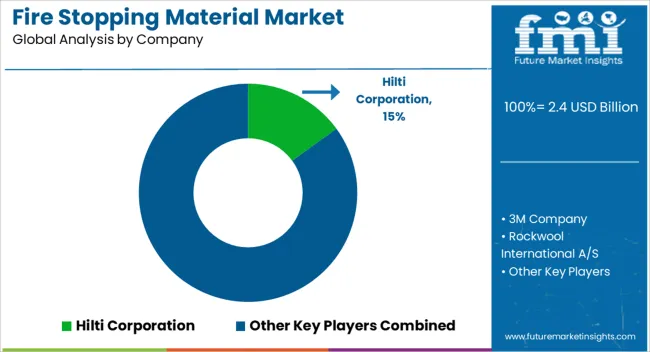

Hilti Corporation, 3M Company, Rockwool International A/S, BASF SE, Specified Technologies Inc. (STI), H. B. Fuller Company, and RectorSeal LLC are key players in the fire stopping materials market. These companies have expanded and diversified their product offerings to cater to a wide range of applications and provide comprehensive solutions for various industries, including construction, infrastructure, and manufacturing. Besides this, they are also adopting emerging technologies in manufacturing, such as automation and advanced material science, to stay competitive and maintain efficiency in production processes.

Recent Developments

The global fire stopping material market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the fire stopping material market is projected to reach USD 7.4 billion by 2035.

The fire stopping material market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in fire stopping material market are sealants, mortars, cast-in devices, boards, putty and putty pads, collars, wraps/strips and others.

In terms of application, electrical segment to command 47.2% share in the fire stopping material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Passive Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA