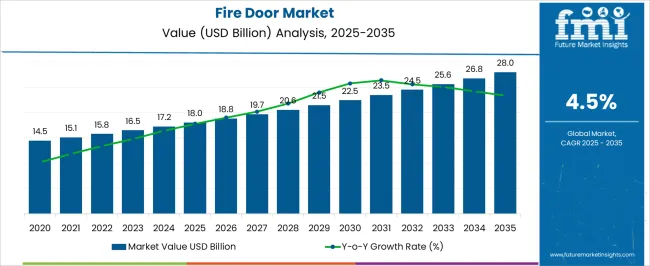

The fire door market is estimated to be valued at USD 18.0 billion in 2025 and is projected to reach USD 28.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The global fire door market is anticipated to grow from 18.0 USD billion in 2025 to 28.0 USD billion by 2035, registering a CAGR of 4.5%. Analysis of the rolling CAGR reveals a moderate and steady expansion pattern, with yearly increments showing incremental acceleration in adoption of fire safety solutions. In the initial years, from 2025 to 2028, growth is relatively stable, supported by regulatory enforcement in commercial and residential construction, increased awareness of fire safety standards, and retrofit demand in older infrastructure. Between 2029 and 2032, the market experiences slightly higher rolling CAGRs, influenced by rising construction activity in emerging economies and the adoption of fire-rated doors with enhanced durability, insulation, and automated safety features. Gradual deceleration is observed in 2033–2034, largely due to market saturation in developed regions and extended replacement cycles for existing installations.

By 2035, the growth curve stabilizes, reflecting steady demand across both new construction projects and renovation activities, particularly in sectors such as healthcare, education, and industrial facilities. The year-on-year increments from 18.0 USD billion to 28.0 USD billion demonstrate a balanced and sustainable growth trajectory, with minor fluctuations in rolling CAGR indicating temporary acceleration in regions with heightened construction investments. Overall, the market exhibits a consistent upward trend shaped by evolving safety regulations, technology-enhanced product offerings, and increasing global emphasis on fire prevention, ensuring that fire doors remain a critical component of building safety solutions over the forecast period.

| Metric | Value |

|---|---|

| Fire Door Market Estimated Value in (2025 E) | USD 18.0 billion |

| Fire Door Market Forecast Value in (2035 F) | USD 28.0 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The fire door market is shaped by interconnected parent segments, each contributing differently to demand and growth. The commercial buildings sector holds the largest share at over 40%, driven by stringent fire safety regulations and the need to protect occupants and property in the event of a fire. This is followed by the residential buildings sector, which accounts for over 30%, as growing awareness of fire safety and an increasing number of residential construction projects drive demand for fire doors in homes and apartments.

Industrial facilities represent a significant segment, with fire doors being essential for ensuring safety in manufacturing plants, warehouses, and factories. Healthcare facilities also require fire doors to protect patients and staff, making up a notable portion of the market. Educational institutions, including schools and universities, are increasingly adopting fire doors to comply with safety standards and protect students and staff. The market is influenced by the materials used in fire doors, with metal doors leading the market due to their durability and fire resistance.

Timber doors also hold a significant share, offering aesthetic appeal and cost-effectiveness. The operation mechanism of fire doors varies, with manual doors being the most common, though automatic and electric doors are gaining popularity for their convenience and compliance with modern building codes. Overall, the fire door market is experiencing steady growth, driven by increasing safety regulations, infrastructure development, and the need for fire-resistant buildings.

The fire door market is witnessing steady growth due to the increasing focus on building safety, fire prevention, and compliance with regulatory standards across commercial, residential, and industrial sectors. Rising awareness about fire hazards and stricter enforcement of fire safety codes in emerging and developed markets are driving demand for high-performance doors. Technological advancements in fire-resistant materials and door manufacturing processes are enhancing performance characteristics, including durability, thermal insulation, and structural integrity during fire events.

Investments in urban infrastructure, high-rise construction, and renovation projects are further fueling market expansion. Manufacturers are increasingly adopting materials and designs that not only meet safety standards but also provide aesthetic appeal and low maintenance.

The growing emphasis on workplace and residential safety, coupled with mandatory fire certifications, is reinforcing the adoption of fire doors across various end-use sectors As construction activities continue to rise globally and fire safety remains a critical concern, the market is positioned for sustained growth, with opportunities for product innovation and customized solutions for specific safety and architectural requirements.

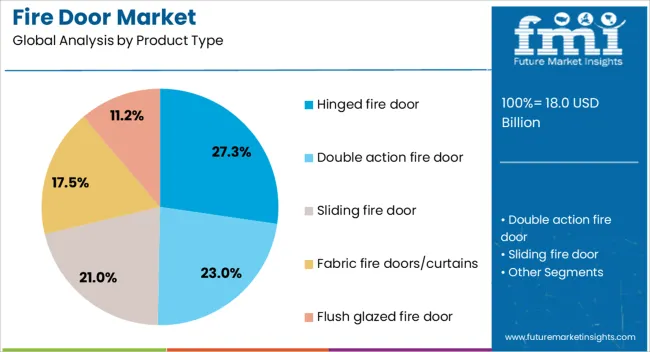

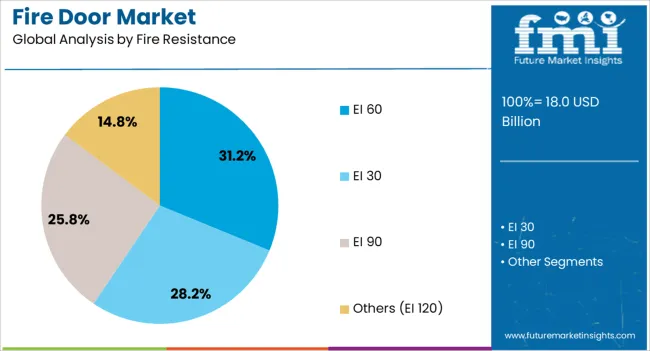

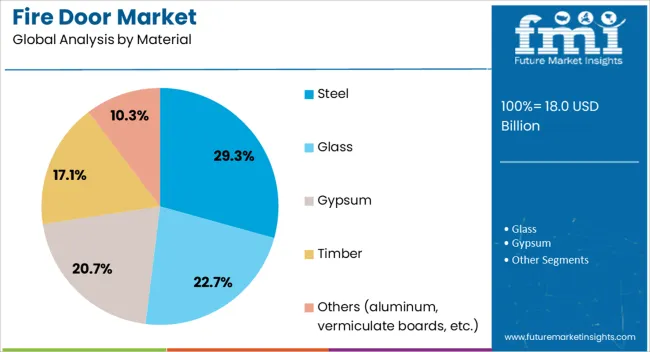

The fire door market is segmented by product type, fire resistance, material, application, and geographic regions. By product type, fire door market is divided into hinged fire door, double action fire door, sliding fire door, fabric fire doors/curtains, and flush glazed fire door. In terms of fire resistance, fire door market is classified into EI 60, EI 30, EI 90, and others (EI 120). Based on material, fire door market is segmented into steel, glass, gypsum, timber, and others (aluminum, vermiculate boards, etc.). By application, fire door market is segmented into commercial, residential, and industrial. Regionally, the fire door industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hinged fire door segment is projected to hold 27.3% of the fire door market revenue share in 2025, making it the leading product type. Its dominance is supported by the ease of installation, robust performance, and compatibility with a wide range of building designs. Hinged doors offer consistent sealing and structural integrity during fire events, which enhances safety in commercial, industrial, and residential properties.

The segment benefits from broad adoption in both new construction and retrofitting projects due to its reliability and proven performance. Manufacturers are providing options with advanced locking mechanisms and customizable sizes to meet specific safety codes and architectural requirements.

The ability of hinged doors to integrate with fire alarm and suppression systems further enhances their effectiveness in preventing the spread of fire and smoke As building regulations become more stringent and safety awareness increases, hinged fire doors are expected to maintain their leadership position by combining compliance, durability, and ease of use, making them the preferred choice for architects, contractors, and facility managers globally.

The EI 60 fire resistance segment is expected to account for 31.2% of the fire door market revenue share in 2025, establishing it as the leading fire resistance category. This segment’s growth is being driven by its ability to provide one hour of structural and insulation protection, which is essential for ensuring safe evacuation and minimizing damage in the event of a fire. EI 60 rated doors are widely specified in building codes for both commercial and residential applications, especially in high-rise buildings, hospitals, and industrial facilities where fire safety is critical.

The segment benefits from continuous advancements in materials and manufacturing processes that enhance thermal insulation and integrity under high temperatures. Rising demand for compliance with international safety standards and certifications is reinforcing adoption.

The ability to integrate EI 60 doors with other fire protection systems, such as smoke seals and automatic closers, increases their effectiveness The consistent performance, regulatory compliance, and proven safety benefits are driving the segment’s leadership in the fire door market.

The steel material segment is projected to hold 29.3% of the fire door market revenue share in 2025, making it the dominant material category. Its leadership is supported by superior structural strength, durability, and resistance to high temperatures and corrosion compared to other materials. Steel fire doors offer extended service life and require minimal maintenance, which is highly valued in commercial, industrial, and public infrastructure projects.

The material allows precise fabrication and incorporation of fire-resistant cores to meet stringent fire ratings, enhancing overall safety performance. The growing adoption is being reinforced by its compatibility with advanced locking systems, integration with security systems, and ability to comply with international fire safety standards.

Steel fire doors are also favored for their adaptability in diverse architectural applications, including high-traffic areas, industrial facilities, and critical infrastructure where safety cannot be compromised As awareness of fire hazards grows and regulatory requirements tighten, steel doors are expected to continue leading the market due to their reliability, robustness, and compliance advantages.

The fire door market is growing steadily due to regulatory enforcement, rising awareness of fire hazards, and increasing construction activities. Adoption of advanced materials, multi-layered designs, and certifications enhances performance and trust among end-users. Urban development and infrastructure projects create project-based demand, while e-commerce and improved supply chains enable wider accessibility and faster delivery. Manufacturers are focusing on durable, aesthetically versatile, and compliant doors to cater to residential, commercial, and industrial sectors.

The fire door market is being propelled by rising adoption of stringent fire safety codes and building regulations worldwide. Residential, commercial, and industrial sectors are mandated to install fire-rated doors to prevent fire spread, protect lives, and minimize property damage. Enhanced awareness of fire hazards and the need for compliance with local and international fire safety standards are driving demand. Fire doors with certifications such as UL, EN, and ISO ensure reliability and trust among architects, contractors, and end-users. Growing investments in construction, retrofitting of existing buildings, and public infrastructure projects further support market expansion, emphasizing the critical role of fire doors in safety management.

Market dynamics are influenced by the integration of advanced materials and innovative construction techniques. Steel, timber composites, gypsum cores, and intumescent coatings are widely used to enhance fire resistance, durability, and structural integrity. Multi-layered designs and insulation enhancements improve thermal performance and smoke protection. Manufacturers focus on developing doors that combine fire safety with aesthetic appeal and acoustic insulation. Lightweight yet robust constructions are preferred for easy installation and long-term performance. Research into novel materials and hybrid assemblies continues to expand product portfolios, addressing the specific needs of high-rise buildings, hospitals, educational institutions, and industrial facilities.

The fire door market is supported by the rapid development of urban infrastructure, industrial complexes, and commercial spaces. New constructions and refurbishment projects require compliance with modern fire safety codes, boosting demand for certified doors. Public and private sectors prioritize the installation of fire doors in airports, hospitals, shopping centers, and high-rise residential buildings. Large-scale infrastructure initiatives in emerging economies are creating opportunities for manufacturers and distributors. Project-based demand encourages collaboration between door suppliers, construction companies, and safety consultants, ensuring that fire doors meet both regulatory and functional requirements while maintaining design flexibility for diverse building layouts.

The rise of online procurement and direct-to-contractor distribution channels is reshaping fire door availability and installation services. Digital platforms facilitate easier ordering, bulk procurement, and timely delivery to construction sites. Warehousing and logistics enhancements ensure the secure handling of heavy and specialized doors, minimizing damage during transit. Manufacturers offer pre-fabricated modules, customizable dimensions, and installation support to enhance convenience for end-users. The growth of e-commerce and streamlined supply chains is particularly beneficial in regions with scattered construction activities, enabling faster market penetration and adoption of fire safety solutions.

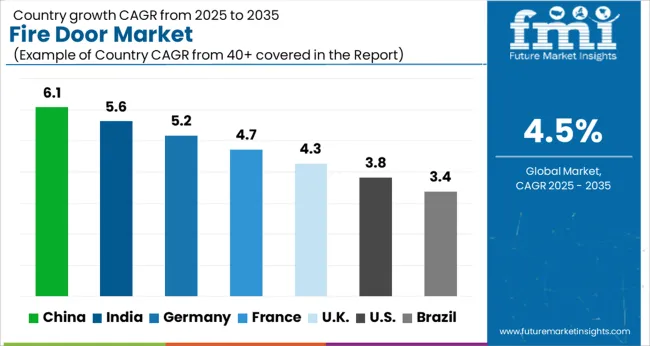

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| U.K. | 4.3% |

| U.S. | 3.8% |

| Brazil | 3.4% |

The global fire door market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads expansion at 6.1%, followed by India at 5.6%, Germany at 5.2%, the U.K. at 4.3%, and the U.S. at 3.8%. Growth is driven by stringent building safety regulations, rising construction activity, and increased awareness of fire protection standards across residential, commercial, and industrial sectors. China and India dominate manufacturing and installation due to rapid urban development and industrial expansion, while Germany, the U.K., and the U.S. focus on high-performance, certified fire-resistant door solutions and retrofitting of existing infrastructure. The analysis includes over 40 countries, with the leading markets detailed below.

The fire door market in China is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by increasing construction activity in commercial, industrial, and residential segments. Rapid urban development, high-rise building projects, and government-mandated fire safety regulations are fueling demand for certified fire doors with advanced resistance ratings. Manufacturers are introducing doors with improved materials, such as steel, composite, and intumescent-treated wood, to enhance durability, fire resistance, and sound insulation. Large-scale infrastructure projects, including airports, metro stations, and industrial complexes, are creating bulk procurement opportunities. Partnerships between domestic manufacturers and international fire safety solution providers facilitate technology transfer, compliance with global standards, and innovation in automated fire door systems. Awareness campaigns and stricter enforcement of building codes are further accelerating adoption in urban centers.

The fire door market in India is expected to grow at a CAGR of 5.6% from 2025 to 2035, supported by a surge in commercial infrastructure, industrial facilities, and high-density residential projects. Rising awareness of fire safety norms, along with regulatory mandates for fire-rated doors in public and private buildings, is boosting adoption. Manufacturers are offering modular and customizable fire doors using steel, aluminum, and engineered wood, meeting both safety and aesthetic requirements. The hospitality, healthcare, and educational sectors are significant consumers due to high compliance standards. Collaboration between local manufacturers and global suppliers ensures adherence to international certifications, training for installers, and advanced fire protection technology integration. Growing urbanization and increased investments in smart building projects are further expanding market potential.

Germany’s fire door market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by stringent fire safety regulations and high standards for commercial, industrial, and residential buildings. Industrial facilities, logistics warehouses, and public infrastructure projects increasingly adopt fire-rated doors with certifications such as EN 1634-1. Manufacturers focus on innovative materials, including steel-core composite doors, and fire-retardant coatings to enhance performance. The rising adoption of smart fire door systems with automated closing and alarm integration is improving building safety. Partnerships between German manufacturers and international fire protection solution providers support innovation, compliance, and large-scale deployment. Additionally, retrofit demand in older buildings and renovation projects contributes to steady market growth across urban and semi-urban regions.

The UK fire door market is expected to grow at a CAGR of 4.3% from 2025 to 2035, influenced by stricter building regulations following major fire incidents and regulatory compliance mandates for commercial and residential properties. Public buildings, hospitals, hotels, and high-rise apartments are primary end users due to fire safety obligations. Manufacturers are introducing high-performance fire doors using steel, aluminum, and composite materials that offer extended fire ratings, soundproofing, and durability. Technological integration such as automated closures, smoke seals, and alarm connectivity enhances safety and compliance. Retrofit demand in older buildings and ongoing urban regeneration projects is contributing to market expansion. Training programs for installers and partnerships with safety certification bodies ensure adherence to UK fire safety standards.

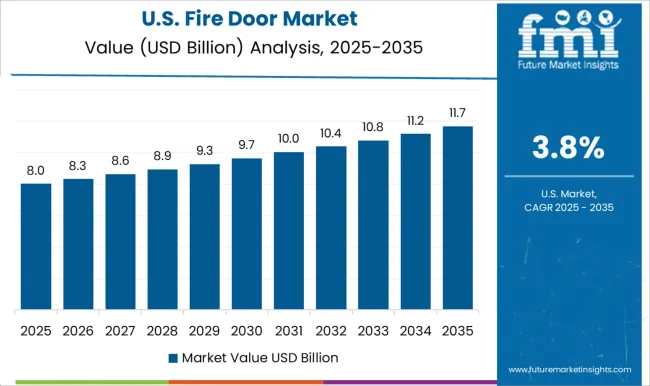

The U.S. fire door market is projected to grow at a CAGR of 3.8% from 2025 to 2035, shaped by increasing safety regulations for commercial, industrial, and multi-residential buildings. Demand is high in sectors such as healthcare, hospitality, education, and manufacturing facilities where fire-rated doors are mandated by local and national building codes. Manufacturers are focusing on high-strength materials, composite core doors, and innovative coatings that improve fire resistance, acoustic insulation, and durability. Smart fire door systems, including automated closers and integrated alarms, are gaining adoption for enhanced safety. Retrofit projects in older urban buildings and expansion of industrial parks also contribute to market growth. Strategic alliances with fire safety certification bodies and technology providers ensure compliance with NFPA and other national standards.

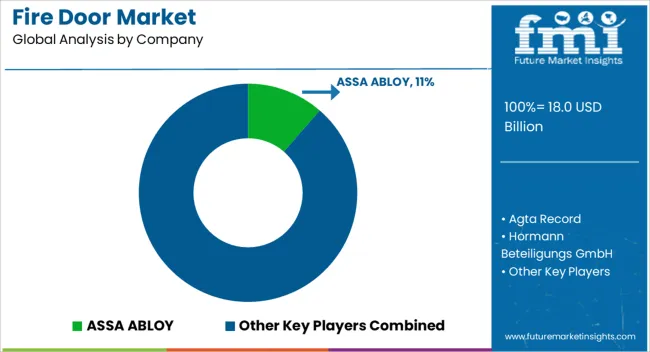

Competition in the fire door market is shaped by regulatory compliance, material innovation, and integration of smart technologies. ASSA ABLOY leads with a comprehensive range of fire-rated doors, including steel, timber, and glass options, emphasizing durability and compliance with global fire safety standards. Allegion focuses on providing secure and reliable fire door solutions, catering to both residential and commercial sectors. Dormakaba offers a variety of fire-rated doors and related hardware, integrating advanced locking systems for enhanced security.

JELD-WEN manufactures a wide array of fire-rated doors, combining aesthetic appeal with fire resistance to meet diverse architectural needs. Hormann Group specializes in high-performance fire doors, incorporating advanced materials and design to ensure safety and functionality. Sanwa Holdings Corporation provides fire-rated doors with a focus on quality and cost-effectiveness, serving various industrial applications. Chinsun Doors Co., Ltd. offers a range of fire-rated doors, emphasizing customization and compliance with international standards. The Cookson Company specializes in industrial fire doors, providing solutions tailored to manufacturing and warehouse environments.

Republic Doors and Frames manufactures fire-rated doors and frames, focusing on durability and ease of installation. Hoshimoto Co., Ltd. offers fire-rated doors with a focus on precision engineering and quality materials. Senneca Holdings provides fire-rated doors and related products, catering to both commercial and industrial applications. Strategies emphasize compliance with stringent fire safety regulations, innovation in materials such as intumescent seals and fire-resistant glass, and integration of smart technologies for enhanced monitoring and control. Companies are investing in research and development to improve the fire resistance, aesthetics, and functionality of their products. Collaborations and partnerships are being formed to expand product offerings and enter new markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 18.0 billion |

| Product Type | Hinged fire door, Double action fire door, Sliding fire door, Fabric fire doors/curtains, and Flush glazed fire door |

| Fire Resistance | EI 60, EI 30, EI 90, and Others (EI 120) |

| Material | Steel, Glass, Gypsum, Timber, and Others (aluminum, vermiculate boards, etc.) |

| Application | Commercial, Residential, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ASSA ABLOY, Agta Record, Hormann Beteiligungs GmbH, Chase Doors, Rapp Bomek AS, Republic Doors and Frames, China Buyang Co., Ltd., Wangli Group Co., Ltd., Fusim Group Co., Ltd., Taotao Group Co. Ltd., Mesker Openings Group, UK Fire Doors Ltd., National Firefighting Manufacturing FZCO, Nihon Funen Co., Ltd., Esserford Joinery Works Ltd., VISTA PANELS LIMITED, and Zhejiang Jiahui Doors Co., Ltd. |

| Additional Attributes | Dollar sales by material (wood, steel, composite) and type (single, double, sliding), share by end-use segment and region, growth trends, fire safety regulations, installation standards, emerging designs, and competitive positioning. |

The global fire door market is estimated to be valued at USD 18.0 billion in 2025.

The market size for the fire door market is projected to reach USD 28.0 billion by 2035.

The fire door market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in fire door market are hinged fire door, double action fire door, sliding fire door, fabric fire doors/curtains and flush glazed fire door.

In terms of fire resistance, ei 60 segment to command 31.2% share in the fire door market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA