The Fire Protective Materials Market is estimated to be valued at USD 36.9 billion in 2025 and is projected to reach USD 58.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. During the first five-year phase (2025–2030), the market will grow from USD 36.9 billion to USD 46.4 billion, adding USD 9.5 billion, which accounts for 44.6% of the total incremental growth. Stricter building codes, fire safety compliance in commercial infrastructure, and increasing use of fire-retardant coatings and insulation in industrial sectors such as oil & gas and transportation will drive this growth. The second half (2030–2035) contributes USD 11.8 billion, representing 55.4% of incremental growth, showing sustained momentum as smart fire protection systems and eco-friendly material formulations gain adoption.

Annual additions during the early phase average USD 1.9 billion, while later years see higher increments as megaprojects and retrofitting activities accelerate in urban centers. Manufacturers focusing on intumescent coatings, lightweight fireproofing solutions, and regional partnerships for distribution will capture the largest share of this USD 21.3 billion opportunity, especially in emerging markets where regulatory frameworks are becoming more stringent for fire safety compliance.

| Metric | Value |

|---|---|

| Fire Protective Materials Market Estimated Value in (2025 E) | USD 36.9 billion |

| Fire Protective Materials Market Forecast Value in (2035 F) | USD 58.2 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The fire protective materials market is witnessing sustained expansion, driven by stringent building safety regulations, heightened fire risk awareness, and increasing adoption across residential, commercial, and industrial sectors. Urban development initiatives and infrastructure investments have elevated the demand for fire-retardant materials that ensure passive protection, minimize structural damage, and enhance occupant safety.

Technological advancements have improved the performance, durability, and environmental compliance of fire-resistant coatings, sealants, and sprays. Moreover, global regulatory harmonization is compelling developers to integrate certified materials into new builds and retrofits.

Rising insurance premiums and risk-based design frameworks are further accelerating adoption. As cities expand vertically and construction codes become more comprehensive, fire safety compliance is poised to remain a primary driver of material innovation and application volume in the coming years.

The fire protective materials market is segmented by material application /end-use and geographic regions. The material of the fire protective materials market is divided into Coatings, Sealants & Fillers, Mortar, Sheets/Boards, Spray, Putty, Preformed Devices, Cast‑In Devices, and others (ablative, perlite, carbon foams, etc.).

In terms of application / end-use, the fire protective materials market is classified into Commercial, Residential, and Industrial / Institutional. Regionally, the fire protective materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Coatings are projected to account for 27.90% of the total revenue in the fire protective materials market by 2025, making them the leading material segment. This dominance is being attributed to their ease of application, cost-effectiveness, and compatibility with a wide range of substrates including steel, concrete, and wood.

Intumescent and ablative coatings have gained traction due to their ability to provide thermal insulation under high heat conditions while maintaining structural integrity. Adoption has been accelerated by compliance needs in multi-story commercial and industrial projects where retrofitting with spray-applied coatings is preferred.

Continuous innovation in low-VOC, high-performance formulations has further enhanced market acceptance. As fire rating requirements become more rigorous across jurisdictions, demand for certified fire-retardant coatings is expected to rise steadily.

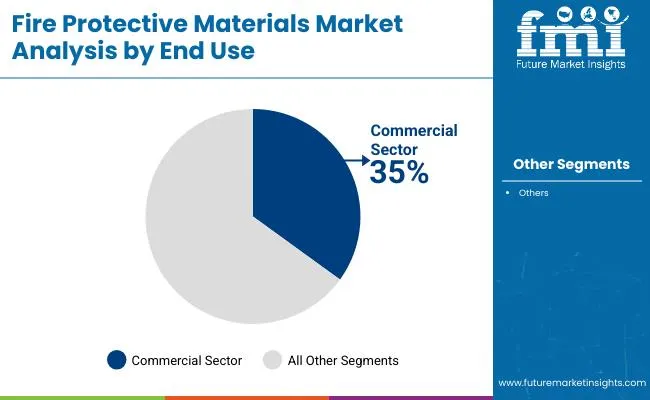

The commercial sector is expected to hold 35.00% of the fire protective materials market revenue in 2025, emerging as the leading end-use segment. This position is being reinforced by the increasing construction of commercial buildings such as offices, retail complexes, hospitals, and educational institutions that must comply with strict fire safety codes.

The focus on life safety, asset protection, and operational continuity has driven the widespread incorporation of passive fire protection systems. Moreover, frequent occupancy, higher fire load densities, and public access considerations in commercial spaces demand enhanced material performance and reliability.

With insurance providers and regulators tightening fire compliance mandates, investment in fire-resistant products during the design phase has become a standard across commercial development projects.

The fire protective materials market is expanding due to increasing emphasis on structural safety in industrial and commercial projects. Growth during 2024 and 2025 was driven by heightened adoption in infrastructure construction, oil and gas facilities, and high-rise buildings. Opportunities are emerging in lightweight intumescent coatings and advanced fireproofing materials for aerospace and energy sectors. Key trends include eco-aligned fire retardants, hybrid coating systems, and passive fire protection integration into modular construction. However, restraints such as fluctuating raw material prices, high installation costs, and compliance challenges with varying regional codes hinder market growth.

The major growth driver is stringent fire safety regulations and the rising need for fire resistance in modern infrastructure. In 2024 and 2025, projects in transportation hubs, tunnels, and commercial complexes incorporated fireproof coatings and insulating panels to meet regulatory standards. Energy plants and petrochemical facilities expanded usage of spray-applied fire-resistive materials for critical structural components. Increased insurance mandates for fire-protected buildings further encouraged adoption. These developments confirm that the combination of safety-driven requirements and rapid infrastructure development continues to accelerate demand for high-performance fire protection solutions globally.

Significant opportunities are present in intumescent coating technologies and lightweight materials tailored for aerospace and defense sectors. In 2025, advanced intumescent coatings delivering thin-film fire resistance became highly sought after in high-rise commercial projects, reducing structural load while ensuring compliance. Aerospace manufacturers focused on lightweight composite fire-retardant solutions for cabin interiors and structural assemblies. Expansion of data centers requiring passive fire barriers to safeguard critical assets opened additional revenue streams. These opportunities indicate that innovation and sector-specific customization will be essential for companies targeting high-growth application areas.

Emerging trends highlight the integration of hybrid protection systems and smart monitoring solutions. In 2024, developers implemented hybrid fireproofing combining cementitious sprays and thin-film coatings to achieve multi-layer protection in industrial settings. Digital integration for predictive maintenance and thermal monitoring of fire-resistant materials gained attention among facility managers seeking lifecycle efficiency. Lightweight composite panels offering thermal insulation and fire retardancy simultaneously became popular in modular building projects. These developments suggest a clear market shift toward multifunctional and technology-enabled solutions that ensure enhanced performance and operational convenience.

Market restraints include elevated application costs, raw material price volatility, and complex compliance requirements. In 2024 and 2025, expensive formulations for advanced coatings limited adoption among cost-sensitive construction projects. Shortages and fluctuating prices of key raw materials such as alumina and specialty polymers further impacted production economics. Stringent regulatory certifications for fireproofing systems added delays and increased testing expenses. These factors emphasize the importance of cost optimization, localized sourcing, and strategic partnerships to overcome adoption barriers and maintain competitiveness in the global fire protective materials market.

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.8% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.4% |

| USA | 4.0% |

| Brazil | 3.5% |

The global fire protective materials market is projected to grow at 4.7% CAGR from 2025 to 2035. China leads with 6.3% CAGR, driven by infrastructure development and strict building safety codes. India follows at 5.8%, supported by large-scale urban construction and fire safety regulations in commercial projects. France records 4.9% CAGR, reflecting rising adoption of advanced fireproof coatings and insulation in industrial and residential sectors. The United Kingdom grows at 4.4%, while the United States posts 4.0%, showing steady demand in mature markets focusing on innovative, eco-friendly fire protection solutions. Asia-Pacific dominates due to increased construction activity and government-led safety compliance programs, while Europe and North America emphasize sustainable and performance-driven materials. This report includes insights on 40+ countries; the top markets are shown here for reference.

The fire protective materials market in China is forecasted to grow at 6.3% CAGR, supported by rapid industrialization and growing emphasis on fire safety standards in high-rise buildings. Demand for fire-resistant coatings, boards, and cladding materials is accelerating across commercial and residential projects. Manufacturers focus on developing eco-friendly, non-toxic fire protection products to meet updated regulatory norms. The transportation and energy sectors further drive consumption of high-performance materials for tunnels, power plants, and chemical facilities.

The fire protective materials market in India is projected to grow at 5.8% CAGR, driven by rapid infrastructure growth and stricter enforcement of fire safety codes in residential and commercial buildings. Rising investment in metro rail, airports, and smart city projects creates significant demand for fire-resistant insulation and coatings. Domestic manufacturers focus on cost-effective solutions, while global players introduce intumescent coatings and advanced fire-retardant systems. Growing awareness in tier-2 and tier-3 cities further contributes to adoption.

The fire protective materials market in France is expected to grow at 4.9% CAGR, driven by compliance with stringent EU building safety standards and energy-efficiency regulations. Adoption of fireproof coatings and insulation materials accelerates in commercial and industrial segments. Manufacturers invest in lightweight and environmentally friendly materials to meet green construction mandates. Demand for passive fire protection in structural steel applications strengthens as urban redevelopment projects rise across major cities.

The fire protective materials market in the United Kingdom is projected to grow at 4.4% CAGR, supported by stringent building codes and emphasis on fire risk mitigation in high-density housing projects. Adoption of spray-applied fireproofing materials and cementitious coatings increases in high-rise and public infrastructure projects. Manufacturers innovate to create hybrid solutions combining thermal insulation and fire resistance. Digital compliance systems for building safety audits encourage demand for certified products.

The fire protective materials market in the United States is forecasted to grow at 4.0% CAGR, reflecting steady demand in a mature market with strong regulatory frameworks. Growth in retrofitting and renovation projects sustains adoption of fireproof paints and passive protection systems. Manufacturers prioritize low-VOC and eco-friendly coatings to align with sustainability requirements. The energy and transportation sectors show increased demand for high-performance fire barriers in tunnels, storage tanks, and petrochemical facilities.

The fire protective materials market is dominated by 3M Company, which secures its leadership through an extensive portfolio of firestopping products, intumescent coatings, and passive fire protection systems engineered for commercial, industrial, and infrastructure projects. 3M strengthens its dominant position with strong R&D capabilities, global supply networks, and proven performance in enhancing structural fire resistance and compliance with stringent building codes. Key players such as BASF Coating GmbH and Morgan Advanced maintain significant shares by offering advanced fireproof coatings, insulating materials, and composite solutions for high-risk environments in construction, oil and gas, and transportation sectors.

These companies prioritize product reliability, durability under extreme conditions, and integration with energy-efficient building solutions. Emerging player Svt Holding GmbH is expanding its market footprint by delivering specialized fire protection systems for critical facilities and introducing environmentally safe, low-VOC coating technologies. Market growth is driven by increasing urban infrastructure development, rising safety regulations for residential and commercial spaces, and the need for fire-resistant solutions in high-value assets. Continuous innovation in lightweight fire protection materials, advanced chemical formulations, and multifunctional coatings is expected to influence competitive strategies, positioning the market for strong adoption across global construction and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.9 Billion |

| Material | Coatings, Sealants & Fillers, Mortar, Sheets/Boards, Spray, Putty, Preformed Devices, Cast‑In Devices, and Others (ablative, perlite, carbon foams, etc.) |

| Application / End-Use | Commercial, Residential, and Industrial / Institutional |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Morgan Advanced, Svt Holding GmbH, and BASF Coating GmbH |

| Additional Attributes | Dollar sales by material type (intumescent coatings, fireproof boards, textiles) and end-use sector (construction, industrial, infrastructure). North America and Europe lead under strict fire-safety codes; Asia-Pacific grows fastest. Buyers prioritize UL/EN-certified, sustainable materials with extended life-cycle. Innovations include bio-based composites, modular containment panels, and high-temperature ceramic systems for structural fire resistance. |

The global fire protective materials market is estimated to be valued at USD 36.9 billion in 2025.

The market size for the fire protective materials market is projected to reach USD 58.2 billion by 2035.

The fire protective materials market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in fire protective materials market are coatings , sealants & fillers, mortar, sheets/boards, spray, putty, preformed devices, cast‑in devices and others (ablative, perlite, carbon foams, etc.).

In terms of application / end-use, commercial segment to command 35.0% share in the fire protective materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fire Resistant Apron Market Size and Share Forecast Outlook 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Sprinkler System Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Suppression System Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA