The firearms market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 16.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Annual increments during this period range from USD 0.4 billion to 0.5 billion, indicating a stable expansion driven by consistent demand. Each year reflects gradual adoption across both personal and institutional segments, with moderate growth in new regions complementing established markets.

The 2025 value of USD 10.4 billion marks a midpoint where the market moves from foundational growth to a more structured expansion phase, establishing baseline expectations for production and sales volumes. From 2025 to 2035, the market continues its consistent upward trajectory, reaching USD 16.4 billion. Yearly increases average between USD 0.5 billion and 0.7 billion, reflecting steady demand and incremental market penetration.

Replacement purchases, incremental product launches, and expansion into emerging segments largely drive growth. By the latter part of this decade, annual growth stabilizes slightly, indicating the market is maturing but still offers opportunities for established players. Overall, the YoY analysis highlights a controlled, predictable expansion pattern, allowing companies to plan production, distribution, and marketing strategies with a clear understanding of incremental growth trends.

| Metric | Value |

|---|---|

| Firearms Market Estimated Value in (2025 E) | USD 10.4 billion |

| Firearms Market Forecast Value in (2035 F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The current landscape is shaped by rising geopolitical tensions, internal security challenges, and a strong emphasis on tactical preparedness, particularly among military and paramilitary forces. Firearms are also seeing growing demand in the commercial and sporting segments, driven by changing regulatory landscapes and evolving consumer preferences.

Advancements in modular weapon systems, enhanced firing accuracy, and lighter materials have improved product usability and performance. In developing economies, domestic production initiatives and strategic procurement programs are enabling wider deployment of advanced firearms.

Technological integration in weapon platforms and demand for multi-caliber systems are expected to open up further opportunities across segments. The market is expected to maintain an upward trajectory as both institutional and individual end users continue to prioritize performance-driven, adaptable, and reliable firearms.

The firearms market is segmented by type, caliber, end use, distribution channel, and geographic regions. By type, the firearms market is divided into Handguns, Rifles, Shotguns, Machine guns, Submachine guns, and Others. In terms of caliber, the firearms market is classified into Small Caliber, Medium Caliber, Large Caliber, and Shotgun Gauges. Based on end use, the firearms market is segmented into Military, Law enforcement agencies, civilians, private security firms, and shooting ranges and clubs. By distribution channel, the firearms market is segmented into Direct sales (manufacturer to consumer) and Indirect sales (distributors to consumers). Regionally, the firearms industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Handguns segment is expected to account for 33.80% of the total Firearms market revenue in 2025, making it the leading type segment. This position is being driven by high demand for compact, concealable, and easily operable firearms among military, law enforcement, and civilian users. Handguns are favored for their maneuverability, ease of handling in close-quarters situations, and suitability for personal defense.

Growth in this segment has also been influenced by the expanding adoption of sidearms as standard issue in armed forces and police departments. The ability to integrate with modern targeting systems and modular accessories has further strengthened their position.

Civilian ownership regulations in certain countries have also led to increased purchases of handguns for self-defense purposes. Additionally, the rising number of certified training institutions and shooting sports events has further boosted the prominence of handguns across both tactical and recreational domains.

The Small Caliber segment is projected to hold 41.20% of the overall Firearms market revenue in 2025, positioning it as the most dominant in terms of caliber. This growth has been supported by widespread deployment of small-caliber weapons in military and law enforcement operations where lightweight, rapid-fire, and low-recoil characteristics are essential.

Small-caliber firearms are well-suited for both short-range combat and urban warfare scenarios, contributing to their broad usage across tactical units. Additionally, the segment has been bolstered by the increasing production of ammunition and small arms under defense modernization schemes.

Civilian and sporting applications have further reinforced the adoption of small caliber weapons due to their affordability, lower maintenance requirements, and versatility. The compatibility of small caliber systems with training platforms and simulation systems has also added to their appeal in institutional settings, solidifying their continued demand.

The Military end use segment is expected to contribute 39.70% of the Firearms market revenue in 2025, establishing it as the largest end user. This leadership has been attributed to growing investments in armed forces modernization, strategic defense procurement, and national security infrastructure. Military demand for firearms is driven by the need for advanced, reliable, and field-adaptable weapons that support mission-critical operations across varied terrains.

Integration of firearms into broader soldier modernization programs has further increased focus on weapon performance, weight reduction, and modularity. The steady induction of new infantry and special forces units has led to increased procurement of both primary and secondary weapons.

In addition, rising geopolitical instability and cross-border threats have reinforced the urgency for armed readiness, leading governments to invest in locally manufactured as well as internationally sourced military firearms. As a result, the military segment remains a primary contributor to overall market revenue, with further growth expected through sustained defense partnerships and procurement cycles.

The firearms market is growing steadily due to rising demand from law enforcement, military, and civilian sectors for personal protection, sport shooting, and defense applications. Technological advancements in lightweight materials, modular designs, and smart firearms enhance functionality and user safety. North America leads the market due to strong civilian ownership and well-established defense procurement, while Asia-Pacific and Europe show increasing adoption in law enforcement and sporting applications. Market expansion focuses on reliability, customization, and integration of optics and accessories. Companies differentiate through advanced manufacturing, precision engineering, and digital safety features.

Stringent regulations and varying gun control laws across regions pose major challenges. Firearms manufacturers must comply with licensing, import/export restrictions, background checks, and safety standards. Civilian firearm ownership rules differ widely, affecting market access and sales volumes. Law enforcement and military procurement also require adherence to standardized performance and safety specifications. Non-compliance can result in legal penalties, limited market access, and reputational risks. Until global firearm regulations become more harmonized, companies must navigate complex regulatory landscapes to ensure compliant manufacturing, distribution, and sales across multiple regions.

Technological innovation is driving firearms market growth. Advancements include modular platforms, lightweight materials like polymer composites, enhanced precision engineering, smart gun technology with biometric authentication, and integrated optics or targeting systems. Firearms manufacturers are also developing quieter, recoil-reducing, and ergonomically optimized models. Research and development partnerships support the creation of high-performance and user-friendly designs. These innovations cater to military, law enforcement, and civilian needs, providing greater accuracy, safety, and adaptability, which drives adoption across all key segments.

The firearms market is highly competitive, with established global manufacturers, regional producers, and emerging startups vying for market share. Competition is based on product reliability, technological innovation, brand reputation, and pricing. Fragmentation exists due to numerous small-scale producers in local markets. Companies invest in R&D, marketing, and partnerships with defense agencies to differentiate their products. Until consolidation or strong brand differentiation occurs, intense rivalry and market fragmentation will continue to influence pricing, innovation pace, and customer loyalty.

Raw materials such as steel, aluminum, and advanced polymers are critical for firearms production. Fluctuations in material availability, geopolitical tensions, and logistics challenges can impact production schedules and costs. Companies investing in vertical integration, strategic sourcing, and inventory management achieve higher reliability and cost efficiency. Supply chain stability also affects delivery timelines for military and law enforcement contracts. Until raw material supply and production scalability improve, manufacturers will continue facing challenges that influence overall market growth and operational efficiency.

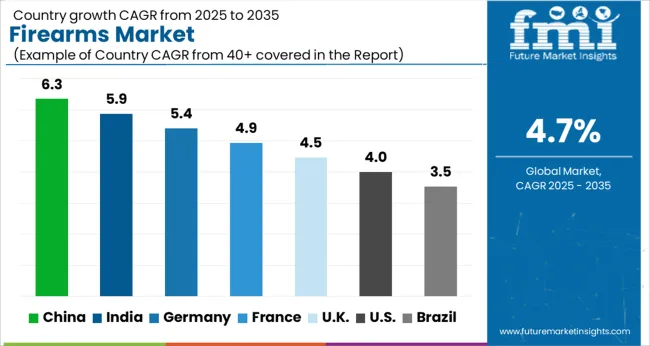

The global firearms market is projected to grow at a CAGR of 4.7% through 2035, supported by increasing demand across defense, law enforcement, and civilian security applications. Among BRICS nations, China has been recorded with 6.3% growth, driven by large-scale production and deployment in military and security sectors, while India has been observed at 5.9%, supported by rising utilization in defense and law enforcement operations. In the OECD region, Germany has been measured at 5.4%, where production and adoption for military, law enforcement, and civilian markets have been steadily maintained. The United Kingdom has been noted at 4.5%, reflecting consistent use in defense and security operations, while the USA has been recorded at 4.0%, with production and deployment for law enforcement, defense, and civilian markets being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The firearms market in China is growing at a CAGR of 6.3%, driven primarily by increasing demand in law enforcement, defense, and security sectors. While civilian ownership is heavily regulated, government agencies are investing in modern firearms for policing, border security, and counter-terrorism operations. Technological advancements, such as smart firearms, modular weapons systems, and improved accuracy, are boosting adoption in military and security forces. Additionally, training programs and modernization of paramilitary units are fueling the demand for advanced firearms. Export of defense equipment, domestic production initiatives, and strategic partnerships with global defense manufacturers also contribute to market expansion. Rising safety awareness, combined with government investments in national security infrastructure, ensures a steady growth trajectory for firearms in China.

The firearms market in India is expanding at a CAGR of 5.9%, supported by increasing security requirements across defense, law enforcement, and private security sectors. Rising threats related to terrorism, border conflicts, and industrial security are driving the procurement of modern firearms. Government initiatives focusing on modernization of police and paramilitary forces, coupled with domestic production of weapons under “Make in India” programs, are fueling market growth. Technological improvements in firearms, including better accuracy, modular design, and ergonomic features, make weapons more efficient for professional use. Training programs for security personnel and rising awareness of safety protocols also contribute to steady adoption. The firearms market in India is expected to grow consistently, supported by rising security investments and strategic partnerships with international defense manufacturers.

The firearms market in Germany is growing at a CAGR of 5.4%, primarily driven by defense modernization, law enforcement needs, and sports shooting activities. The market benefits from stringent regulatory compliance and safety standards, which emphasize quality and reliability of firearms. Demand comes from military units, police forces, and recreational shooting clubs, with advanced firearms offering high precision, modular features, and safety enhancements. Technological innovation in firearms, including smart guns and improved targeting systems, supports adoption. Government investments in defense procurement and industrial partnerships with European firearm manufacturers further bolster market growth. Germany’s established defense ecosystem and strong export orientation ensure that the firearms market remains stable, with moderate but consistent expansion driven by both domestic and international demand.

The firearms market in the United Kingdom is expanding at a CAGR of 4.5%, mainly driven by security forces, specialized defense units, and sporting applications. Civilian ownership is tightly regulated, so demand is primarily from law enforcement agencies, military personnel, and licensed sporting enthusiasts. Modern firearms with enhanced precision, ergonomics, and safety features are being adopted for counter-terrorism, border security, and industrial protection. Government initiatives for law enforcement modernization, training programs, and compliance with international defense standards support market growth. Technological innovations, such as advanced targeting systems, modular firearms, and improved durability, ensure that the UK firearms market continues to grow at a steady pace, despite strict regulations on civilian usage.

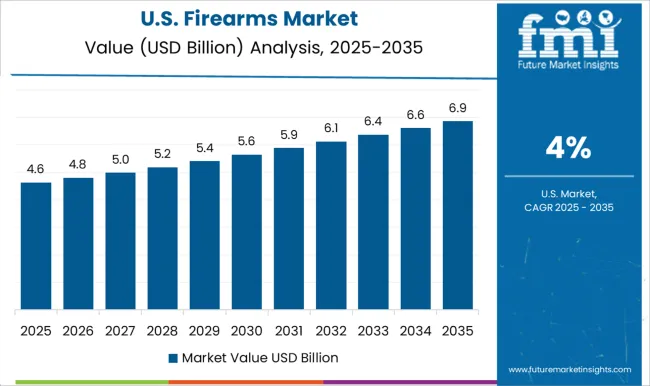

The firearms market in the United States is growing at a CAGR of 4.0%, driven by defense, law enforcement, and civilian segments. While civilian firearm ownership is significant, demand from security agencies, border protection, and defense organizations remains a key factor. Technological advancements, including modular designs, smart firearms, and improved accuracy, enhance usability across multiple sectors. Government initiatives focusing on law enforcement modernization, tactical training, and safety compliance support market growth. Recreational shooting, competitive sports, and hunting also contribute to civilian demand. Continuous innovation in firearm technology, combined with robust manufacturing and distribution infrastructure, ensures sustained expansion of the firearms market in the USA, balancing both regulatory oversight and strong consumer interest.

The firearms market encompasses a broad range of products, including handguns, rifles, shotguns, and specialized tactical firearms, catering to law enforcement, military, recreational shooting, and personal defense needs. Key suppliers and manufacturers are driving technological advancements, safety features, and ergonomic designs in this competitive industry.

Smith & Wesson is a globally recognized firearms manufacturer, renowned for revolvers, pistols, and tactical rifles. Barrett Headquarters specializes in high-precision long-range rifles and heavy-caliber firearms, widely used in military and law enforcement. Colt CZ Group SE produces iconic revolvers and pistols, combining heritage design with modern performance. FN Herstal focuses on military-grade firearms, including rifles and machine guns, emphasizing durability and reliability. Glock Inc. is known for its polymer-framed pistols, widely adopted by law enforcement worldwide. Heckler & Koch develops advanced firearms with cutting-edge safety and modular features, while Kalashnikov Concern JSC manufactures a range of rifles, shotguns, and assault weapons with a focus on rugged performance.

Mossberg & Sons, Inc. specializes in shotguns and tactical firearms for civilian and law enforcement use. Pietro Beretta Arms Factory SpA offers a diverse lineup of pistols, shotguns, and rifles, combining tradition with modern engineering. Other notable players include PTR Industries Inc., RemArms LLC, Ruger & Co., Inc., SIG Sauer, and Taurus International Manufacturing, Inc., each contributing innovations in precision, safety, and customization options for both civilian and professional markets. These leading suppliers continue to shape the global firearms industry through research, development, and a focus on meeting diverse user needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Type | Handguns, Rifles, Shotguns, Machine guns, Submachine guns, and Others |

| Caliber | Small Caliber, Medium Caliber, Large Caliber, and Shotgun Gauges |

| End Use | Military, Law enforcement agencies, civilians, private security firms, and shooting ranges and clubs |

| Distribution Channel | Direct sales (manufacturer to consumer) and Indirect sales (distributors to consumers) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Smith & Wesson, Barrett Headquarters, Colt CZ Group SE, FN HERSTAL, Glock Inc., Heckler & Koch, Kalashnikov Concern JSC, MOSSBERG & SONS, INC., Pietro Beretta Arms Factory SpA, PTR Industries Inc., RemArms LLC., Ruger & Co., Inc., SIG SAUER, and Taurus International Manufacturing, Inc. |

| Additional Attributes | Dollar sales by type including handguns, rifles, and shotguns, application across personal defense, law enforcement, and military sectors, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising security concerns, increasing civilian gun ownership, and defense modernization programs worldwide. |

The global firearms market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the firearms market is projected to reach USD 16.4 billion by 2035.

The firearms market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in firearms market are handguns, rifles, shotguns, machine guns, submachine guns and others.

In terms of caliber, small caliber segment to command 41.2% share in the firearms market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA