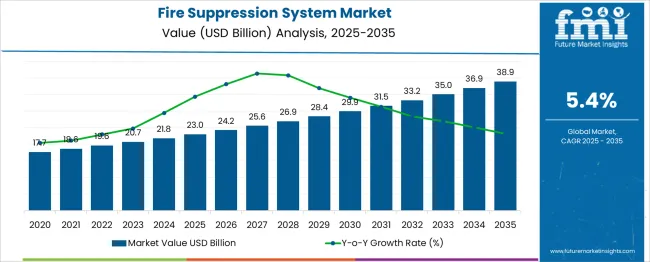

The global fire suppression system market is expected to grow from USD 23 billion in 2025 to approximately USD 38.9 billion by 2035, recording an absolute increase of USD 15.9 billion over the forecast period. This translates into a total growth of 69.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.69X during the same period, supported by increasing safety regulations across industries, rising awareness about fire safety measures, and growing investments in infrastructure development and commercial construction projects.

Between 2025 and 2030, the fire suppression system market is projected to expand from USD 23 billion to USD 30.1 billion, resulting in a value increase of USD 7.1 billion, which represents 44.7% of the total forecast growth for the decade. This phase of development will be shaped by rising safety compliance requirements, increasing adoption of advanced fire suppression technologies, and growing penetration of automated fire safety systems in commercial and industrial facilities. Safety equipment manufacturers are expanding their product portfolios to address the growing demand for comprehensive fire protection solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 23 billion |

| Forecast Value in (2035F) | USD 38.9 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

From 2030 to 2035, the market is forecast to grow from USD 30.1 billion to USD 38.9 billion, adding another USD 8.8 billion, which constitutes 55.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart fire safety systems, the integration of IoT and digital monitoring technologies, and the development of environmentally-friendly suppression agents. The growing adoption of building automation systems and intelligent fire safety solutions will drive demand for advanced fire suppression systems with enhanced detection capabilities and automated response features.

Between 2020 and 2025, the fire suppression system market experienced steady expansion, driven by increasing focus on workplace safety and growing awareness of fire hazards in industrial and commercial settings. The market developed as building owners and facility managers recognized the critical importance of comprehensive fire protection systems. Regulatory requirements and insurance considerations have begun to emphasize the necessity of advanced fire suppression solutions in maintaining safe operating environments.

Market expansion is being supported by the increasing emphasis on fire safety regulations and the corresponding demand for comprehensive fire protection solutions across various sectors. Modern building codes and safety standards are increasingly focused on proactive fire prevention measures that can protect lives and property from fire-related damage. Fire suppression systems' proven effectiveness in rapid fire detection and suppression makes them essential components in commercial, industrial, and residential safety infrastructure.

The growing emphasis on smart building technologies and automated safety systems is driving demand for fire suppression solutions that can integrate with building management systems and provide real-time monitoring capabilities. Facility managers' preference for systems that combine fire protection with data analytics and remote monitoring is creating opportunities for innovative fire suppression implementations. The rising influence of insurance requirements and liability considerations is also contributing to increased adoption of advanced fire suppression systems across different building types and occupancy classifications.

The market is segmented by product, application, and region. By product, the market is divided into fire extinguishers, gas, water, dry chemical powder, others, and sprinklers. Based on application, the market is categorized into industrial, commercial, and residential. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The fire extinguishers segment is projected to account for 57% of the fire suppression system market in 2025, reaffirming its position as the dominant product category. Building owners and safety managers increasingly prefer fire extinguishers for their versatility, portability, and effectiveness in addressing various types of fire hazards across different environments. Fire extinguishers' well-documented reliability in providing immediate fire suppression capability directly addresses safety requirements for first-response fire protection in commercial, industrial, and residential applications.

This product category forms the foundation of most fire safety strategies, as it represents the most accessible and widely deployed fire suppression solution across multiple building types and occupancy scenarios. Safety equipment manufacturer investments in extinguisher technology and ongoing development of specialized formulations continue to strengthen market adoption. With facility managers prioritizing immediate fire response capabilities and regulatory compliance, fire extinguishers align with both safety requirements and practical deployment considerations, making them the central component of comprehensive fire protection systems.

Industrial applications are projected to represent 49% of fire suppression system demand in 2025, underscoring their critical role in protecting manufacturing facilities and industrial operations. Industrial facility managers prefer comprehensive fire suppression systems for their ability to preserve high-value equipment, maintain operational continuity, and ensure worker safety in environments with elevated fire risks. Positioned as essential infrastructure for industrial safety, fire suppression systems offer both immediate fire response capabilities and long-term asset protection benefits.

The segment is supported by stringent industrial safety regulations and insurance requirements that mandate comprehensive fire protection systems in manufacturing and processing facilities. Additionally, industrial users are increasingly investing in specialized fire suppression systems designed for specific hazards such as chemical processing, metal working, and electrical equipment protection. As industrial operations prioritize safety compliance and operational continuity, industrial fire suppression systems will continue to dominate the market while supporting comprehensive facility protection strategies.

The fire suppression system market is advancing steadily due to increasing focus on fire safety regulations and growing demand for comprehensive building protection solutions. However, the market faces challenges including high installation costs, maintenance requirements, and competition from alternative fire protection approaches. Innovation in detection technologies and suppression agents continues to influence product development and market expansion patterns.

The growing adoption of smart building technologies is enabling the integration of fire suppression systems with building management platforms and IoT monitoring capabilities. Smart fire suppression systems offer real-time monitoring, predictive maintenance alerts, and automated response coordination that enhance overall building safety management. Facility managers are increasingly recognizing the operational and safety advantages of connected fire protection systems.

Modern fire suppression manufacturers are incorporating advanced smoke detection, heat sensing, and suppression agent delivery technologies to improve system response times and effectiveness. These technologies enhance fire detection accuracy while reducing false alarms and providing more targeted suppression responses. Advanced system designs also enable integration with building automation systems and emergency response protocols for coordinated safety management.

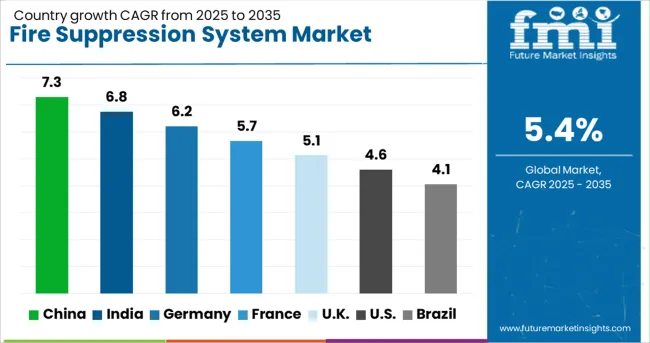

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

The fire suppression system market is experiencing solid growth globally, with China leading at a 7.3% CAGR through 2035, driven by rapid urbanization, expanding industrial development, and increasing focus on safety regulations in construction and manufacturing sectors. India follows closely at 6.8%, supported by growing commercial construction, developing industrial base, and rising awareness of fire safety requirements. Germany shows strong growth at 6.2%, emphasizing advanced industrial safety systems and regulatory compliance solutions. France records 5.7%, focusing on commercial building safety and fire protection technology innovation. The UK shows 5.1% growth, prioritizing building safety standards and smart fire suppression integration. The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from fire suppression systems in China is projected to exhibit strong growth with a CAGR of 7.3% through 2035, driven by rapid urbanization and massive infrastructure development projects. The country's expanding industrial sector and growing focus on workplace safety are creating significant demand for comprehensive fire protection solutions. Major domestic and international fire safety companies are establishing production facilities and distribution networks to serve both domestic construction markets and export opportunities.

Revenue from fire suppression systems in India is expanding at a CAGR of 6.8%, supported by rapidly growing commercial construction, expanding manufacturing sector, and increasing government focus on fire safety regulations. The country's developing infrastructure and rising safety awareness are driving demand for reliable fire protection solutions. International fire safety companies and domestic manufacturers are establishing comprehensive service networks to address the growing demand for fire suppression systems.

Demand for fire suppression systems in Germany is projected to grow at a CAGR of 6.2%, supported by the country's leadership in industrial safety standards and strong emphasis on advanced fire protection technologies. German industrial facilities and commercial buildings consistently demand high-performance fire suppression systems that meet stringent safety requirements and provide reliable protection for high-value operations.

Revenue from fire suppression systems in France is projected to grow at a CAGR of 5.7% through 2035, driven by the country's active commercial construction sector and focus on building safety innovation. French building owners and facility managers consistently demand high-quality fire protection systems that deliver superior performance while maintaining architectural integration and operational efficiency.

Revenue from fire suppression systems in the UK is projected to grow at a CAGR of 5.1% through 2035, supported by a strong emphasis on building safety regulations and fire protection compliance requirements. British building owners and facility managers value comprehensive fire protection, regulatory compliance, and proven system reliability, positioning fire suppression systems as essential components of modern building safety infrastructure.

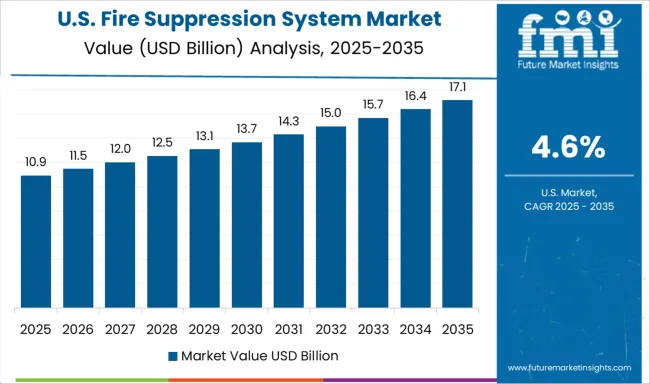

Revenue from fire suppression systems in the USA is projected to grow at a CAGR of 4.6% through 2035, supported by the country's leadership in fire safety technology innovation, advanced building codes, and preference for high-performance fire protection solutions. American building owners and facility managers prioritize system reliability, regulatory compliance, and technological advancement, making advanced fire suppression systems a preferred choice in commercial and industrial applications.

Revenue from fire suppression systems in Brazil is projected to grow at a CAGR of 4.1% through 2035, supported by expanding commercial construction, growing industrial development, and increasing adoption of safety regulations in building design and facility management. The country's developing infrastructure and rising safety consciousness are creating significant opportunities for fire protection system deployment. International fire safety companies and domestic distributors are establishing comprehensive service networks to serve the growing demand for reliable fire suppression solutions.

The fire suppression system market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced manufacturing sector and stringent safety regulations, supported by companies leveraging engineering expertise to develop high-performance fire suppression solutions for industrial applications that emphasize reliability and comprehensive facility protection.

France represents a significant market driven by its commercial construction sector and sophisticated understanding of fire safety requirements, with companies focusing on premium fire suppression systems that combine French engineering with advanced safety technologies for enhanced building protection and regulatory compliance benefits in commercial and industrial facilities.

The UK exhibits considerable growth through its embrace of advanced fire safety standards and building automation integration, with strong adoption of fire suppression systems in commercial buildings, industrial facilities, and residential developments. Germany and France are showing increasing interest in smart fire suppression applications, particularly in automated industrial safety systems and intelligent building management integration. BENELUX countries contribute through their focus on safety compliance and advanced building technologies. At the same time, Eastern Europe and the Nordic regions display growing potential driven by increasing construction activity and expanding adoption of comprehensive fire protection systems across diverse building types.

The fire suppression system market is characterized by competition among established fire safety companies, specialized suppression system manufacturers, and emerging safety technology players. Companies are investing in advanced detection technologies, suppression agent development, system integration capabilities, and comprehensive service networks to deliver reliable, effective, and compliant fire protection solutions. Product innovation, installation expertise, and maintenance support are central to strengthening market position and customer relationships.

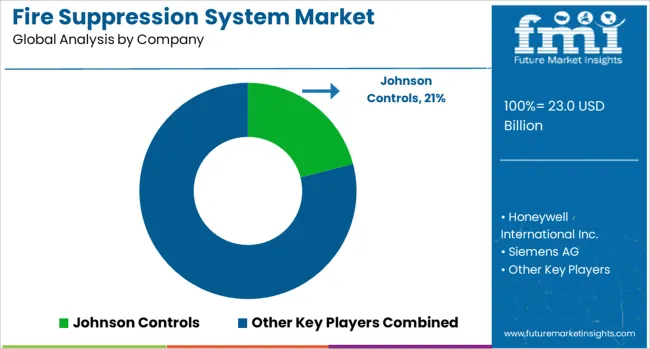

Johnson Controls leads the market with significant global market share, offering comprehensive fire suppression solutions with a focus on building safety integration and advanced detection technologies. Honeywell International Inc. provides advanced fire safety systems with an emphasis on industrial applications and intelligent monitoring capabilities. Siemens AG delivers integrated fire protection solutions with a focus on building automation and smart safety systems. Fike Corporation specializes in suppression systems for special hazards and industrial applications.

Minimax USA LLC focuses on comprehensive fire protection with emphasis on engineered systems and specialized applications. Gentex Corporation provides detection and suppression solutions with a focus on aerospace and specialized markets. Halma Plc offers safety technology solutions, including fire detection and suppression systems. Hochiki America Corporation delivers fire detection and alarm systems with advanced sensing technologies. Robert Bosch GmbH provides building safety solutions, including fire suppression and security integration. Carrier Global Corporation, NAFFCO, Amerex Corporation, ORR Protection, Desautel Feuerschutz GmbH, and Jockel GmbH & Co. KG offer specialized fire suppression products and services for various market segments and applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 23 billion |

| Product | Fire Extinguishers, Gas, Water, Dry Chemical Powder, Others, Sprinklers |

| Application | Industrial, Commercial, Residential |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Johnson Controls, Honeywell International Inc., Siemens AG, Fike Corporation, Minimax USA LLC, Gentex Corporation, Halma Plc, Hochiki America Corporation, Robert Bosch GmbH, Carrier Global Corporation, NAFFCO, Amerex Corporation, ORR Protection, Desautel Feuerschutz GmbH, and Jockel GmbH & Co. KG |

| Additional Attributes | Dollar sales by suppression system type and application category, regional demand trends, competitive landscape, buyer preferences for automated versus manual systems, integration with building management systems, innovations in detection technology, suppression agent development, and smart safety system advancement |

The global fire suppression system market is estimated to be valued at USD 23.0 billion in 2025.

The market size for the fire suppression system market is projected to reach USD 38.9 billion by 2035.

The fire suppression system market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in fire suppression system market are fire extinguishers, gas, water, dry chemical powder, others and sprinklers.

In terms of application outlook , industrial segment to command 49.0% share in the fire suppression system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Fire Suppression System Market Growth - Trends & Forecast 2025 to 2035

Firefighter Tapes Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire Extinguisher Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Material Market Size and Share Forecast Outlook 2025 to 2035

Fireproof Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fire Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Foam Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Cable Market Size and Share Forecast Outlook 2025 to 2035

Fire Stopping Materials Market Size and Share Forecast Outlook 2025 to 2035

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Fire Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Fire Door Market Size and Share Forecast Outlook 2025 to 2035

Fireclay Tiles Market Size and Share Forecast Outlook 2025 to 2035

Firearms Market Size and Share Forecast Outlook 2025 to 2035

Fire-resistant Paint Market Size and Share Forecast Outlook 2025 to 2035

Fire Collar Market Size and Share Forecast Outlook 2025 to 2035

Fire Protective Materials Market Size and Share Forecast Outlook 2025 to 2035

Fire And Explosion Proof Lights Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA