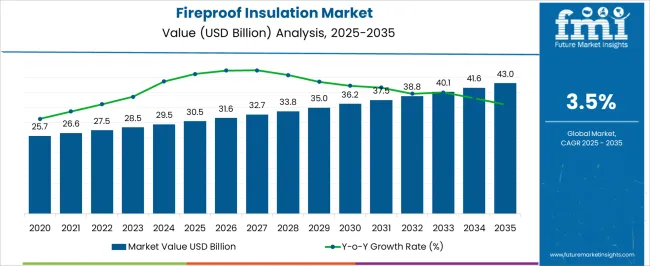

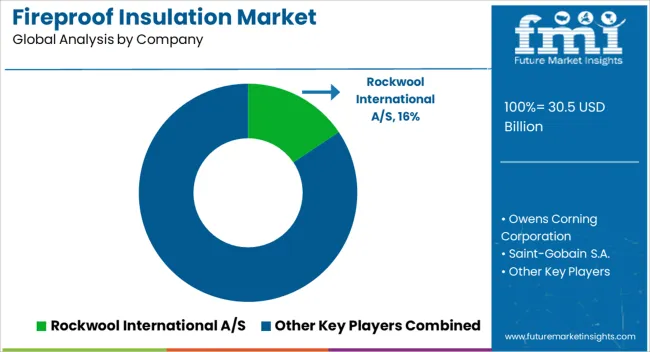

The Fireproof Insulation Market is estimated to be valued at USD 30.5 billion in 2025 and is projected to reach USD 43.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Fireproof Insulation Market Estimated Value in (2025 E) | USD 30.5 billion |

| Fireproof Insulation Market Forecast Value in (2035 F) | USD 43.0 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The fireproof insulation market is witnessing steady growth driven by the increasing emphasis on safety, energy efficiency, and regulatory compliance across residential, commercial, and industrial constructions. Rising awareness of fire hazards and stringent building codes are compelling developers and architects to adopt high-performance insulation materials. Technological advancements in manufacturing, including enhanced thermal resistance, acoustic performance, and durability, are enabling insulation solutions to meet both safety and sustainability objectives.

The demand for fireproof insulation is being further fueled by urbanization, expansion of industrial facilities, and infrastructure development projects globally. The market is also benefiting from the adoption of eco-friendly materials and energy-saving solutions, as governments and corporations increasingly prioritize green building certifications.

With rising investment in large-scale construction and refurbishment projects, manufacturers are focusing on improving material performance while maintaining cost efficiency The convergence of safety requirements, energy standards, and environmental considerations is positioning the market for sustained expansion, with continued opportunities for innovation in high-performance insulation technologies.

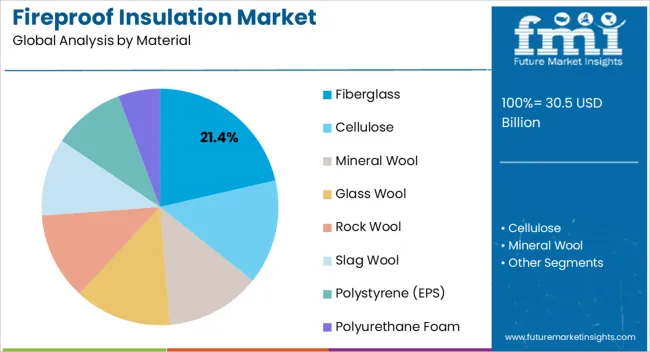

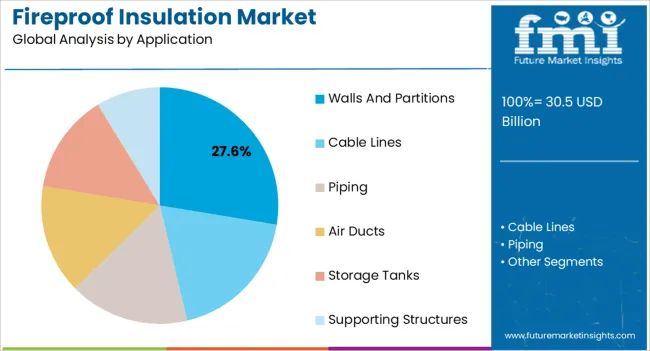

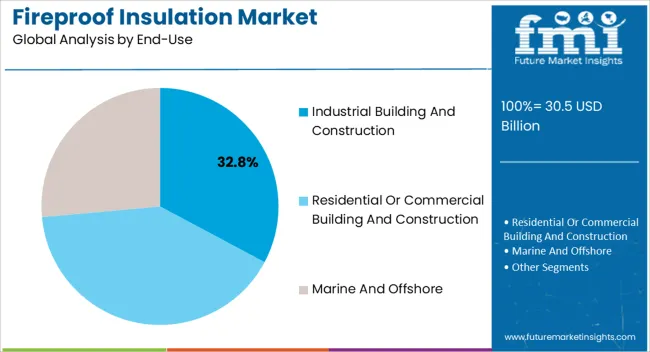

The fireproof insulation market is segmented by material, application, end-use, and geographic regions. By material, fireproof insulation market is divided into Fiberglass, Cellulose, Mineral Wool, Glass Wool, Rock Wool, Slag Wool, Polystyrene (EPS), and Polyurethane Foam. In terms of application, fireproof insulation market is classified into Walls And Partitions, Cable Lines, Piping, Air Ducts, Storage Tanks, and Supporting Structures. Based on end-use, fireproof insulation market is segmented into Industrial Building And Construction, Residential Or Commercial Building And Construction, and Marine And Offshore. Regionally, the fireproof insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fiberglass segment is projected to hold 21.4% of the fireproof insulation market revenue share in 2025, establishing it as the leading material type. Its leadership is supported by superior fire resistance, thermal insulation, and mechanical strength, which make it suitable for diverse construction applications. Fiberglass is being preferred for its ability to maintain structural integrity under high-temperature conditions while also offering soundproofing benefits.

Production advancements have enhanced fiber uniformity and density, improving installation efficiency and overall performance. The material’s lightweight nature and adaptability for both residential and industrial applications further reinforce its widespread adoption. Additionally, fiberglass is compatible with sustainable construction practices, meeting increasing demand for environmentally friendly materials.

Its cost-effectiveness combined with long-term durability makes it a preferred choice for developers and contractors seeking reliable and compliant fireproof insulation solutions These factors collectively sustain the material’s position as the dominant segment in the market.

The walls and partitions application segment is anticipated to account for 27.6% of the fireproof insulation market revenue share in 2025, making it the leading application area. This dominance is being driven by the critical need to enhance fire safety and thermal performance in both commercial and industrial buildings.

Insulation applied to walls and partitions improves overall building energy efficiency and acoustic comfort, while simultaneously reducing the risk of fire propagation. The segment’s growth is further supported by increasing urban construction, renovation, and compliance with stringent fire safety regulations in global markets.

Fiberglass and other advanced insulation materials are being widely utilized for partitioning systems due to their adaptability and performance under operational stress As demand for high-rise and industrial buildings continues to rise, the adoption of fireproof insulation in walls and partitions is expected to remain a key growth driver, ensuring occupant safety and building compliance.

The industrial building and construction segment is expected to hold 32.8% of the fireproof insulation market revenue share in 2025, establishing itself as the leading end-use category. This leadership is being reinforced by the heightened focus on safety, durability, and compliance with fire codes in large-scale industrial facilities, including manufacturing plants, warehouses, and processing units. Fireproof insulation is being deployed to protect both structural components and critical equipment from thermal damage, while also improving energy efficiency.

The segment benefits from the use of high-performance materials such as fiberglass, mineral wool, and composite boards, which offer adaptability across varied industrial applications. Increased investment in industrial infrastructure, expansion of manufacturing capacities, and stringent occupational safety regulations are all driving demand.

Additionally, the ability of these insulation solutions to reduce operational costs through energy savings and long-term durability supports their adoption These factors collectively reinforce the industrial building and construction sector as the largest contributor to market revenue.

The home safety and security sector is developing the demand for fireproof insulation solutions by creating indigenous resolutions that diminish the chances of fire. The market is experiencing a surge, fueled by a confluence of environmental, regulatory, and technological betterment. Globally, a collective push to reduce carbon footprints and greenhouse gas emissions is placing fireproof insulation in the spotlight.

These fireproof materials not only enhance fire safety in buildings but also contribute to energy efficiency by minimizing heating and cooling demands. This synergy aligns perfectly with global sustainability goals, bolstering the industry.

A rise in stringent building codes and regulations is significantly impacting the fireproof insulation market. Fire safety is paramount, and these regulations mandate the use of fire alarm in many jurisdictions. This creates a robust demand for fireproof insulation products such as automatic fire suppression system (AFSS), driving market growth.

The industry is constantly evolving, with manufacturers constantly innovating to create efficient and affordable solutions. This broadens the market's reach, making fire extinguisher more accessible to a wider range of construction projects, ensuring a product suitable for every application.

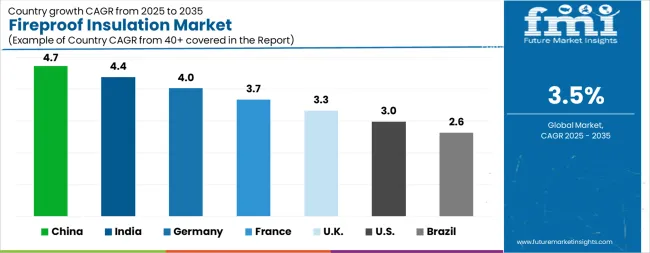

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

The Fireproof Insulation Market is expected to register a CAGR of 3.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.7%, followed by India at 4.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Fireproof Insulation Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.0%. The USA Fireproof Insulation Market is estimated to be valued at USD 11.2 billion in 2025 and is anticipated to reach a valuation of USD 15.0 billion by 2035. Sales are projected to rise at a CAGR of 3.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.4 billion and USD 900.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.5 Billion |

| Material | Fiberglass, Cellulose, Mineral Wool, Glass Wool, Rock Wool, Slag Wool, Polystyrene (EPS), and Polyurethane Foam |

| Application | Walls And Partitions, Cable Lines, Piping, Air Ducts, Storage Tanks, and Supporting Structures |

| End-Use | Industrial Building And Construction, Residential Or Commercial Building And Construction, and Marine And Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rockwool International A/S, Owens Corning Corporation, Saint-Gobain S.A., Paroc Group, Knauf Insulation, GAF, Beijing New Building Material, Kingspan Group plc, Etex Group, 3M Company, and Armacell International S.A. |

The global fireproof insulation market is estimated to be valued at USD 30.5 billion in 2025.

The market size for the fireproof insulation market is projected to reach USD 43.0 billion by 2035.

The fireproof insulation market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in fireproof insulation market are fiberglass, cellulose, mineral wool, glass wool, rock wool, slag wool, polystyrene (eps) and polyurethane foam.

In terms of application, walls and partitions segment to command 27.6% share in the fireproof insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Cork Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Wool Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Market Growth - Trends & Forecast 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Foam Insulation Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA