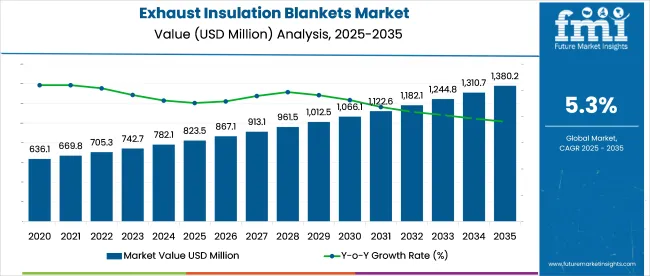

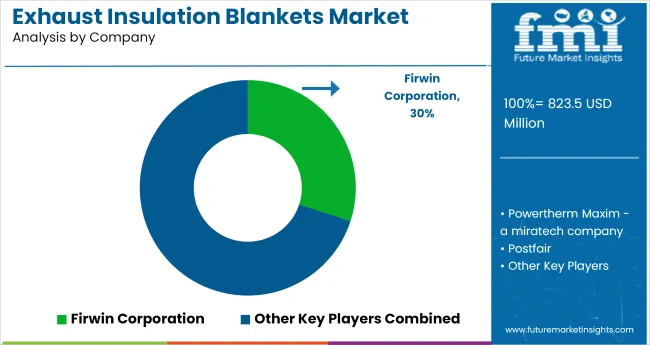

The exhaust insulation blankets market is projected to increase from USD 823.5 million in 2025 to approximately USD 1,380.2 million by 2035, growing at a CAGR of 5.3%. Rising safety standards and growing demand for thermal efficiency in industrial and automotive applications are driving adoption globally.

In Europe, over 65% of new medium-duty trucks now use multi-layer ceramic-fiber blankets that reduce exhaust system temperatures by up to 150 °C and help engines meet Euro VII targets. Commercial airlines are retrofitting older turbofan engines with bio-based insulation wraps that cut auxiliary power unit heat loss by 20%, extending service life and reducing maintenance costs.

In North America, manufacturers supplying oil and gas equipment are adopting stainless-steel encapsulated blankets to shield heat-critical valves and piping, reducing surface temperatures and improving workplace safety.

Material science innovations have led to thinner blankets, now just 3 mm thick, that deliver the same performance as earlier 5 mm products, freeing up space and cutting weight. Distributed supply chains are responding with pre-cut kits matched to chassis and powertrain layouts, streamlining installation for large industrial integrators.

As of 2025, the exhaust insulation blankets market holds a small but important share across several related industries. Around 3-5% of the global automotive thermal management market is contributed by these products, as they help control engine heat and improve performance.

In the industrial insulation space, they make up about 2-3% due to their use in managing high temperatures in factories and power plants. Nearly 4-6% of the exhaust system components market is linked to insulation blankets, especially in meeting emission and safety standards. In the heavy-duty vehicle aftermarket, about 5-7% of sales are tied to these products. Their share in the broader thermal protection market is estimated at 3-4%, driven by steady demand from high-heat sectors.

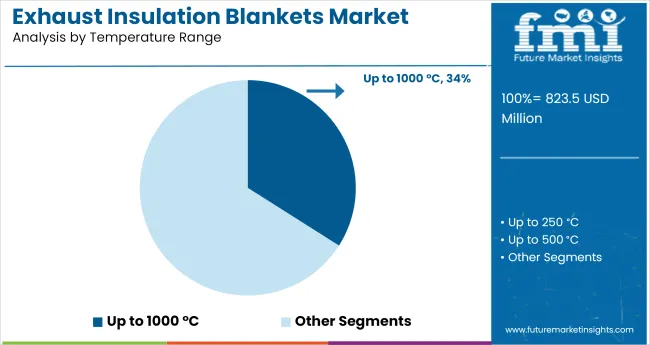

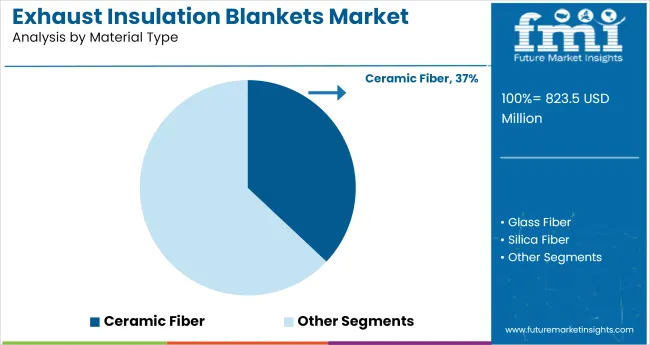

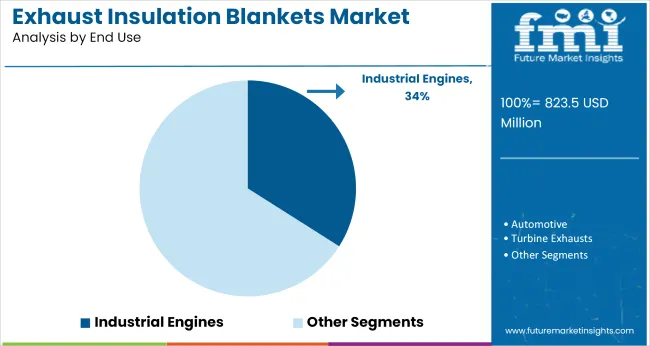

The market is gaining traction due to the increasing need for thermal management in high-temperature industrial systems. Segments such as ceramic fiber material, up to 1000 °C temperature range, and industrial engine applications are capturing investor interest, driven by stricter emissions compliance, energy savings, and workplace safety enhancements.

Blankets rated for up to 1000 °C are projected to account for 34% of the market by 2025. This segment meets the performance requirements of many medium-duty engines and process systems. It balances insulation effectiveness with affordability for a broad range of industrial and commercial uses.

Ceramic fiber is forecasted to represent 37% of the total market by 2025. Known for its exceptional thermal resistance, light weight, and chemical stability, ceramic fiber blankets are the material of choice in high-temperature environments. The segment benefits from consistent use in heavy industries and OEM engine insulation kits.

The industrial engines segment is expected to contribute 34% of market share by 2025. From diesel to natural gas engines, insulation blankets are critical for heat containment, protecting personnel and components. Market growth is fueled by stricter occupational safety norms and enhanced thermal efficiency requirements.

The market is expanding due to rising engine efficiency requirements and tighter thermal safety regulations. In 2024, demand grew by 6.9% globally, with strong uptake in marine, oil & gas, and heavy equipment sectors.

Material Innovation Driving Longevity and Customization

Advanced materials like silica fabric, biosoluble fiber, and stainless-steel mesh are being adopted for harsh environments. In 2024, high-temp blankets with continuous ratings above 1000°C captured 38% of global sales. Laser scanning and 3D CAD are enabling custom designs with tighter seams and longer lifecycle performance.

Marine, Oil & Gas, and Power Generation Remain Key Markets

The offshore segment remains a major revenue generator, accounting for 29% of demand in 2024. Blanket systems are being installed in LNG vessels, FPSOs, and remote generators to prevent onboard fire hazards and reduce radiant heat exposure. Regulatory inspections are driving aftermarket blanket retrofits.

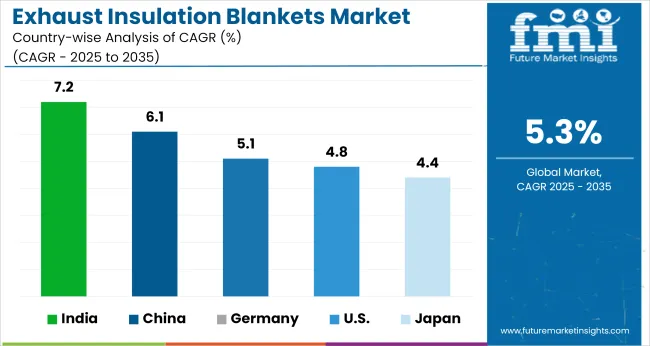

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

| China | 6.1% |

| Germany | 5.1% |

| United States | 4.8% |

| Japan | 4.4% |

The global market is projected to grow at a 5.3% CAGR between 2025 and 2035. India, a BRICS member, is expanding 36% above this baseline at 7.2%, driven by increasing emissions regulations and rapid growth in thermal-heavy industries. China, also part of BRICS, follows at 6.1%, suggesting consistent demand from shipbuilding and power generation.

In contrast, OECD nations such as the USA (4.8%), Germany (5.1%), and Japan (4.4%) are pacing behind the global average. Japan’s figure stands 17% below the global CAGR, reflecting slow retrofit activity and longer industrial equipment cycles. The USA and Germany maintain stable yet restrained growth, influenced by energy efficiency targets and legacy infrastructure.

The diverging pace between BRICS and OECD regions highlights how evolving industrial baselines and regulatory enforcement levels are influencing insulation adoption. ASEAN countries, not covered here, are expected to emerge as opportunistic players due to mid-scale industrial transitions.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 7.2% from 2025 to 2035, India is witnessing rapid advancements in thermal protection solutions across its industrial ecosystem. Rising adoption of gas turbines and diesel-powered generators in power and infrastructure sectors has significantly increased demand for high-temperature insulation.

Local manufacturers are focusing on flame-retardant and corrosion-resistant blanket systems to meet domestic safety standards. Aggressive investment in oil and gas pipelines and shipbuilding is amplifying demand for customized insulation covers.

China’s market is projected to rise at a CAGR of 6.1% between 2025 and 2035, led by aggressive industrial automation and upgrades to thermal systems. Blanket insulation is being rapidly incorporated into exhaust management systems in coal plants, refineries, and HVAC infrastructure.

Demand is particularly strong in coastal provinces where shipbuilding and petrochemical activities are dense. The push for energy-efficient retrofits is also prompting bulk procurement from municipal governments and large EPCs.

Germany is expected to post a CAGR of 5.1% through 2035, reflecting consistent demand across automotive, energy, and process industries. German buyers emphasize precision-fit, high-performance insulation for emission reduction and energy efficiency.

The shift toward hydrogen-powered equipment and renewable systems is creating fresh opportunities for insulation technologies. Engineering firms are prioritizing removable blanket solutions that enable quick inspection and maintenance without compromising thermal control.

The United States is forecast to expand at a CAGR of 4.8% between 2025 and 2035, bolstered by investments in energy infrastructure and plant safety upgrades. End-users in oil refining, chemicals, and aerospace sectors are adopting next-gen insulation blankets for their flexibility and resistance to extreme operating temperatures.

Stricter OSHA regulations around thermal exposure are prompting plant-wide retrofits. Equipment rental firms and military applications are also contributing to sustained blanket usage.

Japan’s market is forecast to grow at a CAGR of 4.4% from 2025 to 2035, driven by demand for compact and efficient thermal insulation across dense urban industries. Applications span power backups, high-efficiency boilers, and automated plant equipment.

Domestic firms are focusing on low-profile, precision-cut blankets that meet space and fire-safety constraints. The country’s emphasis on risk mitigation and thermal stability in public infrastructure and industrial zones continues to support long-term blanket adoption.

Firwin Corporation holds a strong position in North America, supplying over 60% of thermal insulation blankets for industrial generators and diesel-powered equipment. Powertherm Maxim, under Miratech, leads in emission control applications, supplying insulation for over 20,000 retrofit and OEM units globally.

Ningbo Fangtai and BST Thermal Products dominate China’s domestic market, jointly accounting for more than 25% of localized demand in construction and marine engine sectors. Heatshield Products targets the USA performance vehicle and off-highway markets, with over 5,000 SKUs across thermal wraps and shields.

Elasto Proxy, with ISO 9001 and AS9100 certifications, supplies custom multi-layered insulation to Tier-1 defense contractors in North America and Europe, expanding its aerospace and military applications footprint.

Recent Exhaust Insulation Blankets Industry News

In June 2025, BSTFLEX launched a new high-performance exhaust insulation blanket designed for extreme environments, offering improved heat resistance up to 1000 °C, enhanced safety, and reusable modular design targeted at industrial and automotive applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 823.5 million |

| Projected Market Size (2035) | USD 1,380.2 million |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Temperature Ranges Analyzed (Segment 1) | Up to 250 °C, Up to 500 °C, Up to 1000 °C, Above 1000 °C |

| Material Types Analyzed (Segment 2) | Glass Fiber, Silica Fiber, Ceramic Fiber, Aerogel, Others |

| End Uses Analyzed (Segment 3) | Automotive, Industrial Engines, Turbine Exhausts, Marine Engines, Jet Engines, Flare Stacks |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Firwin Corporation, Powertherm Maxim - a Miratech company, Postfair, Ningbo Fangtai Fiberglass Products Co., Ltd., NINGGUO BST THERMAL PRODUCTS CO., LTD., insul-Fab, Elasto Proxy, Heatshield Products |

| Additional Attributes | Dollar sales by material and temperature range, rising demand for high-performance heat shielding, growing focus on engine efficiency and emissions control, and widespread use in transport and industrial combustion systems. |

The market is segmented based on thermal resistance into up to 250 °C, up to 500 °C, up to 1000 °C, and above 1000 °C categories, each suited for different engine and exhaust system environments.

Material types include glass fiber, silica fiber, ceramic fiber, aerogel, and others, offering various combinations of heat resistance, weight, and flexibility for thermal insulation needs.

End-use applications span across automotive, industrial engines, turbine exhausts, marine engines, jet engines, and flare stacks, reflecting the broad demand for high-performance thermal protection in combustion and exhaust systems.

Regional analysis covers North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, each contributing distinct growth dynamics tied to industrial output and vehicle production.

The market is valued at USD 823.5 million in 2025.

The market is expected to reach USD 1,380.2 million by 2035.

The market is anticipated to grow at a CAGR of 5.3% during the forecast period.

Ceramic fiber is the top material type, holding a 37% share in 2025.

India is the fastest growing country, projected to expand at a CAGR of 7.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Exhaust Hood Filters & Cleaning Kits Market – Market Innovations & Industry Growth 2025 to 2035

Exhaust Sensor Market

Aircraft Exhaust System Market

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Headers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Automotive Exhaust Systems Market Trends - Growth & Forecast 2025 to 2035

Motorcycle Exhaust Mounting Brackets Market

Automotive Exhaust Components Aftermarket Market

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA