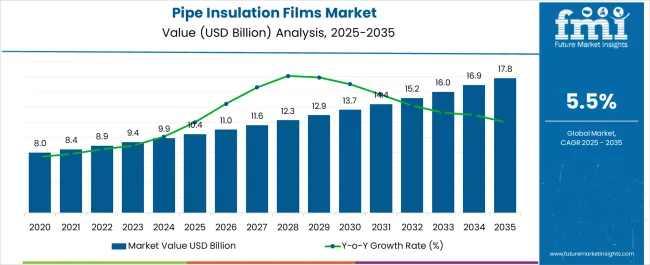

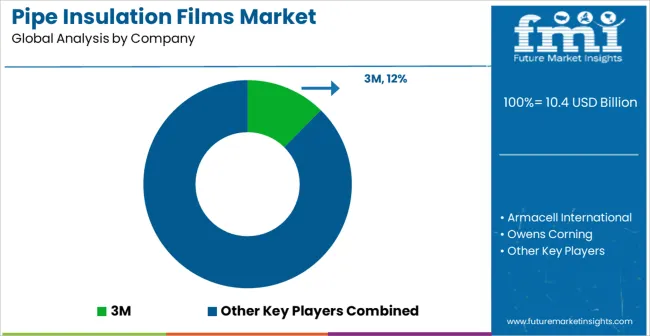

The Pipe Insulation Films Market is estimated to be valued at USD 10.4 billion in 2025 and is projected to reach USD 17.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Pipe Insulation Films Market Estimated Value in (2025 E) | USD 10.4 billion |

| Pipe Insulation Films Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Pipe Insulation Films market is experiencing steady growth, driven by rising demand for energy efficiency and operational safety across industrial sectors. The adoption of insulation films is being fueled by the need to minimize heat loss, prevent condensation, and protect pipelines in energy-intensive industries such as oil and gas, chemical processing, and power generation. Advancements in material engineering, including enhanced thermal resistance, moisture barrier properties, and mechanical durability, are improving performance and lifespan of insulation films.

Regulatory emphasis on energy conservation, industrial safety, and environmental compliance is further accelerating market adoption. The integration of high-performance insulation films in new infrastructure projects and retrofitting initiatives is creating additional demand. Manufacturers are investing in research and development to optimize film compositions, ensuring cost-effectiveness and scalability.

With industrial expansion and rising global energy consumption, pipe insulation films are expected to remain essential components in energy management strategies The market is also benefiting from technological innovations that enhance installation efficiency and reduce maintenance costs, positioning it for long-term growth.

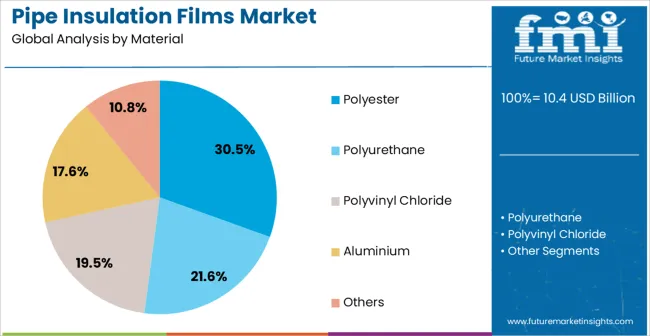

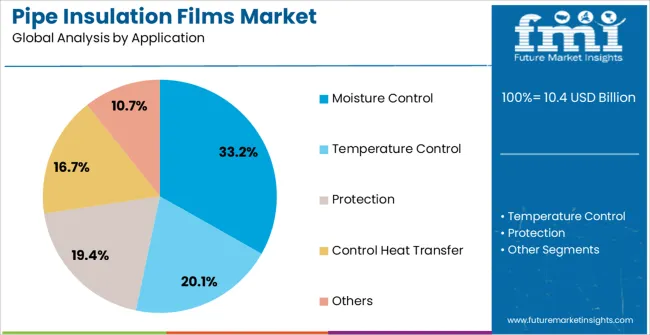

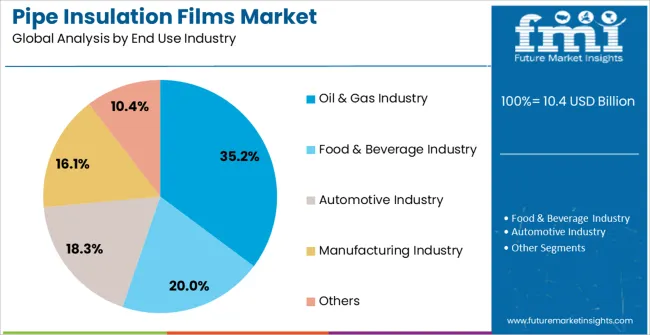

The pipe insulation films market is segmented by material, application, end use industry, and geographic regions. By material, pipe insulation films market is divided into Polyester, Polyurethane, Polyvinyl Chloride, Aluminium, and Others. In terms of application, pipe insulation films market is classified into Moisture Control, Temperature Control, Protection, Control Heat Transfer, and Others. Based on end use industry, pipe insulation films market is segmented into Oil & Gas Industry, Food & Beverage Industry, Automotive Industry, Manufacturing Industry, and Others. Regionally, the pipe insulation films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester material segment is projected to hold 30.5% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is driven by the material’s excellent mechanical strength, thermal resistance, and chemical stability, which make it suitable for a wide range of industrial applications. Polyester films offer durability under high-temperature conditions and resistance to moisture absorption, extending pipeline life and reducing maintenance costs.

Their lightweight and flexible properties allow for easy installation and adaptability across various pipe diameters and configurations. Manufacturers benefit from cost-effective production processes and scalability, which support large-volume deployments. The material’s compatibility with coatings and laminates further enhances performance, making it a preferred choice for critical industrial pipelines.

Rising demand in energy-intensive sectors and increasing regulatory requirements for efficient insulation are strengthening adoption With continued innovation in polymer formulations and enhanced barrier properties, polyester is expected to maintain its leading position in the pipe insulation films market.

The moisture control application segment is anticipated to account for 33.2% of the market revenue in 2025, making it the leading application area. Growth in this segment is driven by the increasing need to prevent condensation, corrosion, and energy loss in pipelines, particularly in oil and gas, chemical, and water infrastructure. Pipe insulation films designed for moisture control improve operational safety, reduce maintenance costs, and enhance the efficiency of heat transfer systems.

The ability to integrate high-performance films that resist water penetration and humidity ensures long-term reliability and regulatory compliance. Industrial adoption is being further supported by rising awareness of energy conservation and pipeline integrity management.

Enhanced barrier properties, easy installation, and adaptability to various pipe sizes make these films highly efficient for moisture control applications As infrastructure modernization and retrofitting initiatives expand globally, moisture control is expected to remain the primary driver of pipe insulation film deployment, reinforcing the segment’s leading market position and growth potential.

The oil and gas industry segment is projected to hold 35.2% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is driven by the critical need for thermal insulation and pipeline protection to maintain operational efficiency and safety in extreme conditions. Pipe insulation films are used extensively to reduce heat loss, prevent condensation, and protect pipelines from corrosion, extending equipment life and reducing maintenance costs.

The high demand is supported by large-scale investments in upstream, midstream, and downstream infrastructure, as well as energy efficiency initiatives across refineries, gas plants, and transportation networks. The adoption of advanced materials with superior mechanical, thermal, and moisture-resistant properties ensures reliable performance in challenging environments.

Regulatory requirements for energy conservation, safety, and environmental compliance further drive implementation in this sector With ongoing global energy demand and industrial expansion, the oil and gas industry is expected to remain the primary driver of market growth, sustaining the leading revenue share for pipe insulation films.

As Industrialization Increases and HVAC Systems Become More Prevalent, the Market for Pipe Insulation Films Will Grow.

The purpose of pipe insulation films is to protect pipes, fittings, structures, and other objects from corrosion, whether they are placed above ground, buried, or submerged in water.

As a preventive measure against the environment, the metal structure must be protected by a layer of film covering the entire surface. In addition to being heat-resistant, the films are extremely rigid, come in a range of colors, and are available on a variety of surfaces.

Specifically, these films are responsible for serving as a surface on which adhesive tapes can be adhered to. This film is suitable for adhesive packaging tapes, including printed and unprinted tapes, adhesive double-sided tapes, contour and embossed cosmetic labels, plaster tapes with embossed cover and removal films, silicone glass fiber tapes, double-sided adhesive tapes, and self-adhesive presentation products.

These films can be used for a variety of applications, including building films, labels, print blankets, greenhouses, floor heating, battery separators, and lampshades.

In addition to its protective properties, the film also has the ability to be impermeable to grease, gases, and oil, plus virtually impervious to moisture. The industrial and commercial environments have unique challenges that need to be addressed by building professionals.

Engineers and contractors must specifically overcome issues that arise from extreme pipe temperatures in terms of efficiency and safety within the pipeline construction process. Construction of buildings containing copper, iron, PVC, CPVC, stainless steel, and PVC pipes requires pipe insulation, with temperature ranges of -18°F to 538°F.

By insulating pipes to a great extent, energy losses can be reduced to a high degree, thereby reducing energy costs. Piping shall be insulated as per the insulation class, operating temperature, and insulation thickness stated in the P&ID.

The Energy Information Administration (EIA) of the USA predicts that buildings will consume 39% of the nation's energy in 2025 (2025). Indoor air quality (IAQ) is achieved by heating, ventilating, and air conditioning (HVAC) systems. Approximately 49% of the electricity used by commercial buildings is accounted for by HVAC systems, according to the EIA.

Managing heat transfer and condensation for HVAC systems is primarily influenced by proper installation, commissioning, and service plans. Most building owners have a desire for an energy-efficient and properly-sized HVAC system in their building. When the design, installation, and maintenance of HVAC pipe insulation are done properly, building owners can reap some of the most rapid returns on their investment.

Pipe insulation is important to protect pipes from various climatic factors such as temperature, humidity, moisture and others. In the same manner, insulation of pipes is necessary as they carry fluids such as water as well as sensitive fluids such as LPG, natural gas, or other petroleum product. All these products have different temperature and atmospheric conditions.

Many kinds of insulations are available in the market for pipes such as rubber, plastic or cement. Nowadays, films are generally used for insulating pipes due to their excellent barrier property against temperature change, moisture and other factors. Pipe insulation films market is triggered by the fact that pipes and pipelines operate in different temperature conditions.

If pipes are used at below normal temperature, then there is a possibility of formation of condensation on pipework, which contribute towards corrosion. Sometimes it is possible that the pipes operate in places where temperature drops very low. It might lead to failure of pipework due to expansion of pipes.

Pipe insulation films can be made up of materials such as polyurethane, polyvinyl chloride, polyester and others. Due to all these factors, the growth outlook for the global insulation films market is expected to remain largely positive during the forecast period.

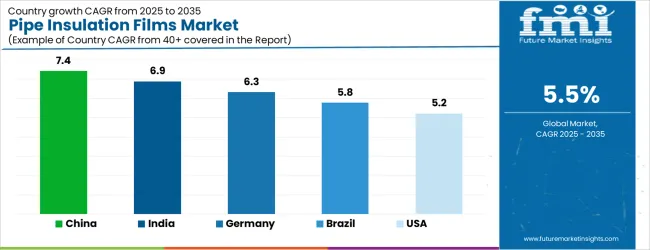

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| Brazil | 5.8% |

| USA | 5.2% |

| UK | 4.7% |

| Japan | 4.1% |

The Pipe Insulation Films Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Pipe Insulation Films Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Pipe Insulation Films Market is estimated to be valued at USD 3.8 billion in 2025 and is anticipated to reach a valuation of USD 3.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 527.6 million and USD 293.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Material | Polyester, Polyurethane, Polyvinyl Chloride, Aluminium, and Others |

| Application | Moisture Control, Temperature Control, Protection, Control Heat Transfer, and Others |

| End Use Industry | Oil & Gas Industry, Food & Beverage Industry, Automotive Industry, Manufacturing Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Armacell International, Owens Corning, BASF, Saint Gobain, Knauf Insulation, Johns Manville, Kingspan Group, Rockwool International, Covestro, Alfa Laval, Huntsman Corporation, Thermaflex, Shenzhen Lanxuan Industrial, and Insulation Technologies |

The global pipe insulation films market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the pipe insulation films market is projected to reach USD 17.8 billion by 2035.

The pipe insulation films market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in pipe insulation films market are polyester, polyurethane, polyvinyl chloride, aluminium and others.

In terms of application, moisture control segment to command 33.2% share in the pipe insulation films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Pipe Marking Tapes Market Growth - Demand, Trends & Forecast 2024 to 2034

Pipe Wrapping Machines Market

Piperylene Market

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Oil Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Gas Pipeline Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA