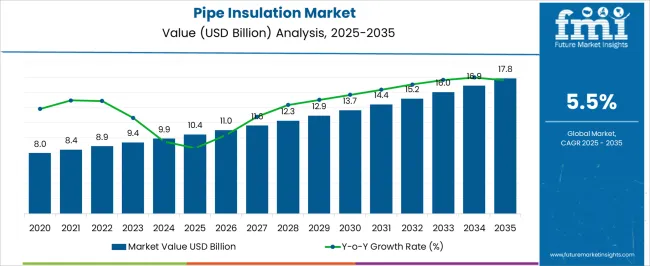

The pipe insulation market is projected to reach 17.8 USD billion by 2035, up from 10.4 USD billion in 2025, registering a CAGR of 5.5%. Growth in this market is driven by increasing demand for energy-efficient building systems, rising focus on industrial process optimization, and stringent regulations on thermal efficiency. Residential and commercial sectors are expected to dominate dollar sales due to growing construction activities and retrofit projects aimed at reducing energy consumption.

Industrial applications, including oil and gas, chemical processing, and power generation, contribute significantly to market share by requiring high-performance insulation solutions for pipelines, reducing heat loss and operational costs. Technological advancements in insulation materials such as mineral wool, elastomeric, and polyurethane foams are anticipated to enhance adoption, providing superior thermal resistance and durability. Regional trends indicate that North America and Europe will maintain a strong share due to regulatory frameworks promoting energy conservation, whereas the Asia-Pacific is expected to witness rapid growth due to urban expansion, infrastructure development, and rising industrialization. Emerging markets are also projected to gain traction as investments in industrial and residential projects increase.

The Growth Contribution Index highlights that industrial applications contribute approximately 40%, residential 35%, and commercial 25% toward market expansion, reflecting a balanced distribution of demand across end-use segments. This trend is likely to continue throughout the forecast period, supported by growing awareness of energy efficiency, cost reduction measures, and technological innovation in insulation materials.

| Metric | Value |

|---|---|

| Pipe Insulation Market Estimated Value in (2025 E) | USD 10.4 billion |

| Pipe Insulation Market Forecast Value in (2035 F) | USD 17.8 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The pipe insulation market is strongly influenced by five interrelated parent markets, each contributing distinctly to overall demand and technological development. The industrial pipeline market holds the largest share at 40%, as oil and gas, chemical, and power generation facilities require high-performance insulation to reduce heat loss, improve process efficiency, and lower operational costs. The residential construction market contributes 30%, driven by the growing need for energy-efficient building systems, retrofitting projects, and thermal comfort in new and existing homes.

The commercial building segment accounts for 20%, fueled by rising adoption in offices, hospitals, and retail infrastructure where energy conservation and regulatory compliance are prioritized. The HVAC systems market holds a 5% share, supporting the use of pipe insulation in heating, ventilation, and air conditioning networks to enhance system efficiency and longevity. Finally, the renewable energy and industrial infrastructure market represents 5%, reflecting increasing investment in sustainable energy plants, district heating systems, and water transport pipelines.

Industrial, residential, and commercial segments contribute approximately 90% of total demand, emphasizing that construction and process industries remain the primary growth drivers, while specialized HVAC and renewable energy applications sustain adoption and technological improvements. This distribution demonstrates that end-use diversification is critical for market expansion, with innovations in insulation materials, installation methods, and thermal performance enabling continued growth across regions.

The pipe insulation market is expanding steadily, supported by increasing demand for energy efficiency, enhanced building codes, and the need to reduce operational costs in industrial, commercial, and residential infrastructure. Rising energy prices and stringent regulations focused on sustainability have accelerated the adoption of insulation solutions that minimize heat loss, prevent condensation, and improve system durability.

Advances in manufacturing processes, including precision cutting and eco-friendly material innovations, are improving product performance and lifecycle value. Infrastructure development in emerging economies, along with retrofitting initiatives in developed markets, is further driving market penetration.

As industries continue to focus on cost optimization and regulatory compliance, pipe insulation is emerging as a critical component for operational efficiency and environmental responsibility across multiple sectors.

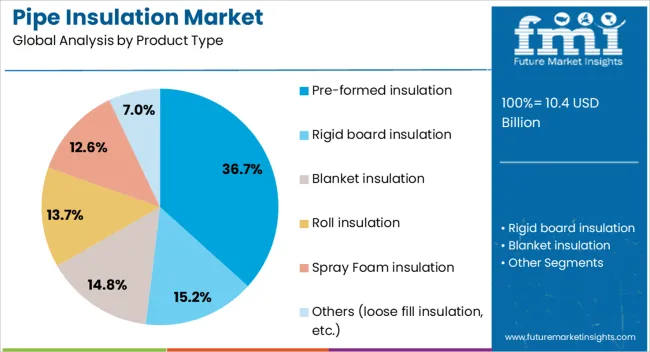

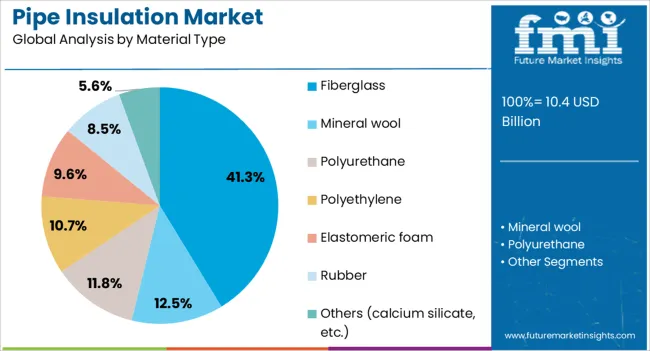

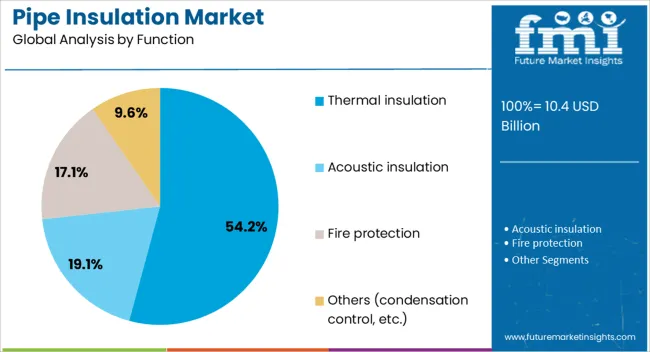

The pipe insulation market is segmented by product type, material type, function, end use, distribution channel, and geographic regions. By product type, pipe insulation market is divided into Pre-formed insulation, Rigid board insulation, Blanket insulation, Roll insulation, Spray Foam insulation, and Others (loose fill insulation, etc.). In terms of material type, pipe insulation market is classified into Fiberglass, Mineral wool, Polyurethane, Polyethylene, Elastomeric foam, Rubber, and Others (calcium silicate, etc.). Based on function, pipe insulation market is segmented into Thermal insulation, Acoustic insulation, Fire protection, and Others (condensation control, etc.). By end use, pipe insulation market is segmented into Residential, Commercial, and Industrial. By distribution channel, pipe insulation market is segmented into Direct and Indirect. Regionally, the pipe insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pre-formed insulation segment is projected to account for 36.70% of total market revenue by 2025 within the product type category, making it the leading segment. Its dominance is attributed to ease of installation, uniform coverage, and the ability to fit precisely around pipes, reducing thermal bridging and improving overall system performance.

This segment is widely used in both new construction and retrofit projects, offering consistent insulation quality while minimizing labor costs.

The pre-formed design also enhances safety during installation and supports long-term operational reliability, which has reinforced its position as the preferred product type in the market.

The fiberglass segment is expected to represent 41.30% of total market revenue by 2025 in the material type category, establishing it as the dominant material. Its widespread adoption is driven by its excellent thermal resistance, fire-retardant properties, and cost-effectiveness.

Fiberglass insulation is compatible with a range of operating temperatures, making it suitable for diverse industrial and commercial applications. Additionally, its durability, resistance to moisture, and low maintenance needs have contributed to long-term value creation.

As industries prioritize both safety and performance, fiberglass remains the most trusted material for pipe insulation.

The thermal insulation segment is anticipated to hold 54.20% of total market revenue by 2025 within the function category, marking it as the top segment. This growth is fueled by increasing emphasis on energy conservation, reduction of heat loss, and compliance with environmental regulations.

Thermal insulation plays a vital role in optimizing system efficiency, lowering operational expenses, and maintaining process temperatures in industrial settings.

The rising demand from sectors such as oil and gas, power generation, and manufacturing has further reinforced the importance of thermal insulation, ensuring its continued market leadership.

Industrial, residential, and commercial applications contribute roughly 90% of pipe insulation demand. Growth is primarily driven by energy efficiency measures, regulatory compliance, and rising infrastructure investments.

Industrial pipelines remain the largest contributor to pipe insulation demand, accounting for around 40% of market share. Oil and gas, chemical, and power generation sectors increasingly require insulation solutions to minimize heat loss, maintain process efficiency, and reduce operational expenses. Stringent energy efficiency regulations across North America and Europe are prompting facility operators to invest in advanced insulation materials, including mineral wool, elastomeric, and polyurethane foams. Retrofit projects in aging industrial plants are further fueling adoption. The demand for long-lasting, high-performance insulation in extreme operating environments is significant, as downtime and energy waste can directly impact profitability. Growth is expected to continue as industrial sectors prioritize efficiency and cost containment.

Residential construction is projected to contribute roughly 30% of total pipe insulation market share by 2035. Increased construction of apartments, housing complexes, and retrofit projects to improve thermal comfort is driving insulation adoption. Governments in various regions are promoting energy-efficient building codes, encouraging homeowners to implement pipe insulation in plumbing and heating systems. Materials such as foam and fiberglass are preferred for ease of installation and long-term durability. Residential applications are expected to expand in emerging regions due to rising housing demand and affordability of advanced insulation solutions. Dollar sales in this segment are anticipated to grow steadily as energy-saving measures become an essential consideration for both new and existing properties.

Commercial buildings account for around 20% of the pipe insulation market, with demand increasing in offices, hospitals, retail spaces, and educational institutions. Growing awareness of operational cost reduction and regulatory compliance has prompted facility managers to integrate insulation in heating and water distribution pipelines. The trend of large-scale construction projects, especially in Asia-Pacific and the Middle East, is further supporting market growth. Adoption of pre-insulated pipe systems in commercial complexes ensures consistent thermal performance and minimizes maintenance needs. Investment in high-quality insulation materials enhances building efficiency and reduces energy bills. This segment remains an important driver for regional market expansion, combining cost savings with improved system reliability and performance.

The renewable energy and HVAC sector contributes approximately 10% to the overall pipe insulation market, driven by district heating systems, solar thermal networks, and advanced HVAC pipelines. District heating projects and industrial water transport systems are increasingly insulated to optimize energy delivery and reduce thermal losses. HVAC applications require effective insulation for heating, cooling, and plumbing networks to ensure efficient system operation and longer equipment lifespan. Innovations in lightweight and durable insulation materials have made adoption easier in large-scale commercial and energy infrastructure projects. Regional investments in energy-efficient infrastructure in Europe, North America, and the Asia-Pacific further support market growth. The segment is poised for steady expansion as energy management becomes a priority across sectors.

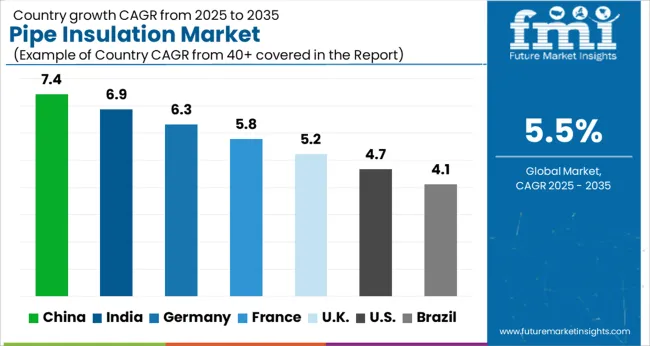

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global pipe insulation market is projected to grow at a CAGR of 5.5% from 2025 to 2035, with China leading at 7.4% and India at 6.9%. Growth is supported by industrial pipeline expansion, energy efficiency initiatives, and demand for thermal and acoustic insulation in construction and oil & gas sectors. France, the UK, and the USA emphasize advanced insulation materials, regulatory compliance, and retrofitting projects. Emerging economies drive adoption through rising urban infrastructure and industrialization, while developed nations focus on high-performance materials and energy-saving standards. The analysis spans over 40+ countries, with the leading markets shown below

The pipe insulation market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035, supported by rapid expansion in industrial pipelines, urban infrastructure, and energy-efficient building projects. Industrial sectors such as oil & gas, chemical processing, and power generation are increasingly adopting advanced thermal and acoustic insulation solutions to reduce energy losses, enhance operational safety, and comply with regulations. Domestic manufacturers are collaborating with international suppliers to integrate high-performance insulation materials, including pre-insulated pipes and advanced polymeric coatings. Retrofitting aging pipelines and large-scale smart city projects further accelerate market expansion. Energy conservation initiatives in residential and commercial buildings are also boosting adoption.

The pipe insulation market in India is expected to grow at a CAGR of 6.9% from 2025 to 2035, driven by industrialization, urban development, and infrastructure upgrades. Thermal insulation requirements in industrial plants, water distribution networks, and HVAC systems are increasing due to energy conservation and cost reduction efforts. Indian manufacturers are adopting high-performance imported materials while enhancing domestic production capabilities. Retrofitting pipelines in oil refineries, power plants, and chemical facilities is rising to meet safety and environmental standards. Collaborations with international technology providers ensure compliance with global quality standards and improved product performance.

The pipe insulation market in Germany is projected to grow at a CAGR of 6.3% from 2025 to 2035, supported by strict energy efficiency regulations and industrial modernization. Thermal and acoustic insulation for industrial pipelines, chemical plants, and HVAC systems is prioritized to reduce energy losses, enhance safety, and comply with EU energy codes. Manufacturers are focusing on eco-friendly materials, including mineral wool, polyurethane, and high-performance elastomers. Industrial sectors such as automotive, pharmaceuticals, and petrochemicals are driving demand for customized solutions, while retrofit projects in aging pipelines create additional opportunities. Advanced insulation systems are increasingly integrated with predictive maintenance technologies to optimize performance and extend service life.

The pipe insulation market in the UK is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by energy-efficient building codes, industrial modernization, and HVAC upgrades. Thermal insulation in water pipelines, industrial plants, and commercial infrastructure is gaining traction to reduce operational costs and environmental impact. The adoption of advanced materials such as pre-insulated pipes, elastomeric foams, and mineral wool ensures compliance with regulatory standards and improved thermal performance. Retrofit projects in chemical, oil & gas, and power sectors continue to create incremental opportunities. Partnerships between UK manufacturers and international suppliers facilitate technology transfer and access to cutting-edge insulation solutions.

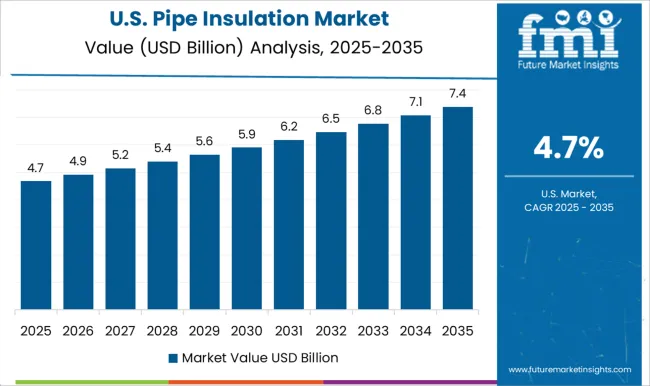

The pipe insulation market in the USA is expected to grow at a CAGR of 4.7% from 2025 to 2035, supported by industrial pipeline expansion, HVAC upgrades, and energy-efficient building initiatives. Thermal and acoustic insulation in oil & gas pipelines, power plants, and commercial infrastructure drives adoption. Manufacturers focus on high-performance materials such as polyurethane foam, fiberglass, and elastomeric insulation to enhance operational efficiency and minimize energy loss. Retrofitting aging pipelines, coupled with federal and state energy regulations, further supports growth. Technological integration, including digital monitoring and predictive maintenance of insulated systems, ensures reliability and durability. Industrial partnerships with global suppliers enable access to innovative materials and optimize cost-performance ratios.

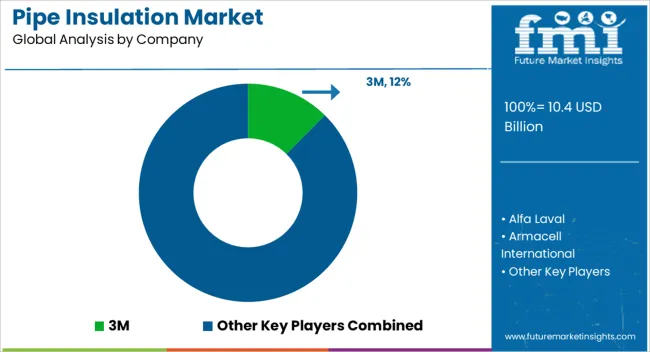

Competition in the pipe insulation market is shaped by material innovation, thermal efficiency, compliance with energy regulations, and integration with industrial and building infrastructure projects. Global leaders, including 3M, BASF, Huntsman Corporation, and Covestro, focus on high-performance insulation materials, such as advanced polymers, elastomers, and mineral wool, tailored for oil & gas pipelines, power plants, and HVAC systems. Companies such as Armacell International, Johns Manville, Knauf Insulation, and Owens Corning emphasize solutions with superior thermal and acoustic performance, fire resistance, and durability in industrial and commercial applications.

European players like Kingspan Group, Rockwool International, and Saint-Gobain differentiate through energy-efficient building solutions, retrofitting applications, and modular pre-insulated piping systems, often integrating digital monitoring for performance optimization. Mid-tier and specialized manufacturers, including Alfa Laval, Insulation Technologies, Shenzhen Lanxuan Industrial, and Thermaflex, provide niche insulation solutions for regional industrial applications, petrochemical plants, and cold-chain pipelines. Their strategies center on material customization, lightweight insulation systems, and regulatory compliance, while supporting service programs for installation, maintenance, and lifecycle management. Partnerships with construction firms, pipeline integrators, and energy utilities are leveraged to accelerate adoption, ensure performance consistency, and facilitate certification.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.4 Billion |

| Product Type | Pre-formed insulation, Rigid board insulation, Blanket insulation, Roll insulation, Spray Foam insulation, and Others (loose fill insulation, etc.) |

| Material Type | Fiberglass, Mineral wool, Polyurethane, Polyethylene, Elastomeric foam, Rubber, and Others (calcium silicate, etc.) |

| Function | Thermal insulation, Acoustic insulation, Fire protection, and Others (condensation control, etc.) |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Alfa Laval, Armacell International, BASF, Covestro, Huntsman Corporation, Insulation Technologies, Johns Manville, Kingspan Group, Knauf Insulation, Owens Corning, Rockwool International, Saint Gobain, Shenzhen Lanxuan Industrial, and Thermaflex |

| Additional Attributes | Dollar sales by insulation type (foam, fiberglass, mineral wool), share by end-use segment (industrial, commercial, residential), regional demand trends, growth drivers, competitive landscape, raw material pricing, installation trends, regulatory impact, emerging applications. |

The global pipe insulation market is estimated to be valued at USD 10.4 billion in 2025.

The market size for the pipe insulation market is projected to reach USD 17.8 billion by 2035.

The pipe insulation market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in pipe insulation market are pre-formed insulation, rigid board insulation, blanket insulation, roll insulation, spray foam insulation and others (loose fill insulation, etc.).

In terms of material type, fiberglass segment to command 41.3% share in the pipe insulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Products Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Pipe Insulation Products Industry

Industrial Pipe Insulation Market Trends 2025 to 2035

Industrial Pipe Insulation Market

Pipeline Integrity Market Size and Share Forecast Outlook 2025 to 2035

Pipe Market Size and Share Forecast Outlook 2025 to 2035

Pipetting Robots Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Pipeline Safety Market Size and Share Forecast Outlook 2025 to 2035

Pipe Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipette Tips Market Size and Share Forecast Outlook 2025 to 2035

Pipe Screw Extruder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pipette Controller Market – Trends & Forecast 2025 to 2035

Pipe Inspection Robot Market Growth – Trends & Forecast 2025 to 2035

Pipe Flange Market Analysis by Material Type, Facing, End-Use Industry, and Region through 2035

Pipe Marking Tapes Market Growth - Demand, Trends & Forecast 2024 to 2034

Pipe Wrapping Machines Market

Piperylene Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA