The Fire-resistant Paint Market is estimated to be valued at USD 1205.0 million in 2025 and is projected to reach USD 1749.6 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Fire-resistant Paint Market Estimated Value in (2025 E) | USD 1205.0 million |

| Fire-resistant Paint Market Forecast Value in (2035 F) | USD 1749.6 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The fire-resistant paint market is experiencing significant growth, driven by increasing safety regulations and growing awareness of fire protection standards across residential, commercial, and industrial sectors. Rising construction activity in urban and high-rise developments is encouraging the adoption of advanced fire-resistant coatings to enhance structural safety and minimize damage in case of fire incidents. Technological advancements in intumescent and water-based formulations are improving the thermal insulation properties and durability of fire-resistant paints, making them more effective and easier to apply.

Regulatory frameworks in multiple regions are emphasizing compliance with fire safety standards for both new constructions and renovations, further stimulating demand. Growing demand from industries such as oil and gas, power generation, and transportation for protective coatings is expanding market opportunities.

Additionally, environmentally friendly formulations with low volatile organic compounds are gaining preference, aligning with sustainability initiatives As awareness of fire safety continues to rise and building codes become more stringent, the market is expected to maintain steady growth, supported by continuous innovation and adoption across multiple sectors.

The fire-resistant paint market is segmented by type, application, and geographic regions. By type, fire-resistant paint market is divided into Liquid and Powder. In terms of application, fire-resistant paint market is classified into Building and Construction, Oil and Gas, Electrical and Electronics, Aerospace, Automotive, Textiles, Marine, and Furniture. Regionally, the fire-resistant paint industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid fire-resistant paint segment is projected to hold 57.9% of the market revenue share in 2025, establishing it as the leading type. Its dominance is being driven by ease of application, uniform coverage, and compatibility with a wide variety of surfaces including metal, concrete, and wood. Liquid formulations allow faster installation and adaptability for both new constructions and renovation projects, reducing labor costs and improving operational efficiency.

Enhanced fire protection performance, achieved through advanced intumescent and resin technologies, ensures that the material expands when exposed to heat, forming an insulating layer that slows fire spread. The segment is also supported by increasing demand from contractors and architects seeking reliable, high-performance coatings that meet stringent safety codes.

Continuous innovation in water-based and environmentally friendly liquid paints is further expanding adoption by aligning with sustainability and regulatory requirements The versatility, cost efficiency, and proven performance of liquid fire-resistant paints make this segment the preferred choice for large-scale commercial and residential projects.

The building and construction application segment is expected to account for 31.2% of the fire-resistant paint market revenue share in 2025, making it the leading application area. This leadership is being driven by the growing emphasis on structural safety in residential, commercial, and industrial buildings, where fire-resistant paints are applied to steel, wood, and concrete to prevent rapid fire spread. Urbanization and high-rise development are increasing the demand for coatings that can protect critical infrastructure and ensure compliance with fire safety regulations.

The segment is further supported by the adoption of sustainable and non-toxic formulations that align with green building initiatives and certifications. Rising awareness among developers, architects, and facility managers about the importance of passive fire protection solutions is also reinforcing demand.

Continuous improvements in performance characteristics, ease of application, and long-term durability are enhancing the attractiveness of fire-resistant coatings for large-scale building projects As regulatory standards evolve and safety remains a priority, the building and construction sector is expected to remain the primary driver of market growth for fire-resistant paints.

The global fire-resistant paint market size is anticipated to reach USD 1,077.4 million in 2025. The industry is set to witness a CAGR of about 3.8% in the assessment period from 2025 to 2035. A value of around USD 1,564.5 million is estimated for the industry by 2035.

Fire-resistant paint demand is rising due to increasing safety regulations and awareness about fire hazards. As urbanization accelerates, more high-rise buildings and densely populated areas are being developed, pushing the risk of fire incidents.

Governments and regulatory bodies worldwide are implementing strict building codes and safety standards that mandate the use of fire-resistant materials, including paints, to minimize fire damage and enhance occupant safety. This regulatory push is driving construction companies and property developers to adopt these paints to ensure compliance and avoid legal liabilities.

| Attributes | Description |

|---|---|

| Estimated Global Fire-resistant Paint Market Size (2025E) | USD 1,077.4 million |

| Projected Global Fire-resistant Paint Market Value (2035F) | USD 1,564.5 million |

| Value CAGR (2025 to 2035) | 3.8% |

Growing emphasis on sustainability and green building practices is further contributing to the rising demand for fire-resistant paints. These paints not only provide crucial fire protection but also feature eco-friendly formulations that appeal to environmentally conscious consumers and builders. As part of broad fire safety strategies, incorporating these paints helps in achieving certifications for green buildings, such as Leadership in Energy and Environmental Design (LEED), which are increasingly sought after in the construction industry.

Technological advancements in the formulation of fire-resistant paints are making these more effective and easier to apply. Innovations have led to the development of paints that offer superior fire retardancy while maintaining aesthetic appeal and durability.

The improved products are gaining acceptance across various sectors, including residential, commercial, and industrial applications. The combination of enhanced performance and regulatory pressures is significantly boosting the demand for fire-resistant paints, making these a key component of modern construction and fire safety protocols.

Implementation of Nanotechnology to Enhance Paint Performance

One of the global fire-resistant paint market trends includes the integration of advanced nanotechnology to enhance the properties and durability of these paints. Nanotechnology allows for the development of paints with nanoparticles that can significantly improve performance.

The nanoparticles enhance the thermal resistance and char formation, providing a more effective barrier against fire. This trend is pushing the boundaries of traditional formulations, making fire-resistant paints not only more efficient in preventing the spread of fire but also more durable and long-lasting. The incorporation of nanotechnology is also enabling the creation of paints that can be applied in thinner layers while still offering high levels of protection.

Booming Construction Activities in Emerging Countries Fuel Demand

A key driver for the industry is the rising investment in infrastructure development, particularly in emerging economies. Countries in Asia, Latin America, and Africa are experiencing rapid urbanization and industrialization, leading to a boom in construction activities. This surge in infrastructure projects, including residential, commercial, and industrial buildings, necessitates the use of advanced safety materials to protect lives and properties.

Adoption of fire-resistant paints in commercial construction projects is becoming a key component in this context, as these provide an essential layer of protection against potential fire hazards. Governments and private sectors in these regions are increasingly recognizing the importance of adopting fire-resistant materials to meet safety regulations and ensure the resilience of new structures. This growing emphasis on infrastructure development is driving demand significantly.

Increasing Modernization of Aging Buildings Creates Growth Avenues

An opportunity in the fire-resistant paint market lies in the retrofitting of existing buildings. Several old structures were built before the implementation of modern fire safety standards and hence lack adequate fire protection.

As awareness of fire safety increases and regulations become more stringent, there is a substantial sector for applying fire-resistant paints to these aging buildings. This retrofitting not only enhances the safety of the buildings but also extends lifespan and reduces potential liabilities for owners.

In regions with a high prevalence of aging infrastructure, particularly in Europe and North America, demand for these paints for retrofitting purposes is set to rise. This provides a lucrative avenue for growth as property owners seek to upgrade their buildings to meet current safety standards and protect investments.

Premium Price May Hamper Sales of Fire Resistant Paints in Developing Countries

A significant hindrance to the sector is the relatively high cost of fire-resistant paints compared to conventional paints. This cost difference can be a substantial barrier, especially for budget-conscious builders and developers who may prioritize short-term savings over long-term safety benefits.

The high cost is primarily due to the advanced materials and technologies used in the formulation of fire-resistant paints, which augment production expenses. In markets where cost is a critical factor in decision-making, this price premium can deter the adoption of such paints despite their safety advantages.

In developing countries where financial resources may be limited, the high cost can be a prohibitive factor, slowing the penetration of these essential safety products. Overcoming this hindrance requires not only technological advancements that can reduce production costs but also increased incentives from governments to prioritize fire safety investments. The impact of building safety regulations on the fire resistant paint market is also projected to be negative.

The fire retardant coating market insights shows that demand is growing in the United States due to several interrelated factors. One significant reason is the increasing frequency and severity of wildfires, particularly in states like California.

The wildfires pose a substantial threat to both residential and commercial properties, accelerating the need for enhanced fire protection measures. Property owners and developers are increasingly turning to fire-resistant products like paints as a proactive measure to protect buildings from potential fire damage.

China's government has been progressively tightening fire safety regulations in response to several high-profile fire incidents over the past few decades. These incidents have highlighted the vulnerabilities in fire safety practices and have led to the implementation of rigorous standards for building materials and construction practices. Compliance with these enhanced regulations requires the market penetration of intumescent fire-resistant paints to meet safety requirements and avoid legal penalties.

China's growing middle class and increasing public awareness of safety issues also contribute to the rising demand for fire-resistant paints. As the standard of living improves, there is a surging emphasis on safety and quality in residential and commercial properties. Consumers and companies are becoming more conscious of the benefits of investing in fire-resistant materials to protect their properties and ensure the safety of occupants.

The ongoing expansion of the real estate and construction sectors in the United Kingdom has led to a competitive market where developers seek to differentiate their projects through superior safety features. Fire-resistant paints offer an additional layer of protection that can be marketed as a value-added feature, attracting buyers and tenants who prioritize safety and durability. This competitive edge drives builders to incorporate these paints into their projects to meet unique demands and enhance their reputation.

Advancements in fire-resistant paint technology have made these products more accessible and appealing. Innovations have led to the development of paints that not only provide superior fire protection but also offer improved aesthetic qualities and durability. These advancements make the paints an attractive option for both new construction and retrofitting existing structures.

Liquid fire-resistant paints are preferred for their ease of application and versatility in design. Unlike traditional fireproofing methods, such as installing fire-resistant materials or coatings, liquid paints can be applied using conventional painting techniques, including spraying, brushing, or rolling.

The high simplicity in application makes these accessible to a broader range of users, from contractors and building owners to homeowners seeking to enhance fire safety in properties. Additionally, liquid paints can be tinted to various colors, allowing for seamless integration with existing architectural designs and aesthetics without compromising on fire protection.

The demand for fire-resistant paints is surging from the building and construction sector primarily due to increasingly stringent building codes and regulations aimed at enhancing fire safety standards. Governments and regulatory bodies worldwide are mandating the use of fire-resistant materials in construction projects to mitigate the risk of fire-related incidents and minimize damage to property and lives. As a result, builders and developers are compelled to incorporate novel paints into their projects to ensure compliance with these regulations.

The construction industry is experiencing a growing awareness of the long-term benefits of using fire-retardant paints. These paints not only enhance safety but also contribute to the durability and longevity of buildings.

By providing an additional barrier against fire damage, fire-resistant paints help protect the structural integrity of buildings and reduce the need for costly repairs or replacements in the event of a fire. This recognition of the value proposition offered by fire-resistant paints is further fueling adoption across the building and construction sector.

Key players in the fire-resistant paint market are adopting a variety of strategies to remain competitive and capture a high share. A prominent strategy is investing heavily in research and development to innovate and improve the performance of these paints.

By focusing on advanced formulations, these companies are able to offer resins in paints and coating market with superior fire-retardant properties, robust durability, and better environmental profiles. Research and development efforts also extend to developing paints that can be applied more easily and efficiently, reducing labor costs and application time for end-users.

Industry Updates

The two leading types include powder and liquid.

A few key applications include oil and gas, building and construction, electrical and electronics, aerospace, automotive, textiles, marine, and furniture.

Data about leading countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa is provided.

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

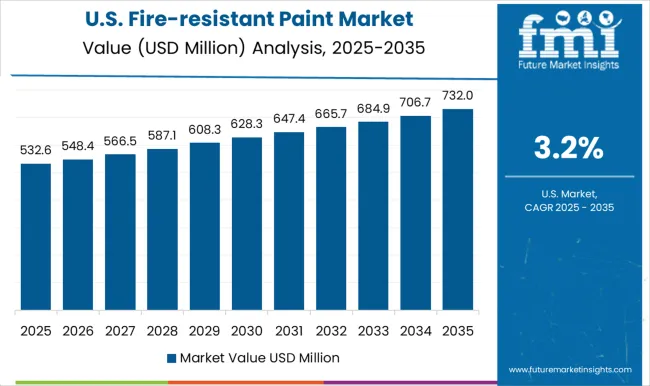

| USA | 3.2% |

| Brazil | 2.9% |

The Fire-resistant Paint Market is expected to register a CAGR of 3.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.1%, followed by India at 4.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Fire-resistant Paint Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.4%. The USA Fire-resistant Paint Market is estimated to be valued at USD 436.0 million in 2025 and is anticipated to reach a valuation of USD 599.1 million by 2035. Sales are projected to rise at a CAGR of 3.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 59.5 million and USD 37.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1205.0 Million |

| Type | Liquid and Powder |

| Application | Building and Construction, Oil and Gas, Electrical and Electronics, Aerospace, Automotive, Textiles, Marine, and Furniture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Akzo Nobel N.V., BASF SE, Nippon Paint Co. Ltd., Sherwin-Williams Company, Hempel A/S, Jotun AS, Contego International INC., Nullifire, Flame Control Coatings Llc, and Firefree Coatings INC. |

| Additional Attributes |

The global fire-resistant paint market is estimated to be valued at USD 1,205.0 million in 2025.

The market size for the fire-resistant paint market is projected to reach USD 1,749.6 million by 2035.

The fire-resistant paint market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in fire-resistant paint market are liquid and powder.

In terms of application, building and construction segment to command 31.2% share in the fire-resistant paint market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paint Cans Market Size and Share Forecast Outlook 2025 to 2035

Painting Robots Market Size and Share Forecast Outlook 2025 to 2035

Paint Curing Lamp Market Size and Share Forecast Outlook 2025 to 2035

Paint Booth Market Size and Share Forecast Outlook 2025 to 2035

Painting Tool Market Size and Share Forecast Outlook 2025 to 2035

Paint Rollers Market Size and Share Forecast Outlook 2025 to 2035

Paint Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Paint Tester Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Buckets Market Size, Share & Forecast 2025 to 2035

Paint Mixing Market Analysis - Size, Share, and Forecast Outlook for 2025-2035

Market Share Insights of Paint Can Manufacturers

Market Share Breakdown of Paint Protection Film Manufacturers

Paint Additives Market Growth 2024-2034

Faux Paints And Coatings Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Small Paint Pail Market Size and Share Forecast Outlook 2025 to 2035

Metal Paint Tray Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Paint Thinner Market Growth - Trends & Forecast 2025 to 2035

Epoxy Paint Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA