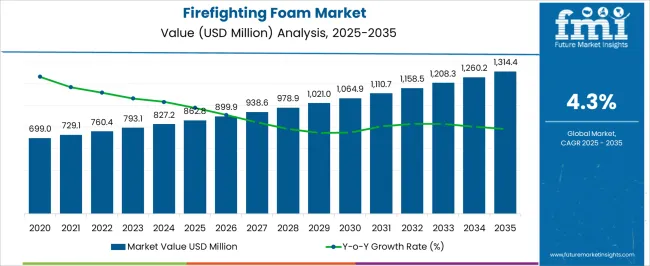

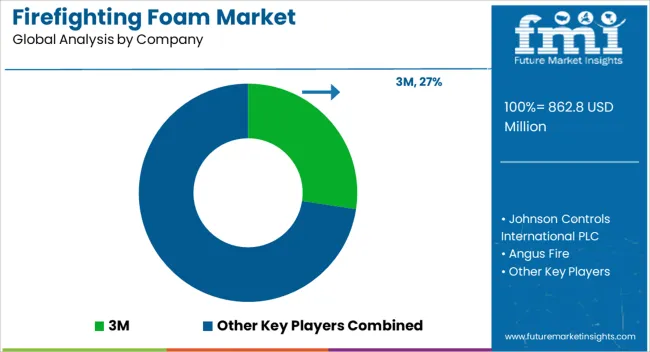

The firefighting foam market is expected to grow from USD 862.8 million in 2025 to USD 1,314.4 million by 2035, registering a 4.3% CAGR and generating an absolute dollar opportunity of USD 451.6 million. Growth is driven by rising safety regulations, increasing fire hazards in industrial, commercial, and residential sectors, and the adoption of advanced firefighting solutions. Innovations in environmentally friendly foams, such as fluorine-free and biodegradable formulations, along with automated dispensing systems, are further supporting adoption across mature and emerging markets.

Rolling CAGR analysis highlights fluctuations in year-over-year growth momentum across the forecast period. From 2025 to 2028, rolling CAGR values remain slightly below the long-term average, reflecting gradual adoption in North America and Europe, where regulatory compliance and replacement of older foam systems drive incremental growth. Between 2029 and 2032, rolling CAGR accelerates above the average, fueled by increasing urbanization, industrial expansion, and rising fire safety awareness in Asia Pacific, Latin America, and the Middle East. From 2033 to 2035, rolling CAGR moderates as early-adopting regions reach higher penetration, and incremental revenue shifts toward maintenance, system upgrades, and replacement cycles rather than new installations.

The USD 451.6 million opportunity demonstrates steady cumulative growth, with rolling CAGR trends revealing early-stage adoption, mid-phase acceleration, and late-stage stabilization across the global firefighting foam market between 2025 and 2035.

| Metric | Value |

|---|---|

| Firefighting Foam Market Estimated Value in (2025 E) | USD 862.8 million |

| Firefighting Foam Market Forecast Value in (2035 F) | USD 1314.4 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The firefighting foam market is primarily driven by the industrial and oil & gas sector, which accounts for around 45% of the market share, as foam is essential for controlling flammable liquid fires in refineries, storage facilities, and chemical plants. The municipal firefighting segment contributes approximately 25%, supplying fire departments with foams for urban and residential fire emergencies. Aviation and airport safety represent close to 15%, where foams are critical for aircraft fire suppression and runway safety. Marine and shipping operations account for roughly 10%, integrating firefighting foam for onboard fire hazards. The remaining 5% comes from defense, petrochemical, and mining sectors requiring specialized foam formulations for high-risk environments. The market is evolving with innovations in environmental safety, formulation, and application efficiency. Fluorine-free and low-toxicity foams are gaining adoption due to regulatory pressure and environmental concerns.

High-expansion and fast-spreading foams are improving fire suppression speed and coverage. Portable, lightweight delivery systems and automated discharge equipment are enhancing operational flexibility for firefighting personnel. Manufacturers are developing foam concentrates compatible with existing fire suppression systems to ensure seamless integration. Training programs and simulation-based deployment solutions are increasing market awareness. Rising safety standards, industrial growth, and the need for rapid fire response continue to drive global demand for advanced firefighting foams

The Firefighting Foam market is experiencing sustained growth driven by the increasing need for advanced fire suppression solutions across high-risk industries and urban infrastructure. Current market dynamics reflect rising demand from oil and gas facilities, industrial complexes, and commercial establishments where rapid response to flammable liquid fires is critical. The market growth is being fueled by advancements in foam formulations that enhance fire suppression efficiency, reduce environmental impact, and support regulatory compliance.

Investment in safety infrastructure, combined with stricter fire safety regulations globally, has accelerated the adoption of advanced foam solutions. The focus on workplace safety, prevention of industrial losses, and integration with automated fire suppression systems is shaping the market’s future outlook.

Increasing awareness regarding environmentally acceptable foam alternatives and the growing requirement for effective Class B fire control solutions are further contributing to market expansion As industries prioritize operational safety and compliance, the demand for firefighting foam is expected to remain robust, creating opportunities for innovation in both aqueous and protein-based foam formulations.

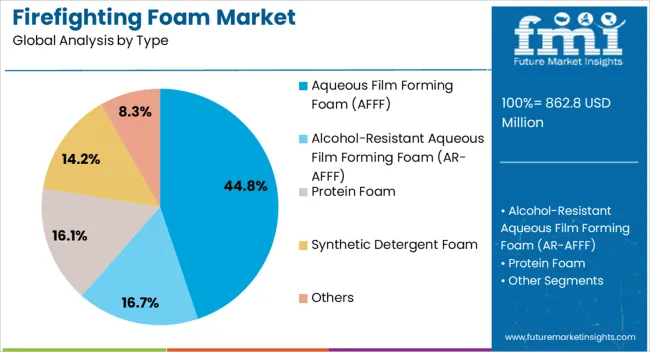

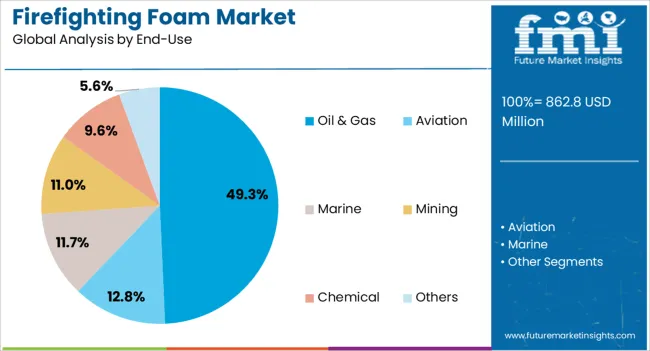

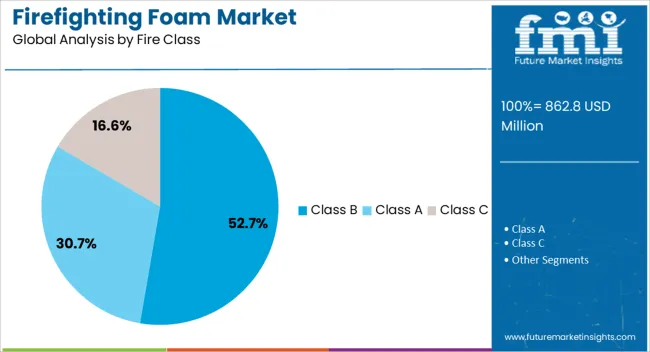

The firefighting foam market is segmented by type, end-use, fire class, and geographic regions. By type, firefighting foam market is divided into Aqueous Film Forming Foam (AFFF), Alcohol-Resistant Aqueous Film Forming Foam (AR-AFFF), Protein Foam, Synthetic Detergent Foam, and Others. In terms of end-use, firefighting foam market is classified into Oil & Gas, Aviation, Marine, Mining, Chemical, and Others. Based on fire class, firefighting foam market is segmented into Class B, Class A, and Class C. Regionally, the firefighting foam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Aqueous Film Forming Foam (AFFF) type is projected to account for 44.8% of the Firefighting Foam market revenue in 2025, making it the leading type segment. This dominance is being attributed to the foam’s ability to rapidly suppress flammable liquid fires and form a protective barrier that prevents reignition. AFFF foams have been widely adopted in oil and gas, petrochemical, and aviation facilities where fast-acting and reliable fire suppression is essential.

The growth of this segment has been supported by its compatibility with standard firefighting equipment, ease of deployment in large-scale facilities, and the ability to deliver consistent performance across varied environmental conditions. Additionally, ongoing formulation improvements have enhanced spreading and vapor suppression properties, further increasing operational efficiency.

Industries are increasingly preferring foam solutions that minimize operational downtime and provide high safety assurance, making AFFF the most sought-after type Future growth is expected to be supported by continuous optimization in foam chemistry and regulatory frameworks encouraging safe and effective fire control systems.

The Oil & Gas end-use segment is expected to hold 49.3% of the Firefighting Foam market revenue in 2025, positioning it as the leading industry segment. This leadership is being driven by the high-risk nature of operations in refineries, offshore platforms, and storage terminals where flammable liquids are handled. The demand for effective fire suppression solutions has been amplified by stringent safety regulations and the critical need to prevent catastrophic fire incidents.

Oil and gas facilities require foam systems capable of rapid response, wide-area coverage, and high thermal resistance, all of which are supported by software-defined and high-performance foam formulations. The growth of this segment has also been influenced by large-scale infrastructure expansion, increasing production capacity, and heightened focus on operational safety.

Industries are investing in solutions that reduce potential downtime, protect personnel, and minimize financial losses, further solidifying the adoption of firefighting foams With ongoing technological advancements and regulatory oversight, the Oil & Gas segment is expected to continue leading the demand for advanced firefighting solutions.

The Class B fire segment is projected to account for 52.7% of the Firefighting Foam market revenue in 2025, making it the largest fire class segment. This segment’s growth is being driven by the prevalence of flammable liquid fires in industrial and commercial environments, where rapid containment is critical for safety and operational continuity. Class B foams are specifically formulated to combat petroleum-based fires, chemical fires, and other high-intensity liquid hazards.

Their effectiveness in forming vapor-suppressing barriers and preventing reignition has made them indispensable in high-risk industries such as oil and gas, chemical manufacturing, and aviation. The adoption of Class B foams has also been supported by safety regulations that mandate their use in critical facilities and by industries’ increasing investment in comprehensive fire protection strategies.

Enhanced formulations offering superior spread, adhesion, and environmental compliance have further contributed to their market dominance As industries continue to focus on safety, efficiency, and regulatory compliance, the Class B foam segment is expected to maintain a leading position in the market for years to come.

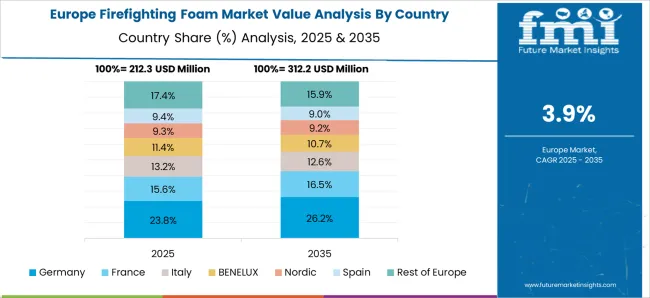

The firefighting foam market is growing due to increasing demand for industrial fire safety, stringent government safety regulations, and rising awareness of emergency preparedness. Asia Pacific leads with 36% adoption, primarily China (18%), Japan (10%), and India (8%). Europe contributes 32%, led by Germany (11%), France (10%), and UK (11%). North America accounts for 28%, mainly the USA, while the rest of the world represents 4%. Key foam types include AFFF (40%), protein-based (25%), fluorine-free (20%), and alcohol-resistant (15%). Applications cover oil & gas, aviation, marine, industrial, and municipal fire services, driving steady growth across sectors.

Market growth is fueled by industrial safety regulations, increasing fire-related incidents, and demand for rapid response solutions. AFFF foam contributes 40% of adoption, protein-based 25%, fluorine-free 20%, and alcohol-resistant 15%. Asia Pacific leads adoption at 36%, Europe 32%, and North America 28%. Aviation, oil & gas, and industrial sectors account for 60% of demand. Rising focus on environmental compliance is driving adoption of fluorine-free foams, especially in Europe and North America. Growing urban infrastructure, petrochemical facilities, and offshore oil platforms increase the need for effective firefighting solutions. Technological advancements in foam formulations enhance fire suppression efficiency and safety.

Key trends include fluorine-free formulations, high-expansion foams, and mobile foam delivery systems. Fluorine-free foams now account for 20% of total adoption due to environmental regulations. High-expansion foams are increasingly used in industrial and municipal applications, representing 15% of market use. Mobile foam delivery systems and portable extinguishing units are gaining adoption in Asia Pacific and Europe. Integration with automated fire suppression systems is rising, improving response times and coverage. Foam concentrates with improved stability and lower environmental impact are also being developed. Adoption of eco-friendly and water-efficient foam solutions is increasing in oil & gas, aviation, and industrial sectors globally.

Opportunities exist in oil & gas, aviation, industrial facilities, marine operations, and municipal services. AFFF foam adoption is 40%, protein-based 25%, fluorine-free 20%, and alcohol-resistant 15%. Asia Pacific contributes 36%, Europe 32%, and North America 28%. Expanding urban infrastructure and offshore energy projects create opportunities for specialized foam solutions. Growth in commercial aviation and port facilities supports demand for high-performance foams. Fluorine-free formulations enable eco-compliant deployment, attracting municipalities and industrial parks. Partnerships with firefighting equipment manufacturers and training providers enhance adoption. Increased investment in fire safety and emergency preparedness is driving consistent market growth worldwide.

Challenges include environmental concerns, regulatory restrictions, and high formulation costs. AFFF foams face scrutiny due to PFAS content, leading to restrictions in Europe and North America. Production costs for fluorine-free foams are 10–15% higher than conventional foams, limiting adoption in developing regions. Storage and shelf-life management of foam concentrates require controlled conditions, adding logistical challenges. Training personnel for proper foam deployment is necessary to ensure efficacy. Regional differences in fire safety regulations increase compliance complexity. Limited adoption in small-scale industrial units and municipal services is observed, particularly in Africa, Latin America, and parts of Asia.

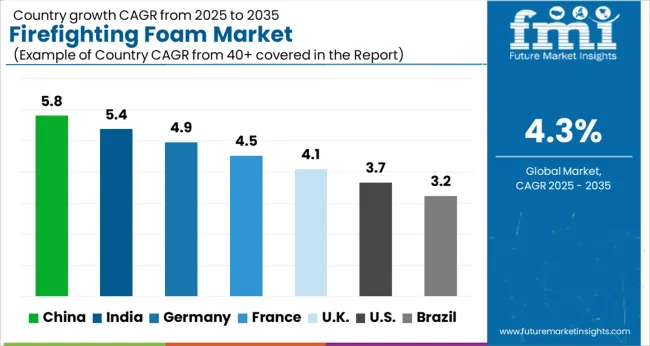

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The firefighting foam market is projected to grow at a global CAGR of 4.3% through 2035, driven by increasing industrial safety regulations, urban development, and demand for effective fire suppression systems. China leads at 5.8%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in industrial facilities, urban infrastructure projects, and emergency response services. India follows at 5.4%, a 1.26× multiple of the global rate, reflecting growing adoption in industrial plants, commercial complexes, and municipal fire safety initiatives. Germany records 4.9%, a 1.14× multiple of the benchmark, shaped by OECD-backed innovation in fire safety technology, stringent compliance standards, and industrial application. The United Kingdom posts 4.1%, 0.95× the global rate, with selective uptake in commercial, industrial, and municipal fire protection projects. The United States stands at 3.7%, 0.86× the benchmark, with steady demand in industrial, commercial, and specialized firefighting applications. BRICS economies drive most of the market volume, OECD countries emphasize technological advancement and safety standards, while ASEAN nations contribute through expanding industrial and urban fire protection infrastructure.

The firefighting foam market in China is projected to grow at a CAGR of 5.8%, driven by industrial expansion, stricter fire safety regulations, and rising demand in chemical, oil, and gas sectors. Domestic manufacturers such as Sinopec Fire and Jiangsu Huaxing supply aqueous film-forming foams (AFFF) and fluorine-free alternatives for industrial and municipal firefighting applications. Technological improvements focus on environmentally safe formulations, enhanced fire suppression efficiency, and compatibility with modern firefighting equipment. Growth is also supported by government-led fire safety modernization programs in industrial zones.

The firefighting foam market in India is expected to grow at a CAGR of 5.4%, supported by rising industrial activity, expansion of oil and gas facilities, and modernization of municipal fire departments. Key suppliers such as TAFE Chemicals and Pidilite Industries provide both AFFF and fluorine-free foam solutions. Technological development emphasizes rapid fire suppression, reduced environmental impact, and compatibility with foam proportioning systems. Adoption is driven by regulatory compliance, increasing awareness of fire safety, and government-led industrial safety initiatives.

Germany’s firefighting foam market is projected to grow at a CAGR of 4.9%, influenced by stringent fire safety regulations, high industrial activity, and environmental compliance requirements. Suppliers such as Minimax and Dräger provide advanced AFFF and fluorine-free foams for industrial and municipal use. Demand is concentrated in chemical, oil, and logistics sectors. Technological focus includes environmentally friendly formulations, enhanced fire suppression efficiency, and compatibility with modern proportioning equipment.

The firefighting foam market in the United Kingdom is expected to grow at a CAGR of 4.1%, driven by modernization of industrial facilities, oil and gas sector expansion, and adoption of environmentally safe foam alternatives. Suppliers focus on AFFF and fluorine-free foams with improved fire suppression efficiency and compliance with environmental regulations. Municipal firefighting and industrial applications continue to drive adoption. Technological improvements emphasize eco-friendly formulations, rapid suppression, and compatibility with existing firefighting infrastructure.

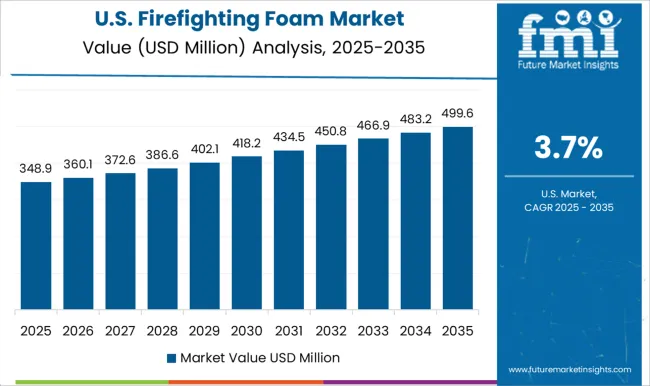

The firefighting foam market in the United States is projected to grow at a CAGR of 3.7%, supported by stringent safety regulations, high industrial activity, and adoption of environmentally safe firefighting solutions. Major suppliers such as 3M and Chemguard provide AFFF and fluorine-free foams for industrial, municipal, and aviation applications. Technological development emphasizes improved suppression efficiency, rapid deployment, and environmental compliance. Growth is concentrated in petrochemical, oil and gas, and airport safety sectors.

Competition in the firefighting foam market is being shaped by extinguishing efficiency, environmental compliance, and application versatility for industrial, municipal, and aviation firefighting operations. Market positions are being reinforced through advanced foam formulations, global supply networks, and adherence to international safety and environmental standards that ensure rapid fire suppression and reliability. 3M and Johnson Controls International PLC are being represented with high-performance foam concentrates engineered for rapid flame knockdown and broad fuel compatibility. Angus Fire and The Solberg Company are being promoted with solutions structured for industrial hazards, aircraft hangars, and storage facilities. Dr. Sthamer and National Foam are being applied with foams optimized for firefighting efficiency, stability, and compliance with regulatory guidelines. Tyco Fire Products LP and Chemguard are being showcased with formulations designed for versatile deployment across hydrocarbon and polar solvent fires. Kerr Fire and Buckeye Fire Equipment are being advanced with durable concentrates structured for municipal and emergency services. Dafo Fomtec AB, ICL Group, Eau&Feu, Kidde-Fenwal Inc., and SFFECO Global are being represented with specialized foams engineered for environmental safety, storage stability, and high expansion capabilities. Strategies in the market are being centered on product innovation, compliance with environmental regulations, and expansion of distribution networks for rapid availability. Research and development are being allocated to improve fire suppression efficiency, foam stability, biodegradability, and compatibility with different application equipment. Product brochures are being structured with specifications covering concentration, expansion ratio, storage life, and application methods. Features such as fast knockdown, compatibility with firefighting equipment, low toxicity, and environmental safety are being emphasized to guide procurement and operational planning. Each brochure is being arranged to present technical performance, regulatory compliance, and handling instructions. Information is being provided in a clear, evaluation-ready format to assist fire departments, industrial safety teams, and procurement managers in selecting firefighting foams that meet performance, safety, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 862.8 Million |

| Type | Aqueous Film Forming Foam (AFFF), Alcohol-Resistant Aqueous Film Forming Foam (AR-AFFF), Protein Foam, Synthetic Detergent Foam, and Others |

| End-Use | Oil & Gas, Aviation, Marine, Mining, Chemical, and Others |

| Fire Class | Class B, Class A, and Class C |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Johnson Controls International PLC, Angus Fire, The Solberg Company, Dr. Sthamer, National Foam, Tyco Fire Products LP, Chemguard, Kerr Fire, Buckeye Fire Equipment, Dafo Fomtec AB, ICL Group, Eau&Feu, Kidde-Fenwal Inc., and SFFECO Global |

| Additional Attributes | Dollar sales by foam type and end use, demand dynamics across industrial, aviation, and municipal firefighting, regional trends in fire safety regulations, innovation in foam effectiveness, environmental safety, and application methods, environmental impact of chemical runoff, and emerging use cases in high-risk facilities and wildfire management. |

The global firefighting foam market is estimated to be valued at USD 862.8 million in 2025.

The market size for the firefighting foam market is projected to reach USD 1,314.4 million by 2035.

The firefighting foam market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in firefighting foam market are aqueous film forming foam (afff), alcohol-resistant aqueous film forming foam (ar-afff), protein foam, synthetic detergent foam and others.

In terms of end-use, oil & gas segment to command 49.3% share in the firefighting foam market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Firefighting Drone Market Size and Share Forecast Outlook 2025 to 2035

Aerial Firefighting Market Size and Share Forecast Outlook 2025 to 2035

Foam Type Vacuum Gripping System Market Size and Share Forecast Outlook 2025 to 2035

Foam Mixing Machine Market Size and Share Forecast Outlook 2025 to 2035

Foam Market Size and Share Forecast Outlook 2025 to 2035

Foam-Free Pad Formers Market Size and Share Forecast Outlook 2025 to 2035

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Granulate Market Size and Share Forecast Outlook 2025 to 2035

Foam Plastics Market Size and Share Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Foam Glass Market Size and Share Forecast Outlook 2025 to 2035

Foamer Pump Market Size, Share & Forecast 2025 to 2035

Foam Food Container Market Size and Share Forecast Outlook 2025 to 2035

Foam Mesh Sleeves Market Growth - Demand & Forecast 2025 to 2035

Foam Edge Protectors Market Size and Share Forecast Outlook 2025 to 2035

Foamer Bottle Market Size and Share Forecast Outlook 2025 to 2035

Foam Cap Liners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA