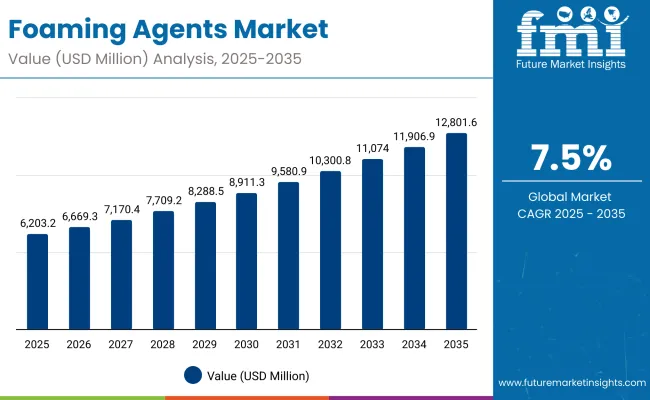

Global sales of foaming agents market are anticipated to be recorded at USD 6,203.2 Million in 2025 and are projected to advance to USD 12,801.6 Million by 2035. This implies an absolute increase of USD 6,598.4 Million across the decade, effectively more than doubling the market value. The expansion corresponds to a CAGR of 7.5%, supported by sustained demand for gentler cleansing systems, growth in premium personal care, and widening application in both mass and professional formulations.

Foaming Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Foaming Agents Market Estimated Value in (2025E) | USD 6,203.2 Million |

| Foaming Agents Market Forecast Value in (2035F) | USD 12,801.6 Million |

| Forecast CAGR (2025 to 2035) | 7.50% |

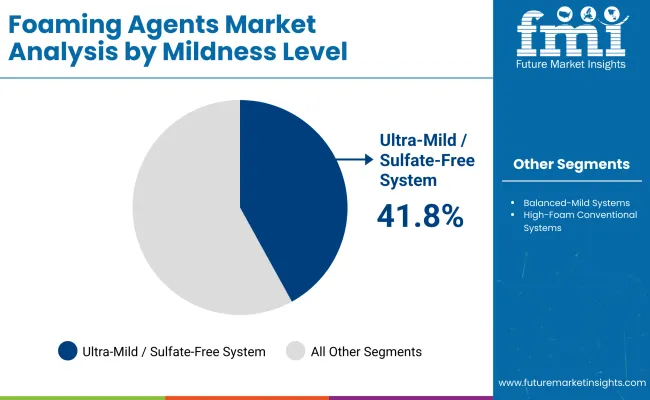

During the initial phase from 2025 to 2030, market value is expected to rise from USD 6,203.2 Million to USD 8,911.3 Million, adding USD 2,708.1 Million. This accounts for 41% of the decade’s incremental growth. Adoption in this period is expected to be shaped by increased use of sulfate-free systems and balanced-mild surfactants as consumer preferences tilt toward skin and scalp comfort. Ultra-mild formulations, representing 41.8% of value in 2025, are expected to sustain strong traction, while high-foam systems remain resilient in cost-sensitive applications.

In the second half of the decade, from 2030 to 2035, the market is projected to expand by a further USD 3,890.3 Million, representing 59% of total decade growth. By 2035, foaming agents are expected to record USD 12,801.6 Million, with the shift toward bio-derived and fermentation-driven sourcing becoming more pronounced.

Petrochemical-derived systems are expected to retain volume stability but lose share to alternatives as cost and sustainability pressures intensify. Premium and dermocosmetic categories are expected to lead value capture, positioning mildness-led formulations as a central growth lever.

From 2020 to 2024, the market advanced steadily, supported by rising demand for mild surfactant systems and wider adoption in premium personal care categories. By 2025, foaming agents are projected to be positioned as critical raw materials in both mass and dermocosmetic formulations, valued at USD 6,203.2 Million. Over the decade to 2035, revenues are expected to more than double, reaching USD 12,801.6 Million.

Growth is projected to be powered by the transition toward sulfate-free and bio-based systems, with China and India leading in volume acceleration while Europe and the United States sustain innovation-led adoption. Competitive dynamics are expected to shift from scale-driven supply to performance-validated mildness, low-irritation claims, and sustainable sourcing credentials.

Leading multinational suppliers are anticipated to expand hybrid portfolios across petrochemical-derived and bio-advantaged systems, while regional players in Asia are projected to capture share through cost-competitive, clean-label solutions. Ecosystem strength, supply resilience, and regulatory alignment are expected to define the competitive advantage moving forward.

The growth of the Foaming Agents Market is being driven by rising demand for mild and sulfate-free surfactant systems, as consumer awareness of skin sensitivity and scalp comfort has increased. Greater emphasis on clean-label and bio-based formulations has been observed, with regulatory pressure and retailer standards accelerating the adoption of sustainable sourcing.

Demand for premium and dermocosmetic products has strengthened, positioning ultra-mild systems as a key growth lever, while conventional foaming agents remain important in cost-sensitive mass categories. Expanding penetration of personal care in emerging economies such as China and India has supported higher wash frequency and premium upgrades, thereby amplifying market momentum.

Technological improvements in concentrated bases and pre-blended systems have been enabling faster formulation and reduced logistics costs. Over the forecast period, expansion is expected to be reinforced by bio-advantaged supply chains, clinical validation of low-irritation claims, and the adoption of refill-friendly formats across retail and professional channels.

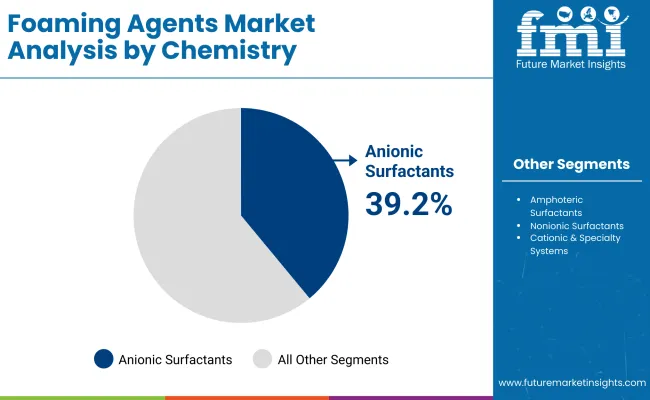

The Foaming Agents Market has been segmented across multiple parameters including chemistry, source, and mildness level, each reflecting distinct formulation priorities and consumer-driven demand. By chemistry, anionic surfactants held dominance in 2025 with a 39.2% share, valued at USD 2,431.65 Million, owing to their strong foaming ability and widespread use in cleansing formulations.

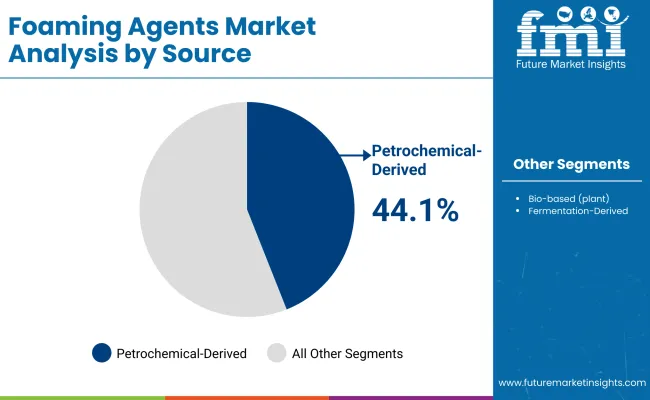

By source, petrochemical-derived agents accounted for the largest share of 44.1% in 2025, valued at USD 2,735.61 Million, sustained by their cost efficiency and consistent performance in high-volume applications. In terms of mildness level, ultra-mild and sulfate-free systems led with 41.8% of market value in 2025, reaching USD 2,592.94 Million, as demand for skin-friendly and low-irritation formulations gained momentum.

These segments are expected to remain influential as regulatory frameworks, sustainability goals, and consumer preferences continue to shape the long-term outlook.

| Chemistry | Market Value Share, 2025 |

|---|---|

| Anionic surfactants | 39.2% |

| Others | 60.8% |

The chemistry segment is expected to be dominated by anionic surfactants, which accounted for 39.2% share in 2025, valued at USD 2,431.65 Million. These agents have been widely utilized due to their ability to deliver high-foam volume and strong cleansing performance across mass personal care and household formulations. Their continued relevance is projected to be supported by cost competitiveness, scalability, and versatility in rinse-off categories.

However, the segment is anticipated to face growing competitive pressure from emerging mild systems as awareness around skin irritation and scalp sensitivity increases. Nevertheless, anionic surfactants are projected to retain a strong role, particularly in cost-driven markets, where affordability and performance efficiency remain the key adoption drivers through the forecast horizon.

| Source | Market Value Share, 2025 |

|---|---|

| Petrochemical-derived | 44.1% |

| Others | 55.9% |

The source segment has been led by petrochemical-derived systems, which represented 44.1% of total market value in 2025, amounting to USD 2,735.61 Million. These systems have been favored for their supply stability, established production processes, and ability to deliver consistent performance across a wide range of end-use applications.

Growth in this segment is projected to be underpinned by high demand in mass formulations where cost control remains critical. However, increasing environmental scrutiny and brand-level commitments to sustainable sourcing are expected to gradually reduce reliance on petrochemical-based foaming agents.

Despite this shift, petrochemical-derived systems are projected to maintain a substantial market presence, particularly in applications where affordability, performance reliability, and global availability remain prioritized.

| Mildness Level | Market Value Share, 2025 |

|---|---|

| Ultra-mild / sulfate-free systems | 41.8% |

| Others | 58.2% |

Ultra-mild and sulfate-free systems represented 41.8% of the market in 2025, valued at USD 2,592.94 Million. Their leadership has been driven by the rising consumer preference for gentle, skin-friendly formulations and sulfate-free claims increasingly perceived as a mark of quality.

Adoption has been particularly strong in premium personal care and dermocosmetic applications. Looking forward, this segment is projected to accelerate growth as regulatory frameworks and retailer lists favor low-irritation and clinically validated surfactants. With expanding penetration in both mature and emerging markets, ultra-mild systems are expected to capture greater share of value creation over the coming decade.

Market expansion has been shaped by complex formulation needs, regulatory alignment, and sustainability targets, even as cost structures and innovation cycles evolve. Increasing emphasis on clean-label credentials and performance-driven differentiation has been central to shaping procurement and development strategies.

Regulatory and Retailer Alignment with Mildness Standards

Stricter regulatory oversight and retailer-driven ingredient lists are expected to shape sourcing and formulation pipelines. Ingredients are being evaluated not only for safety but also for irritation potential, biodegradability, and compatibility with evolving sustainability frameworks. This dynamic is projected to create opportunities for suppliers capable of delivering foaming agents backed by robust toxicology data, lower carbon intensity, and clean-label positioning.

Competitive differentiation will increasingly hinge on proactive compliance and data transparency. Over the decade, companies that align innovation funnels with regulatory foresight are anticipated to secure long-term contracts with global personal care leaders, thereby strengthening market presence while minimizing reformulation risks.

Transition Toward Concentrated and Base-blend Systems

Formulation simplification through pre-blended bases and concentrated formats has been emerging as a defining trend. These systems are being adopted to reduce complexity in manufacturing, lower logistics costs, and accelerate time-to-market. By minimizing bulk transportation of water-heavy formulations, companies are achieving both operational efficiency and carbon reduction.

Concentrated systems are also facilitating innovation in refill and e-commerce channels, where portability and storage optimization provide clear advantages. This trend is projected to reshape supply chain economics, as value migrates from commodity volumes toward specialized blends that deliver measurable efficiency gains. Suppliers developing scalable concentrate platforms are expected to hold a distinct advantage in the competitive landscape.

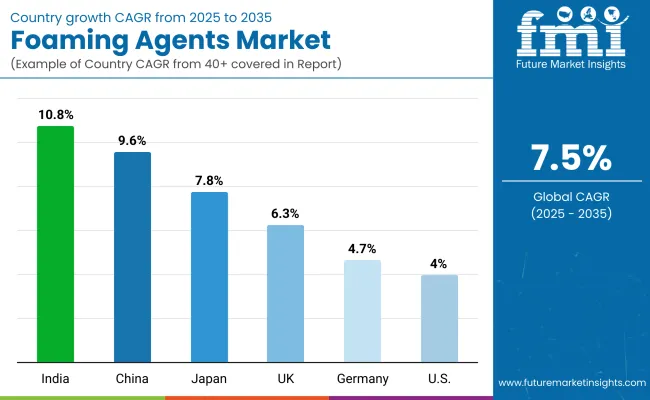

| Country | CAGR |

|---|---|

| China | 9.6% |

| USA | 4.0% |

| India | 10.8% |

| UK | 6.3% |

| Germany | 4.7% |

| Japan | 7.8% |

The Foaming Agents Market has been witnessing varied growth trajectories across leading economies, shaped by regulatory environments, consumer preferences, and industry-scale adoption. India is projected to be the fastest-growing country with a CAGR of 10.8% between 2025 and 2035, supported by increasing wash frequency, premiumization of personal care products, and strong expansion of domestic manufacturing capacity.

China follows with a robust CAGR of 9.6%, where online beauty platforms, local brand proliferation, and evolving consumer awareness toward sulfate-free systems are expected to accelerate demand. Japan, with a CAGR of 7.8%, is forecast to benefit from advanced dermocosmetic trends and strong innovation pipelines emphasizing low-irritation formulations.

Europe is expected to expand at a moderate CAGR of 5.8%, anchored by Germany at 4.7% and the UK at 6.3%, where stringent regulatory standards and sustainability mandates continue to influence sourcing and formulation strategies. The region’s focus on eco-label compliance and dermatology-driven formulations is projected to sustain long-term market value.

North America reflects a more mature growth profile, with the USA anticipated at a CAGR of 4.0%, as the market progresses toward concentrated and refill systems rather than pure volume expansion. Overall, country-level dynamics highlight that Asia is set to lead the next phase of growth, while Europe and North America sustain innovation-driven adoption.

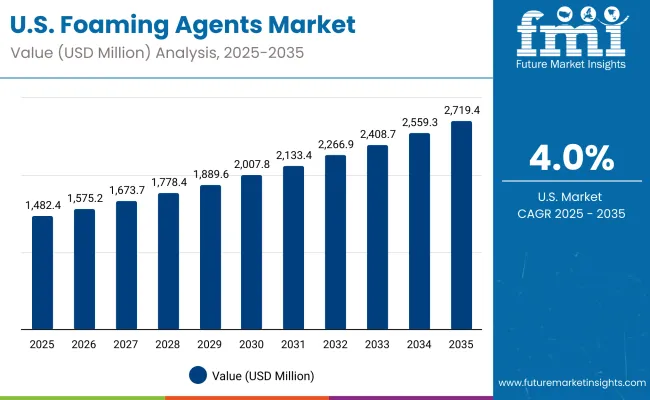

| Year | USA Foaming Agents Market (USD Million) |

|---|---|

| 2025 | 1482.47 |

| 2026 | 1575.20 |

| 2027 | 1673.73 |

| 2028 | 1778.43 |

| 2029 | 1889.67 |

| 2030 | 2007.87 |

| 2031 | 2133.46 |

| 2032 | 2266.91 |

| 2033 | 2408.71 |

| 2034 | 2559.37 |

| 2035 | 2719.46 |

The Foaming Agents Market in the United States is projected to expand at a CAGR of 4.0%between 2025 and 2035, supported by structural shifts toward cleaner formulations and sustainable raw material sourcing. Market progression is expected to be reinforced by premiumization in personal care, regulatory tightening around sulfate systems, and innovation in concentrated blends that optimize logistics and e-commerce distribution.

Domestic brands and multinational subsidiaries are anticipated to increase reliance on low-irritation surfactants, as consumer demand for dermatologist-approved and refill-friendly products accelerates. This growth trajectory positions the USA as a key hub for specialty surfactant innovation despite its moderate pace relative to Asia.

The Foaming Agents Market in the UK is projected to grow at a CAGR of 6.3% from 2025 to 2035, supported by sustained demand for personal care reformulations and compliance with EU-aligned sustainability standards. Growth is anticipated to remain moderate, reflecting market maturity but supported by innovation in sulfate-free and refill-friendly cleansing products.

Domestic formulators are expected to prioritize balanced-mild systems that meet skin safety requirements while maintaining cost competitiveness. Increasing penetration of premium brands and retailer-driven clean-label policies are forecast to strengthen demand for alternatives to conventional foaming systems. As sustainability-linked procurement becomes central, suppliers offering transparency in ingredient sourcing are likely to gain share in the UK.

The Foaming Agents Market in India is forecast to record the fastest growth globally, at a CAGR of 10.8% between 2025 and 2035. Expansion is expected to be powered by higher wash frequency, expanding middle-class consumption, and rapid premiumization of personal care products. Domestic manufacturers are projected to play a stronger role in supply, as cost competitiveness combines with high-volume scalability.

Growth is anticipated to be further reinforced by multinational partnerships that introduce sulfate-free and dermocosmetic-grade surfactants at accessible price points. India’s trajectory is likely to reshape global sourcing strategies, as both local and international players focus on meeting rising demand for mild, clean-label formulations.

The Foaming Agents Market in China is projected to expand at a CAGR of 9.6% during 2025-2035, driven by fast-evolving consumer preferences and robust online retail ecosystems. Demand is expected to be shaped by the proliferation of domestic beauty brands and strong consumer acceptance of sulfate-free and bio-advantaged foaming systems. Increased awareness of skin sensitivity and interest in premium cleansing formats are projected to reinforce the transition toward gentler surfactants.

Digital-first strategies, particularly in e-commerce, are expected to accelerate market adoption, as targeted marketing and influencer-led campaigns boost uptake. China’s regulatory tightening on cosmetic ingredients is anticipated to further strengthen demand for clean-label foaming agents with proven safety profiles.

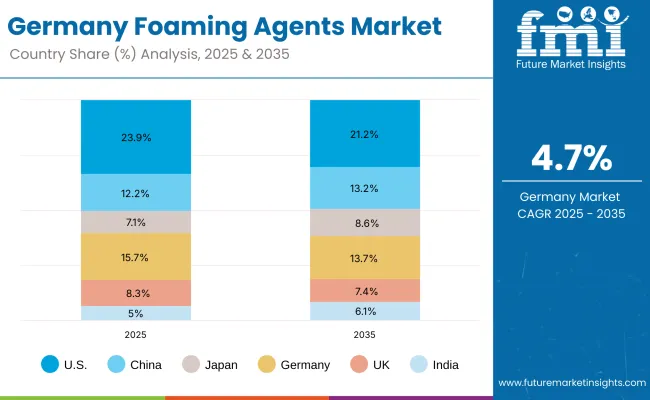

| Country | 2025 |

|---|---|

| USA | 23.9% |

| China | 12.2% |

| Japan | 7.1% |

| Germany | 15.7% |

| UK | 8.3% |

| India | 5.0% |

| Country | 2035 |

|---|---|

| USA | 21.2% |

| China | 13.2% |

| Japan | 8.6% |

| Germany | 13.7% |

| UK | 7.4% |

| India | 6.1% |

The Foaming Agents Market in Germany is expected to grow at a CAGR of 4.7% from 2025 to 2035, reflecting slower but steady adoption across established personal care and household categories. Market maturity is anticipated to moderate overall growth, though opportunities remain in dermocosmetic and premium skincare channels.

Germany’s position as a regulatory leader in Europe is expected to ensure sustained demand for low-irritation and eco-certified foaming systems. Local consumers’ high preference for dermatology-backed products is projected to drive consistent uptake of ultra-mild surfactants. Suppliers with strong sustainability credentials and certifications are likely to be favored in procurement decisions, reinforcing the trend toward bio-advantaged alternatives.

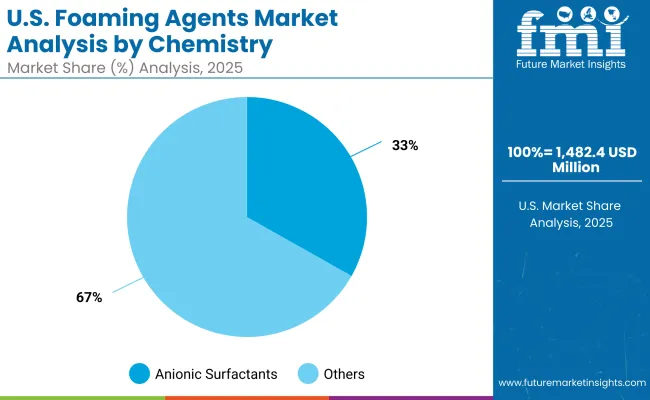

| USA By Chemistry | Market Value Share, 2025 |

|---|---|

| Anionic surfactants | 33.2% |

| Others | 66.8% |

The Foaming Agents Market in the USA is projected at USD 1,482.47 Million in 2025. Anionic surfactants contribute 33.2%, while other chemistries command 66.8%, reflecting a stronger orientation toward diversified systems beyond traditional high-foam agents. This dominance of broader chemistries is expected to be shaped by the transition to mild and multifunctional systems, as regulatory oversight and consumer expectations continue to limit reliance on legacy anionics.

Specialty surfactants are projected to drive incremental innovation, enabling improved skin compatibility and environmentally aligned claims. These shifts position USA suppliers to gain advantage through portfolios offering balanced performance and regulatory resilience. Over time, growth in concentrated blends and sustainable sourcing pathways is expected to reinforce the movement away from reliance on singular chemistry classes.

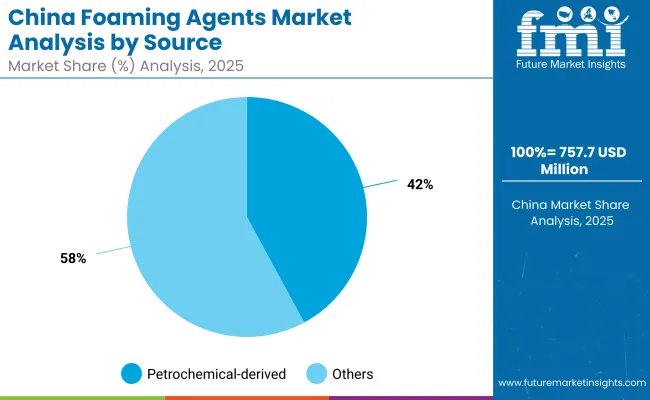

| China By Source | Market Value Share, 2025 |

|---|---|

| Petrochemical-derived | 42.1% |

| Others | 57.9% |

The Foaming Agents Market in China is estimated at USD 757.71 Million in 2025. Petrochemical-derived systems contribute 42.1%, while other sources hold 57.9%, valued at USD 438.71 Million. This tilt toward alternative sourcing reflects the market’s stronger alignment with bio-advantaged and sustainable formulations.

Consumer demand for sulfate-free and eco-labeled products, amplified by e-commerce channels, has been accelerating the transition away from petrochemical reliance. Regulatory tightening in China’s cosmetics sector is also expected to further strengthen the share of alternative sources, particularly fermentation-based and plant-derived systems.

Suppliers operating in the region are anticipated to emphasize cleaner sourcing and transparent supply chains to meet the evolving preferences of digital-first consumers. This trajectory suggests that while petrochemical-derived systems will retain relevance, growth momentum will remain concentrated in alternative pathways.

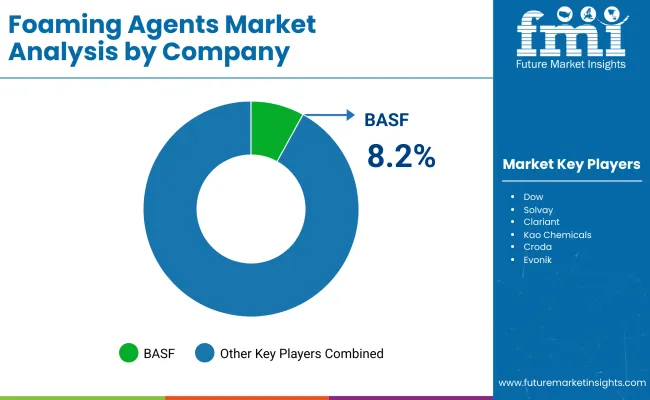

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.2% |

| Others | 91.8% |

The Foaming Agents Market is moderately fragmented, with global leaders, diversified chemical producers, and regional specialists competing across multiple application domains. BASF held the leading position in 2025, accounting for 8.2% of global value share, while the remaining 91.8% was distributed among a wide base of multinational and regional suppliers. BASF’s position has been reinforced by its diversified surfactant portfolio, innovation in ultra-mild and sulfate-free systems, and deep integration with premium and dermocosmetic value chains.

Other prominent companies active in this market include Dow, Solvay, Clariant, Kao Chemicals, Croda, Evonik, Innospec, Nouryon, and Stepan. These players are expected to focus on eco-advantaged chemistries, bio-based sourcing, and concentrated formulation platforms to gain incremental share. Strategic initiatives are being directed toward expanding fermentation-derived surfactants and enhancing transparency in sustainability reporting, in line with global procurement requirements.

Competitive differentiation is projected to move beyond scale and cost efficiency, with suppliers increasingly emphasizing validated mildness data, low-carbon pathways, and advanced blending systems that shorten formulation timelines. As retailer and regulatory standards intensify, partnerships with premium personal care brands and regional formulators are anticipated to shape competitive dynamics.

Key Developments in Foaming Agents Market

| Item | Value |

|---|---|

| Value Quantitative Units | USD 6,203.2 Million (2025E); USD 12,801.6 Million (2035F); 7.5% CAGR (2025-2035) |

| Chemistry | Anionic surfactants; Amphoteric surfactants; Nonionic surfactants; Cationic & specialty systems |

| Source | Petrochemical-derived; Bio-based (plant); Fermentation-derived |

| Mildness Level (Technology analogue) | Ultra-mild/sulfate-free systems; Balanced-mild systems; High-foam conventional systems |

| Delivery System (Range analogue) | Free form; Pre-blended bases; Concentrated paste/needles |

| Physical Form (Type analogue) | Liquid; Paste/needle; Powder |

| End-use Industry | Mass personal care; Premium/dermocosmetic; Professional salon |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; Japan; United Kingdom; Germany |

| Key Companies Profiled | BASF; Dow; Solvay; Clariant; Kao Chemicals; Croda; Evonik; Innospec; Nouryon; Stepan |

| Additional Attributes | Dollar sales by chemistry, source, mildness level, delivery system, physical form, and end use; adoption of pre-blended/concentrated bases; retailer and regulatory influence on sulfate-free/mild systems; sustainability and bio-advantaged sourcing metrics; regional growth outperformance in Asia; USA long-run shift toward concentrated/refill formats; competitive benchmarking including BASF 2025 global share at 8.2%. |

The global Foaming Agents Market is estimated to be valued at USD 6,203.2 Million in 2025.

The market size for the Foaming Agents Market is projected to reach USD 12,801.6 Million by 2035.

The Foaming Agents Market is expected to grow at a CAGR of 7.5% between 2025 and 2035.

The key product types in the Foaming Agents Market include anionic surfactants, amphoteric surfactants, nonionic surfactants, and cationic & specialty systems.

In terms of mildness level, ultra-mild and sulfate-free systems are expected to command a 41.8% share in the Foaming Agents Market in 2025.

|

Table 1: Global Foaming Agents Value (US$ Mn) Forecast by Region, 2020-2035 |

|

Table 2: Global Foaming Agents Volume (Units) Forecast by Region, 2020-2035 |

|

Table 3: Global Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 4: Global Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 5: Global Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 6: Global Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 7: Global Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 8: Global Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 9: Global Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 10: Global Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 11: Global Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 12: Global Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 13: Global Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 14: Global Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 15: Global Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 16: Global Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 17: North America Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 18: North America Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 19: North America Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 20: North America Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 21: North America Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 22: North America Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 23: North America Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 24: North America Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 25: North America Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 26: North America Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 27: North America Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 28: North America Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 29: North America Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 30: North America Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 31: North America Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 32: North America Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 33: Latin America Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 34: Latin America Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 35: Latin America Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 36: Latin America Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 37: Latin America Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 38: Latin America Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 39: Latin America Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 40: Latin America Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 41: Latin America Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 42: Latin America Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 43: Latin America Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 44: Latin America Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 45: Latin America Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 46: Latin America Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 47: Latin America Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 48: Latin America Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 49: Europe Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 50: Europe Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 51: Europe Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 52: Europe Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 53: Europe Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 54: Europe Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 55: Europe Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 56: Europe Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 57: Europe Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 58: Europe Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 59: Europe Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 60: Europe Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 61: Europe Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 62: Europe Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 63: Europe Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 64: Europe Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 65: East Asia Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 66: East Asia Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 67: East Asia Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 68: East Asia Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 69: East Asia Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 70: East Asia Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 71: East Asia Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 72: East Asia Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 73: East Asia Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 74: East Asia Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 75: East Asia Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 76: East Asia Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 77: East Asia Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 78: East Asia Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 79: East Asia Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 80: East Asia Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 81: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 82: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 83: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 84: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 85: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 86: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 87: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 88: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 89: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 90: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 91: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 92: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 93: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 94: South Asia & Pacific Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 95: South Asia & Pacific Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 96: South Asia & Pacific Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Table 97: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Country, 2020-2035 |

|

Table 98: Middle East and Africa Foaming Agents Volume (Units) Forecast by Country, 2020-2035 |

|

Table 99: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Chemistry, 2020-2035 |

|

Table 100: Middle East and Africa Foaming Agents Volume (Units) Forecast by Chemistry, 2020-2035 |

|

Table 101: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Source, 2020-2035 |

|

Table 102: Middle East and Africa Foaming Agents Volume (Units) Forecast by Source, 2020-2035 |

|

Table 103: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Mildness Level, 2020-2035 |

|

Table 104: Middle East and Africa Foaming Agents Volume (Units) Forecast by Mildness Level, 2020-2035 |

|

Table 105: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Delivery System, 2020-2035 |

|

Table 106: Middle East and Africa Foaming Agents Volume (Units) Forecast by Delivery System, 2020-2035 |

|

Table 107: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Physical Form, 2020-2035 |

|

Table 108: Middle East and Africa Foaming Agents Volume (Units) Forecast by Physical Form, 2020-2035 |

|

Table 109: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by Application, 2020-2035 |

|

Table 110: Middle East and Africa Foaming Agents Volume (Units) Forecast by Application, 2020-2035 |

|

Table 111: Middle East and Africa Foaming Agents Value (US$ Mn) Forecast by End Use, 2020-2035 |

|

Table 112: Middle East and Africa Foaming Agents Volume (Units) Forecast by End Use, 2020-2035 |

|

Figure 1: Global Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 2: Global Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 3: Global Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 4: Global Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 5: Global Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 6: Global Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 7: Global Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 8: Global Foaming Agents Value (US$ Mn) by Region, 2025-2035 |

|

Figure 9: Global Foaming Agents Value (US$ Mn) Analysis by Region, 2020-2035 |

|

Figure 10: Global Foaming Agents Volume (Units) Analysis by Region, 2020-2035 |

|

Figure 11: Global Foaming Agents Value Share (%) and BPS Analysis by Region, 2025-2035 |

|

Figure 12: Global Foaming Agents Y-o-Y Growth (%) Projections by Region, 2025-2035 |

|

Figure 13: Global Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 14: Global Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 15: Global Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 16: Global Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 17: Global Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 18: Global Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 19: Global Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 20: Global Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 21: Global Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 22: Global Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 23: Global Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 24: Global Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 25: Global Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 26: Global Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 27: Global Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 28: Global Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 29: Global Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 30: Global Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 31: Global Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 32: Global Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 33: Global Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 34: Global Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 35: Global Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 36: Global Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 37: Global Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 38: Global Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 39: Global Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 40: Global Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 41: Global Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 42: Global Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 43: Global Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 44: Global Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 45: Global Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 46: Global Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 47: Global Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 48: Global Foaming Agents Attractiveness by Region, 2025-2035 |

|

Figure 49: North America Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 50: North America Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 51: North America Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 52: North America Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 53: North America Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 54: North America Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 55: North America Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 56: North America Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 57: North America Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 58: North America Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 59: North America Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 60: North America Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 61: North America Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 62: North America Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 63: North America Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 64: North America Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 65: North America Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 66: North America Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 67: North America Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 68: North America Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 69: North America Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 70: North America Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 71: North America Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 72: North America Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 73: North America Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 74: North America Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 75: North America Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 76: North America Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 77: North America Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 78: North America Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 79: North America Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 80: North America Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 81: North America Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 82: North America Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 83: North America Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 84: North America Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 85: North America Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 86: North America Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 87: North America Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 88: North America Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 89: North America Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 90: North America Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 91: North America Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 92: North America Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 93: North America Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 94: North America Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 95: North America Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 96: North America Foaming Agents Attractiveness by Country, 2025-2035 |

|

Figure 97: Latin America Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 98: Latin America Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 99: Latin America Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 100: Latin America Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 101: Latin America Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 102: Latin America Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 103: Latin America Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 104: Latin America Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 105: Latin America Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 106: Latin America Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 107: Latin America Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 108: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 109: Latin America Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 110: Latin America Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 111: Latin America Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 112: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 113: Latin America Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 114: Latin America Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 115: Latin America Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 116: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 117: Latin America Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 118: Latin America Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 119: Latin America Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 120: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 121: Latin America Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 122: Latin America Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 123: Latin America Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 124: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 125: Latin America Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 126: Latin America Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 127: Latin America Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 128: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 129: Latin America Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 130: Latin America Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 131: Latin America Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 132: Latin America Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 133: Latin America Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 134: Latin America Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 135: Latin America Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 136: Latin America Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 137: Latin America Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 138: Latin America Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 139: Latin America Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 140: Latin America Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 141: Latin America Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 142: Latin America Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 143: Latin America Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 144: Latin America Foaming Agents Attractiveness by Country, 2025-2035 |

|

Figure 145: Europe Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 146: Europe Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 147: Europe Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 148: Europe Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 149: Europe Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 150: Europe Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 151: Europe Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 152: Europe Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 153: Europe Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 154: Europe Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 155: Europe Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 156: Europe Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 157: Europe Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 158: Europe Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 159: Europe Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 160: Europe Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 161: Europe Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 162: Europe Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 163: Europe Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 164: Europe Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 165: Europe Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 166: Europe Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 167: Europe Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 168: Europe Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 169: Europe Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 170: Europe Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 171: Europe Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 172: Europe Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 173: Europe Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 174: Europe Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 175: Europe Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 176: Europe Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 177: Europe Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 178: Europe Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 179: Europe Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 180: Europe Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 181: Europe Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 182: Europe Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 183: Europe Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 184: Europe Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 185: Europe Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 186: Europe Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 187: Europe Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 188: Europe Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 189: Europe Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 190: Europe Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 191: Europe Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 192: Europe Foaming Agents Attractiveness by Country, 2025-2035 |

|

Figure 193: East Asia Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 194: East Asia Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 195: East Asia Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 196: East Asia Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 197: East Asia Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 198: East Asia Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 199: East Asia Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 200: East Asia Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 201: East Asia Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 202: East Asia Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 203: East Asia Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 204: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 205: East Asia Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 206: East Asia Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 207: East Asia Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 208: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 209: East Asia Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 210: East Asia Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 211: East Asia Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 212: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 213: East Asia Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 214: East Asia Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 215: East Asia Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 216: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 217: East Asia Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 218: East Asia Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 219: East Asia Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 220: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 221: East Asia Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 222: East Asia Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 223: East Asia Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 224: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 225: East Asia Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 226: East Asia Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 227: East Asia Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 228: East Asia Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 229: East Asia Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 230: East Asia Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 231: East Asia Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 232: East Asia Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 233: East Asia Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 234: East Asia Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 235: East Asia Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 236: East Asia Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 237: East Asia Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 238: East Asia Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 239: East Asia Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 240: East Asia Foaming Agents Attractiveness by Country, 2025-2035 |

|

Figure 241: South Asia & Pacific Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 242: South Asia & Pacific Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 243: South Asia & Pacific Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 244: South Asia & Pacific Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 245: South Asia & Pacific Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 246: South Asia & Pacific Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 247: South Asia & Pacific Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 248: South Asia & Pacific Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 249: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 250: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 251: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 252: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 253: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 254: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 255: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 256: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 257: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 258: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 259: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 260: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 261: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 262: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 263: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 264: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 265: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 266: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 267: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 268: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 269: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 270: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 271: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 272: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 273: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 274: South Asia & Pacific Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 275: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 276: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 277: South Asia & Pacific Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 278: South Asia & Pacific Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 279: South Asia & Pacific Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 280: South Asia & Pacific Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 281: South Asia & Pacific Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 282: South Asia & Pacific Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 283: South Asia & Pacific Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 284: South Asia & Pacific Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 285: South Asia & Pacific Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 286: South Asia & Pacific Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 287: South Asia & Pacific Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 288: South Asia & Pacific Foaming Agents Attractiveness by Country, 2025-2035 |

|

Figure 289: Middle East and Africa Foaming Agents Value (US$ Mn) by Chemistry, 2025-2035 |

|

Figure 290: Middle East and Africa Foaming Agents Value (US$ Mn) by Source, 2025-2035 |

|

Figure 291: Middle East and Africa Foaming Agents Value (US$ Mn) by Mildness Level, 2025-2035 |

|

Figure 292: Middle East and Africa Foaming Agents Value (US$ Mn) by Delivery System, 2025-2035 |

|

Figure 293: Middle East and Africa Foaming Agents Value (US$ Mn) by Physical Form, 2025-2035 |

|

Figure 294: Middle East and Africa Foaming Agents Value (US$ Mn) by Application, 2025-2035 |

|

Figure 295: Middle East and Africa Foaming Agents Value (US$ Mn) by End Use, 2025-2035 |

|

Figure 296: Middle East and Africa Foaming Agents Value (US$ Mn) by Country, 2025-2035 |

|

Figure 297: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Country, 2020-2035 |

|

Figure 298: Middle East and Africa Foaming Agents Volume (Units) Analysis by Country, 2020-2035 |

|

Figure 299: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Country, 2025-2035 |

|

Figure 300: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Country, 2025-2035 |

|

Figure 301: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Chemistry, 2020-2035 |

|

Figure 302: Middle East and Africa Foaming Agents Volume (Units) Analysis by Chemistry, 2020-2035 |

|

Figure 303: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Chemistry, 2025-2035 |

|

Figure 304: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Chemistry, 2025-2035 |

|

Figure 305: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Source, 2020-2035 |

|

Figure 306: Middle East and Africa Foaming Agents Volume (Units) Analysis by Source, 2020-2035 |

|

Figure 307: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Source, 2025-2035 |

|

Figure 308: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Source, 2025-2035 |

|

Figure 309: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Mildness Level, 2020-2035 |

|

Figure 310: Middle East and Africa Foaming Agents Volume (Units) Analysis by Mildness Level, 2020-2035 |

|

Figure 311: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Mildness Level, 2025-2035 |

|

Figure 312: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Mildness Level, 2025-2035 |

|

Figure 313: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Delivery System, 2020-2035 |

|

Figure 314: Middle East and Africa Foaming Agents Volume (Units) Analysis by Delivery System, 2020-2035 |

|

Figure 315: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Delivery System, 2025-2035 |

|

Figure 316: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Delivery System, 2025-2035 |

|

Figure 317: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Physical Form, 2020-2035 |

|

Figure 318: Middle East and Africa Foaming Agents Volume (Units) Analysis by Physical Form, 2020-2035 |

|

Figure 319: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Physical Form, 2025-2035 |

|

Figure 320: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Physical Form, 2025-2035 |

|

Figure 321: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by Application, 2020-2035 |

|

Figure 322: Middle East and Africa Foaming Agents Volume (Units) Analysis by Application, 2020-2035 |

|

Figure 323: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by Application, 2025-2035 |

|

Figure 324: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by Application, 2025-2035 |

|

Figure 325: Middle East and Africa Foaming Agents Value (US$ Mn) Analysis by End Use, 2020-2035 |

|

Figure 326: Middle East and Africa Foaming Agents Volume (Units) Analysis by End Use, 2020-2035 |

|

Figure 327: Middle East and Africa Foaming Agents Value Share (%) and BPS Analysis by End Use, 2025-2035 |

|

Figure 328: Middle East and Africa Foaming Agents Y-o-Y Growth (%) Projections by End Use, 2025-2035 |

|

Figure 329: Middle East and Africa Foaming Agents Attractiveness by Chemistry, 2025-2035 |

|

Figure 330: Middle East and Africa Foaming Agents Attractiveness by Source, 2025-2035 |

|

Figure 331: Middle East and Africa Foaming Agents Attractiveness by Mildness Level, 2025-2035 |

|

Figure 332: Middle East and Africa Foaming Agents Attractiveness by Delivery System, 2025-2035 |

|

Figure 333: Middle East and Africa Foaming Agents Attractiveness by Physical Form, 2025-2035 |

|

Figure 334: Middle East and Africa Foaming Agents Attractiveness by Application, 2025-2035 |

|

Figure 335: Middle East and Africa Foaming Agents Attractiveness by End Use, 2025-2035 |

|

Figure 336: Middle East and Africa Foaming Agents Attractiveness by Country, 2025-2035 |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anti-Foaming Agents / Defoamers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Agents Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foaming Creamer Market Size and Share Forecast Outlook 2025 to 2035

Low-Foaming Detergent Market

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Optical Foaming Cleaning Solution Market

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA