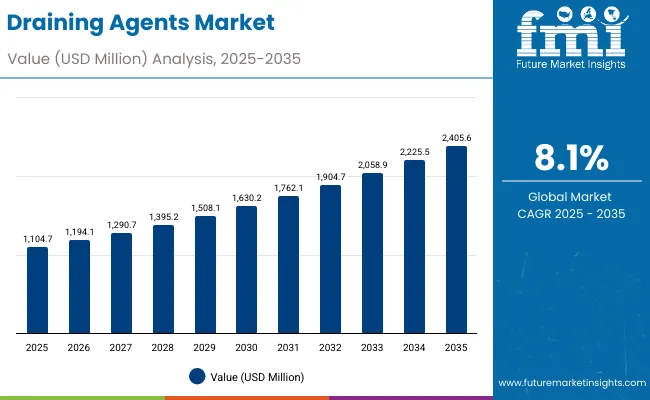

The global Draining Agents Market is expected to record a valuation of USD 1,104.7 million in 2025 and USD 2,405.6 million in 2035, with an increase of USD 1,300.9 million, which equals a growth of 118% over the decade. The overall expansion represents a CAGR of 8.1% and more than a 2X increase in market size.

Global Draining Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Draining Agents Market Estimated Value in (2025E) | USD 1,104.7 million |

| Global Draining Agents Market Forecast Value in (2035F) | USD 2,405.6 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,104.7 million to USD 1,630.2 million, adding USD 525.5 million, which accounts for 40% of the total decade growth. This phase records steady adoption in cosmeceuticals, spa-based treatments, and body care formulations, driven by the need for effective anti-cellulite complexes and botanical extracts. Anti-cellulite creams and leg relief serums dominate this period as they cater to over one-third of consumer applications requiring targeted lymphatic stimulation and microcirculation improvement.

The second half from 2030 to 2035 contributes USD 775.4 million, equal to 60% of total growth, as the market jumps from USD 1,630.2 million to USD 2,405.6 million. This acceleration is powered by widespread integration of encapsulated actives, microemulsion dispersions, and gel-based delivery forms in advanced cosmeceuticals and spa formulations. East Asia, particularly China and Japan, emerges as a critical growth hub, while India records the highest CAGR at 15.9%. Botanical extracts remain a consumer favorite, but synthetic complexes and bio-fermentation actives expand their share by supporting innovation in sustainable formulations.

From 2020 to 2024, the global Draining Agents Market expanded steadily from a small base, reaching over USD 1 billion in 2024, driven by growing adoption of anti-cellulite and body contouring products. During this period, the competitive landscape was dominated by suppliers of botanical and natural active complexes, controlling nearly 60% of revenue, with leaders such as Givaudan, Croda, and BASF focusing on plant-based extracts and bio-fermentation actives. Competitive differentiation relied on efficacy validation, sustainable sourcing, and safety profiles, while delivery systems were largely restricted to free-form applications. Encapsulation and advanced dispersions were still niche and contributed less than 15% of the total market value.

Demand for draining agents will expand to USD 1,104.7 million in 2025, and the revenue mix will gradually shift as encapsulation and advanced carriers grow to over 25% share by 2035. Traditional botanical extract leaders face rising competition from biotech-driven players offering microemulsion dispersions, controlled release actives, and bioengineered complexes. Major ingredient manufacturers are pivoting to hybrid models that combine natural actives with advanced delivery systems to retain relevance. Emerging entrants specializing in precision formulations for cosmeceuticals, spa-based therapies, and wellness-linked applications are gaining share. The competitive advantage is moving away from natural sourcing alone to the ability to deliver clinically validated efficacy, multifunctional activity, and formulation flexibility.

Advances in cosmetic actives and formulation science have improved efficacy, enabling draining agents to deliver measurable improvements in microcirculation, edema reduction, and cellulite management. Anti-cellulite complexes have gained popularity due to their proven performance in targeted fat reduction and body contouring solutions. The rise of botanical extracts has contributed to enhanced consumer trust, aligning with clean-label and natural beauty movements. Industries such as cosmeceuticals, professional spa products, and body care are driving demand for solutions that merge efficacy with sensorial appeal.

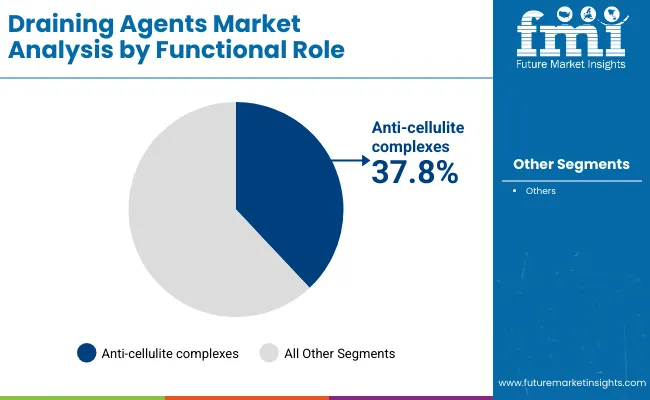

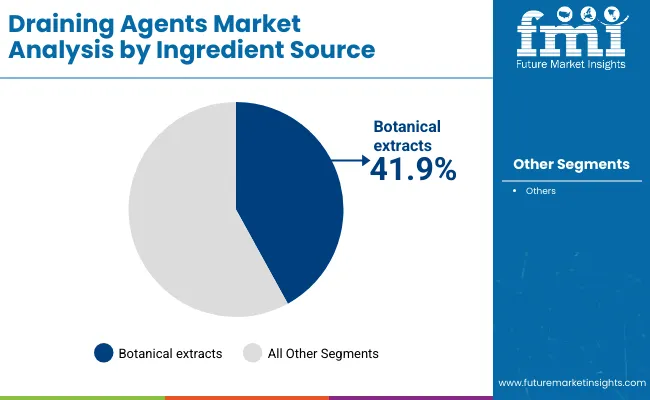

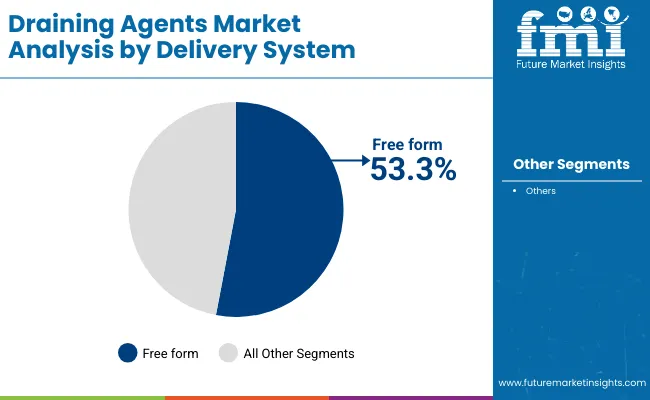

Expansion of professional spa treatments and wellness-linked skincare has fueled market growth. Innovations in encapsulated actives, microemulsions, and gel-based dispersions are expected to open new application areas, ensuring controlled release and enhanced penetration. Segment growth is expected to be led by anti-cellulite complexes in functional role, botanical extracts in ingredient sourcing, and free-form actives in delivery systems, supported by their versatility, adaptability, and cost-effectiveness.

The market is segmented by functional role, ingredient source, delivery system, physical form, application, end use, and geography. Functional roles include microcirculation stimulants, edema-reducing actives, lymphatic drainage boosters, and anti-cellulite complexes, highlighting their distinct physiological benefits. Ingredient sources span botanical extracts, bio-fermentation actives, synthetic complexes, and mineral-derived actives, covering the full spectrum of natural and advanced chemical options. Delivery systems include free form, encapsulated actives, and microemulsion dispersions, catering to varying levels of sophistication. Physical form is classified into liquid concentrate, powdered extract, and gel-based dispersion. Applications include anti-cellulite creams and gels, leg relief serums, body contouring products, and spa & professional treatments. End uses comprise cosmeceuticals, professional spa products, and body care formulations. Regionally, the scope covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Functional Role | Value Share % 2025 |

|---|---|

| Anti-cellulite complexes | 37.8% |

| Others | 62.2% |

The anti-cellulite complexes segment is projected to contribute 37.8% of the global Draining Agents Market revenue in 2025, maintaining its lead as the dominant functional role category. This is driven by strong consumer demand for formulations that visibly reduce cellulite, stimulate lymphatic drainage, and improve skin smoothness. Premium cosmeceuticals and spa-based treatments have prioritized these actives due to their proven efficacy in localized fat reduction and body contouring outcomes.

The segment’s growth is also supported by rising innovation in synergistic formulations that combine botanical extracts and bio-fermentation actives with anti-cellulite complexes, thereby enhancing results. As wellness-driven skincare trends continue to rise globally, demand for multifunctional complexes is set to intensify. The anti-cellulite complexes segment is expected to retain its position as the cornerstone of draining agent applications throughout the forecast period.

| Ingredient Source | Value Share % 2025 |

|---|---|

| Botanical extracts | 41.9% |

| Others | 58.1% |

The botanical extracts segment accounts for 41.9% of the global Draining Agents Market in 2025, highlighting the strong consumer preference for natural and plant-based actives. Extracts rich in flavonoids, polyphenols, and saponins are recognized for their role in reducing edema, improving microcirculation, and enhancing lymphatic drainage. Their alignment with clean-label beauty trends and sustainability initiatives further boosts adoption among leading cosmeceutical brands.

Additionally, botanical actives resonate with spa and professional product lines, which emphasize holistic and natural treatments. Continued R&D in high-potency plant derivatives, supported by eco-friendly sourcing and traceability, is strengthening their market presence. Botanical extracts are projected to remain the leading ingredient source as natural wellness solutions continue to dominate consumer choices worldwide.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 53.3% |

| Others | 46.7% |

Free form actives hold the largest share at 53.3% of the global Draining Agents Market in 2025, reflecting their versatility and ease of incorporation across a wide range of applications. Their cost-effectiveness and straightforward compatibility with creams, gels, and serums make them the preferred choice for most mainstream cosmetic and body care formulations.

However, advancements in encapsulation and microemulsion dispersions are increasingly attracting attention due to their enhanced bioavailability, controlled release, and improved stability of active compounds. These next-generation systems are particularly gaining traction in high-end cosmeceuticals and professional spa formulations. While free form actives will continue to dominate in volume terms, the future growth trajectory indicates a gradual shift toward advanced delivery mechanisms for differentiated performance.

Rising demand for targeted cellulite and body contouring solutions

Consumers across both developed and emerging markets are increasingly focused on visible body shaping results. Anti-cellulite complexes, which already account for 37.8% of market share in 2025, are being integrated into cosmeceuticals, spa treatments, and body care products due to their proven ability to stimulate lymphatic drainage and improve microcirculation. This demand is amplified by lifestyle trends favoring body-positive aesthetics, social media influence, and growing willingness to invest in premium solutions beyond basic moisturization.

Shift toward natural and sustainable ingredient sourcing

Botanical extracts dominate the ingredient source segment with a 41.9% share in 2025, as consumers increasingly associate plant-based actives with safety, sustainability, and holistic wellness. Brands are leveraging flavonoid-rich, anti-inflammatory botanicals for their dual benefits in draining and soothing formulations. The push toward eco-conscious beauty is also encouraging investment in traceable sourcing and bio-fermentation processes, ensuring performance without compromising environmental responsibility.

High reliance on efficacy validation and clinical proof

Unlike standard moisturizers or body creams, draining agents must demonstrate measurable effects such as cellulite reduction, edema control, or improved circulation. This creates significant pressure on manufacturers to invest in clinical trials, efficacy studies, and regulatory-compliant claims. Small and emerging brands often face barriers due to the high costs of generating scientific evidence, slowing adoption in price-sensitive regions.

Limited consumer awareness outside premium markets

While Europe, North America, and East Asia show strong adoption due to established spa culture and cosmeceutical innovation, penetration in Latin America, South Asia, and Africa remains limited. Consumers in these markets are still more focused on general skincare than on specialized draining or anti-cellulite formulations. This knowledge gap restricts market expansion and demands heavy investment in education and marketing to build awareness of product benefits.

Emergence of advanced delivery systems for enhanced efficacy

Free form actives currently lead with 53.3% share, but encapsulated actives and microemulsion dispersions are rapidly gaining attention. Encapsulation allows controlled release and deeper skin penetration, significantly improving performance in high-value formulations. This shift is particularly visible in premium cosmeceuticals and spa products, where consumers expect both faster results and long-term benefits.

Integration of draining agents into multifunctional wellness products

The market is moving beyond standalone anti-cellulite creams toward multifunctional formats such as leg relief serums with cooling effects, body contouring products with added hydration, and spa treatments that combine detoxification with microcirculation stimulation. This convergence of cosmetic efficacy and holistic wellness reflects the growing demand for “all-in-one” solutions that save time while addressing multiple skin and body concerns.

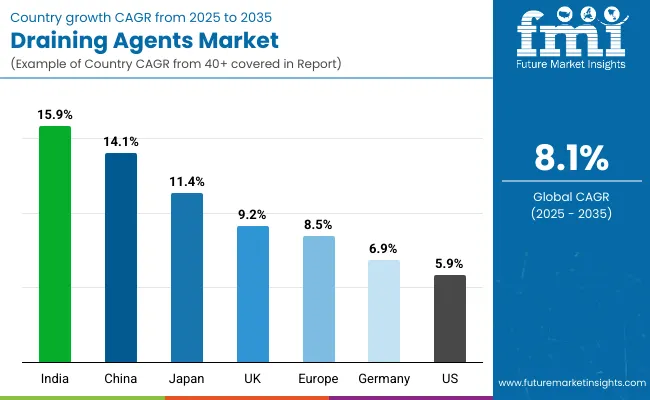

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.1% |

| USA | 5.9% |

| India | 15.9% |

| UK | 9.2% |

| Germany | 6.9% |

| Japan | 11.4% |

| Europe | 8.5% |

China and India are positioned as the most dynamic growth markets in the global Draining Agents industry, with CAGRs of 14.1% and 15.9% respectively between 2025 and 2035. India’s rapid expansion reflects the accelerating penetration of cosmeceuticals and body contouring products in urban centers, coupled with a younger population increasingly adopting preventive skincare routines. China, already a global hub for beauty and wellness, is experiencing rising demand for botanical-based draining actives, supported by consumer preference for traditional herbal ingredients aligned with modern cosmetic science. Both countries benefit from expanding middle-class spending power and strong domestic manufacturing ecosystems, making Asia the most attractive growth corridor for draining agent suppliers.

Mature markets such as the USA, Germany, and the UK show moderate but steady growth, ranging between 5.9% and 9.2% CAGR, reflecting sustained consumer demand for premium body care and spa-based formulations. Japan, with a CAGR of 11.4%, stands out in East Asia due to its advanced beauty culture and early adoption of microemulsion and encapsulated delivery technologies. Broader Europe maintains an 8.5% CAGR, supported by strong spa traditions in countries like Germany and France, alongside regulatory frameworks encouraging innovation in cosmeceuticals. While growth rates are slower than in Asia, these established regions continue to anchor the market with high per-capita spending and early adoption of advanced draining formulations.

| Year | USA Draining Agents Market (USD Million) |

|---|---|

| 2025 | 211.64 |

| 2026 | 226.09 |

| 2027 | 241.52 |

| 2028 | 258.01 |

| 2029 | 275.63 |

| 2030 | 294.44 |

| 2031 | 314.55 |

| 2032 | 336.02 |

| 2033 | 358.96 |

| 2034 | 383.47 |

| 2035 | 409.65 |

The global Draining Agents Market in the United States is projected to grow at a CAGR of 5.9%, supported by rising demand for premium anti-cellulite complexes and botanical-based cosmeceuticals. Growth is concentrated in body contouring creams, leg relief serums, and spa products, where consumers seek clinically validated results. The professional spa channel continues to expand, with drainage-based massages and treatments gaining traction among wellness-conscious consumers. Local brands are investing heavily in marketing anti-edema and circulation-enhancing formulations, particularly those supported by clean-label botanical claims. Innovation in encapsulated delivery systems is also finding early adoption in the USA market, appealing to high-income consumers looking for superior efficacy.

The global Draining Agents Market in the United Kingdom is forecast to expand at a CAGR of 9.2% through 2035, led by innovation in professional spa products and body care formulations. The UK’s strong wellness industry has been quick to incorporate drainage actives into holistic spa offerings, while cosmeceutical brands emphasize anti-cellulite complexes for visible results. Botanical extracts are especially popular due to consumer affinity for natural skincare, supported by clean beauty certifications. Institutions are also playing a role, with dermatology clinics increasingly recommending professional-grade body contouring formulations. This convergence of wellness and clinical credibility is ensuring strong market traction.

India is witnessing rapid growth in the global Draining Agents Market, with the segment expected to expand at the highest CAGR of 15.9% through 2035. The expansion is fueled by urban middle-class consumers adopting body care and anti-cellulite solutions at a faster pace, alongside rising spa and salon culture in metro and tier-2 cities. Local brands are introducing affordable draining actives in gels and serums, expanding accessibility beyond premium urban markets. International players are targeting India as a growth hub by launching botanical-based formulations aligned with ayurvedic and natural beauty traditions. Educational initiatives in dermatology and professional beauty academies are also creating awareness about scientifically backed drainage solutions.

The global Draining Agents Market in China is projected to grow at a CAGR of 14.1%, among the fastest worldwide. Growth is driven by the integration of botanical extracts into cosmeceuticals, which aligns with consumer trust in traditional Chinese medicine-inspired actives. Premium spa and beauty clinics are increasingly offering lymphatic drainage-focused treatments, while cosmeceutical brands are emphasizing body contouring solutions. Affordable botanical-based creams and serums from local manufacturers are broadening reach, supported by competitive domestic pricing. Municipal wellness programs and online beauty platforms are boosting consumer education on drainage solutions, contributing to sustained double-digit expansion.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.2% |

| China | 9.8% |

| Japan | 5.7% |

| Germany | 12.6% |

| UK | 6.6% |

| India | 4.0% |

| Europe | 18.1% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.0% |

| China | 10.6% |

| Japan | 6.9% |

| Germany | 11.0% |

| UK | 6.0% |

| India | 4.9% |

| Europe | 16.5% |

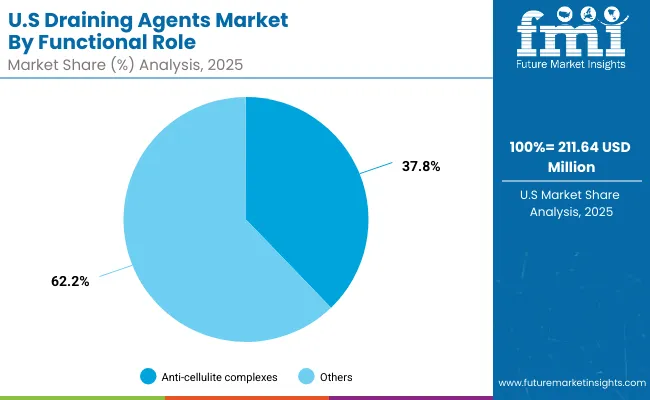

| USA By Functional Role | Value Share % 2025 |

|---|---|

| Anti-cellulite complexes | 37.8% |

| Others | 62.2% |

The global Draining Agents Market in the United States is projected at USD 211.64 million in 2025. Anti-cellulite complexes account for 37.8% of the market, reflecting strong consumer interest in high-performance body contouring formulations. This dominance is reinforced by growing awareness of visible results, particularly in anti-cellulite creams and professional spa treatments. The preference for clinically validated products is evident, as USA consumers prioritize proven outcomes and premium formulations backed by dermatological expertise.

A strong culture of wellness and professional spa services is also accelerating demand for draining agents, where treatments targeting circulation, edema reduction, and lymphatic drainage are integrated into holistic beauty regimens. The growing adoption of encapsulated actives within the premium cosmeceutical space highlights a shift toward advanced delivery systems, as consumers increasingly expect superior efficacy and long-lasting benefits.

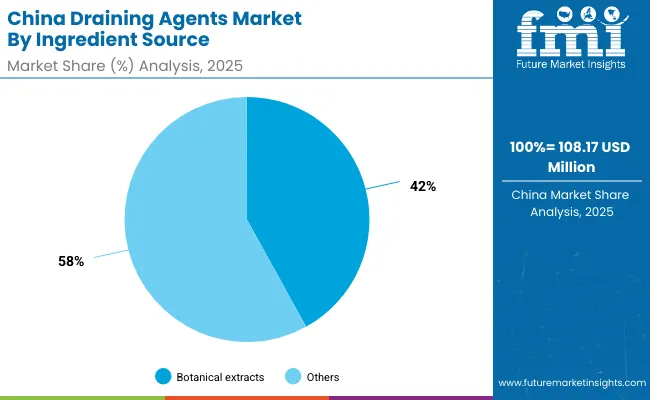

| China By Ingredient Source | Value Share % 2025 |

|---|---|

| Botanical extracts | 42% |

| Others | 58.0% |

The global Draining Agents Market in China is projected at USD 108.17 million in 2025, expanding at a CAGR of 14.1% through 2035. Botanical extracts dominate with a 42.0% share, reflecting the country’s strong affinity for natural actives inspired by traditional medicine. Cosmeceutical brands are increasingly leveraging botanicals with microcirculation and anti-cellulite benefits to capture consumer trust, while spa and wellness clinics are integrating these actives into lymphatic drainage therapies.

China’s competitive advantage lies in its local manufacturing ecosystem, where domestic brands offer affordable yet effective products that broaden accessibility. Rapid expansion of online beauty platforms is amplifying awareness of draining actives, making digital retail an important driver of adoption. Premium consumers, however, are gravitating toward formulations that integrate bio-fermentation actives with botanicals, combining heritage-based trust with modern efficacy.

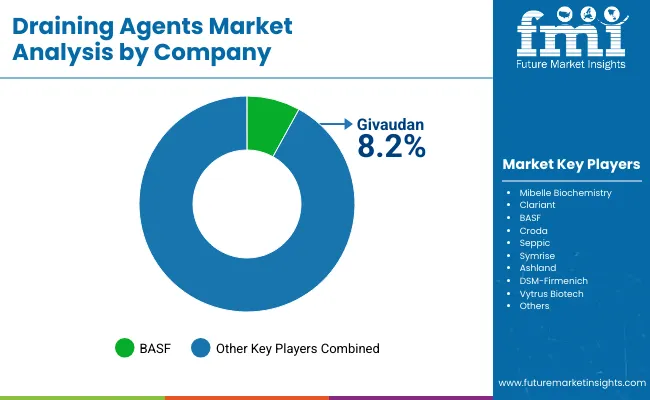

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.2% |

| Others | 91.8% |

The global Draining Agents Market is moderately fragmented, with global ingredient leaders, biotech innovators, and niche botanical specialists competing for market share. Givaudan leads with 8.2% global share in 2025, supported by its strong portfolio of botanical actives and fermentation-derived complexes tailored to anti-cellulite and circulation-enhancing applications. The company’s emphasis on sustainability, efficacy validation, and advanced delivery forms sets the benchmark for competitors.

Established players such as BASF, Croda, Clariant, DSM-Firmenich, and Symrise focus on expanding versatile ingredient portfolios, addressing demand for both mass-market body care formulations and premium cosmeceuticals. Their strategies emphasize multifunctional actives that combine drainage benefits with soothing or hydrating properties, allowing broader application. Meanwhile, mid-sized innovators like Mibelle Biochemistry, Seppic, Ashland, and Vytrus Biotech are building competitive differentiation through biotechnology platforms, encapsulation technologies, and customized solutions for professional spa and wellness markets.

The competitive landscape is shifting from reliance on raw botanical sourcing toward integrated ecosystems that combine clinically validated actives, innovative delivery systems, and sustainability-driven sourcing. The leaders are increasingly positioning themselves not just as ingredient suppliers but as partners offering full formulation support, enabling beauty and wellness brands to accelerate market entry with proven draining solutions.

Key Developments in Global Draining Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Functional Role | Microcirculation stimulants, Edema -reducing actives, Lymphatic drainage boosters, Anti-cellulite complexes |

| Ingredient Source | Botanical extracts, Bio-fermentation actives, Synthetic complexes, Mineral-derived actives |

| Delivery System | Free form, Encapsulated actives, Microemulsion dispersions |

| Physical Form | Liquid concentrate, Powdered extract, Gel-based dispersion |

| Application | Anti-cellulite creams & gels, Leg relief serums, Body contouring products, Spa & professional treatments |

| End Use | Cosmeceuticals, Professional spa products, Body care formulations |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Givaudan , Mibelle Biochemistry, Clariant , BASF, Croda , Seppic , Symrise , Ashland, DSM- Firmenich , Vytrus Biotech |

| Additional Attributes | Dollar sales by functional role, ingredient source, delivery system, physical form, application, and end use; adoption trends in anti-cellulite and lymphatic-drainage formulations; rising demand for botanical extracts and encapsulated actives; growth in spa & professional treatments and cosmeceuticals; revenue split by regions and key countries; innovation in microemulsions and controlled-release delivery; sustainability and clean-label positioning; country-level CAGRs and share shifts (e.g., India/China outpacing mature markets). |

The Global Draining Agents Market is estimated to be valued at USD 1,104.7 million in 2025.

The market size is projected to reach USD 2,405.6 million by 2035.

The Global Draining Agents Market is expected to grow at a CAGR of 8.1% between 2025 and 2035.

Key product types/applications include anti-cellulite creams & gels, leg relief serums, body contouring products, and spa & professional treatments.

By functional role, anti-cellulite complexes lead with 37.8% share in 2025 (USD 417.58 million). By ingredient source, botanical extracts account for 41.9% in 2025 (USD 462.87 million).

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Draining Cellulite Treatments Market Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA