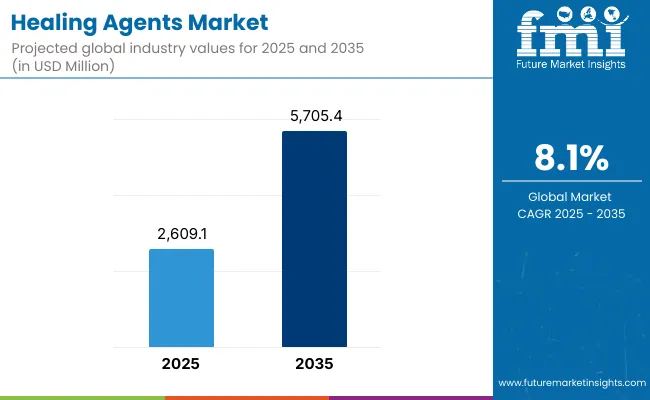

The Healing Agents Market (Skin Repair & Soothing Actives) is projected to attain USD 2,609.1 Million in 2025, expanding to USD 5,705.4 Million by 2035. This shift represents an increase of USD 3,096.3 Million over the decade, marking a near doubling of market value.

Healing Agents Market (Skin Repair & Soothing Actives) Market Key Takeaways

| Metric | Value |

|---|---|

| Healing Agents Market (Skin Repair & Soothing Actives) Market Estimated Value in (2025E) | USD 2,609.1 Million |

| Healing Agents Market (Skin Repair & Soothing Actives) Market Forecast Value in (2035F) | USD 5,705.4 Million |

| Forecast CAGR (2025 to 2035) | 8.10% |

A compound annual growth rate of 8.1% is expected, supported by the growing demand for active ingredients that address post-procedure recovery, sensitive-skin management, and irritation prevention. Momentum will be carried by clinical-grade dermocosmetic adoption in both premium skincare and OTC categories, where evidence-backed claims are being prioritized.

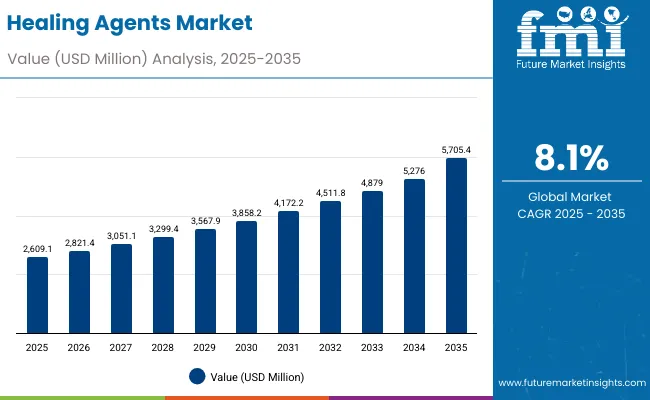

During the first half of the assessment period (2025-2030), the market is forecast to advance from USD 2,609.1 Million to USD 3,858.2 Million, contributing nearly USD 1,249.1 Million in additional value, which accounts for roughly 40% of the projected decade-long growth. This stage is anticipated to reflect stable adoption across developed regions, with biotechnology-derived actives gaining stronger procurement preference due to their consistency and controlled origin. Encapsulated delivery formats are expected to consolidate relevance in this period, as irritation-mitigation and enhanced bioavailability remain focal points for R&D.

The second phase (2030 to 2035) is set to accelerate more sharply, with the market rising from USD 3,858.2 Million to USD 5,705.4 Million. This increase of USD 1,847.2 Million will represent about 60% of the total expansion, highlighting a stronger late-cycle upswing. Expanding penetration of premium formulations in Asia, coupled with regulatory-driven innovation, is projected to reshape supplier competitiveness. By 2035, encapsulated systems and biotech-origin actives are anticipated to capture greater shares, underpinning long-term structural growth.

From 2025 to 2030, steady progress is expected as the market rises from USD 2,609.1 Million to USD 3,858.2 Million, supported by consistent demand for barrier repair and soothing applications. In this phase, encapsulated delivery systems and biotech-origin actives are anticipated to drive adoption across dermocosmetic and OTC formulations. Between 2030 and 2035, sharper growth is forecast, with the market adding USD 1,847.2 Million to reach USD 5,705.4 Million, as premium skincare and sensitive-skin categories expand rapidly in Asia and Europe. Competitive advantage is projected to shift toward suppliers offering encapsulated, irritation-free solutions with strong clinical validation. Regulatory alignment and sustainability credentials are expected to play a central role in shaping partnerships and procurement decisions. By the end of the decade, the market landscape will be characterized by greater reliance on biotech-derived inputs, wider use of encapsulated delivery, and intensified competition among multinational ingredient suppliers positioning for scale and innovation leadership.

Growth in the Healing Agents Market (Skin Repair & Soothing Actives) is being propelled by rising consumer demand for clinically validated soothing and recovery ingredients. The prevalence of sensitive skin conditions, post-procedure care, and irritation linked to active cosmetic routines has elevated the need for advanced formulations. Biotechnology-derived actives are being prioritized for their consistent quality, traceable origin, and regulatory compliance, while encapsulated delivery systems are being favored for their ability to enhance efficacy and minimize irritation. Expanding dermocosmetic and OTC personal care adoption has been reinforced by premium skincare demand in fast-growing regions such as China and India, where clinical-style positioning resonates strongly with consumers. Regulatory tightening around irritation and allergenicity is also expected to push formulators toward ingredients with robust safety and performance data. As formulations become more sophisticated, suppliers offering barrier-restoring systems, postbiotic actives, and advanced carrier technologies are anticipated to drive the next wave of sustained growth.

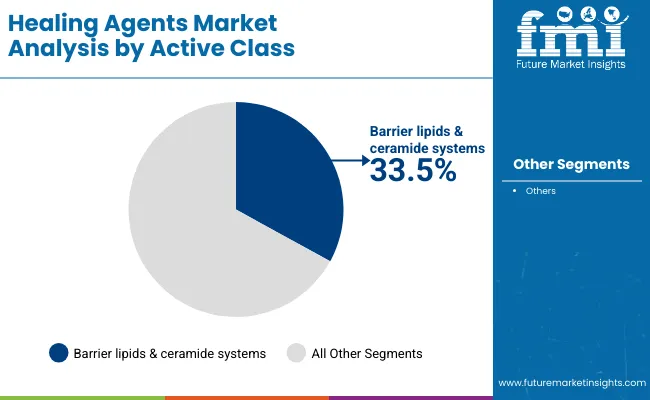

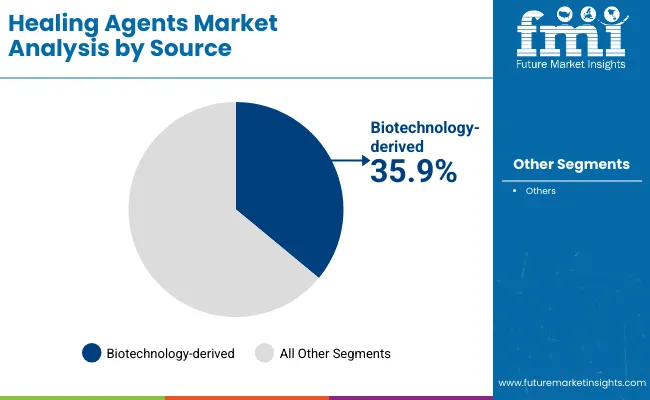

The Healing Agents Market (Skin Repair & Soothing Actives) has been structured across three core segments: Active Class, Source, and Delivery System. Each of these dimensions reflects critical decision points for ingredient procurement and product formulation, as buyers prioritize efficacy, safety, and performance. The Active Class defines the type of functional complex deployed, highlighting the role of barrier-repair systems and alternative soothing blends. Source segmentation underlines the growing divide between biotechnology-derived and other origins, a key factor shaping perceptions of sustainability, traceability, and regulatory acceptance. Delivery System segmentation reflects the methods through which these actives are provided to formulators, with encapsulated formats gaining traction for their enhanced stability and irritation control. Together, these segments form the foundation of growth patterns and competitive differentiation in this market.

| Active Class | Market Value Share, 2025 |

|---|---|

| Barrier lipids & ceramide systems | 33.5% |

| Others | 66.5% |

Barrier lipids & ceramide systems dominate the Active Class segment with a 33.5% share in 2025, valued at USD 874.05 Million. This leadership is attributed to their proven efficacy in strengthening skin structure, restoring barrier function, and reducing moisture loss. Their adoption is expected to rise in dermocosmetic and recovery formulations, particularly as demand intensifies for clinically validated soothing actives. Sensitive-skin care and post-procedure treatments are forecasted to fuel procurement, as consumers increasingly prefer products with a science-backed approach to repair and protection. With sustainability and efficacy shaping market direction, barrier lipids & ceramide systems are projected to remain the core foundation for advanced formulations, reinforcing their importance as the leading sub-segment within Active Class.

| Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 35.9% |

| Others | 64.1% |

Biotechnology-derived actives lead the Source segment with a 35.9% share in 2025, equating to USD 936.67 Million. Their dominance is supported by growing demand for reproducible, clean, and traceable ingredients in formulations that emphasize safety and sustainability. Formulators are increasingly prioritizing biotechnology for its controlled production methods, lower batch variability, and alignment with environmental goals. Rising regulatory scrutiny and consumer preference for transparent sourcing are reinforcing the importance of this category. By integrating biotechnological innovation, suppliers are enhancing performance while addressing cost-efficiency and compliance. Over the next decade, biotechnology-derived actives are forecasted to gain further traction, positioning this segment as the most strategically significant source in the Healing Agents Market.

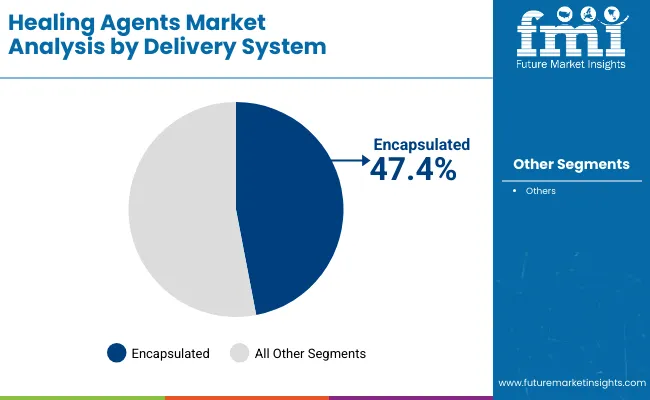

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 47.4% |

| Others | 52.6% |

Encapsulated delivery systems hold leadership with 47.4% share in 2025, valued at USD 1,236.71 Million. This dominance is attributed to their ability to improve stability, enhance bioavailability, and reduce irritation risk, making them highly suited for sensitive-skin and recovery-focused products. Demand is being reinforced by the expansion of dermocosmetic and premium skincare ranges that prioritize clinical performance. Encapsulation technologies enable controlled release and longer on-skin activity, which formulators are increasingly leveraging to differentiate products in crowded markets. With innovation accelerating in polymer science and biopolymer matrices, encapsulated delivery is projected to capture a larger share through 2035. This makes encapsulation the most strategically important system for future-proofing product pipelines.

Growing sophistication in formulation science has been accompanied by stricter regulatory frameworks, shaping both opportunities and challenges for the Healing Agents Market, where innovation in actives and delivery technologies is expected to define the next growth phase.

Integration of Biotechnology with Clinical Validation

Growth in this market is being reinforced by the fusion of biotechnological innovation with rigorous clinical substantiation. Advanced fermentation and bioengineering techniques are being employed to create actives with greater molecular precision, improving reproducibility and reducing batch-to-batch variability. Clinical trials are increasingly being positioned at the center of product launch strategies, with dermatological endpoints such as transepidermal water loss reduction and barrier recovery speed being used to build trust among formulators and regulators. This integration of lab-scale precision with patient-grade validation is anticipated to reshape competitive advantage, as ingredient suppliers that demonstrate both efficacy and scalability are expected to secure stronger procurement preference across premium and mass-market skincare portfolios.

Encapsulation as a Differentiation Strategy in Premium Skincare

Encapsulation technologies are being transitioned from functional carriers into strategic differentiators, as they allow sensitive actives to be delivered with precision while mitigating irritation risks. This is no longer viewed solely as a stability tool but as a platform for targeted release and enhanced claimability in dermocosmetic and OTC categories. Suppliers are exploring biodegradable polymers, hydrogel matrices, and nanostructured lipid carriers to align with both sustainability goals and advanced performance requirements. As encapsulated actives become central to clinical positioning, formulators are expected to leverage them for premiumization and claim reinforcement, making encapsulation a visible trend that redefines both R&D direction and procurement decisions in the Healing Agents Market.

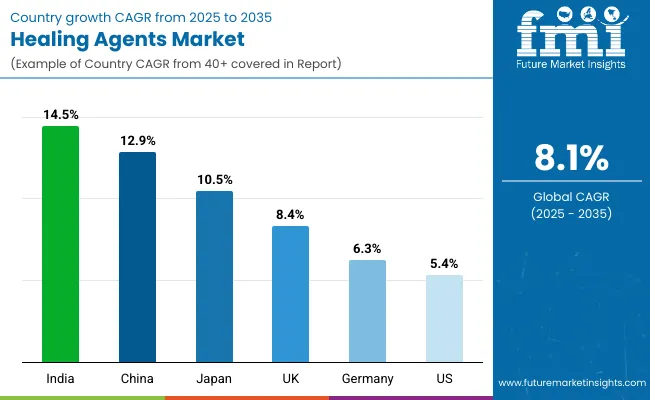

| Country | CAGR |

|---|---|

| China | 12.9% |

| USA | 5.4% |

| India | 14.5% |

| UK | 8.4% |

| Germany | 6.3% |

| Japan | 10.5% |

The Healing Agents Market (Skin Repair & Soothing Actives) is projected to display varied growth dynamics across leading geographies, reflecting differences in consumer behavior, regulatory environments, and formulation strategies. India emerges as the fastest-growing country with a 14.5% CAGR, supported by rapid urbanization, dermatological awareness, and expanding middle-class consumption of dermocosmetic and OTC products. China follows closely at 12.9%, where investments in premium skincare and sensitive-skin portfolios are being reinforced by clinical-style positioning and government focus on local biotech production capabilities. Japan, with a 10.5% CAGR, benefits from its established dermocosmetic tradition and high consumer willingness to pay for encapsulated and biotechnology-derived actives.

In Europe, the UK (8.4%) and Germany (6.3%) are advancing steadily, supported by strong R&D ecosystems and regulatory standards that prioritize irritation-free, safe formulations. Europe overall reflects a 7.8% CAGR, balancing premium innovation with sustainability-driven ingredient sourcing. The USA shows a moderate CAGR of 5.4%, reflective of its mature skincare industry, yet premiumization in sensitive-skin and recovery segments continues to sustain growth. Collectively, Asia-Pacific markets are expected to remain at the forefront of adoption, while Europe will strengthen its position through compliance-driven innovation, and the USA will maintain stable, premium-focused demand.

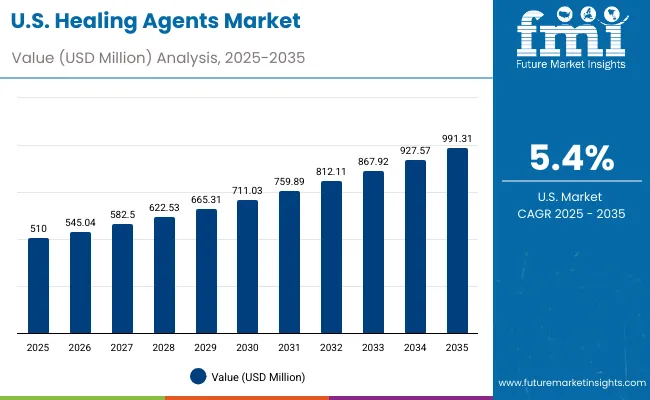

| Year | USA Healing Agents Market (Skin Repair & Soothing Actives) (USD Million) |

|---|---|

| 2025 | 510.00 |

| 2026 | 545.04 |

| 2027 | 582.50 |

| 2028 | 622.53 |

| 2029 | 665.31 |

| 2030 | 711.03 |

| 2031 | 759.89 |

| 2032 | 812.11 |

| 2033 | 867.92 |

| 2034 | 927.57 |

| 2035 | 991.31 |

The Healing Agents Market in the United States is projected to grow at a CAGR of 5.4% between 2025 and 2035, supported by the rising adoption of clinically validated ingredients in dermocosmetic and OTC personal care. Post-procedure recovery and sensitive-skin applications are expected to remain strong demand drivers, reflecting the country’s high consumer focus on irritation-free and dermatologically tested formulations. Premium skincare brands are anticipated to lead procurement, integrating encapsulated and biotechnology-derived actives into their product portfolios. In parallel, baby care and after-sun soothing categories are also expected to expand, supported by trust-driven purchasing behavior. Regulatory alignment with stricter safety and allergenicity standards is projected to further accelerate adoption of advanced formulations.

The Healing Agents Market in the United Kingdom is projected to expand at a CAGR of 8.4% through 2035, supported by the growing consumer preference for clinically backed soothing formulations. Demand will be reinforced by rising skin sensitivity issues linked to pollution, lifestyle, and active-ingredient-heavy regimens. The UK market is expected to benefit from dermocosmetic adoption across both retail and professional channels, where dermatologist endorsements carry strong weight in shaping consumer choices. Premium skincare brands are anticipated to accelerate integration of barrier lipids and encapsulated delivery systems, enabling faster recovery claims. Regulatory frameworks on ingredient safety and transparency are projected to favor biotechnology-derived solutions, strengthening the market’s reliance on clean, traceable actives.

The Healing Agents Market in India is forecasted to grow at a CAGR of 14.5%, the fastest among major countries, driven by expanding access to skincare and rising awareness of sensitive-skin solutions. Growth is being enabled by increasing dermatology consultations, rising middle-class spending power, and demand for advanced OTC personal care products. Multinational and domestic players are actively positioning biotechnology-derived and encapsulated actives in baby care, recovery formulations, and premium skincare, aligning with evolving consumer expectations. With regulatory tightening and consumer preference shifting toward safe, clinically validated actives, India is anticipated to become a critical procurement hub for advanced soothing solutions.

The Healing Agents Market in China is expected to grow at a CAGR of 12.9% through 2035, supported by rapid premiumization in skincare and expansion of dermocosmetic portfolios. Demand is being propelled by a shift toward clinical-style positioning, where evidence-based recovery and sensitive-skin solutions dominate consumer preferences. Biotechnology-derived actives are projected to gain prominence due to government emphasis on local innovation and sustainability, while encapsulation technologies are being widely adopted to strengthen efficacy claims. Regulatory reforms favoring product safety and labeling transparency are expected to further support advanced formulation adoption. China’s strong e-commerce penetration and fast-moving brand launches are anticipated to accelerate procurement across both premium and mass-market channels.

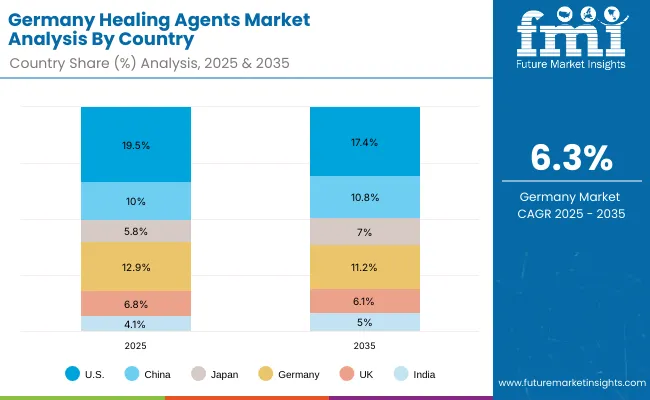

| Country | 2025 |

|---|---|

| USA | 19.5% |

| China | 10.0% |

| Japan | 5.8% |

| Germany | 12.9% |

| UK | 6.8% |

| India | 4.1% |

| USA | 19.5% |

| Country | 2035 |

|---|---|

| USA | 17.4% |

| China | 10.8% |

| Japan | 7.0% |

| Germany | 11.2% |

| UK | 6.1% |

| India | 5.0% |

| USA | 17.4% |

The Healing Agents Market in Germany is forecasted to grow at a CAGR of 6.3%, reflecting steady demand driven by strict regulatory oversight and consumer preference for dermatologist-approved formulations. Growth will be supported by strong dermocosmetic traditions and premium skincare expansion. Germany’s regulatory environment prioritizes irritation-free formulations, which is expected to sustain demand for biotechnology-derived and encapsulated delivery systems. Partnerships between local laboratories and multinational ingredient suppliers are likely to expand, as compliance, sustainability, and safety validation remain critical to procurement decisions. With high consumer trust in clinically tested products, the market is expected to maintain resilience and steady growth momentum.

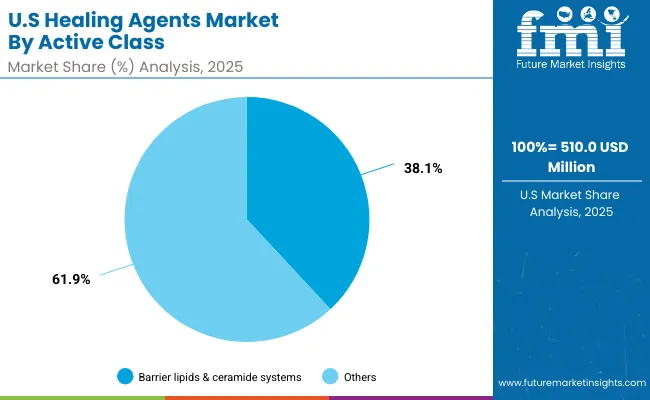

| USA By Active Class | Market Value Share, 2025 |

|---|---|

| Barrier lipids & ceramide systems | 38.1% |

| Others | 61.9% |

The Healing Agents Market in the United States is projected at USD 510.0 Million in 2025. Barrier lipids & ceramide systems contribute 38.1% (USD 194.31 Million), while other active complexes hold 61.9% (USD 315.69 Million), underscoring a preference for multifunctional soothing blends. The strong position of the “Others” category reflects wider adoption of diverse actives including wound-repair peptides, antioxidants, and postbiotic solutions, which address irritation and barrier recovery simultaneously. Yet, barrier lipids and ceramide systems are expected to consolidate their role in premium dermocosmetic formulations, where clinical validation and dermatologist endorsement remain crucial. This sub-segment is projected to benefit from increased focus on sensitive-skin and post-procedure care, reinforcing its long-term relevance despite broader category competition.

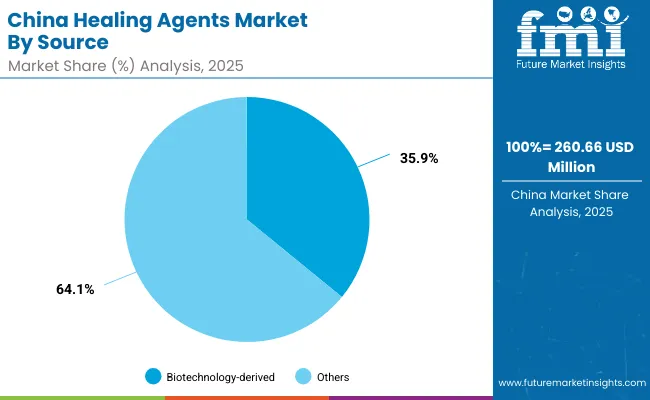

| China By Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 35.9% |

| Others | 64.1% |

The Healing Agents Market in China is projected at USD 260.66 Million in 2025. Biotechnology-derived actives contribute 35.9% (USD 93.58 Million), while other origins such as botanical, marine, and synthetic collectively account for 64.1% (USD 167.09 Million). The strength of the “Others” segment reflects strong consumer familiarity with plant-based and naturally derived solutions, which remain central in mass-market and mid-tier skincare formulations. However, biotechnology-derived actives are expected to gain prominence due to regulatory emphasis on sustainable production, traceability, and higher performance consistency. This sub-segment is projected to expand steadily as Chinese formulators and multinational brands invest in biotech partnerships, aiming to enhance innovation pipelines and reduce reliance on imported raw materials. Over the next decade, biotechnology-derived solutions are anticipated to carve out a stronger position, particularly in premium skincare and dermocosmetic categories.

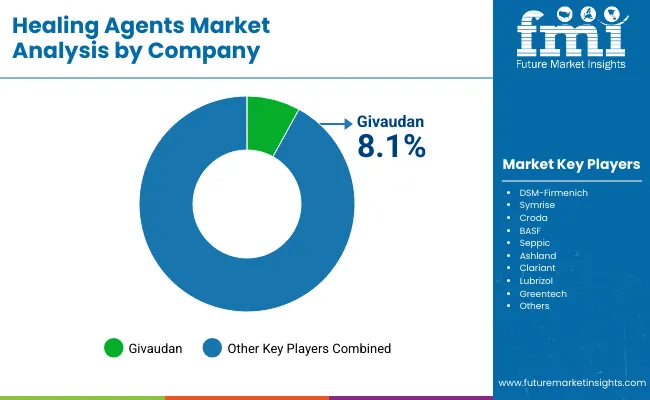

| Company | Global Value Share 2025 |

|---|---|

| Givaudan | 8.1% |

| Others | 91.9% |

The Healing Agents Market (Skin Repair & Soothing Actives) is moderately fragmented, characterized by a mix of multinational leaders, regional specialists, and niche innovators supplying to dermocosmetic, OTC, and premium skincare categories. At the global level, Givaudan emerges as the most dominant player, holding 8.1% share in 2025, while all other competitors together account for 91.9%. Givaudan’s advantage is reinforced by its diversified portfolio of biotech-derived actives, encapsulation technologies, and strong regulatory expertise, enabling deep integration into premium and clinical-grade skincare pipelines.

Mid-sized ingredient houses such as DSM-Firmenich, Symrise, Croda, BASF, Seppic, Ashland, Clariant, Lubrizol, and Greentech remain highly competitive, contributing to fragmented value capture by offering specialized soothing actives, barrier lipids, and microbiome-friendly complexes. These companies are focusing on dermatology-driven validation and sustainable sourcing to strengthen partnerships with both multinational and regional skincare brands.

Niche players are competing through botanical and marine-derived actives, emphasizing clean-label positioning and regional adaptation. Their strategies often revolve around customization, cost-effectiveness, and alignment with cultural preferences for natural-origin solutions.

Competitive differentiation is shifting away from commodity active supply toward evidence-based innovation, clinical substantiation, and delivery technologies such as encapsulation. Over the coming decade, leadership is expected to be defined by suppliers that balance sustainability, regulatory alignment, and claimable efficacy.

Key Developments in Healing Agents Market (Skin Repair & Soothing Actives) Market

| Item | Value |

|---|---|

| Quantitative | USD 2,609.1 Million (2025); USD 5,705.4 Million (2035); CAGR 8.1% (2025 to 2035) |

| Component (Segments) | Active Class: Barrier lipids & ceramide systems; Others. Source: Biotechnology-derived; Others. Delivery System: Encapsulated; Others. |

| Applications | Post-procedure & recovery care; Sensitive/eczema-prone care; After-sun & soothing; Baby care. |

| End Use | Dermocosmetic; OTC personal care; Premium skincare. |

| Dominant 2025 Shares | Barrier lipids & ceramide systems: 33.5% (USD 874.05 Million); Biotechnology-derived: 35.9% (USD 936.67 Million); Encapsulated: 47.4% (USD 1,236.71 Million). |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa. |

| Countries Covered | United States; China; India; Japan; United Kingdom; Germany; (others within listed regions as applicable). |

| Key Companies Profiled | DSM-Firmenich; Givaudan; Symrise; Croda; BASF; Seppic; Ashland; Clariant; Lubrizol; Greentech. |

| Market Structure | Moderately fragmented; top player Givaudan 8.1% (2025); long tail of regional and niche suppliers. |

| Procurement Priorities | Clinically validated soothing/repair outcomes; traceable biotechnology-derived inputs; encapsulation for stability, targeted release, and irritation control. |

| Regulatory & Quality | Preference for low-residual manufacturing, allergenicity control, and transparent origin; documentation for TEWL, redness, and recovery endpoints. |

| Growth Catalysts | Premiumization of sensitive-skin and recovery ranges; expansion of dermocosmetic channels; Asia-centric volume growth; USA/EU compliance raising formulation standards. |

| Risks/Constraints | Tightening claims regulation; supply security for specialty carriers; cost premiums for advanced delivery systems. |

| Additional Attributes | Country CAGRs: India 14.5%, China 12.9%, Japan 10.5%, UK 8.4%, Europe 7.8%, Germany 6.3%, USA 5.4%; USA market path USD 510.00 Million (2025) → USD 991.31 Million (2035); emphasis on sustainability, reproducibility, and ESG-aligned sourcing. |

The global Healing Agents Market (Skin Repair & Soothing Actives) is estimated to be valued at USD 2,609.1 Mn in 2025.

The market size for the Healing Agents Market (Skin Repair & Soothing Actives) is projected to reach USD 5,705.4 Mn by 2035.

The Healing Agents Market (Skin Repair & Soothing Actives) is expected to grow at a CAGR of 8.1% between 2025 and 2035.

The key product types in the Healing Agents Market (Skin Repair & Soothing Actives) include barrier lipids & ceramide systems, biotechnology-derived actives, and encapsulated delivery systems.

In 2025, encapsulated delivery systems are expected to contribute a significant share with 47.4% (USD 1,236.71 Mn), reflecting their importance in irritation-free and high-performance formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-healing Network Market Size and Share Forecast Outlook 2025 to 2035

Self-Healing Concrete Market Size and Share Forecast Outlook 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Analysis and Growth Projections for Wound Healing Nutrition Market

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Cica-Infused Healing Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Osteoporosis Fracture Healing Market Trends – Size & Forecast 2025-2035

Examining Market Share Trends in Anti-Osteoporosis Fracture Healing

UK Anti-Osteoporosis Fracture Healing Market Report – Size, Demand & Industry Outlook 2025-2035

China Anti-Osteoporosis Fracture Healing Market Insights – Size, Growth & Trends 2025-2035

Japan Anti-Osteoporosis Fracture Healing Market Growth – Demand, Trends & Forecast 2025-2035

Germany Anti-Osteoporosis Fracture Healing Market Report – Demand, Trends & Industry Forecast 2025-2035

United States Anti-Osteoporosis Fracture Healing Market Trends – Growth, Innovations & Forecast 2025-2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA