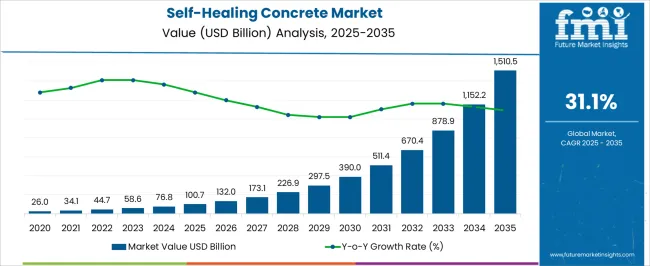

The self-healing concrete market is projected to grow from USD 100.7 billion in 2025 to USD 1,510.5 billion in 2035, reflecting a CAGR of 31.1%. This represents an extraordinary absolute dollar opportunity of USD 1,409.8 billion over the decade. The market is expected to expand rapidly, with values reaching USD 132.0 billion in 2026, USD 226.9 billion in 2029, USD 390.0 billion in 2031, and USD 1,152.2 billion in 2034.

The accelerated growth trajectory highlights the enormous revenue potential, providing manufacturers, investors, and stakeholders a significant opportunity to capitalize on a market poised for exponential expansion over ten years. From an absolute dollar perspective, annual incremental growth accelerates sharply, starting at USD 31.3 billion in 2026 and reaching more than USD 358.3 billion by 2035. Intermediate values, such as USD 297.5 billion in 2030 and USD 670.4 billion in 2033, indicate the market experiences multiple phases of rapid adoption and revenue accumulation. This fast-paced growth offers stakeholders a clear roadmap for scaling production, deploying resources strategically, and maximizing returns.

| Metric | Value |

|---|---|

| Self-Healing Concrete Market Estimated Value in (2025 E) | USD 100.7 billion |

| Self-Healing Concrete Market Forecast Value in (2035 F) | USD 1510.5 billion |

| Forecast CAGR (2025 to 2035) | 31.1% |

Continuing with the self-healing concrete market, a breakpoint analysis highlights periods of rapid acceleration in growth. Between 2025 and 2027, the market grows from USD 100.7 billion to USD 132.0 billion, marking the early adoption phase where initial deployments set the foundation. Another key breakpoint occurs around 2029–2031, as the market rises from USD 226.9 billion to USD 390.0 billion, representing a phase of accelerated growth and higher incremental revenue. These stages are critical for manufacturers and investors to scale production, optimize supply chains, and capture market share during periods of rapid adoption and demand expansion.

The final major breakpoint is observed between 2033 and 2035, when the market surges from USD 1,152.2 billion to USD 1,510.5 billion, representing the largest absolute dollar growth within a two-year period. Intermediate years, such as 2030–2032, show steady expansion from USD 297.5 billion to USD 670.4 billion, serving as bridging periods to sustain market momentum.

The self-healing concrete market is expanding rapidly, driven by the need for longer-lasting construction materials that reduce maintenance costs and improve structural integrity. Advances in material science and civil engineering have enabled the integration of healing agents such as bacteria, polymers, and mineral compounds into concrete formulations, allowing cracks to repair autonomously when exposed to water or air.

Infrastructure modernization projects, along with increasing global investment in sustainable construction, have accelerated the adoption of self-healing solutions. Government initiatives promoting eco-friendly building materials and lifecycle cost savings have further enhanced market acceptance.

The technology’s ability to extend the operational life of structures, reduce repair frequency, and improve safety performance has been a key factor in its growing use across both public and private sectors. Looking ahead, expansion will be supported by scaling production capabilities, optimizing cost efficiency, and integrating self-healing concrete in high-priority sectors such as infrastructure, transportation, and energy facilities.

The self-healing concrete market is segmented by concrete type, form, application, distribution channel, and geographic regions. By concrete type, self-healing concrete market is divided into Biotic concrete and Abiotic concrete. In terms of form, the self-healing concrete market is classified into Intrinsic, capsule-based, and Vascular. Based on application, the self-healing concrete market is segmented into Infrastructure, Residential construction, Commercial construction, and Industrial construction.

By distribution channel, self-healing concrete market is segmented into Offline and Online. Regionally, the self-healing concrete industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

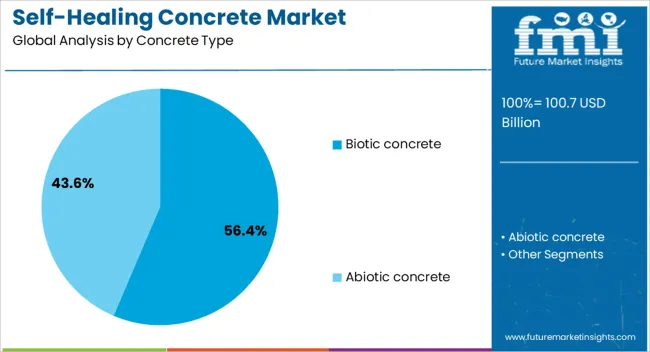

The biotic concrete segment is projected to hold 56.4% of the self-healing concrete market revenue in 2025, maintaining its leading position due to its proven efficiency in repairing microcracks through microbial activity. This type incorporates specific bacteria that produce limestone when activated by water ingress, effectively sealing cracks and restoring structural durability.

The segment’s growth has been driven by the high compatibility of biotic concrete with traditional construction methods and its ability to function without extensive modifications to existing building practices. Academic studies and field trials have demonstrated its strong performance in improving structural lifespan while minimizing environmental impact.

Additionally, the non-toxic and sustainable nature of biotic agents has supported adoption in environmentally regulated markets. As demand for sustainable infrastructure rises and awareness of lifecycle cost benefits increases, the biotic concrete segment is expected to sustain its leadership in the self-healing concrete sector.

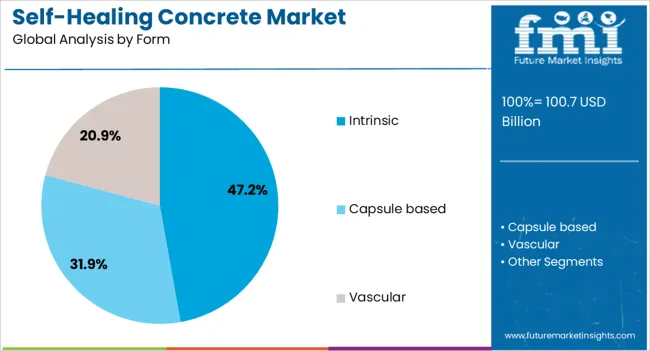

The intrinsic segment is projected to account for 47.2% of the self-healing concrete market revenue in 2025, emerging as the leading form due to its ability to provide self-repair functionality throughout the entire concrete mass. Unlike capsule-based or vascular systems, intrinsic self-healing concrete incorporates healing agents directly into the mix, ensuring consistent crack repair capability over the structure’s lifespan.

Civil engineering research has shown that this form offers enhanced durability in harsh environments, including high-moisture and freeze-thaw conditions. Its long-term performance and minimal maintenance requirements have made it a preferred choice for large-scale, critical infrastructure projects.

Furthermore, the intrinsic approach simplifies the construction process by eliminating the need for additional installation steps associated with embedded systems. Continued advancements in the integration of healing agents and cost reduction strategies are expected to reinforce the dominance of the intrinsic segment in the years ahead.

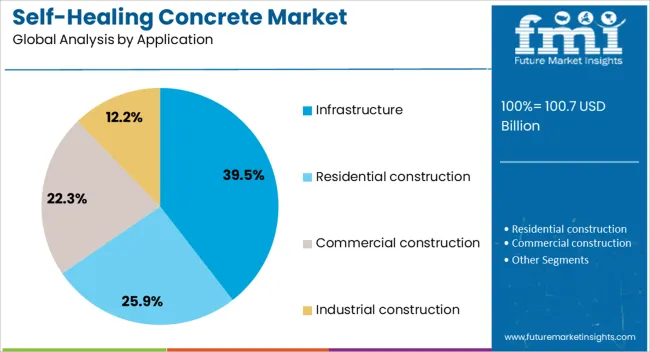

The infrastructure segment is projected to represent 39.5% of the self-healing concrete market revenue in 2025, holding the top position among applications due to the material’s suitability for large-scale, high-value public works. Bridges, tunnels, highways, and dams have been key focus areas where self-healing concrete offers substantial cost savings by reducing maintenance cycles and extending structural life.

Government infrastructure renewal programs and public-private partnerships have increasingly incorporated self-healing concrete in specifications to meet sustainability and resilience goals. Performance data from pilot projects has shown reduced crack propagation and water ingress, enhancing safety and operational efficiency.

The segment’s growth is further supported by its alignment with green building certifications and climate resilience standards, making it an attractive choice for projects seeking long-term environmental and economic benefits. With continued infrastructure investments globally, the adoption of self-healing concrete in this segment is expected to remain strong.

The self-healing concrete market is growing as the construction industry seeks materials that reduce maintenance costs, extend service life, and enhance structural durability. This concrete incorporates bacteria, polymers, or microcapsules that repair cracks autonomously, minimizing water ingress and corrosion.

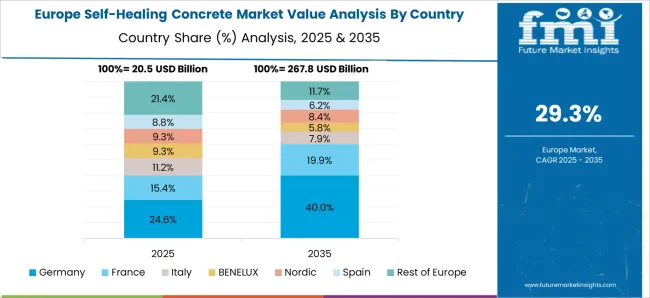

Europe and North America lead adoption due to stringent infrastructure standards and investment in sustainable construction, while Asia Pacific shows strong growth driven by urbanization and large-scale infrastructure projects. Manufacturers focus on mix optimization, crack repair efficiency, and compatibility with conventional construction practices, while production costs, regulatory approvals, and technology adoption rates shape market growth.

Ensuring reliable self-repair is a critical requirement for developers and contractors. Variations in healing agents, curing conditions, or environmental exposure can influence crack closure effectiveness and structural integrity. Laboratory validation, standardized testing, and long-term monitoring are essential to demonstrate material performance. Suppliers providing documented efficacy, reproducible results, and clear application guidelines gain trust among engineers and builders. Inconsistent performance or incomplete crack healing can compromise safety and project budgets, making quality assurance a key differentiator. Companies that achieve uniform repair capabilities are better positioned to secure large-scale infrastructure contracts.

Advancements in material design focus on enhancing crack detection, healing speed, and integration with conventional concrete. Techniques include embedding microcapsules containing healing agents, utilizing bacteria-based bio-concrete, or adding polymeric additives that react with water. Proper selection of mix proportions ensures compatibility with structural strength requirements and workability. Manufacturers that optimize formulations for specific environmental conditions, load-bearing capacities, or project types create competitive advantage. Easy integration with traditional construction workflows allows for broader adoption without specialized training or equipment. Improved formulation methods enhance the practicality and performance of self-healing concrete in real-world projects.

Self-healing concrete is being adopted across a variety of infrastructure projects, including bridges, highways, tunnels, and marine structures. Its ability to reduce maintenance frequency and extend lifespan is particularly valuable in high-traffic or exposed environments. Developers increasingly use this material in urban developments, industrial facilities, and residential complexes to enhance structural safety and reduce lifecycle costs. Adoption is also rising in retrofit projects where cracking is a recurring concern. Suppliers offering adaptable solutions for diverse project scales and exposure conditions can expand market reach and address growing demand for long-lasting construction materials.

Construction standards, material certifications, and environmental regulations influence market growth. Compliance with structural performance codes, safety requirements, and building approvals is essential for project acceptance. Production and supply challenges include sourcing specialized healing agents, ensuring consistent quality, and scaling laboratory formulations to industrial production volumes. Competition exists between established cement and concrete producers and emerging startups offering novel self-healing technologies. Companies that navigate regulatory approvals, maintain reliable supply chains, and provide technical guidance for implementation are better positioned to secure contracts, while inconsistent material availability or regulatory delays can hinder adoption in infrastructure projects.

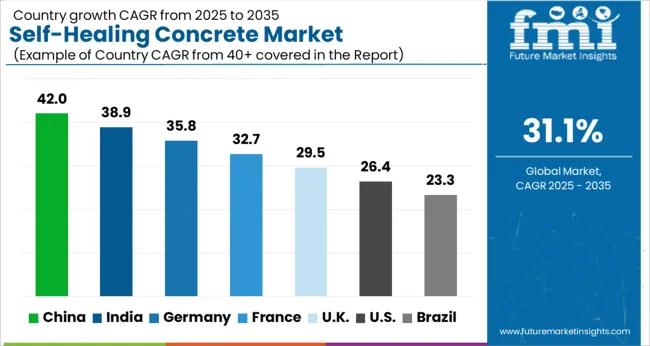

| Country | CAGR |

|---|---|

| China | 42.0% |

| India | 38.9% |

| Germany | 35.8% |

| France | 32.7% |

| UK | 29.5% |

| USA | 26.4% |

| Brazil | 23.3% |

The global self-healing concrete market was projected to grow at a 31.1% CAGR through 2035, driven by adoption in infrastructure, commercial, and residential construction. Among BRICS nations, China recorded 42.0% growth as large-scale production and pilot projects were executed and regional quality standards were enforced, while India, at 38.9% growth, saw expansion of manufacturing facilities and increased use in urban development projects.

In the OECD region, Germany, at 35.8% maintained substantial output under strict construction and material regulations, while the United Kingdom, at 29.5% relied on selective adoption in building and infrastructure projects. The USA, expanding at 26.4%, remained a mature market with steady demand in public works and commercial construction, supported by adherence to federal and state-level building codes and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The self-healing concrete market in China is expanding at a 42.0% CAGR, driven by rapid urbanization, increasing construction of commercial and residential infrastructure, and demand for sustainable and durable building materials. Adoption of self-healing concrete helps reduce maintenance costs, improve structural longevity, and prevent microcracks in high-stress areas. Infrastructure projects, including highways, bridges, and high-rise buildings, are integrating this technology to enhance durability and reduce lifecycle costs. Government initiatives promoting green construction and sustainable materials are encouraging adoption.

Manufacturers are developing innovative solutions using bacteria-based, chemical-based, and encapsulation technologies. Both public and private construction sectors are investing in advanced concrete solutions. Technological innovation, coupled with the need for longer-lasting structures, is expected to drive continued growth. The market is positioned for rapid expansion as awareness of the benefits of self-healing concrete increases among architects, engineers, and developers.

The self-healing concrete market in India is growing at a 38.9% CAGR, supported by large-scale infrastructure development, urbanization, and government programs for sustainable construction. Highways, metro rail projects, and commercial buildings are increasingly using self-healing concrete to prevent cracks, reduce maintenance costs, and extend structural lifespan.

Manufacturers are offering solutions tailored for local climates, including encapsulation and microbial-based technologies. Adoption is accelerating in both public and private construction sectors. Awareness of the environmental and economic benefits of self-healing concrete is increasing among engineers, developers, and contractors. Research and development efforts are improving product performance and scalability. Integration with smart city projects and urban infrastructure initiatives is further boosting market penetration. The market is expected to maintain rapid growth as India continues to invest in resilient and sustainable construction technologies.

The self-healing concrete market in Germany is growing at a 35.8% CAGR, driven by demand for long-lasting infrastructure, energy-efficient building practices, and sustainable construction. Bridges, tunnels, roads, and commercial buildings are integrating self-healing concrete to prevent structural degradation and reduce repair costs. Manufacturers are focusing on chemical-based and biological self-healing solutions that comply with European standards.

Research institutions and universities are collaborating with construction companies to enhance material performance. Adoption is supported by strict building regulations and sustainability guidelines. Technological advancements, including encapsulated healing agents and nano-material integration, are improving product efficiency and durability. Both renovation projects and new constructions contribute to market growth. The German market is expected to continue expanding as government regulations, environmental concerns, and the need for durable infrastructure drive demand.

The self-healing concrete market in the United Kingdom is expanding at a 29.5% CAGR, supported by infrastructure modernization, urban development, and a focus on sustainable construction. Bridges, commercial buildings, and roads are increasingly using self-healing concrete to improve durability, reduce maintenance, and extend lifespan. Manufacturers are developing advanced materials, including bacteria-based and chemical encapsulation solutions. Government initiatives promoting sustainable infrastructure projects and green building practices are supporting adoption. Research and pilot projects in smart cities are increasing awareness of the benefits of self-healing concrete. Both private and public construction projects are contributing to growth. Technological innovations, combined with a growing focus on long-lasting and low-maintenance structures, are expected to drive continued adoption in the UK construction sector.

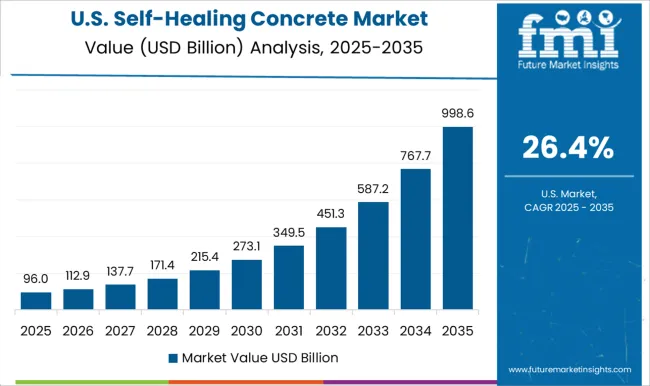

The self-healing concrete market in the United States is growing at a 26.4% CAGR, driven by infrastructure modernization, rising construction investments, and emphasis on sustainable and resilient building materials. Highways, bridges, commercial buildings, and tunnels are using self-healing concrete to prevent cracks, reduce maintenance costs, and increase structural lifespan.

Manufacturers are offering chemical, microbial, and encapsulation-based solutions suitable for different climatic conditions. Research and development initiatives are focused on improving material performance and reducing cost barriers. Government programs promoting durable infrastructure and green building standards are supporting adoption. Both public infrastructure projects and private construction initiatives are driving demand. Increasing awareness of environmental and economic benefits is expected to continue supporting market expansion in the United States.

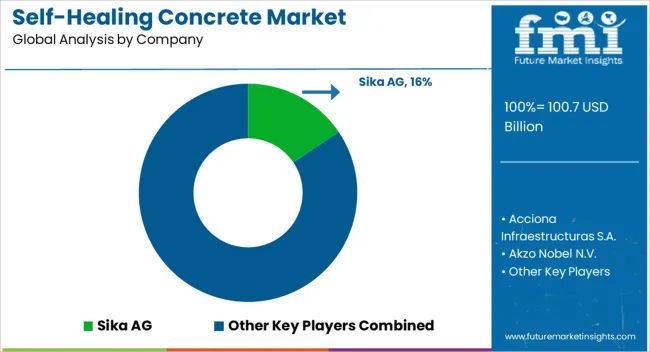

Sika AG, Acciona Infraestructuras S.A., and Akzo Nobel N.V. supply self-healing concrete solutions for infrastructure, commercial, and residential construction, with brochures highlighting crack-sealing efficiency, curing methods, and material composition. Avecom N.V., Basilisk, and Buzzi Unicem USA provide cementitious formulations with embedded healing agents, with datasheets detailing mechanical strength, water permeability reduction, and healing rate under varied environmental conditions. CEMEX S.A.B. de C.V., Corbion, and GCP Applied Technologies Inc. focus on hybrid bio-chemical and mineral-based solutions, with brochures emphasizing integration with conventional concrete mixes, shrinkage control, and load-bearing performance. Giatec Scientific Inc., Green-Basilisk BV, and Kryton International Inc. deliver lab-tested self-healing additives and admixtures, with technical literature presenting dosage guidelines, activation conditions, and long-term durability. MBCC Group, Oscrete Construction Products, and Xypex Chemical Corporation provide crystalline and polymer-modified formulations, with datasheets highlighting resistance to chloride intrusion, freeze-thaw cycles, and high-temperature stability. Other regional suppliers compete with cost-effective or rapid-curing variants, with brochures emphasizing ease of application, compatibility with local aggregates, and compliance with ASTM and EN standards.

Market strategies focus on durability, integration flexibility, and performance verification. Leading suppliers such as Sika and Akzo Nobel emphasize encapsulated healing agents, bacterial-based self-healing, and reduced maintenance cycles for bridges, tunnels, and high-traffic pavements. Avecom and Basilisk differentiate through polymer-enhanced or microcapsule approaches, accelerated crack closure, and predictable healing kinetics.

| Item | Value |

|---|---|

| Quantitative Units | USD 100.7 Billion |

| Concrete Type | Biotic concrete and Abiotic concrete |

| Form | Intrinsic, Capsule based, and Vascular |

| Application | Infrastructure, Residential construction, Commercial construction, and Industrial construction |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, Acciona Infraestructuras S.A., Akzo Nobel N.V., Avecom N.V., Basilisk, Buzzi Unicem USA, CEMEX S.A.B. de C.V., Corbion, GCP Applied Technologies Inc., Giatec Scientific Inc., Green-Basilisk BV, Kryton International Inc., MBCC Group, Oscrete Construction Products, and Xypex Chemical Corporation |

| Additional Attributes | Dollar sales vary by concrete type, including bacterial-based, capsule-based, and vascular self-healing concrete; by application, such as bridges, highways, tunnels, and commercial buildings; by end-use industry, spanning construction, infrastructure, and residential projects; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing infrastructure development, durability requirements, and demand for sustainable, maintenance-free construction materials. |

The global self-healing concrete market is estimated to be valued at USD 100.7 billion in 2025.

The market size for the self-healing concrete market is projected to reach USD 1,510.5 billion by 2035.

The self-healing concrete market is expected to grow at a 31.1% CAGR between 2025 and 2035.

The key product types in self-healing concrete market are biotic concrete and abiotic concrete.

In terms of form, intrinsic segment to command 47.2% share in the self-healing concrete market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Market Share Insights for Hollow Concrete Blocks Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA