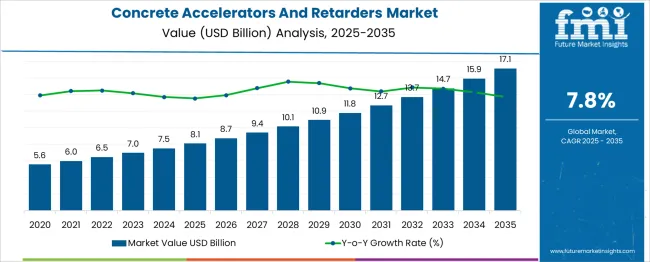

The Concrete Accelerators And Retarders Market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 17.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period. This growth reflects a multiplier of 2.11x, supported by a healthy CAGR of 7.8%, driven by the rising demand for efficient construction solutions in large-scale infrastructure, commercial complexes, and residential projects.

During the first five-year phase (2025–2030), the market is expected to expand to approximately USD 11.8 billion, adding USD 3.7 billion, which represents 41% of the total incremental opportunity, fueled by urban infrastructure projects and time-sensitive construction activities. The second phase (2030–2035) contributes USD 5.3 billion, or 59% of incremental growth, indicating acceleration as megaprojects, industrial construction, and high-performance concrete mixes gain traction. Yearly additions increase from USD 0.7 billion in early years to nearly USD 1.1 billion toward the end, showcasing robust demand in fast-growing economies and regions with large-scale transportation and energy infrastructure investments. Manufacturers focusing on environmentally compliant admixture formulations, regional supply chain expansion, and advanced dosing systems will be well-positioned to capture value within this USD 9.0 billion opportunity, reinforcing their presence in the global construction chemicals sector.

| Metric | Value |

|---|---|

| Concrete Accelerators And Retarders Market Estimated Value in (2025 E) | USD 8.1 billion |

| Concrete Accelerators And Retarders Market Forecast Value in (2035 F) | USD 17.1 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The concrete accelerators and retarders market holds a significant role across multiple construction-related sectors. In the construction chemicals market, its share is approximately 10–12%, as this category also includes waterproofing agents, sealants, and grouts. Within the concrete admixtures market, its contribution is higher at around 18–20%, since accelerators and retarders are key admixtures used for modifying setting times in different environmental and project conditions. In the building and construction materials market, the share is about 3–4%, as cement, aggregates, and structural steel dominate this segment.

The infrastructure development solutions market accounts for nearly 4–5%, supporting large-scale projects that require controlled concrete performance for durability. In the ready-mix concrete market, the share is about 6–8%, as these admixtures are widely used to maintain workability during transport and ensure timely strength development. Growth is driven by increasing demand for fast-track construction, urban infrastructure expansion, and the need for temperature-adaptive concrete solutions. Advances in admixture technology, including eco-friendly formulations and compatibility with high-performance concrete, further support adoption. As construction timelines tighten and projects face varied climatic conditions, the concrete accelerators and retarders market is expected to strengthen its presence across these parent markets, ensuring enhanced efficiency and structural reliability globally.

Accelerators and retarders are being increasingly adopted in infrastructure development projects due to their ability to control setting times in varying climatic conditions. The market is benefitting from rising investments in commercial and residential construction, coupled with growing urbanization and government initiatives focused on improving transportation and civic infrastructure.

Manufacturers are focusing on advanced formulations that enhance workability and performance consistency without compromising structural integrity. Environmental concerns and energy-efficient building standards are also encouraging the use of chemical admixtures that reduce water and cement requirements.

Demand is expected to remain strong across both developed and emerging economies, driven by the need for faster project completion, improved concrete quality, and adaptable solutions for complex construction timelines. The ability of these additives to enhance operational efficiency while aligning with sustainability goals is likely to sustain long-term market growth..

The concrete accelerators and retarders market is segmented by product type, form, application, end use industry, and geographic regions. The concrete accelerators and retarders market is divided by product type into Concrete accelerators and Concrete retarders. The concrete accelerators and retarders market is classified into Liquid and Powder. Based on the application of the concrete accelerators and retarders market, it is segmented into Ready-mix concrete, Precast concrete, Shotcrete, Cold weather concreting, Hot weather concreting, Mass concrete, and Others. The end-use industry of the concrete accelerators and retarders market is segmented into Residential construction, Commercial construction, Infrastructure development, Industrial construction, Mining & underground construction, and Others. Regionally, the concrete accelerators and retarders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The concrete accelerators subsegment within the product type segment is projected to hold 61% of the market revenue share in 2025, making it the dominant category. This leadership position has been driven by the widespread use of accelerators in applications requiring reduced setting time and early strength gain, particularly in cold-weather construction and fast-track projects. Accelerators have been increasingly adopted in infrastructure and commercial construction, where time-sensitive scheduling is a priority.

Their ability to enhance productivity by allowing faster formwork removal and earlier load application has significantly contributed to their growth. The reduction in curing time has also improved efficiency in precast concrete manufacturing and emergency repair operations.

With innovations in non-corrosive and chloride-free formulations, concrete accelerators have gained acceptance for use in reinforced concrete structures. Their compatibility with other admixtures and varied cement types further supports their extensive use, solidifying their leading position in the product type segment..

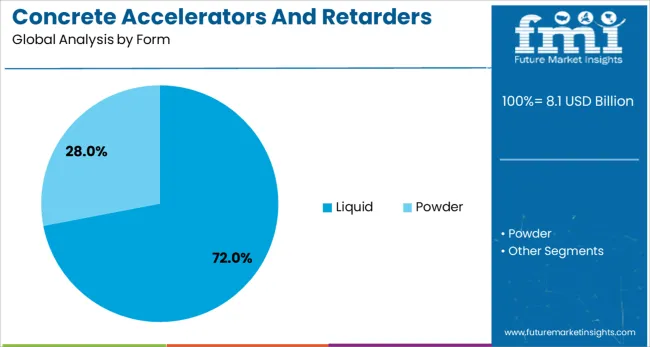

The liquid subsegment in the form category is anticipated to command 72% of the market revenue share in 2025, positioning it as the leading delivery form. This dominance can be attributed to the superior ease of handling, uniform dispersion, and quick integration of liquid admixtures into concrete mixtures. Liquids are preferred for their accurate dosing and high solubility, which ensure consistent performance in large-scale applications.

The use of automated batching systems in modern construction practices has further enhanced the appeal of liquid forms by allowing precise measurement and reduced waste. Their compatibility with advanced mixing equipment and centralized concrete production units has reinforced adoption in commercial and infrastructure projects.

The convenience offered by liquid admixtures in terms of storage, transport, and mixing has helped accelerate their penetration across markets. Additionally, their stability and longer shelf life in varied environmental conditions have made them the form of choice for most construction contractors and manufacturers..

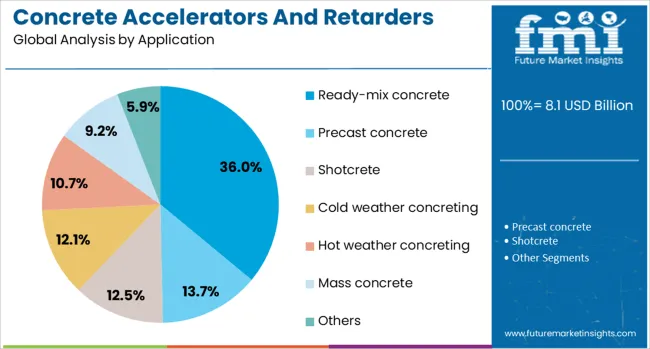

The ready-mix concrete subsegment under the application segment is expected to capture 36% of the market revenue share in 2025, establishing it as the leading application area. This segment's growth has been supported by the increasing use of ready-mix concrete in urban infrastructure and high-volume commercial construction projects. Admixtures such as accelerators and retarders have become essential components in ready-mix production for controlling setting times during long-distance transportation and unpredictable weather conditions.

Their use enables better control over the concrete’s workability, strength development, and durability, which are critical for maintaining quality in ready-mix operations. The rise in demand for high-performance concrete and just-in-time construction delivery models has also boosted the need for customized admixture solutions.

With contractors seeking consistency, speed, and reduced labor dependence, ready-mix concrete integrated with performance-enhancing additives has emerged as a practical and cost-effective solution. This demand has firmly positioned ready-mix concrete as the primary application segment in the overall market..

The concrete accelerators and retarders market is experiencing growth driven by large-scale infrastructure projects, precast applications, and rapid construction timelines in commercial sectors. Opportunities are visible in cold-weather concreting and advanced admixture systems for complex architectural projects. Key trends include demand for chloride-free accelerators, admixture compatibility optimization, and eco-aligned chemical formulations. However, restraints such as fluctuating raw material costs, variability in cement quality, and stringent regulations on chemical usage pose challenges. Overall, the market outlook indicates steady expansion supported by product innovations and rising concrete performance requirements across global construction projects.

The primary growth driver is the surge in infrastructure development and precast concrete applications. In 2024 and 2025, highways, metro projects, and high-rise construction extensively utilized accelerators to achieve faster setting in time-sensitive projects. Retarders gained adoption in hot weather concreting to control hydration rates and prevent cracks during mass pours. Demand from the industrial and commercial construction sectors also accelerated due to the need for consistent performance under diverse environmental conditions. These dynamics underscore the essential role of admixtures in improving workability and optimizing project timelines for large-scale construction.

Significant opportunities exist in the deployment of accelerators in cold climates and specialty admixtures for high-performance concretes. In 2025, northern regions in North America and Europe increased usage of non-chloride accelerators to enable winter construction without compromising structural integrity. Retarders for mass concrete foundations and dams also showed strong demand due to extended workability requirements. Manufacturers introducing admixtures tailored for high-strength and self-consolidating concretes have gained traction among contractors. These opportunities highlight the potential for suppliers offering temperature-specific and performance-enhancing formulations to capture niche yet growing market segments.

Emerging trends include the introduction of chloride-free accelerators and formulations compatible with blended cements and supplementary materials. In 2024, new admixture systems designed to work seamlessly with fly ash and slag-based concretes gained popularity in green building initiatives. The use of advanced retarding agents that ensure extended slump life without compromising early strength development became prevalent in large infrastructure pours. These innovations indicate a strong industry inclination toward safer, more adaptable products that improve mix performance across challenging project environments while complying with evolving construction standards worldwide.

Market restraints are shaped by rising raw material costs, inconsistent cement quality, and stringent chemical regulations. In 2024 and 2025, fluctuations in petrochemical-derived ingredients impacted pricing stability for admixture manufacturers. Compliance with environmental and occupational health standards has extended approval timelines, slowing new product introductions. Additionally, varying regional standards created complexity for global suppliers, resulting in increased certification expenses. These challenges underline the need for supply chain diversification, localized production, and compliance-ready product designs to sustain competitiveness in a market driven by evolving regulatory and performance benchmarks.

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

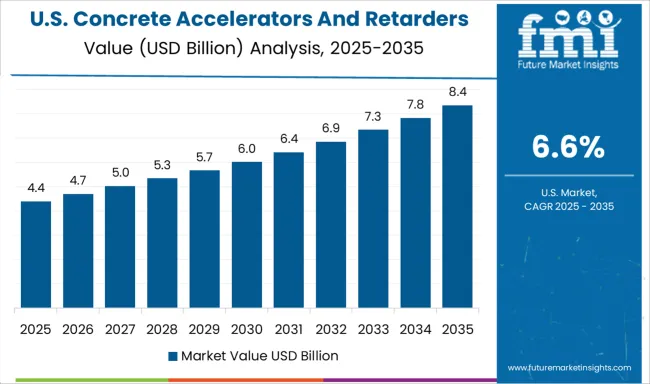

| USA | 6.6% |

| Brazil | 5.9% |

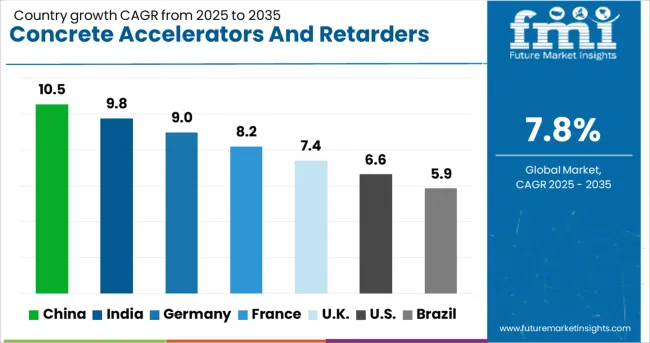

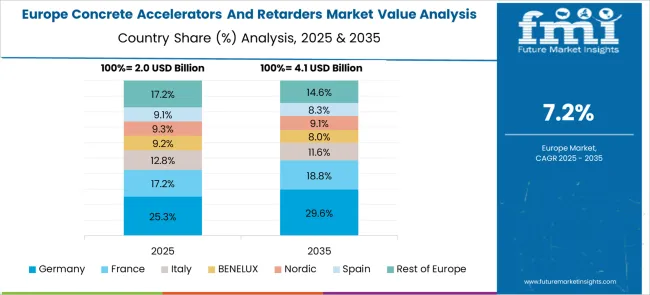

The global concrete accelerators and retarders market is expected to grow at 7.8% CAGR from 2025 to 2035. China leads at 10.5% CAGR, driven by massive urban development, high-speed rail projects, and mega infrastructure initiatives. India follows at 9.8%, propelled by housing programs, smart city projects, and highway construction. Germany records 9.0% CAGR, supported by stringent EU standards for sustainable building materials and adoption of advanced admixture technologies. The UK posts 7.4% CAGR, emphasizing modernization and eco-compliant construction practices, while the US grows at 6.6%, driven by urban renovation, infrastructure resilience, and green building mandates. Asia-Pacific dominates market expansion due to large-scale projects and rapid urbanization, whereas Europe and North America prioritize sustainability and performance-based admixture formulations.

China is projected to maintain its leadership in the market, growing at 10.5% CAGR through 2035. The country’s extensive infrastructure pipeline, including highways, metro networks, and high-speed rail corridors, drives massive demand for accelerators to speed up concrete curing in time-sensitive projects. Large-scale residential and commercial development programs further boost adoption. Advanced admixtures tailored for cold-weather concreting are gaining popularity in northern regions. Local manufacturers dominate bulk supply, while global brands target premium applications requiring enhanced performance and compliance with durability standards.

The market in India is forecasted to grow at 9.8% CAGR, supported by housing development under Pradhan Mantri Awas Yojana and rapid industrialization. Demand for accelerators is driven by the need to complete large-scale highway and metro projects within strict timelines. Retarders find strong application in ready-mix concrete (RMC) plants to ensure workability during long-distance transportation, especially in high-temperature regions. Manufacturers are focusing on cost-effective formulations and low-chloride products to prevent corrosion in reinforced concrete structures. Growth in tier-2 and tier-3 cities adds momentum to retail distribution channels for small-scale contractors.

Germany posts a 9.0% CAGR, driven by stringent EU construction regulations promoting energy-efficient and durable building materials. Adoption of retarders is strong in complex infrastructure requiring precision placement, while accelerators support winter concreting and prefabricated construction systems. Manufacturers innovate with eco-friendly admixtures featuring low-VOC formulations and renewable-based raw materials. Integration of digital dosing systems in batching plants enhances quality control and compliance. Demand for admixtures tailored for high-performance concrete in tunnels, bridges, and large-scale industrial facilities continues to rise.

The United Kingdom market is anticipated to grow at 7.4% CAGR, fueled by retrofitting projects, urban regeneration, and large-scale infrastructure modernization. Accelerators are increasingly used in fast-track projects such as bridge repairs and tunnel construction, while retarders dominate long-span concrete pouring for high-rise structures. Emphasis on eco-compliance drives innovation in chloride-free admixtures and advanced chemical formulations. Digitalization in concrete mixing and dosing operations ensures accuracy in admixture applications, aligning with sustainability-focused procurement practices.

The United States market is projected to grow at 6.6% CAGR, reflecting moderate but steady expansion. Infrastructure resilience programs targeting bridges, highways, and public transit systems sustain demand for accelerators to reduce curing times. Retarders remain essential for ready-mix operations in warm climates and large-scale commercial projects. Innovation centers on admixtures compatible with green concrete and supplementary cementitious materials to reduce carbon footprints. Strategic partnerships between admixture producers and construction firms accelerate the development of performance-based, eco-friendly solutions for large contractors and government-funded projects.

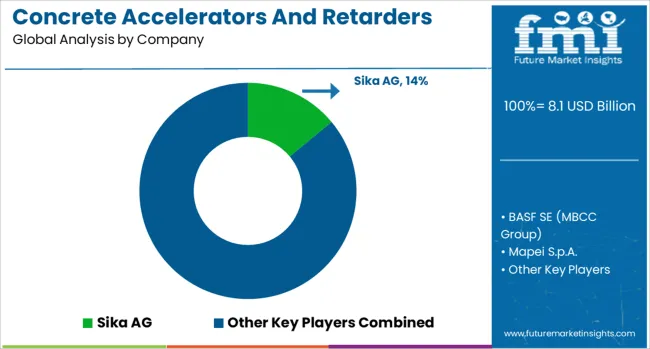

The concrete accelerators and retarders market is moderately consolidated, with Sika AG recognized as a leading player due to its extensive portfolio of admixtures and strong presence in global construction projects. Sika’s expertise in accelerating admixtures for cold-weather concreting and retarding agents for extended workability ensures its competitive advantage across infrastructure and commercial construction sectors. Key players include BASF SE (MBCC Group), Mapei S.p.A., GCP Applied Technologies Inc., Fosroc International Ltd., CICO Technologies Ltd., CHRYSO S.A.S, and RPM International Inc.

These companies offer a range of chemical admixtures designed to optimize the setting time of concrete, improve strength development, and enhance durability under varying environmental conditions. Their solutions cater to applications such as bridges, tunnels, precast elements, and high-rise structures. Market growth is driven by rapid infrastructure development, demand for high-performance concrete in extreme climates, and the need for faster construction cycles.

Leading manufacturers are focusing on the development of eco-friendly admixtures with low environmental impact, advanced formulations for complex mix designs, and compatibility with supplementary cementitious materials. Emerging trends include the adoption of smart admixtures for self-adjusting setting times and integration with digital concrete monitoring systems. Asia-Pacific dominates the market due to large-scale urban and infrastructure projects, while North America and Europe emphasize sustainable construction practices and advanced concrete technologies.

Accelerators accounted for 55.5% of the market share in 2024, driven by their critical role in precast, modular, and cold-weather concrete projects requiring rapid setting and improved efficiency. Asia Pacific emerged as the leading region, supported by robust infrastructure development and rising demand for high-performance concrete admixture solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.1 Billion |

| Product Type | Concrete accelerators and Concrete retarders |

| Form | Liquid and Powder |

| Application | Ready-mix concrete, Precast concrete, Shotcrete, Cold weather concreting, Hot weather concreting, Mass concrete, and Others |

| End Use Industry | Residential construction, Commercial construction, Infrastructure development, Industrial construction, Mining & underground construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, BASF SE (MBCC Group), Mapei S.p.A., GCP Applied Technologies Inc., Fosroc International Ltd., CICO Technologies Ltd., CHRYSO S.A.S, and RPM International Inc. |

| Additional Attributes | Dollar sales by admixture type (accelerators ~55.5% share, retarders) and form (liquid ~74.3%, powder/granular). North America leads (~USD 770.6 M in 2024), Asia‑Pacific grows fastest with infrastructure projects. Buyers prioritize cold‑weather performance, rapid-setting capability, and low‑VOC sustainable solutions. Innovations include nano‑enhanced blends, eco-friendly accelerants, and compatibility with high-performance concrete systems. CAGR ~7.8% to 2034. |

The global concrete accelerators and retarders market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the concrete accelerators and retarders market is projected to reach USD 17.1 billion by 2035.

The concrete accelerators and retarders market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in concrete accelerators and retarders market are concrete accelerators, _chloride-based accelerators, __calcium chloride, __other chloride-based accelerators, _non-chloride accelerators, __calcium nitrate, __calcium formate, __sodium silicate, __sodium aluminate, __aluminum sulfate, __triethanolamine, __others, _alkali-free accelerators, _shotcrete accelerators, _hardening accelerators, _setting accelerators, concrete retarders, _sucrose-based retarders, _phosphate-based retarders, _hydroxycarboxylic acids, _lignosulfonates and _others.

In terms of form, liquid segment to command 72.0% share in the concrete accelerators and retarders market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA