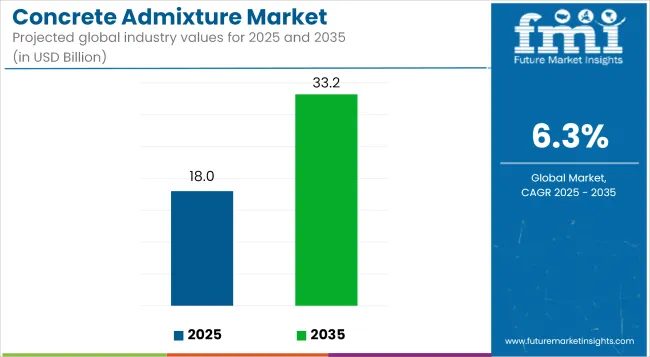

The global concrete admixture market is projected to reach USD 18 billion by 2025 and is expected to grow to USD 33.2 billion by 2035, representing a compound annual growth rate (CAGR) of 6.3%. Growth is driven by increasing demand for high-performance concrete solutions across residential, commercial, and infrastructure projects worldwide.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 18 billion |

| Projected Market Value (2035F) | USD 33.2 billion |

| Value-based CAGR (2025 to 2035) | 6.3% |

Concrete admixtures are being adopted across various construction environments to modify the properties of both fresh and hardened concrete. These compounds are incorporated to improve workability, control setting time, enhance strength, and increase durability. Their use is closely aligned with modern construction requirements that demand greater efficiency, structural resilience, and environmental compliance.

Within the infrastructure segment, the increased deployment of precast elements has accelerated the use of high-range water reducers, retarders, and slump retention admixtures. These formulations enable consistent workability during extended transport and placement times, particularly under high-temperature conditions. In high-rise developments, admixtures such as superplasticizers and pumping aids are being used to support vertical concrete pumping without segregation or loss of strength.

Specialty admixtures are also being utilized in renewable energy projects, including wind turbine foundation construction, where exposure to aggressive chemical and sulfate-rich environments necessitates enhanced sulfate resistance. In tunneling and marine applications, corrosion inhibitors and shrinkage-reducing agents are being used to extend structural longevity.

Growing attention to sustainability and environmental standards has influenced the formulation of admixtures. Admixtures that facilitate the inclusion of supplementary cementitious materials (SCMs), including fly ash, ground granulated blast-furnace slag, and silica fume, are being favored to reduce clinker content and carbon intensity in concrete. This trend is being reinforced by certification frameworks such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method).

Regionally, growth is concentrated in Asia Pacific and the Middle East, where large-scale infrastructure investments, urbanization, and transportation upgrades are being executed. Regulatory mandates to enhance construction quality and longevity are further driving the adoption of admixtures. As advanced concrete designs and performance-based specifications become standard, the market is expected to expand through product innovation, tailored solutions, and compatibility with automated mixing and placement technologies.

Sales of concrete admixture are increasing with the growth in the construction industry worldwide. In 2024, the global construction industry grew by 3.6%, reaching a value of USD 13.3 trillion. With the concrete admixture market closely tied to the construction industry's progress, the demand for concrete admixtures has also increased significantly.

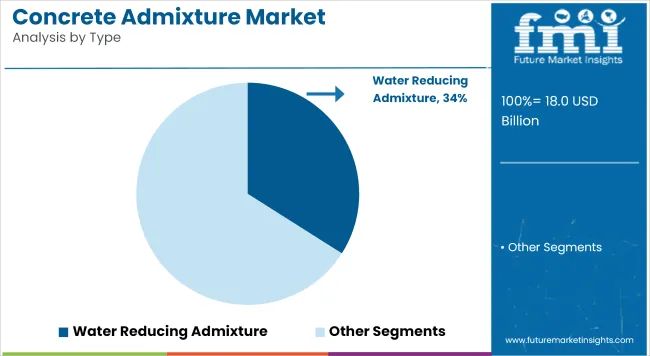

The water-reducing admixture segment is projected to account for approximately 34% of the global concrete admixture market share in 2025 and is forecast to grow at a CAGR of 6.5% through 2035. These admixtures help lower the water-to-cement ratio while maintaining flow characteristics, leading to improved durability, compressive strength, and surface finish.

Widely used in ready-mix and precast concrete, they are essential in high-performance applications including highways, tunnels, and vertical structures. The growing emphasis on cost-efficient construction and longer service life is expected to support increased usage of water reducers, especially in rapidly urbanizing economies.

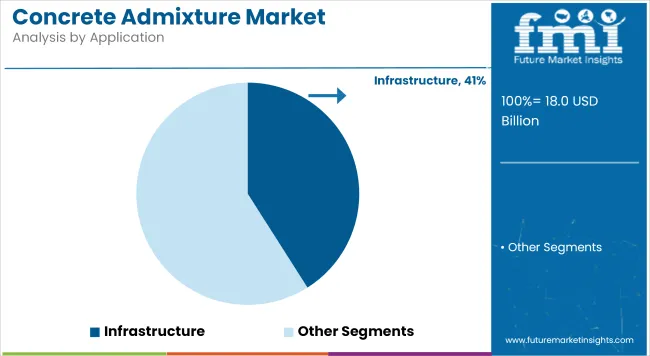

The infrastructure segment is estimated to hold approximately 41% of the global concrete admixture market share in 2025 and is projected to grow at a CAGR of 6.4% through 2035. Major infrastructure developments such as bridges, highways, rail networks, and metro systems rely heavily on concrete formulations that can perform under load, environmental stress, and time constraints.

Admixtures improve setting time, reduce cracking, and enhance resistance to freeze-thaw cycles and chemical exposure. With ongoing investments in transportation, urban utilities, and smart city frameworks, particularly in Asia-Pacific, the Middle East, and Latin America, the demand for performance-enhancing admixtures in infrastructure remains robust across both public and private sector projects.

| Category | Estimated Data/Percentage |

|---|---|

| Improved Efficiency and Reduced Costs |

|

| Enhanced Concrete Durability and Reduced Maintenance |

|

The 2023 market value was USD 16 billion, while the 2024 value is predicted to be USD 17 billion, representing a USD 1 billion increase over the year. Water-reducing admixture is the most in-demand product type, estimated to account for 23% of the market share in 2024. Concrete admixtures are primarily used in infrastructure projects. The infrastructure application is expected to account for 36% of the market share in 2024.

A fundamental factor in the rise of the construction industry is the growth in the number of people living in urban areas. Increasing urbanization is leading to the construction of more buildings, public infrastructure, and other construction projects that prominently use concrete admixture.

Countries like India and China are at the forefront of the urban shift. Hence, these countries are poised to be rife with opportunities for market stakeholders. Conversely, for some countries, the rates of urbanization are slow, for instance, Germany. In Japan, the rate is even negative. The following table highlights the urbanization population and urbanization growth rate across five countries, according to the World Population Review.

| Countries | Urbanization Growth Rate (2020 to 2025 per year) |

|---|---|

| United States | 0.96% |

| China | 1.78% |

| Japan | -0.25% |

| Germany | 0.13% |

| India | 2.33% |

Manufacturers are required to comply with several regulations regarding concrete admixtures. With growing concerns over the environmental impact of construction activities and the need to safeguard buildings, regulations are only increasing.

Regulations include the quantity of chemicals, such as chlorides and sulfates, that are permissible in the admixture, as well as environmental regulations to restrict VOC emissions, waste management, and other relevant considerations. LEED (Leadership in Energy and Environmental Design) is one of the certifications that are required in some cases to prove sustainability requirements have been met.

The safety of handlers is considered paramount; therefore, numerous regulations regarding health and safety are in place. Manufacturers are required to demonstrate the safety of their equipment in terms of handling, storage, and transportation. In addition, innovations in concrete admixtures, such as nanotechnology-based products and superplasticizers, have additional testing and certification requirements.

The following table provides an overview of the standards present in various regions and countries.

| Region/Country | Standards |

|---|---|

| United States | Standards such as ASTM International and EPA guidelines |

| European Union | Construction Products Regulation (CPR) and EN standards |

| India | Bureau of Indian Standards (BIS) |

| China | GB/T (Guobiao Standards) |

Complying with regulations and obtaining certifications puts a strain on companies’ resources and also slows down work. Hence, complying with laws is seen as hindering the market's progress. However, complying with regulations also has its upsides. By adhering to set regulations, stakeholders can ensure the safety and durability of structures. By getting the necessary certifications, manufacturers can also enhance their image in the eyes of contractors and builders, boosting confidence among customers.

Along with the construction industry, demand for cement is another factor that correlates with the progress of the concrete admixture market. Cement is the primary binding agent in concrete, and with increasing construction activities worldwide, both cement and concrete, including admixtures, are in high demand.

One of the key factors driving cement demand is government policies aimed at boosting the construction sector. Governments worldwide are investing extensively in infrastructure, such as roads, bridges, and housing, where cement and admixtures are used prominently.

For instance, in 2021, the Indian government introduced the ‘Gati Shakti National Master Plan’ initiative. This plan aims to provide a holistic, multi-modal approach to infrastructure development. It integrates various ministries and state governments to create efficient and cost-effective infrastructure, including roads, railways, and ports. Cement, a key component in construction, is heavily utilized in this initiative, thereby boosting demand in the sector.

Another instance is the Chinese government’s initiative, the Belt and Road Initiative (BRI). This focuses on infrastructure development and investments across Asia, Europe, and Africa. Under this initiative, China has committed substantial funds to building roads, bridges, and housing, where cement plays a crucial role in the construction of these large-scale projects.

In terms of investment, the United States’ government passed the Infrastructure Investment and Jobs Act in 2021, allocating USD 1.2 trillion to modernize infrastructure, including transportation networks, utilities, and housing. This has increased the demand for materials like cement, as major projects such as bridges, highways, and public buildings are being constructed and upgraded.

Innovations and variations in cement types help keep concrete admixtures diverse and effective. Blended cement and low-clinker cement types aid advancements in admixtures. Innovations like Portland Pozzolana Cement and Sulfate Resistant Cement are also best utilized through admixtures.

While the growth of cement is closely linked to that of concrete admixtures, the progress of the latter is not entirely dependent on the former. The environmental impact of cement is substantial, and cement alternatives such as fly ash and slag are gaining prominence. Hence, concrete admixtures are seeing increasing demand independent of cement.

One of the highlights of the market has been the growing importance of sustainability. A concern for the environment has driven innovation across the market. New manufacturing methods are being explored to enhance eco-friendliness, while sustainable products are also being developed. Companies are working toward solutions that help them minimize the use of water and cement. The following table illustrates the policies undertaken by companies to reduce their environmental footprint.

| Company’s Strategy/Initiative | Examples/Recent Developments Supporting Policies |

|---|---|

| Developing bio-based admixtures | Sika AG’s superplasticizers |

| Development of admixtures that extend durability and reduce carbon emissions |

|

| Sustainable Manufacturing |

|

| Setting Future Goals | Weber Saint-Gobain has set the target of using 50% recycled materials in admixture production by 2030 |

| Complying with Environmental Regulations |

|

| Integration of Technology | GCP Applied Technologies’ VERIFI, a cloud-based concrete management platform |

| Educational Efforts |

|

Concrete admixture companies are cognizant of the opportunities provided by nations like China and India, due to their rapidly developing construction industries. Both local and foreign players in these countries are seeking to expand the scale of their operations. For instance, Shandong Wanshan Chemical Co. Ltd. is focused on upgrading production in the country while also adhering to environmental norms.

Meanwhile, Mapei S.P.A. has opened new facilities in India and Southeast Asia in recent years. These expanding production facilities signify the importance given to the Asia Pacific market, where governments view construction and infrastructure as cornerstones of progress.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 6.9% |

| United Kingdom | 7.2% |

| China | 5% |

The Indian concrete admixture market is projected to grow at a CAGR of 6.9% from 2025 to 2035. The Smart Cities Mission in India has catalyzed immense growth opportunities for the concrete admixture market. With the rapid pace of urbanization, there is a desperate need for infrastructure that can withstand environment-related challenges while promoting energy efficiency. Concrete admixtures improve the performance of concrete by enhancing workability, strength, and durability, making them crucial components in smart city projects.

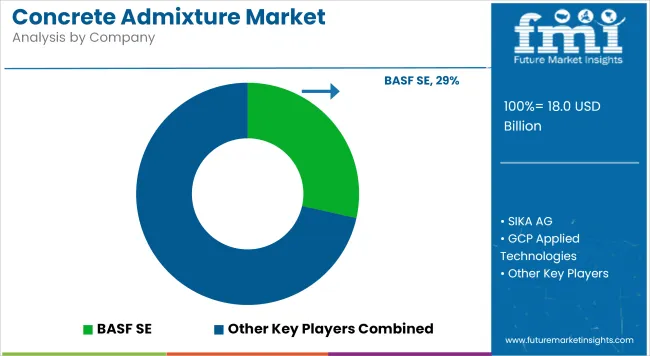

Recent trends in admixtures center on the introduction of innovative admixtures that cater to specific needs, such as high-performance and eco-friendly options. Among these, BASF SE, Sika AG, and Fosroc International lead the market with carbon footprint-reducing formulations and enhanced durability of structures.

As cities become smart hubs, the concrete admixture market is expected to expand significantly, aligning with the broader objectives of urban development and sustainability. Over 100 cities in India have been nominated for the Smart Cities Mission, making the country a lucrative market.

The concrete admixture market in China is projected to grow at a CAGR of 5% from 2025 to 2035. Efforts by the Chinese government to promote sustainable construction are enabling the increased use of eco-friendly concrete admixtures. Companies that invest in low-carbon technologies stand to benefit as they align with national policies, thus increasing their market positions.

China's rapid urbanization creates big infrastructure projects, demanding concrete of superior quality. The adoption of technology in the construction industry, such as AI and IoT for mix design optimization, is taking shape. Companies employing these technologies are enjoying cost benefits through improved operational efficiency, ultimately enhancing profitability while sustaining growth. Key companies in the Chinese market include China National Chemical Corporation (ChemChina) and Sika AG.

The concrete admixture market in the United Kingdom is set to progress at a CAGR of 7.2% from 2025 to 2035. With the enforcement of stricter environmental regulations by the United Kingdom government, construction companies are encouraged to become more sustainable.

There is an ever-growing demand for high-performance and specialty admixtures that satisfy specific construction needs. Companies are investing in research and development to differentiate themselves and serve specific cement needs.

Modern building construction in the United Kingdom utilizes smart technologies, including automated mixing and real-time monitoring. Companies that adopt the use of these new technologies can achieve production optimization, reduce waste, and improve profitability, ultimately ensuring long-term financial stability. Key companies in the United Kingdom market include CEMEX UK and Tarmac.

The concrete admixtures industry is focusing on improving performance while promoting sustainable construction practices. New formulations are enhancing concrete rheology, workability retention, and early strength, especially in low water-cement ratio mixes with long slump retention. Admixtures designed for high clay content are gaining traction, improving consistency and performance while enabling the use of low-carbon materials like recycled aggregates.

By type, the key segments include accelerating admixture, air-entraining admixture, retarding admixture, water-reducing admixture, waterproofing admixture, and others.

By application, key segments include Residential, infrastructure, commercial, and industrial.

By region, key segments are North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Global sales are likely to be worth USD 18 billion in 2025

Sales are set to grow at 6.3% CAGR through 2035.

India is set to be a promising country, with a CAGR of 6.9% over the next ten years.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA