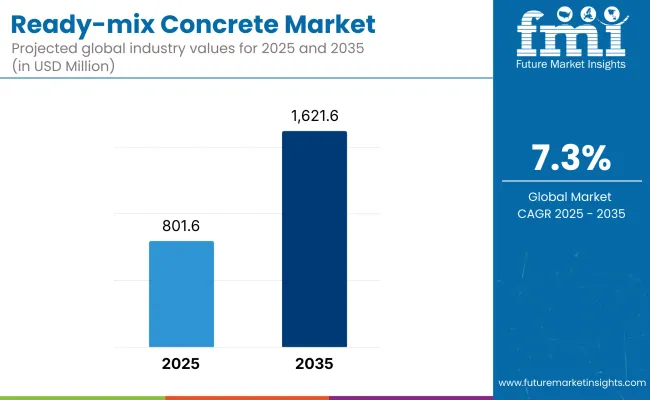

The ready-mix concrete market is projected to grow from USD 801.6 billion in 2025 to USD 1,621.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.3% during the forecast period. The growing demand for sustainable and cost-effective building materials, combined with advancements in concrete technology, will further drive market expansion.

The ready-mix concrete market is reaping the benefits of advanced construction techniques being embraced, which mainly focus on efficiency, sustainability, and durability. Prefabrication and modular construction increase the use of ready-mix concrete prefabricated since it has stable quality and short labor requirements at the site.

New smart technologies, for instance, AI-driven batching plants and digital delivery systems are also introduced to improve the supply chain efficiency. Disposable doubts about global warming as a result of manufacturers' concerted e or carbon-neutral options, such as carbon-capture concrete and ecologically sourced aggregate. This not only gives the construction sector a bigger ecological-holding share but also makes it a greener alternative in ready-mix concrete manufacturing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 801.6 million |

| Industry Value (2035F) | USD 1,621.6 million |

| CAGR (2025 to 2035) | 7.3% |

It is the ready-mix concrete business that enjoys the effect of a rush in construction both commercial and residential. Smart cities, modern transportation networks, and green infrastructure are some of the frontiers where the governments are investing heavily thereby increasing the ready-mix concrete spending. The automatic batching package and the technology of advanced mixing processes together bring increased efficiency and qualitative product thus, construction applications benefit from it.

On top of that, the adhesion of environmental regulation policies is the reason why we are achieving our grades of use in alternative concrete materials such as carbon-neutral and recycled aggregate-based products, which will be marketed in the fore-year to come.

The increasing focus on green building materials and the push for sustainable construction practices are the main drivers of the increased adoption of ready-mix concrete with low carbon footprints. Patents like self-healing concrete, fiber-reinforcement wedges, and nanotechnology-based mixtures are the pioneering factors to the best performance and the longest durability of ready-mix concrete, therefore, it is the favored substance in modern infrastructures being efficient and reaching the height of international standards.

The ready-mix concrete market in North America is supported by cash-strapped infrastructure upkeep, recovery, and more installation of eco-building materials. The infrastructure investment plan of the USA government, containing actions like a road maintenance plan and a bridge restoration program, alongside smart city projects, is strongly mounting the demand.

Then urbanization, and the rise in residential and commercial building activity, especially in the central business districts, are becoming additional factors boosting the market. The rules concerning environmental pollution are the main reasons why companies are devising green products, for instance, carbon-capture concrete and recycled aggregate mixes.

The automation and digital technologies, which are used for concrete production, are enhancing operation performance and cutting waste. Canada, in turn, is also on the growth trail backed by government investments not only in affordable housing but also in green building initiatives that are supposed to be in line with the national goals and reduction of emissions.

Across Europe the ready-mix concrete market is expanding at a more than solid base as the builders trend toward environment and energy-efficient construction. The European Union's Green Deal has made certain states, for instance, Germany, France, and the UK, to invest heavily in clean construction strictly, promoting the shift to green building technologies.

Commercial and industrial activities, including smart infrastructure and renewable energy facilities, have made a demand for more productive high-performance concrete. The market for self-healing concrete and ultra-high-performance mixes has also grown.

Besides, prefabricated and modular construction are being applied more and more, displacing market expansion. Manufacturer's environmentally friendly construction material innovations, stronger regulations on cement emissions, and promotion of the circular economy are helping to shape the restructuring of the European market.

The Asia-Pacific area is the quickest growing home for ready-mix concrete, chiefly nurtured by burgeoning cities, gigantic building works, and smart city investments. China and India are at the helm of this demand explosion, channeling money in highways, rail networks, and commercial developments and housing.

Nationally funded mega-infrastructure projects, such as the Belt and Road initiative and Smart Cities mission in China respectively, and India, have driven the use of ready-mix concrete significantly, moreover, the construction sector is now embracing the concept of building green-as-a-service.

The area has also been transitioning to environmentally sustainable construction with the introduction of green concrete solutions and better mixing technology. The countries in Southeast Asia, like Indonesia, Vietnam, and the Philippines, will have stronger market opportunities as they are the most likely to attract foreign-Investments in real estate and industrial areas that will boost the market development in the region.

The ready-mix concrete market in the rest of the world, due to the urbanization and infrastructure development boom that is taking place in Latin America, the Middle East, and Africa, is experiencing growth. In Latin America, roadways, commercial buildings, and residential housing are the megaprojects that the local governments are investing in with support from the federal government infrastructure spending.

The high need in such structures, the Middle East has its share of extraordinarily good quality and distinct concrete for standout mega projects such as Saudi Arabia's NEOM city and the UAE's urban expansion. The expansion of the African market is the result of growing foreign investments in infrastructure and industrial zones.

Yet, there are also challenges with respect to the supply chain that needs to be addressed like transportation bottlenecks, high transportation cost etc. However, the innovations like green concrete and the technologies that support them are thought to bring long-term growth to the markets.

High Production Costs and Supply Chain Disruptions

The ready-mix concrete industry is facing issues in regard to difficulties related to high production costs and the effects of supply chain disruptions. The high input costs, particularly due to rising costs for raw materials like cement, aggregates, and admixtures, are the primary cause of this problem. Moreover, the fluctuations of fuel and energy prices make production more expensive and less predictable.

On another hand, the supply chain disruptions that take place include transport hindrances, labor shortages, and ups and downs in material size, which actually have a major influence on the roofing system. The common but not the only issue is the inadequate logistics infrastructure and the inefficient distribution networks that are contributors to the delays, which frequently lead to higher project costs and slowdowns.

The necessity for just-in-time delivery and the calibration of batches render supply chain efficiency a priority. To decrease or avoid such issues, the manufacturers have already resorted to hi-tech like digital tracking, AI-driven logistics, and the use of alternative sourcing strategies, nevertheless, costs were a major problem still for the players in the industry.

Environmental Concerns and Regulatory Compliance

Environmental sustainability is the most crucial issue the ready-mix concrete sector faces today as a result of the high carbon emissions connected to cement production. Cement production is responsible for almost 8% of global CO₂ emissions making worldwide regulatory bodies impose stricter emission norms and sustainability mandates on cement manufacturing operations.

Low-carbon and eco-friendly substitutes are the products of innovation. Eco-environmental problems like concrete surplus disposal and water-intensive production processes accumulate with the ones about waste management. Regulations such as carbon taxes, and emission limits plus green building certifications, that are not static, put operational complexity and costs on top of the table.

In the search for solutions to those issues, companies are opting carbon capture technologies, alternative cement-bonding materials, and recycling schemes but large-scale penetration is still experiencing failures and setbacks due to economic restrictions.

Technological Advancements in High Performance and Sustainable Concrete

The ready-mix concrete business is on its way to a new paradigm of technological revolution, which is directed at durability, strength, and environmental sustainability. The optional solutions like the self-healing of the concrete, ultra-high-performance concrete (UHPC), and fiber-reinforced concrete builds up structural integrity while maintenance costs are declining.

Not to mention, the bio-based additives and carbon-converted concrete material are used to help save the environment and lower the cement industry's effects. Smart technologies like AI systems for batching and automating quality checks will greatly increase production yields and decrease material waste.

Also, 3D printing laid the brick to demand for newly designed and advanced ready-mix concrete. These new technologies enable producers to add value, diversify products, and meet new compliant demands, and, furthermore, they will help to satisfy the growing need for green construction products.

Expansion in Emerging Markets and Prefabrication Trends

The latest growth of the ready-mix concrete market will be seen in the emerging markets mainly in Asia, Africa, and Latin America, due to urbanization, and infrastructure investments. The government programs that are centered on affordable housing got the ball rolling by setting up an industrial expansion and transportation network.

The fine illustrations of countries covered include Indonesia, Nigeria, and Brazil that are experiencing a sharp influx of urban settlers. The global move to prefabricated and modular construction is an added plus as this building technique requires quality concrete that is mixed with precision, free of charge assembly.

Prefab is faster, cuts waste, and raises the project bottom line, so it is an appealing alternative to the wrong. By setting up localized production facilities and joining forces with partners, companies can leverage these emerging market opportunities and the shifts in technology.

The ready-mix concrete (RMC) market from 2020 to 2024 was noticeably high due to the ongoing urbanization, infrastructure expansion, and greener construction standards, which it has been promoting. The manufacturers construct new products of higher quality and resistant facility materials by using precast concrete which is a combination of not only mechanical attachment but also service assembly. Because of the Scheme on smart cities and certifications for green buildings, many innovations have taken place.

The coming years from 2025 to 2035 will be the era of unprecedented change depending on stricter regulations on the environment, the rise of technological innovations in concrete production, and the integration of AI-driven batching systems in the business.

These programs will be embedded into the fabric of the concrete industry and therefore cause a shift from traditional business models. Sustainability measures such as the deployment of carbon capture technologies and the use of recycled aggregates as alternative feedstock are anticipated to be the best technologies of the time.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments focus on quality standards and the use of sustainable materials. The LEED and other green-building certifications have been adopted more. |

| Technological Developments | The much stronger and self-compacting concrete is now introduced. GPS and telematics are being utilized for improved delivery. |

| Industry-Specific Demand | The residential and commercial construction along with major infrastructure projects have shown high demand. |

| Sustainability & Circular Economy | Starting with the use of recycled materials and then adding eco-friendly additives. |

| Market Growth Drivers | Growth in urban areas and government investment in infrastructure projects, and the preference for more durable materials. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Emission reduction initiatives, carbon taxes, and the use of green materials in the construction of public facilities are required by law. |

| Technological Developments | An AI-based batching and quality control, 3D printing of concrete structures, and RMC solutions that are carbon-neutral. |

| Industry-Specific Demand | Smart city projects, off-site construction, and the use of resilient materials for climate adaptation have all been beneficial. |

| Sustainability & Circular Economy | Normalizing the use of green concrete, capturing carbon at cement plants, and implementing the circular economy. |

| Market Growth Drivers | Smart cities, decarbonization policies, and advancements in sustainable construction techniques. |

Gradual growth is observable in the USA ready-mix concrete (RMC) market. Factors such as increased infrastructure investments, urbanization, and the rise of sustainable construction contribute to this expansion. As a result, the Infrastructure Investment and Jobs Act (IIJA) emerges as a major factor, allocating funds for the construction of highways, bridges, and public transit projects, all of which demand massive quantities of concrete.

On the other hand, the construction industry's move from traditional to green materials such as carbon-neutral concrete is another force shaping market trends. The shift to prefabricated and modular construction is also a reason for the higher demand for ready-mix solutions.

The commercial and residential sectors are expanding, especially in metropolitan areas that are driving consumption even more. Additionally, concrete production is experiencing progress through technological advancements, such as AI-based batching and self-healing concrete, thereby supporting the market with increased efficiency and durability.

| Country | CAGR (2025 to 2035) |

|---|---|

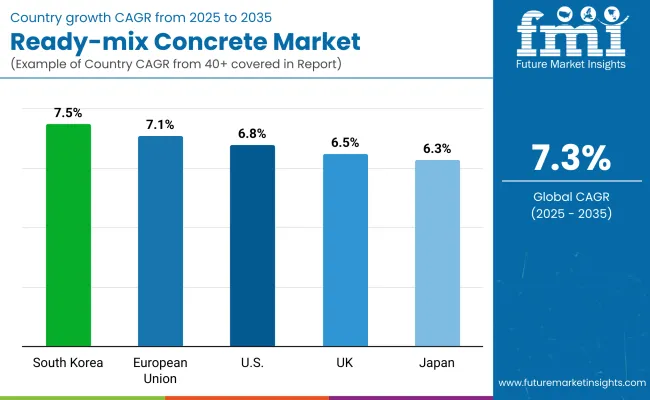

| United States | 6.8% |

The lively growth of the UK ready-mix concrete sector, in the face of the current strong government support for infrastructural and sustainability initiatives, is truly remarkable. The launch of the HS2 project, together with other significant infrastructural advancements, is a powerful trigger for concrete demand. Besides that, with policies like the UK’s Net Zero Strategy, sustainability has become a major determining factor for the acceptance of low-carbon concrete.

The building sector is still a prominent factor, as the demand for cheap and energy-saving houses rises. The use of prefabrication and off-site construction methods is something new and more and more companies prefer it. This has a direct impact on the demand for high-quality ready-mix concrete.

On the other hand, technology has much to do with progress, as for instance, self-compacting and ultra-high-performance concrete are the reasons we are durable and construct faster. The sector is also experiencing positive growth because of stringent building codes, which entail ecological and robust materials for urban and commercial projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

The market for ready-mix concrete in the EU is on an upward trajectory, primarily driven by a surge in funding for green infrastructure, the implementation of stringent environmental laws, and the introduction of urban renewal schemes. The European Green Deal is directing the construction industry toward carbon-neutral alternatives, resulting in a larger proportion of recycling and the use of sustainable concrete.

The need for large infrastructures, such as smart cities, which will be served by high-speed rail networks, along with renewable energy facilities, will also promote demand. The incorporation of new concrete methodologies, such as self-healing and ultra-lightweight concrete, leads to a higher degree of efficiency and sustainability.

Furthermore, the research and technological advancements that are co-financed by the EU are furthermore contributing to the rapid increase of the market. The shift from linear to circular economy practices is recurrently taking place, wherein concrete recycling along with material-efficient practices are being prioritized, thus supporting further demand of eco-friendly RMC.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.1% |

The ready-mix concrete industry in Japan is experiencing growth due to its emphasis on earthquake-resistant construction, urban infrastructure, and innovative concrete technologies. The enforcement of rigid seismic construction codes in this country results in the need for special production of high-performance concrete mixtures.

Urban redevelopment, including the renovation of aging infrastructure and smart city projects, is the primary factor driving the segment's growth. The introduction of precast and high-strength concrete systems has contributed to a decrease in construction time and an increase in durability.

Japan is investing in the production of sustainable concrete, which involves capturing carbon dioxide during the cement manufacturing process. The increased demand for infrastructure enhancement, such as building roads, bridges, and rail networks, encourages the market to expand. The switch to automated and AI-powered concrete mixing facilities also leads to better quality control and productivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

Rapid urbanization, large-scale infrastructure projects, and advancements in technology within the construction sector are driving the growth of South Korea's ready-mix concrete market. Distributed throughout the country, the smart city scheme developments, epitomized by the Songdo and Sejong projects, have increased the demand for high-performance concrete.

Furthermore, the rise of skyscrapers and the construction of multi-mode transport in the form of bridges, tunnels, and airports are other reasons for the market to grow strongly. The government's green programs, which promote the use of less environmentally harmful technology, are the main driving force behind the shift to eco-friendly and energy-efficient concrete solutions.

Lastly, artificial intelligence and automated processes are being used by the R.O.K. to manufacture concrete batching plants which aid in productivity increases and material waste minimization. The need for ultra-high-strength concrete in the construction of towers and in high-speed rail projects is also driving market growth, offering promise for future development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Off-Site Production Dominates the Market Due to Cost Efficiency and Quality Control

Off-site production, or plant-mixed concrete, is the dominant player in the ready-mix concrete (RMC) segment, thanks to its better quality control, consistent composition, and ability to produce it in large quantities. It is a method that allows for accurate mixing in a controlled environment, thereby reducing material waste and increasing efficiency.

Off-site RMC finds a great deal of application in the case of civil engineering structures, commercial buildings, and industrial establishments, which necessitate the properties of homogeneity and high strength. The ongoing improvements in transportation and logistics such as transit mixers and pumping systems make it possible to deliver them seamlessly to construction sites.

The stringent rules about sustainable construction are also in favor of off-site production, since it results in less environmental impact. Asia-Pacific and North America are the major markets with their booming urbanization and government investment in infrastructure projects.

On-Site Production Grows in Popularity for Remote and Specialized Projects

On-site production of ready-mix concrete is a trend that is gradually being established, particularly in remote areas, places where construction of skyscrapers is done, and construction sites that are intricate, which on transportation of pre-mixed concrete are challenging. This way offers flexibility by which contractors can change the mix proportions according to the needs of the moment.

On-site RMC lessens reliance on suppliers, thus minimizing logistical constraints and difficulties with delays. This process is particularly useful in cases where concrete that needs to set for specific time periods is used, for example, of tunnels and populous houses projects.

While they are laborious to run and need a lot of setup, mobile batching plants have made impressive strides in efficiency due to advancements in technology. Developing markets in Africa and Southeast Asia are utilizing this method more and more as the infrastructure is on the rise and because they are not having access to large-scale plants for off-site RMC.

Residential Sector Dominates RMC Market as Urbanization and Housing Demand

The largest consumer of ready-mix concrete is the residential sector that benefits from the strong urbanization, population boom, and demand for affordable housing. RMC is the material of choice in building houses which is due to its light weight, strength, and less amount of labor compared to site mixing. It is commonly used in building structures like basements, walls, slabs, etc., where it ensures water and air-tight seals and longer service life.

The housing schemes and smart city initiatives run by the governments of different areas such as those in the Asia-Pacific and North America regions are main propellants for residential projects. Plus, the new high-performance concrete versions, such as self-compacting and lightweight concrete, which are eco-friendly, are getting more and more involved in the process of development in residential projects.

Infrastructure Expansion Aids Market Development in Developing Countries

The infrastructural segment forms a substantial part of the ready-mix concrete market, backboned by extensive investments from both public and private sectors in highways, green power projects, and urban construction. RMC, which is the choice for infrastructure creations including roads, sculptors, barrows, and traveller's ports which need high-strength concrete having accurate quality determinations, is a main product.

The expansion of the belt and road hybrid of China and the USA 's Infrastructure Investment and Job Act are favorable government action plans. Infrastructure trends are boosting the implementation of green cement which causes fewer carbon emissions. Prefabricated methods that use RMC are another way to enhance the efficiency of big projects. Rapid growth in Asia-Pacific and the Middle East is thanks to the infrastructural development and the boost of infrastructure budgets.

The Ready-Mix Concrete (RMC) market forms a crucial part of the global construction industry which thrives on urbanization, infrastructure extension, and the demand for ecologically-friendly building applications. RMC is a pre-mixed, precisely formulated concrete that enhances efficiency, reduces on-site labor, and ensures quality consistency in construction projects.

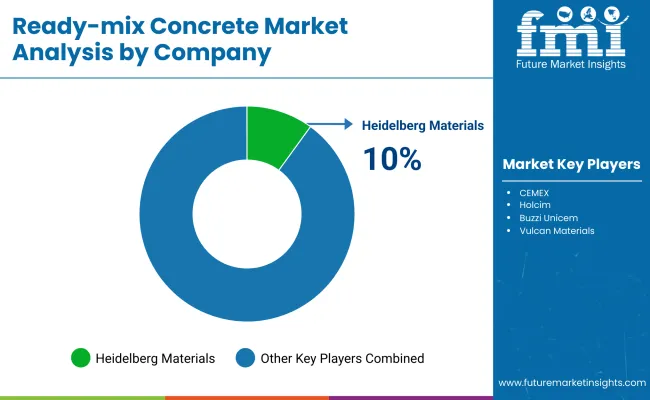

The companies which dominate this market include global firms such as Heidelberg Materials, CEMEX, Holcim, Buzzi Unicem, and Vulcan Materials, as well as many local manufacturers. The industry is transforming with the introduction of low-carbon concrete, digital batching systems, and biodegradable materials.

The increasing requests for smart cities, roads, and business hubs are the forces pushing the market forward. R&D and sustainability are retained as the core issues which are being addressed by companies through the use of recycled materials, AI-driven production processes, and carbon capture technologies which increase competitiveness and environmental responsibility.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Heidelberg Materials | 10-14% |

| CEMEX | 8-12% |

| Holcim | 7-10% |

| Buzzi Unicem | 4-7% |

| Vulcan Materials | 3-6% |

| Other Companies | 55-65% |

| Company Name | Key Offerings/Activities |

|---|---|

| Heidelberg Materials | Focuses on sustainable concrete solutions, digital batching, and large-scale infrastructure projects. |

| CEMEX | Develops low-carbon concrete and specialty admixtures for durability and performance. |

| Holcim | Invests in green building materials and circular economy initiatives to reduce carbon footprint. |

| Buzzi Unicem | Specializes in high-strength concrete for industrial and residential applications. |

| Vulcan Materials | Supplies regional construction projects, with a focus on local production efficiency. |

Key Company Insights

Heidelberg Materials

Heidelberg Materials is a global leader in the production of ready-mix concrete, with a huge market presence in Europe, North America, and developing markets. The firm is devoted to low-carbon concrete solutions and uses technologies that cut CO₂ alongside recycled aggregates for environmental problems.

Heidelberg is a pacesetter in digital batching systems, using AI-driven analytics for the accurate mixture of components, thus ensuring efficiency and sustainability. Recent strategic acquisitions have consolidated its global presence, especially in areas with the highest growth.

Company's invention of climate-neutral cement and self-healing concrete makes it a pioneer in the sector. Heidelberg is making strides in the area of circular economy by aligning with international policies and industry regulations that would give them the edge in the market for sustainable construction materials.

Verifi

A key player in this transformation is Verifi, a pioneer in in-transit concrete management systems. Installed in thousands of trucks globally, Verifi’s platform ensures precise slump control and real-time delivery monitoring, setting benchmarks for digital quality control.

CEMEX

CEMEX is a global company that is both a high-performance and specialized ready-mix concrete supplier, serving commercial and residential construction. The company is committed to developing low-carbon and energy-efficient building materials, with a focus on self-healing cement, carbon-neutral cement, and digital construction technologies.

CEMEX collaborates closely with automated and AI-driven batching plants to enhance efficiency and sustainability. The company is also the one introducing the Vertua® product line that now includes ecological concrete options adhering to the tough environmental criteria.

CEMEX remains aggressively focused on direct partnerships and acquisitions, the two weapons that will propel it ahead of the competition in the market, notably in North America and Europe. Its digital transformation, construction efficiency, and decarbonization make it a major player in the sustainable concrete sector.

Holcim

Holcim is a major innovator in green building and a proponent of sustainability through circular economy initiatives and carbon-neutral concrete techniques. The firm is a leader in recycling construction materials, applying waste-based aggregates and carbon capture technologies to mitigate its carbon footprint.

Holcim has introduced ECOPact, the first sustainable concrete with low-carbon emissions, to the market, thereby supporting construction projects in their pursuit of greener buildings. The company is investing in AI batching plants to increase operational efficiency and ensure high-quality products.

Holcim is diversifying by tapping into the emerging market, which will not only improve the global supply chain but regional operations as well. With a firm stance on net-zero emissions by 2050, Holcim leads the way in climate-safe concrete advancements and will, therefore, ensure long-term market leadership.

Buzzi Unicem

Buzzi Unicem is a specialized company that offers high-strength and cost-effective concrete solutions for industrial, infrastructure, and residential construction markets. The firm has established a massive presence in Europe and North America, while its focus is mainly on efficiency-driven production techniques. Buzzi Unicem has been automating batching technology to ensure product consistency while at the same time minimizing material waste.

The company is mainly innovating in self-compacting concrete and single-netted fiber reinforced solutions as they enhance durability and construction efficiency. The firm has recently turned its attention to investments in cement factories run by sustainable means and CO₂ reduction technologies, which is what has made Buzzi Unicem a formidable competitor in the ready-mix sector. Through the redesign and upgrade of plants, the company is increasing its production capacity while still focusing on being sustainable and innovative.

Vulcan Materials

Vulcan Materials is a trusty regional supplier in North America of ready-mix concrete mainly targeting projects in the infrastructure and commercial sectors. The company has a strong focus on localized production efficiency/agility and the environmental aspect, which results in the delivery of cost-effective, high quality concrete for the road construction, bridges, and large scale developments.

The Vulcan Materials Company invests in smart logistics, and the AI-driven supply chain management to optimize material sourcing and transportation. The addition of aggregate mining and production facilities that support the new expanded footprint of Vulcan strengthens this company in the region.

The sustainability initiatives are highlighted by the introduction of low-carbon concrete programs and the strategic use of alternative materials for better eco-efficiency. Vulcan has secured its status as a key player in the North American ready-mix concrete market, through the strategic blend of market consolidation and infrastructure investment.

In terms of Production, the industry is divided into On-Site and Off-Site

In terms of Product Type, the industry is divided into Residential, Non-Residential, Infrastructural, Commercial, Industrial

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Ready-mix Concrete market is projected to reach USD 801.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 7.3% over the forecast period.

By 2035, the Ready-mix Concrete market is expected to reach USD 1,621.6 million.

The Off-Site segment is expected to dominate the market, due to its controlled production environment, reduced material wastage, enhanced quality, faster construction timelines, and growing demand for prefabricated structures in residential and commercial projects.

Key players in the Ready-mix Concrete market include Heidelberg Materials, CEMEX, Holcim, Buzzi Unicem, Vulcan Materials.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Production, 2018 to 2033

Table 4: Global Volume (Tons) Forecast by Production, 2018 to 2033

Table 5: Global Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 7: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Value (US$ Million) Forecast by Production, 2018 to 2033

Table 10: North America Volume (Tons) Forecast by Production, 2018 to 2033

Table 11: North America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 13: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Value (US$ Million) Forecast by Production, 2018 to 2033

Table 16: Latin America Volume (Tons) Forecast by Production, 2018 to 2033

Table 17: Latin America Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Latin America Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 19: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Value (US$ Million) Forecast by Production, 2018 to 2033

Table 22: Western Europe Volume (Tons) Forecast by Production, 2018 to 2033

Table 23: Western Europe Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Western Europe Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 25: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Value (US$ Million) Forecast by Production, 2018 to 2033

Table 28: Eastern Europe Volume (Tons) Forecast by Production, 2018 to 2033

Table 29: Eastern Europe Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Eastern Europe Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 31: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Value (US$ Million) Forecast by Production, 2018 to 2033

Table 34: South Asia and Pacific Volume (Tons) Forecast by Production, 2018 to 2033

Table 35: South Asia and Pacific Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: South Asia and Pacific Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Value (US$ Million) Forecast by Production, 2018 to 2033

Table 40: East Asia Volume (Tons) Forecast by Production, 2018 to 2033

Table 41: East Asia Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: East Asia Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 43: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Value (US$ Million) Forecast by Production, 2018 to 2033

Table 46: Middle East and Africa Volume (Tons) Forecast by Production, 2018 to 2033

Table 47: Middle East and Africa Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Middle East and Africa Volume (Tons) Forecast by Product Type, 2018 to 2033

Figure 1: Global Value (US$ Million) by Production, 2023 to 2033

Figure 2: Global Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 9: Global Volume (Tons) Analysis by Production, 2018 to 2033

Figure 10: Global Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 11: Global Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 12: Global Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 14: Global Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Global Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Global Attractiveness by Production, 2023 to 2033

Figure 17: Global Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Attractiveness by Region, 2023 to 2033

Figure 19: North America Value (US$ Million) by Production, 2023 to 2033

Figure 20: North America Value (US$ Million) by Product Type, 2023 to 2033

Figure 21: North America Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 27: North America Volume (Tons) Analysis by Production, 2018 to 2033

Figure 28: North America Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 29: North America Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 30: North America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 31: North America Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 32: North America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 33: North America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 34: North America Attractiveness by Production, 2023 to 2033

Figure 35: North America Attractiveness by Product Type, 2023 to 2033

Figure 36: North America Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Value (US$ Million) by Production, 2023 to 2033

Figure 38: Latin America Value (US$ Million) by Product Type, 2023 to 2033

Figure 39: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 45: Latin America Volume (Tons) Analysis by Production, 2018 to 2033

Figure 46: Latin America Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 47: Latin America Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 48: Latin America Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 50: Latin America Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: Latin America Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: Latin America Attractiveness by Production, 2023 to 2033

Figure 53: Latin America Attractiveness by Product Type, 2023 to 2033

Figure 54: Latin America Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Value (US$ Million) by Production, 2023 to 2033

Figure 56: Western Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 57: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 63: Western Europe Volume (Tons) Analysis by Production, 2018 to 2033

Figure 64: Western Europe Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 65: Western Europe Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 66: Western Europe Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 67: Western Europe Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 68: Western Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Western Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Western Europe Attractiveness by Production, 2023 to 2033

Figure 71: Western Europe Attractiveness by Product Type, 2023 to 2033

Figure 72: Western Europe Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Value (US$ Million) by Production, 2023 to 2033

Figure 74: Eastern Europe Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 81: Eastern Europe Volume (Tons) Analysis by Production, 2018 to 2033

Figure 82: Eastern Europe Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 83: Eastern Europe Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 84: Eastern Europe Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 85: Eastern Europe Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 86: Eastern Europe Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 87: Eastern Europe Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 88: Eastern Europe Attractiveness by Production, 2023 to 2033

Figure 89: Eastern Europe Attractiveness by Product Type, 2023 to 2033

Figure 90: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Value (US$ Million) by Production, 2023 to 2033

Figure 92: South Asia and Pacific Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 99: South Asia and Pacific Volume (Tons) Analysis by Production, 2018 to 2033

Figure 100: South Asia and Pacific Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 101: South Asia and Pacific Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 102: South Asia and Pacific Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 103: South Asia and Pacific Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 104: South Asia and Pacific Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 105: South Asia and Pacific Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 106: South Asia and Pacific Attractiveness by Production, 2023 to 2033

Figure 107: South Asia and Pacific Attractiveness by Product Type, 2023 to 2033

Figure 108: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Value (US$ Million) by Production, 2023 to 2033

Figure 110: East Asia Value (US$ Million) by Product Type, 2023 to 2033

Figure 111: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 117: East Asia Volume (Tons) Analysis by Production, 2018 to 2033

Figure 118: East Asia Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 119: East Asia Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 120: East Asia Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 121: East Asia Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 122: East Asia Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 123: East Asia Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 124: East Asia Attractiveness by Production, 2023 to 2033

Figure 125: East Asia Attractiveness by Product Type, 2023 to 2033

Figure 126: East Asia Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Value (US$ Million) by Production, 2023 to 2033

Figure 128: Middle East and Africa Value (US$ Million) by Product Type, 2023 to 2033

Figure 129: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Value (US$ Million) Analysis by Production, 2018 to 2033

Figure 135: Middle East and Africa Volume (Tons) Analysis by Production, 2018 to 2033

Figure 136: Middle East and Africa Value Share (%) and BPS Analysis by Production, 2023 to 2033

Figure 137: Middle East and Africa Y-o-Y Growth (%) Projections by Production, 2023 to 2033

Figure 138: Middle East and Africa Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Middle East and Africa Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 140: Middle East and Africa Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Middle East and Africa Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Attractiveness by Production, 2023 to 2033

Figure 143: Middle East and Africa Attractiveness by Product Type, 2023 to 2033

Figure 144: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Market Share Insights for Hollow Concrete Blocks Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA