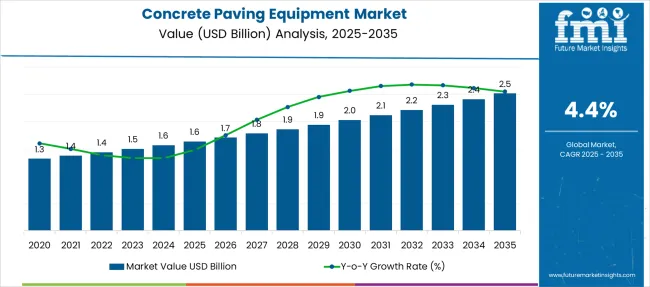

The Concrete Paving Equipment Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. Market observations from 2020 pegged valuations near USD 1.3 billion, outlining gradual yet reliable growth for mechanized paving systems. Infrastructure commitments toward expressways, airport runways, and smart city corridors amplify equipment utilization across Asia-Pacific and North America. Technological refinements in slipform pavers and automation-assisted concrete finishing tools are expected to elevate operational throughput for large-scale contractors. Demand peaks during 2028–2033 as state-backed capital expenditure aligns with urban mobility programs. Key differentiators include machine ergonomics, fuel efficiency, and remote control integration for precision alignment during continuous paving cycles. The aftermarket opportunity remains substantial, driven by recurring maintenance of high-duty paver units and rising preference for modular attachments supporting varied width specifications.

Competitor strategies increasingly revolve around distribution partnerships with regional construction equipment dealers, strengthening service responsiveness. The forward scenario positions sustainability-linked procurement norms and equipment electrification pilots as emerging discussion points, influencing procurement criteria across progressive economies over the forecast horizon.

Growth is fueled by large-scale infrastructure development, urban transit projects, and roadway rehabilitation initiatives where concrete durability outperforms asphalt alternatives. The demand trend remains steady, driven more by government investment cycles and long-term transportation master plans rather than short-term construction spikes.

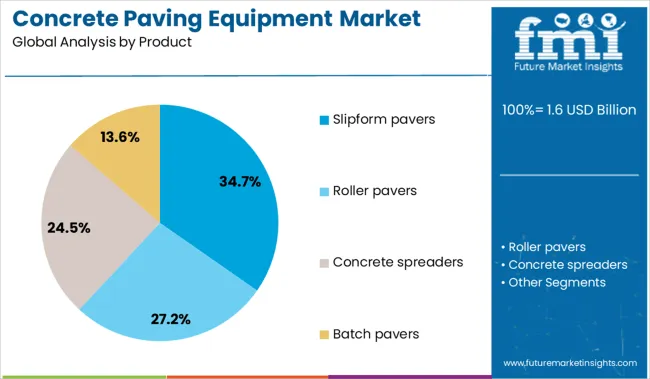

Slipform pavers, with 34.7% share, dominate due to their efficiency in producing continuous, high-quality pavements for highways and airport runways. Regional momentum is strongest in Asia-Pacific, propelled by rapid road network expansion and economic corridors in China and India, while North America focuses on concrete for freeway upgrades and climate-resilient pavements. Europe emphasizes mechanized solutions in urban mobility projects and sustainability-compliant construction.

Emerging innovations are centered on digital paving controls, 3D machine guidance, and telematics integration for predictive maintenance, which can reduce operational downtime. However, challenges such as fluctuating cement prices and emission norms for diesel-powered equipment are prompting OEMs to explore hybrid and electric paving systems.

| Metric | Value |

|---|---|

| Concrete Paving Equipment Market Estimated Value in (2025E) | USD 1.6 billion |

| Concrete Paving Equipment Market Forecast Value in (2035F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The concrete paving equipment market is experiencing a phase of consistent expansion supported by ongoing investments in urban infrastructure, road rehabilitation, and airport runway construction. Increased emphasis on quality surface finishes, precise paving control, and high productivity in large-scale civil projects has made advanced paving equipment integral to modern construction workflows. Technological integration is being accelerated by government-backed digital construction programs and contractor demand for real-time diagnostics, automated steering, and reduced operator fatigue.

Manufacturers are focusing on equipment that offers higher paving accuracy and longer maintenance cycles to reduce operational costs. Environmental standards and fuel consumption norms are also influencing innovation in engine design and hydraulic systems.

With urban expansion continuing globally and public infrastructure remaining a key focus area in emerging markets, demand for high-efficiency paving machines is anticipated to increase across the planning horizon. Continued equipment upgrades and automation will further enable contractors to meet deadlines while adhering to strict quality and regulatory benchmarks.

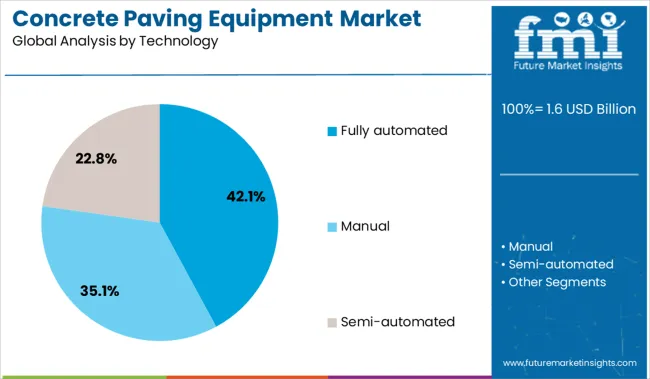

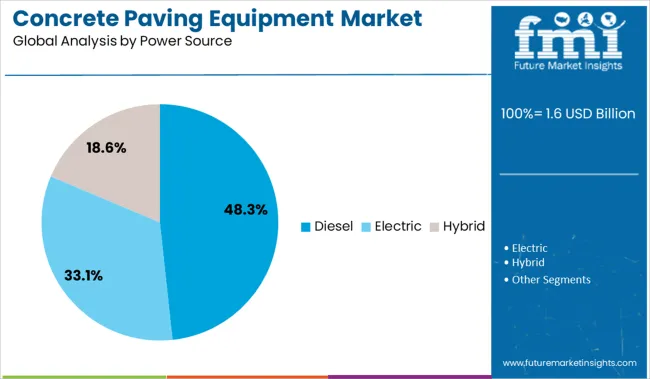

The concrete paving equipment market is segmented by product, technology, power source, application, end user, and region. By product, it includes slipform pavers, roller pavers, concrete spreaders, and batch pavers, each designed for specific paving operations. In terms of technology, the segmentation comprises fully automated, semi-automated, and manual systems, catering to varying levels of mechanization. Based on power source, the market is categorized into diesel, electric, and hybrid-powered equipment, reflecting the shift toward energy-efficient solutions. By application, it spans road construction, residential construction, commercial construction, and other infrastructure projects.

End users include construction companies, rental firms, and government agencies managing large-scale projects. Regionally, the market covers North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Slipform pavers are projected to account for 34.7% of total product-based revenue in 2025, establishing them as the leading equipment type. Their dominance is driven by the ability to achieve consistent surface finish, structural integrity, and high-speed performance on continuous concrete paving projects.

These machines are engineered to handle complex curb and gutter profiles, highway barriers, and wide pavements without the need for extensive formwork, reducing labor costs and setup times. Contractors favor slipform pavers for their capacity to support automated features such as sensor-based guidance systems and material distribution control, which enhance productivity and ensure compliance with engineering specifications.

Increased public infrastructure budgets and requirements for efficient highway construction have further reinforced their adoption. The segment's performance is also supported by OEMs offering modular designs and customizable attachments, making slipform pavers suitable for varied project conditions and reinforcing their dominant market share.

The fully automated segment is expected to command 42.1% of revenue in the technology category by 2025, reflecting growing reliance on intelligent control systems in paving operations. Automation is being prioritized to minimize human error, improve finish accuracy, and enable precise execution of design profiles.

Contractors have increasingly adopted GPS-guided systems, automated screed adjustments, and load-sensing hydraulics to streamline operations and reduce manual intervention. As labor shortages and cost pressures mount, fully automated paving equipment offers a solution that supports higher throughput with fewer skilled operators.

These machines are also capable of real-time data capture and remote diagnostics, allowing site managers to monitor performance and address inefficiencies proactively. In regions with high infrastructure development targets and digital construction mandates, automated systems have become the standard for large-scale paving, supporting the segment's continued growth trajectory.

The diesel-powered segment is forecast to hold 48.3% of total market revenue in 2025 within the power source category, positioning it as the dominant energy platform. Diesel engines remain preferred due to their proven power density, torque characteristics, and durability under heavy-duty construction conditions.

These machines are capable of delivering consistent output in remote and high-load environments, where access to electric infrastructure is limited. In developing regions, diesel-powered paving equipment is essential for projects in off-grid or semi-urban areas, supporting uninterrupted operations across varied terrain.

Manufacturers continue to enhance engine designs for fuel efficiency and emissions compliance, aligning with global environmental regulations. Additionally, the widespread availability of diesel service networks and spare parts supports operational continuity, making diesel the default choice for contractors handling large-scale, time-sensitive concrete paving projects.

Growth in concrete paving equipment has been influenced by increased infrastructure funding, highway repair programs, and the shift toward mechanized construction practices. Equipment demand has remained strong in both developed and developing nations, where urban transport networks, airport runways, and industrial zones require durable surfacing. Automation, precision control systems, and fuel-efficient engines have enhanced machine reliability, productivity, and operator safety, supporting long-term adoption across public and private projects.

Investment in concrete paving machinery has been supported by rising public expenditure on roads, highways, and logistics corridors. National and regional governments have prioritized road modernization projects to improve vehicular flow, reduce maintenance costs, and support economic development. Concrete’s longer service life and structural integrity, especially in high-traffic zones, have driven its selection over flexible pavement alternatives.

This trend has led to strong adoption of slip form pavers, texture cure machines, and automated curb & gutter systems. Federal infrastructure packages in the USA, highway tenders in India, and EU transport funds have all contributed to machine procurement.

Project developers have increasingly sought equipment that offers GPS integration, automated depth control, and reduced downtime. The push for mechanization in public works has created sustained demand for concrete paving systems with higher throughput and improved operator ergonomics.

Opportunities in the concrete paving equipment sector have emerged through automation integration and the development of digital control platforms. OEMs have invested in paving systems equipped with 3D machine control, remote diagnostics, and data logging for quality assurance. This has improved project traceability and ensured alignment with evolving construction codes and ESG standards.

Simultaneously, rental models have been expanded to improve access for mid-sized contractors, municipal authorities, and emerging market developers. Compact pavers and modular machines are being preferred for urban environments and narrow corridors, especially in renovation or infill projects.

Equipment-as-a-service platforms and predictive maintenance programs are also gaining interest, reducing ownership barriers and lifecycle costs. Markets in Southeast Asia, Africa, and Eastern Europe are witnessing rising bids for durable paving equipment, driven by regional development banks and public-private partnerships targeting transport resilience.

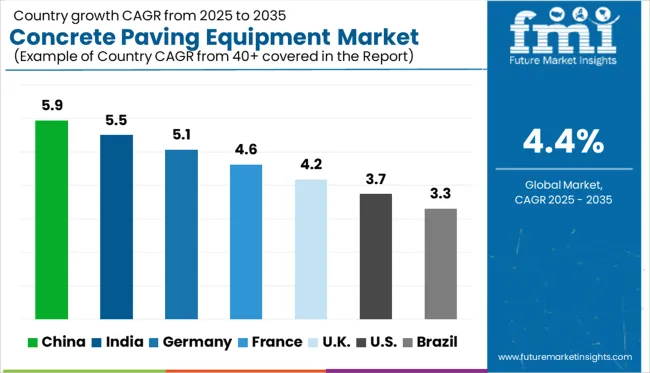

| Countries | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global concrete paving equipment market is projected to grow at a 4.4% CAGR from 2025 to 2035, driven by demand for road durability, accelerated infrastructure execution, and rising mechanization in public projects. China leads with 5.9%, supported by large-format highway development, hybrid machine upgrades, and integration of remote diagnostics in equipment.

India follows at 5.5%, driven by expressway rollout, leasing models in emerging zones, and mechanized paving in national and state-level initiatives. Germany records 5.1%, with demand shaped by autobahn reinforcement, BIM-integrated pavers, and smart resurfacing tools.

France posts 4.6%, reflecting a focus on night-compatible and low-emission machines across suburban and intercity projects. The United Kingdom grows at 4.2%, emphasizing durable slipform usage in logistics corridors and council-funded site access roads. These five countries highlight both volume-led growth in developing regions and technology-intensive modernization across OECD economies, based on a broader 40+ country review.

China is projected to expand at a CAGR of 5.9%, led by large-scale infrastructure rehabilitation and expansion of highway networks in secondary provinces. Provincial-level investments in road widening, bridge surfacing, and expressway renovation are creating consistent demand for slipform pavers and automatic screening machines.

Domestic manufacturers are introducing modular machines equipped with laser-guided controls and remote diagnostics. High-speed rail corridors and logistics-focused industrial zones are prioritizing concrete durability over asphalt due to lifecycle cost savings.

Provincial subsidies for machinery upgrades have also enhanced the adoption of fuel-efficient and hybrid paving models. Concrete paving equipment is being treated as a strategic enabler in long-term public infrastructure spending, particularly where asphalt degradation remains a concern.

India is expected to register a CAGR of 5.5%, supported by demand from expressway corridors, border infrastructure, and airport runway development. National highway expansion plans under Bharatmala and PM Gati Shakti schemes have amplified the deployment of concrete slipform pavers and curb casting machines.

State-level public works departments are shifting toward mechanized paving to reduce completion timelines and labor dependency. Equipment manufacturers are partnering with EPC contractors to offer leasing models and maintenance services, encouraging adoption across Tier II and peripheral regions. The industry is being influenced by the need to achieve higher per-day concrete placement rates while maintaining quality, especially in flood-prone and high-load-bearing zones.

Germany is forecast to grow at a CAGR of 5.1%, driven by climate-resistant road engineering, smart city redevelopment, and autobahn upgrades. Concrete slipform equipment is being deployed to meet durability standards for high-volume traffic zones.

Public infrastructure tenders increasingly require automation-enabled paving systems integrated with BIM platforms. Domestic OEMs are advancing toward fully electric pavers with GPS-guided screeding and edge profiling. A shift toward prefabricated slab placements in industrial estates and logistics parks is also influencing demand for compact, mobile pavers. Germany’s emphasis on minimizing roadwork disruption has resulted in multi-functional equipment being prioritized in federal procurement frameworks, particularly in urban renewal corridors.

France is projected to grow at a CAGR of 4.6%, with demand shaped by regional rail redevelopment, peri-urban highway refurbishments, and logistics hub expansion. Equipment usage is increasing in suburban bypass upgrades and intercity link modernization, where jointless concrete roads are replacing older bitumen layers.

National tenders are emphasizing emission control, prompting contractors to select fuel-optimized, low-noise machines. Public procurement is favoring units capable of working in night shifts and narrow corridors, where mobility and precision are critical. France’s mid-sized equipment rental market is evolving, with concrete paver leasing growing in small and medium municipalities facing budget constraints for direct ownership.

The United Kingdom is projected to grow at a CAGR of 4.2%, led by demand from logistics corridors, HS2-associated feeder roads, and intermodal hubs. Infrastructure contractors are favoring slipform paving for median barriers, road shoulders, and site-access lanes. High specification requirements in regulatory frameworks have pushed suppliers to offer machines with onboard sensors, variable-width screeds, and integrated curing systems.

Local councils and transport bodies are targeting asset longevity, with concrete seen as a preferred choice for industrial park access routes and flood-prone roads. While overall highway investments remain moderate, niche deployments of high-performance pavers are being prioritized in constrained projects requiring long-life cycle solutions.

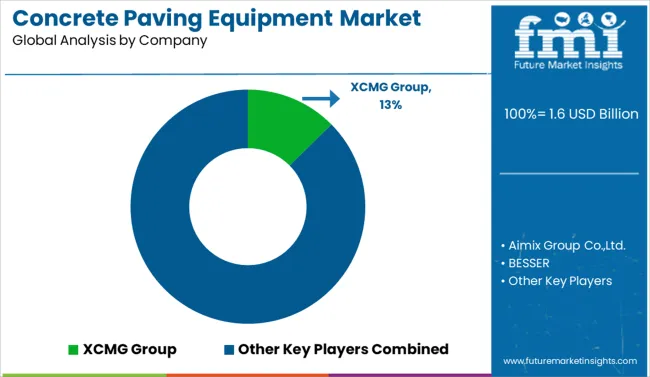

The concrete paving equipment industry is led by XCMG Group with a 12.6% market share, supported by its expansive portfolio of slipform pavers, batching systems, and global project integration. Wirtgen Group and Caterpillar maintain dominant positions in road construction through high-output pavers and automated screeds.

Bid-Well (Terex), Gomaco, and Guntert & Zimmerman focus on bridge deck and canal pavers, favored in infrastructure-heavy regions. Curb Fox and Power Curbers specialize in curb-and-gutter machines, while SCHWING Stetter and Aimix Group cater to cost-sensitive markets with compact and mobile pavers.

BESSER and CMI Roadbuilding emphasize modularity and precision, supporting airport and expressway projects. Competitive dynamics now revolve around grade control systems, mix consistency, jobsite automation, and adaptability to diverse concrete formulations.

Key Developments in the Concrete Paving Equipment Market

Companies are focusing on developing electric and hybrid-powered pavers to address emission norms and improve efficiency in urban environments. Slipform pavers continue to dominate due to their versatility, while automated paving systems are being adopted for higher precision and productivity. Players are expanding into Asia-Pacific markets, leveraging large-scale infrastructure and smart city projects as growth drivers. Strategic moves also include upgrading product portfolios with advanced control technologies, enhancing operator safety, and forming partnerships with contractors for long-term fleet integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product | Slipform pavers, Roller pavers, Concrete spreaders, and Batch pavers |

| Technology | Fully automated, Manual, and Semi-automated |

| Power Source | Diesel, Electric, and Hybrid |

| Application | Road construction, Commercial construction, Others, and Residential construction |

| End User | Construction companies, Rental companies, and Government agencies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | XCMG Group, Aimix Group Co.,Ltd., BESSER, Bid-Well (Terex Corporation), Caterpillar, CMI Roadbuilding Inc., Curb Fox, Fayat Group, Gomaco Corporation, Guntert & Zimmerman, HEM Paving Equipment, Power Curbers Companies LLC, SANY Group, SCHWING Stetter India, and Wirtgen Group |

| Additional Attributes | Dollar sales are segmented by equipment type such as concrete pavers, slipform machines, screeds, and curb-and-gutter systems with ride-on pavers gaining market share. Demand is rising for GPS-guided automation, fast cycle times, and modular attachments for varied paving tasks. OEMs and contract manufacturers provide turnkey fleets. Adoption is strongest in North America and Europe, driven by infrastructure renewal and precision-driven urban projects. |

The global concrete paving equipment market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the concrete paving equipment market is projected to reach USD 2.5 billion by 2035.

The concrete paving equipment market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in concrete paving equipment market are slipform pavers, roller pavers, concrete spreaders and batch pavers.

In terms of technology, fully automated segment to command 42.1% share in the concrete paving equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA