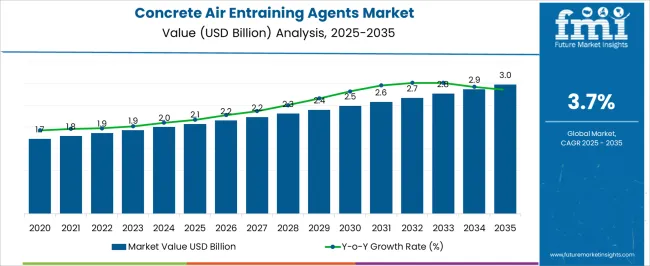

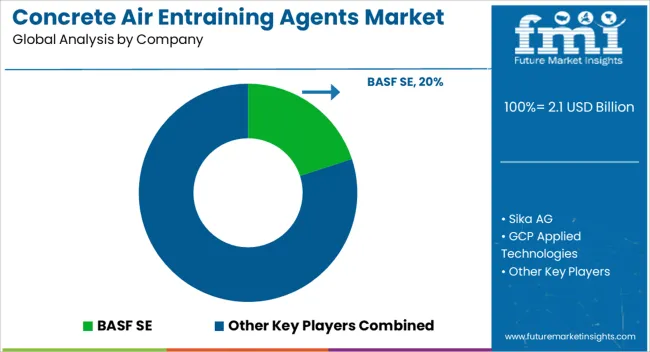

The concrete air entraining agents market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

Over the span of 10 years, the market demonstrates a gradual but consistent trajectory, starting from USD 1.7 billion in the pre-2025 phase and maintaining incremental growth throughout the forecast. The first half of the decade (2025–2030) sees values shift modestly from USD 2.0 billion to around USD 2.5 billion, underscoring the sector’s reliance on infrastructure upgrades, particularly in emerging economies where durability and longevity in concrete structures remain top priorities. In contrast, the latter half of the decade (2030–2035) advances more firmly from USD 2.5 billion to USD 3.0 billion, fueled by stricter building codes, heightened demand for freeze-thaw resistance, and increasing adoption of sustainability practices in concrete formulations.

Unlike more volatile construction inputs, air entraining agents sustain demand through their role in enhancing workability and reducing maintenance costs for roads, bridges, and urban housing. This balance of technical necessity and regulatory push not only secures a stable market environment but also signals broader opportunities in green building certifications and public infrastructure modernization programs that are likely to sustain momentum through 2035.

| Metric | Value |

|---|---|

| Concrete Air Entraining Agents Market Estimated Value in (2025 E) | USD 2.1 billion |

| Concrete Air Entraining Agents Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The concrete air entraining agents market holds an essential position within the global construction chemicals ecosystem, representing about 26–28% share of the broader concrete admixtures segment due to its crucial role in improving freeze-thaw resistance and enhancing durability. Within the specialty admixtures category, air entraining agents contribute nearly 20–22%, supported by their widespread use in roadways, bridges, and high-strength infrastructure exposed to harsh climatic conditions. In the ready-mix concrete domain, they account for around 17–19% share, as batching plants integrate these agents to optimize workability and long-term performance. Within the residential and commercial construction space, their share stands close to 13–15%, where demand is fueled by rising emphasis on structural integrity and extended service life of buildings.

Growth momentum is being influenced by increasing adoption in emerging markets, where infrastructure investments are expanding rapidly, as well as stricter quality standards across developed economies. Leading chemical manufacturers are focusing on performance-based formulations that deliver controlled air voids, reducing permeability and improving concrete resilience. While higher raw material costs and fluctuating construction activity remain key restraints, adoption is expected to remain strong due to the absence of equivalent alternatives that provide comparable durability benefits. With ongoing R&D in eco-compatible formulations and region-specific blends, air entraining agents continue to strengthen their role as a cornerstone in modern concrete applications worldwide.

The market is experiencing consistent expansion, driven by the rising demand for durable concrete solutions in infrastructure and construction projects. Increasing focus on improving concrete workability, freeze-thaw resistance, and overall structural longevity has accelerated the adoption of air-entraining agents across various applications.

The industry is benefiting from the surge in urban development projects, government investments in infrastructure, and the growing need for sustainable construction practices. Technological advancements in formulation have enabled manufacturers to develop agents with improved compatibility and performance, supporting diverse environmental conditions.

The market outlook remains strong, as the construction sector continues to prioritize high-performance materials that reduce maintenance costs and extend service life Additionally, the adoption of advanced admixture technologies in both residential and commercial projects is expected to drive further growth, with regulatory support for quality and durability standards reinforcing long-term demand for air-entraining agents.

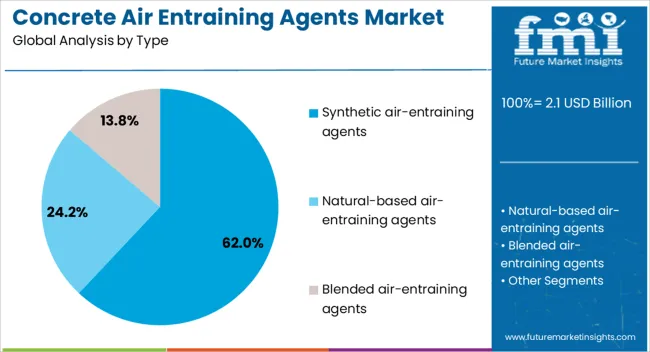

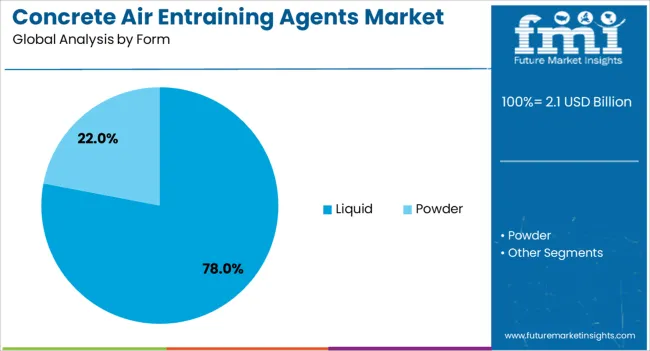

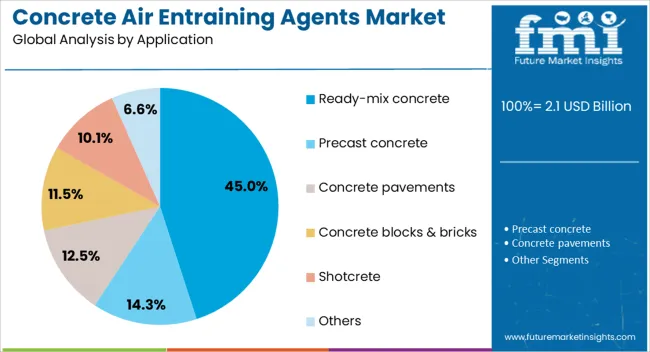

The concrete air entraining agents market is segmented by type, form, application, end use industry, and geographic regions. By type, concrete air entraining agents market is divided into synthetic air-entraining agents, natural-based air-entraining agents, and blended air-entraining agents. In terms of form, concrete air entraining agents market is classified into liquid and powder. Based on application, concrete air entraining agents market is segmented into ready-mix concrete, precast concrete, concrete pavements, concrete blocks & bricks, shotcrete, and others. By end use industry, concrete air entraining agents market is segmented into infrastructure development, residential construction, commercial construction, roads & highways, bridges & dams, airports & ports, others, and industrial construction. Regionally, the concrete air entraining agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic air-entraining agents segment is projected to hold 62% of the concrete air entraining agents market revenue share in 2025, making it the leading type. This dominance has been driven by the superior stability, controlled air content, and enhanced performance characteristics offered by synthetic formulations. These agents have been preferred for their consistency in delivering uniform air distribution in concrete mixes, leading to improved freeze-thaw resistance and reduced risk of scaling. The segment's growth has also been supported by the ability of synthetic agents to adapt to different cement compositions and environmental conditions, ensuring reliable results across a wide range of applications. Manufacturers have invested in refining synthetic blends to improve efficiency and minimize dosage requirements, contributing to cost savings in large-scale projects The combination of performance reliability, adaptability, and cost-effectiveness has positioned synthetic air-entraining agents as the most widely adopted solution in the industry, securing their leading position in the market.

The liquid form segment is expected to account for 78% of the market revenue share in 2025, establishing itself as the dominant form. This leadership position has been attributed to the ease of handling, accurate dosing, and quick dispersion properties of liquid formulations. The widespread adoption of liquid forms has been reinforced by their compatibility with automated batching systems, enabling precise integration into the concrete mix. Their ability to deliver consistent performance across varying production scales has made them highly preferred in both ready-mix and precast operations. The segment has also benefited from advancements in formulation technology, which have enhanced stability during storage and ensured uniform performance under diverse climatic conditions. The liquid form’s efficiency in achieving desired air content without extensive mixing adjustments has further strengthened its market share As production facilities continue to prioritize efficiency, precision, and reliability, the liquid form is expected to retain its dominant role in the industry.

The ready-mix concrete segment is anticipated to hold 45% of the market revenue share in 2025, positioning it as the leading application. The segment's growth has been fueled by the widespread use of ready-mix concrete in large-scale infrastructure, commercial, and residential construction projects. Air-entraining agents have been extensively adopted in this segment to enhance durability, improve workability, and provide resistance to freeze-thaw cycles, which are critical for long-term performance. The centralized production of ready-mix concrete has facilitated the precise incorporation of agents, ensuring consistent quality across batches. This approach reduces on-site variability and supports compliance with stringent building standards. The segment has also been supported by increasing demand for time-efficient construction solutions, as ready-mix concrete allows faster project execution The combination of quality assurance, durability enhancement, and operational efficiency has solidified the dominance of air-entraining agents in ready-mix applications, ensuring continued growth for this segment.

The concrete air entraining agents industry is shaped by infrastructure expansion, performance advantages, regulatory standards, and cost challenges. Growth remains strong as these admixtures play a critical role in delivering durable and compliant concrete structures.

The concrete air entraining agents industry is experiencing notable growth as large-scale infrastructure projects expand globally. Governments are investing heavily in highways, bridges, airports, and smart city initiatives, which require concrete mixes that can withstand harsh weather conditions. Air entraining agents improve freeze-thaw durability, reduce cracking, and enhance long-term performance, making them indispensable for modern infrastructure. Their use ensures cost savings over time by lowering maintenance requirements and increasing structural reliability. Emerging economies are becoming central to this demand shift as construction intensity rises. This adoption pattern underscores the critical role of air entraining agents in supporting resilient infrastructure and ensuring that concrete structures meet performance and longevity requirements.

Concrete air entraining agents are gaining wider acceptance due to their proven performance benefits across construction applications. By creating microscopic air bubbles within concrete, these agents improve workability, reduce segregation, and provide resistance against moisture-related damage. This functionality has driven adoption in both commercial and residential sectors where durability and ease of placement are key considerations. Construction firms see added value in using these agents to meet project specifications and deliver structures with longer service life. Their compatibility with other admixtures further enhances concrete performance, allowing tailored formulations for specific projects. This blend of functional efficiency and adaptability has cemented their importance in the construction chemicals portfolio.

The role of concrete air entraining agents is being reinforced by regulatory standards emphasizing durability, quality assurance, and compliance in construction practices. Governments and industry bodies are mandating the use of admixtures that enhance structural integrity and reduce long-term deterioration, particularly in public infrastructure projects. This regulatory backing has increased reliance on air entraining agents across developed and emerging markets. Certifications, testing protocols, and quality benchmarks have also influenced procurement decisions, encouraging adoption among contractors seeking compliance. With regulations becoming more stringent over time, manufacturers are aligning product offerings to meet these evolving standards. This trend highlights how compliance-driven adoption continues to expand market penetration significantly.

The concrete air entraining agents industry faces challenges due to fluctuating raw material costs and pricing pressures. Manufacturers often deal with volatility in chemical inputs, which directly impacts production economics. Smaller contractors in price-sensitive regions may be hesitant to adopt these admixtures when budgets are tight, limiting penetration in some markets. Competition from alternative additives and substitute construction practices also creates obstacles. Producers are focusing on optimizing supply chains and developing cost-efficient formulations to address these hurdles. While cost pressures remain a constraint, the performance benefits and regulatory support ensure continued demand. Addressing pricing barriers will be key to wider adoption across global markets.

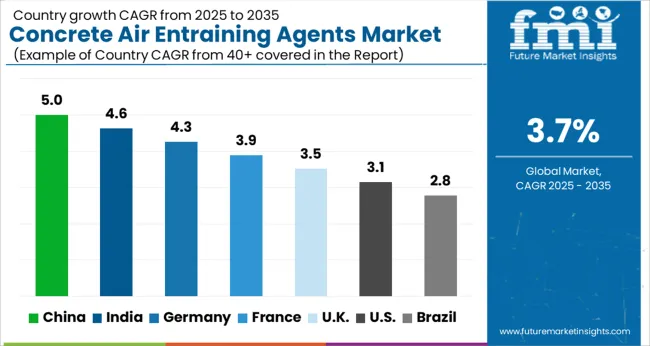

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The concrete air entraining agents market is projected to expand globally at a CAGR of 3.7% from 2025 to 2035, supported by infrastructure investments, quality-driven concrete usage, and regulatory focus on long-term durability. China leads with a CAGR of 5.0%, fueled by massive construction programs, highway expansion, and the widespread adoption of admixtures to withstand freeze-thaw cycles. India follows at 4.6%, supported by rising infrastructure spending, smart city projects, and the adoption of advanced admixtures in both residential and commercial construction. France records 3.9%, shaped by strong regulatory frameworks and the use of performance-based admixtures in public infrastructure. The United Kingdom achieves 3.5%, influenced by urban redevelopment and the need for durable concrete in bridges, tunnels, and heritage projects. The United States posts 3.1%, reflecting a mature construction sector with demand largely driven by repair, maintenance, and compliance requirements. This outlook highlights Asia as the fastest-growing hub for air entraining agents, Europe as a compliance-driven region, and North America as a mature but steady market shaped by refurbishment needs and performance standards.

China is expected to post a CAGR of 5.0% for 2025–2035, higher than the 4.3% estimated during 2020–2024, outpacing the global average of 3.7%. This progression is largely driven by large-scale infrastructure development, high-speed rail expansion, and increased focus on concrete durability in regions exposed to freeze-thaw cycles. During the earlier period, adoption was steady but limited by regional variations in admixture penetration. The stronger rise reflects widespread government-backed investment in urban infrastructure and stricter quality standards in public works. With stronger emphasis on cost efficiency and durability, air entraining agents have secured higher relevance in China’s expanding construction ecosystem.

India is forecasted to achieve a CAGR of 4.6% for 2025–2035, compared with about 4.0% observed between 2020–2024, higher than the global benchmark of 3.7%. The initial years saw gradual integration of admixtures in select metro and highway projects. The improvement in the next phase is linked to broader adoption across smart city initiatives, rural infrastructure, and commercial real estate expansion. Regional concrete producers are adopting admixtures to meet evolving standards of quality and strength. As the government invests heavily in both rural and urban infrastructure, demand for air entraining agents continues to expand, positioning India as a key growth market.

France is projected to record a CAGR of 3.9% during 2025–2035, rising from nearly 3.3% achieved in 2020–2024, marginally above the global rate of 3.7%. The earlier period reflected steady adoption in civil projects and residential builds under compliance-driven frameworks. The improved pace in the later phase is due to enhanced demand for durable concrete in public infrastructure, tunnels, and bridges, aligned with EU construction directives. National focus on quality assurance has also promoted higher integration of air entraining agents. France’s position demonstrates balanced growth where regulatory support, structural durability needs, and advanced admixture applications drive long-term adoption.

The United Kingdom is forecasted to achieve a CAGR of 3.5% for 2025–2035, higher than the approximate 2.9% seen in 2020–2024, compared with the global rate of 3.7%. The earlier period reflected slower adoption linked to cost sensitivity and selective usage in key infrastructure. The rise in the next phase is explained by wider adoption in heritage restoration, tunnel networks, and bridge durability projects under government quality mandates. Integration of admixtures into both new builds and repair works has improved adoption levels. This increase indicates stronger reliance on performance-based admixtures, helping the UK move closer to the global benchmark.

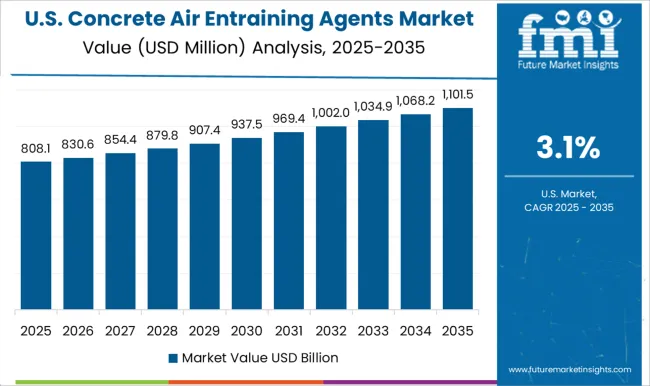

The United States is expected to post a CAGR of 3.1% during 2025–2035, compared with about 2.7% in 2020–2024, reflecting a modest but steady rise below the global 3.7% rate. Earlier adoption was primarily driven by replacement projects in roadways and selective federal contracts. The improved outlook is supported by higher demand in maintenance programs, retrofitting of bridges, and durability upgrades in critical infrastructure. Although the market is mature, replacement cycles and regulatory standards are sustaining growth. The marginal increase demonstrates the country’s reliance on long-term refurbishment rather than large-scale new projects, keeping expansion consistent but moderate.

The concrete air entraining agents market is dominated by a mix of global chemical companies and specialized construction solution providers. BASF SE remains a leader, leveraging its strong construction chemicals portfolio and extensive distribution networks to deliver high-performance admixtures for infrastructure and commercial projects. Sika AG maintains a prominent position with innovations in admixture formulations that improve durability and workability of concrete in diverse climatic conditions. GCP Applied Technologies strengthens its competitive edge by offering air entraining products integrated into broader concrete admixture solutions, widely adopted in ready-mix and precast concrete applications. RPM International, through its subsidiaries, plays a significant role by providing specialized construction chemicals tailored for regional markets and long-term durability requirements.

Fosroc is a key competitor, known for its broad construction chemicals expertise and focus on infrastructure-driven markets in Asia, the Middle East, and Africa. Mapei enhances its presence through strong penetration in European and North American markets, delivering admixtures suited to residential, commercial, and industrial construction. CHRYSO, along with regional firms like CICO and Rhein-Chemotechnik, adds further depth by catering to localized construction practices and offering customized admixture formulations. The competitive dynamics are defined by product performance, regulatory compliance, and adaptability to diverse construction conditions. Strategies pursued by these players include investments in R&D for eco-compatible formulations, regional expansion in emerging economies, and partnerships with concrete producers to secure long-term contracts. Collectively, these companies differentiate through scale, innovation, and technical support, ensuring continued relevance in the evolving global construction chemicals industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Type | Synthetic air-entraining agents, Natural-based air-entraining agents, and Blended air-entraining agents |

| Form | Liquid and Powder |

| Application | Ready-mix concrete, Precast concrete, Concrete pavements, Concrete blocks & bricks, Shotcrete, and Others |

| End Use Industry | Infrastructure development, Residential construction, Commercial construction, Roads & highways, Bridges & dams, Airports & ports, Others, and Industrial construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Sika AG, GCP Applied Technologies, RPM International (including subsidiaries), Fosroc, Mapei, and Rhein-Chemotechnik |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive landscape, raw material costs, regulatory impact, infrastructure growth drivers, and adoption in ready-mix and precast concrete. |

The global concrete air entraining agents market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the concrete air entraining agents market is projected to reach USD 3.0 billion by 2035.

The concrete air entraining agents market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in concrete air entraining agents market are synthetic air-entraining agents, alkyl aryl sulfonates, and others.

In terms of form, liquid segment to command 78.0% share in the concrete air entraining agents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA