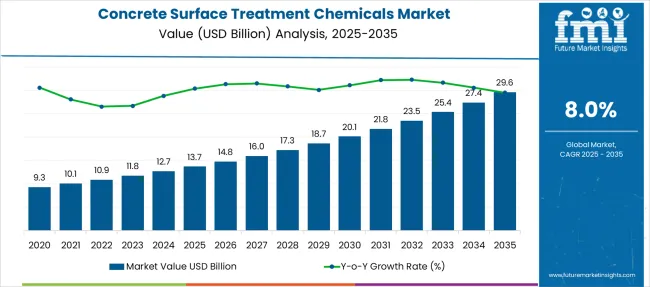

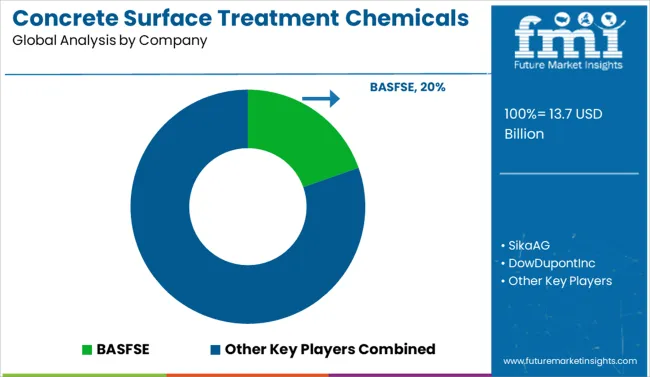

The Concrete Surface Treatment Chemicals Market is estimated to be valued at USD 13.7 billion in 2025 and is projected to reach USD 29.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Concrete Surface Treatment Chemicals Market Estimated Value in (2025E) | USD 13.7 billion |

| Concrete Surface Treatment Chemicals Market Forecast Value in (2035F) | USD 29.6 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The concrete surface treatment chemicals market is witnessing a steady upward trajectory driven by increasing demand for long-lasting construction solutions, particularly in urban and semi-urban settings. As infrastructure projects expand globally, the emphasis on enhancing the durability, strength, and water resistance of concrete has intensified. Concrete surface treatment chemicals are being widely utilized to extend service life, minimize maintenance costs, and protect against environmental degradation.

Regulatory bodies and government agencies are setting higher standards for concrete quality, leading to increased adoption of specialized surface treatment compounds that comply with these evolving norms. Advancements in formulation technologies are also contributing to wider usage across residential, commercial, and industrial projects.

The construction industry's ongoing transition toward sustainable practices and smart material use is paving the way for product innovation and strategic partnerships among manufacturers. As real estate investment and infrastructure modernization gain momentum across developing economies, demand for performance-enhancing concrete additives is projected to remain robust, positioning the market for consistent growth.

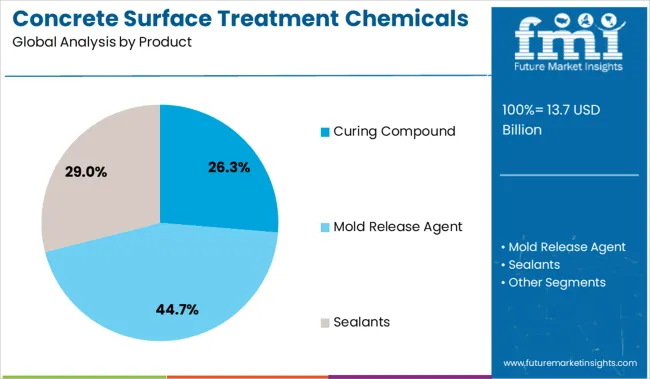

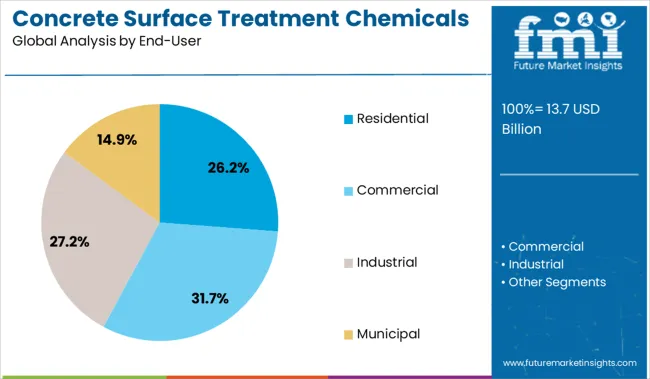

The concrete surface treatment chemicals market is segmented by product, end-user, and geographic regions. The concrete surface treatment chemicals market is divided into Curing Compound, Mold Release Agent, Sealants, and Others. In terms of end-users, the concrete surface treatment chemicals market is classified into Residential, Commercial, Industrial, and Municipal. Regionally, the concrete surface treatment chemicals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The curing compound subsegment is expected to account for 26.3% of the total revenue share in the product category in 2025, making it the leading product type in the market. This leadership is driven by the essential role curing compounds play in enhancing concrete hydration, minimizing cracking, and improving overall structural integrity. These compounds are widely utilized in both horizontal and vertical construction applications where consistent moisture retention during the curing phase is critical.

The ease of application and compatibility with various surface types have contributed to the widespread adoption of curing compounds across residential, commercial, and infrastructure projects. Additionally, curing compounds help improve concrete resistance to abrasion and environmental stress, making them particularly valuable in regions exposed to extreme temperatures or heavy usage.

Regulatory emphasis on ensuring structural durability and reducing construction defects has further solidified their role in project specifications. As awareness of long-term concrete performance grows among contractors and engineers, the demand for high-quality curing solutions is expected to remain elevated.

The residential end-user segment is projected to capture 26.2% of the total market revenue in 2025, positioning it as a leading contributor within the end-user category. This segment’s growth is being supported by the global expansion of housing projects, particularly in developing regions where urbanization and population growth are accelerating demand for cost-efficient and durable construction materials.

Concrete surface treatment chemicals are increasingly being integrated into residential construction to enhance aesthetics, protect structural surfaces, and reduce long-term maintenance. Products such as sealers, curing compounds, and hardeners are being adopted for their ability to improve surface finish and extend the usable life of flooring, driveways, and exterior walls.

Homebuilders and contractors are also responding to rising homeowner expectations for quality and sustainability by incorporating advanced treatment chemicals that comply with green building codes. The scalability and versatility of these chemicals have made them suitable for varied residential formats, from affordable housing units to premium villas, supporting their sustained use across diverse residential construction projects.

Concrete surface treatment chemicals are gaining traction due to rising construction activity and stringent structural standards, driving demand for sealers and curing compounds. Increasing preference for multifunctional, performance-based formulations with durability, aesthetic benefits, and easy application is shaping future product strategies.

The market for concrete surface treatment chemicals is influenced by increasing requirements in large-scale construction and repair projects. These chemicals are utilized for sealing, curing, and protecting concrete surfaces, ensuring durability under environmental stress. Rapid expansion in residential and commercial construction projects has created a substantial demand for protective coatings, sealers, and curing compounds. Regulatory emphasis on structural quality standards has further strengthened the usage of these chemicals. It is believed that manufacturers will continue focusing on product formulations that provide improved resistance against moisture penetration and surface wear, as these characteristics remain critical for extending the lifecycle of concrete structures and maintaining long-term performance in harsh climatic conditions.

Another significant dynamic in this market is the growing preference for performance-oriented formulations with multifunctional benefits. Customers are choosing solutions that not only improve surface hardness but also enhance aesthetic appeal through dust-proof and stain-resistant properties. The increasing popularity of polished concrete in industrial and commercial facilities is driving the adoption of specialized treatments that offer gloss retention and slip resistance. Chemical suppliers are expected to emphasize advanced polymer blends and eco-compatible ingredients to capture demand from projects focused on long-term operational efficiency. It is viewed as essential for vendors to develop products that ensure easy application while delivering superior bonding and durability characteristics.

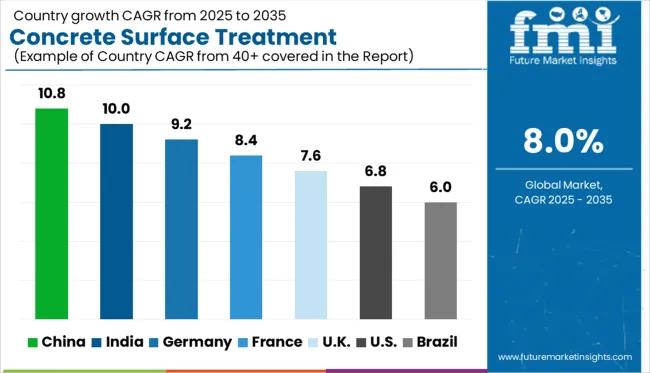

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

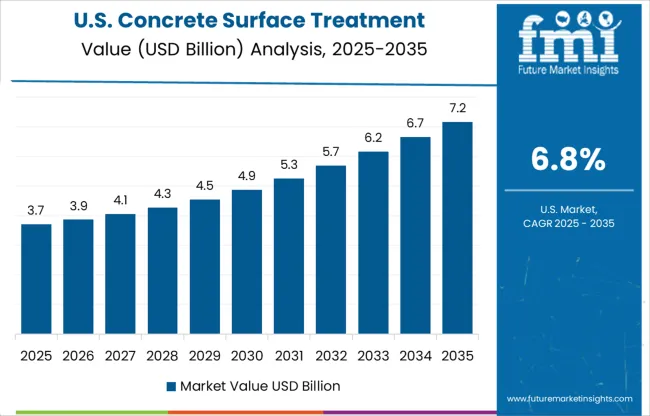

| USA | 6.8% |

| Brazil | 6.0% |

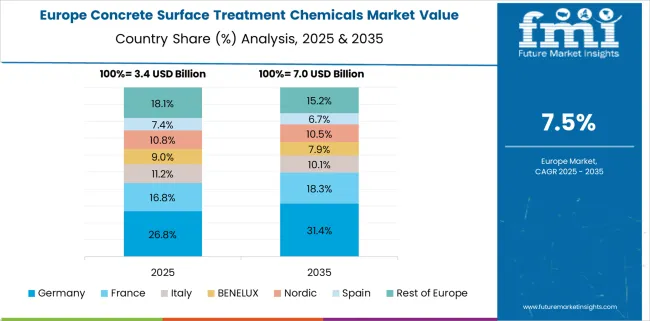

The concrete surface treatment chemicals market, projected to expand at a global CAGR of 8.0% from 2025 to 2035, is exhibiting strong regional variations. China, a BRICS member, is expected to lead with a 10.8% CAGR, supported by extensive infrastructure investments and large-scale urban construction initiatives. India follows with a 10.0% CAGR, driven by accelerated housing development and industrial expansion that require surface curing and protection solutions. Germany, an OECD country, is forecast to grow at 9.2%, driven by demand for high-performance coatings in commercial projects and strict building quality standards. The United Kingdom shows a 7.6% CAGR, reflecting steady adoption of advanced sealers in renovation activities. The United States records a 6.8% CAGR, indicating a mature market with consistent demand in both residential and industrial sectors. The report includes insights into 40+ countries, while the top five have been highlighted for reference.

The CAGR of the USA market increased from nearly 5.9% during 2020–2024 to 6.8% in 2025–2035, attributed to gradual modernization in infrastructure maintenance and steady demand in residential renovations. Growth in earlier years was moderate due to the reliance on conventional treatment solutions and budget constraints in municipal projects. The next decade indicates acceleration as stricter building codes are expected to push the adoption of curing agents, sealers, and hardeners. Expansion of industrial flooring refurbishments and warehousing projects is anticipated to create new requirements for advanced treatment solutions. Increased focus on energy-efficient construction and operational longevity has strengthened the role of high-performance coatings in commercial spaces.

The CAGR for the UK improved from around 6.4% in 2020–2024 to 7.6% during 2025–2035, primarily due to regulatory-driven improvements in structural durability standards. Earlier growth was restricted by dependence on imported formulations and fluctuating project approvals. The current trend favors higher adoption of advanced sealers and curing compounds as the refurbishment of commercial buildings gains priority. Government-backed urban renewal initiatives and investments in public housing are fostering wider application of dust-proof and slip-resistant treatments. Contractors are adopting polymer-modified solutions for enhanced protection against moisture ingress, aligning with modern performance benchmarks. Manufacturers are introducing easy-application liquid formulations, reinforcing contractor preference for high productivity on-site.

Germany’s CAGR increased from 8.3% in 2020–2024 to 9.2% across 2025–2035, supported by industrial expansion and stringent compliance standards in construction. Earlier years saw strong uptake of curing and sealing compounds in infrastructure development programs, with private housing acting as a secondary driver. Current momentum is shaped by regulatory norms prioritizing durability and energy efficiency across structures. Performance-based formulations integrating advanced polymer components are being sought for flooring in commercial and logistics facilities. Contractors view hardeners and moisture-resistant sealers as critical to lifecycle cost optimization, fueling supplier competition in premium-grade products. Digital platforms for procurement are also enhancing distribution reach among mid-sized builders and contractors.

China experienced a rise in CAGR from 9.7% during 2020–2024 to 10.8% for 2025–2035, driven by sustained infrastructure investments and rapid expansion of transport corridors. Previous growth was influenced by mega residential projects and government-funded housing schemes across Tier 2 and Tier 3 cities. The forward period projects accelerated consumption as smart city programs and large-scale urban redevelopment initiatives create a surge in demand for high-performance coatings and curing agents. Domestic suppliers are strengthening portfolios to compete with international brands through cost-effective products designed for mass application. Regional clusters are emphasizing formulations with superior abrasion resistance, suitable for heavy-duty industrial flooring.

The CAGR in India rose from 8.8% in 2020–2024 to 10.0% for the 2025–2035 period, underpinned by accelerated growth in real estate and industrial warehousing. Earlier years showed consistent expansion linked to housing demand and regional infrastructure projects, but limited adoption of premium-grade coatings restricted value growth. Anticipated future performance is anchored on government-backed smart infrastructure and commercial zone development, which will require advanced curing, sealing, and surface protection solutions. Market participants are expanding capacity for polymer-modified formulations to cater to industrial flooring and heavy-load applications. Distribution partnerships with large contractors and local builders are emerging as a priority for enhancing supply chain responsiveness.

In the concrete surface treatment chemicals market, top companies are concentrating on performance-driven formulations, advanced curing technologies, and eco-compatible sealers to meet stringent structural durability requirements. BASF SE and Sika AG are leading players emphasizing polymer-modified solutions and high-penetration sealers designed for industrial and commercial flooring. DowDuPont Inc. and Henkel Corporation focus on easy-application liquid products and moisture-resistant coatings tailored to accelerate project timelines while maintaining quality benchmarks. The Euclid Chemical Company and AkzoNobel Chemicals AG are expanding portfolios to include hardeners, water repellents, and protective coatings aligned with energy-efficient construction practices and extended lifecycle performance. Arkema and Laticrete International Inc. are gaining traction in customized applications, such as decorative concrete treatments and slip-resistant finishes for public infrastructure projects. Croda International Plc is strengthening its footprint by offering specialty additives that enhance bonding efficiency and improve surface aesthetics for large-scale architectural developments.

In June 2025, Sika AG's strategic expansion was announced through new manufacturing investments in China, Brazil, and Morocco.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.7 Billion |

| Product | Curing Compound, Mold Release Agent, Sealants, and Others |

| End-User | Residential, Commercial, Industrial, and Municipal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASFSE, SikaAG, DowDupontInc, HenkelCorporation, TheEuclidChemicalCompany, AkzoNobelChemicalsAG, Arkema, LaticreteInternationalInc, and CrodaInternationalPlc |

| Additional Attributes | Dollar sales, share by product type and application, regional demand trends, competitive landscape with company market share, regulatory compliance standards, procurement channels, contractor buying patterns, forecast for industrial, residential, and commercial usage volumes, innovations in curing compounds, sealers, and hardeners, as well as price sensitivity analysis and margin benchmarking across regions. |

The global concrete surface treatment chemicals market is estimated to be valued at USD 13.7 billion in 2025.

The market size for the concrete surface treatment chemicals market is projected to reach USD 29.6 billion by 2035.

The concrete surface treatment chemicals market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in concrete surface treatment chemicals market are curing compound, _residential, _commercial, _industrial, _municipal, mold release agent, _residential, _commercial, _industrial, _municipal, sealants, _residential, _commercial, _industrial, _municipal, others, _residential, _commercial, _industrial and _municipal.

In terms of end-user, residential segment to command 26.2% share in the concrete surface treatment chemicals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Bonding Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA