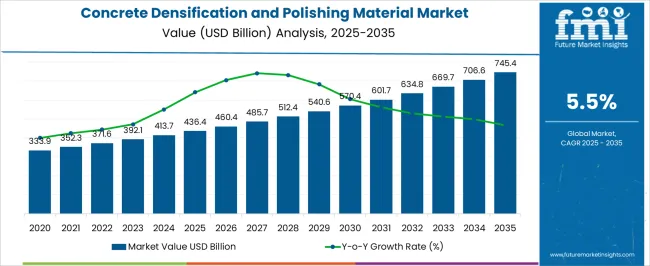

The concrete densification and polishing material market is projected to grow from USD 436.4 billion in 2025 to USD 745.4 billion by 2035, reflecting a CAGR of 5.5%. A breakpoint analysis of the market highlights several key inflection points over the decade, marking shifts in growth intensity driven by technological adoption, infrastructure development, and industrial demand.

Between 2025 and 2030, the market grows from USD 436.4 billion to USD 570.4 billion, with a notable breakpoint around 2027–2028 at USD 460.4–485.7 billion. This period corresponds to increased investment in commercial and industrial flooring projects, rising construction activities in the Asia-Pacific region, and the adoption of advanced densifiers and polishing compounds for long-lasting concrete surfaces. From 2030 to 2035, the market further expands from USD 570.4 billion to USD 745.4 billion, with another critical breakpoint around 2032–2033 at USD 601.7–634.8 billion, driven by large-scale urban infrastructure initiatives, green building mandates, and advancements in polymer-enhanced polishing materials.

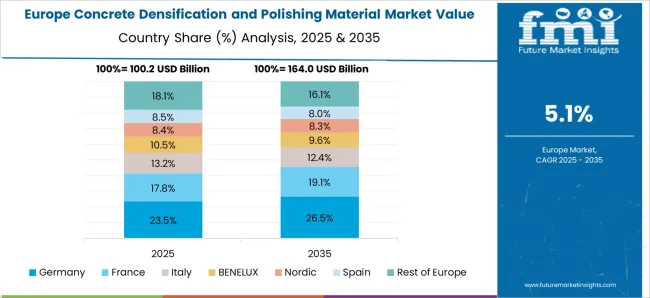

These breakpoints reflect periods where incremental technology adoption and project scaling significantly accelerate revenue growth. Regionally, North America and Europe maintain high-value demand due to premium construction standards, while Asia-Pacific exhibits volume-driven growth. The market demonstrates steady growth punctuated by strategic breakpoints, indicating opportunities for suppliers to capitalize on technology upgrades, infrastructure booms, and regulatory-driven demand, making it a resilient and investment-attractive segment in the construction materials landscape.

| Metric | Value |

|---|---|

| Concrete Densification and Polishing Material Market Estimated Value in (2025 E) | USD 436.4 billion |

| Concrete Densification and Polishing Material Market Forecast Value in (2035 F) | USD 745.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The concrete densification and polishing material market is primarily driven by the construction chemicals market, which accounts for approximately 40–45% of total demand, as densifiers, hardeners, and polishing compounds are essential for enhancing surface strength, durability, and aesthetic finish. The commercial and industrial flooring market contributes around 20–22%, reflecting the widespread adoption of polished concrete in warehouses, factories, airports, and retail spaces where low-maintenance, durable flooring is critical. The residential construction market holds roughly 15–17%, driven by flooring, countertops, and decorative concrete applications in homes and apartments.

The infrastructure and public works market contributes approximately 10–12%, with adoption in roads, bridges, airports, and public buildings requiring high-performance, polished concrete surfaces. Lastly, the concrete equipment and accessories market accounts for 5–6%, supported by grinders, polishing machines, and application tools essential for proper material deployment.

These parent markets define the technological, operational, and application ecosystem of the concrete densification and polishing material market, enabling contractors, architects, and facility managers to achieve enhanced durability, low maintenance, and visually appealing concrete surfaces across commercial, industrial, residential, and infrastructure projects worldwide.

The concrete densification and polishing material market is being shaped by increasing adoption across construction, renovation, and refurbishment projects, with demand supported by the need for durable, low-maintenance, and aesthetically enhanced flooring solutions. Growth is being reinforced by expanding commercial infrastructure investments, rising preference for polished concrete in high-traffic environments, and advancements in surface treatment technologies that extend service life while reducing lifecycle costs.

Regulatory encouragement for environmentally sustainable building practices is fostering greater use of densifiers and polishing solutions due to their ability to enhance existing concrete rather than replace it. Supply-side developments, including improved manufacturing techniques and distribution networks, are improving product availability in both mature and emerging markets.

Competitive positioning is increasingly influenced by integration of eco-friendly formulations and the ability to offer turnkey surface preparation and finishing solutions. Over the forecast period, continued urban expansion, coupled with refurbishment cycles in developed economies, is expected to sustain steady revenue growth and expand the market’s penetration across diversified end-user segments.

The concrete densification and polishing material market is segmented by product, end-user, and geographic regions. By product, concrete densification and polishing material market is divided into Densifiers & hardeners, Sealers & crack fillers, and Conditioners. In terms of end-user, concrete densification and polishing material market is classified into Commercial, Residential, Institutional, and Industrial.

Based on product, the concrete densification and polishing material market is segmented into walk-behind concrete floor grinders and polishing machines, handheld floor grinders and polishing machines, and ride-on floor Grinders and polishing machines. Regionally, the concrete densification and polishing material industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The densifiers and hardeners category, holding 42.70% of the product segment, has maintained its lead due to its crucial role in strengthening concrete surfaces, increasing abrasion resistance, and reducing porosity. This category has been favored for its ability to enhance durability and support high-performance finishes, which are critical in commercial, industrial, and institutional spaces. Demand stability has been underpinned by construction sector growth, particularly in large-scale infrastructure and refurbishment projects.

The integration of advanced chemical formulations has improved penetration efficiency and compatibility with various concrete grades, enhancing application outcomes. Distribution strategies have been optimized to cater to contractors and flooring specialists, ensuring a consistent supply.

The segment’s resilience against substitution is driven by performance-based purchasing decisions, as alternative surface treatments often fail to match the long-term durability benefits. Anticipated market expansion is likely to be fueled by stricter building performance standards, ongoing urban development, and rising awareness regarding lifecycle cost advantages of densified and hardened concrete surfaces.

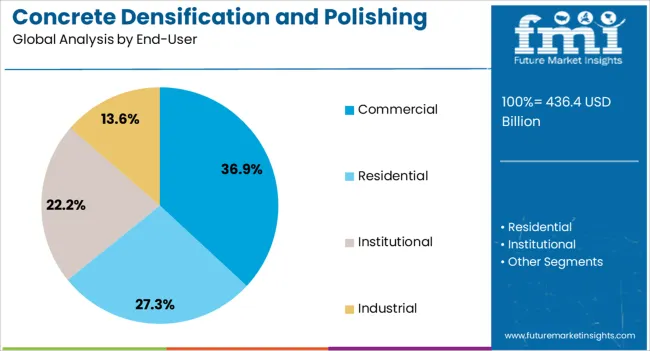

The commercial sector, accounting for 36.90% of the end-user category, continues to dominate due to the extensive use of polished concrete in retail spaces, offices, hospitality venues, and institutional buildings. Its preference is driven by the combination of aesthetic appeal, slip resistance, and cost efficiency over the long term.

Large-scale adoption has been facilitated by commercial developers’ focus on durable and low-maintenance flooring solutions that align with sustainability certifications and operational efficiency goals. The segment’s growth has also been supported by an increase in high-traffic facilities requiring surfaces that withstand continuous wear without frequent repairs.

Technological advancements in polishing equipment and chemical treatments have reduced installation downtime, enabling faster project turnover. The commercial sector’s demand trajectory is expected to remain stable, backed by global retail expansion, the evolution of workspace design, and modernization initiatives in hospitality and institutional settings.

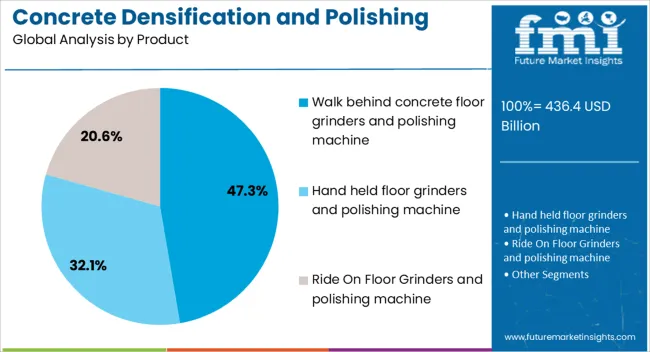

The walk-behind concrete floor grinders and polishing machine category, representing 47.30% of the machinery segment, has emerged as the most preferred equipment type due to its operational flexibility, maneuverability, and suitability for both small and medium-sized floor areas. Contractors favor these machines for their ability to deliver consistent surface finishes while allowing precise control over grinding depth and polishing stages.

The category’s dominance is further supported by its cost-effectiveness compared to larger ride-on units, especially for projects with spatial constraints or intricate floor layouts. Ergonomic design enhancements and the integration of dust-control systems have improved operator safety and compliance with workplace health regulations.

Product availability through rental networks and dealer channels has expanded accessibility for small contractors, boosting usage frequency. Over the forecast horizon, increased demand for equipment that balances performance, ease of transport, and versatility is expected to solidify the walk-behind machines’ leadership within the machinery segment of the concrete polishing industry.

The concrete densification and polishing material market is expanding as construction firms, architects, and facility managers prioritize durability, wear resistance, and aesthetic appeal for flooring projects. Demand is driven by commercial, industrial, and residential projects requiring smooth, long-lasting surfaces that reduce maintenance costs.

Challenges include fluctuations in raw material prices, specialized application skills, and compatibility with diverse concrete mixes. Opportunities exist in high-performance chemical densifiers, multi-functional polishing compounds, and turnkey application solutions. Trends highlight fast-curing products, high-gloss finishes, and abrasion-resistant formulations.

Construction and industrial developers are increasingly adopting densification and polishing materials to improve floor strength, wear resistance, and visual appeal. Polished concrete is widely applied in commercial buildings, warehouses, airports, retail outlets, and high-traffic industrial spaces to provide durable, low-maintenance surfaces. Key priorities include abrasion resistance, chemical resistance, slip prevention, and ease of cleaning. Urbanization, infrastructure expansion, and growing demand for visually attractive, long-lasting floors are driving adoption. With designers and facility managers seeking both performance and aesthetics, densification and polishing materials are becoming essential for modern construction, renovation, and facility management projects across industrial, commercial, and residential spaces.

Constraints include high costs of specialty chemical formulations, raw material price volatility, and dependence on skilled labor for proper application. Supply chain disruptions and regional material availability can affect project timelines. Compliance with chemical handling, safety, and environmental regulations adds operational complexity. Technical challenges include ensuring uniform penetration, curing compatibility with various concrete mixes, achieving consistent gloss levels, and maintaining durability under heavy loads. Buyers increasingly demand certified products, application guidance, training, and quality assurance to optimize floor performance, minimize defects, and comply with local standards, reducing operational and regulatory risks.

Market opportunities lie in high-performance chemical densifiers, polishing compounds, and multi-functional products that enhance abrasion resistance, hardness, surface finish, and additional benefits such as dust reduction and moisture control. Rapid construction growth in Asia-Pacific, North America, and Europe, alongside modern architectural trends, is driving demand. Suppliers providing application training, technical support, and turnkey solutions are best positioned to capture these opportunities. Collaboration with contractors, architects, and developers enhances adoption, ensures project success, and strengthens supplier positioning in competitive global construction and facility management markets.

The market is trending toward fast-curing densifiers and polishing materials that reduce project timelines and downtime. High-gloss, visually appealing surfaces are increasingly demanded in commercial and retail environments, while low-maintenance, abrasion-resistant finishes are critical in industrial spaces. Integration with automated polishing equipment and digital surface monitoring enhances efficiency and quality control. Suppliers offering high-performance, application-ready materials with technical guidance and training are best positioned to meet evolving customer requirements. Durability, aesthetics, and operational convenience continue to drive market adoption among contractors, architects, and facility managers worldwide.

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

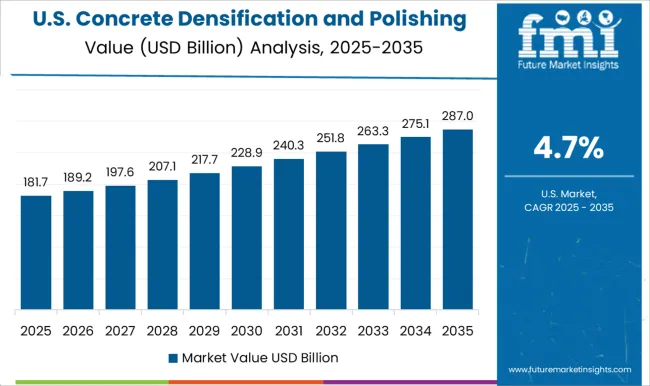

| USA | 4.7% |

| Brazil | 4.1% |

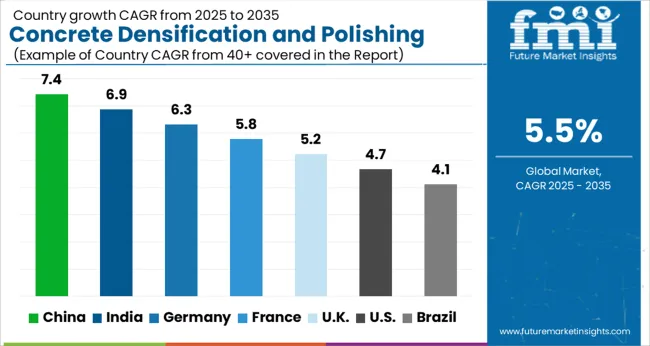

The global concrete densification and polishing material market is expected to expand at a CAGR of 5.5% from 2025 to 2035. China leads growth at 7.4%, followed by India at 6.9%, Germany at 6.3%, the UK at 5.2%, and the USA at 4.7%. Market expansion is driven by increased adoption of silicate- and lithium-based densifiers, rising demand for polished concrete floors in industrial, commercial, and retail facilities, and integration with automated polishing technologies for consistent finishes. Rapid urbanization, large-scale infrastructure projects, and international collaborations are supporting innovations in high-performance materials, operational efficiency, and superior surface quality, positioning key markets for sustained long-term growth. The analysis spans over 40+ countries, with the leading markets shown below.

The concrete densification and polishing material market in China is projected to grow at a CAGR of 7.4% from 2025 to 2035. Growth is driven by rapid urbanization, large-scale industrial and commercial construction projects, and the increasing adoption of silicate- and lithium-based densifiers. Automated polishing technologies are being integrated into construction practices, enhancing surface durability, aesthetic appeal, and operational efficiency. Domestic manufacturers are investing in R&D to improve product longevity, ease of application, and performance under heavy traffic conditions. Government infrastructure initiatives and modern building codes further support market expansion. Applications in warehouses, airports, retail spaces, and office complexes are increasing, while international collaborations enable advanced technology transfer and high-quality solutions. Rising demand for polished concrete flooring in both public and private sectors is boosting market adoption.

In India, the market is expected to expand at a CAGR of 6.9% from 2025 to 2035, fueled by growing urbanization, infrastructure development, and rising industrial construction. Adoption of advanced densifiers and polishing materials is increasing for commercial spaces, airports, and high-traffic facilities. Domestic manufacturers are focusing on durable, cost-effective, and high-performance materials suitable for large-scale projects. Government initiatives supporting smart cities, metro expansion, and industrial parks drive demand for modern flooring solutions. Increased awareness about maintenance efficiency, surface longevity, and premium finishes further promotes adoption. International partnerships are enabling technology transfer, quality improvement, and innovation in polishing techniques. The trend toward polished concrete for retail, institutional, and industrial spaces is strengthening market growth across urban and semi-urban regions.

Demand for concrete densification and polishing material is anticipated to grow at a CAGR of 5.8% from 2025 to 2035, supported by increasing commercial, retail, and institutional construction projects. High-quality densifiers and polishing materials are increasingly used to enhance surface durability, aesthetics, and safety. Domestic manufacturers are focusing on modular and efficient solutions capable of meeting stringent European construction standards. Growing adoption in warehouses, offices, and public spaces is driving demand for automated polishing systems. Collaborations with international technology providers are enabling innovation in densification compounds and surface treatments. Demand for polished concrete flooring in premium commercial and institutional buildings is further boosting market growth. Urban development, renovation of historical buildings, and modernization of industrial facilities are additional factors contributing to adoption.

The UK market is expected to grow at a CAGR of 5.2% from 2025 to 2035, driven by the expansion of commercial, industrial, and public infrastructure. Demand for densification and polishing materials is rising for retail outlets, airports, warehouses, and office buildings. Manufacturers focus on high-performance compounds, long-lasting finishes, and automated polishing systems to improve operational efficiency and reduce maintenance costs. Compliance with British and European building codes ensures quality and safety. Domestic companies are increasingly collaborating with international players to adopt advanced densification and polishing technologies. Urban redevelopment projects, commercial refurbishments, and industrial expansions are creating steady demand. The trend toward aesthetic, durable, and easy-to-maintain concrete flooring solutions is further fueling growth in both new and retrofitted construction projects.

The USA market is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by industrial, commercial, and retail construction. Advanced densifiers, including silicate- and lithium-based products, are increasingly used to improve concrete durability and surface quality. Automated polishing technologies are being adopted to enhance efficiency, reduce labor, and extend floor life. Industrial hubs and warehouse complexes are major end-users, alongside commercial and public facilities. Domestic manufacturers focus on high-performance compounds and customized solutions to meet diverse project requirements. Infrastructure upgrades, retail expansion, and airport refurbishments are driving market adoption. Collaborations with global technology providers further improve product performance and operational efficiency. Demand for polished concrete as a durable, low-maintenance, and aesthetically appealing flooring solution is steadily increasing across major USA markets.

The concrete densification and polishing material market is driven by the growing demand for durable, aesthetically appealing, and low-maintenance concrete surfaces across commercial, industrial, and residential projects. Densifiers and polishing compounds enhance surface hardness, abrasion resistance, and chemical durability, while improving visual appeal through gloss and finish. Market growth is fueled by urbanization, infrastructure development, and the adoption of sustainable, long-lasting flooring solutions that reduce maintenance costs over time. Rising preference for polished concrete in retail, industrial, and institutional spaces is further stimulating demand for advanced chemical formulations and compatible grinding and polishing systems.

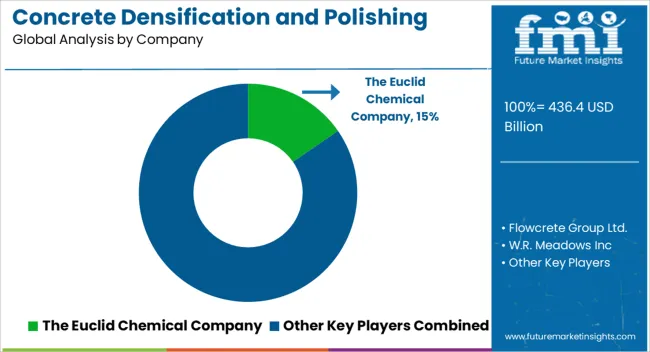

Competition is defined by chemical performance, surface finish quality, application ease, and compatibility with grinding equipment. The Euclid Chemical Company leads with high-performance densifiers and surface hardeners tailored for commercial floors and industrial environments. Flowcrete Group Ltd. and LATICRETE International, Inc. differentiate with integrated systems combining polishing compounds, sealers, and coatings for uniform gloss and chemical resistance. W.R. Meadows Inc. and Markham Global Ltd. emphasize specialty formulations for high-traffic and chemical-exposed areas.

| Item | Value |

|---|---|

| Quantitative Units | USD 436.4 Billion |

| Product | Densifiers & hardeners, Sealers & crack fillers, and Conditioners |

| End-User | Commercial, Residential, Institutional, and Industrial |

| Product | Walk behind concrete floor grinders and polishing machine, Hand held floor grinders and polishing machine, and Ride On Floor Grinders and polishing machine |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Euclid Chemical Company, Flowcrete Group Ltd., W.R. Meadows Inc, Canzac, LATICRETE International, Inc, Markham Global Ltd., Concrete Earth, BLENDER GROUP S.A. DE C.V., Husqvarna AB, The Werkmaster, Bosch, Hilti, KLINDEX, Changsha Honway Machinery Co.,Ltd, Diamatic, TYROLIT, LINAX co.,ltd, and SASE Company, LLC |

| Additional Attributes | Dollar sales by product type (densifiers, hardeners, polishing compounds, diamond abrasives), application (commercial, industrial, residential), and equipment type (manual grinders, automated polishing machines). Demand is driven by infrastructure development, urbanization, and the trend toward high-durability, polished concrete surfaces. Regional trends highlight strong growth in North America and Europe due to commercial and industrial flooring demand, while Asia-Pacific shows rapid expansion with increasing construction activity and modernization of industrial facilities. |

The global concrete densification and polishing material market is estimated to be valued at USD 436.4 billion in 2025.

The market size for the concrete densification and polishing material market is projected to reach USD 745.4 billion by 2035.

The concrete densification and polishing material market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in concrete densification and polishing material market are densifiers & hardeners, sealers & crack fillers and conditioners.

In terms of end-user, commercial segment to command 36.9% share in the concrete densification and polishing material market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA