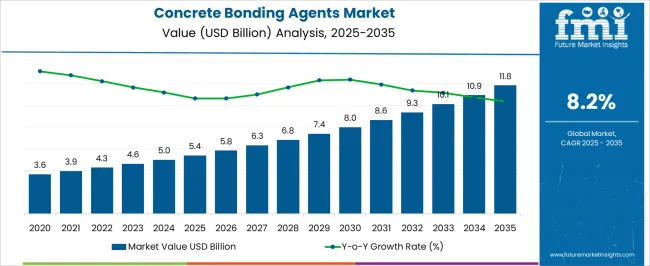

The concrete bonding agents market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 11.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. The concrete bonding agents market is projected to grow from USD 5.4 billion in 2025 to USD 8 billion by 2030, generating an incremental gain of USD 2.6 billion over the first five years. This represents 43.3% of the total incremental growth over the 10-year forecast period.

The growth is driven by increasing demand for durable, high-performance construction materials and the rising use of bonding agents in both residential and commercial construction. Early-phase growth is marked by steady increments, with demand fueled by infrastructure development, urbanization, and the need for stronger and more sustainable concrete applications. The second half (2030–2035) will contribute USD 3.2 billion, representing 56.7% of the total growth, driven by larger-scale projects and technological advancements in bonding agents, including the use of eco-friendly and high-strength formulations. Annual increments rise from USD 0.6 billion in early years to USD 1 billion by 2035, as global demand for construction materials intensifies. Manufacturers focusing on product innovation, cost-effectiveness, and sustainability will capture the largest share of this USD 5.8 billion opportunity.

| Metric | Value |

|---|---|

| Concrete Bonding Agents Market Estimated Value in (2025 E) | USD 5.4 billion |

| Concrete Bonding Agents Market Forecast Value in (2035 F) | USD 11.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The current market growth is being supported by increasing infrastructure investments, aging building stock in developed economies, and rising demand for high-performance bonding materials in both new and repair-based construction. Industry publications and press releases from leading construction chemical companies indicate a growing preference for advanced bonding technologies that ensure long-term adhesion and structural cohesion.

As regulatory authorities enforce more stringent quality and safety standards across residential, commercial, and industrial projects, demand for reliable bonding agents is expected to rise further. Future opportunities are anticipated to emerge from the adoption of environmentally sustainable and VOC-compliant formulations.

The incorporation of smart construction practices and digital tools for quality control has also encouraged adoption of standardized bonding solutions These trends collectively suggest a strong and consistent outlook for the market, particularly in regions experiencing rapid urbanization and renovation activity.

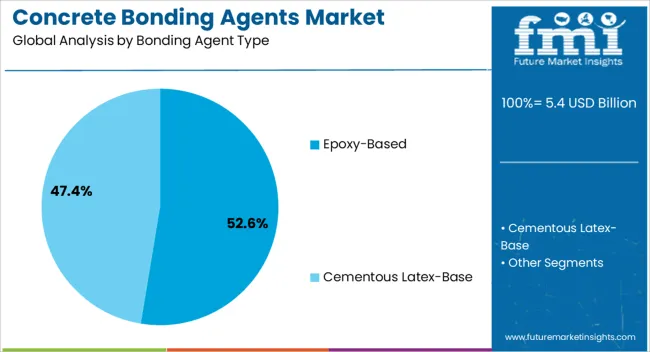

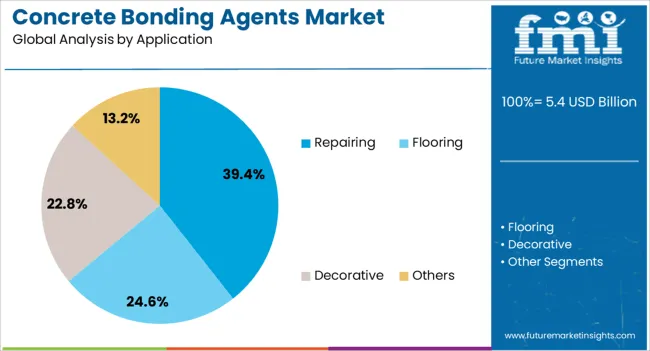

The concrete bonding agents market is segmented by bonding agent type, application, end use, and geographic regions. By bonding agent type, the concrete bonding agents market is divided into Epoxy-Based and Cementous Latex-Based. In terms of application, the concrete bonding agents market is classified into Repairing, Flooring, Decorative, and Others.

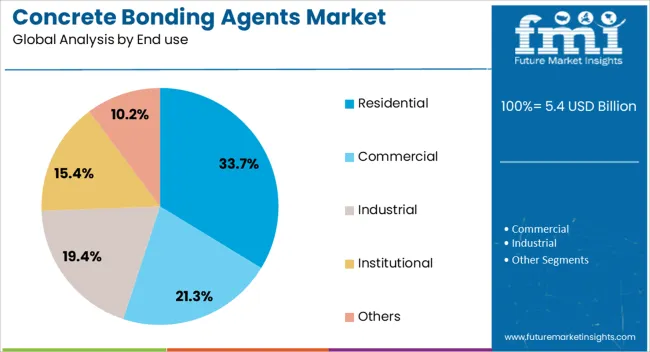

Based on end use, the concrete bonding agents market is segmented into Residential, Commercial, Industrial, Institutional, and Others. Regionally, the concrete bonding agents industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy-based bonding agent type is projected to hold 52.6% of the market revenue share in 2025, establishing it as the leading segment by bonding type. This dominance is being driven by the superior mechanical strength, chemical resistance, and long-term durability that epoxy-based formulations offer. Construction industry journals and corporate technical datasheets have emphasized that epoxy-based bonding agents provide high adhesion to both old and new concrete, making them ideal for structural repairs and load-bearing applications.

The ability to cure under a wide range of environmental conditions has also made them favorable for field use. As noted in corporate updates and product innovations, epoxy-based systems are widely adopted in critical infrastructure projects such as bridges, highways, and industrial floors where high bonding reliability is essential. Additionally, their compatibility with automated application tools and rapid curing characteristics support cost-effective project execution.

The repairing application segment is estimated to capture 39.4% of the Concrete Bonding Agents market revenue share in 2025, making it the most prominent use case within the industry. This position has been influenced by increasing rehabilitation activities across aging infrastructure and the growing need to restore structural performance without complete rebuilding. Investor presentations and construction updates highlight a surge in maintenance budgets from both public and private sectors, particularly in regions where concrete structures are subject to wear from climate and load stress.

The use of bonding agents in repair scenarios has proven to extend the service life of existing assets while minimizing costs and downtime. Epoxy and polymer-modified formulations have enabled effective bonding in surface crack filling, delamination, and spall repair. Industry statements also note that compliance with performance standards for restoration projects has further elevated the use of specialized bonding agents.

The residential end-use segment is forecasted to hold 33.7% of the Concrete Bonding Agents market revenue share in 2025, representing the largest share among end-use categories. This growth has been supported by sustained residential construction activity in both urban and semi-urban regions, particularly in developing economies where housing demand continues to rise. News articles and industry associations have reported increased emphasis on structural reliability, aesthetic durability, and ease of maintenance in residential buildings.

Bonding agents have become an integral component in floor overlays, tile installations, waterproofing applications, and minor structural repairs. The adoption of do-it-yourself trends and packaged bonding solutions for small-scale home improvements is also influencing the segment’s expansion.

Construction chemical companies have highlighted the importance of product versatility, ease of use, and affordability in capturing residential market share. These factors, combined with rising consumer awareness and regulatory push for quality housing materials, have reinforced the residential segment’s leading position in the overall market.

The concrete bonding agents market is driven by the increasing demand for durable, high-strength construction materials, especially in expanding infrastructure projects. Opportunities in the construction sector, along with emerging trends in eco-friendly and high-performance bonding agents, are shaping the market. However, high costs and product availability remain obstacles. By 2025, addressing these challenges with cost-efficient, sustainable solutions will be crucial for continued market growth and adoption across the construction industry.

The concrete bonding agents market is growing due to the increasing demand for high-strength and durable construction materials. Concrete bonding agents are essential for enhancing the adhesion between new and old concrete surfaces, ensuring structural integrity and long-lasting results. As the construction industry prioritizes longevity and quality in infrastructure projects, the need for advanced bonding solutions is rising. By 2025, this demand will continue, particularly in commercial, residential, and civil engineering projects that require durable concrete surfaces.

Opportunities in the concrete bonding agents market are growing with the expansion of construction and infrastructure projects globally. As governments and private developers invest heavily in new infrastructure, the need for efficient bonding solutions to ensure durability and safety in concrete construction is on the rise. By 2025, significant growth will be driven by the increasing number of construction and renovation projects, particularly in emerging markets where infrastructure development is expanding rapidly.

Emerging trends in the concrete bonding agents market include the rising demand for eco-friendly and high-performance products. Manufacturers are increasingly developing bonding agents that offer superior strength while reducing environmental impact, catering to the growing need for sustainable construction solutions. By 2025, the shift toward more efficient and environmentally conscious bonding agents will reshape the market, with products offering enhanced performance and reduced environmental footprints gaining greater adoption.

Despite growth, challenges related to high costs and limited product availability persist in the concrete bonding agents market. The cost of high-quality bonding agents, particularly those with advanced chemical formulations, can be a significant barrier for small-scale construction projects. Additionally, fluctuations in raw material availability can disrupt production, leading to supply chain issues. By 2025, overcoming these challenges through cost-effective solutions and more stable supply chains will be critical for expanding market reach.

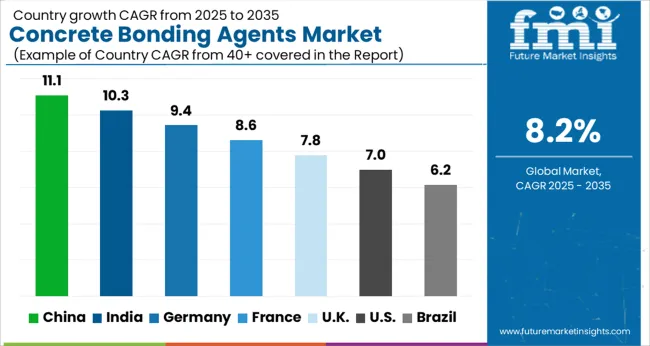

The global concrete bonding agents market is projected to grow at an 8.2% CAGR from 2025 to 2035. China leads with a growth rate of 11.1%, followed by India at 10.3%, and France at 8.6%. The United Kingdom records a growth rate of 7.8%, while the United States shows the slowest growth at 7.0%. These varying growth rates are driven by factors such as the increasing demand for construction and renovation activities, the rising need for durable and high-performance bonding materials, and government initiatives to improve infrastructure. Emerging markets like China and India are seeing higher growth due to rapid urbanization, industrialization, and infrastructure development, while more mature markets like the USA and the UK experience steady growth driven by technological advancements, sustainability trends, and the increasing adoption of green building practices. This report includes insights on 40+ countries; the top markets are shown here for reference.

The concrete bonding agents market in China is growing at a rapid pace, with a projected CAGR of 11.1%. China’s booming construction sector, driven by urbanization, infrastructure development, and the expanding real estate market, is fueling demand for high-performance bonding agents. The country’s increasing focus on durability and quality in construction materials, combined with government policies promoting sustainable and energy-efficient construction practices, is contributing to market growth. Additionally, the rising demand for renovation and retrofitting of existing buildings and infrastructure is further driving the adoption of concrete bonding agents in China.

The concrete bonding agents market in India is projected to grow at a CAGR of 10.3%. India’s rapidly expanding construction and infrastructure sectors, coupled with the increasing focus on improving the quality of construction materials, are driving the demand for concrete bonding agents. The country’s growing urban population and the rise of residential, commercial, and industrial construction projects further fuel market growth. Additionally, the government’s initiatives to boost infrastructure development and improve the quality of buildings, coupled with the increasing use of green building practices, contribute to the rising adoption of bonding agents in the Indian market.

The concrete bonding agents market in France is projected to grow at a CAGR of 8.6%. France’s increasing focus on infrastructure modernization, along with the growing demand for sustainable and high-performance construction materials, is driving steady market growth. The country’s regulatory emphasis on quality standards and the rise in construction activities, particularly in the residential and commercial sectors, further contributes to the adoption of concrete bonding agents. Additionally, France’s focus on energy-efficient and eco-friendly construction practices is promoting the use of innovative bonding materials that enhance durability and reduce environmental impact.

The concrete bonding agents market in the United Kingdom is projected to grow at a CAGR of 7.8%. The UK market is driven by increasing demand for construction and renovation materials, coupled with a growing emphasis on high-performance, durable bonding agents. The country’s strong construction sector, focused on infrastructure improvement and residential projects, continues to support steady market growth. Additionally, the UK’s regulatory frameworks, which prioritize sustainability and energy efficiency, further accelerate the adoption of concrete bonding agents in both new constructions and renovation projects.

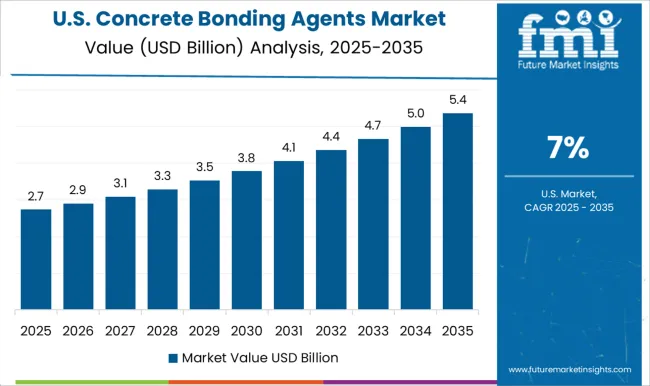

The concrete bonding agents market in the United States is expected to grow at a CAGR of 7.0%. The USA market is steady, driven by the increasing need for durable and high-quality materials in construction and infrastructure projects. The growing adoption of sustainable and energy-efficient building practices, along with advancements in bonding technologies, is contributing to steady market growth. Additionally, the USA market benefits from ongoing infrastructure projects, government regulations, and the rise in residential and commercial construction activities, all of which drive the demand for concrete bonding agents.

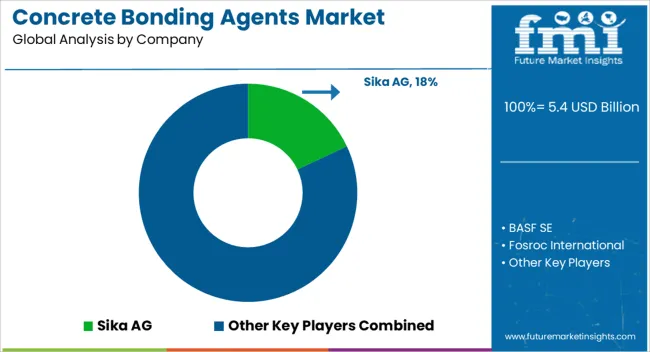

The concrete bonding agents space has been led by specialist construction chemicals producers. Sika AG offers a broad portfolio of acrylic, epoxy, and cementitious primers that join new concrete to existing substrates for repair and protection work. Fosroc International supplies Nitobond grades spanning epoxy, latex, and acrylic use cases. Master Builders Solutions, the successor to BASF Construction Chemicals, provides epoxy and polymer bonding agents for civil and industrial applications.

GCP Applied Technologies now operates within Saint-Gobain Construction Chemicals, with bonding and repair solutions marketed in the combined portfolio. MAPEI Corporation provides Planibond products for concrete restoration and anchoring. Holcim, formerly LafargeHolcim, is primarily a building materials group rather than a dedicated bonding agent specialist. Rehabilitation programs, tighter shutdown windows, and demand for low odor, low VOC chemistry with faster cure, high early bond strength, and moisture tolerance have supported growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 Billion |

| Bonding Agent Type | Epoxy-Based and Cementous Latex-Base |

| Application | Repairing, Flooring, Decorative, and Others |

| End use | Residential, Commercial, Industrial, Institutional, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, BASF SE, Fosroc International, GCP Applied Technologies, LafargeHolcim, and MAPEI Corporation |

| Additional Attributes | Dollar sales by agent type and application, demand dynamics across construction, repair, and infrastructure sectors, regional trends in concrete bonding agent adoption, innovation in high-strength and eco-friendly formulations, impact of regulatory standards on material safety and environmental impact, and emerging use cases in sustainable construction and advanced repair technologies. |

The global concrete bonding agents market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the concrete bonding agents market is projected to reach USD 11.8 billion by 2035.

The concrete bonding agents market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in concrete bonding agents market are epoxy-based and cementous latex-base.

In terms of application, repairing segment to command 39.4% share in the concrete bonding agents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Concrete Epoxy Repair Market Size and Share Forecast Outlook 2025 to 2035

Concrete Fiber Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densification and Polishing Material Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Densifier Market Size and Share Forecast Outlook 2025 to 2035

Concrete Containing Polymer Market Size and Share Forecast Outlook 2025 to 2035

Concrete Block Making Machines Market Size and Share Forecast Outlook 2025 to 2035

Concrete Placing Booms Market Size and Share Forecast Outlook 2025 to 2035

Concrete Accelerators And Retarders Market Size and Share Forecast Outlook 2025 to 2035

Concrete Chain Saw Market Size and Share Forecast Outlook 2025 to 2035

Concrete Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Concrete Paving Equipment Market Size and Share Forecast Outlook 2025 to 2035

Concrete Admixture Market Growth - Trends & Forecast 2025 to 2035

Concrete Floor Coatings Market Growth - Trends & Forecast 2025 to 2035

Concrete Saw Market Growth - Trends & Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Concrete Testers Market Growth – Trends & Forecast 2025-2035

Concrete Air Entraining Agents Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Hollow Concrete Blocks Providers

Precast Concrete Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA