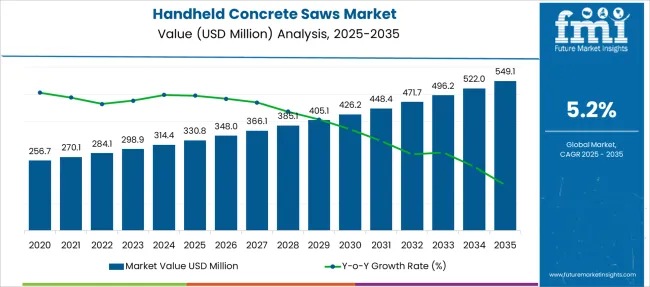

The Handheld Concrete Saws Market is estimated to be valued at USD 330.8 million in 2025 and is projected to reach USD 549.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Handheld Concrete Saws Market Estimated Value in (2025E) | USD 330.8 million |

| Handheld Concrete Saws Market Forecast Value in (2035F) | USD 549.1 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

The handheld concrete saws market is growing steadily due to increased construction and infrastructure activities worldwide. The demand for efficient and precise cutting tools has risen as projects become more complex and require durable equipment. Advances in power tool technologies have improved the performance and portability of handheld saws, making them more attractive to construction professionals.

Environmental regulations and safety standards have also influenced product design and adoption. Additionally, the growth of the industrial sector has contributed to a steady demand for concrete saws capable of handling heavy-duty cutting tasks.

Future market expansion is expected to be supported by innovations in power sources and blade materials. Segmental growth is forecast to be driven by electric-powered saws, diamond blade usage, and industrial end-users.

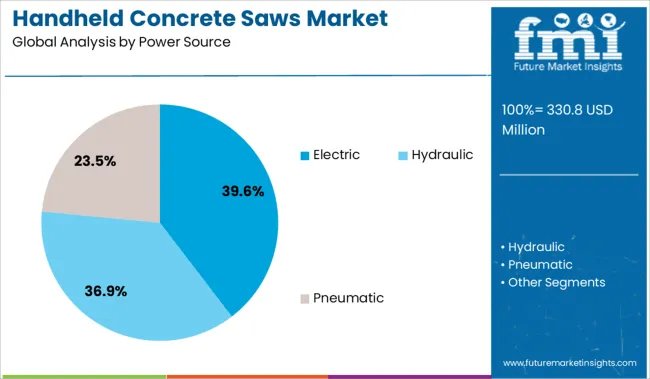

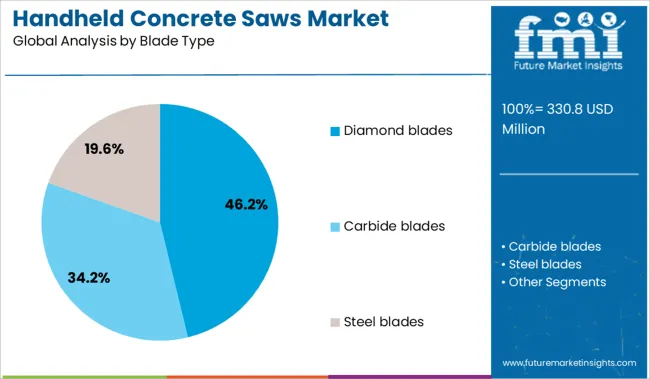

The market is segmented by Power Source, Blade Type, End-user, and Distribution Channel and region. By Power Source, the market is divided into Electric, Hydraulic, and Pneumatic. In terms of Blade Type, the market is classified into Diamond blades, Carbide blades, and Steel blades.

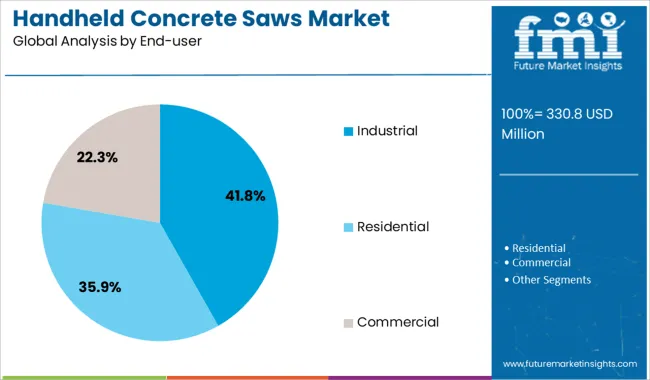

Based on End-user, the market is segmented into Industrial, Residential, and Commercial. By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric power source segment is projected to hold 39.6% of the handheld concrete saws market revenue in 2025. Growth has been driven by the convenience and eco-friendliness of electric saws, which offer reduced emissions compared to gas-powered alternatives. Electric saws are favored for indoor and urban construction projects where noise and air quality are concerns.

Improvements in battery technology have enhanced the runtime and power output of cordless electric saws, increasing their adoption. Portability and ease of maintenance have also contributed to their growing popularity.

These factors have established electric saws as a preferred power source segment in the market.

Diamond blades are expected to account for 46.2% of the market revenue in 2025, leading the blade type segment. Their superior cutting ability and durability make them ideal for handling a variety of concrete materials and reinforcing structures. Diamond blades provide cleaner cuts and longer service life, which reduces operational costs and downtime.

The versatility of diamond blades across different applications and materials has increased their demand.

The growing focus on precision and efficiency in construction projects has further encouraged the use of diamond blades in handheld concrete saws.

The industrial end-user segment is projected to capture 41.8% of the market revenue in 2025, maintaining its position as the largest end-user category. This growth is linked to the extensive use of handheld concrete saws in manufacturing facilities, construction sites, and heavy engineering projects.

Industrial operators prioritize reliable and robust cutting tools capable of withstanding rigorous usage. The ongoing expansion of industrial infrastructure and refurbishment projects continues to drive demand for concrete saws.

Furthermore, safety regulations and quality standards in industrial operations require precise and efficient cutting equipment, reinforcing this segment’s dominance in the market.

Growing demand in construction, renovation, and infrastructure maintenance fuels handheld concrete saw adoption. Opportunities lie in lightweight cordless models, safety feature upgrades, rental partnerships, and expansion in emerging construction markets.

The market for handheld concrete saws is expanding as builders, renovators, and infrastructure crews require tools for precision cutting in flooring, segmenting, and trenching tasks. Projects such as road repairs, waterline installations, and emergency concrete removal necessitate portable saws capable of handling tough materials in confined workspaces.

Increased emphasis on rapid turnover in renovation and public works pushes contractors to choose handheld saws for faster setup and shutdown versus larger equipment. Safety features like vibration reduction, kickback protection, and integrated dust control are becoming standard, improving operator comfort and site compliance. In addition, rental fleets for short-term jobs are rising, giving access to high-end handheld models without purchase. These factors are widening adoption across contractors, rental firms, and maintenance operations.

Growth opportunities include development of battery-powered handheld saws that eliminate cord limitations and support jobsite mobility without compromising power. Brands designing lightweight saws with ergonomic grips and reduced vibration can attract users concerned with operator fatigue and repetitive use. Expanding equipment-as-a-service partnerships and tool rental networks enables contractors and DIY consumers to access advanced models with minimal upfront cost.

Training programs highlighting proper use and maintenance will build confidence among smaller contractors. In fast-growing construction regions, especially emerging economies, increasing infrastructure activity and limited ownership budgets create demand for affordable, reliable saws. Manufacturers who offer modular accessories such as diamond blades, depth guides, or cutting stands alongside local service support can build stronger market presence and customer loyalty.

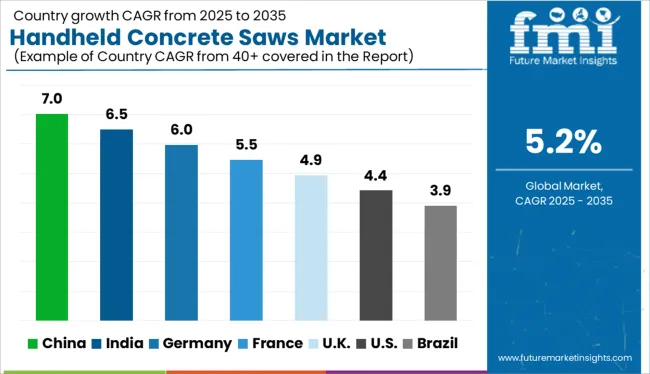

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global handheld concrete saws market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by accelerating construction activity, urban redevelopment, and precision cutting requirements across infrastructure and civil works. China leads with a 7.0% CAGR, benefiting from large-scale urban expansion, road-building, and high-rise construction in both state and private sectors. India follows at 6.5%, supported by growth in affordable housing, highway development, and demand for cost-effective cutting tools.

Germany, an OECD leader, is growing at 6.0%, reflecting advancements in blade technology, safety compliance, and usage in commercial retrofits. The United Kingdom (4.9%) and the United States (4.4%) exhibit steady demand through rental channels and continued investment in remodeling and municipal projects. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a projected CAGR of 7.0%, China is expected to lead global demand for handheld concrete saws due to accelerated urbanization, high-rise construction, and widespread infrastructure upgrades. The rise of prefabricated concrete components and rapid redevelopment of old housing districts are driving daily jobsite needs for compact, high-torque cutting equipment. Domestic brands are launching battery-powered models to meet green construction mandates, especially in Tier 1 cities. Additionally, stringent safety norms for demolition work are boosting sales of low-emission, precision saws with built-in dust suppression.

The handheld concrete saws market in India is growing at a CAGR of 6.5%, underpinned by the ongoing boom in real estate, smart cities, and civil infrastructure projects. Tier 2 and Tier 3 cities are emerging as growth hubs, where compact and affordable power tools are required for quick deployment. Indian construction crews prefer multi-surface cutting tools with fuel-efficient engines due to intermittent access to grid power. Equipment rental chains are also expanding, enabling wider access to imported and professional-grade cutting solutions at job sites.

Handheld Concrete Saws Market in Germany is forecast to grow at a CAGR of 6.0%, backed by demand from restoration projects, smart building retrofits, and commercial site development. German buyers prioritize durability, noise control, and dust extraction features, aligning with EU safety regulations. Precision remains paramount, with handheld concrete saws being deployed for window enlargements, beam cutting, and interior wall modifications. Domestic toolmakers are investing in ergonomic designs and hybrid engine formats, targeting both independent contractors and facility maintenance crews working in confined or sensitive areas.

The handheld concrete saws market in the United Kingdom is expected to grow at a CAGR of 4.9%, supported by demand from repair and redevelopment initiatives across transportation and industrial assets. Retrofit construction in aging cities is pushing contractors to choose mobile, high-efficiency saws for confined spaces and narrow job sites. Battery-integrated models are gaining momentum due to emission-free compliance in indoor and enclosed environments. While imports dominate the market, a growing number of distributors are bundling services like operator training and extended warranties to add value.

With a CAGR of 4.4%, the handheld concrete saws market in the United States is growing steadily as commercial construction rebounds and DIY segments expand. Contractors are demanding lightweight saws with advanced cooling systems for prolonged daily use on residential and commercial sites. OSHA’s dust exposure regulations are pushing buyers toward integrated wet-cutting systems and vacuum-compatible attachments. While gas-powered models remain dominant, battery-powered and corded electric options are gaining favor in municipalities and interior renovation contracts where emissions and noise are restricted.

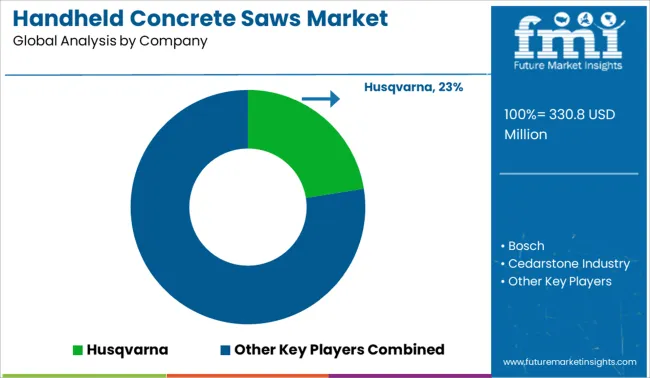

The handheld concrete saws market is moderately consolidated, with a strong presence of global power tool manufacturers offering durable, high-performance solutions for construction, demolition, and infrastructure work. Tier 1 players like Husqvarna, Bosch, and Stihl dominate with advanced cutting technologies, wide product ranges, and established contractor trust.

Husqvarna leads the market with a significant share, backed by innovation in ergonomics, dust control, and battery-powered systems. Tier 2 companies such as Makita, Hilti, and Dewalt focus on professional-grade reliability and cordless integration for job site efficiency. Tier 3 players like MK Diamond Products, Ryobi, and Cedarstone Industry serve niche markets and DIY users with cost-effective options. Market demand is driven by construction growth, precision cutting needs, and increasing adoption of electric and low-emission tools.

On August 8, 2023, Milwaukee Tool officially announced the MX FUEL™ 6-inch Green Concrete Saw via its website. Designed for fresh concrete cutting up to 1½″ deep, it offers zero emissions, quieter performance, and on-board blade-depth adjustment

| Item | Value |

|---|---|

| Quantitative Units | USD 330.8 Million |

| Power Source | Electric, Hydraulic, and Pneumatic |

| Blade Type | Diamond blades, Carbide blades, and Steel blades |

| End-user | Industrial, Residential, and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Husqvarna, Bosch, Cedarstone Industry, Dewalt, ECHO, Flex Tools, Hilti, Koki, Makita, Milwaukee, MK Diamond Products, Ryobi, Saint-Gobain, Stihl, and Wacker Neuson |

| Additional Attributes | Dollar sales by saw type (gas-powered, electric, battery-operated, hydraulic), blade type (dry cutting, wet cutting, diamond blades), and end-use sector (construction, demolition, road maintenance, emergency rescue); regional demand trends influenced by urban infrastructure projects and construction safety regulations; performance factors such as cutting depth, portability, and vibration control; innovation in dust suppression, ergonomic design, and battery efficiency; lifecycle cost considerations including maintenance and blade replacement; environmental impact of emissions and noise pollution; and emerging use cases in precision concrete cutting and green building practices. |

The global handheld concrete saws market is estimated to be valued at USD 330.8 million in 2025.

The market size for the handheld concrete saws market is projected to reach USD 549.1 million by 2035.

The handheld concrete saws market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in handheld concrete saws market are electric, hydraulic and pneumatic.

In terms of blade type, diamond blades segment to command 46.2% share in the handheld concrete saws market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Handheld Point of Sale Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Arthroscopic Instruments Market Growth – Trends & Forecast 2025 to 2035

Handheld Marijuana Vaporizer Market Insights – Demand & Forecast 2025-2035

Handheld Device Accessories Market

Handheld GPS Units Market

Handheld Retinal Scanners Market

Handheld DC Torque Tools Market

Rugged Handheld Electronic Devices Market Analysis – Size, Share & Forecast 2025 to 2035

Wireless Handheld Spectrometer Market

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA