The Cooling Agents Market is expected to record a valuation of USD 1,206.2 million in 2025 and USD 2,653.2 million in 2035, with an increase of USD 1,447.0 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.2% and a 2X increase in market size.

Cooling Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Cooling Agents Market Estimated Value in (2025E) | USD 1,206.2 million |

| Cooling Agents Market Forecast Value in (2035F) | USD 2,653.2 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

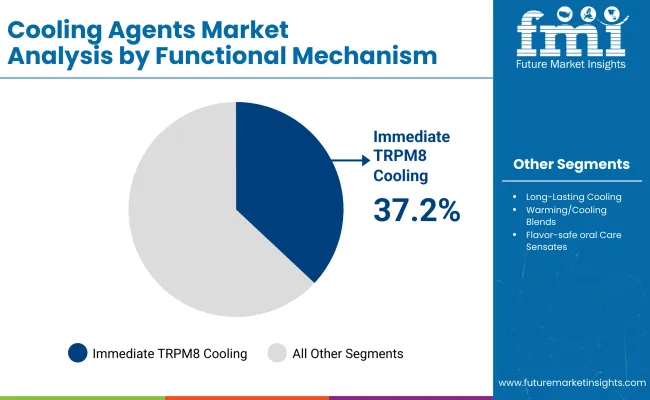

During the first five-year period from 2025 to 2030, the market increases from USD 1,206.2 million to USD 1,788.9 million, adding USD 582.7 million, which accounts for 40% of the total decade growth. This phase records steady adoption in oral care, lip care, and body & face care, driven by the demand for safe and consumer-friendly sensates. Immediate TRPM8 cooling agents dominate this period as they cater to over 37% of applications requiring fast-acting cooling performance.

The second half from 2030 to 2035 contributes USD 864.3 million, equal to 60% of total growth, as the market jumps from USD 1,788.9 million to USD 2,653.2 million. This acceleration is powered by widespread deployment of encapsulated sensates, WS-type synthetics, and premium dermocosmetic applications.

Encapsulated delivery systems and solution concentrates together capture a larger share above 50% by the end of the decade. Botanical cooling oils, clean-label sensates, and premium positioning in skin and hair products add recurring revenue, increasing the dermocosmetic and personal care segments beyond 12% each in total value.

From 2020 to 2024, the Cooling Agents Market expanded steadily, driven by oral care and personal care formulations. During this period, the competitive landscape was dominated by menthol & derivative-based products, which controlled nearly 70% of revenue. Leaders such as Symrise, Givaudan, and IFF focused on expanding TRPM8 activators and menthol derivatives for toothpaste, mouthwash, and lip care categories. Competitive differentiation relied on safety, intensity, and duration of cooling effects, while botanical cooling oils and encapsulated sensates remained in early adoption stages. Premium dermocosmetic use cases contributed less than 10% of the total market value.

Demand for cooling agents will expand to USD 1,206.2 million in 2025, and the revenue mix will gradually shift as WS-type synthetics and encapsulated delivery systems grow beyond 50% share. Traditional menthol-driven leaders face rising competition from innovators specializing in botanical sensates, encapsulated formats, and clean-label cooling oils.

Major incumbents are pivoting to hybrid models, integrating synthetic blends with natural oils to maintain consumer trust and regulatory compliance. Emerging entrants focusing on AR/VR sensory integration in beauty, digital twin-based product simulation, and AI-personalized cooling formulations are gaining visibility. The competitive advantage is moving away from menthol-centric innovation toward portfolio diversity, encapsulation technologies, and recurring demand from dermocosmetic and scalp/hair care formulations.

Cooling agents are increasingly integrated into oral hygiene products like toothpaste and mouthwash, where consumers associate freshness with efficacy. Additionally, rising consumer focus on skin wellness and scalp comfort is driving adoption in personal care and dermocosmetics. Brands are reformulating with menthol derivatives, WS-type synthetics, and encapsulated sensates to provide longer-lasting, safe, and pleasant experiences. This steady expansion across oral and skin care contributes significantly to the sustained growth of the Cooling Agents Market through 2035.

The market is benefiting from technological advancements such as encapsulated sensates and pre-blended formulations that allow controlled release, extended effect, and improved stability. At the same time, the clean-label movement is fueling demand for botanical cooling oils and natural flavor-safe sensates, particularly in Asia-Pacific and Europe. This shift toward safer, eco-friendly, and high-performance ingredients aligns with regulatory standards and consumer expectations. As a result, premium positioning and wider application in dermocosmetic and hair care categories are accelerating growth opportunities across the decade.

The Cooling Agents Market is segmented by functional mechanism, chemistry type, delivery system, physical form, application, end use, and geography. Functional mechanisms include immediate TRPM8 cooling, long-lasting cooling, warming/cooling blends, and flavor-safe oral care sensates, catering to diverse sensory needs. By chemistry type, the market is divided into menthol & derivatives, WS-type synthetics, botanical cooling oils, and encapsulated sensates, reflecting both synthetic and natural innovations.

Delivery systems comprise free form, encapsulated, and pre-blended formats, while physical forms span powders, solution concentrates, and beads/encapsulates. Applications cover oral care, lip care, body & face care, and scalp & hair products.

End-use adoption is concentrated in personal care, oral care, and premium dermocosmetic categories. Regionally, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China and India showing the fastest CAGR growth during 2025 to 2035.

| Functional Mechanism | Value Share % 2025 |

|---|---|

| Immediate TRPM8 cooling | 37.2% |

| Others | 62.8% |

The Immediate TRPM8 cooling segment is projected to contribute 37.2% of the Cooling Agents Market revenue in 2025, maintaining its lead as the dominant functional mechanism category. Growth is fueled by strong adoption in oral care, lip care, and body & face care products, where consumers demand instant freshness and noticeable sensorial effects. TRPM8 activators such as menthol derivatives and synthetic sensates deliver rapid cooling perception, making them highly sought after by formulators across personal care and healthcare applications.

The segment’s expansion is further supported by rising innovation in flavor-safe oral care sensates and incorporation into scalp & hair products for enhanced user experience. As encapsulation and hybrid blends evolve, TRPM8-driven cooling solutions are being reformulated to deliver more controlled and longer-lasting effects. The Immediate TRPM8 cooling segment is expected to remain the backbone of the Cooling Agents Market throughout the forecast period.

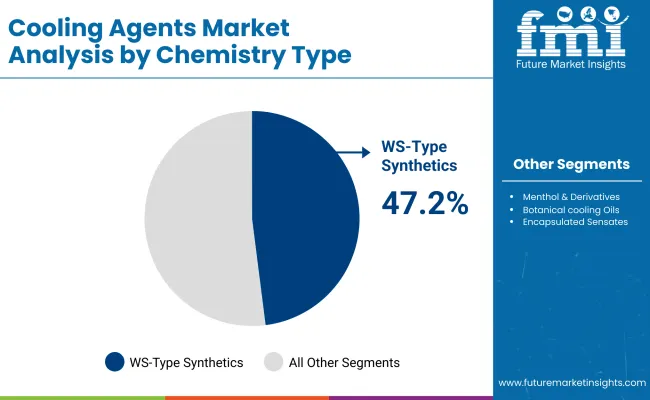

| Chemistry Type | Value Share % 2025 |

|---|---|

| WS-type synthetics | 47.2% |

| Others | 52.8% |

The WS-type synthetics segment is forecasted to hold 47.2% of the Cooling Agents Market share in 2025, driven by its ability to deliver strong, long-lasting cooling effects across oral care and personal care formulations. These sensates are favored for their stability, safety profile, and versatility in blending with other active ingredients, making them ideal for modern consumer products.

Their consistent performance and compatibility with encapsulation systems have facilitated widespread adoption in oral care, lip balms, and dermocosmetic lines. The segment’s growth is further supported by continuous innovation in synthetic cooling compounds that extend cooling duration while minimizing irritation. As brands increasingly prioritize controlled-release technologies and sensorial differentiation, WS-type synthetics are expected to retain their leadership position in the chemistry type segment of the Cooling Agents Market.

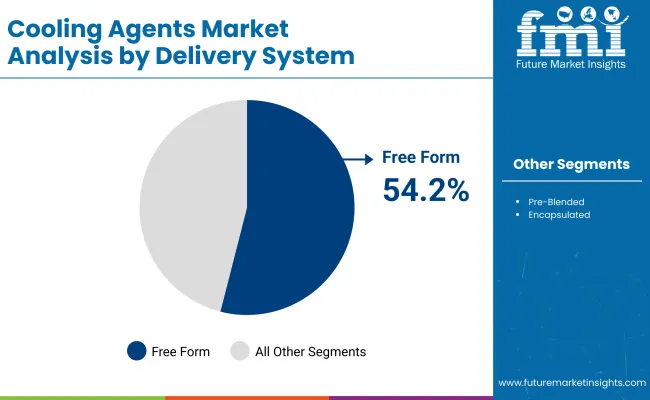

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 54.2% |

| Others | 45.8% |

The Free form delivery system segment is projected to account for 54.2% of the Cooling Agents Market revenue in 2025, establishing it as the leading format. Free form cooling agents are preferred for their ease of formulation, direct incorporation into oral and personal care products, and cost-effectiveness compared to more complex encapsulated systems.

Their suitability for delivering rapid cooling sensations and compatibility with a wide range of product bases from toothpaste and chewing gum to creams, balms, and shampoos has accelerated adoption. Continuous improvements in blending techniques and stability optimization are further enhancing performance, ensuring uniform cooling intensity. Given its balance of effectiveness, simplicity, and affordability, the Free form segment is expected to maintain its leading role in the Cooling Agents Market through 2035.

Rising demand in oral and personal care products

Cooling agents are increasingly being used in oral care products such as toothpaste, mouthwash, and chewing gum, where freshness perception is directly linked to product efficacy and consumer satisfaction. Similarly, personal care categories like lip balms, facial creams, and scalp-care solutions are adopting cooling sensates to enhance user experience. The growing consumer shift toward products offering multi-sensorial benefits is amplifying this demand. With Asia-Pacific and Europe leading in oral hygiene and dermocosmetic innovation, cooling agents are set to experience steady growth across diverse end-use applications.

Expansion of encapsulation and controlled-release technologies

One of the strongest growth drivers is the adoption of encapsulation technologies that enable controlled and prolonged cooling effects. Unlike traditional free-form sensates, encapsulated delivery systems provide better stability, reduce volatility, and allow targeted release during application. This innovation is especially valuable in premium skincare, haircare, and high-end oral care, where consumers seek long-lasting freshness and comfort. With rising R&D investment by global players and increased regulatory acceptance of encapsulated actives, the cooling agents market is witnessing a technological transformation that broadens its application scope and improves product differentiation.

High regulatory scrutiny and formulation challenges

The market faces significant restraint from regulatory approvals and formulation complexities, particularly in oral and dermocosmetic applications. Cooling agents like menthol derivatives must adhere to stringent dosage guidelines to ensure safety and avoid irritation. Meanwhile, synthetic WS-type sensates often face consumer pushback in clean-label markets, limiting their acceptance in natural or organic product lines. Additionally, blending challenges such as volatility, stability issues, and compatibility with other actives increase development costs. These hurdles restrict faster product launches, especially in regions with stricter frameworks like the European Union and North America.

Shift toward natural and clean-label cooling sensates

A major trend shaping the market is the growing consumer preference for botanical cooling oils and natural sensates that align with clean-label, vegan, and sustainable claims. Brands are reformulating with peppermint, eucalyptus, and menthol oils to appeal to eco-conscious buyers while balancing efficacy with natural origin. This trend is reinforced by regulatory and retail demand for transparency and sustainability certifications. At the same time, premium brands are combining natural oils with encapsulation techniques to deliver longer-lasting, safe, and eco-friendly cooling effects. This natural-synthetic hybrid innovation is becoming a cornerstone of product differentiation in the coming decade.

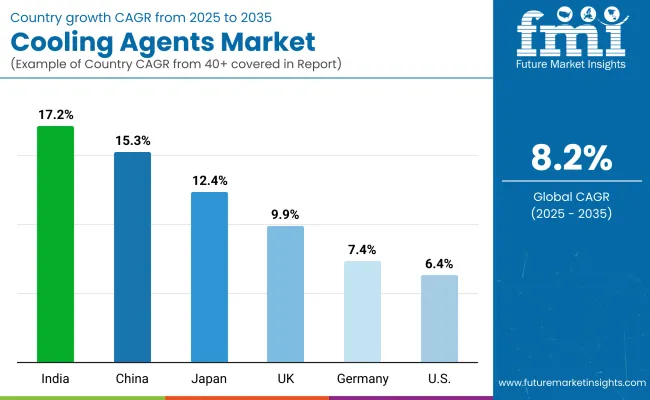

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.3% |

| USA | 6.4% |

| India | 17.2% |

| UK | 9.9% |

| Germany | 7.4% |

| Japan | 12.4% |

The global Cooling Agents Market shows clear regional variations in adoption speed, shaped by consumer preference for sensorial experiences, regulatory frameworks, and innovation in formulation technologies. Asia-Pacific emerges as the fastest-growing region, anchored by China at 15.3% CAGR and India at 17.2% CAGR. Growth in China is fueled by strong oral care penetration, rising demand for cooling flavors in confectionery, and expanding dermocosmetic launches. India reflects rapid adoption in personal care, scalp-care, and clean-label formulations, supported by a young consumer base and growing premium beauty retail.

Europe maintains a strong growth profile, led by the UK at 9.9% CAGR and Germany at 7.4% CAGR, supported by consumer preference for clean-label cooling oils and compliance with EU cosmetic safety regulations. Premium dermocosmetic formulations and botanical-based sensates are particularly driving growth in Western Europe. Japan records a 12.4% CAGR, propelled by innovation in encapsulated cooling sensates and their integration into hybrid skincare products combining hydration and anti-aging benefits.

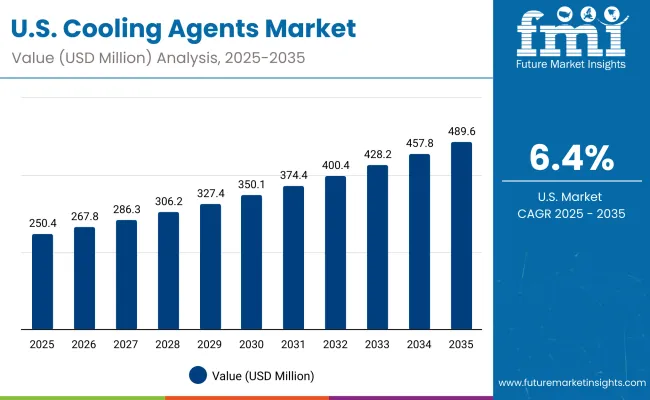

North America shows moderate expansion, with the USA growing at 6.4% CAGR, reflecting a mature oral care market and slower adoption of encapsulated sensates compared to Asia. Growth here is more innovation-driven, with rising demand for long-lasting WS-type synthetics and clean-label cooling sensates in premium oral and lip care categories, alongside expansion into functional beverages.

| Year | USA Cooling Agents Market (USD Million) |

|---|---|

| 2025 | 250.43 |

| 2026 | 267.80 |

| 2027 | 286.37 |

| 2028 | 306.23 |

| 2029 | 327.46 |

| 2030 | 350.17 |

| 2031 | 374.46 |

| 2032 | 400.43 |

| 2033 | 428.20 |

| 2034 | 457.89 |

| 2035 | 489.65 |

The Cooling Agents Market in the United States is projected to grow at a CAGR of 6.4% from 2025 to 2035, reaching nearly USD 490 million by the end of the forecast period. Growth is driven by consistent consumer demand for oral care products such as toothpaste, mouthwash, and chewing gum, where cooling freshness is a key purchase driver.

Additionally, lip care, body care, and scalp-care products are adopting WS-type synthetics and encapsulated sensates to differentiate through long-lasting cooling effects. Premium dermocosmetics and wellness-oriented formulations are further boosting innovation, with encapsulated cooling sensates gaining traction for sustained performance.

The Cooling Agents Market in the United Kingdom is expected to grow at a CAGR of 9.9% from 2025 to 2035, supported by rising applications in oral care, premium skincare, and personal wellness products. Leading oral hygiene brands are reformulating with WS-type synthetics and menthol derivatives to deliver more refreshing and long-lasting effects. In skincare, cooling sensates are being incorporated into lip balms, face creams, and scalp treatments to enhance consumer experience and differentiate product portfolios.

Retail growth is supported by premium beauty and pharmacy chains adopting clean-label botanical cooling oils to meet sustainability and natural ingredient demand. Government-backed innovation programs in cosmetic science and strong collaboration between academic institutions and consumer goods companies continue to drive product launches and accelerate adoption.

India is witnessing rapid growth in the Cooling Agents Market, which is forecast to expand at a CAGR of 17.2% through 2035. Rising consumer awareness of oral hygiene, scalp health, and premium skincare is driving adoption, particularly in tier-2 and tier-3 cities where affordability and accessibility are improving.

Local and multinational oral care brands are incorporating menthol derivatives and WS-type synthetics into toothpaste, mouthwash, and chewing gum, while personal care players are launching lip balms, face creams, and hair products with cooling sensates to tap into demand for freshness and comfort. Increasing distribution through pharmacies, specialty beauty retail, and e-commerce platforms is further accelerating penetration.

The Cooling Agents Market in China is expected to grow at a CAGR of 15.3%, the highest among leading economies. This momentum is driven by strong demand in oral care, confectionery, and personal care segments, supported by rapid urbanization and rising consumer spending on health and wellness. Local manufacturers are innovating with WS-type synthetics and botanical cooling oils, offering affordable solutions tailored to mass-market products.

At the same time, premium beauty and dermocosmetic brands are leveraging encapsulated sensates to deliver long-lasting cooling effects in skincare and haircare. Expanding e-commerce penetration and government-backed initiatives to promote high-quality consumer products are further accelerating adoption.

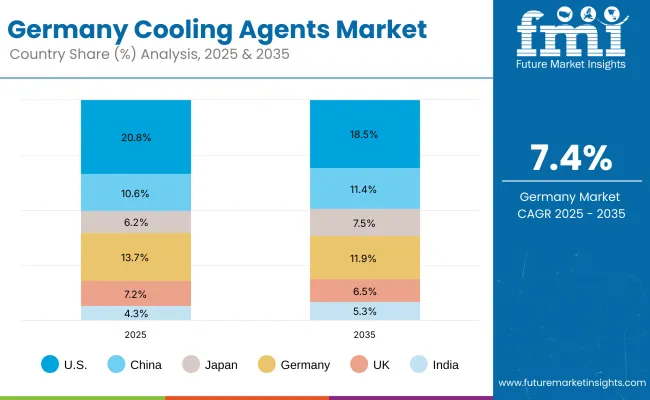

| Country | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.2% |

| India | 4.3% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Cooling Agents Market in Germany is projected to grow at a CAGR of 7.4%, supported by its leadership in personal care innovation and dermocosmetic formulations. German manufacturers are focusing on encapsulated sensates and WS-type synthetics to deliver longer-lasting freshness in oral care, lip balms, and premium skincare.

In addition, the country’s dermocosmetic industry, driven by pharmacy chains and specialist retailers, is integrating cooling agents into face creams, scalp products, and post-sun repair lotions. Compliance with stringent EU cosmetic safety standards and consumer preference for clean-label botanical oils are shaping new product pipelines. Sustainable sourcing and eco-certification requirements are further pushing companies to innovate in natural and hybrid cooling formulations.

.webp)

| USA By Functional Mechanism | Value Share % 2025 |

|---|---|

| Immediate TRPM8 cooling | 36.3% |

| Others | 63.7% |

The Cooling Agents Market in the United States is projected at USD 250.43 million in 2025, expanding at a CAGR of 6.4% through 2035. Immediate TRPM8 cooling sensates account for 36.3% share, reflecting strong adoption in oral care, chewing gum, and lip balm products, where fast-acting freshness is a key consumer demand driver. However, WS-type synthetics and encapsulated sensates are steadily gaining share, as brands pursue longer-lasting effects and controlled-release technologies.

Growth is further supported by the rising demand for premium dermocosmetic formulations in face creams, post-sun repair lotions, and scalp-care products, where cooling agents are positioned as both sensorial enhancers and comfort additives. In addition, USA consumers are showing increasing preference for clean-label and vegan formulations, prompting brands to incorporate botanical oils and natural cooling derivatives. This dual track of synthetic innovation and botanical-based positioning is reshaping the USA market outlook.

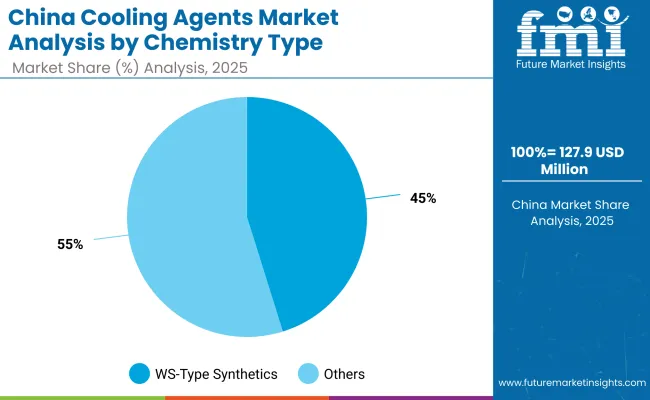

| China By Chemistry Type | Value Share % 2025 |

|---|---|

| WS-type synthetics | 45.2% |

| Others | 54.8% |

The Cooling Agents Market in China is valued at USD 127.99 million in 2025, expanding at a CAGR of 15.3% through 2035. WS-type synthetics hold 45.2% share, reflecting strong adoption in oral care, confectionery, and chewing gum products where long-lasting freshness is critical. Opportunities are particularly strong in the personal care and dermocosmetic sectors, as consumers increasingly demand cooling sensations in face creams, scalp treatments, and lip balms.

Growth is being accelerated by domestic manufacturers, who are offering cost-effective synthetics tailored for mass-market oral care and gum brands, while international players are leveraging encapsulation technologies to serve premium skincare and haircare lines. Additionally, clean-label positioning with botanical oils presents an untapped opportunity, as China’s younger consumers associate natural cooling with safety and wellness. The convergence of e-commerce penetration, premium product launches, and local innovation in cooling sensates positions China as one of the most dynamic markets globally.

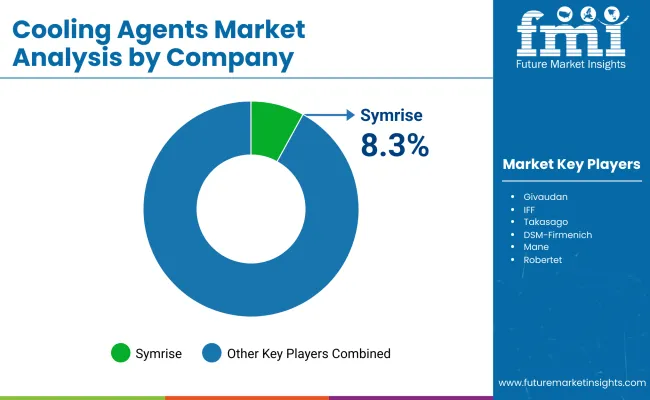

| Company | Global Value Share 2025 |

|---|---|

| Symrise | 8.3% |

| Others | 91.7% |

The Cooling Agents Market is moderately fragmented, with a mix of global fragrance and flavor leaders, mid-sized innovators, and niche specialists competing across oral care, personal care, and dermocosmetic applications. Global leaders such as Symrise, Givaudan, IFF, Takasago, and DSM-Firmenich hold significant market share, driven by broad portfolios spanning menthol derivatives, WS-type synthetics, botanical oils, and encapsulated sensates. Their strategies emphasize R&D in long-lasting cooling effects, natural-synthetic hybrids, and encapsulation technologies to enhance performance in premium formulations.

Established mid-sized players like Mane, Robertet, Sensient, and Bell Flavors & Fragrances are expanding their footprint through tailored blends and flavor-safe oral care sensates. They cater to regional demand for clean-label, vegan, and eco-certified cooling agents, particularly in Europe and Asia. Specialized companies such as Nikkol focus on niche dermocosmetic applications, offering sensates optimized for scalp and skin-care products with specific cooling intensity levels. Their strength lies in customization, regulatory compliance, and regional partnerships with personal care brands.

Competitive differentiation is shifting away from menthol-driven formulations toward portfolio diversity, encapsulated delivery systems, botanical integration, and clean-label positioning, reflecting consumer preferences for sustainability and long-lasting sensory experiences.

Key Developments in Cooling Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,206.2 Million |

| Functional Mechanism | Immediate TRPM8 cooling, Long-lasting cooling, Warming/cooling blends, Flavor-safe oral care sensates |

| Chemistry Type | Menthol & derivatives, WS-type synthetics, Botanical cooling oils, Encapsulated sensates |

| Delivery System | Free form, Encapsulated, Pre-blended |

| Physical Form | Powder, Solution/concentrate, Beads/encapsulates |

| Application | Oral care, Lip care, Body & face care, Scalp & hair products |

| End Use | Personal care, Oral care, Premium dermocosmetic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Symrise , Givaudan , IFF, Takasago, DSM- Firmenich , Mane, Robertet , Sensient , Bell Flavors & Fragrances, Nikkol |

| Additional Attributes | Dollar sales by functional mechanism and chemistry type, adoption trends in oral care and dermocosmetics , rising demand for encapsulated and clean-label botanical sensates , sector-specific growth in personal care, lip care, and scalp-care, delivery system revenue segmentation, integration with AI-personalized skincare and routine builders, regional trends influenced by clean-label and sustainability initiatives, and innovations in encapsulation, hybrid natural-synthetic blends, and flavor-safe oral care sensates . |

The global Cooling Agents Market is estimated to be valued at USD 1,206.2 million in 2025.

The market size for the Cooling Agents Market is projected to reach USD 2,653.2 million by 2035.

The Cooling Agents Market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key chemistry types in Cooling Agents Market are menthol & derivatives, WS-type synthetics, botanical cooling oils, and encapsulated sensates.

In terms of functional mechanism, the Immediate TRPM8 cooling segment is set to command the largest share at 37.2% in 2025, driven by its strong presence in oral care and personal care formulations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Grain Cooling Spear Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA