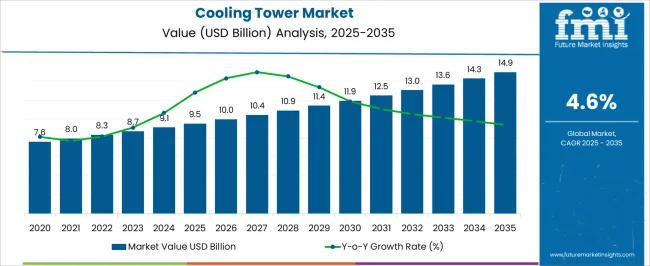

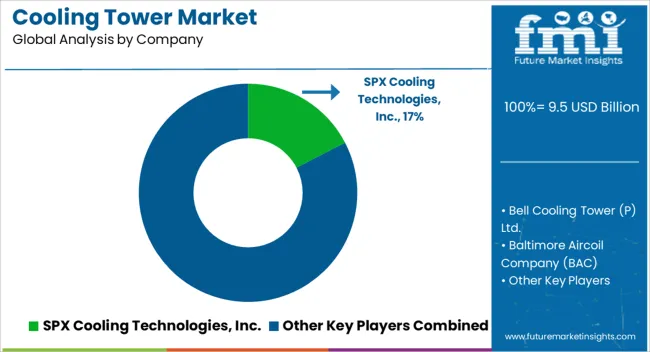

The cooling tower market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

From 2020 to 2024, the market grows from USD 7.6 billion to USD 9.1 billion, reflecting the early adoption phase supported by demand from power generation, petrochemical, and manufacturing industries. Annual increments such as USD 8.0 billion in 2021, USD 8.3 billion in 2022, and USD 8.7 billion in 2023 highlight consistent momentum, driven by industrial expansion, stricter thermal efficiency regulations, and the replacement of aging systems. In 2025, the market stands at USD 9.5 billion, marking a transition into the scaling phase. Between 2026 and 2030, the industry progresses from USD 10.0 billion to USD 11.9 billion, contributing almost 40% of the total projected expansion.

Growth during this stage is fueled by increased deployment of advanced cooling tower designs with improved water conservation, lower energy consumption, and enhanced corrosion resistance, alongside rising demand from HVAC systems in commercial complexes and industrial parks. From 2031 to 2035, the market expands from USD 12.5 billion to USD 14.3 billion, adding around 33% of the overall increase. This phase reflects steady adoption in food processing, chemicals, and large-scale energy infrastructure. The cooling tower market demonstrates consistent growth through 2035, supported by infrastructure upgrades, industrial modernization, and technological improvements in energy and water efficiency.

| Metric | Value |

|---|---|

| Cooling Tower Market Estimated Value in (2025 E) | USD 9.5 billion |

| Cooling Tower Market Forecast Value in (2035 F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The cooling tower market holds a pivotal role across multiple industrial and commercial segments, reflecting its significance in thermal management and process efficiency. Within the broader industrial equipment domain, cooling towers account for nearly 8–10% share, driven by demand in power generation, petrochemical, and steel manufacturing sectors where effective heat rejection is critical. In the power generation segment, their contribution stands at about 12–14% share, as both nuclear and thermal power plants rely on cooling towers to maintain operational efficiency and manage condenser temperatures. The HVAC and commercial building category represents approximately 6–7% share, where large-scale air conditioning and district cooling systems integrate cooling towers for energy-efficient heat discharge. In the chemical and petrochemical processing industry, cooling towers capture close to 5–6% share, ensuring process water recirculation and temperature regulation for continuous operations.

Within data centers and high-performance computing facilities, cooling towers contribute around 2–3% share, supporting indirect or hybrid cooling systems to maintain optimal server performance. The market is further reinforced by retrofit and modernization projects, stricter environmental compliance, and rising emphasis on water and energy efficiency, which drive the replacement of older units with advanced designs. Constraints such as water scarcity, chemical treatment requirements, and site-specific installation challenges continue to influence adoption strategies. Overall, cooling towers are recognized as a fundamental component for industrial thermal management, balancing operational efficiency, regulatory adherence, and long-term cost optimization across a diverse range of applications.

The cooling tower market is expanding steadily, driven by the rising demand for heat rejection systems across industrial, commercial, and power generation sectors. The need for efficient thermal management solutions has surged with increasing energy production and process intensification in manufacturing.

Government regulations mandating water conservation and thermal discharge control are encouraging the adoption of advanced cooling technologies.

Additionally, the integration of smart monitoring systems and durable, low-maintenance materials is enhancing lifecycle efficiency and reliability, making cooling towers a vital component in sustainability-focused infrastructure upgrades.

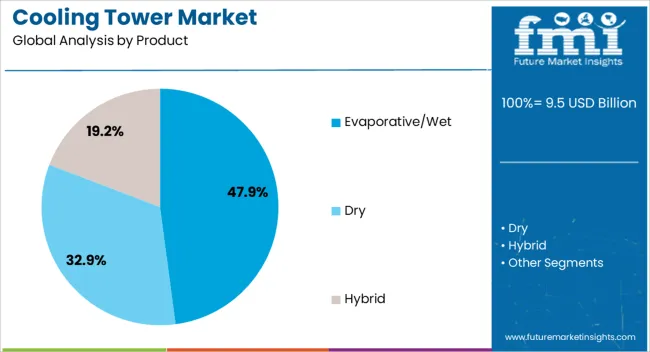

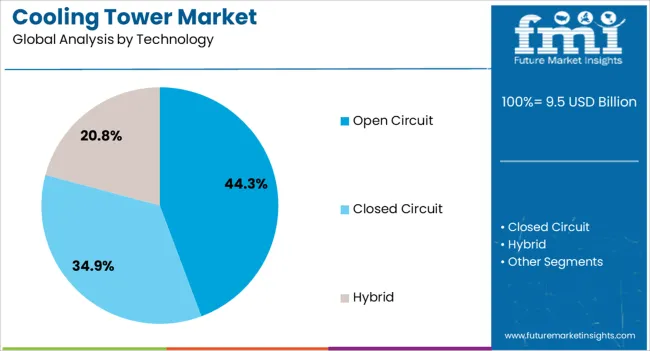

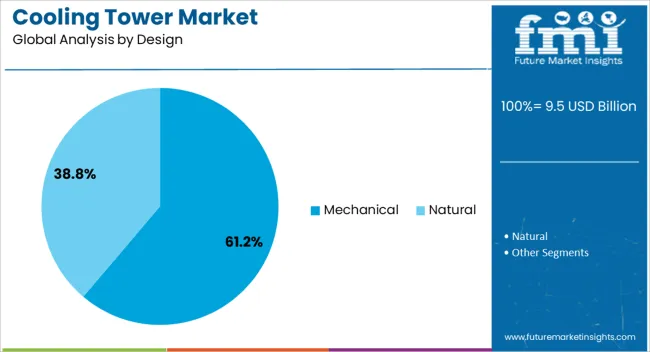

The cooling tower market is segmented by product, technology, design, build, construction material, flow, and geographic regions. By product, cooling tower market is divided into evaporative/wet, dry, and hybrid. In terms of technology, cooling tower market is classified into open circuit, closed circuit, and hybrid. Based on design, cooling tower market is segmented into mechanical and natural. By build, cooling tower market is segmented into field erection and package. By construction material, cooling tower market is segmented into FRP, concrete, steel, wood, and others. By flow, cooling tower market is segmented into cross flow and counter flow. Regionally, the cooling tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Evaporative or wet cooling towers are projected to dominate the product category with 47.9% market share in 2025. Their high cooling efficiency and cost-effectiveness in dissipating large volumes of heat make them the preferred choice in energy-intensive applications. These towers are particularly suitable for regions with favorable climatic conditions, where water availability supports evaporative processes. Growing deployment in power plants, petrochemical facilities, and HVAC systems is reinforcing demand. Innovations such as hybrid systems and plume abatement technologies are further strengthening this segment's appeal by improving performance and environmental compliance.

Open circuit cooling towers are expected to lead the market in the technology segment with 44.3% share by 2025. Their simple design, lower capital costs, and operational efficiency have made them widely adopted across chemical plants, refineries, and commercial buildings. The continued expansion of industrial infrastructure in emerging markets is bolstering adoption. Open circuit systems are particularly favored where water treatment is manageable and thermal loads fluctuate seasonally. The development of corrosion-resistant materials and automated flow control has helped mitigate maintenance issues and extend equipment longevity.

The mechanical segment is set to capture 61.2% of the market share in 2025, making it the dominant design type in cooling tower installations. Mechanical draft towers offer enhanced airflow control and compact footprints, enabling their use in space-constrained urban and industrial locations. Fans powered by electric motors ensure consistent air movement, increasing cooling efficiency and adaptability to variable load conditions. The ability to scale performance and integrate with building management systems is positioning mechanical cooling towers as a top choice in both retrofits and new infrastructure development.

Cooling towers are critical for industrial, power, and commercial applications, driven by efficiency, retrofit needs, and regulatory compliance. Market growth is supported by energy optimization, modern design adoption, and sector-specific regulations that enhance operational reliability.

Cooling towers are increasingly deployed across power generation and heavy industries to manage heat loads and maintain operational efficiency. Thermal power plants, petrochemical refineries, and steel manufacturing units rely on them to control condenser temperatures and ensure uninterrupted production. Demand is fueled by ongoing capacity expansions, replacement of aging infrastructure, and the integration of process water recirculation systems. Operational efficiency and energy optimization remain central to adoption, with manufacturers emphasizing modular designs, high-capacity units, and corrosion-resistant materials. Water treatment integration, low-noise operation, and compliance with local environmental standards further influence selection. Industrial projects in emerging regions and modernization initiatives in developed markets are driving steady installations. These dynamics create significant opportunities for engineering excellence and service contracts.

The cooling tower retrofit and replacement segment is expanding as older units face performance degradation, regulatory pressure, and higher operational costs. Facilities are prioritizing replacements that enhance thermal efficiency, reduce energy consumption, and lower maintenance expenses. Modular and packaged cooling towers are gaining traction due to shorter installation times and scalable capacity options. Chemical-resistant coatings, anti-fouling technologies, and vibration-reduction features are increasingly sought to prolong operational life. Operators are targeting units that integrate with existing water treatment solutions to maintain compliance. The segment growth is supported by project financing models, industrial maintenance contracts, and specialized engineering services. Aging infrastructure, efficiency mandates, and environmental considerations are shaping competitive differentiation.

Cooling towers are playing an expanding role in commercial and HVAC applications, particularly for large office complexes, district cooling, and industrial campuses. Efficient heat rejection ensures reliable temperature regulation and energy optimization in centralized air conditioning systems. Facility managers increasingly consider hybrid or indirect cooling designs to reduce water and energy usage. Noise reduction, footprint minimization, and ease of maintenance are critical design factors. Growth is encouraged by demand for green building certifications, enhanced occupant comfort, and long-term operational cost savings. Vendor partnerships with engineering contractors, system integrators, and building management companies are strengthening market penetration. The sector benefits from predictive maintenance, remote monitoring, and digital integration for enhanced operational control.

Environmental regulations, water usage policies, and chemical discharge limits are influencing cooling tower design and deployment. Industries are adopting closed-loop or hybrid configurations to minimize water loss and comply with local discharge standards. Treatment systems for blowdown, biofouling, and chemical management are becoming standard. Thermal efficiency, air emissions, and wastewater management influence project approvals and investment decisions. Regional variations in compliance, such as stringent European guidelines or localized permits in Asia, affect procurement strategies. Operators seek units that balance regulatory adherence with operational performance. Compliance-driven upgrades, inspections, and engineering consultancy services generate additional revenue streams for manufacturers. Awareness of regulatory frameworks ensures safer, efficient, and cost-optimized deployment across sectors.

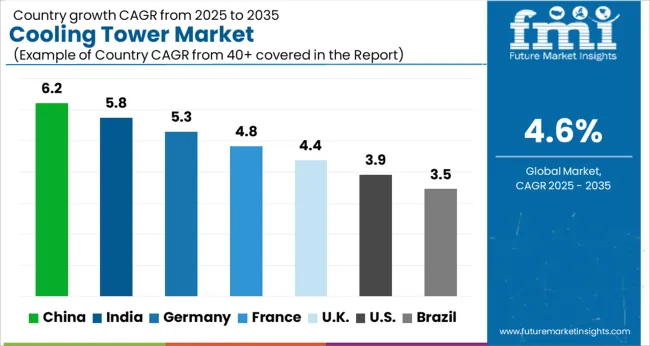

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

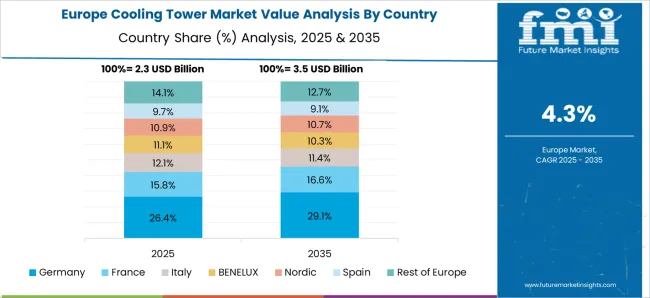

The cooling tower market is projected to expand at a global CAGR of 4.6%, with growth varying across key economies. China leads at 6.2%, driven by new industrial capacity, power plant expansions, and modernization of aging thermal infrastructure. India follows at 5.8%, supported by rising demand in industrial manufacturing, HVAC projects, and infrastructure development. France posts 4.8%, where replacement of older units and adoption of energy-efficient towers in power and industrial sectors is prominent. The United Kingdom grows at 4.4%, shaped by retrofit projects, commercial HVAC deployments, and regulatory compliance for water and environmental standards. The United States registers 3.9%, reflecting a mature market with slower growth, driven mainly by maintenance and selective replacement of existing units. These trends indicate faster adoption in Asia-Pacific due to industrial expansion, whereas Europe and North America show steady uptake focused on efficiency, regulatory adherence, and modernization initiatives.

The United Kingdom is expected to achieve a CAGR of 4.4% during 2025–2035, slightly below the global 4.6% average. In the 2020–2024 period, the CAGR was approximately 4.0%, supported by replacement of aging cooling towers in industrial and power applications and gradual adoption of modular and low-water-consumption units. The progression from 4.0% to 4.4% is explained by stricter environmental and water usage regulations, increasing retrofits in commercial HVAC systems, and growing emphasis on energy efficiency in industrial operations. Capital expenditure for modernization and the adoption of smart monitoring solutions have bolstered steady market expansion. I expect continued replacement cycles, integration of advanced materials, and compliance-driven upgrades to underpin moderate growth in the UK cooling tower segment.

China is projected to record a CAGR of 6.2% from 2025–2035, exceeding the global 4.6% benchmark. The 2020–2024 period observed a CAGR of roughly 5.4%, driven by rapid industrialization, construction of new power plants, and rising thermal plant capacity. The acceleration to 6.2% is attributed to large-scale infrastructure projects, replacement of obsolete systems, and government initiatives targeting industrial efficiency and water conservation. Expansion in commercial and industrial sectors has increased demand for modular and induced-draft towers. In my view, continued government-backed industrial growth and large-scale adoption of modern cooling solutions will reinforce China’s position as the highest-growth market globally.

India is expected to achieve a CAGR of 5.8% during 2025–2035, above the global baseline of 4.6%. Between 2020–2024, the CAGR was near 5.1%, supported by growth in industrial units, thermal power generation, and expanding HVAC projects in commercial infrastructure. The increase to 5.8% is explained by rising industrial output, modernization of older cooling systems, and enhanced regulatory enforcement for water usage and emissions. Investments in renewable energy plants and manufacturing clusters are also stimulating tower deployment. In my assessment, industrial and commercial expansion, coupled with policy-driven efficiency measures, will sustain India’s higher-than-average growth trajectory in cooling towers.

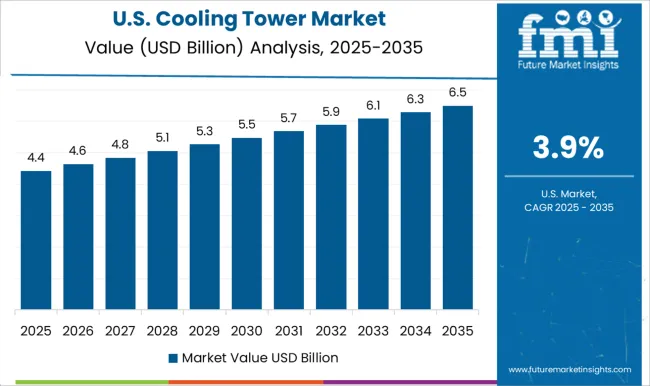

The United States is projected to grow at a CAGR of 3.9% during 2025–2035, below the global average of 4.6%. In the 2020–2024 period, the CAGR was near 3.5%, shaped by replacement of legacy cooling towers, selective retrofits in industrial and commercial buildings, and moderate expansion in power infrastructure. The increase to 3.9% is driven by focus on water and energy efficiency, adoption of low-maintenance designs, and integration of monitoring technologies to optimize performance. In my view, the market remains steady with incremental growth largely tied to replacement cycles and regulatory compliance, while new large-scale installations are limited due to mature infrastructure.

France is expected to post a CAGR of 4.8% for 2025–2035, slightly above the global 4.6% average. During 2020–2024, growth was approximately 4.3%, supported by retrofits in industrial plants, nuclear and thermal power facilities, and commercial HVAC expansions. The shift from 4.3% to 4.8% is attributed to regulatory mandates for environmental compliance, water usage reduction, and energy efficiency. Industrial modernization projects, particularly in chemical and automotive sectors, are expanding demand for advanced cooling solutions. In my assessment, replacement of aging units and adoption of modular, low-water consumption towers will continue to drive incremental growth and stabilize market dynamics.

The cooling tower market is shaped by leading global and regional manufacturers including SPX Cooling Technologies, Inc., Bell Cooling Tower (P) Ltd., Baltimore Aircoil Company (BAC), BERG Chilling Systems, Inc., and Brentwood Industries, Inc. These companies compete on design innovation, energy and water efficiency, modularity, and capacity to deliver reliable thermal management solutions across industrial, power, and commercial applications. SPX Cooling Technologies maintains a strong presence through diversified product lines and integrated service solutions. Bell Cooling Tower emphasizes customization and high-efficiency systems for emerging markets. BAC leverages engineering expertise and global distribution, while BERG Chilling Systems focuses on precision cooling solutions for process industries. Brentwood Industries differentiates through durable, corrosion-resistant designs. Additional players such as Delta Cooling Towers, Inc., EVAPCO, Inc., ENGIE Refrigeration GmbH, and International Cooling Tower Inc. further intensify competition by offering specialized solutions for power plants, HVAC systems, and industrial applications.

Johnson Controls, Inc. integrates smart monitoring with tower operations to enhance performance. Regional companies including Mesan Group, Perfect Cooling Towers, Paharpur Cooling Tower Ltd., REYMSA Cooling Towers, Inc., S.A. HAMON, Star Cooling Towers Pvt. Ltd., SPIG S.p.A., Thermal Care, Inc., and Thermax Limited focus on cost-effective designs, local manufacturing, and rapid deployment to serve niche customer segments. Key competitive strategies in this sector involve strategic partnerships with EPC contractors, investment in modular and hybrid cooling technologies, and after-sales service networks. Differentiation is achieved through product efficiency, compliance with environmental regulations, and capability to scale across various capacities. Manufacturers continue to explore new materials, advanced fan and fill technologies, and integrated monitoring systems to improve energy and water performance. Long-term competitiveness will depend on operational efficiency, innovation in design, and ability to meet increasingly stringent regulatory and performance standards in industrial and commercial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 billion |

| Product | Evaporative/Wet, Dry, and Hybrid |

| Technology | Open Circuit, Closed Circuit, and Hybrid |

| Design | Mechanical and Natural |

| Build | Field Erection and Package |

| Construction Material | FRP, Concrete, Steel, Wood, and Others |

| Flow | Cross Flow and Counter Flow |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SPX Cooling Technologies, Inc., Bell Cooling Tower (P) Ltd., Baltimore Aircoil Company (BAC), BERG Chilling Systems, Inc., Brentwood Industries, Inc., Delta Cooling Towers, Inc., EVAPCO, Inc., ENGIE Refrigeration GmbH, International Cooling Tower Inc., Johnson Controls, Inc., Mesan Group, Perfect Cooling Towers, Paharpur Cooling Tower Ltd., REYMSA Cooling Towers, Inc., S.A. HAMON, Star Cooling Towers Pvt. Ltd., SPIG S.p.A., Thermal Care, Inc., and Thermax Limited |

| Additional Attributes | Dollar sales, share, regional demand trends, capacity type adoption, industrial vs commercial usage, replacement vs new installations, technological preferences, regulatory impact, competitive landscape, and growth opportunities. |

The global cooling tower market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the cooling tower market is projected to reach USD 14.9 billion by 2035.

The cooling tower market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in cooling tower market are evaporative/wet, dry and hybrid.

In terms of technology, open circuit segment to command 44.3% share in the cooling tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Field Erected Cooling Tower Market Growth – Trends & Forecast 2024-2034

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA