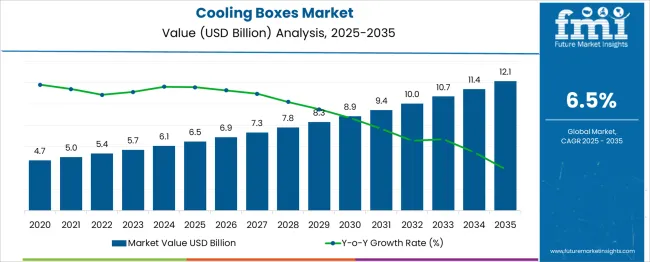

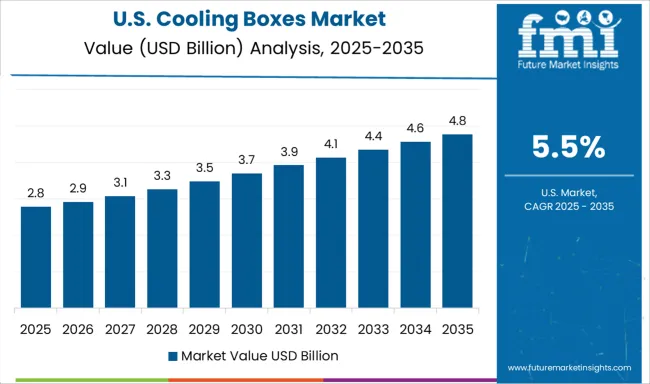

The Cooling Boxes Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. A year-on-year growth analysis reveals a steady and gradual increase in market value, with increments averaging between USD 0.4 billion and USD 0.7 billion annually. From 2025 to 2026, the market expands by USD 0.4 billion, followed by similar gains in subsequent years, with slight acceleration as the decade progresses.

The YoY growth rate, calculated as the percentage increase over the previous year, begins at roughly 6.15% between 2025 and 2026 and maintains a range between 5.7% and 6.9% in later years. This indicates a stable upward momentum without significant volatility, a key characteristic of markets driven by predictable seasonal demand, gradual technological advancements, and consistent consumer adoption patterns. The near-linear nature of annual percentage changes suggests that no abrupt demand surges or contractions are expected. Incremental demand growth is likely influenced by expanding outdoor leisure activities, portable refrigeration innovations, and commercial applications. The market demonstrates a balanced YoY growth trajectory, with stable gains supporting a sustainable long-term expansion pattern and reduced susceptibility to disruptive cyclical fluctuations.

| Metric | Value |

|---|---|

| Cooling Boxes Market Estimated Value in (2025 E) | USD 6.5 billion |

| Cooling Boxes Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The cooling boxes market is experiencing consistent growth, fueled by heightened demand for portable temperature-controlled storage across consumer and commercial domains. Reusability and sustainability have emerged as central themes, driven by environmental regulations and shifting consumer behavior toward non-disposable, long-lasting products. Rising penetration of outdoor recreational activities, urban picnic culture, and increased focus on safe food and beverage transport have supported market expansion.

Manufacturers are investing in insulation innovations, ergonomic designs, and durable materials to meet evolving expectations. The shift toward high-efficiency, lightweight designs with longer thermal retention periods is shaping product development strategies.

Online retail penetration and e-commerce delivery services are also increasing the need for reliable cold chain support in the last-mile delivery segment, broadening the application base. As consumers become more conscious of product lifecycle impact, demand is expected to favor multipurpose, eco-responsible cooling solutions with improved usability.

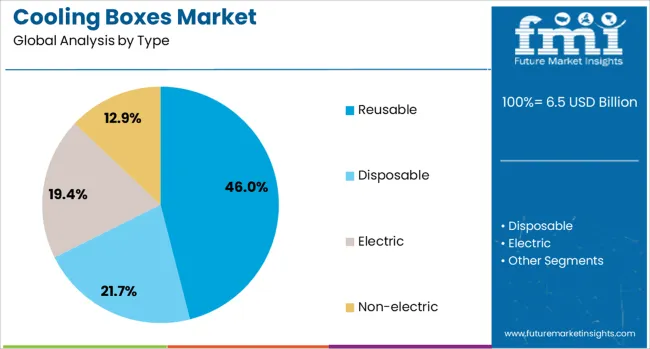

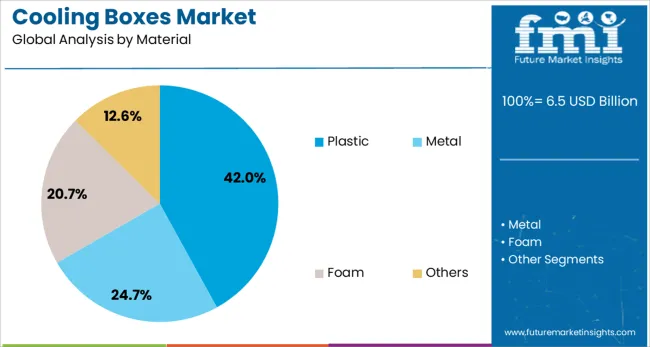

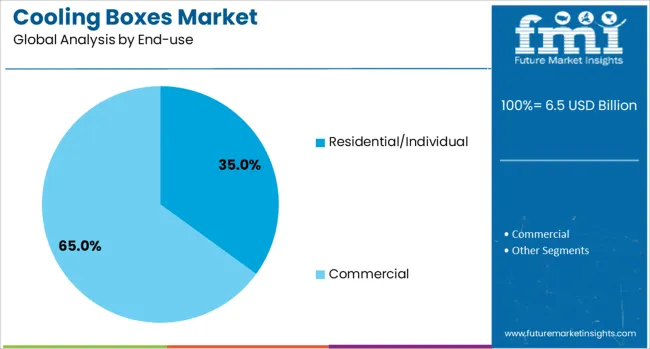

The cooling boxes market is segmented by type, material, end-use, distribution channel, and geographic regions. The cooling boxes market is divided into Reusable, Disposable, Electric, and Non-electric. In terms of material, the cooling boxes market is classified into Plastic, Metal, Foam, and others. The end-use of the cooling boxes market is segmented into Residential/Individual and Commercial. The distribution channel of the cooling boxes market is segmented into indirect and direct. Regionally, the cooling boxes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Reusable cooling boxes are projected to hold 46.00% of the market share in 2025, establishing them as the dominant product type. Their appeal is driven by growing consumer preference for sustainable and cost-effective solutions that support repeated use without compromising performance.

Regulatory push against single-use plastics has reinforced the adoption of reusable formats, especially in urban and eco-conscious markets. These boxes are favored for their long lifecycle, robustness under varied environmental conditions, and ability to offer consistent cooling over extended periods.

Industries such as food delivery, event catering, and outdoor recreation have increasingly integrated reusable cooling boxes into their operations to reduce waste and align with green supply chain goals. Design advancements in stackability, ease of cleaning, and modular insulation are further reinforcing the value proposition of reusable products over their disposable counterparts.

Plastic-based cooling boxes are expected to account for 42.00% of the market in 2025, emerging as the preferred material category. This segment’s strength is being shaped by the material’s superior durability, lightweight properties, and cost-efficiency, especially for repeated outdoor and household usage.

High-density polyethylene (HDPE) and other impact-resistant polymers offer structural integrity and insulation effectiveness, making plastic a reliable choice for portable cooling solutions. Additionally, the ability to mold plastic into varied shapes and sizes supports customized designs, enhancing product usability.

Manufacturers are also increasingly utilizing recycled plastic and introducing BPA-free formulations to address environmental and health considerations. As material science progresses, thermally-efficient and UV-resistant plastic variants are expected to maintain their competitiveness, especially among price-sensitive consumers and mass-market retail channels.

The residential/individual segment is forecast to lead with 35.00% market share in 2025, driven by lifestyle trends centered around outdoor leisure, picnics, road trips, and home-based cold storage needs. With rising awareness of food safety and temperature control, consumers are turning to compact, user-friendly cooling boxes for short-term and daily-use applications.

The convenience offered by lightweight, portable designs and flexible storage formats appeals to urban households seeking functional and space-efficient cooling solutions. Additionally, the growth of DIY culture and backyard social gatherings is reinforcing demand for personal-use cooling products.

Product visibility in retail outlets and online platforms, combined with aggressive marketing campaigns targeting young, mobile consumers, has solidified the segment’s dominance. Demand is expected to remain strong as seasonal travel and domestic tourism continue to influence consumer purchasing behavior.

Cooling boxes have been utilized across diverse applications ranging from food preservation during transport to maintaining temperature-sensitive goods in recreational and commercial activities. These insulated containers have been designed to retain cold temperatures for extended periods through passive insulation or integrated cooling mechanisms. Their adoption has been influenced by outdoor leisure activities, cold chain logistics, and the transportation of medical supplies. Manufacturers have developed varied capacities and materials to meet durability, portability, and thermal performance requirements, positioning cooling boxes as essential tools in both personal and professional environments.

Demand for cooling boxes has been strongly influenced by recreational activities such as camping, fishing, road trips, and beach outings. Consumers have relied on these containers to store beverages, fresh produce, and perishable goods without the need for external power sources. Lightweight designs and ergonomic handles have improved portability, while robust outer shells have ensured resistance to impact during outdoor use. The growth of adventure tourism and extended outdoor stays has supported consistent sales. Enhanced ice retention through multi-layer insulation and precision sealing has increased the attractiveness of premium models. In parallel, collapsible and modular designs have been developed for users with limited storage space, expanding market penetration in urban households and travel enthusiasts.

In commercial applications, cooling boxes have been deployed for transporting perishable goods, pharmaceutical products, and biological samples where temperature stability is critical. Their use in foodservice delivery has expanded alongside demand for fresh meal kits and grocery delivery services. In the healthcare sector, cooling boxes have ensured the safe transport of vaccines, blood samples, and diagnostic reagents. High-density insulation materials and phase change cooling packs have been incorporated to maintain precise temperature ranges during transit. Customizable inserts and compliance with temperature-control regulations have strengthened their role in cold chain networks. These attributes have positioned cooling boxes as cost-effective and mobile solutions for businesses seeking reliable thermal management without large-scale refrigeration systems.

Advancements in manufacturing have introduced cooling boxes made from rotationally molded plastics, high-impact polypropylene, and composite insulation foams. These materials have improved strength, weather resistance, and thermal retention, enabling prolonged cooling without frequent ice replacement. Anti-microbial linings have been adopted to prevent bacterial growth in food-contact surfaces. UV-resistant exteriors have reduced material degradation in prolonged sun exposure, ensuring product longevity in harsh outdoor conditions. Integrated digital thermometers, drainage systems, and multi-compartment layouts have increased user convenience. Energy-assisted variants using thermoelectric cooling modules have expanded functionality for users requiring extended cold storage without ice. These innovations have differentiated products in both consumer and industrial segments.

Despite market growth, premium cooling boxes with advanced insulation or integrated electronics have faced resistance due to high purchase costs. Budget-conscious consumers have opted for low-cost alternatives such as insulated bags or traditional ice chests. In professional sectors, competition from refrigerated transport units and portable compressor coolers has challenged adoption in certain applications. Limited awareness of long-term durability benefits has further hindered premium segment penetration. Additionally, the bulky nature of large-capacity models has restricted storage and handling convenience for some users. Overcoming these barriers will require cost optimization, lightweight material innovation, and targeted promotion of value-added features that justify higher price points.

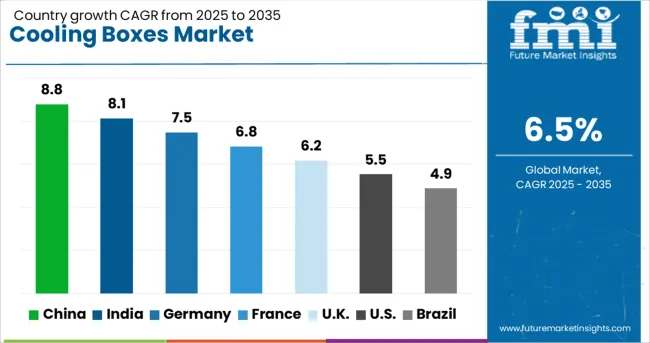

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The market is projected to record a CAGR of 6.5% from 2025 to 2035, supported by growth in portable cold storage needs, advancements in insulation materials, and expanding demand in food, beverage, and pharmaceutical logistics. China is expected to achieve an 8.8% CAGR, benefiting from its robust manufacturing sector and expanding cold chain infrastructure. India, with a growth rate of 8.1%, is driven by the food delivery boom and rural healthcare storage needs. Germany is forecasted to grow at 7.5% due to innovations in eco-friendly cooling solutions and regulatory compliance. The U.K., expanding at 6.2%, benefits from demand for outdoor leisure equipment and sustainable packaging. The U.S. market, growing at 5.5%, is shaped by recreational trends and cold chain modernization. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.8% in the cooling boxes market from 2025 to 2035. Rising domestic production capacity and improvements in insulation technology have enhanced product durability for both consumer and industrial applications. Cold chain logistics expansion in provinces such as Guangdong and Shandong has boosted the use of cooling boxes for perishable goods transport. Local manufacturers are integrating eco-friendly materials to meet environmental guidelines. Outdoor recreation demand and e-commerce grocery delivery services are further increasing market adoption.

India is expected to register a CAGR of 8.1% with growth driven by improved cold storage infrastructure and rising food delivery services. Government investments in refrigerated transport under agri-export policies have supported adoption of cooling boxes in rural and urban supply chains. Small and mid-scale manufacturers are increasing production of low-cost portable boxes for household use. Seasonal demand spikes during summer and festive food distribution periods have strengthened market performance.

Germany is projected to grow at a CAGR of 7.5% due to rising demand for premium thermal insulation and energy-efficient cooling solutions. Automotive and outdoor equipment manufacturers are collaborating with box producers to develop specialized cooling units. Use of phase-change materials is becoming more common to extend temperature retention without continuous power. Export opportunities within the EU are also driving local production.

The United Kingdom is forecasted to expand at a CAGR of 6.2% with strong market presence in retail grocery packaging and outdoor recreational activities. Consumer preference for lightweight and collapsible designs is guiding production trends. Increased participation in camping, fishing, and festivals has led to higher seasonal sales. Retailers are integrating cooling boxes into premium picnic and holiday packages to boost unit turnover.

The United States is anticipated to record a CAGR of 5.5% driven by online retail growth and demand for custom-sized cooling boxes for niche industries. Logistics companies are increasingly using temperature-controlled boxes for last-mile delivery of pharmaceuticals and specialty foods. Consumer adoption is high among tailgating, boating, and RV travel communities. Innovation in battery-powered cooling units is creating new product categories.

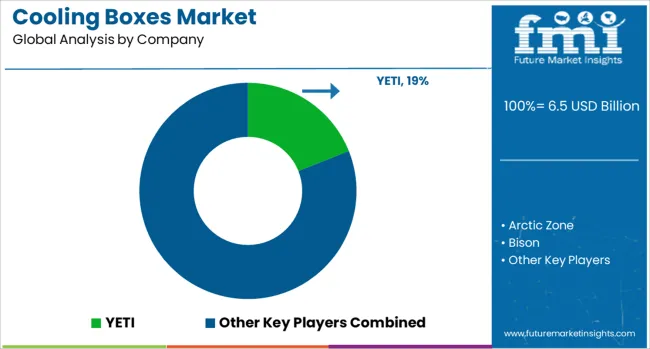

The market includes a broad spectrum of manufacturers delivering insulated storage products capable of maintaining low temperatures for prolonged periods. These solutions serve applications across outdoor leisure, food and beverage transport, marine activities, and temperature-sensitive logistics. Performance is primarily influenced by insulation efficiency, material durability, portability, and design versatility, while consumer choice is also shaped by brand reputation and product lifespan. YETI, Pelican, and RTIC have established dominance in the premium segment with rotomolded models offering exceptional ice retention and impact resistance, targeting professional users and extreme environment enthusiasts. Igloo, Coleman, and Arctic Zone hold strong positions in mass-market distribution, offering affordable designs in both hard and soft formats.

Engel, Orca, and Grizzly maintain a niche among high-performance users seeking heavy-duty construction and advanced thermal protection. Bison and K2 focus on delivering mid-tier coolers that balance long-term insulation with portability for general recreational use. Campingaz and IceMule concentrate on lightweight, collapsible, and inflatable designs suited for hikers, beachgoers, and compact storage needs. Cabela’s integrates its cooler portfolio within a broader outdoor equipment range, while Magma develops marine-grade units that withstand harsh saltwater exposure. Market growth is expected to be supported by expanding adventure tourism, increasing participation in outdoor sports, and the wider adoption of premium insulated storage in catering and specialized transport sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Type | Reusable, Disposable, Electric, and Non-electric |

| Material | Plastic, Metal, Foam, and Others |

| End-use | Residential/Individual and Commercial |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | YETI, Arctic Zone, Bison, Cabela's, Campingaz, Coleman, Engel, Grizzly, IceMule, Igloo, K2, Magma, Orca, Pelican, and RTIC |

| Additional Attributes | Dollar sales by cooling technology and end-use sector, demand dynamics across outdoor recreation, medical transport, and food logistics, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in phase-change materials, solar-powered cooling, and lightweight insulated composites, environmental impact of refrigerant usage, insulation material disposal, and energy consumption, and emerging use cases in vaccine cold chains, last-mile grocery delivery, and temperature-sensitive electronics transport. |

The global cooling boxes market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the cooling boxes market is projected to reach USD 12.1 billion by 2035.

The cooling boxes market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in cooling boxes market are reusable, disposable, electric and non-electric.

In terms of material, plastic segment to command 42.0% share in the cooling boxes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryoboxes Market Size and Share Forecast Outlook 2025 to 2035

Wax Boxes Market Insights - Growth & Demand Forecast 2025 to 2035

Market Share Breakdown of Cryoboxes Manufacturers

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Soap Boxes Market Analysis – Growth & Demand 2025 to 2035

Gift Boxes Market Trends - Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA