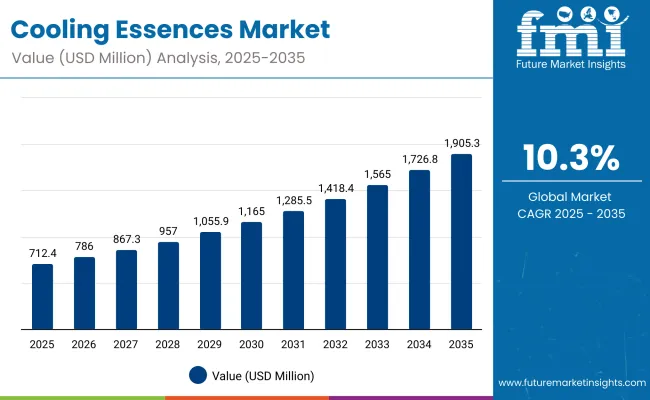

The Global Cooling Essences Market is expected to record a valuation of USD 712.4 million in 2025 and USD 1,905.3 million in 2035, with an increase of USD 1,192.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 10.3% and a near 3X increase in market size.

| Metric | Value |

|---|---|

| Global Cooling Essences Market Estimated Value in (2025E) | USD 712.4 million |

| Global Cooling Essences Market Forecast Value in (2035F) | USD 1,905.3 million |

| Forecast CAGR (2025 to 2035) | 10.3% |

During the first five-year period from 2025 to 2030, the market increases from USD 712.4 million to USD 1,165.0 million, adding USD 452.6 million, which accounts for 38% of the total decade growth. This phase records steady adoption in oral care, personal care, and confectionery, driven by the need for enhanced freshness and sensory performance. Oral care dominates this period as it caters to over 30% of industrial applications requiring long-lasting cooling intensity.

The second half from 2030 to 2035 contributes USD 740.3 million, equal to 62% of total growth, as the market jumps from USD 1,165.0 million to USD 1,905.3 million. This acceleration is powered by beverage innovation, premium skincare launches, and pharma OTC formulations adopting WS-series amides. Cooling amides (WS-3, WS-23) capture a larger share above 35% by the end of the decade. Encapsulation technologies and biotech-derived menthols add recurring demand, increasing the premium specialty systems share beyond 25% in total value.

From 2020 to 2024, the Global Cooling Essences Market grew from USD 500 million to USD 648 million, driven by menthol-dominated formulations. During this period, the competitive landscape was dominated by global F&F houses controlling nearly 60% of revenue, with leaders such as Symrise, Givaudan, and Firmenich focusing on menthol crystals and liquids for oral care and confectionery. Competitive differentiation relied on purity, sensory duration, and compliance, while advanced encapsulation systems were niche offerings. Premium biotech cooling agents had minimal traction, contributing less than 10% of the total market value.

Demand for cooling essences will expand to USD 712.4 million in 2025, and the revenue mix will shift as WS-series and biotech-derived menthols grow to over 35% share. Traditional menthol leaders face rising competition from specialty cooling innovators offering odorless, long-lasting systems and encapsulated formats. Major suppliers are pivoting to hybrid portfolios, integrating natural sourcing with sustainable biotech solutions to retain relevance. Emerging entrants specializing in microencapsulation, vegan compliance, and regulatory-advantaged formulations are gaining share. The competitive advantage is moving away from bulk menthol supply alone to innovation in delivery systems, sustainability, and recurring B2B partnerships.

Advances in cooling chemistry have improved odorless, long-lasting sensory effects, allowing for more versatile use across oral care, food & beverages, cosmetics, and OTC pharma. Menthol remains popular due to its familiarity and strong consumer recognition, while WS-series amides are gaining traction for their low odor and enhanced duration. Demand from oral hygiene, confectionery, and beverages is driving widespread adoption.

Expansion of microencapsulation technologies and fermentation-derived menthols has fueled growth, aligning with clean-label, sustainable, and premium product trends. Segment growth is expected to be led by menthol family ingredients, oral care applications, and synthetic sources due to scalability and cost efficiency, while biotech-derived formats represent the fastest-growing sub-segment.

The market is segmented by chemistry, origin, form & delivery system, sensory performance, application, certification & compliance, packaging, end-user type, sales channel, price tier, and region. Chemistry includes menthol family, menthyl esters, WS-series cooling amides, and other blends, highlighting the core actives driving adoption. Origin classification covers natural mint-derived, nature-identical, synthetic, and biotech-derived essences to cater to diverse sourcing needs. Based on form & delivery system, the segmentation includes solid crystals, liquid solutions, emulsions, and encapsulated beadlets or powders.

In terms of sensory performance, categories encompass fast onset, delayed onset, long-lasting cooling, intensity levels, and aroma profiles. Applications include oral care, personal care & cosmetics, food & beverage, pharmaceuticals & OTC, household & fabric, and pet care, reflecting multi-industry utilization. Certification & compliance covers IFRA, FEMA GRAS, REACH, China GB, India FSSAI, Halal, Kosher, Non-GMO, and Vegan requirements. Packaging is classified into 1-5 kg packs, 5-25 kg packs, and 25-200 kg drums/IBCs.

End-user types include flavor & fragrance houses, ingredient premix blenders, contract manufacturers (OEM/ODM), and brand owners. Sales channels include direct supply, authorized distributors, and online B2B platforms. Price tiers are divided into value, standard, and premium/specialty long-lasting systems. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

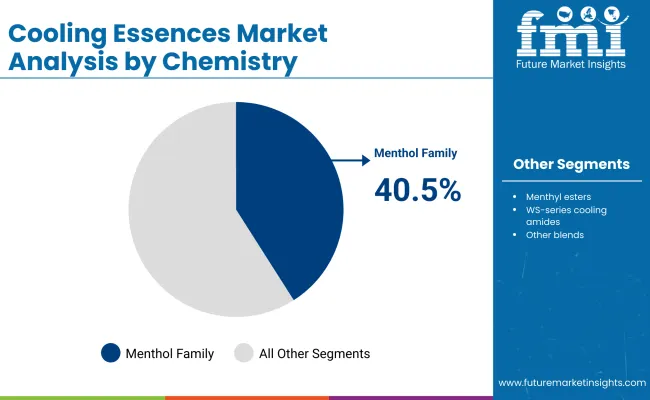

| Chemistry Segment | Market Value Share, 2025 |

|---|---|

| Menthol Family | 40.5% |

| Others | 59.5% |

The menthol family segment is projected to contribute 40.5% of the Global Cooling Essences Market revenue in 2025, maintaining its lead as the dominant chemistry category. This is driven by the widespread use of menthol in oral care, confectionery, and pharmaceutical formulations where strong familiarity and consumer acceptance support its dominance. Menthol’s ability to deliver immediate freshness and its natural association with cooling make it indispensable in toothpaste, chewing gum, and topical analgesics. The segment’s growth is also supported by scalable supply from both synthetic and natural mint sources, ensuring stable pricing and consistent availability. While WS-series amides and advanced blends are growing quickly, menthol remains the backbone ingredient for most mainstream applications.

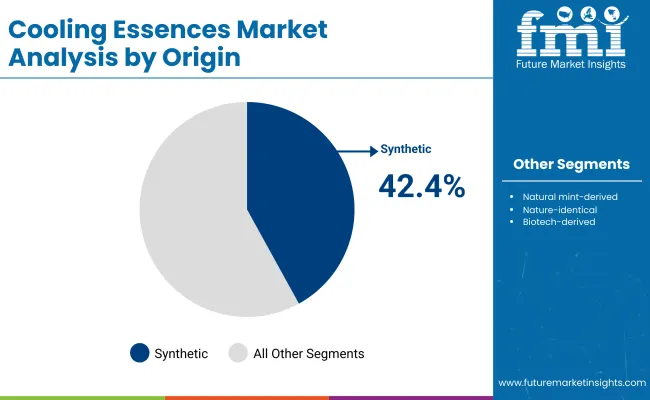

| Origin Segment | Market Value Share, 2025 |

|---|---|

| Synthetic | 42.4% |

| Others | 57.6% |

The synthetic origin segment is expected to account for 42.4% of the Global Cooling Essences Market in 2025, making it the leading origin type. Its dominance is attributed to cost efficiency, high purity levels, and scalable production, which are critical for large-volume buyers in oral care and beverage industries. Synthetic menthol and WS-series agents are widely preferred by manufacturers seeking consistent performance and global regulatory compliance. The segment also benefits from the ability to offer odorless and tailored cooling profiles that natural sources cannot always guarantee. Although biotech-derived and natural mint-based formats are gaining traction, especially in premium and clean-label categories, synthetics continue to lead due to their balance of affordability, reliability, and supply security.

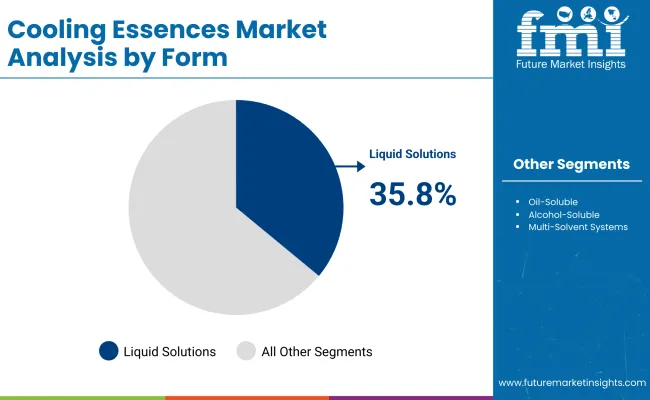

| Form & Delivery System Segment | Market Value Share, 2025 |

|---|---|

| Liquid Solutions | 35.8% |

| Others | 64.2% |

The liquid solutions segment is forecasted to hold 35.8% of the Global Cooling Essences Market share in 2025, emerging as the most widely used form. Liquids dominate because they are easy to dose, highly versatile, and compatible with multiple applications ranging from toothpaste and mouthwash to beverages and skincare formulations. Their adaptability in blending, superior solubility in both oil- and water-based systems, and established usage in oral care make them the preferred choice for formulators. Additionally, liquid formats allow for precise concentration adjustments, which is essential for tailoring cooling intensity in different product categories. While encapsulated beadlets and powder forms are expanding rapidly due to demand for controlled release and stability, liquid solutions remain the most dominant delivery system due to their simplicity, cost-effectiveness, and broad formulation flexibility.

Rising Demand in Oral Care and Beverages

The strongest driver for the cooling essences market is the accelerating demand from oral care and beverage industries, which together account for more than half of global consumption. In oral care, cooling actives like menthol and WS-series amides are indispensable for toothpaste, mouthwash, and gum formulations, where consumer perception of freshness directly impacts brand loyalty. Similarly, the beverage sector is witnessing innovation in functional waters, energy drinks, and dairy-based products, where cooling sensations enhance refreshment and create unique consumption experiences. The trend is further amplified in Asia-Pacific, where rapid urbanization and increasing disposable incomes are boosting demand for oral hygiene and premium beverages, thereby expanding opportunities for cooling essence suppliers.

Growth of Premium and Sustainable Ingredients

Another key growth driver is the shift toward sustainable, clean-label, and premium product positioning. Consumers, especially in Europe and North America, increasingly prefer biotech-derived menthols and encapsulated cooling systems that offer odorless, long-lasting effects with a natural or environmentally friendly claim. Biotech fermentation routes not only address environmental concerns tied to synthetic processes but also mitigate raw material volatility associated with mint crop yields. Premium positioning allows suppliers to capture higher margins by offering customized cooling profiles, microencapsulation technologies, and regulatory-compliant formulations. This shift from commodity menthol to specialty cooling solutions ensures higher adoption across personal care, skincare, and high-end food & beverage categories.

Volatility in Raw Material Prices and Synthetic Dependency

A major restraint is the price fluctuation in raw materials used for both synthetic and natural cooling essences. For natural menthol, variations in mint crop yields, weather conditions, and regional supply chain disruptions can cause unpredictable cost spikes. Synthetic menthol and amides, though more stable, are dependent on petrochemical inputs, which expose the industry to crude oil price volatility and geopolitical risks. These fluctuations challenge both ingredient manufacturers and brand owners in managing consistent pricing strategies, often limiting adoption in cost-sensitive FMCG categories and emerging markets.

Stringent Regulatory Frameworks Across Regions

The global cooling essences market faces regulatory complexities that can restrict market growth. Usage levels and compliance vary significantly across geographies: FEMA GRAS in the USA, REACH regulations in Europe, and China GB standards all impose different maximum permissible levels. Non-compliance can result in product recalls, fines, or restricted entry into lucrative markets. Additionally, categories such as tobacco alternatives, vaping liquids, and functional beverages face heightened scrutiny, with certain cooling actives under evaluation for safety concerns. These regulatory hurdles increase formulation complexity, raise compliance costs, and slow the speed of innovation.

Rise of WS-Series Amides in Place of Traditional Menthol

A major trend reshaping the market is the rapid adoption of WS-series cooling amides (WS-3, WS-23, WS-5, WS-12) as alternatives to menthol. These actives offer odorless cooling, longer-lasting effects, and better stability under heat and pH fluctuations, which makes them attractive in cosmetics, beverages, and pharma applications. The shift toward WS-series is particularly evident in premium skincare, where menthol’s strong minty odor can be undesirable, and in beverages, where amides deliver cooling without altering flavor profiles. This trend is expected to accelerate as formulators seek differentiated sensory experiences beyond conventional menthol.

Expansion of Encapsulation and Controlled-Release Technologies

Another critical trend is the integration of advanced encapsulation and delivery systems for cooling essences. Microencapsulation, beadlets, and liposomal carriers are enabling time-release cooling, improved stability, and reduced volatility, which enhance product performance in oral care and cosmetics. Controlled-release systems are particularly popular in chewing gum, lozenges, and topical skincare, where a sustained cooling effect increases consumer satisfaction. Encapsulation also aligns with clean-label and cost-efficiency strategies, as it allows manufacturers to use smaller amounts of active while maintaining strong sensory impact, thereby improving margins. This trend is expected to dominate R&D pipelines and product launches over the next decade.

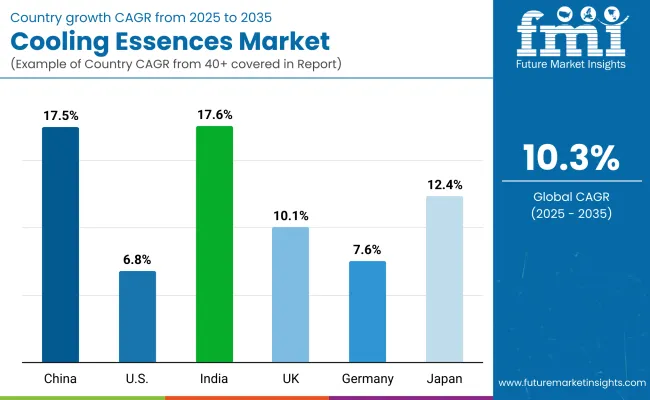

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 17.5% |

| USA | 6.8% |

| India | 17.6% |

| UK | 10.1% |

| Germany | 7.6% |

| Japan | 12.4% |

Between 2025 and 2035, India (17.6%) and China (17.5%) are expected to record the fastest CAGR in the Global Cooling Essences Market. Rapid population growth, rising disposable incomes, and increasing consumption of oral care and functional beverages are driving demand in these two countries. Both markets are also witnessing a surge in premium personal care and pharmaceutical applications, where WS-series cooling amides and biotech-derived menthol are gaining traction. Asia’s strong manufacturing base and favorable regulatory pathways further support large-scale adoption, positioning the region as the global growth engine.

In contrast, mature markets such as the USA(6.8%), Germany (7.6%), and the UK (10.1%) show steady but slower expansion. Growth here is largely tied to premiumization, sustainability trends, and product innovation in cosmetics, confectionery, and OTC pharmaceuticals. Japan (12.4%) sits between the two clusters, driven by strong consumer demand for high-performance skincare and oral care products that incorporate encapsulated cooling systems. Overall, the disparity highlights how emerging Asian economies are expanding rapidly, while Western markets contribute steady, innovation-led growth.

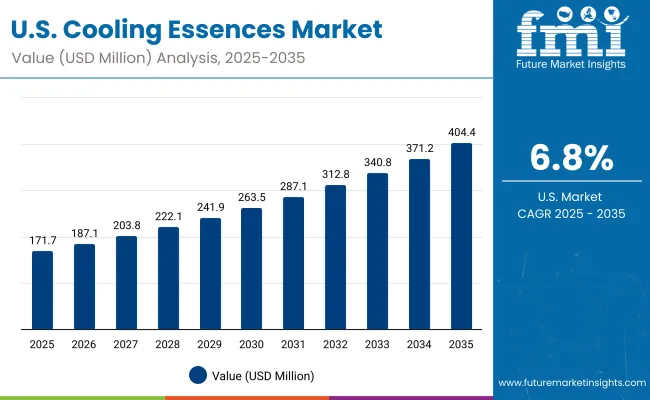

| Year | USA Cooling Essences Market (USD Million) |

|---|---|

| 2025 | 171.8 |

| 2026 | 187.1 |

| 2027 | 203.9 |

| 2028 | 222.1 |

| 2029 | 241.9 |

| 2030 | 263.6 |

| 2031 | 287.2 |

| 2032 | 312.8 |

| 2033 | 340.8 |

| 2034 | 371.3 |

| 2035 | 404.5 |

The Cooling Essences Market in the United States is projected to grow at a CAGR of 6.8%, supported by consistent demand across oral care, confectionery, and beverages. Toothpaste and mouthwash continue to dominate usage, while chewing gum and candies add stable consumption volumes. Functional beverages, particularly flavored waters and sports drinks, are expanding the role of cooling essences in F&B categories.

Premium skincare and OTC pharma applications are also introducing odorless WS-series cooling amides to differentiate formulations. Growth is further reinforced by a preference for synthetic menthol and consistent WS-series supply, which ensures regulatory compliance and stability.

The Cooling Essences Market in the United Kingdom is expected to grow at a CAGR of 10.1%, supported by applications in oral care, confectionery, and high-end cosmetics. Chewing gum and mints drive steady demand, while confectionery companies are experimenting with encapsulated cooling agents for differentiated taste experiences. Premium skincare brands are adopting menthol derivatives and WS-series amides for long-lasting, odorless cooling sensations. Regulatory emphasis on safety and clean-label demand is also pushing companies toward biotech-derived and sustainable menthol alternatives.

India is witnessing rapid growth in the Cooling Essences Market, which is forecast to expand at a CAGR of 17.6% through 2035. Demand is led by oral care, with strong growth in toothpaste, mouthwash, and affordable gum products across both urban and rural areas. Rising disposable incomes and greater hygiene awareness are driving premium oral care launches, while confectionery and beverages add incremental demand. Synthetic menthol dominates mass-market categories due to affordability, while biotech and sustainable cooling essences are being introduced in premium FMCG products.

The Cooling Essences Market in China is expected to grow at a CAGR of 17.5%, the highest among major economies. This momentum is powered by high oral care penetration, functional beverage innovation, and expanding personal care adoption. Domestic brands are introducing odorless WS-series agents into cosmetics and skincare, aligning with local consumer preferences. Confectionery remains another strong growth pillar, with gums and mints increasingly incorporating long-lasting cooling agents. China also benefits from local synthetic menthol production and competitive pricing, which makes cooling essences more accessible across FMCG categories.

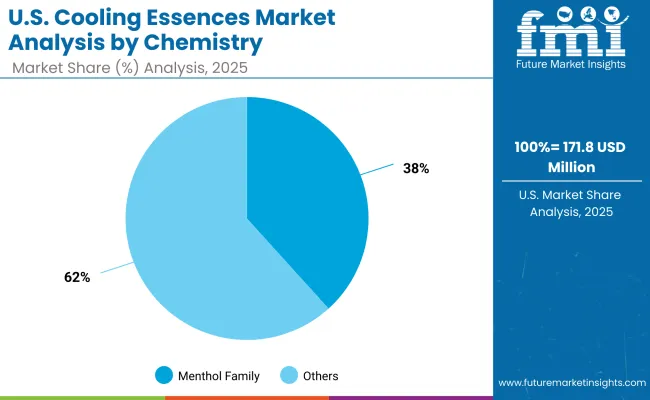

| Chemistry Segment | Market Value Share, 2025 |

|---|---|

| Menthol Family | 38.3% |

| Others | 61.7% |

The Cooling Essences Market in the United States is valued at USD 171.8 million in 2025, with menthol family leading at 38.3%. The dominance of menthol is linked to its strong role in oral care and confectionery, where consumer familiarity with the classic cooling profile drives large-scale adoption. Toothpaste, chewing gum, and mouthwash continue to rely heavily on menthol’s immediate freshness and recognizable sensory signature. While WS-series cooling agents are expanding, menthol’s broad availability and regulatory acceptance make it the core chemistry for mainstream applications.

This advantage positions menthol as a reliable backbone for consistent performance across oral hygiene and confectionery. Other chemistries, including WS-series amides and menthyl esters, are rising in demand, particularly in premium skincare and functional beverages, but they remain complementary. As innovation accelerates, menthol’s ability to blend with advanced delivery systems will keep it integral to the USA cooling essences market.

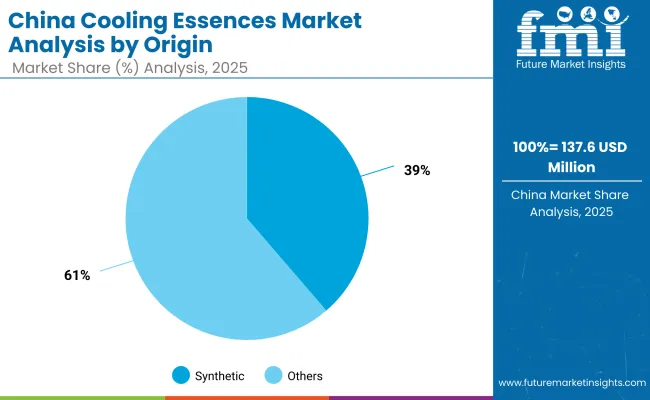

| Origin Segment | Market Value Share, 2025 |

|---|---|

| Synthetic | 38.7% |

| Others | 61.3% |

The Cooling Essences Market in China is valued at USD 137.6 million in 2025, with synthetic sources leading at 38.7%. The dominance of synthetics reflects cost efficiency, large-scale availability, and consistency, which are crucial for high-volume FMCG categories such as toothpaste, chewing gum, and beverages. Local manufacturers have strengthened capacity in synthetic menthol and WS-series actives, making them accessible across both premium and mass-market products.

This advantage positions synthetic cooling essences as the primary growth driver for affordable oral care and functional beverage launches in China. Other origins, including natural mint and biotech-derived menthol, are expanding as clean-label demand rises, but synthetics continue to set the pace due to price competitiveness and stable supply. As China advances in functional foods, cosmetics, and OTC pharmaceuticals, synthetic cooling essences will remain critical for scaling adoption.

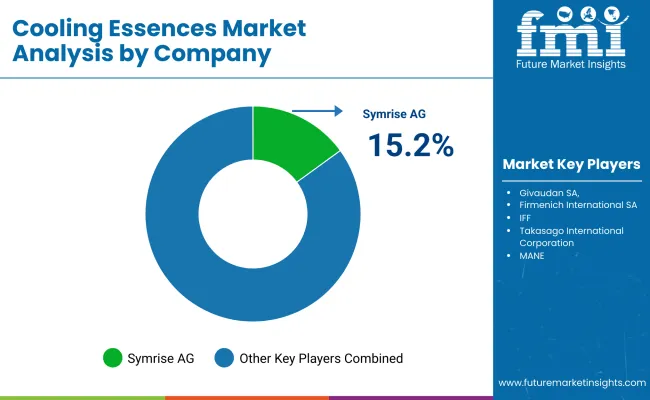

| Company | Global Value Share 2025 |

|---|---|

| Symrise AG | 15.2% |

| Others | 84.8% |

The Global Cooling Essences Market is moderately fragmented, with multinational flavor & fragrance houses, regional ingredient suppliers, and specialty innovators competing across oral care, beverages, personal care, and pharmaceuticals. Global leaders such as Symrise AG, Givaudan SA, Firmenich International SA, and IFF command significant share through their extensive portfolios of menthol, WS-series amides, and advanced delivery systems. Their strategies increasingly emphasize sustainable sourcing, biotech-derived menthol, and encapsulation technologies to align with clean-label trends and premium product positioning.

Established mid-sized players, including Takasago International Corporation, Sensient Technologies, Kerry Group, and MANE, are actively expanding their presence in fast-growing Asia-Pacific markets by offering tailored cooling blends and cost-effective synthetic formats. These companies are also leveraging regional distribution networks and partnerships with FMCG manufacturers to strengthen market penetration. Specialty providers, such as Zhejiang NHU Co., Ltd. and Wanxiang International Limited, focus on high-volume synthetic menthol production and competitive pricing, making them critical suppliers for mass-market oral care and confectionery.

Their strength lies in scalability and affordability, which positions them as key contributors to emerging market growth. Competitive differentiation is shifting away from commodity menthol supply toward value-added innovation, including odorless WS-series actives, controlled-release encapsulation, and regulatory-compliant clean-label solutions. Players investing in biotech fermentation, AI-driven formulation design, and sustainability certifications are expected to consolidate stronger positions in the decade ahead.

Key Developments for Global Cooling Essences Market

| Item | Value |

|---|---|

| Quantitative Units | USD 712.4 million |

| Chemistry | Menthol family, Menthyl esters, WS-series cooling amides, and Other blends |

| Origin | Natural mint-derived, Nature-identical, Synthetic, and Biotech-derived |

| Technology | Solid crystals, Liquid solutions, Emulsions, and Encapsulated beadlets /powders |

| Form & Delivery System | Oil-Soluble, Water-Soluble, Alcohol-Soluble, Multi-Solvent Systems |

| Solubility & Carrier | Automotive, Aerospace & defense, Consumer electronics, Healthcare, Oil & gas, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Symrise AG, Givaudan SA, Firmenich International SA, IFF, Takasago International Corporation, Sensient Technologies Corporation, Kerry Group plc, MANE, Zhejiang NHU Co., Ltd., Wanxiang International Limited |

| Additional Attributes | Dollar sales by chemistry and application, adoption trends in oral care and functional beverages, rising demand for odorless WS-series cooling agents, sector-specific growth in pharmaceuticals and personal care, regulatory compliance segmentation (FEMA/IFRA/REACH/GB/FSSAI), integration with encapsulation and controlled-release technologies, regional trends influenced by clean-label and premiumization, and innovations in biotech-derived menthol and sustainable cooling systems |

The Global Cooling Essences Market is estimated to be valued at USD 712.4 million in 2025.

The market size for the Global Cooling Essences Market is projected to reach USD 1,905.3 million by 2035.

The Global Cooling Essences Market is expected to grow at a 10.3% CAGR between 2025 and 2035.

The key chemistry types in the Global Cooling Essences Market are menthol family, menthyl esters, WS-series cooling amides, and other blends.

In terms of application, the oral care segment is expected to command 30% share in the Global Cooling Essences Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Self Cooling Packaging Market Size and Share Forecast Outlook 2025 to 2035

Green Cooling Technologies Market

Vacuum Cooling Equipment Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Combined Cooling Heat and Power Plant Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

District Cooling Market - Growth & Demand 2025 to 2035

Seawater Cooling Pumps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA