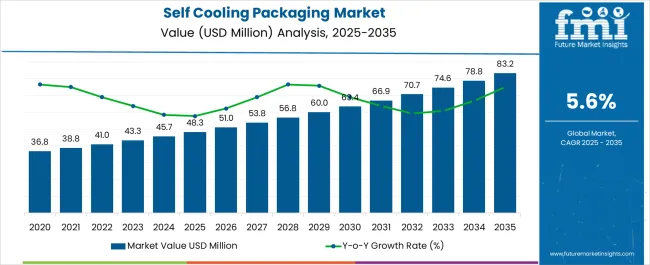

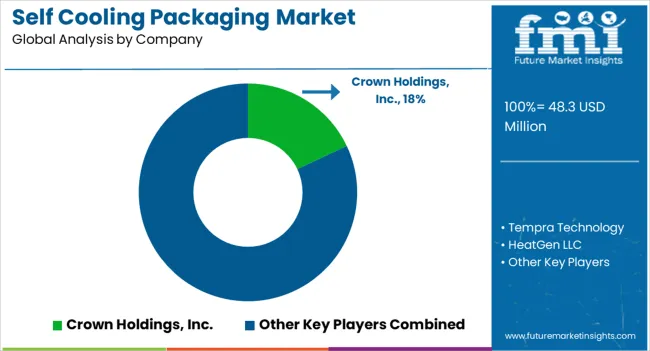

The self cooling packaging market is valued at USD 48.3 million in 2025 and is projected to reach USD 83.2 million by 2035, growing at a CAGR of 5.6% during the forecast period. Growth is influenced by increasing demand for on-the-go beverages, outdoor food consumption, and convenience-driven packaging formats. Beverage companies are experimenting with self cooling cans and containers to enhance consumer experience, particularly in premium and sports drink categories.

Rising adoption in outdoor events, travel, and defense applications has further reinforced demand. Manufacturers are focusing on eco-friendly cooling agents and compact activation mechanisms to balance performance with safety regulations. While North America and Europe lead in innovation-driven adoption, emerging markets in Asia are witnessing gradual interest as consumer preferences shift toward convenience-based packaging solutions in urban centers.

| Metric | Value |

|---|---|

| Self Cooling Packaging Market Estimated Value in (2025 E) | USD 48.3 million |

| Self Cooling Packaging Market Forecast Value in (2035 F) | USD 83.2 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Self Cooling Packaging market is experiencing strong growth as industries prioritize innovative packaging solutions that enhance consumer convenience and product differentiation. Advances in thermal control materials and compact cooling mechanisms have enabled manufacturers to create packaging that maintains optimal product temperature without external refrigeration. Rising demand from food, beverages, pharmaceuticals, and specialty goods has been instrumental in driving adoption, with consumers seeking portable, ready-to-use cooling solutions.

Growing urbanization, busy lifestyles, and the rise of on-the-go consumption have further boosted interest in self cooling technologies. The ability to extend shelf life, preserve product quality, and support sustainable practices by reducing reliance on external cooling infrastructure is also contributing to market expansion.

Strategic investments in R&D, combined with increasing awareness about premium packaging formats, are paving the way for further innovations As global supply chains adapt to evolving consumer expectations, the market is positioned for sustained growth, with enhanced performance and eco-friendly designs likely to play a central role in future developments.

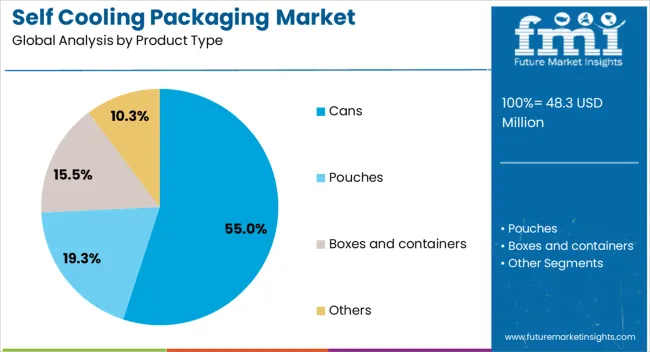

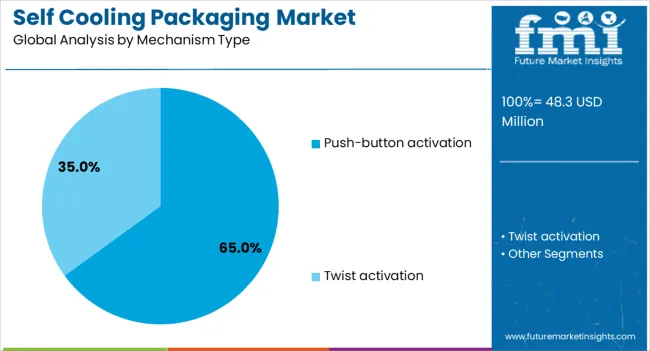

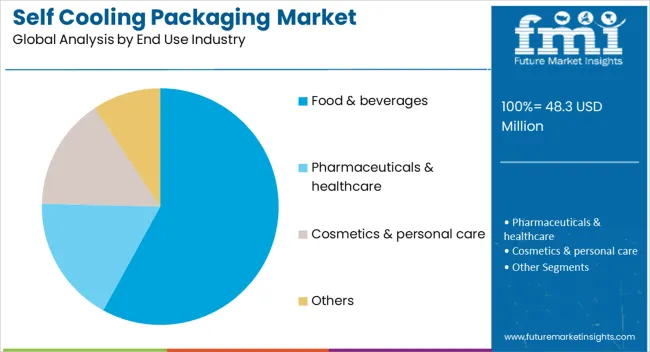

The self cooling packaging market is segmented by product type, mechanism type, end use industry, and geographic regions. By product type, self cooling packaging market is divided into Cans, Pouches, Boxes and containers, and Others. In terms of mechanism type, self cooling packaging market is classified into Push-button activation and Twist activation. Based on end use industry, self cooling packaging market is segmented into Food & beverages, Pharmaceuticals & healthcare, Cosmetics & personal care, and Others. Regionally, the self cooling packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cans product type segment is projected to hold 55% of the Self Cooling Packaging market revenue share in 2025, making it the leading product type. Growth in this segment has been driven by the robust demand for beverages and perishable goods requiring quick and reliable cooling. The structural integrity of cans provides excellent protection while accommodating integrated cooling mechanisms, ensuring consistent performance.

Their high recyclability and compatibility with mass production processes have made them a preferred choice for manufacturers aiming to combine convenience with sustainability. The ability to store a variety of products, coupled with extended shelf stability, has strengthened the segment’s market position.

In addition, advancements in self cooling technology have allowed for reduced activation time and improved energy efficiency, enhancing user satisfaction As consumer demand for portable, ready-to-consume chilled products continues to rise, the cans segment is expected to maintain its leadership through its balance of practicality, durability, and environmental benefits.

The push button activation mechanism type segment is anticipated to account for 65% of the Self Cooling Packaging market revenue share in 2025, positioning it as the dominant mechanism type. The popularity of this mechanism has been supported by its ease of use and reliable performance, which enhance the consumer experience. With a simple press, the integrated cooling system is activated, rapidly lowering the product’s temperature without the need for external equipment.

This functionality is particularly valued in outdoor, travel, and on-the-go consumption scenarios where convenience is paramount. Advances in miniaturized cooling agents and safe activation components have made the push button method more efficient and environmentally friendly.

Manufacturers have increasingly integrated this mechanism into mainstream packaging formats, broadening its application across various product categories As market awareness of self cooling technology grows, the push button activation method is expected to retain its competitive advantage by combining user-friendly design with consistent cooling effectiveness.

The food and beverages end use industry segment is expected to capture 58% of the Self Cooling Packaging market revenue share in 2025, making it the leading end use category. This growth has been supported by the sector’s high demand for innovative packaging solutions that maintain freshness, taste, and quality until consumption. Self cooling packaging has been particularly valuable for products such as chilled drinks, dairy items, and specialty foods, where temperature control directly impacts consumer satisfaction.

The increasing prevalence of on-the-go consumption, coupled with the expansion of outdoor leisure and travel activities, has further driven demand in this segment. The technology’s ability to extend product shelf life without external refrigeration aligns with sustainability goals by reducing energy use throughout the supply chain.

Food and beverage brands have embraced self cooling packaging as a differentiator in competitive markets, enhancing brand value and customer loyalty Continuous improvements in cooling efficiency and eco-friendly materials are expected to reinforce this segment’s leading position.

The self cooling packaging market is advancing as consumers demand convenience-driven solutions that provide instant chilling for beverages and ready-to-consume products. Self cooling cans and containers have become attractive for outdoor activities, travel, and sporting events where refrigeration access is limited. Beverage brands are leveraging this technology to differentiate premium offerings, particularly in energy drinks, soft drinks, and specialty beverages. Growing interest from defense and emergency service applications has added further scope, where instant cooling improves usability in critical environments. Rising consumer preference for convenience packaging formats that combine functionality and novelty continues to drive adoption. Marketing campaigns highlighting lifestyle appeal, combined with product launches in limited-edition beverages, are shaping consumer perception and willingness to pay a premium for convenience.

Despite its appeal, the self cooling packaging market faces challenges from high manufacturing costs and technical limitations in maintaining safety standards. Cooling agents and integrated systems require specialized materials and engineering, raising production expenses compared to conventional packaging. Concerns around recyclability and compliance with environmental regulations add another layer of complexity. Limited cooling duration and inconsistent temperature control in early-stage designs have restrained broader adoption, particularly in mainstream beverage categories where affordability is critical. Smaller beverage companies find it difficult to integrate self cooling technology due to higher unit costs, restricting penetration beyond niche and premium markets. Without scalable production methods and cost-effective innovations, self cooling packaging remains limited in its global rollout.

A key trend shaping the market is the pursuit of eco-friendly and consumer-safe cooling mechanisms that align with sustainability goals. Manufacturers are moving away from chemical-based cooling systems toward designs that utilize recyclable, non-toxic, and biodegradable materials. Advances in micro-engineered capsules, vacuum-based systems, and phase-change materials are opening new possibilities for compact, lightweight, and environmentally responsible packaging formats. Integration of smart indicators, such as temperature change markers, enhances consumer confidence and experience. Partnerships between packaging innovators and major beverage brands are accelerating R&D efforts, with pilot launches already expanding across North America and Europe. As innovation balances environmental compliance with performance, self cooling packaging is positioned to gain stronger traction in both premium and mass-market segments.

The self cooling packaging market is advancing as consumers demand convenience-driven solutions that provide instant chilling for beverages and ready-to-consume products. Self cooling cans and containers have become attractive for outdoor activities, travel, and sporting events where refrigeration access is limited. Beverage brands are leveraging this technology to differentiate premium offerings, particularly in energy drinks, soft drinks, and specialty beverages. Growing interest from defense and emergency service applications has added further scope, where instant cooling improves usability in critical environments. Rising consumer preference for convenience packaging formats that combine functionality and novelty continues to drive adoption. Marketing campaigns highlighting lifestyle appeal, combined with product launches in limited-edition beverages, are shaping consumer perception and willingness to pay a premium for convenience.

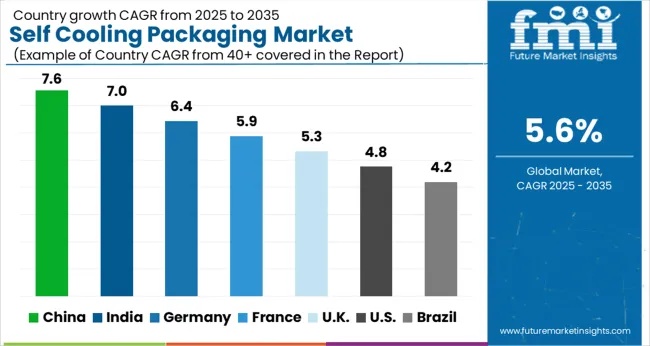

Growth in the self cooling packaging market in China has been recorded at a CAGR of 7.6%, supported by large-scale beverage consumption and strong domestic manufacturing capacity. Leading beverage brands are piloting self cooling cans and portable containers to appeal to urban consumers seeking convenience. Industrial clusters in Guangdong and Zhejiang are producing cost-effective variants at scale for both local and export markets. Outdoor lifestyle and travel consumption patterns have further reinforced demand, particularly in premium energy drinks and specialty beverages. Investments in eco-friendly cooling agents and recyclable formats are also shaping product launches. Distribution through e-commerce platforms and retail chains has expanded accessibility to a wider consumer base.

India’s self cooling packaging market is advancing at a CAGR of 7.0%, fueled by rising disposable incomes and a growing preference for convenience-oriented beverage formats. Adoption has been most notable in metropolitan cities such as Delhi, Mumbai, and Bengaluru, where premium beverages are marketed using innovative packaging formats. Domestic packaging firms are partnering with global beverage companies to localize designs suited for regional climatic conditions. Consumer demand has been reinforced by outdoor events, hospitality venues, and on-the-go consumption trends. Limited-scale trials of eco-friendly self cooling technologies have begun, with interest from both multinational and local brands. Expansion of organized retail and strong e-commerce penetration continue to improve product visibility.

Beverage firms partner with domestic packaging companies

Growing demand from urban hospitality and outdoor events

Organized retail and e-commerce improve accessibility

Germany is projected to grow at a CAGR of 6.4%, supported by innovation in eco-friendly packaging formats and consumer preference for premium beverage experiences. Packaging companies have integrated recyclable cooling agents and smart activation mechanisms to comply with EU regulations. Adoption has been visible in specialty beverages, energy drinks, and luxury consumer goods marketed through supermarkets and online platforms. Outdoor consumption trends, including festivals and sporting events, have provided steady opportunities for trial launches. Local firms are investing in additive manufacturing and advanced materials to enhance cooling performance. Export-oriented suppliers are also targeting nearby EU markets with niche product offerings.

Eco-friendly packaging designs meet EU compliance standards

Outdoor festivals and sporting events drive adoption

Export activity supports growth in regional EU markets

France’s self cooling packaging market is expanding at a CAGR of 5.9%, shaped by demand from premium beverage launches and hospitality segments. Wine, energy drink, and flavored water brands have experimented with limited-edition packaging that integrates self cooling technology. Urban consumers in Paris, Lyon, and Marseille have shown growing interest in novelty-driven packaging formats that enhance lifestyle appeal. French suppliers have invested in lightweight, recyclable materials for compact packaging solutions, supported by local environmental initiatives. Growth is also reinforced by seasonal tourism, outdoor dining, and leisure activities that encourage portable cooling options. Retail partnerships with premium outlets and supermarkets have further expanded consumer exposure.

Limited-edition packaging supports premium beverage launches

Lightweight recyclable materials gain design preference

Tourism and outdoor dining drive seasonal demand

The United Kingdom is advancing at a CAGR of 5.3%, reflecting steady demand for innovative beverage packaging in urban markets. Adoption has been most visible in energy drinks and niche premium beverages, often marketed through convenience stores and e-commerce channels. Beverage companies are using self cooling packaging to differentiate products in highly competitive categories. Local packaging firms are experimenting with recyclable and non-toxic cooling agents to address environmental compliance requirements. Events such as sports tournaments and music festivals have created opportunities for brand activations using portable cooling cans. Retail distribution across supermarkets and online platforms continues to broaden product reach.

Energy drinks lead adoption in urban retail markets

Sports and music events create promotional opportunities

Local firms emphasize recyclable cooling technologies

The self cooling packaging market is shaped by a concentrated group of innovators and packaging specialists developing thermally active systems for beverages and on-the-go applications. Tempra Technology and The Joseph Company International lead with proprietary cooling technologies, including the Chill-Can® system, which has been piloted with beverage brands. Crown Holdings, Hydropac, and NanoCool contribute through scalable packaging solutions that integrate phase-change materials and non-toxic cooling agents. European and Asian firms such as Zeo-Tech, Kitasangyo, and Woolcool are expanding niche applications across premium drinks, hospitality, and defense segments. Startups like deltaH Innovations are introducing disruptive press-activated self-chilling containers. The competitive focus remains on reducing costs, improving safety, and scaling production, while strategic partnerships with beverage companies support the commercial adoption of these initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 48.3 Million |

| Product Type | Cans, Pouches, Boxes and containers, and Others |

| Mechanism Type | Push-button activation and Twist activation |

| End Use Industry | Food & beverages, Pharmaceuticals & healthcare, Cosmetics & personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Crown Holdings, Inc., Tempra Technology, HeatGen LLC, Luxfer Magtech, The 42 Degrees Company, and [Other players — e.g., Hydropac, NanoCool, etc.] |

| Additional Attributes | Dollar sales by type including chemical reaction-based, endothermic material-based, and phase change material-based packaging, application across beverages, ready-to-eat meals, and pharmaceuticals, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for convenience, temperature-sensitive product transportation, and innovations in sustainable cooling technologies. |

The global self cooling packaging market is estimated to be valued at USD 48.3 million in 2025.

The market size for the self cooling packaging market is projected to reach USD 83.2 million by 2035.

The self cooling packaging market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in self cooling packaging market are cans, pouches, boxes and containers and others.

In terms of mechanism type, push-button activation segment to command 65.0% share in the self cooling packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-sealing Ziplock Bag Market Size and Share Forecast Outlook 2025 to 2035

Self-service Billiards System Market Size and Share Forecast Outlook 2025 to 2035

Self-propelled Orchard Top-cutting Machines Market Forecast and Outlook 2025 to 2035

Self-healing Network Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Biologics Market Size and Share Forecast Outlook 2025 to 2035

Self-fusing Silicone Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Parenteral Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Self-service Analytics Market Size and Share Forecast Outlook 2025 to 2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Labels Market Size and Share Forecast Outlook 2025 to 2035

Self-Healing Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Self Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Self Sensing Nanocomposites Market Size and Share Forecast Outlook 2025 to 2035

Self-Lubricating Bearings Market Size and Share Forecast Outlook 2025 to 2035

Self - Locking Trays Market Size and Share Forecast Outlook 2025 to 2035

Self-urinary Infection Testing Market Size and Share Forecast Outlook 2025 to 2035

Self-chilling Cans Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA