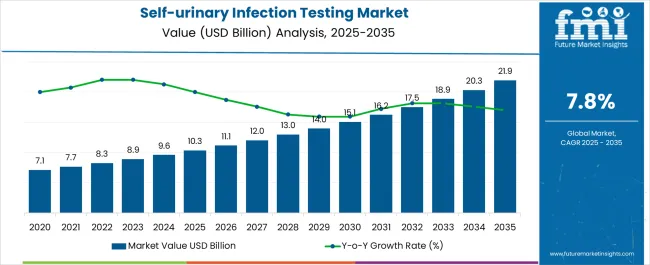

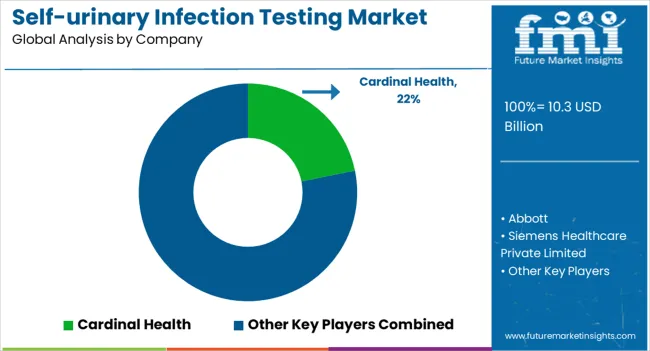

The Self-urinary Infection Testing Market is estimated to be valued at USD 10.3 billion in 2025 and is projected to reach USD 21.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Self-urinary Infection Testing Market Estimated Value in (2025 E) | USD 10.3 billion |

| Self-urinary Infection Testing Market Forecast Value in (2035 F) | USD 21.9 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The self urinary infection testing market is experiencing strong momentum as rising cases of urinary tract infections and associated kidney complications are driving the need for fast, accessible, and reliable diagnostic solutions. Increasing patient preference for home based testing, coupled with the growing burden on healthcare systems, is accelerating adoption of easy to use formats that provide immediate results.

Advancements in dipstick technology, improved sensitivity, and integration with mobile health applications are expanding the utility of these products. Healthcare cost pressures and a focus on preventive diagnostics are further encouraging widespread uptake.

Regulatory encouragement for self diagnostic solutions and heightened consumer awareness of early detection benefits are creating strong growth opportunities. The market outlook remains positive as testing solutions continue to align with trends in decentralization, affordability, and patient centric healthcare.

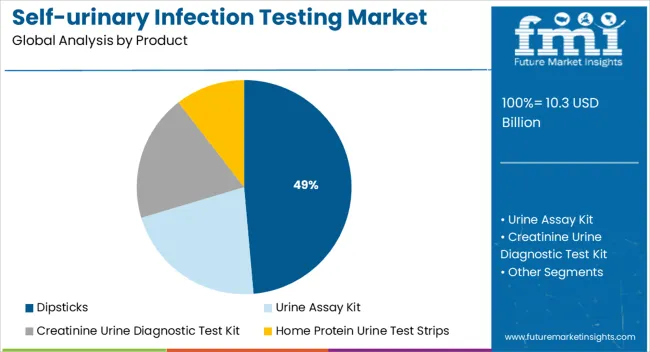

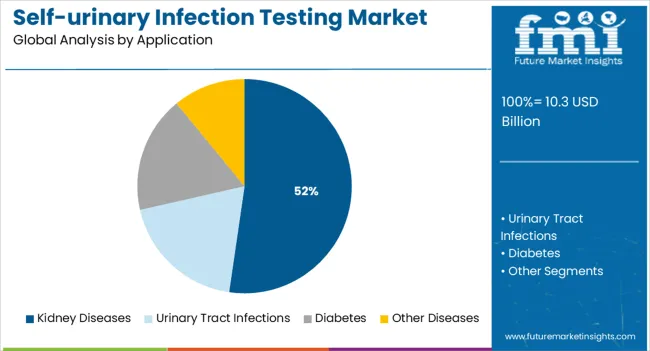

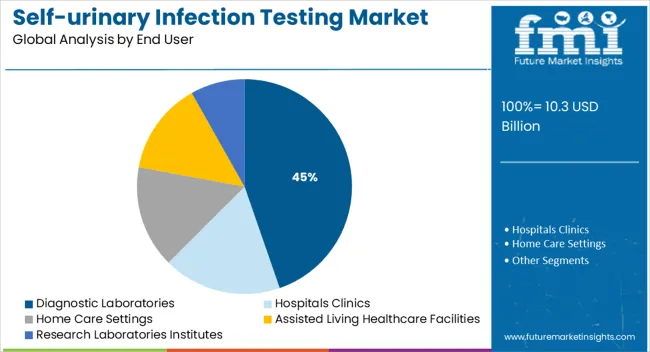

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into Dipsticks, Urine Assay Kit, Creatinine Urine Diagnostic Test Kit, and Home Protein Urine Test Strips. In terms of Application, the market is classified into Kidney Diseases, Urinary Tract Infections, Diabetes, and Other Diseases. Based on End User, the market is segmented into Diagnostic Laboratories, Hospitals Clinics, Home Care Settings, Assisted Living Healthcare Facilities, and Research Laboratories Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dipsticks segment is projected to hold 48.60% of total market revenue by 2025 within the product category, making it the dominant segment. Growth in this category is being driven by the affordability, rapid result delivery, and ease of use that dipsticks offer for urinary infection testing.

Their minimal training requirement and portability have reinforced adoption among both home users and clinical professionals. The ability to detect multiple parameters such as leukocytes, nitrites, and protein in a single test has improved diagnostic efficiency.

As demand for cost effective and widely available testing solutions increases, dipsticks remain the preferred choice, strengthening their leadership in the product category.

The kidney diseases application segment is expected to account for 52.30% of total market revenue by 2025, positioning it as the leading application category. This growth is supported by the strong clinical need for early detection of kidney related complications arising from urinary infections.

Rising prevalence of chronic kidney disease and the growing importance of preventive care have reinforced demand for reliable and routine testing. The use of self urinary testing kits has facilitated timely medical intervention, reducing the risk of advanced renal damage.

These factors have established kidney diseases as the most significant application segment in the market.

The diagnostic laboratories segment is projected to represent 44.70% of total market revenue by 2025 within the end user category, making it the largest segment. This leadership is attributed to the widespread reliance on laboratory confirmation for self testing results, coupled with the capacity of labs to process high volumes of tests with greater accuracy.

Laboratories have increasingly adopted automated analyzers and digital platforms that complement self urinary infection testing kits, enabling efficient result management. Rising patient inflows for confirmatory testing and integration of lab data with electronic medical records are further driving adoption.

Consequently, diagnostic laboratories continue to dominate as the key end user group in the self urinary infection testing market.

According to the latest research by Future Market Insights, Self-urinary infection testing market is set to witness a 7.8% growth during the year 2024 to 2035. The market is expected to witness growth owing to increasing prevalence of urinary tract infections and kidney diseases, surging volume of patients suffering from nephropathic disorders across the globe, increasing prevalence of geriatric population, changing lifestyle of the people.

A major factor boosting the growth of the market is the increasing prevalence of UTIs and nephropathic disorders. The lifestyle diseases like hypertension, diabetes, and obesity have an adverse effect on the excretion system, which includes the urinary tract, kidneys, lungs, skin and bladder. It affects the content of urine, appearance, and the concentration, hence leading to different nephropathic disorders.

Moreover, rise in the healthcare expenditure by the government initiatives promotes the affordability of devices, leading to growth sales of urinalysis products, boosting the growth of the market.

Furthermore, technological advancements in the field of self-diagnostics which is expected to boost the development of the market. For instance, in 2020, the federal FDA (Food and Drug Administration) approved a smartphone-based home urine test which allows patients with high-risk pregnancies, chronic diseases or urinary tract infections to observe their health by means of a testing method which is as easy as taking a smartphone selfie.

Self-urinary infection testing industry growth is projected to accelerate in the next five years, boosted by increasing prevalence of UTIs and nephropathic disorders which creates higher demand for different types of urine tests. The rising prevalence of UTIs and nephropathic diseases are caused by lifestyle diseases such as diabetes, hypertension, and obesity which makes an adverse effect on the excretion system, including bladder, urinary tract, and kidney.

A urinary screening program is suggested as an essential element for reducing the incidence of UTIs and kidney diseases which is anticipated to drive the demand for urinalysis test and boost the growth of Self-urinary infection testing market.

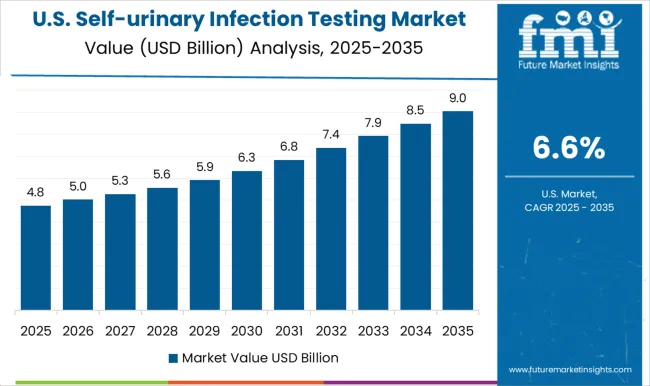

The USA Self-urinary infection testing market is expected to observe a robust growth in the market owing to high adoption of urinalysis for treatment of the urinary tract infections and liver disease, growth in research activities in the field of urinalysis and rising awareness among the people about urinalysis.

As per the National Diabetes Statics Report in 2020, approximately 30.3 million Americans (nearly 1 in 10) are affected with diabetes. Moreover, rising government initiatives for growing awareness of urinalysis among the people is a key factor boosting the market.

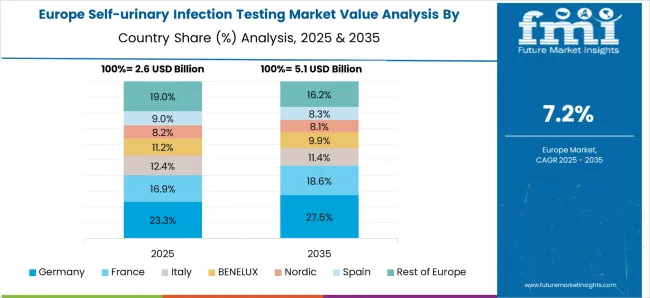

Europe would witness the highest growth after North America because of the rising prevalence of kidney diseases, rising per capita income resulting to better standard of living, rising healthcare spending, increasing demand for improved quality medical care, and rising awareness regarding urinalysis tests in Europe.

In addition, the rise in the incidence of nephropathic disorders and UTIs leads to the increasing demand for the diagnostic system, particularly self-diagnostic, because it is the most rapid growing segment of the diagnostic systems.

Some of the leading manufacturers and suppliers of Self-urinary infection testing include

The global Self-urinary infection testing market is slightly fragmented over the forecast years because of the presence of numerous testing device manufacturers who offer devices such as urinalysis test consumables and systems. Different Self-urinary infection testing device manufacturers are concentrated on developing novel technologies like dipsticks, recently approved mobile based home urine test.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global self-urinary infection testing market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the self-urinary infection testing market is projected to reach USD 21.9 billion by 2035.

The self-urinary infection testing market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in self-urinary infection testing market are dipsticks, urine assay kit, creatinine urine diagnostic test kit and home protein urine test strips.

In terms of application, kidney diseases segment to command 52.3% share in the self-urinary infection testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infection Control Market Size and Share Forecast Outlook 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Disinfection Cap Market Size and Share Forecast Outlook 2025 to 2035

Disinfection Equipment Market Analysis - Trends & Forecast 2025 to 2035

Global Eye Infections Treatment Market Report - Trends & Forecast 2025 to 2035

Yeast Infection Diagnostics Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Yeast Infection Treatment Market by Drug Type, Distribution Channel, End User, and Region, 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Systemic Infection Treatment Market

Difficile Infections (Clostridium Difficile Associated Disease) Market Size and Share Forecast Outlook 2025 to 2035

Norovirus Infection Treatment Market

Pertussis Infection Testing Market

Urinary Tract Infection (UTI) Treatment Market (UTI) Analysis - Size, Share, and Forecast 2025 to 2035

Pork Tapeworm Infection Treatment Market Trends – Demand & Innovations 2025 to 2035

Surgical Site Infections Market

Point Of Care Infection Control Market

Toxoplasmosis Infection Treatment Market

Urinary Tract Infection Testing Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Salivary Gland Infection Treatment Market Size and Share Forecast Outlook 2025 to 2035

Coxsackievirus Infections Treatment Market – Growth & Drug Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA