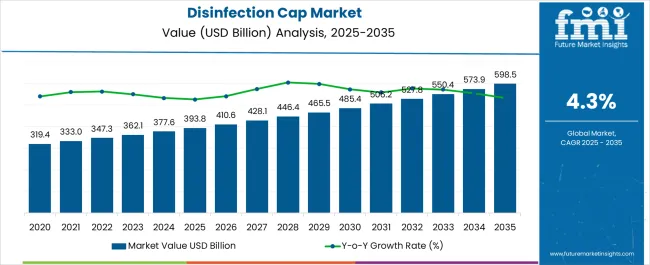

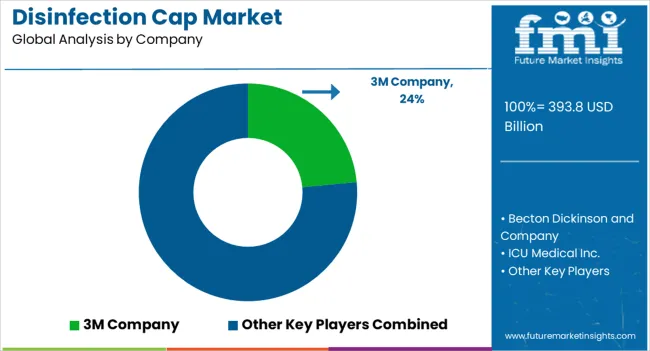

The Disinfection Cap Market is estimated to be valued at USD 393.8 billion in 2025 and is projected to reach USD 598.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Disinfection Cap Market Estimated Value in (2025 E) | USD 393.8 billion |

| Disinfection Cap Market Forecast Value in (2035 F) | USD 598.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The disinfection cap market is experiencing strong momentum driven by rising demand for infection prevention solutions across healthcare facilities. Current market conditions are supported by the growing incidence of hospital-acquired infections, regulatory emphasis on sterilization practices, and increasing awareness among healthcare providers regarding patient safety. Adoption is further enhanced by innovations in cap designs that improve usability, compliance, and cost-effectiveness.

Strategic partnerships between manufacturers and healthcare institutions are enabling broader implementation of disinfection caps within routine clinical protocols. The future outlook is defined by expanding healthcare infrastructure, particularly in emerging economies, and the integration of disinfection solutions within comprehensive infection control programs.

Market growth is also being reinforced by continuous improvements in antimicrobial technologies and streamlined distribution channels The rationale for expansion is founded on the critical role disinfection caps play in reducing contamination risk, ensuring regulatory compliance, and enabling safe patient care, thereby positioning the market for sustained growth and long-term adoption across global healthcare systems.

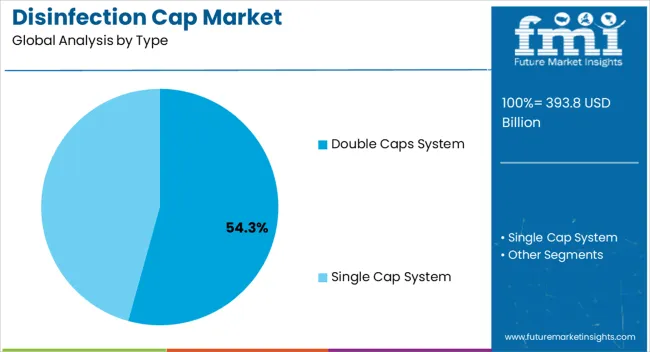

The double caps system segment, holding 54.30% of the type category, has established dominance due to its superior ability to provide enhanced protection and improved sealing efficiency. Its preference has been reinforced by clinical evidence highlighting reduced bloodstream infection rates and greater compliance with sterilization protocols.

Healthcare providers have increasingly adopted this system as it ensures dual-layer protection and minimizes human error during handling. Market confidence has been strengthened by regulatory validation and continuous innovations in cap materials and ergonomic designs.

Cost-effectiveness combined with ease of integration into existing workflows has further supported market share retention Over the forecast horizon, ongoing advancements in material science and design optimization are expected to sustain leadership of the double caps system within the type segment.

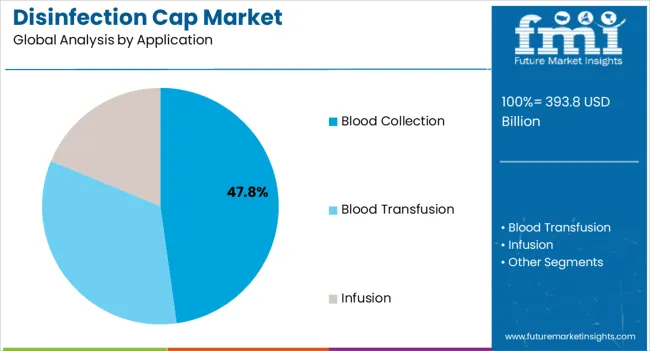

The blood collection segment, accounting for 47.80% of the application category, has been leading the market due to the high risk of contamination associated with venous access and transfusion procedures. Its share is supported by the widespread integration of disinfection caps into phlebotomy and transfusion practices where consistent sterility is critical.

Adoption has been reinforced by hospital safety programs, regulatory recommendations, and growing awareness of the clinical and economic impact of bloodstream infections. Improved product availability and compatibility with a wide range of connectors have further contributed to segment growth.

Technological improvements in disinfection solutions, alongside increasing emphasis on patient safety, are expected to maintain the segment’s strong position within the application landscape.

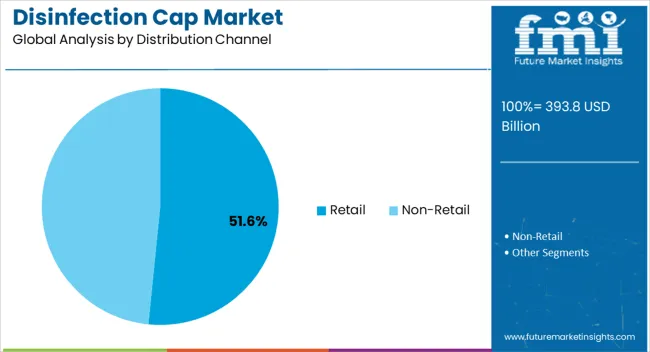

The retail segment, representing 51.60% of the distribution channel category, has emerged as the leading channel owing to its broad accessibility and ability to cater to both healthcare institutions and individual practitioners. Market leadership has been reinforced by the expansion of online platforms and medical supply chains that enable rapid procurement and delivery.

Retail channels have benefited from increasing purchasing flexibility, cost transparency, and consistent product availability. Adoption has been further supported by the integration of retail distribution within hospital and clinic procurement strategies, particularly in decentralized healthcare systems.

With the growth of e-commerce platforms and greater focus on convenient access to infection control solutions, the retail segment is expected to sustain its dominance and continue driving market penetration globally.

| Attributes | Details |

|---|---|

| Disinfection Cap Market Size (2020) | USD 319.4 million |

| Disinfection Cap Market Value (2025) | USD 393.8 million |

| Historical Growth Rate % (2020 to 2025) | 4% |

The disinfection cap market extrapolated from USD 319.4 million in 2020 to USD 393.8 million in 2025. Meanwhile, the market experienced a CAGR of 4%. Top factors that have been fueling the sales of disinfection caps are as follows:

Disinfection cap sales are projected to swing up from USD 393.8 million in 2025 to USD 598.5 million by 2035. FMI analysts have estimated that the market is anticipated to observe a CAGR of 4.5% throughout this period. An increase in CAGR over the forecast period indicates that the market is anticipated to flourish in upcoming years.

The rise in global population, lifestyle changes, and surging hospitalizations are, in combination, projected to increase the market value. Core factors raising the disinfection cap market value are mentioned below:

| Historical CAGR % (2020 to 2025) | 4% |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.5% |

| Country | The United States |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.1% |

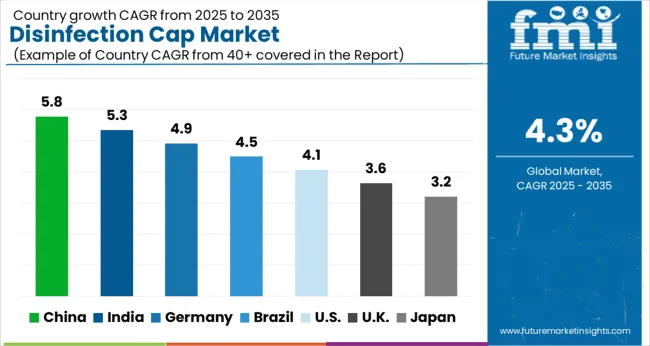

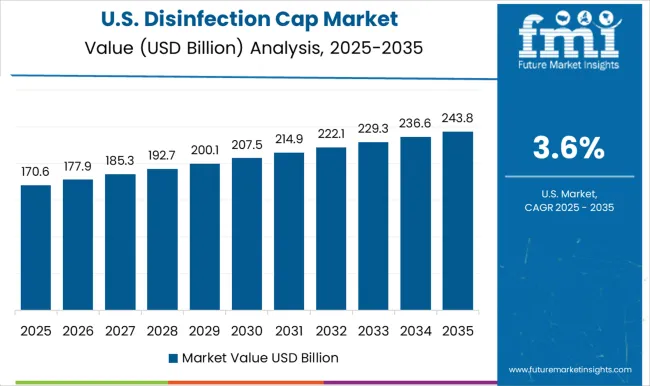

The United States disinfection cap market holds a prominent position in North America as well as internationally. As per the latest market estimates, the country is set to expand at a CAGR of 4.10% through 2035. Crucial factors raising the sales of disinfection caps are as follows:

| Country | Germany |

|---|---|

| Forecast CAGR % (2025 to 2035) | 3.6% |

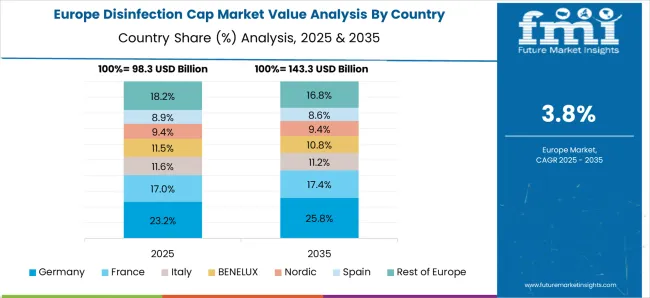

Germany is projected to be an important market for disinfection caps in Europe. The country is set to accelerate through the forecast period at a 3.6% CAGR. Given below are the leading components that are driving the German market:

| Country | China |

|---|---|

| Forecast CAGR % (2025 to 2035) | 5.5% |

In China, the disinfection cap market is projected to expand at a greater rate of 5.5% CAGR than its counterparts. This can be attributed to the considerable and rapidly growing population as well as medical incidences in the country. As a result, manufacturers are scouting for opportunities in China. Other factors that are consolidating China’s position on a global scale are as follows:

| Country | India |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.9% |

India is projected to emerge as a steadfast player in the overall disinfection cap market. As per analysis, the market is projected to be driven at a 4.9% CAGR through 2035. Players are traversing boundaries to possess a larger consumer base. Other factors increasing the sales of medical disinfection caps are as follows:

| Country | Australia |

|---|---|

| Forecast CAGR % (2025 to 2035) | 4.60% |

Australia is forecast to expand at a CAGR of 4.60% through 2035. Key factors pulling the market’s growth are listed below:

| Leading End Use | Hospitals |

|---|---|

| Value Share % (2025) | 38.80% |

The hospital segment is projected to acquire a prominent market share of 38.80% in 2025. Considerable patient footfall in hospitals is raising the share of this segment in the disinfection cap market.

Increasing utilization of intravenous connectors and catheters for multiple purposes like blood transfusion, parenteral nutrition, dialysis, etc., is pushing product demand. Additionally, mounting healthcare expenditure to develop more hospitals is favoring sales of disinfection caps.

| Leading Distribution Channel | Non-retail |

|---|---|

| Value Share % (2025) | 63.80% |

The non-retail segment is anticipated to obtain a 63.80% share of the global market in 2025. Non-retail distribution of disinfection caps has become a norm as hospitals and clinics usually come into long-term contracts and alliances with distributors and manufacturers.

The rising count of group purchasing organizations (GPOs) that accumulate purchasing power of multiple healthcare facilities is also contributing to this segment's growth. This gives them bargaining power to negotiate a lower price for disinfection caps with manufacturers.

Market leaders in the disinfection cap industry are zeroing in on organic growth tactics like new product developments and product approvals. These steps are expected to forward participants' revenue and clientele in the disinfection cap market.

Market distributors are deploying their resources to lead to innovations in disinfection cap technology. The widened product portfolio is anticipated to raise companies' revenue generation.

Disinfection cap players ceaselessly invest in research and development to advance the market's growth. Inorganic growth strategies employed by players include acquisitions, collaborations, and partnerships.

Key Developments Favoring the Growth of the Disinfection Cap Market

| Company Name | Company Particulars |

|---|---|

| 3M Company | It is an American MNC that works in the fields of healthcare, worker safety, and consumer goods. The company has a culture of innovation and applies science to life. The company caters to numerous industries, such as automotive, health care, electronics, consumer markets, etc. |

| Becton Dickinson and Company | It is a global med-tech company. The company is advancing the world of health by launching innovative technology, solutions, and services for healthcare practitioners and patients. |

| ICU Medical Inc. | It is a California-based company that operates globally. The company designs products aiming to prevent bloodstream infections and safeguard healthcare workers from exposure to hazardous drugs or infectious diseases. |

| B. Braun Melsungen AG | B. Braun Melsungen AG is a German company that delivers medical and pharmaceutical devices. Presently, the company has over 63,000 employees internationally, with production facilities and offices in over 60 countries. |

| Baxter International Inc. | It is a healthcare MNC with headquarters in Deerfield, Illinois. The firm focuses on products that treat kidney diseases and other acute and chronic medical conditions. The company is pursuing healthcare transformation to help providers and patients beat the challenges they face. |

The global disinfection cap market is estimated to be valued at USD 393.8 billion in 2025.

The market size for the disinfection cap market is projected to reach USD 599.9 billion by 2035.

The disinfection cap market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in disinfection cap market are double caps system and single cap system.

In terms of application, blood collection segment to command 47.8% share in the disinfection cap market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Capacitor Bushing Market Size and Share Forecast Outlook 2025 to 2035

Caprolactam Market Size and Share Forecast Outlook 2025 to 2035

Capacitor Film Slitter Market Size and Share Forecast Outlook 2025 to 2035

Cap Liner Market Size and Share Forecast Outlook 2025 to 2035

Capsule Vision Inspection Solution Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Capacitance Meter Market Size and Share Forecast Outlook 2025 to 2035

Capsule Hotels Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Tactile Sensor Market Size and Share Forecast Outlook 2025 to 2035

Capryloyl Glycine Market Size and Share Forecast Outlook 2025 to 2035

Captive Chemical Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Position Sensors Market Size and Share Forecast Outlook 2025 to 2035

Capacitive Sensor Market Analysis - Size, Share, and Forecast 2025 to 2035

Caprylic Capric Triglyceride Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

Capnography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Capillary Electrophoresis Market Size, Growth, and Forecast 2025 to 2035

Capsule Endoscope and Workstations Market - Growth & Demand 2025 to 2035

Disinfection Equipment Market Analysis - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA