Global Disinfection equipment market is expected to witness strong growth during the forecast period 2025 to 2035. Factors such as growing concerns regarding hygiene and sanitation, increasing incidence of infectious disease and technological advancements in sterilization methods are expected to drive the demand for disinfection equipment globally.

Disinfection equipment, such as UV sterilizers, chemical disinfectants, and advanced fogging systems, has always been a critical solution in healthcare, food processing, water treatment, and in public sanitation. Market growth is further attributed to the increased adoption of automated and touchless disinfection solutions and innovation in eco-friendly and chemical-free sterilization techniques. The increasing investment in public health safety, the rapid expansion of healthcare infrastructures and the greater regulatory focus on infection control are also pacing for an extremely dynamic need of the global industry.

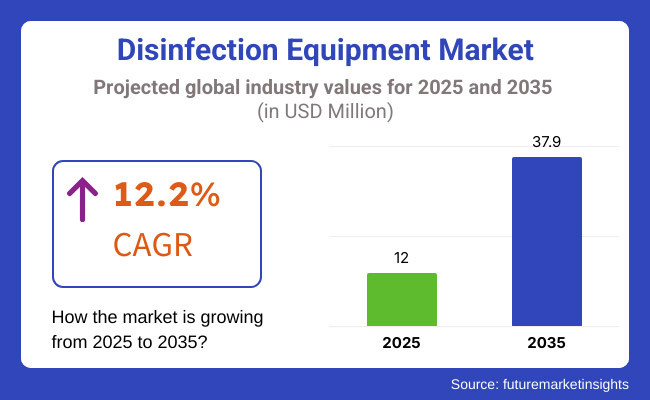

The Disinfection equipment industry was estimated at around USD 12.0 million in ESIL, 2025. It is estimated to be USD 37.9 million by 2035 at a CAGR of 12.2% during the forecast period. Factors like rising demand for high-efficiency sterilization solutions, growing adoption of UV and ozone-based disinfection, and increasing investments in smart sanitation technologies drive the growth of this market.

The integration of AI-based monitoring, improved energy-efficient sterilization systems, and low-cost production methods is additionally driving market growth. MRI [magnetic resonance imaging] System: A Novel Solution for Treating Mental Disorders3) Hospital: IoT solutions connected to the hospital will include information about vital signs, heart rate, level of oxygen in the blood, temperature, and electromagnetic information.

The North America region continues to be a leading market for disinfection equipment due to strict healthcare regulations, demand for infection control solutions and major investments in advanced sterilization technologies. The leadership of the United States and Canada in these fields drives the development and commercialization of next-generation disinfection solutions - from autonomous disinfecting robots using UV rays, ultra-high efficiency air purifiers and air conditioning devices, to AI-based sterilization systems.

Market expansion is attributed to rise in demand for regulatory-compliant hygiene solutions, growing awareness about antimicrobial resistance, and increasing adoption of smart disinfection technologies in hospitals, public spaces, and water treatment facilities. Further, increased penetration of connected and remote-monitoring disinfection solutions is pushing product innovation and adoption.

The Europe market is characterized by rising demand of sustainable and chemical-free disinfection solutions, government initiatives and policies promoting public health and safe environment, technological advancements in germicidal radiations for hospital sterilization systems.

High-efficiency, environmentally-friendly disinfection equipment is the target for Germany, France, UK and other countries, for applications in medical, food safety, municipal water treatment. The increasing focus on preventing healthcare-associated infections (HAIs), wider applications in personal and commercial hygiene and R&D activities involving UV-C and ozone-based disinfection also continue to drive the market adoption. Increasing applications in the pharmaceutical cleanrooms, sanitization of public transport and sterilization of consumer electronics are also creating new opportunities for manufacturers and service providers.

The Disinfection equipment market in the Asia-Pacific region is growing at the fastest rate, owing to increased healthcare expenditure, increased awareness of hygiene and infection control methods, and increased need for industrial sterilization solutions. Countries including China, India, and Japan are heavily investing in the research and development of affordable, highly-effective disinfection equipment, including efficient plasma-based sterilizers, automated hand sanitization stations, and state of the art, hospital-grade air purification systems.

The increase in demand for cleaning healthcare facilities, the quick development of public sanitation efforts, and the changing regulatory framework, along with government programs supporting solutions for clean water and air, all contribute to regional market growth. In addition, the growing awareness of antimicrobial resistance and the introduction of smart disinfection systems also help to increase market penetration. The existence of local medical device manufacturers and partnerships with foreign health care companies also contribute to market growth.

Ongoing innovations in sterilization technology, sustainable hygiene solutions, and AI-powered infection monitoring should drive the Disinfection equipment market to exponential growth within a decade. To enable better functionality, market viability, and long-term nature of use, companies are concentrating on innovation in energy usage disinfection systems, portable sterilization apparatuses, and IoT empowered cleanliness arrangements. Moreover, growing consumer awareness about the need for antimicrobial protection, increasing digitalization in public health solutions, and changing infection control regulations are some of the factors that are influencing the future of this industry. Along with the rising demand for AI-powered disinfection analytics, new-age UV sterilization, and green hygiene technology are seen further optimizing market efficiency and maintaining high quality of global public health security.

Challenge

High Initial Investment and Maintenance Costs

The high costs involved in advanced technology disinfection equipment like UV sterilization, electrostatic sprayers, and ozone-based systems, are daunting challenges to the Disinfection equipment market. Automated and high-efficiency disinfection equipment often requires substantial capital investment by businesses and healthcare facilities for integration.

Plus, operating costs are compounded by regular maintenance, including replacing ultraviolet bulbs and filters, and refilling chemicals. As a result, businesses need to create more cost-effective, long-lasting disinfection options that need less maintenance and use less energy.

Regulatory Compliance and Evolving Safety Standards

Disinfection equipment manufacturers face challenges in product development and market entry due to stringent regulations imposed by agencies, including the Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and World Health Organization (WHO). Regulatory hurdles for safety regulations, efficacy examination and its authorization can contribute to extended product development timelines and greater expenses.

In addition, emerging global health threats require regular updates to decontamination standards and guidance for decontamination equipment. Organizations need to invest in regulatory know-how, superior product validation methods, and flexible design plans to comply with these new regulations and remain competitive in the advancing disinfection arena.

Opportunity

Growing Demand for Healthcare and Public Safety Applications

Growing focus on Infection control measures across hospitals, laboratories and public spaces is majorly driving the demand for disinfection equipment. Healthcare, hospitality, and transportation were early adopters of UV-C disinfection robots, antimicrobial surface coatings, and air purification systems as a result of the COVID-19 pandemic.

There will need for touchless disinfect solutions which will put companies providing touch-less surface disinfect solutions in a better position as businesses gear towards hygiene and disease prevention. There is a big market opportunity around innovations like real-time pathogen detection, AI-powered cleaning monitoring and mobile sanitization unmanned vehicles.

Expansion of Smart and IoT-Enabled Disinfection Solutions

Moreover, the advent of Internet of Things (IoT), artificial intelligence (AI), and data analytics is revolutionizing the Disinfection equipment market by providing real-time monitoring, automated disinfection cycles, and remote operation functionalities. Smart disinfection systems that combine AI-powered pathogen identification and cloud-based tracking improve both efficiency and compliance.

Also in line with sustainability goals is the growing availability of green disinfection technologies, like chemical-free UV and plasma-based sterilization. The future of disinfection technology revolves around AI-powered sanitation optimizations, sustainable disinfectants, and IoT-enabled monitoring systems on companies that focus on these areas.

Disinfection equipment market has been witnessing most of the above shifts from year 2020 to Year 2024 and the future trends (2025 to 2035) the disinfection equipment market has seen rapid growth from Year 2020 to Year 2024 due to global health crises, regulatory requirements and heightened awareness around hygiene.

UV-C light sterilization, hydrogen peroxide vapor systems and antimicrobial coatings saw rapid adoption due to pandemic-related fears. But barriers to entry including cost, regulatory, and inconsistent claims on efficacy meant that market penetration was challenged. In response to this, companies improved product validation, increased digital monitoring capabilities and looked into cost-effective methods for manufacturing.

Future Market and Technologies: 2025 to 2035 for the period of 2025 to 2035, the future market will witness further CPI (Cleansing, Purifying, and Improving) services alongside innovative technologies as AI-driven disinfection automation, nanotechnology-based antimicrobial solutions, and energy-efficient sterilization machines.

Blockchain in the form of hygiene compliance tracking, self-sanitizing surfaces and biodegradable disinfectant chemicals will set new standards in the industry. Moreover, trends such as emerging wearable disinfection technologies, smart air purification systems, and next-gen. personalized hygiene solutions will further drive future market expansion. Sustainable, digital transformation, and next-gen disinfection innovation will be the trump card for companies to grow in the changed landscape.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pandemic-driven hygiene mandates and EPA/FDA regulations |

| Technological Advancements | Growth in UV-C and electrostatic disinfection technologies |

| Industry Adoption | Increased use in healthcare, transportation, and commercial spaces |

| Supply Chain and Sourcing | Dependence on traditional chemical disinfectants and UV technology |

| Market Competition | Dominance of medical-grade disinfection equipment providers |

| Market Growth Drivers | Demand for hospital-grade disinfection and air purification |

| Sustainability and Energy Efficiency | Initial focus on chemical-free disinfection solutions |

| Integration of Smart Monitoring | Limited real-time data tracking and manual sanitation audits |

| Advancements in Disinfection Innovation | Development of antimicrobial coatings and hydrogen peroxide vapors |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-powered compliance tracking, blockchain-based hygiene verification, and sustainability-focused disinfection policies |

| Technological Advancements | Expansion of AI-driven pathogen detection, nanotech antimicrobial coatings, and plasma-based sterilization |

| Industry Adoption | Widespread adoption in residential, wearable, and personalized disinfection solutions |

| Supply Chain and Sourcing | Shift toward sustainable, biodegradable disinfectants, smart monitoring, and AI-driven supply chain optimization |

| Market Competition | Rise of AI-powered sanitation startups, self-cleaning technology firms, and eco-friendly sterilization innovators |

| Market Growth Drivers | Growth in autonomous sanitation robots, smart HVAC disinfection systems, and real-time contamination monitoring |

| Sustainability and Energy Efficiency | Large-scale implementation of zero-waste, energy-efficient, and AI-optimized disinfection technologies |

| Integration of Smart Monitoring | AI-powered sanitation analytics, IoT-enabled tracking, and automated contamination detection |

| Advancements in Disinfection Innovation | Introduction of self-cleaning surfaces, bioengineered disinfectants, and autonomous mobile sterilization units |

With growing focus on hygiene, increasing demand for advanced sterilization solutions, and the strong presence of healthcare and pharmaceutical industries, the United States holds the largest share of the Disinfection equipment market. The continuous drive towards reducing the risk of infection in hospitals, food processing units and water treatment facilities is expected to increase the demand for the product in the market thereby propelling the growth of the market.

Increasing investments in UV-C disinfection, automated sanitization systems, and electrostatic spraying technologies also bolster market growth. Moreover, the incorporation of AI-enabled patient monitoring, IoT-connected sterilization equipment, and self-sanitizing surfaces are augmenting operational efficiency.

Other businesses are committed to creating environmentally friendly, chemical free, and energy efficient products that can achieve the regulatory requirements in place. In the USA, demand is further driven by the growing usage of high-performance sterilization equipment in medical, hospitality and public transportation industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.5% |

The United Kingdom is another eminent market for disinfection equipment on account of strict hygiene regulations, increased demand for antimicrobial technologies, and growing investments in healthcare infrastructure. An increase in awareness among governments, hospitals, and the general population about the importance of reducing hospital-acquired infections and improving public sanitation is further fueling the growth of the market.

The government's policies encouraging the use of disinfection best practices in the concerned sectors, along with advancements in ozone-based sterilization and touchless disinfection systems, is expected to lead to market growth. Furthermore, advances in mobile UV sterilisers, smart sanitation robots and environmentally friendly disinfectants are making headway. Others are deploying AI-based compliance tracking systems to better track and optimize disinfection procedures.

The growth of sustainable and automated cleaning technologies also supports the adoption of such commercial cleaning services in the UK market. The increased prevalence of antimicrobial surface coatings and water purification systems is also contributing to growth in demand for disinfection equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.0% |

The European Disinfection equipment market is dealt with by Germany, France and Italy, are the Business Development countries with the well-designed and steady Health improvement framework, Rising guidelines over sterilization necessities and Rising speculations towards the propelled cleaning innovation.

The rapid market growth is due to the growing interest of the European Union in infection prevention and investments in next generation disinfection systems. Moreover, the use of AI-powered disinfection robots, smart sensor-based sanitation systems, and eco-friendly sterilization methods are optimizing the efficiency.

Increasing adoption of chemical-free sterilization across food processing, pharmaceuticals, and water treatment is also expected to accelerate the growth of the market. Additional adoption is being driven by the expansion of regulatory compliance frameworks and the demand for sustainable disinfection solutions across the EU. Real-time monitoring and the adoption of IoT-enabled tracking for sterilization processes are also driving disinfection efficiency across different sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.1% |

Japan disinfection equipment market is the growing rate in Japan the high concentration on hygiene in the nation increasing consumption of high-tech sterilization and rising investment in automation. Market growth is attributed to an increasing demand for chemical-free, non-toxic disinfection methods.

The focus on technology, combined with robotics, AI-based pathogen detection and UV-C disinfection tunnels, is revolutionizing the country. In addition, stringent government regulations for sanitation and infection control are catalyzing corporations to develop next-generation sterilization solutions.

The need for automated, touchless disinfection systems in public spaces, transportation hubs, and healthcare facilities is also driving Japan market growth increasingly. Japan is also investing into technologies such as nanotechnology based antimicrobial coatings, and smart sterilization chambers to shape the future of disinfection technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

The South Korea disinfection equipment market has shown considerable potential and is expected to grow at a significant rate during the forecast period.Rising level of healthcare and food safety regulations, as well as growing uptake of smart disinfection machines help in market growth. High efficiency UV sterilizers, air purification systems, and AI-assisted surface disinfectors are improving competitiveness by enhancing disinfection efficiency in the country.

Market adoption is further propelled by increasing automation in smart buildings, hospitals, and public transportation. To address the changing needs of consumers, companies are increasingly pursuing investments in energy-efficient, chemical-free, and multi-purpose disinfection solutions. Furthermore, the smart city initiatives and sensor-based sanitation networks in South Korea, which are being used for automatic monitoring and cleaning of the living space, are also witnessing an increase in demand for the advanced disinfection equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.2% |

Disinfection sprayers are essential cleaning tools used for hygiene maintenance in commercial, industrial, and residential spaces. These sprayers allow liquid disinfectants to be sprayed in order to cover a larger surface area in a more efficient and quicker manner.

Innovation in this segment has been supported by the increasing demand for touchless cleaning solutions, hospital-grade disinfection, and high-precision sprayer technologies Further, Manufacturers are adopting adjustable nozzles, electrostatic spray, and automated dispensing systems to enhance the efficiency and overall coverage of chemicals. Moreover, the increasing usage of eco-friendly and chemical-free disinfectants has driven the development of low-waste and high-performance sprayers in alignment with sustainability goals.

The treatment with physical agents such as UV for sterilization and disinfection has become a popular trend, as the UV disinfection equipment is non-contact, chemical-free, and characterized by high purification efficiency. These systems use ultraviolet-C (UVC) radiation to kill viruses, bacteria and airborne pathogens, perfect for hospitals, laboratories, food processing facilities and public transportation systems.

The Cleanliness of businesses and industries nearing pre-pandemic levels makes the use of portable UV sterilizers, robotic UV disinfection systems, and IoT-enabled UV units increasingly popular. Moreover, growing concerns regarding antimicrobial resistance along with the strict hygiene regulations have gained high demand for the UV-based sanitation technologies in high-risk settings.

The commercial segment continues to represent a leading buyer of disinfection equipment due to a focus on employee safety, customer cleanliness, and regulatory adherence across industries. Electrostatic sprayers, automated disinfectant dispensers and UV sanitation units are in high usage in industries like hospitality, healthcare, education and retail, where the sanitation requirements are at their max. Increased use of autonomous disinfection robots, smart sensor based sprayers, and AI-based sanitation tracking systems has further bolstered the commercial segment. Further, companies are now spending on the most effective long term hygiene practices to ensure that all employees/customers are in a safe, virus-free zone.

In the household segment, the demand for compact, user-friendly, and cost-effective disinfection solutions has increased. Consumers focus on utility products - handheld UV sterilizers, battery-operated sprayers and natural disinfectant applicators - for everyday home cleaning.

Awareness of protection against airborne viral loads, pet-friendly hygiene and non-toxic disinfection has spurred new innovations in home-based solutions for cleaning. Moreover, the trend of smart home integration and automated disinfection systems openings for manufacturers to manufacture AI-enabled voice command and self-sanitizing home appliances.

Instead, online retailers have opened up access to disinfection equipment like never before - with delivery to your doorstep, side-by-side product comparisons and customer reviews. The growth of subscription-based sanitization services, bundled cleaning kits and e-commerce exclusive products have widened the digital platforms. Moreover, the inclusion of AI-based product recommendations, livestock update, and virtual demos have provided a further boost to the online selling of disinfection solutions.

Wholesalers and distributors serve as integral bulk procurement and large-scale supply chain distributors for sectors that require ongoing sanitization solutions. Wholesalers are essential to businesses, hospitals and government agencies, which buy industrial-grade disinfectant sprayers, high-capacity UV sterilization units, electrostatic misting systems and other items in bulk.

As the demand for bespoke sanitation contracts and supply chain automation, as well as just in time inventory solutions, has increased, it has paved the way for partnerships between the manufacturers and wholesale distributors in the hygiene tech sector.

Factors such as growing awareness of hygiene, strict regulations in the healthcare and food & beverage industries, and the need for infection control are driving the Disinfection equipment market. The in-flux of companies working to innovate within the cleaning process, from UV-C disinfection, electrostatic sprayers, and automatic sanitization systems all focused on efficiency and efficacy at scale. Essential trends include intelligent disinfection technology, green solutions, and AI-powered monitoring for peak performance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Xenex Disinfection Services | 18-22% |

| Ecolab Inc. | 14-18% |

| Steris plc | 11-15% |

| 3M Company | 8-12% |

| Advanced Sterilization Products (ASP) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Xenex Disinfection Services | Leading provider of UV-C disinfection robots for hospitals and high-risk environments. |

| Ecolab Inc. | Specializes in chemical disinfection solutions and automated sanitization systems. |

| Steris plc | Develops high-end sterilization and decontamination equipment for medical and industrial applications. |

| 3M Company | Offers surface disinfectants and electrostatic sprayers for commercial and healthcare use. |

| Advanced Sterilization Products (ASP) | Focuses on low-temperature sterilization and high-level disinfection systems. |

Key Company Insights

Xenex Disinfection Services (18-22%)

Xenex, at the forefront of the industry, provides cutting-edge UV-C disinfection robots for speedy and efficient microbial destruction in health-care facilities.

Ecolab Inc. (14-18%)

Ecolab, which provides chemical and automated disinfection systems to industries with stringent hygiene compliance requirements.

Steris plc (11-15%)

Steris is a provider of sterilization and decontamination products for hospitals, pharmaceutical companies, and laboratories.

3M Company (8-12%)

3M Speaks to Surface Disinfectants, Needs for Innovative Electrostatic Spraying Technology Solutions to Combat Infections.

Advanced Sterilization Products (ASP) (6-10%)

ASP designs, manufactures and distributes low-temperature sterilization and high-level disinfection systems for hospitals and critical care units.

Other Key Players (30-40% Combined)

Numerous universal and native producers are engaged in innovations in the production of atmosphere disinfectant apparatus's, with a focus on robotization, maintainability and enactment of regulatory prerequisites. Key players include:

The overall market size for Disinfection equipment market was USD 12.0 Million in 2025.

The disinfection equipment market expected to reach USD 37.9 Million in 2035.

Factors impacting the market growth include increasing awareness regarding hygiene and sanitation, rising prevalence of infectious diseases, stringent government regulations regarding sterilization, increased adoption of disinfection and sterilization in healthcare and food industries, and advancements in disinfection technologies including ultraviolet (UV), electrostatic and automated disinfection.

The top 5 countries which drives the development of disinfection equipment market are USA, UK, Europe Union, Japan and South Korea.

Disinfection sprayers and UV disinfection solutions drive growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Equipment Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Equipment Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Equipment Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Equipment Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Equipment Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Equipment Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Equipment Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Equipment Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Equipment Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Equipment Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Equipment Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Equipment Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 143: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disinfection Cap Market Size and Share Forecast Outlook 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Endoscopic Probe Disinfection Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Garage Equipment Market Growth – Trends & Forecast 2024-2034

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA