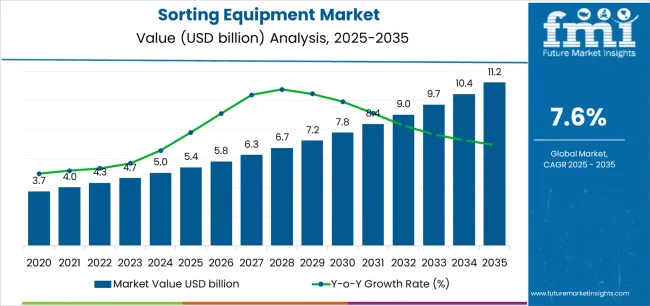

The sorting equipment industry stands at the threshold of a decade-long expansion trajectory that promises to reshape automated quality control technology, material recovery solutions, and advanced inspection applications. The market's journey from USD 5.4 billion in 2025 to USD 11.2 billion by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced optical sorting configurations and AI-driven inspection technology across food processing, recycling, mining, and manufacturing sectors.

The first half of the decade (2025-2030) will witness the market climbing from USD 5.4 billion to approximately USD 7.8 billion, adding USD 2.4 billion in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of optical sorter systems, driven by increasing food safety requirements and the growing need for high-performance automated inspection equipment worldwide. Advanced multispectral imaging capabilities and AI-powered defect recognition systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 7.8 billion to USD 11.2 billion, representing an addition of USD 3.4 billion or 55% of the decade's expansion. This period will be defined by mass market penetration of specialized hyperspectral imaging systems, integration with comprehensive production management platforms, and seamless compatibility with existing processing infrastructure. The market trajectory signals fundamental shifts in how manufacturers approach quality assurance optimization and waste reduction management, with participants positioned to benefit from sustained demand across multiple technology types and end-use segments.

Pharmaceutical manufacturing introduces stringent validation requirements for sorting equipment used in tablet inspection and capsule quality control. FDA compliance mandates extensive documentation protocols that strain relationships between production teams focused on batch completion and quality assurance groups requiring comprehensive testing records. Equipment qualification processes can extend 3-6 months while production schedules demand immediate implementation, creating project management conflicts between engineering departments and regulatory affairs teams. Sorting system software requires regular updates to maintain compliance standards, yet change control procedures often delay critical upgrades for weeks.

Mining operations integrate sorting equipment to separate valuable minerals from waste rock, reducing downstream processing costs while meeting environmental regulations for tailings management. Ore processing facilities utilize X-ray transmission sorting systems that generate operational data requiring interpretation by both geology teams and process engineers.

Supply chain disruptions affect sorting equipment availability as specialized sensors and control systems rely on semiconductor components with extended lead times. Service contracts become critical as equipment complexity increases, yet skilled technicians remain scarce across industrial regions, forcing facilities to compete for maintenance resources through premium service pricing that can double annual operating costs.

The sorting equipment market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its automation acceleration phase, expanding from USD 5.4 billion to USD 7.8 billion with steady annual increments averaging 7.6% growth. This period showcases the transition from manual inspection and basic mechanical sorting to advanced optical systems with enhanced AI analytics and integrated quality monitoring becoming mainstream features.

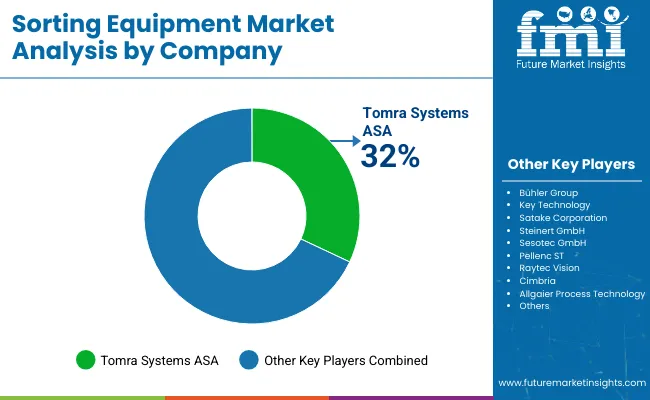

The 2025-2030 phase adds USD 2.4 billion to market value, representing 45% of total decade expansion. Market maturation factors include standardization of multispectral imaging protocols, declining component costs for optical sorting systems, and increasing processor awareness of yield improvement benefits reaching 95-98% recovery effectiveness in food applications. Competitive landscape evolution during this period features established equipment manufacturers like TOMRA and Bühler expanding their AI-powered sorting portfolios while specialty manufacturers focus on advanced hyperspectral development and enhanced throughput capabilities.

From 2030 to 2035, market dynamics shift toward advanced machine learning integration and global food safety expansion, with growth continuing from USD 7.8 billion to USD 11.2 billion, adding USD 3.4 billion or 55% of total expansion. This phase transition centers on fully autonomous quality control systems, integration with comprehensive production analytics platforms, and deployment across diverse processing and recycling scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic defect detection capability to comprehensive process optimization systems and integration with predictive maintenance platforms.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5.4 billion |

| Market Forecast (2035) | USD 11.2 billion |

| Growth Rate | 7.6% CAGR |

| Leading Technology | Optical Sorters Product Type |

| Primary End Use | Food Industry Segment |

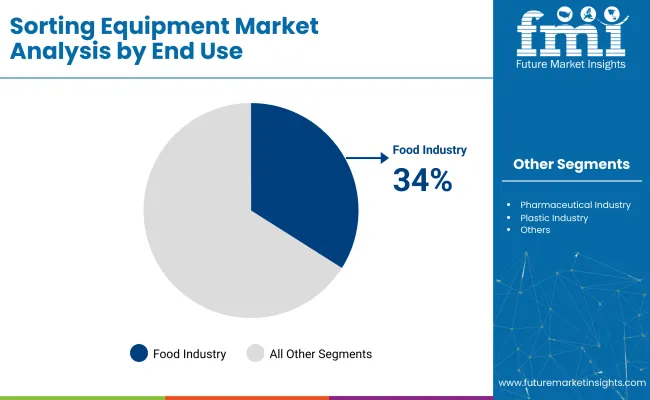

The market demonstrates strong fundamentals with optical sorter systems capturing a dominant share through advanced detection accuracy and operational versatility capabilities. Food industry applications drive primary demand, supported by increasing safety regulations and automated inspection technology requirements. Geographic expansion remains concentrated in developed markets with established food processing infrastructure, while emerging economies show accelerating adoption rates driven by food safety modernization and rising quality standards.

Market expansion rests on three fundamental shifts driving adoption across the food processing, recycling, and manufacturing sectors. First, food safety regulation tightening creates compelling inspection advantages through automated sorting that provides consistent foreign material detection without human subjectivity, enabling processors to meet enhanced contamination standards while maintaining production throughput and reducing recall risks. Second, circular economy mandates accelerate worldwide as waste management facilities seek advanced optical systems that replace manual picking, enabling material recovery optimization and contamination reduction that align with recycling targets and extended producer responsibility standards.

Third, labor shortage pressures drive adoption from food processors and recyclers requiring effective automated solutions that eliminate manual sorting dependency while maintaining quality control during production operations and material recovery processes. However, growth faces headwinds from capital investment barriers that vary across small processors regarding the procurement of advanced optical systems with AI capabilities, which may limit adoption in price-sensitive processing environments. Technical complexity also persists regarding system integration and material handling optimization that may reduce effectiveness in diverse product applications and varying contamination scenarios, which affect sorting accuracy and operational continuity.

The sorting equipment market represents a specialized yet critical automation opportunity driven by expanding food safety requirements, circular economy advancement, and the need for superior quality control in diverse applications. As processors worldwide seek to achieve 95-98% defect detection accuracy, reduce manual labor by 60-80%, and integrate advanced inspection systems with production management platforms, sorting equipment is evolving from basic mechanical separation to sophisticated quality assurance solutions ensuring product safety and material value recovery.

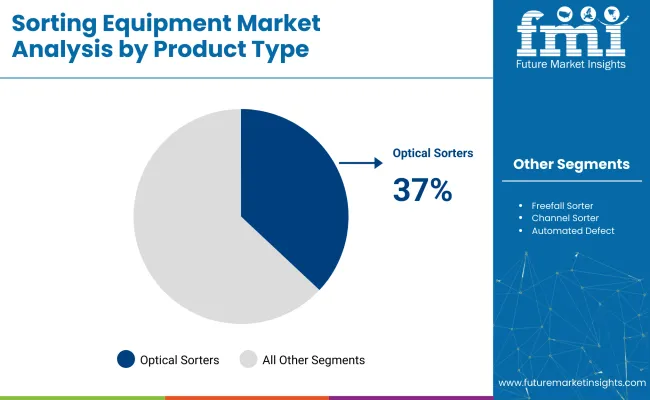

The market's growth trajectory from USD 5.4 billion in 2025 to USD 11.2 billion by 2035 at a 7.6% CAGR reflects fundamental shifts in food safety requirements and waste management optimization. Geographic expansion opportunities are particularly pronounced in North American and European markets, while the dominance of optical sorter systems (37.0% market share) and food industry applications (34.0% share) provides clear strategic focus areas.

Strengthening the dominant optical sorters segment (37.0% market share) through enhanced AI algorithm configurations, superior camera resolution, and automated parameter adjustment systems. This pathway focuses on optimizing imaging sensor technology, improving classification accuracy, extending equipment effectiveness to diverse product applications, and developing specialized sorters for challenging defect types. Market leadership consolidation through machine vision engineering and deep learning integration enables premium positioning while defending competitive advantages against manual inspection alternatives. Expected revenue pool: USD 420-550 million

Rapid food safety regulation enforcement and labor shortage acceleration across North America creates substantial opportunities through processor partnerships and system integration services. Growing smart factory investment and municipal recycling automation drive sustained demand for advanced sorting systems. Regional market strategies enhance technical support, enable faster installation, and position companies advantageously for food safety compliance programs while accessing large processing markets. Expected revenue pool: USD 370-480 million

Expansion within the dominant food industry segment (34.0% market share) through specialized equipment addressing fresh produce, processed foods, and ingredient quality control requirements. This pathway encompasses foreign material detection, defect removal systems, and compatibility with diverse food handling workflows. Premium positioning reflects superior hygiene design and comprehensive validation support enabling modern food safety and quality assurance operations. Expected revenue pool: USD 320-420 million

Strategic advancement in multispectral/color sensing (41.0% market share) requires enhanced spectral resolution and specialized algorithms addressing subtle defect detection requirements. This pathway addresses color sorting optimization, near-infrared material identification, and comprehensive classification capability with advanced spectral analysis. Premium pricing reflects detection accuracy and operational reliability through proven sensing technology and material discrimination capability. Expected revenue pool: USD 280-360 million

Development of specialized sorting systems for recycling facilities (22.0% market share) addressing material recovery, contamination removal, and circular economy compliance requirements. This pathway encompasses plastic sorting capability, e-waste component recovery, and municipal solid waste processing automation. Technology differentiation through material recognition enables diversified revenue streams while accessing growing waste management and resource recovery markets requiring automated separation. Expected revenue pool: USD 240-310 million

Expansion targeting premium food processing and pharmaceutical applications through advanced hyperspectral systems providing comprehensive spectral fingerprinting for complex defect detection. This pathway encompasses chemical composition analysis, subtle defect identification, and regulatory compliance documentation capability. Market development through application validation enables differentiated positioning while accessing high-value segments requiring ultimate detection sensitivity and material characterization. Expected revenue pool: USD 210-270 million

Development of comprehensive sorting data analytics systems addressing process optimization, quality trending, and predictive maintenance requirements across processing operations. This pathway encompasses IoT sensor integration, machine learning analytics, and comprehensive production intelligence platforms. Premium positioning reflects operational excellence and total cost optimization while enabling access to Industry 4.0 initiatives and smart manufacturing programs requiring comprehensive process visibility. Expected revenue pool: USD 180-230 million

Primary Classification: The market segments by product type into Optical Sorters, Freefall Sorters, Belt Sorters, Channel/Lane Sorters, and Automated Defect Removal systems, representing the evolution from basic mechanical separation to comprehensive automated quality control solutions for diverse processing optimization.

Secondary Classification: End use segmentation divides the market into Food Industry, Recycling & Waste Management, Mining & Minerals, Plastics & Chemicals, Pharmaceuticals, Agriculture, and Packaging/Others, reflecting distinct requirements for material separation, quality control, and contamination detection standards.

Tertiary Classification: Technology segmentation encompasses Multispectral/Color, Hyperspectral Imaging, X-ray Inspection, Laser/Shape & Texture, and Magnetic/Metal Detection systems, representing diverse sensing approaches for material identification and defect detection.

Quaternary Classification: Throughput class segmentation includes Low (<3 t/h), Medium (3-10 t/h), and High (>10 t/h) capacity ranges, representing different production scale requirements and processing volumes.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, Africa, and the Middle East, with developed markets leading technology adoption while emerging economies show accelerating growth patterns driven by food safety modernization programs.

The segmentation structure reveals technology progression from conventional mechanical sorting toward AI-powered optical systems with enhanced imaging and predictive analytics capabilities, while application diversity spans from fresh produce inspection to specialized pharmaceutical tablet sorting requiring comprehensive quality verification solutions.

Market Position: Optical sorter systems command the leading position in the Sorting Equipment market with approximately 37.0% market share through advanced detection features, including multi-sensor capability, real-time processing, and operational versatility that enable processors to achieve optimal product quality across diverse material types and defect categories.

Value Drivers: The segment benefits from processor preference for non-contact inspection systems that provide consistent performance without product damage, comprehensive defect detection capability, and integration flexibility supporting diverse applications from agricultural commodities to processed foods. Advanced camera systems enable simultaneous color, shape, and structural defect detection through high-resolution imaging, where detection accuracy and throughput capability represent critical performance requirements.

Competitive Advantages: Optical sorter systems differentiate through proven multi-application versatility, optimal detection-to-cost ratios, and integration with existing processing lines that enhance product quality while maintaining equipment costs suitable for diverse food and material processing applications requiring automated inspection.

Key market characteristics:

Belt sorter systems maintain 21.0% market share due to their essential gentle handling characteristics for delicate products and continuous high-throughput processing capability. Freefall sorters capture 16.0% share through bulk commodity applications, granular material processing, and high-speed inspection of free-flowing products. Channel/lane sorters and automated defect removal systems demonstrate 13.0% each for specialized applications including beverage container sorting and automated trim removal in processing operations.

Market Context: Food industry applications dominate the Sorting Equipment market with approximately 34.0% market share due to stringent food safety regulations and increasing focus on foreign material contamination prevention, defect removal, and quality consistency applications that maximize consumer protection while maintaining processing efficiency standards.

Appeal Factors: Food processors prioritize reliable contamination detection, regulatory compliance capability, and integration with HACCP systems that enable comprehensive quality control without excessive manual labor requirements. The segment benefits from substantial retail specification pressure and food safety modernization investment that emphasize automated inspection for glass, stone, plastic contamination detection, plus biological defect removal including mold, insects, and discoloration meeting enhanced safety standards.

Growth Drivers: Food safety regulation enhancement programs incorporate automated sorting as critical control points for hazard prevention, while labor shortage challenges increase demand for systems that eliminate manual inspection dependency complying with production continuity requirements and optimizing workforce utilization.

Market Challenges: Varying product characteristics and defect types across different food categories may necessitate system customization and application-specific tuning for optimal performance.

Application dynamics include:

Recycling and waste management maintains 22.0% market share through plastic sorting, municipal solid waste processing, and e-waste component recovery requiring material identification and contamination removal. Mining and minerals capture 14.0% share via ore sorting, mineral separation, and material concentration applications. Plastics and chemicals account for 10.0% through polymer sorting, color separation, and contamination detection for reprocessing operations.

Growth Accelerators: Food safety regulation enforcement drives primary adoption as automated sorting provides consistent foreign material detection and contamination prevention that enable processors to meet enhanced FSMA, EU regulations, and retailer specifications without excessive manual inspection labor, supporting brand protection and recall risk reduction that align with consumer safety expectations and liability management. Labor shortage acceleration demand expands market growth as food processors and recyclers seek automated systems that eliminate manual picking dependency while maintaining quality standards during production operations with unreliable workforce availability. Circular economy mandate spending increases worldwide, creating sustained demand for material recovery equipment that complements plastic sorting, packaging recycling, and resource conservation processes providing compliance effectiveness in extended producer responsibility programs.

Growth Inhibitors: Capital cost barriers vary across small food processors regarding the procurement of advanced optical systems with AI capabilities and hyperspectral imaging, which may limit market penetration in price-sensitive segments or regions with limited equipment financing access. Application complexity persists regarding system optimization for diverse product characteristics and varying contamination scenarios that may reduce detection effectiveness without extensive testing and parameter tuning, affecting sorting accuracy and rejection rates. Market fragmentation across custom application requirements and processor-specific specifications creates integration challenges between different equipment suppliers and existing production line configurations.

Market Evolution Patterns: Adoption accelerates in large food processors and municipal recycling facilities where safety and efficiency benefits justify sorting system investments, with geographic concentration in regulated markets transitioning toward mainstream acceptance in emerging economies driven by food safety awareness and waste management modernization. Technology development focuses on enhanced AI algorithms enabling adaptive learning from production data, improved hyperspectral imaging extending detection to chemical composition analysis, and integration with blockchain traceability systems enabling comprehensive product documentation. The market could face disruption if alternative inspection technologies including inline sensors or post-packaging scanning significantly address applications currently requiring pre-packaging sorting, though the industry's fundamental need for upstream defect removal continues to make automated sorting essential in quality assurance.

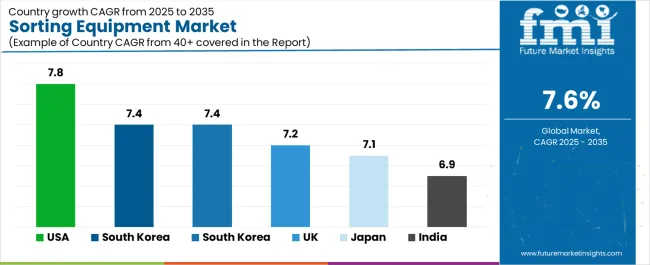

The sorting equipment market demonstrates varied regional dynamics with Growth Leaders including the United States (7.8% CAGR) driving expansion through food safety compliance and circular economy initiatives. Technology Adopters encompass South Korea (7.4% CAGR), Germany (7.4% CAGR), and the United Kingdom (7.2% CAGR), benefiting from manufacturing automation and strict regulatory frameworks. Established Markets feature Japan (7.1% CAGR) and India (6.9% CAGR), where quality control requirements and food processing modernization support consistent growth patterns.

| Country | CAGR (2025-2035) |

|---|---|

| United States | 7.8% |

| South Korea | 7.4% |

| Germany | 7.4% |

| United Kingdom | 7.2% |

| Japan | 7.1% |

| India | 6.9% |

Regional synthesis reveals North American markets leading adoption through food safety regulation enforcement and smart factory investment, while European countries maintain robust demand supported by circular economy mandates and packaging compliance requirements. Asian markets show strong growth driven by food processing modernization and electronics manufacturing quality control.

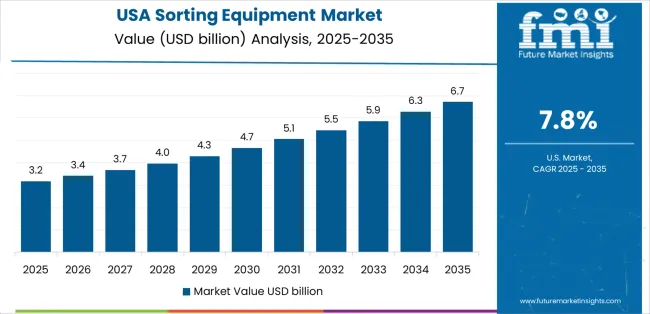

The United States leads market momentum with a 7.8% CAGR, driven by AI-driven food safety upgrades, municipal recycling automation expansion, and labor shortage pressures accelerating smart factory investment across food processing hubs, recycling facilities, and manufacturing centers. FDA Food Safety Modernization Act enforcement and retailer food safety specifications drive optical sorter adoption for foreign material detection, contamination prevention, and HACCP compliance in produce, nuts, processed foods, and ingredient applications.

Municipal solid waste recycling programs including single-stream processing and plastic recovery require automated sorting for material separation and contamination removal meeting recycling purity standards. Labor shortage challenges in food processing and agriculture accelerate automation investment with sorting systems reducing manual inspection dependency and workforce requirements.

The convergence of food safety regulation requiring automated inspection capability, labor availability challenges driving automation adoption, and smart factory initiatives supporting Industry 4.0 integration positions the United States as the highest-growth market for sorting equipment. Reshoring of food processing and manufacturing operations creates additional domestic equipment demand supporting production capacity additions and quality control infrastructure investment.

Performance Metrics:

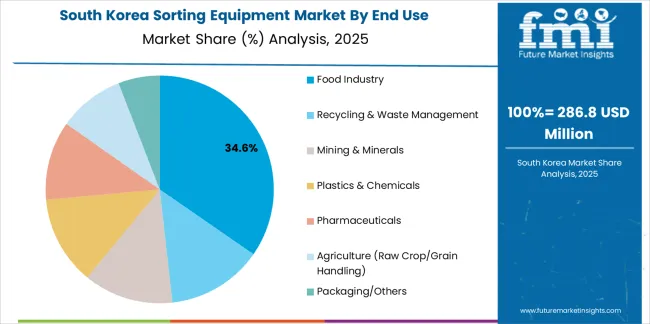

South Korea's advanced manufacturing market demonstrates sophisticated sorting deployment with documented operational effectiveness in electronics component recovery, e-waste processing, and food processing modernization through integration with smart factory platforms at 7.4% CAGR. The country leverages technology leadership and manufacturing excellence to drive adoption in electronics recycling, semiconductor component sorting, and battery material recovery requiring precision separation and contamination removal.

Smart manufacturing initiatives incorporating Industry 4.0 automation include vision-based quality control for electronics assembly, pharmaceutical production, and precision component manufacturing. Food processing modernization including fresh produce, seafood, and prepared foods incorporates optical sorting for quality grading, foreign material detection, and consistency improvement meeting consumer quality expectations.

Government smart factory incentives and circular economy programs support equipment investment. Electronics manufacturing and e-waste recovery sectors drive specialized sorting requirements for component recovery and material recycling.

Strategic Market Indicators:

Germany maintains strong expansion at 7.4% CAGR through high-specification optical platforms, industrial automation leadership, and strict packaging recyclability compliance driving food processor and recycler investment. German food processors prioritize premium optical sorting systems for nuts, coffee, grains, and frozen vegetables meeting stringent quality standards and retailer specifications. Industrial automation culture supports vision-based quality control adoption across manufacturing sectors including automotive components, pharmaceuticals, and precision parts requiring defect detection and sorting. Packaging recyclability regulations including extended producer responsibility mandates drive recycling facility investment in advanced plastic sorting, paper recovery, and packaging material separation meeting purity requirements for closed-loop recycling.

Manufacturing excellence emphasis creates demand for integrated quality control solutions. Circular economy leadership drives recycling infrastructure investment with advanced sorting technology enabling material recovery targets.

Market Characteristics:

The UK market focuses on recycling infrastructure development with documented effectiveness in municipal waste processing, food processor safety upgrades, and automation-driven labor optimization at 7.2% CAGR. British waste management sector emphasizes recycling target achievement through automated sorting for municipal solid waste processing, packaging recovery, and e-waste material separation addressing government recycling goals and extended producer responsibility compliance.

Food processors adopt hyperspectral systems for enhanced foreign material detection, defect removal, and quality control meeting retailer specifications and regulatory requirements including UK food safety standards. Labor shortage challenges accelerate automation adoption with sorting systems reducing manual picking dependency in food processing and waste management operations addressing workforce availability constraints.

Government recycling targets and extended producer responsibility regulations create infrastructure investment drivers. Food safety regulations and retail chain specifications require processor investment in automated inspection capability.

Strategic Development Indicators:

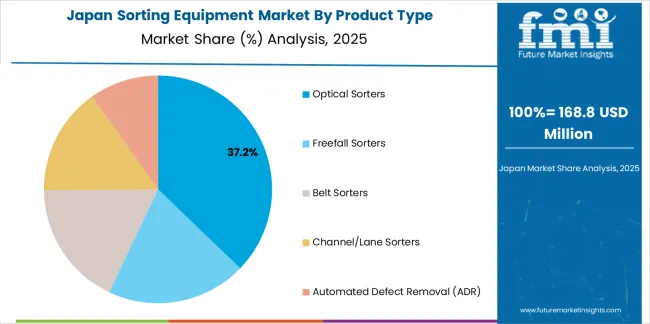

Japan demonstrates advanced market presence at 7.1% CAGR through robotics-first manufacturing philosophy, premium food quality requirements, and comprehensive materials recovery supporting metals and e-waste sorting applications. The Japanese market focuses on integrated automation where sorting systems combine with robotic handling for seamless production flow in food processing, electronics manufacturing, and materials recovery applications.

Premium food quality culture drives optical sorting adoption for rice, seafood, produce, and processed foods requiring stringent defect detection and grading meeting consumer quality expectations. Materials recovery including electronics recycling and metals sorting addresses resource scarcity through component recovery, precious metal extraction, and material recycling supporting circular economy objectives.

Manufacturing automation leadership supports vision-based quality control integration. Resource conservation priorities drive comprehensive materials recovery and recycling infrastructure investment.

Market Development Factors:

India demonstrates emerging market development at 6.9% CAGR characterized by rapid packaged food industry expansion, urban waste segregation program rollout, and growing plastics processing sector requiring quality control and material recovery. The Indian market focuses on food processing modernization where optical sorting addresses quality improvement, export standards compliance, and food safety enhancement for grains, pulses, spices, nuts, and processed foods supporting domestic consumption and export market requirements.

Urban waste management programs including Swachh Bharat initiatives and smart city developments incorporate mechanical segregation facilities with automated sorting for material recovery and waste processing optimization. Plastics processing and agro-processing sectors adopt sorting technology for quality control, contamination removal, and material grading improving product consistency and market value.

Government food processing support programs and waste management modernization initiatives create equipment demand. Growing organized retail and export-oriented food processing drive food safety and quality control investment.

Performance Metrics:

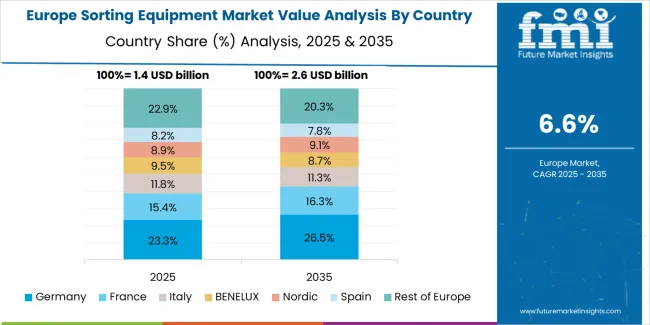

The sorting equipment market in Europe is projected to grow from USD 1.7 billion in 2025 to USD 3.5 billion by 2035, registering a CAGR of approximately 7.5% over the forecast period. Europe accounts for approximately 32% of global sorting equipment revenues in 2025. Germany leads European market with approximately 26% share supported by high-specification optical platforms for food and plastics processing, industrial automation leadership across manufacturing sectors, and strict packaging recyclability regulations driving recycling facility investment in advanced material separation technology.

United Kingdom follows with approximately 18% share driven by recycling target achievement requirements, food processor upgrades to hyperspectral systems meeting retailer specifications, and automation adoption offsetting labor shortage pressures across food processing and waste management sectors. France holds approximately 16% share reflecting food processing modernization, municipal waste management automation, and pharmaceutical quality control applications.

Italy accounts for approximately 15% share supported by food processing sector strength including pasta, rice, and specialty crop handling, plus packaging manufacturing quality control requirements. Spain represents approximately 10% share driven by fresh produce export operations, food processing investments, and emerging recycling infrastructure development. Nordic and Benelux countries collectively hold approximately 9% share with strong adoption in food safety applications, comprehensive recycling programs, and advanced manufacturing quality control. Rest of Europe including Central & Eastern European countries represents approximately 6% share reflecting emerging food processing modernization and recycling infrastructure development.

Japan demonstrates advanced market development characterized by robotics-first plant integration, premium food quality requirements, and comprehensive materials recovery programs for metals and e-waste sorting reflecting manufacturing excellence and resource conservation priorities. The Japanese market focuses on integrated automation systems where sorting equipment combines with robotic handling, conveyor systems, and packaging automation for seamless production flow in food processing and electronics manufacturing applications.

Equipment procurement emphasizes reliability, precision control, and long-term performance that align with Japanese quality standards and continuous improvement culture. The market benefits from domestic equipment manufacturers including Satake Corporation maintaining comprehensive sorting technology product lines with local engineering support and service networks.

Market Development Factors:

South Korea demonstrates sophisticated market characteristics focused on electronics component recovery, smart manufacturing quality control, and food processing modernization reflecting technology leadership and industrial sophistication. The Korean market emphasizes e-waste processing where specialized sorting addresses component recovery from consumer electronics, battery material separation, and precious metal extraction supporting circular economy objectives and resource conservation.

Korean food processors and manufacturers prioritize technology integration, data analytics, and comprehensive quality management systems that create demand for sorting equipment with IoT connectivity, production data integration, and predictive maintenance capabilities reflecting smart factory adoption. The market benefits from government Industry 4.0 initiatives, circular economy programs, and manufacturing competitiveness policies supporting automation investment and technology adoption.

Strategic Development Indicators:

The Sorting Equipment Market is growing as food processors, recyclers, mining operations, and packaging facilities adopt automated systems to improve throughput, reduce labor dependency, and enhance product purity. Optical sensing, AI-driven classification, and advanced material-handling technologies are central to the shift toward fully automated sorting lines. Increasing regulatory focus on food safety and recycling efficiency, along with the need to extract greater value from raw materials and waste streams, is pushing manufacturers to adopt high-speed, high-accuracy sorting systems.

TOMRA Systems ASA and Bühler Group lead the global landscape with comprehensive optical and sensor-based sorting solutions widely used in food production and high-volume recycling facilities. Key Technology (Duravant) and Satake Corporation serve both food and grain processing markets, focusing on color sorting, foreign material removal, and gentle handling capabilities. Steinert GmbH and Sesotec GmbH are strong players in metal separation and industrial recycling, offering magnetic, X-ray, and sensor systems tailored for mixed waste and complex material streams.

Specialized providers such as Pellenc ST and Raytec Vision S.p.A. emphasize high-definition optical sorting for recyclables and fresh produce. CP Manufacturing Inc. is well positioned in municipal recycling system integration, while Meyer Optoelectronic Technology Inc. is expanding quickly in Asia with competitive, sensor-rich sorting platforms. The market continues to benefit from the adoption of machine learning and data-driven process optimization across automated sorting lines.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.4 billion |

| Product Type | Optical Sorters, Freefall Sorters, Belt Sorters, Channel/Lane Sorters, Automated Defect Removal (ADR) |

| End Use | Food Industry, Recycling & Waste Management, Mining & Minerals, Plastics & Chemicals, Pharmaceuticals, Agriculture, Packaging/Others |

| Technology/Sensing | Multispectral/Color (RGB+NIR), Hyperspectral Imaging, X-ray Inspection, Laser/Shape & Texture, Magnetic/Eddy Current/Metal Detection |

| Throughput Class | Low Throughput (<3 t/h), Medium Throughput (3-10 t/h), High Throughput (>10 t/h) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Africa, Middle East |

| Countries Covered | United States, European Union, South Korea, Germany, United Kingdom, Japan, India, and 25+ additional countries |

| Key Companies Profiled | TOMRA Systems ASA, Bühler Group, Key Technology (Duravant), Satake Corporation, Steinert GmbH, Sesotec GmbH, Pellenc ST, Raytec Vision S.p.A., CP Manufacturing Inc., and Meyer Optoelectronic Technology Inc. |

| Additional Attributes | Dollar sales by product type, end use, technology, and throughput categories, regional adoption trends across North America, Europe, and Asia Pacific, competitive landscape with sorting equipment manufacturers and machine vision suppliers, processor preferences for detection accuracy and operational reliability, integration with production management platforms and quality assurance systems, innovations in hyperspectral imaging and AI-powered classification capabilities, and development of smart factory solutions with enhanced automation and process optimization capabilities. |

The global sorting equipment market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the sorting equipment market is projected to reach USD 11.2 billion by 2035.

The sorting equipment market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in sorting equipment market are optical sorters, freefall sorters, belt sorters, channel/lane sorters and automated defect removal (adr).

In terms of end use, food industry segment to command 34.0% share in the sorting equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sorting and Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Sorting Hampers Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cell Sorting Market Share Analysis: Global Industry Analysis and Opportunity Assessment 2025 to 2035

Cash Sorting Machines Market

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA