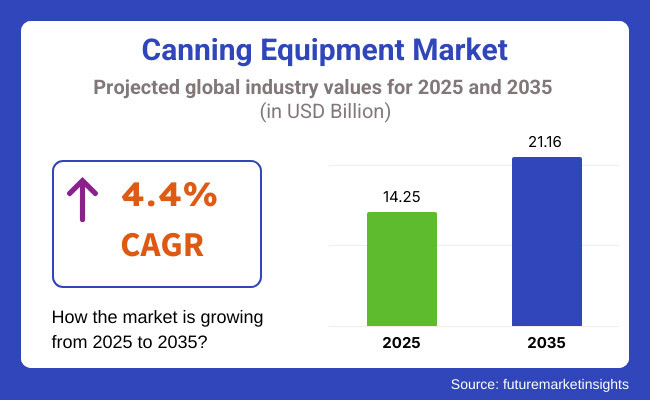

The canning equipment market is valued at USD 14.25 billion in 2025 and is expected to reach USD 21.16 billion by 2035, advancing at a 4.4 % CAGR throughout the forecast period.

Within the canning equipment market, the United States remains the most lucrative country in 2025 thanks to its expansive craft-beverage segment and stringent FSMA compliance standards that drive continuous upgrades. Meanwhile, Brazil is poised to be the fastest-growing national market from 2025 to 2035 as agrifood exporters invest in high-speed, energy-efficient canning lines to supply shelf-stable purées and ready-to-drink coffee across Latin America.

Across food and beverage plants, labour shortages, decarbonisation targets, and zero-defect mandates are reshaping the canning equipment market. Producers are replacing pneumatic seamers with servo-driven models, pairing optical lid-inspection cameras with IoT edge sensors that flag defects in real time.

Energy costs restrain adoption among craft brewers, prompting suppliers to launch inverter-controlled drives and heat-recovery modules that cut power draw by up to 20 %. Key trends steering the canning equipment market include recipe-based change-overs, quick-swap hygienic turrets, and biodegradable internal coatings that align with ESG purchasing policies.

Looking ahead, the canning equipment market is set to evolve toward closed-loop, AI-supervised packaging cells that learn from every fill cycle. Predictive algorithms will auto-adjust torque and seam height based on temperature and viscosity drift, reducing spoilage and liner waste. By 2030, modular robotic palletisers and cobot depalletisers are expected to become standard, trimming end-of-line labour by 30 % and enabling lights-out night shifts.

Vendors that offer subscription-based “canning-as-a-service” programmes, integrate carbon-tracking dashboards, and guarantee 95 % overall equipment effectiveness will capture outsized share through 2035. Emerging African processors will leapfrog legacy lines, rapidly adopting smart modular blocks from day one.

The 100-500 cans-per-hour class is hitting an adoption inflection point as specialty beverage brands, craft breweries, and gourmet food start-ups seek flexible, space-saving lines that balance throughput with capital cost.

Compact footprints, recipe-driven PLCs, and tool-free change-overs let operators switch from 250 mL energy drinks to 473 mL ale in minutes, slashing downtime. Meanwhile, lines rated above 1,000 CPH remain essential for mega-breweries but require costly heat-recovery retrofits to meet Scope 2 emission targets.

| Canning Capacity Band | CAGR (2025 to 2035) |

|---|---|

| 100-500 CPH | 5.1 % |

Food and beverage processors account for over two-thirds of global canning equipment revenue, with RTD tea/coffee, craft beer, and functional beverages fuelling line upgrades. Large beverage plants install high-speed monoblocs with integrated seam inspection to hit >50,000 CPH, while niche sauce and pâté makers favour modular fillers with hygienic CIP cycles.

Pharmaceutical and cosmetics firms adopt nitrogen-dosing seamers for oxygen-sensitive formulations but at lower volumes. The surge in premium pet-food formats-single-serve pâtés and broths-adds another layer of growth, especially in North America and Western Europe.

| End-user Segment | CAGR (2025 to 2035) |

|---|---|

| Food & Beverage Manufacturers | 4.8 % |

These high-growth niches-mid-capacity flexible lines and F&B-anchored deployments-highlight where suppliers should focus R&D, smart-sensor integration, and channel partnerships to maximise share in the canning equipment market through 2035

According to a survey conducted by Future Market Insights (FMI) with some of the top stakeholders in the canning machinery sector, the market is set to witness moderate growth influenced by technological developments, sustainability practices, and changing customer demands.

The survey gathered data from producers, suppliers, and end-users across various geographical locations, painting the picture of demand for automation, power-saving equipment, and smart packaging solutions. An impressive 68% of the polled respondents stated that smart canning equipment, supported by IoT and AI for real-time monitoring, would be a priority in the next five years.

Sustainability then became the prime concern, with 74% of the producers keeping on reducing their carbon footprints as the top priority by investing in sustainable canning solutions. Producers are looking into biodegradable coatings, recyclable metal cans, and energy-efficient machinery to adapt to the world’s environmental standards. Additionally, government incentives for sustainable packages as investment drivers in new equipment were among the main incentives.

| Countries/Regions | Regulatory Authority & Key Regulations |

|---|---|

| United States | The Food and Drug Administration (FDA) enforces the Food Safety Modernization Act (FSMA), which emphasizes preventive controls in food processing, including canning operations. Compliance with Current Good Manufacturing Practices (cGMP) is mandatory. |

| European Union | The European Food Safety Authority (EFSA) oversees food safety regulations, including the implementation of Good Manufacturing Practices (GMP) as outlined in EudraLex Volume 4. These regulations ensure the quality and safety of canned food products. |

| India | The Food Safety and Standards Authority of India (FSSAI) regulates the manufacture, storage, distribution, sale, and import of food articles under the Food Safety and Standards Act, 2006. Compliance with these standards is essential for canning operations. |

| Japan | The Ministry of Health, Labour, and Welfare enforces the Food Sanitation Act, which requires importers to submit notifications for food, additives, apparatuses, or containers/packages intended for sale or business use. This ensures the safety of canned products. |

| Australia and New Zealand | Food Standards Australia New Zealand (FSANZ) develops food standards, including those related to canning processes, to ensure the safety and quality of food products. |

| Canada | The Canadian Food Inspection Agency (CFIA) oversees food safety, including the enforcement of Good Manufacturing Practices in canning facilities, to protect consumer health. |

| China | The State Food and Drug Administration (FDA) supervises the safety management of food, health food, and cosmetics, ensuring that canning practices meet national safety standards. |

| Brazil | The National Health Surveillance Agency (ANVISA) regulates food safety, including enforcing GMPs in canning operations, to ensure product quality and consumer safety. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) is responsible for ensuring the safety of food products, including canned goods, by enforcing relevant regulations and standards. |

| Pakistan | The Pure Food Ordinance 1960 and the Pakistan Hotels and Restaurants Act 1976 regulate food safety standards, including those applicable to canning processes, to prevent adulteration and ensure hygienic practices. |

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Technological Adoption: Gradual integration of automation, IoT, and AI-based monitoring in canning processes. | Advanced Technologies: Further AI-driven quality control, machine learning for predictive maintenance, and robotics integration will dominate the industry. |

| Consumer Trends: Rising demand for ready-to-drink (RTD) beverages, non-alcoholic drinks, and healthy canned products. | Evolving Preferences: Increased demand for functional beverages, plant-based drinks, and premium canned products catering to health-conscious consumers. |

| Sustainability Focus: Companies began adopting energy-efficient machinery, recyclable materials, and reducing carbon footprints. | Eco-Friendly Innovations: Stronger government mandates will push manufacturers toward biodegradable coatings, zero-waste production, and sustainable packaging. |

| Market Demand Drivers: Growth fueled by urbanization, changing lifestyles, and convenience-based consumption. | Growth Catalysts: Expansion in emerging markets, regulatory support for sustainable canning, and tech-driven efficiency improvements. |

| Regional Insights: USA, Europe, and China led the market, with India and Southeast Asia emerging as high-potential regions. | Market Expansion: Improved economic conditions will drive further growth in Africa, Latin America, and Middle Eastern markets. |

| COVID-19 Impact: The pandemic initially disrupted supply chains but later boosted demand for canned food and beverages due to consumer stockpiling. | Post-Pandemic Stability: Stable supply chains, increased automation, and resilient production strategies will support long-term market growth. |

The USA is at the forefront of the global market for canning equipment, owing primarily to the country's vast food and beverage sector. Increasing consumer demand for ready-to-drink (RTD) drinks, such as energy drinks, craft beers, and canned cocktails, has hugely driven the need for sophisticated scanning solutions.

Large beverage players in the United States have large-capacity canning lines with production capacities ranging up to 50,000 cans per hour. This boom is driven by the ease of use provided by canned foods and the increased demand for on-the-go consumption.

The canning equipment market in the United Kingdom is experiencing strong growth due to the growing craft beer market and increasing demand for convenient food. The UK's craft beer market has witnessed a revival, with drinkers demanding locally brewed and diverse varieties.

This has resulted in breweries making more investments in commercial canning machinery to cater to the rising demand. Additionally, the increasing preference for on-the-go snacking has driven the demand for effective canning solutions within the food market.

France's canning equipment market is driven by its rich gastronomic heritage and the need for preserved gourmet food products. The nation's focus on high-quality canned products, including pâtés, confits, and vegetable preserves, has driven the implementation of sophisticated canning technologies to preserve product integrity and shelf life.

The French drinks industry, specifically the wine industry, is also considering cans as a means of serving younger consumers who want convenience without sacrificing quality. This change is likely to fuel demand for specialized canning machinery designed to capture the subtlety of traditional French items.

Germany's food and canning equipment industry is defined by its high engineering strengths and well-developed food and drink sector. The focus on precision and efficiency for the German economy has translated into innovation and the implementation of cutting-edge canning machinery.

The rising demand for canned craft beers and ready-to-eat foods by German consumers has further fueled the market. In addition, environmental sustainability in Germany has driven the transition to recyclable metal cans, thus enhancing the demand for advanced canning machinery.

Italy's canning machinery market flourishes on its deep-rooted history of preserved food products, such as tomatoes, olives, and seafood. The country's food industry is dependent on canning to ship these staples globally, requiring efficient and consistent canning equipment.

The Italian beverage market, which offers a wide variety of products, is also turning to canned formats to reach modern consumers who are looking for convenience. This trend will continue to drive the need for sophisticated canning equipment in Italy.

The country's distinct food culture drives Japan's canning machinery industry and needs for high-quality preserved products. The nation's consumers prioritize convenience without sacrificing quality, which has driven the popularity of canned seafood, fruit, and ready-to-drink beverages. Japan's focus on technological advancement has led to the creation of sophisticated canning machinery that meets product safety and shelf life requirements.

The canning equipment market in China is developing rapidly due to the country's enormous population and rising urbanization. The rising demand for convenient and packaged foods has caused an upsurge in the usage of scanning technologies.

China's soft drink industry, especially the beer market, is also experiencing a trend towards canned items, which is in line with international patterns. Government efforts to enhance food safety and the development of the food processing business are likely to support the canning equipment market in China further.

Some of the major players in the canning equipment market share dominate the industry, contributing to market expansion with innovation and strategic efforts:

The market for canning equipment lies under the umbrella of industrial machinery and food processing machinery, which is one significant subset of packaging machinery. Food and beverage contribute highly to the canning equipment market, with macroeconomic inputs such as trade policies, the cost of raw materials, and technology development.

At the macroeconomic level, the need for canning machinery is tied directly to international consumption trends in packaged foods and beverages. Increasing disposable incomes, urbanization, and shifting consumer attitudes-particularly towards convenience foods and ready-to-drink (RTD) beverages-are spurring demand for sophisticated and effective scanning technologies.

The worldwide supply chain disruption over the last few years has also affected raw material availability, such as aluminum and stainless steel, resulting in fluctuating prices of canning machinery production. Moreover, government policies on food safety and sustainability are driving investment in new canning technologies. Nations with strict food preservation and packaging regulations, including the United States, Germany, and China, are seeing increased demand for automated and environmentally friendly canning machinery.

Growth Prospects

Smart Canning innovations

The convergence of AI, IoT, and robotics in canning machinery is likely to bring major efficiency improvements. Real-time monitoring of automated canning lines can minimize waste, enhance accuracy, and increase productivity, making them a profitable investment for producers.

Strategic Recommendations

Invest in Automation & AI-based Quality Control

Firms must invest in intelligent canning systems that combine sensors, machine learning, and predictive maintenance to maximize efficiency and minimize downtime.

Create Customizable & Scalable Equipment

Offering modular canning solutions that suit small-scale and large-scale producers will enable flexibility in operations and increase the customer base.

With respect to canning capacity, the market is classified into up to 100 cans per hour, between 100-500 cans per hour, 500-1000 cans per hour, and more than 1000 cans per hour.

In terms of end-user, the market is segmented into agriculture industry, food & beverages industry, pharmaceutical industry, petrochemical industry, cosmetics industry, and beer industry.

In terms of product type, the market is divided into can seaming machines, can body reformers, and can flanging machines.

In terms of can material type, the market is divided into metallic can seamers and non-metallic can seamers.

In terms of automation grade, the market is divided into automatic, semi-automatic, and manual.

In terms of region, the market is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Consumers ' growing demand for packaged food and drink, technological advancements, and requirements for increased shelf life are major drivers for canning solutions.

Soft drinks, beer, ready-to-drink beverages, and processed food industries heavily depend on canning technology. Both the chemical and pharmaceutical industries employ it to secure run their operations smoothly.

Automated machines improve efficiency levels, save time, and assure precision sealing to enhance the rate of overall production. The addition of intelligent technologies like IoT and AI optimizes quality monitoring as well as proactive maintenance.

Escalating sustainability initiatives, more usage of recyclable materials, the need for compact and mobile canning systems, and the popularity of craft beverage manufacturing are influencing new equipment design.

Production capacity, level of automation, material compatibility, energy efficiency, and compliance with regulations should be considered before selecting an appropriate system.

Table 1: Global Market Value (US$ Billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 5: Global Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 7: Global Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 9: Global Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 11: Global Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 13: North America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 19: North America Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: North America Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 23: North America Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 25: Latin America Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 29: Latin America Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 31: Latin America Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 35: Latin America Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 37: Europe Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 41: Europe Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 43: Europe Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Europe Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 47: Europe Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 49: East Asia Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 53: East Asia Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 55: East Asia Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 57: East Asia Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 58: East Asia Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 59: East Asia Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 60: East Asia Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 61: South Asia Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 62: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: South Asia Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 64: South Asia Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 65: South Asia Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 66: South Asia Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 67: South Asia Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 68: South Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 69: South Asia Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 70: South Asia Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 71: South Asia Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 72: South Asia Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 73: Oceania Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 74: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 75: Oceania Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 76: Oceania Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 77: Oceania Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 78: Oceania Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 79: Oceania Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 80: Oceania Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 81: Oceania Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 82: Oceania Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 83: Oceania Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 84: Oceania Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Table 85: MEA Market Value (US$ Billion) Forecast by Country, 2018 to 2033

Table 86: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 87: MEA Market Value (US$ Billion) Forecast by Canning Capacity, 2018 to 2033

Table 88: MEA Market Volume (MT) Forecast by Canning Capacity, 2018 to 2033

Table 89: MEA Market Value (US$ Billion) Forecast by End-user, 2018 to 2033

Table 90: MEA Market Volume (MT) Forecast by End-user, 2018 to 2033

Table 91: MEA Market Value (US$ Billion) Forecast by Product Type, 2018 to 2033

Table 92: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 93: MEA Market Value (US$ Billion) Forecast by Can Material Type, 2018 to 2033

Table 94: MEA Market Volume (MT) Forecast by Can Material Type, 2018 to 2033

Table 95: MEA Market Value (US$ Billion) Forecast by Automation grade, 2018 to 2033

Table 96: MEA Market Volume (MT) Forecast by Automation grade, 2018 to 2033

Figure 1: Global Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 3: Global Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 4: Global Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 5: Global Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 6: Global Market Value (US$ Billion) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Billion) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 15: Global Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 19: Global Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 23: Global Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 27: Global Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 31: Global Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 32: Global Market Attractiveness by End-user, 2023 to 2033

Figure 33: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Can Material Type, 2023 to 2033

Figure 35: Global Market Attractiveness by Automation grade, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 38: North America Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 39: North America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 40: North America Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 41: North America Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 42: North America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 51: North America Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 55: North America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 59: North America Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 63: North America Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 67: North America Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 68: North America Market Attractiveness by End-user, 2023 to 2033

Figure 69: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Can Material Type, 2023 to 2033

Figure 71: North America Market Attractiveness by Automation grade, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 74: Latin America Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 75: Latin America Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 77: Latin America Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 78: Latin America Market Value (US$ Billion) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 87: Latin America Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 91: Latin America Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 99: Latin America Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 104: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Can Material Type, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Automation grade, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 110: Europe Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 111: Europe Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 113: Europe Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 114: Europe Market Value (US$ Billion) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 123: Europe Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 127: Europe Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: Europe Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 135: Europe Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 139: Europe Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 140: Europe Market Attractiveness by End-user, 2023 to 2033

Figure 141: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 142: Europe Market Attractiveness by Can Material Type, 2023 to 2033

Figure 143: Europe Market Attractiveness by Automation grade, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 146: East Asia Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 147: East Asia Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 149: East Asia Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 150: East Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: East Asia Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 156: East Asia Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 159: East Asia Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 160: East Asia Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 163: East Asia Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 164: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 167: East Asia Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 168: East Asia Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 171: East Asia Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 172: East Asia Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 176: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Can Material Type, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Automation grade, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 182: South Asia Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 183: South Asia Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 184: South Asia Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 185: South Asia Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 186: South Asia Market Value (US$ Billion) by Country, 2023 to 2033

Figure 187: South Asia Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 192: South Asia Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 195: South Asia Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 196: South Asia Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 197: South Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 199: South Asia Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 200: South Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 201: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 203: South Asia Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 204: South Asia Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 207: South Asia Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 208: South Asia Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 211: South Asia Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 212: South Asia Market Attractiveness by End-user, 2023 to 2033

Figure 213: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 214: South Asia Market Attractiveness by Can Material Type, 2023 to 2033

Figure 215: South Asia Market Attractiveness by Automation grade, 2023 to 2033

Figure 216: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 217: Oceania Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 218: Oceania Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 219: Oceania Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 220: Oceania Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 221: Oceania Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 222: Oceania Market Value (US$ Billion) by Country, 2023 to 2033

Figure 223: Oceania Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: Oceania Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 228: Oceania Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 231: Oceania Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 232: Oceania Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 233: Oceania Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 235: Oceania Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 236: Oceania Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 239: Oceania Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 240: Oceania Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 243: Oceania Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 244: Oceania Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 247: Oceania Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 248: Oceania Market Attractiveness by End-user, 2023 to 2033

Figure 249: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 250: Oceania Market Attractiveness by Can Material Type, 2023 to 2033

Figure 251: Oceania Market Attractiveness by Automation grade, 2023 to 2033

Figure 252: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 253: MEA Market Value (US$ Billion) by Canning Capacity, 2023 to 2033

Figure 254: MEA Market Value (US$ Billion) by End-user, 2023 to 2033

Figure 255: MEA Market Value (US$ Billion) by Product Type, 2023 to 2033

Figure 256: MEA Market Value (US$ Billion) by Can Material Type, 2023 to 2033

Figure 257: MEA Market Value (US$ Billion) by Automation grade, 2023 to 2033

Figure 258: MEA Market Value (US$ Billion) by Country, 2023 to 2033

Figure 259: MEA Market Value (US$ Billion) Analysis by Country, 2018 to 2033

Figure 260: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 261: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: MEA Market Value (US$ Billion) Analysis by Canning Capacity, 2018 to 2033

Figure 264: MEA Market Volume (MT) Analysis by Canning Capacity, 2018 to 2033

Figure 265: MEA Market Value Share (%) and BPS Analysis by Canning Capacity, 2023 to 2033

Figure 266: MEA Market Y-o-Y Growth (%) Projections by Canning Capacity, 2023 to 2033

Figure 267: MEA Market Value (US$ Billion) Analysis by End-user, 2018 to 2033

Figure 268: MEA Market Volume (MT) Analysis by End-user, 2018 to 2033

Figure 269: MEA Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 270: MEA Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 271: MEA Market Value (US$ Billion) Analysis by Product Type, 2018 to 2033

Figure 272: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 273: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 274: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 275: MEA Market Value (US$ Billion) Analysis by Can Material Type, 2018 to 2033

Figure 276: MEA Market Volume (MT) Analysis by Can Material Type, 2018 to 2033

Figure 277: MEA Market Value Share (%) and BPS Analysis by Can Material Type, 2023 to 2033

Figure 278: MEA Market Y-o-Y Growth (%) Projections by Can Material Type, 2023 to 2033

Figure 279: MEA Market Value (US$ Billion) Analysis by Automation grade, 2018 to 2033

Figure 280: MEA Market Volume (MT) Analysis by Automation grade, 2018 to 2033

Figure 281: MEA Market Value Share (%) and BPS Analysis by Automation grade, 2023 to 2033

Figure 282: MEA Market Y-o-Y Growth (%) Projections by Automation grade, 2023 to 2033

Figure 283: MEA Market Attractiveness by Canning Capacity, 2023 to 2033

Figure 284: MEA Market Attractiveness by End-user, 2023 to 2033

Figure 285: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 286: MEA Market Attractiveness by Can Material Type, 2023 to 2033

Figure 287: MEA Market Attractiveness by Automation grade, 2023 to 2033

Figure 288: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Canning Jars Market

Canning Labels Market

Canning Machine Market

Scanning and Migration Software Market

3D Scanning Market Size and Share Forecast Outlook 2025 to 2035

Assessing Beer Canning Machines Market Share & Industry Trends

SPECT Scanning Services Market Growth - Trends & Forecast 2025 to 2035

Laser Scanning Microscopes Market

Mason Jars & Canning Supplies Market Trends - Growth & Forecast 2025 to 2035

Differential Scanning Calorimetry Market Size and Share Forecast Outlook 2025 to 2035

Mobile Laser Scanning Market Size and Share Forecast Outlook 2025 to 2035

3D Orthopedic Scanning Systems Market

Terrestrial Laser Scanning Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA