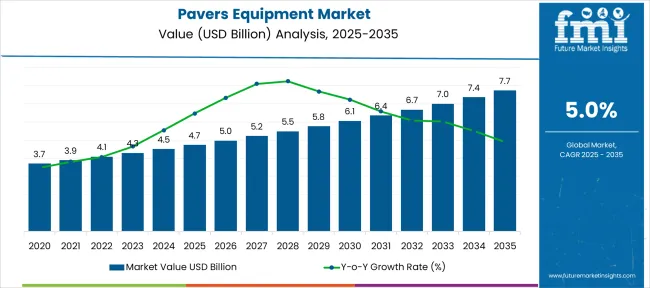

The Pavers Equipment Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 7.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Pavers Equipment Market Estimated Value in (2025E) | USD 4.7 billion |

| Pavers Equipment Market Forecast Value in (2035F) | USD 7.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The pavers equipment market is witnessing steady expansion driven by increasing infrastructure development and road construction activities globally. Urbanization and government initiatives to improve transportation networks have fueled demand for efficient and reliable paving machinery. The need for faster project completion with high-quality results has prompted contractors to invest in advanced pavers that offer precision and durability.

Technological innovations have improved equipment performance, reducing operational costs and fuel consumption. Rising public and private investments in highways, urban roads, and industrial zones further support the market growth.

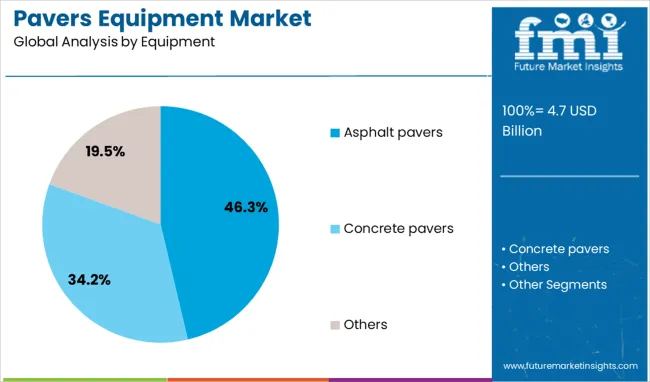

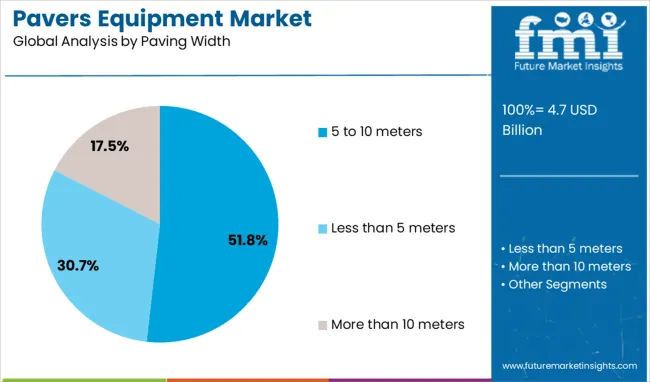

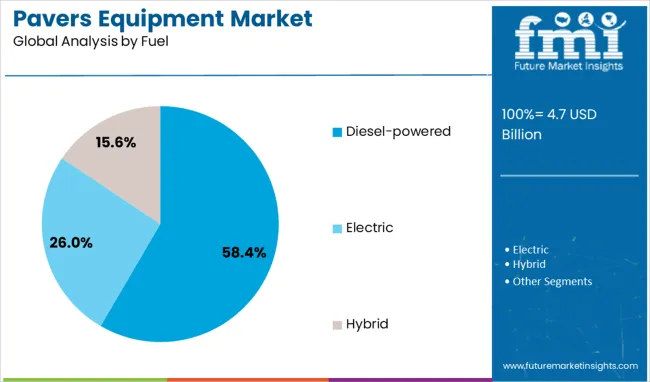

Sustainable construction practices and fuel-efficient machinery are becoming priorities in the sector. Segment growth is expected to be led by asphalt pavers due to their versatility and widespread use, paving widths between 5 and 10 meters for optimal coverage, and diesel-powered equipment for their reliability and power.

The pavers equipment market is segmented by equipment, paving width, fuel, leveling technology, and application, as well as geographic regions. By equipment, the pavers market is divided into Asphalt pavers, Concrete pavers, and Others. In terms of paving width, the pavers equipment market is classified into 5 to 10 meters, less than 5 meters, and More than 10 meters.

Based on fuel, the pavers equipment market is segmented into Diesel-powered, Electric, and Hybrid. The pavers equipment market is segmented by technology into Laser, Sonic, and Manual. By application of the pavers equipment market is segmented into Road Construction, Infrastructure Development, Maintenance and Repair, and Residential and Commercial.

Regionally, the pavers equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The asphalt pavers segment is projected to hold 46.3% of the market revenue in 2025, maintaining its position as the dominant equipment type. Growth has been driven by the extensive use of asphalt in road construction due to its cost-effectiveness and durability. Asphalt pavers provide uniform and smooth pavement surfaces and accommodate a wide range of project scales.

Contractors have favored these pavers for their adaptability and ability to deliver consistent results under varying environmental and operational conditions. Increased investment in road maintenance and expansion projects has also supported the demand for asphalt pavers.

As infrastructure development accelerates worldwide asphalt pavers are expected to remain the equipment of choice.

The 5 to 10 meters paving width segment is projected to contribute 51.8% of the market revenue in 2025, establishing itself as the preferred paving width category. This range balances operational efficiency with maneuverability making it suitable for highways urban roads and industrial paving projects.

Equipment within this width category allows contractors to cover substantial ground in a single pass without compromising on quality. The segment growth is also supported by advancements in machinery that optimize paving performance and enhance surface finish.

As road construction projects become more complex the demand for paving equipment offering this range of coverage is expected to grow steadily.

The diesel-powered segment is projected to hold 58.4% of the pavers equipment market revenue in 2025 positioning it as the leading fuel type. Diesel engines are favored for their high torque and fuel efficiency which are critical for operating heavy construction machinery.

The durability and reliability of diesel-powered equipment make it well-suited for demanding paving operations often performed in challenging environments. Additionally diesel fuel availability and established servicing infrastructure support its continued use in construction machinery globally.

Despite growing interest in alternative fuels diesel remains the dominant choice due to its proven performance and cost-effectiveness. The diesel-powered segment is expected to maintain market leadership as equipment manufacturers enhance engine efficiency and emissions control technologies.

The pavers equipment market is growing as road network development and public infrastructure programs gain pace worldwide. Market expansion is driven by highway modernization projects and demand for advanced paving machines offering higher productivity. Compact, digitally controlled pavers are shaping procurement strategies as contractors prioritize precision and fuel efficiency.

However, high acquisition cost, complex maintenance, and competition from rental fleets remain significant restraints. It is considered that manufacturers offering modular designs, telematics integration, and energy-efficient models will dominate industry adoption in the next forecast cycle.

The surge in infrastructure investments has strengthened demand for modern asphalt and concrete paving equipment. In 2024, several nations accelerated highway expansion, airport runway construction, and city road upgrades, leading to higher procurement of both slipform and tracked pavers. Government-backed transport programs in Asia-Pacific and North America drove bulk orders for large-format paving machines.

It is widely believed that equipment with superior compaction performance and reduced downtime will remain the preferred choice for large-scale contractors engaged in transportation and smart-city development initiatives.

Opportunities have been created by the introduction of hybrid and fully electric pavers aimed at reducing operational emissions and improving energy efficiency. In 2025, contractors in urban areas deployed battery-supported asphalt pavers for projects requiring low noise and environmental compliance.

Modular pavers with interchangeable screeds gained adoption for their ability to handle diverse paving widths with minimal setup time. It is considered that manufacturers offering connected pavers with integrated sensors, automated grade control, and efficient powertrain designs will gain a strong foothold in the rapidly evolving equipment market.

A key trend emerging in 2024 and 2025 is the integration of telematics platforms and advanced grade-control systems for real-time operational monitoring. These systems enable contractors to track productivity, optimize material usage, and reduce fuel costs. Compact pavers with GPS-based thickness control and remote diagnostics gained traction among municipal contractors managing constrained urban job sites.

It is strongly believed that the future of paving will be shaped by connected machines delivering superior accuracy, predictive maintenance capabilities, and data-driven decision-making for fleet optimization.

The market faces significant challenges from rising equipment costs, complex servicing requirements, and lengthy lead times for critical spare parts. In 2024, several contractors postponed new equipment purchases due to capital constraints and uncertainty in project timelines. Increased reliance on rental fleets and refurbished machinery has been observed, limiting sales of new units among smaller firms.

It is considered that manufacturers offering financing solutions, extended warranties, and simplified maintenance features will be better positioned to overcome these barriers and support market penetration in developing regions.

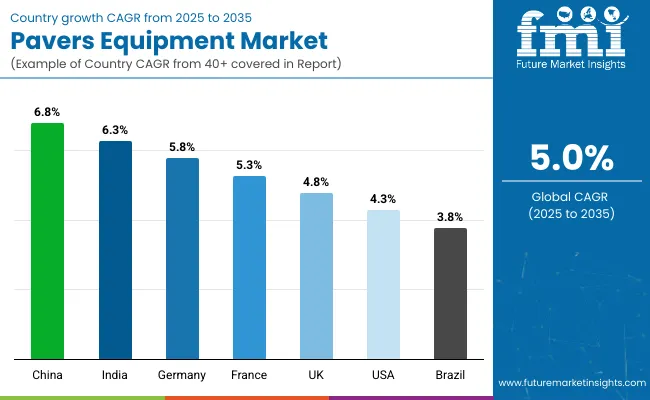

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global pavers equipment market is projected to grow at a CAGR of 5% from 2025 to 2035. China leads with 6.8%, followed by India at 6.3%. France posts 5.3%, while the United Kingdom records 4.8%, and the United States stands at 4.3%. Growth is driven by infrastructure modernization, smart city development, and highway expansion projects. China and India dominate due to extensive road construction programs and public infrastructure investments. France emphasizes advanced paving technologies for urban mobility projects, while the UK and US focus on sustainable paving solutions and automated machinery for enhanced efficiency.

The pavers equipment market in China is forecast to grow at 6.8%, supported by aggressive investments in urban road networks and highway expansions. Asphalt pavers dominate adoption for large-scale projects. Manufacturers introduce GPS-enabled paving systems for precise layering. Government-backed initiatives for smart infrastructure boost the integration of advanced paving equipment in municipal projects.

The pavers equipment market in India is projected to grow at 6.3%, driven by ongoing national highway development programs and rural connectivity projects. Crawler pavers dominate usage in heavy-duty construction. Manufacturers develop cost-efficient models with enhanced fuel economy for local contractors. Public-private partnerships in infrastructure projects stimulate sustained equipment demand.

The pavers equipment market in France is expected to grow at 5.3%, supported by municipal road upgrades and high-speed rail link projects. Wheeled pavers dominate for urban road resurfacing tasks. Manufacturers integrate automated screed controls for uniform surface quality. Growing preference for low-emission paving machinery aligns with European sustainability mandates.

The pavers equipment market in the UK is forecast to grow at 4.8%, driven by road maintenance programs and airport runway upgrades. Compact pavers dominate small-scale urban projects. Manufacturers integrate telematics for predictive maintenance. Increased investment in green mobility infrastructure supports demand for electric-powered paving machines.

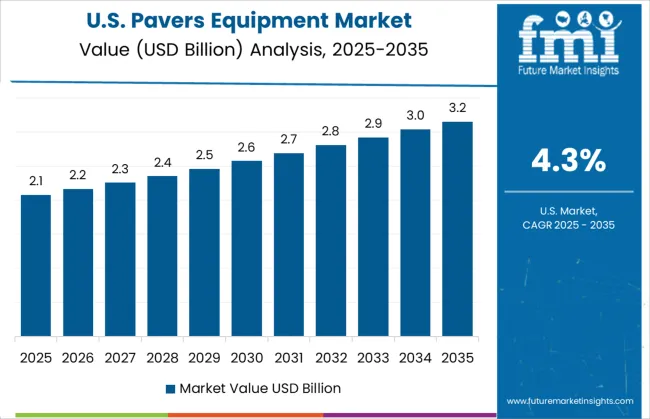

The pavers equipment market in the USA is expected to grow at 4.3%, driven by rehabilitation of interstate highways and modernization of logistics corridors. Asphalt pavers dominate adoption in large highway resurfacing projects. Manufacturers introduce advanced material flow systems for consistent surface finish. Federal infrastructure stimulus packages further accelerate demand for high-capacity paving equipment.

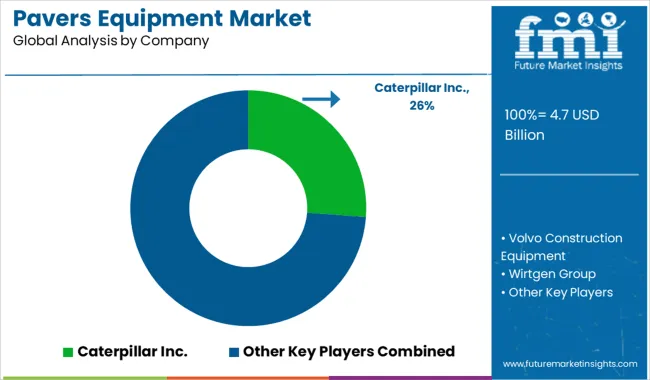

The pavers equipment market is moderately consolidated, with Caterpillar Inc. recognized as a leading player owing to its comprehensive range of asphalt and concrete pavers, robust global distribution network, and advanced technology integration for precision paving. The company’s focus on fuel efficiency, operator comfort, and digital monitoring systems reinforces its strong position in infrastructure development projects worldwide.

Key players include Volvo Construction Equipment, Wirtgen Group, BOMAG GmbH, SANY Group, Terex Corporation, and Astec Industries, Inc. These companies offer high-performance pavers designed for highway construction, airport runways, and urban development, with emphasis on durability, automated controls, and compliance with stringent paving quality standards.

Their solutions incorporate features like grade and slope sensors, telematics, and low-emission engines to optimize productivity and meet environmental regulations. Market growth is driven by rising investments in road construction, urban infrastructure projects, and modernization of transportation networks globally. Leading manufacturers are investing in automation technologies, intelligent compaction, and hybrid drive systems to enhance efficiency and reduce operational costs.

Emerging trends include the integration of IoT-enabled monitoring, predictive maintenance tools, and electric-powered pavers for sustainable construction solutions. While North America and Europe remain mature markets due to infrastructure maintenance demand, Asia-Pacific leads in growth potential with large-scale highway and smart city projects.

In December 2023, Ammann Group agreed to purchase Volvo CE’s ABG paver business, including the Hameln, Germany facility. The deal, set to close in early 2024, expands Ammann’s paving equipment portfolio and reinforces global aftermarket service while preserving ABG’s established brand heritage and manufacturing expertise.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Equipment | Asphalt pavers, Concrete pavers, and Others |

| Paving Width | 5 to 10 meters, Less than 5 meters, and More than 10 meters |

| Fuel | Diesel-powered, Electric, and Hybrid |

| Leveling Technology | Laser, Sonic, and Manual |

| Application | Road Construction, Infrastructure Development, Maintenance and Repair, and Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Volvo Construction Equipment, Wirtgen Group, BOMAG GmbH, SANY Group, Terex Corporation, and Astec Industries, Inc. |

| Additional Attributes | Dollar sales segmented by equipment type (asphalt pavers, concrete pavers, screeds, compactors) and power source (diesel, electric, hybrid). Applications span highways, urban roads, and runways. Regional demand shows Asia-Pacific as fastest growing and North America holding the largest share. Innovations include AI-enabled automation, GPS/telematics, precision leveling, and eco-friendly electric paver models. |

The global pavers equipment market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the pavers equipment market is projected to reach USD 7.7 billion by 2035.

The pavers equipment market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in pavers equipment market are asphalt pavers, concrete pavers and others.

In terms of paving width, 5 to 10 meters segment to command 51.8% share in the pavers equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asphalt Pavers Market Growth - Trends & Forecast 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Hunting Equipment and Accessory Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA