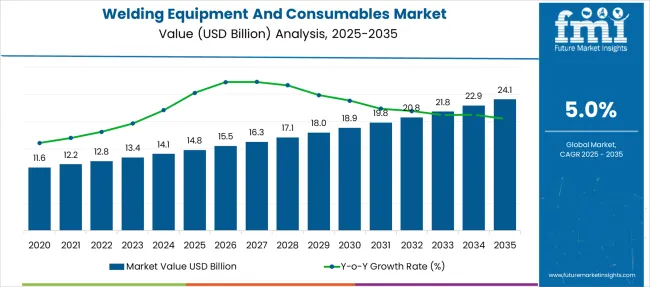

The Welding Equipment And Consumables Market is estimated to be valued at USD 14.8 billion in 2025 and is projected to reach USD 24.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The growth curve demonstrates a compound expansion pattern with a strong early-phase trajectory that begins to flatten after 2030, signaling a gradual move toward market maturity. Between 2025 and 2029, the market adds USD 4.1 billion, driven primarily by infrastructure development, construction projects, and the automation of welding operations in automotive and heavy engineering. In contrast, the late phase from 2030 to 2035 contributes USD 5.2 billion, but this growth is powered by innovation rather than volume, emphasizing robotic welding systems, laser-based processes, and AI-enabled quality monitoring to address labor shortages and productivity demands.

The Growth Rate Volatility Index remains low, as welding is an essential process across multiple industries, though minor fluctuations may occur due to raw material cost cycles and regional investment patterns. An inflection point emerges around 2030, when adoption shifts from conventional systems to smart welding ecosystems with IoT integration and predictive maintenance capabilities. This evolution positions digitalization and energy-efficient consumables as critical differentiators, aligning welding technologies with Industry 4.0-driven manufacturing ecosystems.

| Metric | Value |

|---|---|

| Welding Equipment And Consumables Market Estimated Value in (2025 E) | USD 14.8 billion |

| Welding Equipment And Consumables Market Forecast Value in (2035 F) | USD 24.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The welding equipment and consumables market is witnessing consistent growth, driven by infrastructure modernization, expanding industrial fabrication, and the increasing complexity of materials used in manufacturing. With rising investment in sectors such as automotive, energy, and construction, the demand for reliable and cost-efficient welding solutions has intensified.

Technological enhancements in welding automation, power source efficiency, and safety compliance are transforming operational productivity across large-scale production lines. The growing shift toward lightweight materials and high-strength alloys is reinforcing the need for precise and versatile welding technologies.

Government-backed infrastructure projects, particularly in developing economies, along with stringent quality standards in manufacturing, are expected to support long-term growth. The trend toward digitalized and remote welding monitoring tools is also gaining momentum, enabling predictive maintenance and enhanced quality assurance across industries.

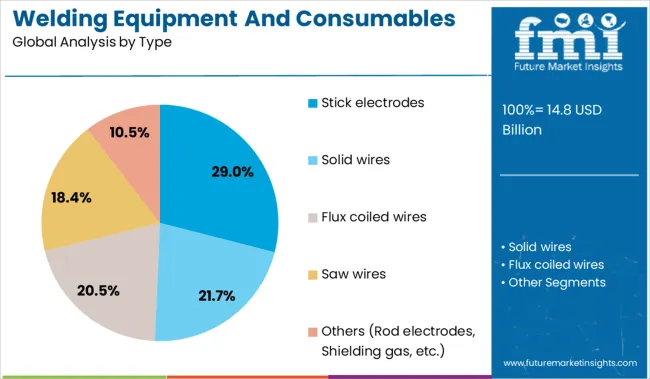

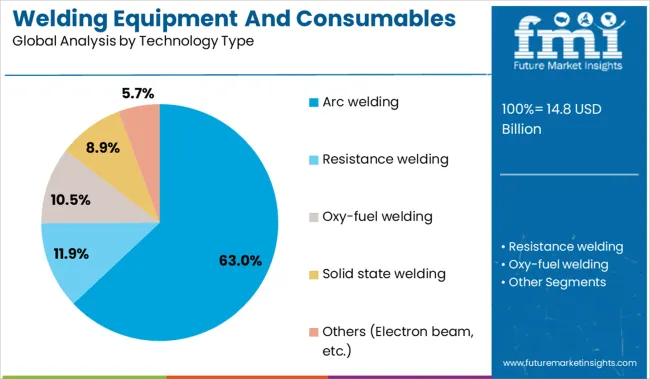

The market is segmented by type, technology type, application, distribution channel, and region. By type, it includes stick electrodes, solid wires, flux-coiled wires, saw wires, and others, such as rod electrodes and shielding gas. In terms of technology type, the segmentation covers arc welding, resistance welding, oxy-fuel welding, solid-state welding, and other advanced methods like electron beam welding. Based on application, the market comprises automotive, building and construction, marine, aerospace and defense, oil and gas, and other sectors, including metal and mining. By distribution channel, it is divided into direct and indirect sales networks, catering to diverse purchasing models. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Stick electrodes are expected to account for 29.0% of the revenue share in the welding equipment and consumables market by 2025, making them the leading product segment. Their dominance is being driven by ease of use, compatibility with a wide range of materials, and the minimal need for auxiliary equipment.

These electrodes are particularly valued in outdoor, maintenance, and structural welding applications due to their versatility and ability to operate effectively under challenging environmental conditions. Cost efficiency, low operator training requirements, and reduced dependency on shielding gases have also contributed to their continued relevance.

As developing regions continue to invest in construction, power plants, and shipbuilding, stick electrodes remain a preferred choice for durable and scalable welding tasks.

Arc welding is projected to hold a 63.0% revenue share in 2025, solidifying its position as the leading technology type in the market. This leadership is attributed to the process’s adaptability across both manual and automated operations, enabling strong, high-integrity welds for diverse metal types and thicknesses.

The technology’s proven reliability, high deposition rates, and lower operational costs have made it indispensable in industries ranging from automotive manufacturing to structural engineering. Advances in inverter-based arc welding machines, along with integration of real-time monitoring and energy-efficient components, have further expanded their use.

Continued adoption of arc welding systems is anticipated in both new industrial facilities and retrofit applications where flexibility and consistency are critical.

The automotive sector is forecast to contribute 34.0% of the welding equipment and consumables market revenue in 2025, establishing it as the dominant application segment. This growth is being propelled by the sector’s ongoing focus on lightweight vehicle design, electric vehicle (EV) battery integration, and precision joining techniques.

Welding technologies play a critical role in assembling body structures, chassis systems, exhaust modules, and powertrain components. With increasing automation on production floors, high-speed robotic welding systems have become integral to ensuring productivity and structural quality.

Stringent safety standards and fuel efficiency mandates are pushing automakers to innovate in material engineering, thereby raising demand for welding solutions capable of handling advanced steels and aluminum alloys. The rise of global automotive hubs in Asia and Eastern Europe is further reinforcing the application dominance of this segment.

Rising industrial activity across sectors like shipbuilding and energy has been driving demand for advanced welding systems and consumables. Labor shortages and strict regulatory norms have influenced a shift toward automation, quality compliance, and localized sourcing.

Significant momentum has been experienced in the welding equipment and consumables market due to the heightened adoption across shipbuilding, pipeline construction, and the manufacturing of heavy machinery. A growing reliance on metal joining processes in both emerging and established economies has been observed, particularly where infrastructure renewal and energy-related installations are prioritized. Increased output from oil and gas operations, along with capacity expansions in thermal and hydropower segments, has been indirectly fueling demand. A shift toward automation-integrated welding systems has been steadily favored by end users seeking higher throughput and precision. Strategic partnerships between fabricators and OEMs have also been promoted, resulting in stable procurement cycles for filler metals, flux-cored wires, and shielding gases.

Considerable constraints have been encountered due to the limited availability of skilled welding professionals, prompting the broader utilization of user-friendly semi-automatic and robotic welding setups. Cost-efficient operations have been preferred, especially in fabrication units operating under high regulatory scrutiny, including those within aerospace and pressure vessel industries. Welding processes such as GTAW and GMAW have been selectively implemented to meet evolving quality standards across international certifications. Stronger emphasis has been placed on consumable traceability and compliance with region-specific safety benchmarks. Global players have been increasingly required to localize their consumable product offerings to align with domestic welding codes. This has caused a gradual shift in procurement strategies, where quality consistency, regulatory adherence, and process repeatability are given precedence.

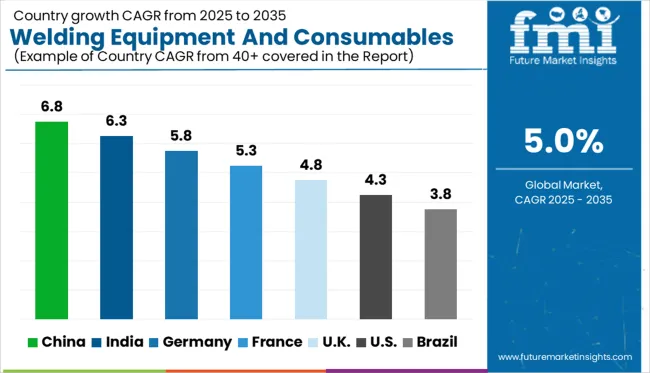

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global welding equipment and consumables market is growing at a CAGR of 5.0% from 2025 to 2035, with several countries, especially within BRICS and advanced OECD economies, outpacing this benchmark. China leads with a 6.8% CAGR, fueled by large-scale infrastructure development, shipbuilding, and heavy machinery sectors, backed by state-driven industrial policies.

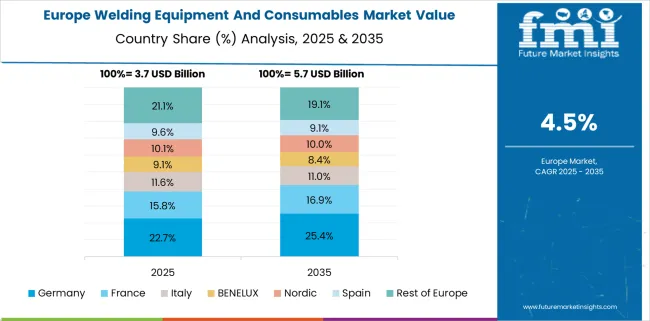

India follows at 6.3%, gaining momentum from localized fabrication demand in energy, automotive, and railways, further bolstered by its “Make in India” agenda. Germany, a key OECD nation, is growing at 5.8%, driven by advanced automation in welding processes and the adoption of high-precision welding technologies across automotive and renewable energy sectors.

The UK and USA trail behind the global average with CAGRs of 4.8% and 4.3%, respectively, due to reliance on legacy systems and slower capital investment cycles. ASEAN nations, while not listed here, are increasingly critical due to their manufacturing cost competitiveness and export-oriented welding demand. The report covers a detailed analysis of 40+ countries, with the top five featured above.

The CAGR for the USA welding equipment and consumables market grew from approximately 3.1% in the 2020 to 2024 period to 4.3% during 2025 to 2035, indicating a moderate but stable growth trajectory. This increase has been influenced by the gradual rebound in domestic infrastructure projects post to 2024 and renewed investments in pipeline refurbishment and highway expansion.

USA-based manufacturers have focused more on high-performance filler metals and process-specific consumables, especially for sectors such as defense, aerospace, and automotive repairs. A favorable policy shift under infrastructure modernization plans led to steady equipment procurement from OEMs and maintenance contractors.

Robotic welding solutions also gained preference, driven by labor cost optimization and safety standards under OSHA directives. Growth is expected to remain supply-chain-sensitive, given the fluctuating import dynamics of shielding gases and rare-earth-based flux materials.

The UK market saw its CAGR rise from around 3.4% in the 2020 to 2024 period to 4.8% between 2025 and 2035, supported by a post-Brexit push for manufacturing independence and internal supply-chain resilience. Investments in localized fabrication and shipbuilding have been encouraged under the British Industrial Strategy, which has emphasized the importance of secure domestic welding capabilities.

Steel-intensive sectors such as rail transit manufacturing and offshore wind installations have shown rising reliance on high-efficiency welding tools and prequalified consumables. Regulatory harmonization with EU welding standards post to 2025 improved product approvals, enabling faster equipment integration in sectors requiring specialized welding, like medical equipment and renewable plant assembly. Rising apprenticeship initiatives in fabrication trades helped offset labor constraints, which previously held back productivity growth.

Germany’s CAGR moved from 4.2% during 2020 to 2024 to 5.8% in the 2025 to 2035 timeframe, underpinned by a revival in heavy engineering and shipbuilding across Northern and Western German states. The increasing adoption of high-precision welding automation for energy-efficient railcar manufacturing and high-voltage infrastructure has been driving demand.

German industrial standards, particularly DIN and ISO EN certifications, led to higher compliance-based spending on qualified consumables. Demand for specialized welding robots, especially in automotive and aerospace OEM lines, grew as smart factories expanded under Industrie 4.0. Federal subsidies for energy transition projects also incentivized the use of consumables suited for renewable power assets, like offshore wind turbine towers and hydrogen-ready pipelines.

China’s CAGR increased from 5.1% in 2020 to 2024 to 6.8% during 2025 to 2035, spurred by industrial transformation and mega infrastructure rollouts under the Belt and Road Initiative. The strong growth has been linked to capacity upgrades across shipyards, petrochemical plants, and railway engineering hubs.

Provincial governments prioritized smart fabrication hubs in coastal zones, where automation-led welding systems are deployed to reduce manual variability and enhance efficiency. Government subsidies for domestic welding OEMs improved competitiveness, and Chinese consumable brands gained traction in both domestic and Southeast Asian export corridors. Expansion in defense manufacturing and space exploration programs also played a role in boosting high-spec welding machine imports and locally developed shielding technologies.

India’s CAGR improved from 5.2% during 2020 to 2024 to 6.3% in the 2025 to 2035 forecast window, bolstered by state-sponsored initiatives such as "Make in India" and the National Infrastructure Pipeline. Substantial growth has been driven by expanding railway modernization, renewable power installations, and defense infrastructure developments.

Domestic manufacturers scaled up production of SMAW electrodes and MIG wires in industrial zones across Gujarat, Tamil Nadu, and Odisha. A rise in public-private partnerships in construction led to bulk equipment tenders favoring compact and energy-efficient welding systems. Growing use of welding simulation tools in skill development programs under the Skill India Mission helped reduce human error in operations and widened the certified workforce pool.

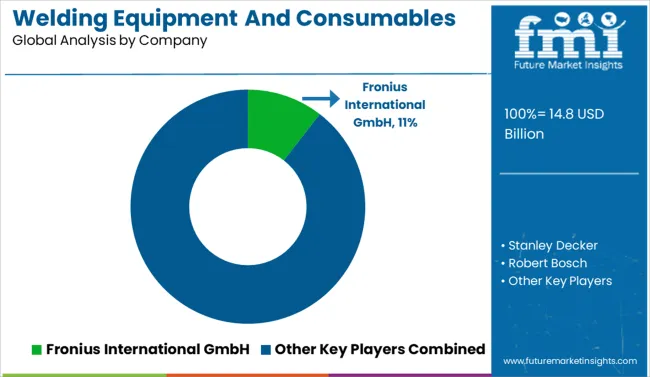

In the welding equipment and consumables market, leading companies are strengthening their positions through automation integration, consumable specialization, and industry-specific customization. Fronius International GmbH, Emerson Electric, and Panasonic Welding Systems Co., Ltd. are investing heavily in robotic welding systems optimized for high-volume fabrication and automotive assembly.

Companies like Atlas Copco, Kemppi Oy, and Robert Bosch are aligning their portfolios with demand from aerospace, shipbuilding, and energy sectors, offering digitally controlled power sources, precision torches, and advanced arc monitoring tools. Industrial leaders such as Stanley Decker, Colfax Corporation, and Daihen Corporation have broadened their reach by enhancing distributor networks and supporting modular welding solutions across emerging markets.

Air Liquide Welding and voestalpine Böhler Welding GmbH have developed flux and wire lines tailored to international compliance standards. Niche players like Arcon Welding Equipment and Ador Welding Limited continue serving localized fabrication ecosystems, while Obara Corporation and Kobe Steel, Ltd., specialize in high-performance spot and arc welding solutions for precision engineering.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.8 Billion |

| Type | Stick electrodes, Solid wires, Flux coiled wires, Saw wires, and Others (Rod electrodes, Shielding gas, etc.) |

| Technology Type | Arc welding, Resistance welding, Oxy-fuel welding, Solid state welding, and Others (Electron beam, etc.) |

| Application | Automotive, Building and construction, Marine, Aerospace & Defense, Oil & Gas, and Others (Metal, Mining) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fronius International GmbH, Stanley Decker, Robert Bosch, Emerson Electric, Atlas Copco, Kemppi Oy, Panasonic Welding Systems Co., Ltd., Colfax Corporation, Air Liquide Welding, Obara Corporation, Daihen Corporation, Ador Welding Limited, voestalpine Böhler Welding GmbH, Kobe Steel, Ltd., and Arcon Welding Equipment |

| Additional Attributes | Dollar sales, share by product type, regional demand trends, automation adoption, key end-use sectors, pricing benchmarks, and competitor positioning for strategic planning. |

The global welding equipment and consumables market is estimated to be valued at USD 14.8 billion in 2025.

The market size for the welding equipment and consumables market is projected to reach USD 24.1 billion by 2035.

The welding equipment and consumables market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in welding equipment and consumables market are stick electrodes, solid wires, flux coiled wires, saw wires and others (rod electrodes, shielding gas, etc.).

In terms of technology type, arc welding segment to command 63.0% share in the welding equipment and consumables market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Welding Material Market Analysis by Type, Technology, End User, and Region 2025 to 2035

Welding Guns Market Growth - Trends & Forecast 2025 to 2035

Welding Helmets Market

Welding Consumables Market Growth - Trends & Forecast 2025 to 2035

Welding Torch and Tip Changing Robotic Station Market Growth – Trends & Forecast 2024-2034

Welding Fume Extraction Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seam Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Stud Welding Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Smart Welding Monitoring Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Oxy-Fuel Welding Equipment Market Growth – Trends & Forecast 2025 to 2035

Underwater Welding Consumable Market Size and Share Forecast Outlook 2025 to 2035

Underwater Welding Equipment Market Growth – Trends & Forecast 2024-2034

Reusable Crate Welding Lines Market Size and Share Forecast Outlook 2025 to 2035

Copper and Aluminum Welding Bar Market Size and Share Forecast Outlook 2025 to 2035

Plastic Pipe Jointing and Welding Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA