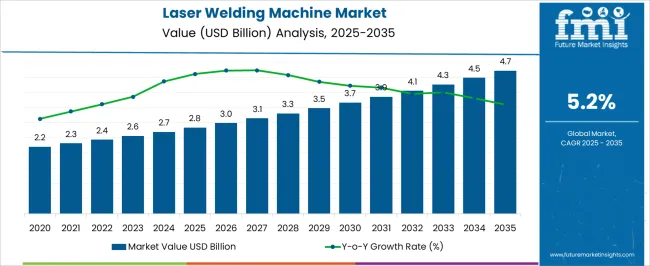

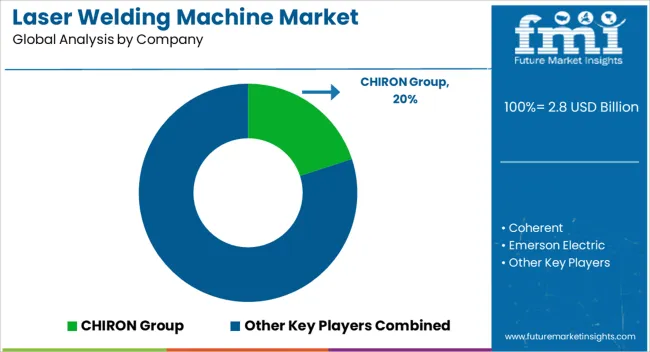

The laser welding machine market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

. Growth is supported by the rising adoption of high-precision welding solutions in automotive, aerospace, electronics, and medical device manufacturing, where laser welding offers speed, accuracy, and reduced material distortion compared to conventional methods. Technological advancements, including fiber laser systems and automation integration, are strengthening market adoption across industries. Market share erosion or gain analysis highlights shifting dynamics among regional players, technology types, and application segments. Established players in North America and Europe face moderate share erosion as Asia Pacific manufacturers, supported by cost advantages and strong electronics and automotive industries, gain larger revenue contributions.

Fiber lasers are expected to capture additional share from CO₂ and solid-state lasers due to superior efficiency and adaptability. On the application side, automotive and electronics segments are expected to record share gains, driven by electric vehicle production and miniaturization in consumer electronics, while traditional heavy industrial segments may face slight erosion due to slower modernization rates. Overall, the USD 1.9 billion opportunity reflects a balance of share gains in emerging regions and advanced technologies offsetting gradual erosion in legacy equipment and mature markets between 2025 and 2035.

| Metric | Value |

|---|---|

| Laser Welding Machine Market Estimated Value in (2025 E) | USD 2.8 billion |

| Laser Welding Machine Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

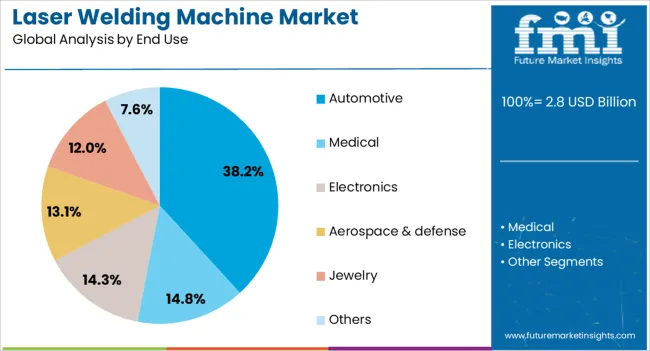

The laser welding machine market is largely driven by the automotive industry, which contributes nearly 35% of the market share, as manufacturers depend on laser welding for precision and high-strength joints in vehicle components. Electronics and electrical equipment account for about 25%, where laser welding supports miniaturization and assembly of delicate parts. Metal fabrication represents close to 20%, using these machines for structural applications and customized products. Aerospace and defense contribute around 10%, requiring high-performance welding for complex assemblies. The remaining 10% comes from medical device manufacturing, where precision welding is critical for implants, surgical tools, and equipment.

The laser welding machine market is advancing through improvements in automation, precision, and material compatibility. Fiber laser technology is being widely adopted for its efficiency, lower maintenance, and higher beam quality. Portable and compact systems are gaining attention for flexible use across production environments. Integration with robotic arms is improving speed and consistency in mass production, particularly in automotive and electronics sectors. Companies are focusing on energy-efficient models to reduce operating costs. Customized solutions for welding dissimilar materials are expanding the scope of applications. Investments in R&D and strategic collaborations are helping manufacturers strengthen global presence and customer adoption.

The Laser Welding Machine market is experiencing robust expansion, driven by the rising demand for precision joining technologies across high-growth manufacturing sectors. Increasing automation, the shift toward lightweight materials, and the demand for clean and contactless welding solutions have contributed to the widespread adoption of laser welding systems.

The market's trajectory is also supported by advancements in laser source efficiency, reduced maintenance requirements, and greater energy control in industrial operations. Integration of laser welding with robotics and CNC systems is further streamlining production workflows, particularly in high-volume sectors.

Growing focus on production scalability, waste reduction, and energy efficiency continues to pave the way for broader implementation across automotive, electronics, and heavy engineering As industrial modernization efforts accelerate globally, the laser welding machine market is poised for sustained growth driven by innovation in laser technology and increasing capital investment in advanced manufacturing infrastructure.

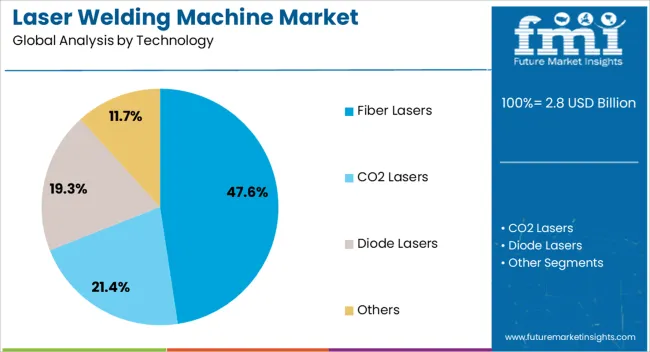

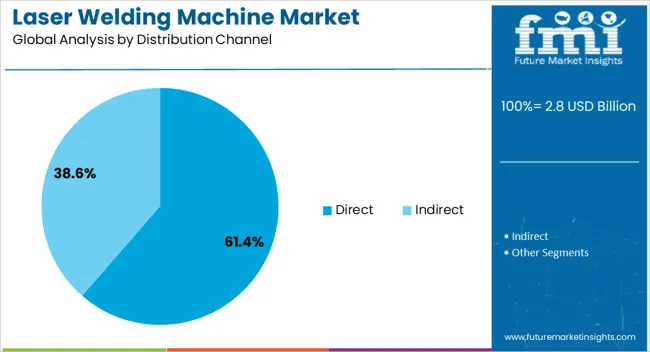

The laser welding machine market is segmented by technology, end use, distribution channel, and geographic regions. By technology, laser welding machine market is divided into fiber lasers, CO2 lasers, diode lasers, and others. In terms of end use, laser welding machine market is classified into automotive, medical, electronics, aerospace & defense, jewelry, and others. Based on distribution channel, laser welding machine market is segmented into direct and indirect. Regionally, the laser welding machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fiber lasers segment is projected to account for 47.6% of the overall laser welding machine market revenue in 2025, positioning it as the leading technology type. This dominant share is being attributed to the segment’s superior beam quality, high energy efficiency, and lower operational costs compared to conventional laser types.

Fiber lasers offer high-speed welding capabilities with minimal thermal distortion, making them suitable for thin and reflective materials often used in precision manufacturing. The technology’s compact design and solid-state reliability have further supported its adoption across sectors requiring consistent performance and minimal downtime.

Additionally, fiber lasers have been favored due to their scalability in power output and compatibility with automation platforms As production lines increasingly rely on adaptable and efficient welding systems, fiber lasers have emerged as the preferred solution for meeting quality and throughput demands.

The automotive end use segment is anticipated to hold 38.2% of the market revenue in 2025, marking it as the most prominent industrial user. This leading position is being driven by the growing application of laser welding in body-in-white assembly, battery module fabrication, and electric vehicle components.

Automotive manufacturers are prioritizing laser welding for its precision, strength, and ability to join dissimilar materials without additional filler. The rising adoption of electric vehicles has further increased the need for clean and efficient welding of battery packs and lightweight components.

Additionally, automation of production lines in the automotive sector has favored laser systems for their repeatability and integration with robotic arms The segment’s growth is expected to remain strong as manufacturers continue to focus on cost reduction, safety improvements, and performance optimization through advanced joining techniques.

The direct distribution channel is expected to capture 61.4% of the market revenue in 2025, establishing it as the dominant route to market. This preference is being influenced by the technical complexity of laser welding systems, which often require customization, training, and post-sales support.

Manufacturers are increasingly opting for direct engagement to ensure comprehensive understanding of system capabilities, seamless integration, and ongoing service relationships. Direct distribution allows suppliers to offer tailored solutions that align with specific production requirements and industry standards.

Furthermore, the need for close collaboration during installation, system calibration, and maintenance has made direct sales the preferred choice for enterprises investing in capital-intensive equipment As customers prioritize reliability, long-term support, and optimized system performance, the direct channel is expected to maintain its leadership in the distribution landscape.

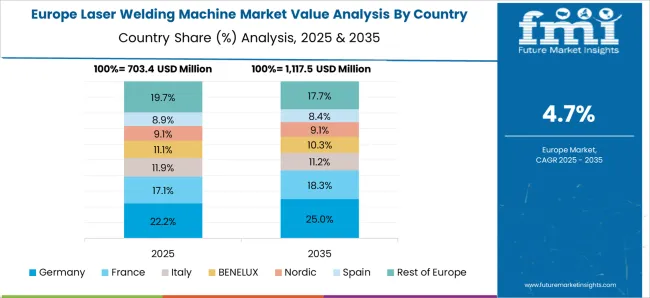

The laser welding machine market is expanding due to strong demand in automotive, electronics, aerospace, and medical device industries. Global revenue crossed USD 3.9 billion in 2024, with Asia Pacific holding 41% share led by China, Japan, and South Korea. Europe accounts for 28%, supported by Germany, France, and Italy’s advanced manufacturing base. North America contributes 25%, with strong adoption in automotive assembly and aerospace components. Fiber laser welding machines dominate the market, representing nearly 60% of installations, followed by solid-state and CO₂ variants. Rising automation, demand for precision, and adoption of Industry 4.0 solutions are driving investments in laser-based welding equipment worldwide.

Automotive and aerospace applications account for 48% of global laser welding machine demand. Automotive contributes 35%, where lightweight structures, electric vehicle batteries, and body assembly rely on laser welding. Aerospace adds 13%, focusing on precision welding for turbine blades, fuselage panels, and engine parts. Asia Pacific dominates with 41% share, supported by large-scale automotive manufacturing in China and Japan. Europe contributes 28%, with Germany’s automotive and aerospace sectors driving adoption. North America accounts for 25% with growing demand from electric vehicle production. Laser welding machines reduce material waste by 10–15%, improve accuracy, and support high-volume production requirements in advanced industries.

Technological innovations are enhancing welding precision, efficiency, and reliability. Fiber lasers provide up to 25–30% higher energy efficiency compared to CO₂ lasers. Advanced beam delivery systems improve welding depth and reduce defects by 15–20%. Robotic integration enables automated high-speed welding in automotive and electronics assembly. Remote monitoring and AI-driven controls improve quality assurance and reduce downtime. Asia Pacific emphasizes cost-effective fiber laser machines, while Europe invests in high-precision systems for aerospace and medical devices. North America focuses on integrating welding machines with Industry 4.0 manufacturing lines. These advancements ensure stronger joints, improved productivity, and lower operating costs for manufacturers globally.

Electronics, medical devices, and energy industries are increasing adoption of laser welding machines. Electronics account for 20% of global usage, covering smartphones, sensors, and microelectronics. Medical devices contribute 12%, including surgical instruments, implants, and pacemakers requiring high precision. Energy applications represent 10%, focusing on battery packs, solar panels, and fuel cells. Asia Pacific leads adoption with large-scale electronics and battery manufacturing in China and South Korea. Europe emphasizes precision medical device welding, while North America grows in energy storage and renewable energy projects. Expanding applications across multiple industries ensure consistent growth in demand for laser welding machines worldwide.

Laser welding machines face challenges from high capital investment and the need for skilled operators. Average system costs range between USD 70,000–250,000, creating affordability barriers for small and medium manufacturers. Maintenance, calibration, and spare parts increase operating costs by 10–15% annually. Skilled labor shortages limit adoption in regions with developing manufacturing sectors. Complexities in heat management and joint design can lead to defects if not properly managed. Asia Pacific addresses cost barriers through mass production of fiber lasers, while Europe and North America focus on training programs. Despite these efforts, cost intensity and skill requirements remain key constraints globally.

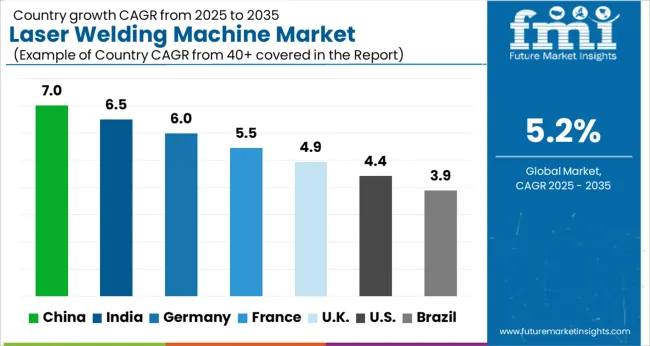

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The laser welding machine market is forecast to grow at a global CAGR of 5.2% between 2025 and 2035, supported by rising use in automotive engineering, aerospace fabrication, electronics assembly, and heavy industrial manufacturing. China leads at 7.0%, which is 34.6% above the global benchmark, driven by BRICS-led expansion in automotive production, battery pack welding for electric vehicles, and large-scale industrial fabrication. India follows at 6.5%, 25% higher than the global average, reflecting growing adoption in precision electronics, machinery manufacturing, and metal component fabrication. Germany records 6.0%, 15.4% above the benchmark, shaped by OECD-driven advancements in high-precision welding systems, robotics integration, and industrial automation. The United Kingdom posts 4.9%, 5.8% below the global rate, with applications concentrated in aerospace, automotive prototyping, and specialized fabrication. The United States stands at 4.4%, 15.4% below the benchmark, with consistent demand in defense manufacturing, industrial machinery, and niche applications requiring high-reliability welds. BRICS economies anchor overall volume expansion, OECD countries prioritize technological advancement and process efficiency, while ASEAN nations contribute through expanding electronics assembly, machinery exports, and mid-scale industrial production.

The laser welding machine market in China is projected to expand at a CAGR of 7.0%, outperforming the global CAGR of 5.2%, with growth propelled by large-scale industrial automation and adoption in automotive, electronics, and heavy engineering sectors. In 2024, production facilities across Jiangsu, Guangdong, and Zhejiang increased machine output by 14% to address both domestic consumption and exports. Local and global suppliers including Han’s Laser, HGTech, and Trumpf China are prioritizing compact fiber laser welding systems with improved precision and lower operating costs. Industrial modernization and increasing adoption of EV manufacturing lines continue to drive demand, with rising preference for automated welding solutions integrated with robotics.

India’s laser welding machine market is expected to register a CAGR of 6.5%, higher than the global CAGR of 5.2%, due to rapid penetration in automotive, construction equipment, and consumer electronics manufacturing. In 2024, production capacity expanded by 12% across hubs in Pune, Chennai, and Noida, as suppliers scaled up operations. Domestic players like SLTL and Sahajanand Laser Technology are competing with multinational firms such as Trumpf and Bystronic to provide cost-effective, high-speed welding machines. Strong demand is being driven by infrastructure projects and the shift toward lightweight components, where precision welding offers structural advantages.

Germany’s laser welding machine market is forecast to grow at a CAGR of 6.0%, above the global CAGR of 5.2%, supported by strong manufacturing standards and high-value applications in automotive and aerospace industries. In 2024, laser welding machine installations increased by 11%, with emphasis on robotic integration and energy-efficient systems. German manufacturers such as Trumpf, Precitec, and Bystronic reinforced their competitive edge with advancements in fiber laser technology and process monitoring systems. Demand has been concentrated in precision engineering, EV component production, and aerospace part assembly, with rising adoption of automated and smart welding solutions.

The laser welding machine market in the United Kingdom is anticipated to advance at a CAGR of 4.9%, slightly below the global CAGR of 5.2%, with moderate growth driven by demand in electronics, precision tooling, and aerospace component fabrication. In 2024, machine installations increased by 7%, with London, Midlands, and Northern England serving as key adoption hubs. Suppliers such as Trumpf UK, IPG Photonics, and Coherent focused on promoting compact fiber laser units and service-based solutions for SMEs. Growth is being influenced by the need for precision engineering in high-value industries, coupled with efficiency improvements in local manufacturing.

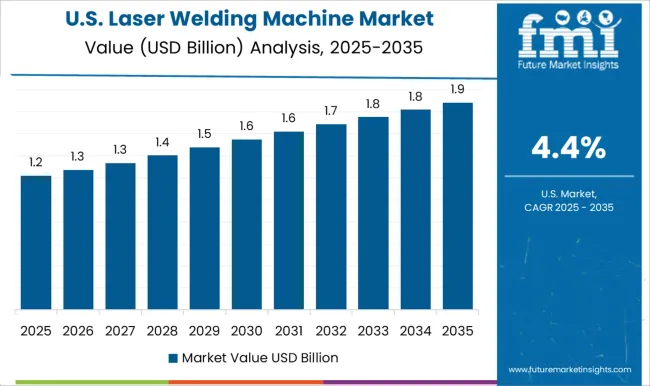

The laser welding machine market in the United States is projected to grow at a CAGR of 4.4%, lower than the global CAGR of 5.2%, reflecting a mature industrial base with selective adoption. In 2024, installations rose by 6%, driven by demand from aerospace, defense, and medical device manufacturing. Manufacturers such as IPG Photonics, Coherent, and Lincoln Electric emphasized technological upgrades, including automation-ready systems and advanced cooling technologies. Demand was concentrated in high-spec applications, where precision and compliance with regulatory standards are critical. While growth remains steady, market expansion is primarily linked to replacement demand and niche adoption.

Competition in the laser welding machine market is being defined by precision, automation readiness, and suitability across automotive, aerospace, medical device, and electronics applications. Market positions are being sustained through certified equipment, training services, and extensive distribution that ensures consistent supply and technical support. CHIRON Group is being represented with integrated laser machining centers designed for complex part manufacturing, while Coherent is being promoted with high-power systems tailored for micro-welding and industrial production. Emerson Electric is being applied with advanced welding solutions engineered for reliability in automated environments.

Han's Laser Technology Industry Group is being showcased with flexible platforms structured for mass production. Huagong Laser Engineering is being recognized with systems designed for material adaptability and cost efficiency. IPG Photonics is being advanced with fiber laser welding machines optimized for speed and accuracy. Jenoptik is being promoted with laser solutions tailored for automotive component welding. KEYENCE is being applied with compact, user-friendly laser welders structured for precision work. Laser Technologies is being represented with specialized machines designed for custom applications. Laserline is being advanced with diode laser systems suitable for industrial welding processes. LaserStar Technologies is being showcased with benchtop and portable models structured for jewelry and fine welding. Penta Laser is being applied with systems engineered for sheet metal processing.

Precitec is being promoted with welding heads and monitoring technology integrated into industrial setups. TRUMPF is being recognized with advanced laser welding machines designed for scalability, automation, and multi-material applications. Strategies are being directed toward advancing automation integration, enhancing energy efficiency, and expanding customer training programs. Product brochures are being structured with technical specifications covering laser type, power output, beam quality, spot size, cooling requirements, and compatibility with robotic systems. Features such as process monitoring, modular upgrades, and multi-axis capabilities are being emphasized to support operational decisions. Each brochure is being arranged to highlight application suitability, safety measures, and maintenance guidance. Technical content is being presented in a clear, evaluation-ready format to assist production managers, engineers, and procurement teams in selecting laser welding machines that align with precision, reliability, and cost-efficiency requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Technology | Fiber Lasers, CO2 Lasers, Diode Lasers, and Others |

| End Use | Automotive, Medical, Electronics, Aerospace & defense, Jewelry, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CHIRON Group, Coherent, Emerson Electric, Han's Laser Technology Industry Group, Huagong Laser Engineering, IPG Photonics, Jenoptik, KEYENCE, Laser Technologies, Laser line, Laser Star Technologies, Penta Laser, Precitec, and TRUMPF |

| Additional Attributes | Dollar sales by machine type and end use, demand dynamics across automotive, electronics, and metal fabrication, regional trends in advanced manufacturing adoption, innovation in precision, speed, and automation, environmental impact of energy consumption and waste, and emerging use cases in medical devices and additive manufacturing. |

The global laser welding machine market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the laser welding machine market is projected to reach USD 4.7 billion by 2035.

The laser welding machine market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in laser welding machine market are fiber lasers, co2 lasers, diode lasers and others.

In terms of end use, automotive segment to command 38.2% share in the laser welding machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Measurement Integrating Sphere Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

Laser Safety Glasses Market Growth – Trends & Forecast 2025 to 2035

LASER Light Cables Market Growth – Trends & Forecast 2025 to 2035

Laser Trackers Market - Growth, Demand & Forecast 2025 to 2035

Laser Projection Market Analysis & Forecast by Product Type, Vertical, and Region through 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA