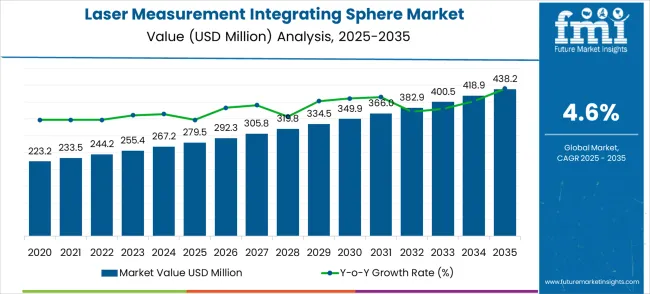

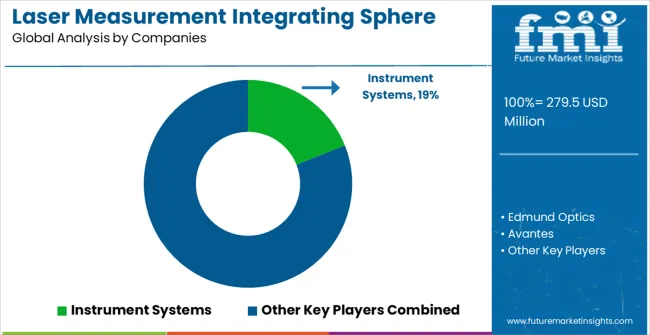

The global laser measurement integrating sphere market is forecasted to grow from USD 279.5 million in 2025 to USD 438.2 million by 2035, reflecting a steady CAGR of 4.6%. A year-on-year (YoY) growth analysis reveals a consistent upward trajectory without significant volatility, suggesting stable demand driven by increasing adoption of laser measurement technologies in manufacturing, medical instrumentation, photonics research, and optical testing. The incremental growth each year reflects a mature market with moderate expansion, supported by ongoing innovations in laser measurement accuracy and efficiency.

From 2025 to 2027, the market grows from USD 279.5 million to USD 305.8 million, with YoY growth rates of approximately 4.6% in 2026 and 4.6% in 2027. These early years show consistent expansion as industries adopt integrating sphere technologies for enhanced laser power measurements and beam characterization. Growth during this period is driven by steady industrial automation demand and advancements in optical metrology systems. The absence of sharp fluctuations reflects stable investment in precision measurement infrastructure rather than speculative market surges.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 279.5 million |

| Forecast Value in (2035F) | USD 438.2 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

Between 2028 and 2031, the market progresses from USD 319.8 million to USD 382.9 million. YoY growth remains stable within the 4.5–4.8% range, with the highest incremental increase observed in 2030. This phase reflects the market entering a mature growth stage, with steady adoption across sectors such as laser manufacturing, defense, and biomedical applications. Factors such as continuous improvements in laser measurement resolution, integration of automated calibration systems, and growing requirements for quality control in production contribute to steady growth. Volatility remains minimal, reflecting stable industry demand and reliable technological adoption cycles.

From 2032 to 2035, the market continues its steady growth, reaching USD 438.2 million by 2035. The YoY growth during this period ranges from 4.6% to 4.7%, with an average annual increase of about USD 19.7 million over the decade. This consistent pace underlines the reliability of demand for integrating sphere technology in precision laser measurement. The average YoY growth rate over the forecast period is approximately 4.6%, confirming the sector’s steady trajectory without major fluctuations. The market reflects a mature and predictable growth pattern, ideal for strategic long-term investment.

Market expansion is being supported by the exponential growth of LED and laser technologies and the corresponding demand for precise optical measurement equipment that can support product development, quality control, and performance validation in photonics and optoelectronics applications. Modern research institutions and manufacturers are increasingly focused on measurement solutions that provide accurate spectral analysis, consistent repeatability, and compliance with international measurement standards. Laser measurement integrating spheres' proven ability to deliver uniform light distribution, measurement accuracy, and calibration reliability makes them essential equipment for optical characterization and quality assurance initiatives.

The growing focus on renewable energy technologies and solid-state lighting development is driving demand for measurement equipment that can support solar cell efficiency testing, LED characterization, and photovoltaic device validation. Research preference for measurement solutions that combine measurement accuracy with operational reliability and standard compliance is creating opportunities for innovative integrating sphere implementations. The rising influence of precision manufacturing and quality control standards is also contributing to increased adoption of integrating spheres that can provide traceable measurements and support regulatory compliance requirements.

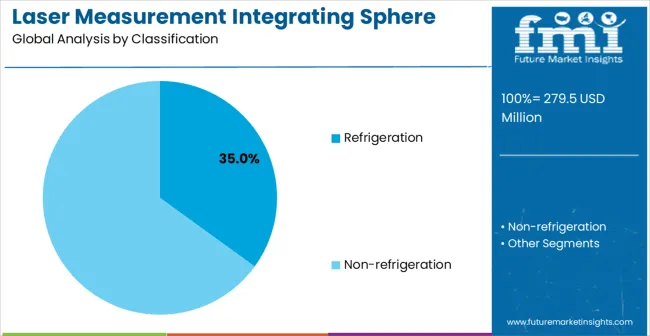

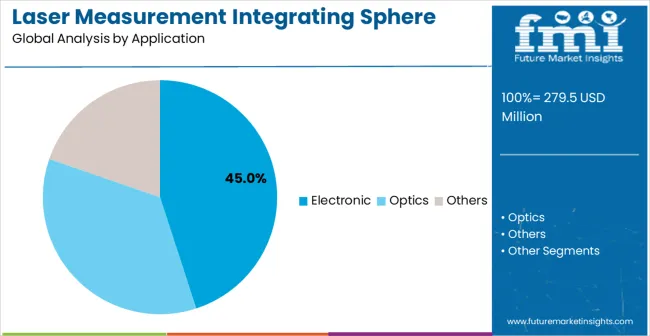

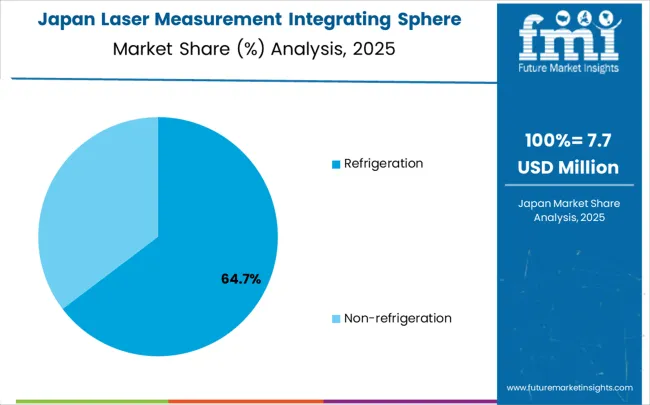

The market is segmented by cooling method and application. By cooling method, the market is divided into refrigeration, non-refrigeration, and others. Based on application, the market is categorized into electronic instruments, optics, and others.

The refrigeration segment is projected to account 35.0% share for the laser measurement integrating sphere market in 2025, reaffirming its position as the leading cooling method category. Refrigeration-cooled systems increasingly attract research institutions for their temperature stability characteristics, measurement precision benefits, and suitability for high-accuracy applications requiring consistent thermal conditions. Refrigeration systems' thermal control capabilities directly address the precision and repeatability requirements for optical measurements across various research and industrial applications.

This cooling method segment forms the foundation of precision integrating sphere adoption, as it represents the cooling category with the greatest appeal for applications requiring ultra-stable measurement conditions and minimal thermal drift effects. Research investments in measurement accuracy optimization and calibration reliability strategies continue to strengthen adoption among refrigeration-cooled system users. With researchers prioritizing measurement precision and thermal stability, refrigeration cooling systems align with both accuracy requirements and scientific standards, making them the central component of laser measurement integrating sphere market growth strategies.

Electronic instruments are projected to account 45.0% share for application segment of laser measurement integrating sphere demand in 2025, underscoring their critical role in driving market growth and technology adoption. Electronic instrument applications prefer integrating spheres for their measurement accuracy, calibration capabilities, and ability to support precision optical characterization and testing protocols. Positioned as essential measurement equipment for electronic device development, laser measurement integrating spheres offer both technical advantages and quality assurance benefits for electronic instrument manufacturing and testing.

The segment is supported by continuous expansion in electronic device production and the growing recognition of the importance of optical measurement, which enables accurate device characterization and quality control. Integrating sphere manufacturers are investing in electronic instrument-focused solutions to support semiconductor testing, display characterization, and optical sensor development. As electronic instruments become more sophisticated and optically dependent, they will continue to dominate integrating sphere utilization while supporting market expansion and technology advancement.

The market is advancing steadily due to increasing precision measurement requirements and growing demand for accurate optical characterization equipment that supports research and development, quality control, and calibration applications. The market faces challenges, including high equipment costs for precision measurement systems, technical complexities associated with calibration and maintenance procedures, and specialized expertise requirements for proper operation and measurement interpretation. Innovation in coating technology and measurement automation continues to influence market development and adoption patterns.

The expanding photonics research sector and advancing LED technology development are enabling laser measurement integrating spheres to support critical measurement applications where conventional measurement methods cannot provide the accuracy, uniformity, and repeatability required for photonic device characterization. Photonics research growth provides enhanced market opportunities while allowing precise measurement solutions across various optical applications and research disciplines. Research organizations are increasingly recognizing the competitive advantages of integrating sphere technology for optical measurement accuracy and research credibility.

Modern laser measurement integrating sphere providers are incorporating digital measurement interfaces and automated calibration capabilities to enhance system appeal and address researcher concerns about measurement efficiency, data management, and calibration consistency. These technological enhancements improve measurement system value while enabling new market segments, including automated testing laboratories and high-throughput measurement applications requiring streamlined measurement processes and data integration. Advanced automation integration also allows integrating spheres to differentiate from conventional measurement equipment while supporting modern laboratory workflows and measurement digitalization.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| Brazil | 4.8% |

| USA | 4.4% |

| UK | 3.9% |

| Japan | 3.5% |

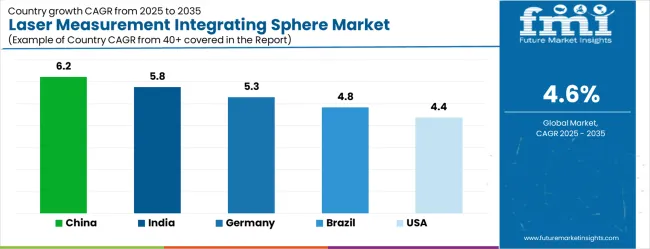

The market is experiencing steady growth globally, with China leading at a 6.2% CAGR through 2035, driven by expanding photonics research infrastructure, increasing LED manufacturing capabilities, and comprehensive investment in optical measurement technology development. India follows closely at 5.8%, supported by a rapidly developing electronics manufacturing sector, expanding research and development facilities, and growing adoption of precision measurement technologies. Germany shows strong growth at 5.3%, focusing advanced optical engineering capabilities and comprehensive photonics research programs. Brazil records 4.8%, focusing on electronics manufacturing development and optical technology adoption. The United States shows 4.4% growth, prioritizing photonics research leadership and precision measurement innovation. The United Kingdom demonstrates 3.9% growth, supported by advanced optical research capabilities and scientific instrumentation development. Japan shows 3.5% growth, prioritizing precision manufacturing and optical technology excellence.

China is projected to exhibit exceptional growth with a CAGR of 6.2% through 2035, driven by massive photonics research infrastructure expansion and advancing LED manufacturing programs requiring sophisticated optical measurement equipment. The country's leadership in electronics manufacturing and strong government support for photonics technology development are creating significant demand for precision measurement systems. Major domestic and international optical equipment manufacturers are establishing comprehensive integrated sphere development and production capabilities to serve both domestic research markets and global optical measurement export opportunities.

India is expanding at a CAGR of 5.8%, supported by the rapidly developing electronics manufacturing sector, expanding research and development infrastructure, and increasing adoption of precision optical measurement technologies among growing research institutions. The country's large electronics market and strong focus on technology development are driving requirements for advanced measurement equipment. International optical equipment companies and domestic manufacturers are establishing comprehensive development and distribution capabilities to address the growing demand for optical measurement systems.

Germany is projected to grow at a CAGR of 5.3% through 2035, prioritizing advanced optical engineering capabilities and comprehensive photonics research programs within Europe's leading precision instrumentation hub. The country's established optical industry and commitment to scientific excellence are driving sophisticated measurement equipment requirements. German research institutions and optical companies consistently demand high-precision integrating sphere systems that meet stringent measurement standards and provide superior integration capabilities with advanced spectroscopic instrumentation.

Brazil is expanding at a CAGR of 4.8% through 2035, focusing on electronics manufacturing development and optical technology adoption across Latin America's largest technology market. Brazilian organizations value cost-effective measurement solutions, operational reliability, and proven performance characteristics, positioning laser measurement integrating spheres as essential equipment for emerging electronics manufacturing quality control. The country's expanding technology sector and increasing focus on precision manufacturing are creating constant demand for advanced optical measurement technologies.

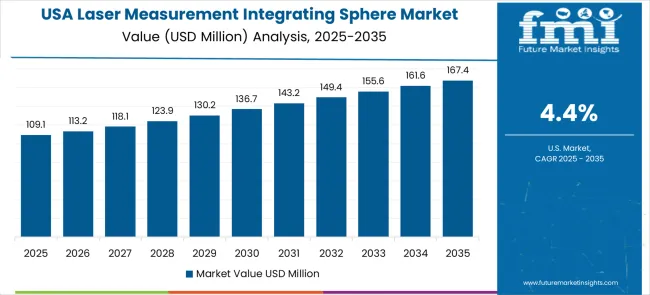

The United States is projected to grow at a CAGR of 4.4% through 2035, driven by photonics research leadership, precision measurement innovation programs, and established regulatory frameworks supporting advanced optical technologies. American organizations prioritize technological innovation, measurement accuracy, and regulatory compliance, making laser measurement integrating spheres a strategic choice for comprehensive optical characterization applications. The market benefits from mature research infrastructure and sophisticated measurement technology requirements.

The United Kingdom is expanding at a CAGR of 3.9% through 2035, supported by advanced optical research capabilities, established scientific instrumentation expertise, and growing commitment to photonics innovation and precision measurement excellence. British organizations value regulatory compliance, technological sophistication, and operational reliability, positioning laser measurement integrating spheres as essential technology for advanced optical research applications.

Japan is projected to grow at a CAGR of 3.5% through 2035, prioritizing precision manufacturing excellence, advanced quality control standards, and comprehensive optical technology integration aligned with Japanese instrumentation excellence. Japanese organizations prioritize technological precision, measurement reliability, and long-term performance, making laser measurement integrating spheres a strategic choice for premium optical measurement applications. The market is supported by sophisticated research infrastructure and established precision optical expertise.

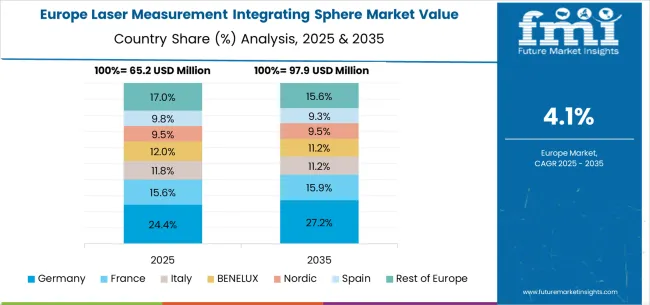

The laser measurement integrating sphere market in Europe is projected to grow from USD 71.8 million in 2025 to USD 109.2 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership position with a 31.7% market share in 2025, projected to reach 32.4% by 2035, supported by its advanced optical engineering capabilities and comprehensive photonics research programs, including major research facilities in Munich, Berlin, and other scientific centers.

The United Kingdom follows with a 24.3% share in 2025, projected to reach 24.8% by 2035, driven by comprehensive optical research programs and advanced scientific instrumentation development in major research institutions and universities. France holds a 19.1% share in 2025, expected to reach 19.4% by 2035 due to expanding photonics research and optical technology development initiatives. Italy commands a 13.4% share, while Spain accounts for 7.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.7% to 4.1% by 2035, attributed to increasing optical measurement adoption in Nordic countries and emerging Eastern European research markets implementing advanced measurement technologies.

The market is characterized by competition among established optical equipment manufacturers, specialized measurement system providers, and emerging photonics technology companies. Companies are investing in coating technology development, thermal management systems, measurement accuracy enhancement, and comprehensive optical measurement solutions to deliver precise, reliable, and calibration-traceable integrating sphere systems. Innovation in sphere coating materials, detector integration, and measurement automation is central to strengthening market position and research community acceptance.

Systems leads the market with comprehensive optical measurement solutions, offering advanced integrating sphere systems with a focus on measurement accuracy and calibration traceability. Edmund Optics provides specialized optical components and measurement systems with focus on research and industrial applications. Avantes delivers innovative spectroscopic measurement solutions with a focus on compact and modular integrating sphere systems. Shimadzu focuses on analytical instrumentation with emphasis on precision measurement and scientific applications.

Labsphere specializes in integrating sphere technology with focus on measurement standards and calibration services. MKS Instruments provides comprehensive photonics measurement solutions with a focus on industrial and research applications. Horiba delivers advanced optical measurement systems with scientific instrumentation expertise. Ophir Optronics Solution focuses on laser measurement and optical power measurement systems. Additional key players, including WY Optics, Lab Sphere, TEO, Gu Optics, Ocean Optics, Unice, Ruhai Optoelectronics, Fuxiang Optics, and MulanSphere, contribute specialized manufacturing capabilities and technology development across various optical measurement applications.

Laser measurement integrating spheres are precision optical instruments essential for accurate characterization of light sources, LEDs, lasers, and optical devices, providing uniform light distribution and traceable measurements that support photonics research, quality control, and industry standards compliance. With the market projected to grow from USD 279.5 million in 2025 to USD 438.2 million by 2035 at a 4.6% CAGR, these sophisticated instruments enable critical measurements in LED manufacturing, solar cell testing, electronic instruments development, and advanced photonics research. The market expansion is constrained by high equipment costs, specialized technical expertise requirements, and complex calibration procedures. Accelerating adoption requires coordinated efforts across research institutions and standards organizations, precision optical equipment manufacturers, calibration service providers and metrology labs, end-user industries and applications specialists, and technology investment and commercialization partners.

How Research Institutions and Standards Organizations Could Drive Market Development?

Measurement Standards Development: Establish comprehensive international standards for integrating sphere measurements, including calibration protocols, traceability requirements, and measurement uncertainty guidelines. Develop standardized test procedures for LED characterization, laser measurements, and photovoltaic device testing that ensure consistent results across laboratories worldwide.

Advanced Research Programs: Fund fundamental research in integrating sphere technology, including novel coating materials, improved thermal management systems, and enhanced measurement techniques. Support collaborative research programs between universities and industry to develop next-generation measurement capabilities and applications.

Calibration Infrastructure: Develop national and regional calibration facilities providing traceable measurement services for integrating sphere systems. Establish reference standards and primary measurement capabilities that support industry calibration requirements and ensure measurement traceability to international standards.

Technical Education and Training: Create specialized education programs for optical metrology, including integrating sphere theory, measurement techniques, and calibration procedures. Develop professional certification programs for optical measurement specialists and provide continuing education for industry practitioners.

International Collaboration: Facilitate international cooperation on measurement standards, calibration procedures, and research initiatives. Organize technical conferences, workshops, and inter-laboratory comparison programs that advance measurement science and promote best practices globally.

How could Precision Optical Equipment Manufacturers strengthen Technology Development?

Advanced Coating Technology: Develop next-generation sphere coating materials with improved diffuse reflectance properties, enhanced durability, and better spectral uniformity. Invest in coating application techniques that ensure consistent performance and longer service life under demanding measurement conditions.

Thermal Management Innovation: Create sophisticated temperature control systems for refrigeration-cooled integrating spheres that provide ultra-stable measurement conditions with minimal thermal drift. Develop energy-efficient cooling solutions that reduce operational costs while maintaining measurement precision.

Digital Integration and Automation: Incorporate advanced digital measurement interfaces, automated calibration capabilities, and data management systems that streamline measurement workflows. Develop software solutions that provide real-time measurement monitoring, statistical analysis, and integration with laboratory information management systems.

Modular System Design: Create flexible, modular integrating sphere platforms that can be configured for specific measurement applications, including LED testing, laser characterization, and solar cell evaluation. Develop standardized interfaces that enable easy integration with various detectors, sources, and measurement systems.

Application-Specific Solutions: Develop specialized integrating sphere configurations optimized for specific industries, including electronic instruments manufacturing, photovoltaic device testing, and solid-state lighting development. Provide complete measurement solutions, including spheres, detectors, software, and calibration services.

How Calibration Service Providers and Metrology Labs Could Support Market Growth?

Comprehensive Calibration Services: Establish specialized calibration facilities providing traceable measurements for integrating sphere systems, including sphere calibration, detector characterization, and system validation. Develop mobile calibration services that bring metrology capabilities directly to customer facilities.

Measurement Uncertainty Analysis: Provide detailed uncertainty analysis services that help customers understand measurement limitations and optimize measurement procedures. Develop uncertainty budgets for complex measurement applications and guide achieving required measurement accuracy.

Training and Consultation: Offer specialized training programs covering integrating sphere measurement techniques, calibration procedures, and measurement best practices. Provide technical consulting services, helping customers optimize measurement systems and solve complex measurement challenges.

Quality Assurance Programs: Develop comprehensive quality systems supporting the integration of sphere measurements, including proficiency testing programs, inter-laboratory comparisons, and measurement validation services. Provide documentation and procedures that support customer quality system requirements.

Technology Transfer: Bridge the gap between research developments and practical applications by providing testing services for new measurement techniques and technologies. Support technology commercialization by validating performance claims and providing independent measurement verification.

How End-User Industries and Applications Specialists Could Drive Adoption?

Application Development: Identify and develop new measurement applications for integrating sphere technology, including emerging LED technologies, novel photovoltaic devices, and advanced optical materials. Create application-specific measurement protocols and procedures that address industry-specific requirements.

Performance Validation: Conduct a comprehensive evaluation of integrating sphere systems for specific applications, including LED manufacturing quality control, solar cell efficiency testing, and electronic instrument characterization. Publish performance data and case studies demonstrating measurement benefits and return on investment.

Integration Capabilities: Develop expertise in integrating sphere measurements with manufacturing processes, quality control systems, and research workflows. Create automated measurement systems that provide high-throughput testing capabilities for production environments.

Technical Specifications: Work with equipment manufacturers to define technical requirements for application-specific integrating sphere systems, including measurement range, accuracy requirements, and environmental conditions. Provide feedback on system performance and identify improvement opportunities.

Market Education: Educate potential users about integrating sphere measurement benefits, including improved measurement accuracy, enhanced product quality, and regulatory compliance advantages. Demonstrate measurement capabilities through technical presentations, trade shows, and demonstration programs.

How Technology Investment and Commercialization Partners Could Unlock Market Value?

Innovation Investment: Support the development of breakthrough integrating sphere technologies, including advanced coating materials, novel measurement techniques, and intelligent measurement systems. Fund research programs that address current technology limitations and enable new measurement capabilities.

Manufacturing Scale-Up: Provide capital for expanding production capabilities of precision optical components, including sphere fabrication, coating application, and system assembly. Support the development of manufacturing processes that reduce costs while maintaining measurement accuracy and quality.

Market Development Capital: Finance market development activities, including technical education programs, demonstration projects, and application development initiatives that accelerate integrating sphere adoption. Support expansion into emerging markets with growing photonics industries.

Strategic Partnerships: Facilitate partnerships between integrating sphere manufacturers, measurement system companies, and end-user industries to accelerate technology commercialization and market adoption. Support joint development programs that address specific market needs and applications.

International Expansion: Fund international business development, including the establishment of regional service centers, distribution networks, and technical support capabilities. Support market entry in high-growth regions like China (6.2% CAGR) and India (5.8% CAGR), where photonics research and electronics manufacturing are rapidly expanding.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 279.5 million |

| Cooling Method | Refrigeration, Non-refrigeration, Others |

| Application | Electronic Instruments, Optics, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Systems, Edmund Optics, Avantes, Shimadzu, Labsphere, MKS Instruments, Horiba, Ophir Optronics Solution, WY Optics, Lab Sphere, TEO, Gu Optics, Ocean Optics, Unice, Ruhai Optoelectronics, Fuxiang Optics, MulanSphere |

| Additional Attributes | Dollar sales by cooling method and application, regional demand trends, competitive landscape, research preferences for refrigeration versus non-refrigeration cooling systems, integration with spectroscopic measurement systems and calibration standards, innovations in coating technology and thermal management for diverse optical measurement applications |

The global laser measurement integrating sphere market is estimated to be valued at USD 279.5 million in 2025.

The market size for the laser measurement integrating sphere market is projected to reach USD 438.2 million by 2035.

The laser measurement integrating sphere market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in laser measurement integrating sphere market are refrigeration and non-refrigeration.

In terms of application, electronic segment to command 45.0% share in the laser measurement integrating sphere market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laser Frequency Splitting and Mode Competition Teaching Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Component Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Laser-Assisted Smart Lathes Market Size and Share Forecast Outlook 2025 to 2035

Laser Drilling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Transverse Mode Teaching Instrument Market Forecast and Outlook 2025 to 2035

Laser Welding Equipment Market Forecast and Outlook 2025 to 2035

Laser Welding Market Size and Share Forecast Outlook 2025 to 2035

Laser Ablation Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Safety Cloths Market Size and Share Forecast Outlook 2025 to 2035

Laser Dazzler Market Size and Share Forecast Outlook 2025 to 2035

Laser Cable Marking Market Size and Share Forecast Outlook 2025 to 2035

Laser Cladding Market Size and Share Forecast Outlook 2025 to 2035

Laser Marking Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Laser Wire Marking Systems Market Size and Share Forecast Outlook 2025 to 2035

Laser Photomask Market Size and Share Forecast Outlook 2025 to 2035

Laser Measuring Instrument Market Size and Share Forecast Outlook 2025 to 2035

Laser Welding Machine Market Size and Share Forecast Outlook 2025 to 2035

Laser Technology Market Size and Share Forecast Outlook 2025 to 2035

Laser Interferometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA